Professional Documents

Culture Documents

Term Structure of Interest Rates

Term Structure of Interest Rates

Uploaded by

abdulraqeeb alareqiCopyright:

Available Formats

You might also like

- Fabozzi Fofmi4 Ch11 ImDocument12 pagesFabozzi Fofmi4 Ch11 ImYasir ArafatNo ratings yet

- Discussion QuestionsDocument19 pagesDiscussion QuestionsrahimNo ratings yet

- Chap 007Document17 pagesChap 007van tinh khucNo ratings yet

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementFrom EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementRating: 5 out of 5 stars5/5 (1)

- Deconstrucing The OsceDocument129 pagesDeconstrucing The OsceHas Mas100% (1)

- Policy - Co-2-034 Independent Double Check High Alert MedicationsDocument8 pagesPolicy - Co-2-034 Independent Double Check High Alert MedicationsTravel JunkyNo ratings yet

- MINI Cooper Service Manual: 2002-2006 - Table of ContentsDocument2 pagesMINI Cooper Service Manual: 2002-2006 - Table of ContentsBentley Publishers40% (5)

- Yield CurveDocument7 pagesYield CurveromanaNo ratings yet

- Activity#2Document9 pagesActivity#2Hagad, Angelica BA 2ANo ratings yet

- GW JEL DraftDocument65 pagesGW JEL DraftFirman Aditya BaskoroNo ratings yet

- Term Premia: Models and Some Stylised FactsDocument13 pagesTerm Premia: Models and Some Stylised FactssdafwetNo ratings yet

- ZinyoroDocument12 pagesZinyoroEdwin Lwandle NcubeNo ratings yet

- FIM Term ReportDocument8 pagesFIM Term ReportYousuf ShabbirNo ratings yet

- Term Structure of Interest RatesDocument8 pagesTerm Structure of Interest RatesMoud KhalfaniNo ratings yet

- Unit 3 Tutorial Questions MemoDocument5 pagesUnit 3 Tutorial Questions Memondonithando2207No ratings yet

- The Structure of Interest Rates (Note)Document18 pagesThe Structure of Interest Rates (Note)Hoi Mun100% (1)

- Investments Chapter 11Document32 pagesInvestments Chapter 11m.shehrooz23No ratings yet

- Yield Curves Three TypesDocument6 pagesYield Curves Three TypesKamran89AliNo ratings yet

- Task 1: What It IsDocument4 pagesTask 1: What It IsharishranaNo ratings yet

- Term Structure of Interest RatesDocument13 pagesTerm Structure of Interest RatesAnfal_Shaikh_3139No ratings yet

- Monetary Policy and The Term Structure of Interest Rates Monetary PolicyDocument3 pagesMonetary Policy and The Term Structure of Interest Rates Monetary PolicyNerea FrancesNo ratings yet

- Bond Yield Curve Holds Predictive PowersDocument15 pagesBond Yield Curve Holds Predictive PowersZuniButtNo ratings yet

- Running Head: Term Structure of Interest RateDocument6 pagesRunning Head: Term Structure of Interest Ratejack petersNo ratings yet

- Interest Rate DeteminationnDocument13 pagesInterest Rate DeteminationnkafiNo ratings yet

- Term Structure of Interest RatesDocument17 pagesTerm Structure of Interest RatesSudha SinghNo ratings yet

- Yield Curve and TheoriesDocument9 pagesYield Curve and TheorieskalukollasjpNo ratings yet

- Fixed Income and Credit Risk v3Document27 pagesFixed Income and Credit Risk v3FNo ratings yet

- Capital Markets Project Yield Curve Analysis: Shaheed Sukhdev College of Business StudiesDocument50 pagesCapital Markets Project Yield Curve Analysis: Shaheed Sukhdev College of Business StudiesSrijan SaxenaNo ratings yet

- Predictive Power of YIeld CurveDocument24 pagesPredictive Power of YIeld CurveRavi KumarNo ratings yet

- 4 - Term Structures TheoriesDocument15 pages4 - Term Structures Theoriesmajmmallikarachchi.mallikarachchiNo ratings yet

- A Note On Term Structure and Inflationary Expectations in Kenya - by Francis MwegaDocument14 pagesA Note On Term Structure and Inflationary Expectations in Kenya - by Francis Mwegamburu. hNo ratings yet

- Interest Rates Fortitude and ConfigurationDocument11 pagesInterest Rates Fortitude and ConfigurationEugene AlipioNo ratings yet

- TTP 0611 Can You Time LongDurationDocument3 pagesTTP 0611 Can You Time LongDurationEun Woo HaNo ratings yet

- EM4001Ch6 Gearing and Cost of CapitalDocument42 pagesEM4001Ch6 Gearing and Cost of CapitalGabriel OkuyemiNo ratings yet

- Filipino SalinDocument5 pagesFilipino SalinCherry Destreza ManzanillaNo ratings yet

- Use Duration and Convexity To Measure RiskDocument4 pagesUse Duration and Convexity To Measure RiskSreenesh PaiNo ratings yet

- Chapter 4: The Structure of Interest Rate: M OneyDocument14 pagesChapter 4: The Structure of Interest Rate: M OneyReignNo ratings yet

- Module 1 - The Role of Financial Markets and Financial IntermediariesDocument11 pagesModule 1 - The Role of Financial Markets and Financial IntermediariesAriaga CapsuPontevedraNo ratings yet

- Term Structure of Interest Rates, Spot Rate & Forward RateDocument18 pagesTerm Structure of Interest Rates, Spot Rate & Forward RateShruti Savant DodaniNo ratings yet

- DurationDocument5 pagesDurationNiño Rey LopezNo ratings yet

- 3 Forward Rate Agreements and Interest Rate Swaps: B. A. Eales, Financial Engineering © Brian Eales 2000Document2 pages3 Forward Rate Agreements and Interest Rate Swaps: B. A. Eales, Financial Engineering © Brian Eales 2000Thao NguyenNo ratings yet

- Term Structure of Interest Rates: The Theories: Abdul MunasibDocument6 pagesTerm Structure of Interest Rates: The Theories: Abdul MunasibSana NazNo ratings yet

- Advanced Financial Accounting - Interest Rates QuestionDocument12 pagesAdvanced Financial Accounting - Interest Rates Questionailiwork worksNo ratings yet

- Chapter 10 - Risk and Term Structure of Interest RatesDocument28 pagesChapter 10 - Risk and Term Structure of Interest RatesSilva, Phoebe Chates Bridget B.No ratings yet

- Interest RateDocument32 pagesInterest RateMayur N Malviya85% (13)

- Yield Curve and Its Importance: Short-Term Versus Long-Term Rates and YieldsDocument4 pagesYield Curve and Its Importance: Short-Term Versus Long-Term Rates and YieldsJulio GaziNo ratings yet

- Federal RserveDocument4 pagesFederal RserveShandyNo ratings yet

- Yield CurveDocument9 pagesYield Curvejackie555No ratings yet

- Macro Economics ProjectDocument12 pagesMacro Economics ProjectnilaykmajmudarNo ratings yet

- Math Business Combine ProjectDocument8 pagesMath Business Combine ProjecthassanzeshanhassanNo ratings yet

- The Mortgage Production LineDocument4 pagesThe Mortgage Production LinesonalicooljnNo ratings yet

- Chapter 11: Answers To Concepts in Review: Gitman/Joehnk - Fundamentals of Investing, Ninth EditionDocument4 pagesChapter 11: Answers To Concepts in Review: Gitman/Joehnk - Fundamentals of Investing, Ninth EditionCarl Ivan GambalaNo ratings yet

- U5 Risk Premium and Term Structure of Interest RatesDocument39 pagesU5 Risk Premium and Term Structure of Interest RatesJC HuamánNo ratings yet

- Unit 3 - Term Structure of Interest Rates Slides 2022Document53 pagesUnit 3 - Term Structure of Interest Rates Slides 2022ndonithando2207No ratings yet

- MacroDocument29 pagesMacrozohaibsikandarNo ratings yet

- Swap Rate PaperDocument50 pagesSwap Rate PaperAshwin R JohnNo ratings yet

- Duration PDFDocument8 pagesDuration PDFMohammad Khaled Saifullah CdcsNo ratings yet

- Govt Bonds and Yield Curve NotesDocument4 pagesGovt Bonds and Yield Curve NotesPranjalNo ratings yet

- Chapter 9 - Interest Rate and Currency Swaps (Q&A)Document5 pagesChapter 9 - Interest Rate and Currency Swaps (Q&A)Nuraisyahnadhirah MohamadtaibNo ratings yet

- Bond Pricing and Immunization Strategy - Asset Allocation in Bond InvestmentDocument8 pagesBond Pricing and Immunization Strategy - Asset Allocation in Bond InvestmentJulian Brescia2No ratings yet

- Yield CurveDocument3 pagesYield Curveapplehead2009No ratings yet

- The Big Ebook of Sustainability Reporting Frameworks - enDocument73 pagesThe Big Ebook of Sustainability Reporting Frameworks - enabdulraqeeb alareqiNo ratings yet

- What Is CSR - Corporate Social Responsibility ExplainedDocument6 pagesWhat Is CSR - Corporate Social Responsibility Explainedabdulraqeeb alareqiNo ratings yet

- 401 - Unit I - IMS MBADocument11 pages401 - Unit I - IMS MBAabdulraqeeb alareqiNo ratings yet

- Introduction To Strategic ManagementDocument28 pagesIntroduction To Strategic Managementabdulraqeeb alareqiNo ratings yet

- ValuationDocument31 pagesValuationabdulraqeeb alareqiNo ratings yet

- Risk, Types and MeasurementDocument9 pagesRisk, Types and Measurementabdulraqeeb alareqiNo ratings yet

- Areas of Tax PlanningDocument10 pagesAreas of Tax Planningabdulraqeeb alareqiNo ratings yet

- Set Off & Carry Forward of LossesDocument17 pagesSet Off & Carry Forward of Lossesabdulraqeeb alareqiNo ratings yet

- Tax Benefits Under Telecommunication ServicesDocument10 pagesTax Benefits Under Telecommunication Servicesabdulraqeeb alareqiNo ratings yet

- Lect03 - GST Numericals (Cont)Document20 pagesLect03 - GST Numericals (Cont)abdulraqeeb alareqiNo ratings yet

- Wa0028.Document6 pagesWa0028.abdulraqeeb alareqiNo ratings yet

- Composition 1 S2 2020 FinalDocument46 pagesComposition 1 S2 2020 Finalelhoussaine.nahime00No ratings yet

- Assignment 9-Ra 9184 (Ce Laws, Ethics, and Contracts)Document4 pagesAssignment 9-Ra 9184 (Ce Laws, Ethics, and Contracts)Luke MoraledaNo ratings yet

- SOLIDserver Administrator Guide 5.0.3Document1,041 pagesSOLIDserver Administrator Guide 5.0.3proutNo ratings yet

- Leson PLANDocument7 pagesLeson PLANMarivic SeverinoNo ratings yet

- Kodedkloud Instalation HardwayDocument153 pagesKodedkloud Instalation HardwayJuca LocoNo ratings yet

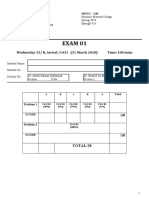

- Meng 310 Exam 01 Spring 2010Document4 pagesMeng 310 Exam 01 Spring 2010Abdulrahman AlzahraniNo ratings yet

- Trade WorksheetDocument11 pagesTrade WorksheetAsma KamranNo ratings yet

- Kalakalpa Sabda BrahmaDocument51 pagesKalakalpa Sabda Brahmasunil sondhiNo ratings yet

- 99tata Motors Ltd. Letter of Offer 18.09.08Document403 pages99tata Motors Ltd. Letter of Offer 18.09.08Sharmilanoor Nurul BasharNo ratings yet

- Pentosan PDFDocument54 pagesPentosan PDFCinthia StephensNo ratings yet

- Effective Written CommunicationDocument3 pagesEffective Written CommunicationSudeb SarkarNo ratings yet

- Vertex OSeries v7.0 SR2 MP12 Release Notes - 5Document97 pagesVertex OSeries v7.0 SR2 MP12 Release Notes - 5Krishna MadhavaNo ratings yet

- Marinediesels - Co.uk - Members Section Starting and Reversing Sulzer ZA40 Air Start SystemDocument2 pagesMarinediesels - Co.uk - Members Section Starting and Reversing Sulzer ZA40 Air Start SystemArun SNo ratings yet

- Genshin AchievementsDocument31 pagesGenshin AchievementsHilmawan WibawantoNo ratings yet

- 09-Humble Homemade Hifi - PhleaDocument4 pages09-Humble Homemade Hifi - Phleajns0110No ratings yet

- Spill Kit ChecklistDocument1 pageSpill Kit Checklistmd rafiqueNo ratings yet

- Genesis g16Document2 pagesGenesis g16Krist UtamaNo ratings yet

- Unit I (Magnetic Field and Circuits - Electromagnetic Force and Torque)Document43 pagesUnit I (Magnetic Field and Circuits - Electromagnetic Force and Torque)UpasnaNo ratings yet

- Owner Manual - Avh-A205bt - Avh-A105dvd RC AseanDocument140 pagesOwner Manual - Avh-A205bt - Avh-A105dvd RC AseanalejandrohukNo ratings yet

- Kx15dtam Installation Manual Multi LanguageDocument5 pagesKx15dtam Installation Manual Multi Languageginesrm89No ratings yet

- How To Log DefectsDocument6 pagesHow To Log DefectsGino AnticonaNo ratings yet

- BSBWOR404 Assessment Task 1Document6 pagesBSBWOR404 Assessment Task 1SearaNo ratings yet

- Led LCD TV / LCD TV: Owner'S ManualDocument236 pagesLed LCD TV / LCD TV: Owner'S ManualAndy DFNo ratings yet

- SIP Presentation On MSMEDocument15 pagesSIP Presentation On MSMEShradha KhandareNo ratings yet

- Ec6004 Satellite Communication r2013Document2 pagesEc6004 Satellite Communication r2013Anonymous JnvCyu85No ratings yet

- Unit 1 - 18EC61Document93 pagesUnit 1 - 18EC61Pritam SarkarNo ratings yet

- Porter's Five Forces Model of Competition-1Document14 pagesPorter's Five Forces Model of Competition-1Kanika RustagiNo ratings yet

Term Structure of Interest Rates

Term Structure of Interest Rates

Uploaded by

abdulraqeeb alareqiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Term Structure of Interest Rates

Term Structure of Interest Rates

Uploaded by

abdulraqeeb alareqiCopyright:

Available Formats

____________________________________________________________________________________________________

Subject ECONOMICS

Paper No and Title 11: Money and Banking

Module No and Title 13: Theories of Term Structure of Interest Rates

Module Tag ECO_P11_M13

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

TABLE OF CONTENTS

1. Learning Outcomes

2. Introduction

3. Importance of Term Structure Analysis

4. Theories of Term Structure of Interest Rates

5. Implications of the Yield Curve for the Yield-Curve Theories

6. Summary

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

1. Learning Outcomes

After studying this module, you shall be able to:

Know about what is term structure of interest rates

Know about the importance of term structure analysis

Understand several theories of term structure of interest rate

2. Introduction

The term structure of interest rates describes the various yields to maturity (YTM) on

similar debt securities, with yields usually being higher the longer the period until

maturity. For instance, a U.S. Treasury bill with a 6-month maturity might carry a 4.5

percent yield, while a 30-year Treasury bond bought at the same time may yield a 5.5

percent return. When such a difference exists, it is known as a term premium. In U.S.,

Treasury securities are generally used to map the term structure of interest rates (i.e.,

the yield curve) because they are virtually free of default risk. However, term structures

may be computed and analyzed for any number of interest bearing instruments.

The term structure of interest rates is the differentiation of the yield of bonds with alike

risk profiles with the terms of those bonds. The yield curve is the relationship of

the yield to maturity (YTM) of bonds to the time to maturity, or more accurately, to

duration, which is sometimes referred to as the effective maturity. In most cases, bonds

with longer maturities have higher yields. However, sometimes the yield curve

becomes inverted, with short-term notes and bonds having higher yields than long-term

bonds. Sometimes, the yield curve may even be flat, where the yield is the same

irrespective of the maturity. The actual shape of the yield curve depends on economic

conditions, fiscal policies, expected forward rates, inflation, foreign exchange rates,

foreign capital inflows and outflows, credit ratings of the bonds, tax policies, and the

current state of the economy. The term structure of interest rates has 3 characteristics:

1. The change in yields of different term bonds tends to move in the similar

direction.

2. The yields on short-term bonds are more instable than long-term bonds.

3. The yields on long-term bonds tend to be higher than short-term bonds.

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

3. Importance of Term Structure Analysis

Economists and financial analysts employ term structure analysis, which frequently

involves creating or using mathematical models, for a range of applications. Some of the

most common include

forecasting future interest rates

estimating the cost of capital for discounting future cash flows

building predictive models of general economic development (e.g., to project

gross domestic product)

formulating monetary policy

estimating future inflation

understanding dynamics in financial markets

constructing a portfolio or hedging strategy

The shape of the term structure may vary from period to period, being either upward

sloping (i.e., long-term rates are higher than short-term rates), downward sloping (i.e.,

long-term rates are lower than short-term rates), or flat (long-term rates same as short-

term rates). Most often, however, the term structure is upward sloping. In addition to the

direction of the slope, term structure analysis is concerned with the steepness of the slope

at any particular time, where a greater slope signifies a larger disparity between interest

rates over some period of time. The yield curve in Figure I illustrates the nominal term

structure (that is, using the current face value and not adjusting for future inflation)

for U.S. Treasury securities based on current rates as of mid-1999.

4. Term Structure of Interest Rates: Theories

Of all the factors that influence the yields offered on debt securities, the factor that is

most difficult to understand is the term to maturity. For this reason, a more detailed

explanation of the association between term to maturity and annualized yield (referred to

as the term structure of interest rates) is necessary.

Numerous theories have been used to describe the relationship between maturity &

annualized yield of securities, including the pure expectations theory, liquidity premium

theory and segmented markets theory. Each of these theories is explained here:

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

Pure Expectations Theory

According to the pure expectations theory, the term structure of interest rates (as reflected

in the shape of the yield curve) is assessed by expectations of future interest rates.

Impact of an Expected Increase in Interest Rates

To understand how interest rate expectations can influence the yield curve, assume that

the annualized yields of short-term& long-term risk-free securities are similar; that is, the

yield curve is flat. Then assume that investors begin to believe that interest rates will rise.

They will respond by investing their funds mostly in the short term so that they can soon

invest their funds at higher yields after interest rates increase. When investors flood the

short-term market and avoid the long-term market, they may cause the yield curve to

adjust as shown in Panel A of the Exhibit. The large supply of funds in the short-term

markets will force annualized yields down. Meanwhile, the reduced supply of long-term

funds forces long-term yields up.

Though the annualized short-term yields become lower than annualized long-term yields,

investors in short-term funds are satisfied because they expect interest rates to increase.

They will make up for the lower short-term yield when the short-term securities mature,

and they reinvest at a higher rate (if interest rates rise) at maturity.

Assuming that the borrowers who plan to issue securities also expect interest rates to

increase, they will prefer to lock in the present interest rate over a long period of time.

Thus, borrowers will generally prefer to issue long-term securities rather than short-term

securities. This leads to a relatively small demand for short-term funds. Consequently,

there is descending pressure on the yield of short-term funds. There is also an increase in

demand for long-term funds by borrowers, which places upward pressure on long-term

funds. Overall, the expectation of higher interest rates changes demand for funds and

supply of funds in different maturity markets, which forces the original flat yield curve

(marked YC1) to pivot upward (counterclockwise) & become upward sloping (YC2).

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

Panel A: Impact of a Sudden Expectation of Higher Interest Rates

PANEL A: FIGURE 1(A)

PANEL A: FIGURE 1(B)

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

PANEL A: FIGURE 1 (C)

Panel B: Impact of a Sudden Expectation of Lower Interest Rates

PANEL B: FIGURE 1(D)

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

PANEL B: FIGURE 1(E)

PANEL B: FIGURE 1 (F)

Impact of an Expected Decline in Interest Rates

If investors expect interest rates to decrease in the future, they will prefer to invest in

long-term funds rather than short-term funds, because they could lock in today’s interest

rate before interest rates fall. Borrowers will prefer to borrow short-term funds so that

they can re-borrow at a lower interest rate once interest rates decline.

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

Based on the expectation of lower interest rates in the future, the supply of funds

provided by investors will be low for short-term funds and high for long-term funds. This

will place upward pressure on short-term yields and downward pressure on long-term

yields as shown in Panel B of the exhibit. Overall, the expectation of lower interest rates

causes the shape of the yield curve to pivot downward (clockwise).

Expectations about the Future Interest Structure of the Yield Curve

Rate

Higher than today’s rate Upward Slope

Same as today’s rate Flat

Lower than today’s rate Downward Slope

Liquidity Premium Theory

Some investors may prefer to own short-term rather than long-term securities because a

shorter maturity represents greater liquidity. In this case, they may be willing to hold

long-term securities only if compensated with a premium for the lower degree of

liquidity. Though long-term securities can be liquidated prior to maturity, their prices are

more sensitive to interest rate movements. Short-term securities are generally regarded to

be more liquid because they are more likely to be converted to cash without a loss in

value.

The preference for the more liquid short-term securities places an upward pressure on the

slope of a yield curve. Liquidity may be more critical factor to investors at particular

points in time, and the liquidity premium will change over time accordingly. As it does,

so will the yield curve. This is the liquidity premium theory (also referred to as liquidity

preference theory).

The exhibit combines the simultaneous existence of expectations theory and a liquidity

premium. Each graph shows different interest rate expectations by the market. Regardless

of the interest rate forecast, the yield curve is affected in a somewhat similar manner by

the liquidity premium.

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

Scenario 1: Market expects stable interest rates

FIGURE 2(A)

Scenario 2: Market expects an increase in interest rates

FIGURE 2(B)

Scenario 3: Market expects a reduction in interest rates

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

FIGURE 2(C)

Segmented Markets Theory

According to the segmented markets theory, investors and borrowers choose securities

with maturities that fulfil their anticipated needs of cash. Pension funds and life insurance

companies may generally prefer long-term investments that coincide with their long-term

liabilities. Commercial banks may prefer more short-term investments to coincide with

their short-term liabilities. If investors and borrowers participate only in the maturity

market that satisfies their particular needs, markets are segmented. That is, investors or

borrowers will shift from the long-term market to the short-term market and vice versa

only if the timing of their cash needs changes. According to the segmented markets

theory, the choice of long-term vs. short-term maturities is predetermined according to

need rather than expectations of future interest rates.

For instance, assume that most investors have funds available to invest only for a short

period of time and therefore desire to invest primarily in short-term securities. Also

assume that most borrowers need funds for a long period of time and therefore desire to

issue mostly long-term securities. The result will be downward pressure on the yield of

short-term securities and upward pressure on the yield of long-term securities. Overall,

the scenario described would create an upward-sloping yield curve.

Now consider the opposite scenario in which most investors wish to invest their funds for

a long time period, while most borrowers need funds for only a short period of time.

According to the segmented markets theory, there will be upward pressure on the yield of

shirt-term securities and downward pressure on the yield of long-term securities. If the

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

supply of funds provided by investors and the demand for funds by borrowers were better

balanced between the short-term and long-term markets, the yields of short & long-term

securities would be more similar.

A limitation of the segmented markets theory is that some borrowers & savers have the

flexibility to select among several maturity markets. Corporations that need long-term

funds may firstly obtain short-term financing if they expect interest rates to fall. Investors

with long-term funds may make short-term investments if they expect interest rates to

rise. Some investors with short-term funds available may be willing to purchase long-

term securities that have an active secondary market.

Some financial institutions focus on a particular maturity market, but others are more

flexible. Commercial banks obtain most of their funds in short-term markets but spread

their investments into short, medium and long term markets. Saving institutions have

historically focused on attracting short-term funds and lending funds for long-term

periods. If maturity markets were completely segmented, an alteration in the interest rate

in 1 market would have no influence on other markets. Yet, there is clear evidence that

interest rates among maturity markets move closely in tandem over time, proving there is

some interaction among markets, which implies that funds are being transferred across

markets. Note that this theory of segmented markets conflicts with the general

presumption of the pure expectations theory that maturity markets are perfect substitutes

for one another.

Although markets are not completely segmented, the preference for particular maturities

can affect the prices & yields of securities with different maturities and therefore affect

the yield curve’s shape. Therefore, the segmented markets theory appears to be a partial

explanation for the yield curve’s shape, but not the sole explanation.

A more flexible perspective of the segmented markets theory, called the preferred

habitat theory, offers a compromise explanation for the term structure of interest rates.

This theory proposes that though investors & borrowers may usually concentrate on a

specific natural maturity market, few events may cause them to wander from it. E.g.,

commercial banks that get mostly short-term funds may choose investments with short-

term maturities as a natural habitat. However, if they wish to benefit from an anticipated

decline in interest rates, they may select medium and long term maturities instead.

Preferred Habitat Theory acknowledges that natural maturity markets may influence the

yield curve but recognizes that interest rate expectations could entice market participants

to stray from preferred maturities.

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

Integrating the theories of the Term Structure

To illustrate how all three theories can simultaneously affect the yield curve, assume the

following conditions:

1. Investors and borrowers who select security maturities based on anticipated

interest rate movements currently expect interest rates to rise.

2. Most borrowers are in need of long-term funds, while most investors have only

short-term funds to invest.

3. Investors prefer more liquidity to less.

The first condition, related to expectations theory, suggests the existence of an upward-

sloping yield curve, other things being equal. This is shown in the exhibit as Curve E.

The segmented markets information (condition 2) also favors the upward-sloping yield-

curve. When conditions 1 and 2 are considered simultaneously, the appropriate yield

curve may look like curve E+S. The third condition relating to liquidity would then place

a higher premium on the longer-term securities because of their lower degree of liquidity.

When this condition is included with the first two, the yield curve may look like Curve

E+S+L.

Impact of simultaneous interaction of Pure Expectation, Segmented Markets and

Liquidity Premium theories

FIGURE 3

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

In this example, all conditions placed upward pressure on long-term yields relative to

short-term yields. In reality, there will sometimes be offsetting conditions, as one

condition places downward pressure on the slope of the yield curve while others place

upward pressure on slope. If condition 1 was revised to suggest the expectation of lower

interest rates in the future, this condition by itself would result in a downward-sloping

yield curve. When combined with the other conditions that favor an upward-sloping

curve. It would create a partial offsetting effect. This yield curve would exhibit a

downward slope if the effect of the interest rate expectations dominated the combined

liquidity premium and segmented markets effects. Conversely, an upward slope would

exist if the liquidity premium and segmented markets effects dominated the effects of

interest rate expectations.

5. Implications of the Yield Curve for the Yield-Curve Theories

1. Pure Expectations Theory

According to this theory, a rising term structure of rates means the market is expecting

short-term rates to rise. So if the 2-year rate is higher than the 1-year rate, rates should

rise. The market expects that short-term rates will be low or constant in the future, if the

curve is flat. A declining rate-term structure indicates the market believes that rates will

continue to decline.

2. Liquidity Preference Theory

Under this theory, the curve starts to get a little bit more bent. Since the yield curve is

upward sloping, this theory has no opinion as to where the yield curve will head. It could

continue to be upward sloping, flat, or declining, but the yield premium will increase fast

enough to continue to produce an upward curve with no concerns of short-term interest

rates. When it comes to a flat or declining term structure of rates, this suggests that rates

will continue to decline in the short end of the curve given the theory's prediction that the

yield premium will continue to raise with maturity.

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

____________________________________________________________________________________________________

3. Market Segmentations Theory

As per this theory, any type of yield curve can occur, stretching from a positive slope to

an inverted one, as well as a humped curve. A humped curve is where the yields in the

middle of the curve are higher than the short and long ends of the curve. The forthcoming

shape of the curve is going to be based on where the investors are most contented and not

where the market expects yields to go in the future.

6. Summary

As per the pure expectations theory, the term structure of interest rates (as

reflected in the shape of the yield curve) is found merely by expectations of future

interest rates

According to the pure expectations theory, the term structure of interest rates (as

reflected in the shape of the yield curve) is determined solely by expectations of

future interest rates

Liquidity may be more precarious aspect to investors at particular points in time,

and the liquidity premium will vary over time accordingly

According to the segmented markets theory, investors & borrowers choose

securities with maturities that satisfy their forecasted cash needs

A more flexible perspective of the segmented markets theory, called the

preferred habitat theory, offers a compromise explanation for the term structure

of interest rates

ECONOMICS Paper 11: Money and Banking

Module 13: Theories of Term Structure of Interest Rates

You might also like

- Fabozzi Fofmi4 Ch11 ImDocument12 pagesFabozzi Fofmi4 Ch11 ImYasir ArafatNo ratings yet

- Discussion QuestionsDocument19 pagesDiscussion QuestionsrahimNo ratings yet

- Chap 007Document17 pagesChap 007van tinh khucNo ratings yet

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementFrom EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementRating: 5 out of 5 stars5/5 (1)

- Deconstrucing The OsceDocument129 pagesDeconstrucing The OsceHas Mas100% (1)

- Policy - Co-2-034 Independent Double Check High Alert MedicationsDocument8 pagesPolicy - Co-2-034 Independent Double Check High Alert MedicationsTravel JunkyNo ratings yet

- MINI Cooper Service Manual: 2002-2006 - Table of ContentsDocument2 pagesMINI Cooper Service Manual: 2002-2006 - Table of ContentsBentley Publishers40% (5)

- Yield CurveDocument7 pagesYield CurveromanaNo ratings yet

- Activity#2Document9 pagesActivity#2Hagad, Angelica BA 2ANo ratings yet

- GW JEL DraftDocument65 pagesGW JEL DraftFirman Aditya BaskoroNo ratings yet

- Term Premia: Models and Some Stylised FactsDocument13 pagesTerm Premia: Models and Some Stylised FactssdafwetNo ratings yet

- ZinyoroDocument12 pagesZinyoroEdwin Lwandle NcubeNo ratings yet

- FIM Term ReportDocument8 pagesFIM Term ReportYousuf ShabbirNo ratings yet

- Term Structure of Interest RatesDocument8 pagesTerm Structure of Interest RatesMoud KhalfaniNo ratings yet

- Unit 3 Tutorial Questions MemoDocument5 pagesUnit 3 Tutorial Questions Memondonithando2207No ratings yet

- The Structure of Interest Rates (Note)Document18 pagesThe Structure of Interest Rates (Note)Hoi Mun100% (1)

- Investments Chapter 11Document32 pagesInvestments Chapter 11m.shehrooz23No ratings yet

- Yield Curves Three TypesDocument6 pagesYield Curves Three TypesKamran89AliNo ratings yet

- Task 1: What It IsDocument4 pagesTask 1: What It IsharishranaNo ratings yet

- Term Structure of Interest RatesDocument13 pagesTerm Structure of Interest RatesAnfal_Shaikh_3139No ratings yet

- Monetary Policy and The Term Structure of Interest Rates Monetary PolicyDocument3 pagesMonetary Policy and The Term Structure of Interest Rates Monetary PolicyNerea FrancesNo ratings yet

- Bond Yield Curve Holds Predictive PowersDocument15 pagesBond Yield Curve Holds Predictive PowersZuniButtNo ratings yet

- Running Head: Term Structure of Interest RateDocument6 pagesRunning Head: Term Structure of Interest Ratejack petersNo ratings yet

- Interest Rate DeteminationnDocument13 pagesInterest Rate DeteminationnkafiNo ratings yet

- Term Structure of Interest RatesDocument17 pagesTerm Structure of Interest RatesSudha SinghNo ratings yet

- Yield Curve and TheoriesDocument9 pagesYield Curve and TheorieskalukollasjpNo ratings yet

- Fixed Income and Credit Risk v3Document27 pagesFixed Income and Credit Risk v3FNo ratings yet

- Capital Markets Project Yield Curve Analysis: Shaheed Sukhdev College of Business StudiesDocument50 pagesCapital Markets Project Yield Curve Analysis: Shaheed Sukhdev College of Business StudiesSrijan SaxenaNo ratings yet

- Predictive Power of YIeld CurveDocument24 pagesPredictive Power of YIeld CurveRavi KumarNo ratings yet

- 4 - Term Structures TheoriesDocument15 pages4 - Term Structures Theoriesmajmmallikarachchi.mallikarachchiNo ratings yet

- A Note On Term Structure and Inflationary Expectations in Kenya - by Francis MwegaDocument14 pagesA Note On Term Structure and Inflationary Expectations in Kenya - by Francis Mwegamburu. hNo ratings yet

- Interest Rates Fortitude and ConfigurationDocument11 pagesInterest Rates Fortitude and ConfigurationEugene AlipioNo ratings yet

- TTP 0611 Can You Time LongDurationDocument3 pagesTTP 0611 Can You Time LongDurationEun Woo HaNo ratings yet

- EM4001Ch6 Gearing and Cost of CapitalDocument42 pagesEM4001Ch6 Gearing and Cost of CapitalGabriel OkuyemiNo ratings yet

- Filipino SalinDocument5 pagesFilipino SalinCherry Destreza ManzanillaNo ratings yet

- Use Duration and Convexity To Measure RiskDocument4 pagesUse Duration and Convexity To Measure RiskSreenesh PaiNo ratings yet

- Chapter 4: The Structure of Interest Rate: M OneyDocument14 pagesChapter 4: The Structure of Interest Rate: M OneyReignNo ratings yet

- Module 1 - The Role of Financial Markets and Financial IntermediariesDocument11 pagesModule 1 - The Role of Financial Markets and Financial IntermediariesAriaga CapsuPontevedraNo ratings yet

- Term Structure of Interest Rates, Spot Rate & Forward RateDocument18 pagesTerm Structure of Interest Rates, Spot Rate & Forward RateShruti Savant DodaniNo ratings yet

- DurationDocument5 pagesDurationNiño Rey LopezNo ratings yet

- 3 Forward Rate Agreements and Interest Rate Swaps: B. A. Eales, Financial Engineering © Brian Eales 2000Document2 pages3 Forward Rate Agreements and Interest Rate Swaps: B. A. Eales, Financial Engineering © Brian Eales 2000Thao NguyenNo ratings yet

- Term Structure of Interest Rates: The Theories: Abdul MunasibDocument6 pagesTerm Structure of Interest Rates: The Theories: Abdul MunasibSana NazNo ratings yet

- Advanced Financial Accounting - Interest Rates QuestionDocument12 pagesAdvanced Financial Accounting - Interest Rates Questionailiwork worksNo ratings yet

- Chapter 10 - Risk and Term Structure of Interest RatesDocument28 pagesChapter 10 - Risk and Term Structure of Interest RatesSilva, Phoebe Chates Bridget B.No ratings yet

- Interest RateDocument32 pagesInterest RateMayur N Malviya85% (13)

- Yield Curve and Its Importance: Short-Term Versus Long-Term Rates and YieldsDocument4 pagesYield Curve and Its Importance: Short-Term Versus Long-Term Rates and YieldsJulio GaziNo ratings yet

- Federal RserveDocument4 pagesFederal RserveShandyNo ratings yet

- Yield CurveDocument9 pagesYield Curvejackie555No ratings yet

- Macro Economics ProjectDocument12 pagesMacro Economics ProjectnilaykmajmudarNo ratings yet

- Math Business Combine ProjectDocument8 pagesMath Business Combine ProjecthassanzeshanhassanNo ratings yet

- The Mortgage Production LineDocument4 pagesThe Mortgage Production LinesonalicooljnNo ratings yet

- Chapter 11: Answers To Concepts in Review: Gitman/Joehnk - Fundamentals of Investing, Ninth EditionDocument4 pagesChapter 11: Answers To Concepts in Review: Gitman/Joehnk - Fundamentals of Investing, Ninth EditionCarl Ivan GambalaNo ratings yet

- U5 Risk Premium and Term Structure of Interest RatesDocument39 pagesU5 Risk Premium and Term Structure of Interest RatesJC HuamánNo ratings yet

- Unit 3 - Term Structure of Interest Rates Slides 2022Document53 pagesUnit 3 - Term Structure of Interest Rates Slides 2022ndonithando2207No ratings yet

- MacroDocument29 pagesMacrozohaibsikandarNo ratings yet

- Swap Rate PaperDocument50 pagesSwap Rate PaperAshwin R JohnNo ratings yet

- Duration PDFDocument8 pagesDuration PDFMohammad Khaled Saifullah CdcsNo ratings yet

- Govt Bonds and Yield Curve NotesDocument4 pagesGovt Bonds and Yield Curve NotesPranjalNo ratings yet

- Chapter 9 - Interest Rate and Currency Swaps (Q&A)Document5 pagesChapter 9 - Interest Rate and Currency Swaps (Q&A)Nuraisyahnadhirah MohamadtaibNo ratings yet

- Bond Pricing and Immunization Strategy - Asset Allocation in Bond InvestmentDocument8 pagesBond Pricing and Immunization Strategy - Asset Allocation in Bond InvestmentJulian Brescia2No ratings yet

- Yield CurveDocument3 pagesYield Curveapplehead2009No ratings yet

- The Big Ebook of Sustainability Reporting Frameworks - enDocument73 pagesThe Big Ebook of Sustainability Reporting Frameworks - enabdulraqeeb alareqiNo ratings yet

- What Is CSR - Corporate Social Responsibility ExplainedDocument6 pagesWhat Is CSR - Corporate Social Responsibility Explainedabdulraqeeb alareqiNo ratings yet

- 401 - Unit I - IMS MBADocument11 pages401 - Unit I - IMS MBAabdulraqeeb alareqiNo ratings yet

- Introduction To Strategic ManagementDocument28 pagesIntroduction To Strategic Managementabdulraqeeb alareqiNo ratings yet

- ValuationDocument31 pagesValuationabdulraqeeb alareqiNo ratings yet

- Risk, Types and MeasurementDocument9 pagesRisk, Types and Measurementabdulraqeeb alareqiNo ratings yet

- Areas of Tax PlanningDocument10 pagesAreas of Tax Planningabdulraqeeb alareqiNo ratings yet

- Set Off & Carry Forward of LossesDocument17 pagesSet Off & Carry Forward of Lossesabdulraqeeb alareqiNo ratings yet

- Tax Benefits Under Telecommunication ServicesDocument10 pagesTax Benefits Under Telecommunication Servicesabdulraqeeb alareqiNo ratings yet

- Lect03 - GST Numericals (Cont)Document20 pagesLect03 - GST Numericals (Cont)abdulraqeeb alareqiNo ratings yet

- Wa0028.Document6 pagesWa0028.abdulraqeeb alareqiNo ratings yet

- Composition 1 S2 2020 FinalDocument46 pagesComposition 1 S2 2020 Finalelhoussaine.nahime00No ratings yet

- Assignment 9-Ra 9184 (Ce Laws, Ethics, and Contracts)Document4 pagesAssignment 9-Ra 9184 (Ce Laws, Ethics, and Contracts)Luke MoraledaNo ratings yet

- SOLIDserver Administrator Guide 5.0.3Document1,041 pagesSOLIDserver Administrator Guide 5.0.3proutNo ratings yet

- Leson PLANDocument7 pagesLeson PLANMarivic SeverinoNo ratings yet

- Kodedkloud Instalation HardwayDocument153 pagesKodedkloud Instalation HardwayJuca LocoNo ratings yet

- Meng 310 Exam 01 Spring 2010Document4 pagesMeng 310 Exam 01 Spring 2010Abdulrahman AlzahraniNo ratings yet

- Trade WorksheetDocument11 pagesTrade WorksheetAsma KamranNo ratings yet

- Kalakalpa Sabda BrahmaDocument51 pagesKalakalpa Sabda Brahmasunil sondhiNo ratings yet

- 99tata Motors Ltd. Letter of Offer 18.09.08Document403 pages99tata Motors Ltd. Letter of Offer 18.09.08Sharmilanoor Nurul BasharNo ratings yet

- Pentosan PDFDocument54 pagesPentosan PDFCinthia StephensNo ratings yet

- Effective Written CommunicationDocument3 pagesEffective Written CommunicationSudeb SarkarNo ratings yet

- Vertex OSeries v7.0 SR2 MP12 Release Notes - 5Document97 pagesVertex OSeries v7.0 SR2 MP12 Release Notes - 5Krishna MadhavaNo ratings yet

- Marinediesels - Co.uk - Members Section Starting and Reversing Sulzer ZA40 Air Start SystemDocument2 pagesMarinediesels - Co.uk - Members Section Starting and Reversing Sulzer ZA40 Air Start SystemArun SNo ratings yet

- Genshin AchievementsDocument31 pagesGenshin AchievementsHilmawan WibawantoNo ratings yet

- 09-Humble Homemade Hifi - PhleaDocument4 pages09-Humble Homemade Hifi - Phleajns0110No ratings yet

- Spill Kit ChecklistDocument1 pageSpill Kit Checklistmd rafiqueNo ratings yet

- Genesis g16Document2 pagesGenesis g16Krist UtamaNo ratings yet

- Unit I (Magnetic Field and Circuits - Electromagnetic Force and Torque)Document43 pagesUnit I (Magnetic Field and Circuits - Electromagnetic Force and Torque)UpasnaNo ratings yet

- Owner Manual - Avh-A205bt - Avh-A105dvd RC AseanDocument140 pagesOwner Manual - Avh-A205bt - Avh-A105dvd RC AseanalejandrohukNo ratings yet

- Kx15dtam Installation Manual Multi LanguageDocument5 pagesKx15dtam Installation Manual Multi Languageginesrm89No ratings yet

- How To Log DefectsDocument6 pagesHow To Log DefectsGino AnticonaNo ratings yet

- BSBWOR404 Assessment Task 1Document6 pagesBSBWOR404 Assessment Task 1SearaNo ratings yet

- Led LCD TV / LCD TV: Owner'S ManualDocument236 pagesLed LCD TV / LCD TV: Owner'S ManualAndy DFNo ratings yet

- SIP Presentation On MSMEDocument15 pagesSIP Presentation On MSMEShradha KhandareNo ratings yet

- Ec6004 Satellite Communication r2013Document2 pagesEc6004 Satellite Communication r2013Anonymous JnvCyu85No ratings yet

- Unit 1 - 18EC61Document93 pagesUnit 1 - 18EC61Pritam SarkarNo ratings yet

- Porter's Five Forces Model of Competition-1Document14 pagesPorter's Five Forces Model of Competition-1Kanika RustagiNo ratings yet