Professional Documents

Culture Documents

ABC Chpater 1 All Answers

ABC Chpater 1 All Answers

Uploaded by

Kay Khaing WinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABC Chpater 1 All Answers

ABC Chpater 1 All Answers

Uploaded by

Kay Khaing WinCopyright:

Available Formats

MYK – Finance & Accountancy Training Level 3 - ABC

Chapter (1)

Interest

Simple Interest

Interest amount ( I )

p.a

Time period ( T ) = Number of years

eg. T = 5 years,

three year and half = 3.5 years

Six months = 6/12 = 0.5 years

Nine months = 9/12 = 0.75 years

Three months = 3/12 = 0.25 year

I=P*R*T

Interest amount (I) = Principle (P) x interest Rate(R) x Time period (T)

= $ xxx

R = I / (P * T )

Principle (P)

P = I / ( R* T)

= $ xx

Amount after/end the period = Principle + Interest amount

A=P+I

I = A- P

Principle (P) P=A-I

Daw Mon Yi Khin ( 09 256078487) Page 1

MYK – Finance & Accountancy Training Level 3 - ABC

Compound Interest

Number of years

Amount after the period (A) = Principle x ( 1 + Rate)

A=P+I

I = A- P

Question (1)

Calculate the simple interest(I=?) over 5 years (T) , of £ 12,500 (P) is loaned at the rate

of 8 ½ percent (R)per annum. Calculate also the amount owing at the end of the period

(A) =?.

Answer:

Interest amount = 12500 * 8.5% * 5

= £ 5312.5

Amount owing at the end of the period = 12500 + 5312.5 = £ 17812.5

Question (2)

A woman borrowed £ 7,400 (P) for four and a half 4.5 years (T) . The amount owing at

the end of the period was £ 9,731 (A) . What was the rate of simple interest on the loan?

Answer:

Interest amount = 9731 – 7400 = £ 2331

Interest rate = 2331 / (7400 * 4.5 )

= 0.07

=7 % per annum

Question (3)

An investor buys a bill of exchange for £ 95,000 (P) and six months (0.5 years)

later(after) it matures for £ 100,000 (A). Calculate the rate of interest per annum.

Answer:

Interest amount = 100000 – 95000 =£ 5000

Interest rate = 5000 / (95000 * 0.5 )

= 0.1053

= 10.53 % per annum

Daw Mon Yi Khin ( 09 256078487) Page 2

MYK – Finance & Accountancy Training Level 3 - ABC

Question (4)

An investor tenders £ 198,050 (P) for a £ 200,000 (A)Treasury bill which is to be

redeemed at par after 3 months (0.25 year) . Calculate the rate of simple interest per

annum.

Answer:

Interest amount = 200000 – 198050 =£ 1950

Interest rate = 1950 / (198050 * 0.25 )

= 0.394

= 3.94 % per annum

Notes :

Cash book Bank statement

Cash at bank Dr Cr

Bank overdraft Cr Dr

B kS m ဘ

Date Particular Debit Credit Balance

Withdraw / Saving / xxxx

Charges / Deposit

overdraft

Interest payable to person = ဘ person ဘ

payable to earned % saving %

Credit balance > earned %

Interest payable by person = person ဘ ဘ

payable by charged % ဘ

Debit balance > charged %

Daw Mon Yi Khin ( 09 256078487) Page 3

MYK – Finance & Accountancy Training Level 3 - ABC

Using Product method ,

Balance Dr/Cr No.of days Product

£ £

B

=Balance x No.of days Dr/Cr

-

date

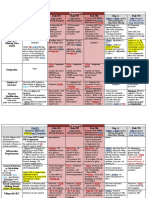

Question (5)

Miss Clarke has a bank account on which simple interest is earned at 3 ¼ percent per

annum on credit balances. Simple interest is charged by the bank at 11 percent per

annum on debit balances. Interest is calculated daily on all balances and paid/earned at

the end of the month.

The bank statement account of August is shown below.

Date Details Debit Credit Balance

£ £ £

1 Aug Balance b/d 1,403.64Cr

2 Aug Cheque 350.00 1053.64 Cr

19 Aug Cheque 1,195.00 141.36 Dr

29 Aug Deposit 2,122.83 1,981.47Cr

The balance at the August, before interest and charges is £ 1,981.47 in credit.

(a) Give your answer to the nearest penny, calculate the interest payable to, or by,

Miss Clarke on 31 August.

Daw Mon Yi Khin ( 09 256078487) Page 4

MYK – Finance & Accountancy Training Level 3 - ABC

Answer :

Balance Dr/Cr No.of days Product

£ £

1403.64 Cr 1 1403.64 Cr

1053.64 Cr 17 17911.88 Cr

141.36 Dr 10 1413.6 Dr

1981.47 Cr 3 5944.41 Cr

Total Credit = 1403.64+17911.88+5944.41 =£ 25259.93

Total Debit = £ 1413.6

£

Interest payable to Miss Clarke 2.25 Cr

=25259.93 x 3.25% / 365

Interest payable by Miss Clarke 0.43 Dr

= 1413.6 x 11% /365

Interest payable to Miss Clarke = 1.82 Cr

(b) The bank charges £ 20 for a letter to Miss Clarke telling her she is more than £ 100

overdrawn. Calculate the final balance figure.

Answer : £

Balance before interest and charges 1981.47 Cr

Interest payable to Miss Clarke 1.82 Cr

Bank charges 20 Dr

Final balance figure = 1963.29 Cr

Daw Mon Yi Khin ( 09 256078487) Page 5

MYK – Finance & Accountancy Training Level 3 - ABC

Compounded Interest

Eg:

Year 1 10000 x10% = 1000 ( interest )

Year 2 11000 x 10% = 1100 (interest )

Year 3 12100 x 10 % = 1210 (interest)

compounded annually ,

N

Amount after the period = A = P x ( 1 + R% )

N

Principle (P) P = A /( 1 + R% )

Interest rate % R% =( √ – 1 ) X 100

Question (7)

A man invests £ 5,600 at 8 % compound interest per annum. How much is the investment

worth after two years?

2

Amount after two years = 5600 x ( 1 + 8%)

=

£ 6531.84

Question (8)

A couple borrows £ 85,000 at a fixed rate of 4.25 percent compound interest per annum,

to be repaid in full after 25 years. Find the amount of the final repayment.

25

Amount of final payment = 85000 x ( 1 + 4.25% )

=£ 240613.8

Daw Mon Yi Khin ( 09 256078487) Page 6

MYK – Finance & Accountancy Training Level 3 - ABC

Question (9)

An investment account of £ 14,950 attracts 6.25 percent compound interest per annum.

How much will be in the account after 7 years if the interest is compounded annually?

How much of this is interest?

7

Amount after 7 years = 14950 x ( 1 + 6.25% )

= £ 22853.03

Interest = 22853.03 – 14950 = £ 7903.03

How much more interest would have been earned if the interest had been compounded

six-monthly?

compounded annually ,

N

A = P x (1+R)

m m

2N

m A = P x (1+R/2)

2N

m A = P x (1+R)

Compounded six monthly ,

2x7=14

Amount after 7 years = 14950 x ( 1 + 6.25%/2 )

= £ 23000.47

Interest = 23000.47 – 14950 = £ 8050.47

More interest earned = £ 8050.47 - £ 7903.03 =£ 147.44

Daw Mon Yi Khin ( 09 256078487) Page 7

MYK – Finance & Accountancy Training Level 3 - ABC

Homework:

Question (6)

M Farooq has a bank account on which simple interest is earned at 3¾ percent per

annum on credit balances. Simple interest is charged by the bank at 9 percent per annum

on debit balances.

Interest is calculated daily on all balances and paid /earned at the end of the month.

The bank statement for April is shown below

Date Details Debit Credit Balance

£ £ £

31 March Balance c/d 8,384.51Cr

6 Apr Cheque 3,350.00 5,034.51Cr

19 Apr Cheque 5,100.00 65.49 Dr

27 Apr Deposit 2,530.37 2,464.88Cr

The balance at the end of April, before interest and charges, is £ 2,464.88 in credit. M

Farooq uses the products method to check the interest he receives from the bank.

(a) Complete Table

Balance Credit or Debit Number of Days Product

£

8,384.51 Credit 5 41922.55

5,034.51 ? 13 ?

? Debit ? 523.92

? Credit 4 ?

Total debit = ?

Total credit = ?

(b) Giving your answer to the nearest penny, calculate the interest payable to M Farooq on 30

April.

(c) Calculate the final balance figure.

Daw Mon Yi Khin ( 09 256078487) Page 8

MYK – Finance & Accountancy Training Level 3 - ABC

NO. 6 Answer: (a,b)

Balance Dr/Cr Days Product

£ £

8,384.51 Cr 5 41922.55

5,034.51 Cr 13 65448.63

65.49 Dr 8 523.92

2,464.88 Cr 4 9859.52

Total debit 523.92

Total credit 117230.7

£

Interest payable to M Farooq 12.04 Cr

=117230.7x 3.75% / 365

Interest payable by Miss Clarke 0.13 Dr

= 523.92 x 9% /365

Interest payable to M Farooq = 11.91 Cr

(c) : £

Balance before interest and charges 2,464.88 Cr

Interest payable to M Farooq 11.91 Cr

Final balance figure = 2476.79 Cr

********************************************

Daw Mon Yi Khin ( 09 256078487) Page 9

MYK – Finance & Accountancy Training Level 3 - ABC

Old Questions:

1. Miss Marshall has a bank account on which simple interest is earned at 1.5% per

annum on credit balances (Cr). The bank charges simple interest at 8% per annum on

debit balances (Dr).

Interest is calculated at the end of each day on the current balance at a daily rate of

interest that is 1/365 of the annual rate, and credited or debited to the account at the

end of the month.

The account for September is shown below.

The balance at the end of September (length 30 days), before interest, is £2,810.78 in

credit.

(a) Calculate the:

(i) opening balance carried forward from 31 August (1)

opening balance carried forward = 2823.28 + 2580 =£ 5403.28

(ii) amount of the deposit made on 26 September. (1)

Amount of deposit = 2810.78 + 176.72 =

(b) Show that the interest earned from the 26 September deposit to the end of

September is £0.58, and provide a more accurate figure. (4)

Amount of interest earned for last 5 days = 2810.78 x 1.5% /365 x 5 days

= 0.57756

= £ 0.578

(c) Calculate the interest charged for the period in September when the account was in

debit. (2)

Amount of interest charged = 176.72 x 8% /365 x 14 days = £ 0.542

Daw Mon Yi Khin ( 09 256078487) Page 10

MYK – Finance & Accountancy Training Level 3 - ABC

The interest earned for the first 3 days of September is £0.666

(d) Calculate the balance at the end of September (length 30 days) after interest is paid

and charged. (3)

Amount of interest earned 4 Sep to 11 Sep =£ 2823.28 x 1.5% / 365 x 8 days

= £ 0.928

Balance at end of September after interest earned and charged

= £ 2810.78 +£ 0.666 + £ 0.928 – £ 0.542 + £ 0.578

= £ 2812 .41

The bank charges £30 for writing a letter to Miss Marshall (on 1 October) telling her that

she has been overdrawn.

(e) Calculate this charge as a multiple of the interest charged for the period in September

when the account was in debit. (2)

Bank charges as a multiple of the interest charged = 30 / 0.542 =55.35

(Total for April 2015 = 13 marks)

Daw Mon Yi Khin ( 09 256078487) Page 11

MYK – Finance & Accountancy Training Level 3 - ABC

2. Martin uses the products method to check the interest on his savings account. He

calculates that he is receiving interest at the rate of 0.0096% per day.

Calculate the:

(a) annual rate of simple interest paid to Martin (2)

Annual rate = 0.0096 % x 365

= 3.504 % per annum

(b) interest earned on a balance of £25,000

(i) for 3 days (2)

Interest earned for 3 days = 25000 x 0.0096% x 3 days

= £ 7.2

(ii) for 3 years. (2)

Interest earned for 3 years = 25000 x 3.504% x 3 years

= £ 2628

F m1J 2000 1J 201 , v fM ’ se increased from

£200,000 to £380,000.

(c) Calculate the rate of increase per annum based on simple interest. (3)

Principle = £ 200000 Amount after 15 year = £ 380000

Interest = 380000 – 200000 = £ 180000

Interest rate = 180000 / (200000 x 15 )

= 0.06

= 6 % p.a

Daw Mon Yi Khin ( 09 256078487) Page 12

MYK – Finance & Accountancy Training Level 3 - ABC

Martin believes that the increase is approximately 4.4% per annum based on compound

interest.

(d) Provide a calculation to show if Martin is correct. (3)

15

Amount after 15 year = 200000 x ( 1 +rate )

15

380000 = 20000 x (1 + rate )

Rate = √ -1

= 0.0437 ( accurate figure)

=0.044

=4.4%

Martin is correct

(e) State whether the true rate of compound interest per annum is exactly 4.4%, more

than 4.4%, or less than 4.4%. (1)

True rate is Less than 4.4 %

(Total for Question June 2015= 13 marks)

*********************************************************

Simple int

Annual rate Daily rate ÷ 365

Monthly rate ÷ 12

Six monthly ÷2

Weekly ÷ 52

rate ÷

Daily rate Annual rate x 365

Monthly rate x 12

Six monthly x2

Weekly x 52

rate

Daw Mon Yi Khin ( 09 256078487) Page 13

MYK – Finance & Accountancy Training Level 3 - ABC

3. Investor A invests £170,000 in Investment Account B and receives interest,

compounded six-monthly, at a rate of 3% per six months.

(a) Calculate the:

(i) amount in the account after four years (3)

2x4=8

Amount after 4 years = 170000 x ( 1+3%)

= £ 215350.91

(ii) portion of this amount that is interest, expressed as a percentage of the investment(3)

Interest = 215350.91 – 170000 =£ 45350.91

Interest percentage = interest x 100

Investment

= 45350.91 x 100

170000

= 26.67 %

(iii) annual rate of simple interest that would produce the same amount of interest over

this period. (2)

Annual rate = 26.67% / 4 = 6.67% per annum

A bank successfully tenders $484,000 for a $500,000 Treasury bill that runs for six

months and is to be redeemed at par.

(b) Calculate the rate of simple interest per annum received on this investment. (4)

Principle = $ 484000

Amount after six month = $ 500000

Interest amount = 500000 – 484000 = $ 16000

Interest rate = 16000

484000 x 0.5

=0.066

= 6.6%

(Total for Question Nov 2015 = 12 marks)

*********************************************************

Daw Mon Yi Khin ( 09 256078487) Page 14

MYK – Finance & Accountancy Training Level 3 - ABC

4. Eugene calculates the interest credited to his bank account for 5 days in May, when the

rate of simple interest was 2.25% per annum (assume 1 year = 365 days).

He calculates that the interest for this period is £2.97

(a) Calculate the balance in the account during this period, based on this figure. (2)

Interest amount = Balance x 2.25% /365 x 5 days

2.97 = Balance x 2.25% / 365 x 5

Balance this period = 2.97 x 365

2.25% x 5

=£ 9636

A more accurate figure for the interest for this period is £2.969439

(b) Calculate the actual balance in the account during this period. (2)

Actual Balance = 2.969439 x 365

2.25% x 5

=£ 9634.1798

= £ 9634.18

Eugene is charged 8.9% per annum simple interest on debit balances.

(c) Calculate the amount of interest charged daily on a debit balance of £550. (2)

Interest charged = 550 x 8.9% /365 = £ 0.1341

(d) Calculate the principle that will earn £41,603.68 interest, when invested at 3.3%

compound interest per annum for four years. (4)

Interest = 41603.68 , Amount after 4 year = 41603.68 + Principle

4

Amount after 4 year = Principle x ( 1+3.3%)

4

41603.68 + Principle = principle x ( 1+3.3%)

4

41603.68 = principle x [ ( 1+3.3%) -1 ]

4

Principle = 41603.68 / [ ( 1+3.3%) -1 ]

= 299999.9987

= £ 300000

Daw Mon Yi Khin ( 09 256078487) Page 15

MYK – Finance & Accountancy Training Level 3 - ABC

(e) Calculate the compound interest rate per annum that will give interest of £1,099.80

after one year on an investment of £56,400. (2)

Amount after one year = 56400 + 1099.80

=£ 57499.8

1

Amount after one year = 56400 x ( 1+ Rate )

57499.8 = 56400 x (1+ Rate )

Rate = 57499.8 / 56400 – 1

Rate = 0.0195

=1.95 %

(Total for Question April 2016= 12 marks)

*********************************************************

Compound interest

Annual rate Daily rate √

√ Monthly rate √

Six monthly √

Weekly √

rate root

compounded 1+

eg: 5% per annum to convert daily rate

1+daily rate = √

1+daily rate = 1.000133681

Daily rate = 0.000133681

=0.013368 %

Daw Mon Yi Khin ( 09 256078487) Page 16

MYK – Finance & Accountancy Training Level 3 - ABC

Daily rate Annual rate

Monthly rate

Six monthly

Weekly

rate power

Eg. Daily rate 0.012% to convert annual rate

1 + annual rate =

1 + annual rate = 1.04478

Annual rate = 0.04478

Annual rate = 4.478%

5. A v €19,000 4.6 compound interest per annum.

(a) Calculate the balance in the account after 3 years. (2)

3

Balance after 3 year = 19000 x (1+4.65%)

= € 21775.66

Taking a year as 365 days, Adnan calculates that the annual percentage rate of compound

interest is equivalent to a rate of 0.012% compound interest per day.

(b) Calculate:

(i) a more accurate figure for the rate of compound interest per day (2)

1 + daily rate = √

1 + daily rate = 1.0001245

Daily rate = 1.0001245 -1

= 0.0001245

= 0.01245%

Daw Mon Yi Khin ( 09 256078487) Page 17

MYK – Finance & Accountancy Training Level 3 - ABC

(ii) the annual percentage rate of interest equivalent to a rate of 0.012% compound

interest per day

1 + annual rate =

1 + annual rate = 1.04478

Annual rate = 0.04478

Annual rate = 4.478%

(iii) the inte €19,000 f 300 , f 0.012 compound interest

per day (3)

300

Amount after 300 days = €19,000 x (1+0.012%)

=

€ 19696.4185

Interest = € 19696.4185 - €19,000

= € 696.4185

v €19,000 f 300 , f 0.012 simple interest per

day. (2)

Interest = € 19,000 x 0.012% x 300

= € 684

(Total for Question June 2016 = 11 marks)

*********************************************************

Daw Mon Yi Khin ( 09 256078487) Page 18

You might also like

- Pearson International Primary Science Year 5 Textbook..Document157 pagesPearson International Primary Science Year 5 Textbook..Kay Khaing Win100% (3)

- P Science 6 Learner Book AnswersDocument23 pagesP Science 6 Learner Book AnswersKay Khaing Win100% (12)

- Complete Physics For Cambridge Secondary 1 Teacher's PackDocument55 pagesComplete Physics For Cambridge Secondary 1 Teacher's PackKay Khaing Win100% (2)

- Fed Securities Laws - Rule OutlineDocument30 pagesFed Securities Laws - Rule OutlineVirginia Crowson100% (12)

- Solution Manual For Introduction To Finance 17th Edition Ronald W MelicherDocument23 pagesSolution Manual For Introduction To Finance 17th Edition Ronald W MelicherJonathanLindseymepj100% (49)

- BUSANA1 Chapter 3 (2) : Annuities With Simple DataDocument95 pagesBUSANA1 Chapter 3 (2) : Annuities With Simple Data7 bit0% (1)

- Intermediate Accounting 2 Second Grading Examination: Name: Date: Professor: Section: ScoreDocument25 pagesIntermediate Accounting 2 Second Grading Examination: Name: Date: Professor: Section: ScoreNah Hamza100% (1)

- Amortization and Sinking FundDocument27 pagesAmortization and Sinking FundKelvin BarceLonNo ratings yet

- Pedrosa Excel1Document11 pagesPedrosa Excel1Madaum Elementary100% (1)

- Accrualschap 10Document33 pagesAccrualschap 10Munyaradzi Onismas ChinyukwiNo ratings yet

- Business Finance Peirson 11e CH 3Document24 pagesBusiness Finance Peirson 11e CH 3RitaNo ratings yet

- Bài tập C3Document10 pagesBài tập C3Khanh LêNo ratings yet

- Fra 3Document7 pagesFra 3Subhajyoti MukhopadhyayNo ratings yet

- Simple and Compound Interest: Concept of Time and Value OfmoneyDocument11 pagesSimple and Compound Interest: Concept of Time and Value OfmoneyUnzila AtiqNo ratings yet

- Chapter 7 SpreadsheetDocument9 pagesChapter 7 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Notes Receivable: Long QuizDocument8 pagesNotes Receivable: Long Quizfinn mertensNo ratings yet

- Content: Practice Exams: Chapter Six and Seven (Notes Receivable) Practice ProblemsDocument10 pagesContent: Practice Exams: Chapter Six and Seven (Notes Receivable) Practice ProblemsTrina Mae GarciaNo ratings yet

- Chapter Four Lecture Notes On Business MathematicsDocument24 pagesChapter Four Lecture Notes On Business MathematicsErmias Guragaw100% (3)

- Module 8 Business MathematicsDocument26 pagesModule 8 Business MathematicsMaam AprilNo ratings yet

- Quiz Chapter 5 Notes Receivable PDFDocument8 pagesQuiz Chapter 5 Notes Receivable PDFShantal kate LimNo ratings yet

- Recap of Previous LectureDocument5 pagesRecap of Previous LectureRaja Hamza rasgNo ratings yet

- TVM-Practical QuestionsDocument6 pagesTVM-Practical Questionsparag nimjeNo ratings yet

- Fin440 Chapter 6 v.2Document51 pagesFin440 Chapter 6 v.2Lutfun Nesa AyshaNo ratings yet

- Discounted Cah Flow Valuation Chapter 6Document31 pagesDiscounted Cah Flow Valuation Chapter 6Rahul KhadkaNo ratings yet

- FIN. MATHS-Question ADocument16 pagesFIN. MATHS-Question ATian HuiNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Time Value of MoneyDocument29 pagesTime Value of Moneyrohan angelNo ratings yet

- CMP Lecture 7 Construction EconomicsDocument22 pagesCMP Lecture 7 Construction EconomicsGebriel UbananNo ratings yet

- Chapter 4 - Concept Questions and Exercises StudentDocument9 pagesChapter 4 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- HW 2-SolnDocument9 pagesHW 2-SolnZhaohui ChenNo ratings yet

- Simple Discount FINALDocument23 pagesSimple Discount FINALMa Regina Orejola ReyesNo ratings yet

- CMPM Lecture 7 EconomicsDocument67 pagesCMPM Lecture 7 EconomicszednanreffreylsNo ratings yet

- Advanced Business Calculation: Professional and Business AcademyDocument54 pagesAdvanced Business Calculation: Professional and Business AcademyChit Myo HlaingNo ratings yet

- General Mathematics 2nd Quarter LectureDocument9 pagesGeneral Mathematics 2nd Quarter LectureSakamoto MiraiNo ratings yet

- Time Value of Money-ExercisesDocument15 pagesTime Value of Money-Exerciseshassan baradaNo ratings yet

- Mortgages and Other Loans: AprDocument18 pagesMortgages and Other Loans: AprJillian BeckerNo ratings yet

- BUSANA1 Chapter 3 (1) : Annuities With Simple DataDocument51 pagesBUSANA1 Chapter 3 (1) : Annuities With Simple Data7 bit100% (1)

- PDFFFFFDocument7 pagesPDFFFFFkyla manaloNo ratings yet

- Tutorial 2 SolutionsDocument4 pagesTutorial 2 SolutionsSadia R ChowdhuryNo ratings yet

- IA ReviewerDocument7 pagesIA ReviewerEg CachaperoNo ratings yet

- Quant Methods L1 (SS 1-2) AOF PDFDocument116 pagesQuant Methods L1 (SS 1-2) AOF PDFErwin NavarreteNo ratings yet

- 2017 May Exam SolutionDocument9 pages2017 May Exam SolutionSimbarashe MupfupiNo ratings yet

- Unit 4 MMDocument21 pagesUnit 4 MMChalachew EyobNo ratings yet

- CH 3Document15 pagesCH 3Gizaw BelayNo ratings yet

- GM-Q2-Module 1Document14 pagesGM-Q2-Module 1Zandria Camille Delos Santos75% (8)

- Present Value AnnuityDocument16 pagesPresent Value AnnuityRajalaxmiNo ratings yet

- Financial MathematicsDocument44 pagesFinancial MathematicsJhon Albert RobledoNo ratings yet

- Chapter - ThreeDocument19 pagesChapter - Threemagarsa hirphaNo ratings yet

- Muskan Valbani PGP/24/456Document6 pagesMuskan Valbani PGP/24/456Muskan ValbaniNo ratings yet

- Assignment 3.Document5 pagesAssignment 3.Yusuf RaharjaNo ratings yet

- Certificate in Advanced Business Calculations Level 3/series 3-2009Document18 pagesCertificate in Advanced Business Calculations Level 3/series 3-2009Hein Linn Kyaw100% (10)

- Payment Stage: Interest PayableDocument13 pagesPayment Stage: Interest Payablekrisha milloNo ratings yet

- CH 11 Time Value of MoneyDocument27 pagesCH 11 Time Value of MoneyMichelle Davinna Michael HerryNo ratings yet

- L9: Equivalence Analysis Using Effective Interest RatesDocument17 pagesL9: Equivalence Analysis Using Effective Interest RatesSajid IqbalNo ratings yet

- SeminarDocument16 pagesSeminarShairamie P. QuiapoNo ratings yet

- Assignment #1 Solution (Chapters 3 and 5)Document5 pagesAssignment #1 Solution (Chapters 3 and 5)aklank_218105No ratings yet

- What's More: Quarter 2 - Module 7: Deferred AnnuityDocument4 pagesWhat's More: Quarter 2 - Module 7: Deferred AnnuityChelsea NicoleNo ratings yet

- MC Graw Hill Chapter 11 Selected SolutionsDocument6 pagesMC Graw Hill Chapter 11 Selected SolutionspareenNo ratings yet

- Corporate Finance: Chapter 3: Time Value of MoneyDocument26 pagesCorporate Finance: Chapter 3: Time Value of Moneynaila FaizahNo ratings yet

- Adms3530f17 - Past Midterm Exam Solutions - Fall 2012Document17 pagesAdms3530f17 - Past Midterm Exam Solutions - Fall 2012Max100% (1)

- L1 IntroductionDocument21 pagesL1 Introductionwhyvictoria0812No ratings yet

- OrdinaryAnnuities NOV2020Document23 pagesOrdinaryAnnuities NOV2020meepNo ratings yet

- Ch. 4 LoansandannuitiesDocument40 pagesCh. 4 LoansandannuitiesayaanNo ratings yet

- Skinning FundsDocument12 pagesSkinning FundsNehemia T MasiyaziNo ratings yet

- My Pals ScienceDocument2 pagesMy Pals ScienceKay Khaing WinNo ratings yet

- Macmillan Math 2Document2 pagesMacmillan Math 2Kay Khaing WinNo ratings yet

- Double Entry Bookkeeping NoteDocument2 pagesDouble Entry Bookkeeping NoteKay Khaing WinNo ratings yet

- P3myanmar C+BWDocument74 pagesP3myanmar C+BWKay Khaing WinNo ratings yet

- Challenging EnglishDocument3 pagesChallenging EnglishKay Khaing WinNo ratings yet

- GE 2nd LB1 AnsDocument7 pagesGE 2nd LB1 AnsKay Khaing WinNo ratings yet

- Step by Step Mathematics 3Document207 pagesStep by Step Mathematics 3Kay Khaing WinNo ratings yet

- CPM 1 WB AnsDocument15 pagesCPM 1 WB AnsKay Khaing Win100% (2)

- Chapter-I: Derivatives (Futures & Options)Document18 pagesChapter-I: Derivatives (Futures & Options)burranareshNo ratings yet

- Gemini - Institutional Account Application - Document RequirementsDocument4 pagesGemini - Institutional Account Application - Document RequirementsEjimnkeonye DennismaryNo ratings yet

- 1.) The 4 Aspects of TradingDocument1 page1.) The 4 Aspects of Tradingrichie2885100% (1)

- Credit ControlDocument7 pagesCredit ControlR SURESH KUMAR IINo ratings yet

- Pob Notes: Reasons For Starting A BusinessDocument10 pagesPob Notes: Reasons For Starting A BusinessrohanNo ratings yet

- Lesson 3-1: - Effects of Owner'S Investment/ Withdrawal and Cash Acquisition of AssetsDocument13 pagesLesson 3-1: - Effects of Owner'S Investment/ Withdrawal and Cash Acquisition of AssetsPaul Brian BumanlagNo ratings yet

- Lipsa Pradhan (SIP PDFDocument10 pagesLipsa Pradhan (SIP PDFDebasis sahuNo ratings yet

- Markov Interest Rate Models - Hagan and WoodwardDocument28 pagesMarkov Interest Rate Models - Hagan and WoodwardlucaliberaceNo ratings yet

- 1 Risk Management 00 - 1Document34 pages1 Risk Management 00 - 1RiantyasYunelzaNo ratings yet

- First Year MBA StudentsDocument2 pagesFirst Year MBA StudentsAyush ChamariaNo ratings yet

- Financial Instrument: What Are Financial Instruments?Document9 pagesFinancial Instrument: What Are Financial Instruments?Ammara NawazNo ratings yet

- Customer Awareness Regarding Systematic Investment PlanDocument37 pagesCustomer Awareness Regarding Systematic Investment PlanRaja kamal ChNo ratings yet

- Stop Coddling The Super-Rich BuffetDocument3 pagesStop Coddling The Super-Rich BuffetSanyu LakhaniNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Microsoft Intuit Case SolutionDocument22 pagesMicrosoft Intuit Case SolutionHamid S. ParwaniNo ratings yet

- Valuation - Models - DamodaranDocument47 pagesValuation - Models - DamodaranJuan Manuel VeronNo ratings yet

- Vietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsDocument56 pagesVietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsViet HoangNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- 2.-Olectra HiddenGems Feb2021 v1Document10 pages2.-Olectra HiddenGems Feb2021 v1monilNo ratings yet

- HST4015 EA Individual Assignment Answer Sheet AY2021Document9 pagesHST4015 EA Individual Assignment Answer Sheet AY2021Shania MayNo ratings yet

- UDCF 10YR (EBITDA Exit) Template - FinboxDocument19 pagesUDCF 10YR (EBITDA Exit) Template - FinboxteenavNo ratings yet

- PDF EngDocument2 pagesPDF EngHan JaNo ratings yet

- Does Arbitrage Destabilize Foreign Exchange Markets Point YesDocument1 pageDoes Arbitrage Destabilize Foreign Exchange Markets Point Yestrilocksp SinghNo ratings yet

- SMT Annual Report 2020Document92 pagesSMT Annual Report 2020messistuffNo ratings yet

- PreliOfferDocument96 pagesPreliOfferMuhammad IbadNo ratings yet

- Morning - India 20231107 Mosl Mi PG048Document48 pagesMorning - India 20231107 Mosl Mi PG048Karthick JayNo ratings yet

- Dairy Business Analysis ProjectDocument26 pagesDairy Business Analysis ProjectGoodman HereNo ratings yet

- Sayeedh GhouseDocument17 pagesSayeedh GhouseSayeedh GhouseNo ratings yet