Professional Documents

Culture Documents

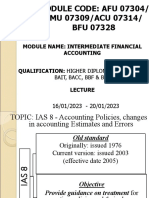

Chapter 9 IAS-8 Accounting Policies, Change in Estimates and Errors

Chapter 9 IAS-8 Accounting Policies, Change in Estimates and Errors

Uploaded by

zarnab azeemCopyright:

Available Formats

You might also like

- Chapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document49 pagesChapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (2)

- Theories of Crime CausationDocument59 pagesTheories of Crime CausationRey John Dizon88% (32)

- F.E. Campbell - Fetters Are Forever - HIT 180Document160 pagesF.E. Campbell - Fetters Are Forever - HIT 180HokusLocus63% (8)

- Ias 8 Accounting Policies, Change in Accounting Estimates and ErrorsDocument13 pagesIas 8 Accounting Policies, Change in Accounting Estimates and ErrorsSyed Munib AbdullahNo ratings yet

- Chapter 21 SolutionsDocument28 pagesChapter 21 SolutionsRachel RajanayagamNo ratings yet

- Shocking Psychological Studies and The Lessons They TeachDocument99 pagesShocking Psychological Studies and The Lessons They TeachArun Sharma100% (1)

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and Errorsmusic niNo ratings yet

- Accounting Policies, Changes in Estimates and ErrorsDocument91 pagesAccounting Policies, Changes in Estimates and Errorsnishania pillayNo ratings yet

- IAS8-Summary Notes PDFDocument8 pagesIAS8-Summary Notes PDFWaqas Younas BandukdaNo ratings yet

- Chapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesChapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsFerb CruzadaNo ratings yet

- Ias 8 - Review QuestionsDocument5 pagesIas 8 - Review QuestionssmsechuNo ratings yet

- Chapter 12 Accounting Policies, Estimate and ErrorsDocument4 pagesChapter 12 Accounting Policies, Estimate and ErrorsEllen MaskariñoNo ratings yet

- 11 Ias 8Document5 pages11 Ias 8Irtiza AbbasNo ratings yet

- Topic 6 MFRS 108 Changes in Acc Policies, Estimates, ErrorsDocument30 pagesTopic 6 MFRS 108 Changes in Acc Policies, Estimates, Errorsdini sofiaNo ratings yet

- Accounting ChangesDocument5 pagesAccounting Changeskty yjmNo ratings yet

- Conceptual Framework - PAS 8Document15 pagesConceptual Framework - PAS 8Dewdrop Mae RafananNo ratings yet

- Change in Accounting PolicyDocument5 pagesChange in Accounting PolicySandia EspejoNo ratings yet

- IAS 8 PPT FinalDocument19 pagesIAS 8 PPT Finaljaneth pallangyoNo ratings yet

- Module 6Document12 pagesModule 6Jomar Ramos QuinosNo ratings yet

- Exercise 6-1 Analyzing Discontinued OperationsDocument6 pagesExercise 6-1 Analyzing Discontinued OperationsHeldi MulyadiNo ratings yet

- Chapter 11 Acctg Policies Est. and Errors PAS 8 For MergeDocument5 pagesChapter 11 Acctg Policies Est. and Errors PAS 8 For MergeMicsjadeCastilloNo ratings yet

- Chapter 11 Accounting Policies PDFDocument8 pagesChapter 11 Accounting Policies PDFAthena LansangNo ratings yet

- Accounting Standard DiscosuresDocument24 pagesAccounting Standard DiscosuresplmahalakshmiNo ratings yet

- Module 6Document12 pagesModule 6Cha Eun WooNo ratings yet

- Section 10Document20 pagesSection 10Abata BageyuNo ratings yet

- Ias 8Document9 pagesIas 8Muhammad SaeedNo ratings yet

- Accounting Changes and ErrorsDocument31 pagesAccounting Changes and Errorslascona.christinerheaNo ratings yet

- Pas 8 SuperfinalDocument16 pagesPas 8 SuperfinalmattNo ratings yet

- Statement of Clhanges in EquityDocument21 pagesStatement of Clhanges in EquityBon juric Jr.No ratings yet

- Class 1 and 2 Chapter 3. Reporting Financial PerformanceDocument59 pagesClass 1 and 2 Chapter 3. Reporting Financial PerformanceTowhidul IslamNo ratings yet

- Income Statement and Related Information: Chapter ReviewDocument4 pagesIncome Statement and Related Information: Chapter ReviewTia WhoserNo ratings yet

- Unit Number/ Heading Learning OutcomesDocument10 pagesUnit Number/ Heading Learning OutcomesariesNo ratings yet

- Change in Accounting Policy, Estimates and Error PAS 8Document17 pagesChange in Accounting Policy, Estimates and Error PAS 8RNo ratings yet

- Accounting Standard (As) 5Document19 pagesAccounting Standard (As) 5Ashish NemaNo ratings yet

- (Acctg 112) Pas 8, 10, 12Document8 pages(Acctg 112) Pas 8, 10, 12Mae PandoraNo ratings yet

- 26 Accounting Policies Estimates and Errors s20 FinalDocument49 pages26 Accounting Policies Estimates and Errors s20 FinalMalcolmNo ratings yet

- Accounting policies, changes estimates and errors and disclosure (1)Document21 pagesAccounting policies, changes estimates and errors and disclosure (1)joehe2625No ratings yet

- AS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesDocument22 pagesAS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesbosskeyNo ratings yet

- PAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument37 pagesPAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsPeralta Renn JethroNo ratings yet

- Accounting Changes CH 22Document62 pagesAccounting Changes CH 22chloekim03No ratings yet

- IAS 8 Accounting Policies Changes in Accounting Estimates and Errors (December 2003)Document3 pagesIAS 8 Accounting Policies Changes in Accounting Estimates and Errors (December 2003)wenni89100% (3)

- 03-IAS 8 Accounting Policies, Changes in Estimates and Correction of ErrorsDocument20 pages03-IAS 8 Accounting Policies, Changes in Estimates and Correction of Errorsrfhunxaie100% (2)

- Accounting Changes and Prior Period Adjustments: REAC PHA-Finance Accounting BriefsDocument3 pagesAccounting Changes and Prior Period Adjustments: REAC PHA-Finance Accounting BriefsAnna Mae CortezNo ratings yet

- Accounting Changes and Error AnalysisDocument8 pagesAccounting Changes and Error AnalysisAlbert SteveNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument37 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita HassanNo ratings yet

- Resume ch04 AkmDocument9 pagesResume ch04 AkmRising PKN STANNo ratings yet

- 10accounting ChangesDocument31 pages10accounting ChangesLily DaniaNo ratings yet

- Accounting Theories and ProblemsDocument9 pagesAccounting Theories and ProblemsDonnelly Keith MumarNo ratings yet

- Accounting Changes and Errors: HapterDocument40 pagesAccounting Changes and Errors: HapterWilsonNo ratings yet

- Philippine Financial Reporting StandardsDocument9 pagesPhilippine Financial Reporting StandardsKristan John ZernaNo ratings yet

- Test 1 PreparationDocument11 pagesTest 1 PreparationSze ChristienyNo ratings yet

- Current Applicable International Accounting Standard (IAS) Under IASBDocument11 pagesCurrent Applicable International Accounting Standard (IAS) Under IASBEZEKIEL100% (1)

- Kieso Inter Ch22 - IfRS (Accounting Changes)Document59 pagesKieso Inter Ch22 - IfRS (Accounting Changes)Restika FajriNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument48 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsHồ Đan ThụcNo ratings yet

- Lecture Ias 8Document37 pagesLecture Ias 8SikderSharifNo ratings yet

- Advanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESDocument4 pagesAdvanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESGedie RocamoraNo ratings yet

- Accounting Changes NotesDocument5 pagesAccounting Changes NotesfunkpopsicleNo ratings yet

- PPSAS 3 - Accounting Policies Changes in Accounting EstimatesDocument24 pagesPPSAS 3 - Accounting Policies Changes in Accounting EstimatesLeonardo Don Alis CordovaNo ratings yet

- 74705bos60485 Inter p1 cp7 U2Document14 pages74705bos60485 Inter p1 cp7 U2jdeconomic06No ratings yet

- Notes To Interim Finacial StatementsDocument7 pagesNotes To Interim Finacial StatementsJhoanna Marie Manuel-AbelNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Praktikum Epid Kelompok 11Document7 pagesPraktikum Epid Kelompok 11Aldrich CNo ratings yet

- SociolinguisticsDocument21 pagesSociolinguisticsWella WilliamsNo ratings yet

- The Black Map-A New Criticism AnalysisDocument6 pagesThe Black Map-A New Criticism AnalysisxiruomaoNo ratings yet

- State of The Satellite Industry Report May12 - SIADocument26 pagesState of The Satellite Industry Report May12 - SIAPho Duc NamNo ratings yet

- Group Practice Agency AuthorizationDocument2 pagesGroup Practice Agency AuthorizationAurangzeb JadoonNo ratings yet

- Psychiatric Nursing NotesDocument13 pagesPsychiatric Nursing NotesCarlo VigoNo ratings yet

- Blue Economy CourseDocument2 pagesBlue Economy CourseKenneth FrancisNo ratings yet

- Only For Rs. 6,00,000 Lakhs : Own 10,000 SQ - Ft. of LandDocument1 pageOnly For Rs. 6,00,000 Lakhs : Own 10,000 SQ - Ft. of LandkastaNo ratings yet

- Debate Against UA PDFDocument5 pagesDebate Against UA PDFHermione Shalimar Justice CaspeNo ratings yet

- Mayank Mehta EYDocument10 pagesMayank Mehta EYyasmeenfatimak52No ratings yet

- Memorial For The Appellants-Team Code L PDFDocument44 pagesMemorial For The Appellants-Team Code L PDFAbhineet KaliaNo ratings yet

- IncotermsDocument39 pagesIncotermsVipin Singh Gautam100% (1)

- FDI and Corporate StrategyDocument15 pagesFDI and Corporate StrategyKshitij TandonNo ratings yet

- English Ancestral Homes of Noted Americans (1915)Document386 pagesEnglish Ancestral Homes of Noted Americans (1915)liketoread100% (1)

- Maimonides 0739 Ebk v6Document525 pagesMaimonides 0739 Ebk v6futurity34No ratings yet

- Profiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003Document115 pagesProfiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003National Education Policy CenterNo ratings yet

- CH 3Document41 pagesCH 3Diana BaRobNo ratings yet

- Rehabilitation Finance V AltoDocument4 pagesRehabilitation Finance V AltoChristian AnresNo ratings yet

- Answers Unit 2 IMK Part 1Document8 pagesAnswers Unit 2 IMK Part 1Vivi SamaniegoNo ratings yet

- Sp-Ishares-Nasdaq-Biotechnology-Etf-3-31 02-13-2023Document20 pagesSp-Ishares-Nasdaq-Biotechnology-Etf-3-31 02-13-2023jorge huerta durazoNo ratings yet

- Ers. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewDocument10 pagesErs. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewVolcaneum100% (2)

- Sasmo 2020 Grade 8 RankDocument7 pagesSasmo 2020 Grade 8 RankEtty SabirinNo ratings yet

- Equatorial Realty Vs Mayfair TheaterDocument2 pagesEquatorial Realty Vs Mayfair TheaterSaji Jimeno100% (1)

- Philippine Criminology Profession Act of 2018 (RADocument46 pagesPhilippine Criminology Profession Act of 2018 (RARhem Rick CorpuzNo ratings yet

- 10 Sample Paper Chennai Region 2Document11 pages10 Sample Paper Chennai Region 2Illaya BharathiNo ratings yet

- LABELDocument2 pagesLABELerinNo ratings yet

- ScarletLetter StudyGuideDocument8 pagesScarletLetter StudyGuidejongambiaNo ratings yet

Chapter 9 IAS-8 Accounting Policies, Change in Estimates and Errors

Chapter 9 IAS-8 Accounting Policies, Change in Estimates and Errors

Uploaded by

zarnab azeemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 9 IAS-8 Accounting Policies, Change in Estimates and Errors

Chapter 9 IAS-8 Accounting Policies, Change in Estimates and Errors

Uploaded by

zarnab azeemCopyright:

Available Formats

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

IAS-8 Accounting policies, changes in estimates and errors

This IAS discusses three items:

(i) Accounting policies

(ii) Change in estimates

(iii) Errors

1. Accounting Policies

When an IFRS specifically applies to a transaction, other event or condition, the accounting policy or

policies applied to that item shall be determined by applying the IFRS.

In the absence of an IFRS that specifically applies to a transaction, other event or condition,

management shall use its judgement in developing and applying an accounting policy that results in

information that is:

(a) relevant to the economic decision-making needs of users; and

(b) reliable, in that the financial statements: (i) represent faithfully (ii) reflect the economic substance

(iii) are neutral, ie free from bias; (iv) are prudent; and (v) are complete in all material respects.

1.1 Consistency of accounting policies

An entity shall select and apply its accounting policies consistently for similar transactions,

other events and conditions, unless an IFRS specifically requires or permits categorisation of

items for which different policies may be appropriate. If an IFRS requires or permits such

categorisation, an appropriate accounting policy shall be selected and applied consistently to

each category.

1.2 Changes in accounting policies

An entity shall change an accounting policy only if the change:

(a) is required by an IFRS; or

(b) results in the financial statements providing reliable and more relevant information.

1.3 The following are not changes in accounting policies

(a) the application of an accounting policy for transactions, other events or conditions

that differ in substance from those previously occurring; and

(b) the application of a new accounting policy for transactions, other events or conditions

that did not occur previously or were immaterial.

The initial application of a policy to revalue assets in accordance with IAS 16 Property, Plant

and Equipment or IAS 38 Intangible Assets is a change in an accounting policy to be dealt

with as a revaluation in accordance with IAS 16 or IAS 38, rather than in accordance with

this Standard. (i.e: prospective application)

1.4 Applying changes in accounting policies

CAF-7 Financial accounting and reporting II 176 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

(a) an entity shall account for a change in accounting policy resulting from the initial

application of an IFRS in accordance with the specific transitional provisions, if any, in that

IFRS; and

(b) when an entity changes an accounting policy upon initial application of an IFRS that does

not include specific transitional provisions applying to that change, or changes an accounting

policy voluntarily, it shall apply the change retrospectively.

1.5 What is retrospective application

Retrospective application is applying a new accounting policy to transactions, other events

and conditions as if that policy had always been applied.

The entity shall adjust the opening balance of each affected component of equity for the

earliest prior period presented and the other comparative amounts disclosed for each prior

period presented as if the new accounting policy had always been applied.

1.6 Limitations on retrospective application

When retrospective application is required, a change in accounting policy shall be applied

retrospectively except to the extent that it is impracticable to determine either the period-

specific effects or the cumulative effect of the change.

When an entity applies a new accounting policy retrospectively, it applies the new

accounting policy to comparative information for prior periods as far back as is practicable.

1.7 Disclosures

When a voluntary change in accounting policy has an effect on the current period or any

prior period, would have an effect on that period except that it is impracticable to determine

the amount of the adjustment, or might have an effect on future periods, an entity shall

disclose:

(a) the nature of the change in accounting policy;

(b) the reasons why applying the new accounting policy provides reliable and more relevant

information;

(c) for the current period and each prior period presented, to the extent practicable, the

amount of the adjustment:

(d) the amount of the adjustment relating to periods before those presented, to the extent

practicable; and

(e) Limitation on retrospective application, if any, and circumstance which led to limitation

and date from when change in accounting policy has been applied.

2. Changes in accounting estimates

As a result of the uncertainties inherent in business activities, many items in financial

statements cannot be measured with precision but can only be estimated. Estimation

involves judgements based on the latest available, reliable information. For example,

estimates may be required of:

(a) bad debts;

(b) inventory obsolescence;

(c) the fair value of financial assets or financial liabilities;

(d) the useful lives of, or expected pattern of consumption of the future economic

benefits embodied in, depreciable assets; and

CAF-7 Financial accounting and reporting II 177 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

(e) warranty obligations.

2.1 Effect of change in estimate

The effect of a change in an accounting estimate shall be recognised prospectively by

including it in profit or loss in:

(a) the period of the change, if the change affects that period only; or

(b) the period of the change and future periods, if the change affects both.

2.2 Disclosure

An entity shall disclose the nature and amount of a change in an accounting estimate that

has an effect in the current period or is expected to have an effect in future periods, except

for the disclosure of the effect on future periods when it is impracticable to estimate that

effect.

If the amount of the effect in future periods is not disclosed because estimating it is

impracticable, an entity shall disclose that fact.

3. Errors

An entity shall correct material prior period errors retrospectively in the first set of financial

statements authorized for issue after their discovery by:

(a) restating the comparative amounts for the prior period(s) presented in which the error

occurred; or

(b) if the error occurred before the earliest prior period presented, restating the opening

balances of assets, liabilities and equity for the earliest prior period presented.

3.1 Limitations on retrospective restatement

A prior period error shall be corrected by retrospective restatement except to the extent that

it is impracticable to determine either the period-specific effects or the cumulative effect of

the error.

When it is impracticable to determine the period-specific effects of an error on comparative

information for one or more prior periods presented, the entity shall restate the opening

balances of assets, liabilities and equity for the earliest period for which retrospective

restatement is practicable (which may be the current period).

Corrections of errors are distinguished from changes in accounting estimates. Accounting

estimates by their nature are approximations that may need revision as additional

information becomes known. For example, the gain or loss recognised on the outcome of a

contingency is not the correction of an error.

3.2 Disclosure of prior period errors

An entity shall disclose the following:

(a) the nature of the prior period error;

(b) for each prior period presented, to the extent practicable, the amount of the

correction:

CAF-7 Financial accounting and reporting II 178 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

(c) the amount of the correction at the beginning of the earliest prior period presented;

and

(d) if retrospective restatement is impracticable for a particular prior period, the

circumstances that led to the existence of that condition and a description of how and

from when the error has been corrected.

CAF-7 Financial accounting and reporting II 179 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Comprehensive illustration

CI-1: Chief Accountant of Careless Ltd. has prepared the following financial statements for

the year ended 30 June 2011.

Statement of Comprehensive Income

2011 2010

Rs. in 000 Rs. in 000

Sales 25,000 20,000

Cost of sales 15,000 13,000

Gross profit 10,000 7,000

Operating expenses 3,000 2,700

7,000 4,300

Income tax @ 50% 3,500 2,150

Net profit 3,500 2,150

Statement of Changes in Equity

Retained earnings

2011 2010

Rs. in 000 Rs. in 000

At the beginning of year 5,000 3,600

Net profit 3,500 2,150

8,500 5,750

Less: Dividend 1,000 750

At the end of year 7,500 5,000

During the audit it was discovered that sales for the year ended 30 June 2009 and 2010

amounting to Rs. 500 (000) and Rs. 700 (000) respectively had been omitted and have been

included in sales for the year 2011. However, relevant costs were properly accounted for

Auditor also pointed out the operating expenses of Rs.3,000 (000) included overtime for the

year 2010 amounting to Rs. 150 (000) which was approved and disbursed in August 2010

before the finalization of financial statements for the year ended 30 June 2010.

Required:

(a) How would you describe the above matters.

(b) Account for the above. Also give the necessary disclosures.

CI-2: Dynamic Ltd used to account for revenue on despatch of goods. They observed that

over the years instances of goods dispatched being rejected by customers at the time of

receipt were on the increase. Also due to unreliable courier services, quantity received by

customers was often less than the quantity dispatched. The directors, therefore, decided that

revenue should be recognized after receiving the acknowledgement from customers.

Financial statements before the change are as under:

Statement of Comprehensive Income

CAF-7 Financial accounting and reporting II 180 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

2005 2004

Rs. in 000 Rs. in 000

Sales 300,000 291,000

Cost of sales 200,000 194,000

Gross profit 100,000 97,000

Operating expenses 30,000 31,000

70,000 66,000

Income tax @ 33% 23,100 21,780

Net profit 46,900 44,220

Statement of Changes in Equity

Retained earnings

2005 2004

Rs. in 000 Rs. in 000

At the beginning of year 44,000 30,000

Net profit 46,900 44,220

90,900 74,220

Less: Dividend 40,900 30,220

50,000 44,000

Relevant amounts of goods dispatched but not received in relevant year by customers are

as under:

Rs.

30 June 2003 30,000,000

30 June 2004 35,000,000

30 June 2005 37,000,000

Required:

How would you describe the above change and do you agree with it? Account for the effect

of above and give necessary disclosures.

CI-3: Wonder Limited (WL) is engaged in the manufacturing and sale of textile machinery.

Following are the draft extracts of the statement of financial position and the income

statement for the year ended 30 June 2012:

Statement of Financial Position

2012 2011

------Rs. in million----

Property, plant and equipment 189 130

Retained earnings 166 108

Deferred tax liability 45 27

Income Statement

2012 2011

------Rs. in million----

Profit before taxation 90 120

Taxation 32 42

Profit after taxation 58 78

CAF-7 Financial accounting and reporting II 181 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Following additional information has not been taken into account in the preparation of the

above financial statements:

(i) Cost of repairs amounting to Rs. 20 million was erroneously debited to the machinery

account on 1 October 2010. The estimated useful life of the machine is 10 years.

(ii) On 1 July 2011, WL reviewed the estimated useful life of its plant and revised it from 5

years to 8 years. The plant was purchased on 1 July 2010 at a cost of Rs. 70 million.

Depreciation is provided under the straight line method. Applicable tax rate is 30%.

Required:

Prepare relevant extracts (including comparative figures) for the year ended 30 June 2012

related to the following:

(a) Statement of financial position

(b) Income statement

(c) Statement of changes in equity

(d) Correction of error note

CI-4: The following information pertains to a listed company, Fu-tech (Pakistan) Limited.

(i) Shareholders’ equity as at 1 January 2013:

Share capital (Rs. 10 each) Rs. 116 million

Retained earnings Rs. 58 million

(i) Profit after tax for the year ended 31 December 2013 amounted to Rs. 47 million.

(2012: Rs. 38 million)

(ii) In May 2013 the management discovered that inventories costing Rs. 18 million have

been misappropriated. The entire loss has been recorded in 2013. However, it is

estimated that inventories costing Rs. 13 million and Rs. 5 million were

misappropriated in the years 2012 and 2013 respectively.

(iii) Depreciation expense for the year ended 31 December 2013 included incremental

depreciation amounting to Rs. 6.5 million on account of revaluation surplus.

(iv) Right shares were issued on 15 September 2013 at Rs. 12 per share in the ratio of 1

right share for every 4 shares held by the shareholders of the company.

(v) Dividend information is as under:

2013 2012 2011

Cash dividend – Interim *18% - 10%

Cash dividend – Final 14% 15% -

Bonus shares – Final - - 16%

*interim dividend was announced before the issue of right shares.

(vi) Applicable tax rate for the company is 34%.

Required:

Prepare a statement of changes in equity for the year ended 31 December 2013 in

accordance with the requirements of the Companies Ordinance, 1984. (Show comparative

figures)

♣

CAF-7 Financial accounting and reporting II 182 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Practice Questions

PQ-1

The following information has been extracted from the financial statements of Fine Fibre

Limited (FFL) for the year ended 30 June 2013:

2013 2012

Rs. in million

Profit before tax 140 128

Tax expense: Current (39) (36)

Deferred (8) (10)

Share capital (Rs. 10 each) 30 30

Retained earnings at the end of the year 186 105

Subsequent to preparation of the draft financial statements, an error has been detected in

the financial statements for the year ended 30 June 2012 whereby the accounting

depreciation on an assembly plant was mistakenly accounted for at Rs. 21.8 million instead

of Rs. 12.8 million.

Other relevant information is as under:

(i) The assembly plant was installed on 1 July 2010 at a cost of Rs. 80 million and is

depreciated at 20% per annum using the diminishing balance method.

(ii) The error has not affected the tax depreciation which has been worked out correctly.

(iii) Applicable tax rate is 35%.

(iv) Final cash dividend for the year ended 30 June 2012 was approved at the Annual

General Meeting held on 25 September 2012 at Rs. 4 per share (2011: Rs. 5 per

share).

Required:

Prepare the following extracts (including comparative figures) from FFL’s financial

statements for the year ended 30 June 2013 in accordance with the International Financial

Reporting Standards:

(a) Retained earnings column as would appear in the statement of changes in equity; and

(b) Correction of error note.

PQ-2

Clay Pakistan Limited (CPL), a public listed company is in the process of finalizing its

accounts for the year ended 30 June 2011. The following information is available:

(i) The profit after tax and other comprehensive income for the years ended 30 June

2009, 2010 and 2011 (based on draft financial statements) are as follows:

2011 2010 2009

Rs. in million

Profit after tax 5,240 4,120 3,710

Other comprehensive income

Exchange difference on translation of foreign operations 155 120 110

Total comprehensive income 5,395 4,240 3,820

CAF-7 Financial accounting and reporting II 183 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

(ii) CPL changed the method of valuation of inventories from weighted average to first-in

first out (FIFO), for the year ended 30 June 2011. The impact of this change on

inventory valuation is given in the following table.

Year ended Impact on inventory valuation

30 June 2009 Increased by Rs. 20 million

30 June 2010 Decreased by Rs. 30 million

30 June 2011 Increased by Rs. 20 million

The above change has not been incorporated in the financial statements.

(iii) Incremental depreciation for the year ended 30 June 2010 and 2011 amounting to

Rs. 1,769 million and Rs. 1,483 million respectively was directly transferred from

surplus on revaluation of property, plant and equipment to retained earnings.

(iv) Cash dividend and bonuses declared/paid during the three years are as follows:

Cash dividend Bonus

Interim Final Interim Final

For the year ended 30 June 2009 15% 25% - -

For the year ended 30 June2010 - 20% 10% 10%

For the year ended 30 June 2011 20% 30% - -

(v) CPL follows a policy of transferring 30% of its profit after tax to general reserve.

(vi) Share capital and reserves as at 30 June 2009 and 2010 were as follows:

2010 2009

Rs. in million

Share capital 10,340 9,400

Capital reserve 3,210 3,210

Translation reserve 870 750

General reserve 10,141 8,905

Un-appropriated profit 6,242 5,410

(vii) Tax rate applicable to the company is 30%.

Required:

Prepare Statement of Changes in Equity for the year ended 30 June 2011 in accordance

with the requirements of Companies Ordinance, 1984 and International Financial Reporting

Standards.

PQ-3

CAF-7 Financial accounting and reporting II 184 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

On July 1, 2005, Humayun Chemicals Limited acquired a machine at a cost of Rs. 10 million.

The useful life of the machine and its salvage value was estimated at 5 years and Rs. 3.0

million respectively. The cost of machine is being depreciated under the straight line method.

Based on the practice followed by similar type of companies, the company has determined

that the remaining useful economic life of the machine is six years. It has also been

established that the residual value at the end of the useful life will be equal to 10% of the

cost of machine.

Required:

Compute the depreciation expenses and other adjustments (if any) required to be made in

the financial statements of the company for the year ended June 30, 2008 under each of the

following assumptions:

(i) the review of useful life and residual value was carried out on June 30, 2008;

(ii) the review of useful life and residual value was carried out on June 30, 2007 but in

the financial statements for the year then ended the depreciation expense was

erroneously recorded on the previous basis.

PQ-4

The following is an abridged profit and loss account of Mumtaz & Co.

Rs. Rs.

2004 2003

Sales 1,200,000 850,000

Cost of goods sold 900,000 680,000

Gross Profit 300,000 170,000

Selling and Administrative expenses 180,000 127,500

Profit before tax 120,000 42,500

Taxation (40%) 48,000 17,000

Profit after tax 72,000 25,500

Opening Retained Earnings 475,500 450,000

In 2004 the company decided to change its costing method of inventories from lastin-first out

(LIFO) to first-in-first out (FIFO) in order to follow the benchmark treatment of IAS 2.

The impact on the cost of inventories was as follows:

2004 2003

Closing Inventories (understated) 25,000 35,000

Required:

The company has decided to follow the benchmark treatment of IAS 8 [Net Profit or Loss for

the Period, Fundamental Errors and Changes in Accounting Policies] and has requested you

to prepare all related disclosures including the profit and loss account and statement of

retained earnings, as required under the IAS.

PQ-5

CAF-7 Financial accounting and reporting II 185 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Following is the fixed assets schedule and partial income statement of Plastic Card (Pvt)

Limited for the year ended 30 June, 2003:

Fixed Asset Schedule

Opening

AccumulatedDepreciation

W.D.V. on

Particulars Cost as on Addition Total RateDepreciation for the year

30.6.2003

Rs. Rs. Rs. % Rs. Rs. Rs.

Land 1,000,000 -- 1,000,000 -- -- --

1,000,000

Building 3,500,000 -- 3,500,000 5% 175,000 175,000

3,150,000

Plant & Machinery 56,000,000 -- 56,000,000 10% 5,600,000 5,600,000

44,800,000

Office Equipment 1,680,000 -- 1,680,000 10% 168,000 168,000

1,344,000

Vehicles 1,082,977 52,902 1,135,879 20% 216,595 227,176

692,108

Total 63,262,977 52,902 63,315,879 6,159,595 6,170,176

50,986,108

Partial Income Statement

2003 2002

Rs. Rs.

Profit before tax 5,650,000 4,560,000

Tax @ 43% (2002 : 45%) 2,429,500 2,052,000

Net profit after tax 3,220,500 2,508,000

Retained earning – opening 2,508,000 -

Retained earning – closing 5,728,500 2,508,000

The company was incorporated in the month of July 2001 and acquired assets just after

incorporation. At the time of finalizing of financial statements of the company for the year

ended June 30, 2003, it was found that the vehicle was acquired on lease having cost of Rs.

1,000,000/- and subsequent additions to vehicle are in fact, markup paid to the leasing

company. There were no other additions. Company's policy is to charge depreciation on

reducing balance method.

Required:

(a) Redraft fixed assets schedule.

(b) Prepare partial Income Statement and Statement of Changes in Equity as per related

IAS.

PQ-6

On January 1, 2001, Sigma Enterprises purchased a machine for Rs. 20,000 that had an

estimated useful life of 5 years. The accountant incorrectly charged of this machine in 2001.

the error was discovered in 2002. The company desires to use straight-line depreciation

CAF-7 Financial accounting and reporting II 186 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

method on this asset.

Required:

Pass the entry and give computation in this effect on December 31, 2002, to correct for this

error, given that the:

(i) Books have not been closed for 2002

(ii) Books have been closed for 2002

PQ-7

The list of account balance of Perseus, a limited liability company, contains the following

items at 31st December 2000:

Dr. Cr.

Rs. Rs.

Opening inventory 3,850,000

Accounts receivable ledger balances 2,980,000 1,970

Accounts payable ledger balances 14,300 1,210,400

Prepayments 770,000

Cash at bank A 940,000

Overdraft at bank B 360,000

The closing inventory amounted to Rs. 4,190,000, before allowing for the adjustments

required by items (2) and (3) below.

In the course of preparing the financial statements at 31st December 2000, the need for a

number of adjustments emerged, as detailed below:-

(i) The opening inventory was found to have been overstated by Rs. 418,000 as a result

of errors in calculations of values in the inventory sheets.

(ii) Some items included in closing inventory at cost of Rs. 16,000 were found to be

defective and were sold after the balance sheet date for Rs. 10,400. Selling costs

amounted to Rs. 600.

(iii) Goods with a sales value of Rs. 88,000 were in the hands of customers at 31 st

December 2000 on a sale or return basis. The goods had been treated as sold in the

records and the full sales value of Rs. 88,000 had been included in trade receivables.

After the balance sheet date, the goods were returned in good condition. The cost of

the goods was Rs. 66,000.

(iv) Accounts receivable amounting to Rs. 92,000 are to be written off.

(v) An allowance for doubtful debts is to be set-up for 5% of the accounts receivable

total.

(vi) The manager of the main selling outlet of Perseus is entitled, from 1 st January 2000,

to a commission of 2% of the company’s profit after charging that commission. The

profit amounted to Rs. 1,101,600 before including the commission, and after

adjusting for items (1) to (5) above. The manager has already received Rs. 25,000 on

account of the commission due during the year ended 31st December 2000.

Required:

(a) (i) Explian how adjustment should be made for the error in the opening

inventory, according to IAS-8 (Assume that it consititute a material and

fundamental amount).

(ii) State two disclosure required by IAS-8 in the financial statements at 31 st

December 2000 for the adjustment in (i) above.

(b) Show how the final figures for current assets should be presented in the balance

sheet at 31st December 2000.

CAF-7 Financial accounting and reporting II 187 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

PQ-8

During the audit of Axis Industries Limited for the year ended 30 June 2000, you observed

that 1040 liters of palm- oil, which was already sold by the company during the year 1999,

was incorrectly included in closing inventory as at 30 June 1999. Such quantity carries a

financial impact of Rs. 52,000. Extracts from the accounts are as follows:

Year ending Year ending

30 June 2000 30 June 1999

(Rs.) (Rs.)

Sales 832,000 588,000

Cost of sales (Note 1) 692,000 428,000

Pretax profit 140,000 160,000

Income Tax @ 30% 42,000 48,000

Net profit after tax 98,000 112,000

Note 1:Cost of sales for the year ended 30 June 2000 contains the above mentioned error in

the opening inventory

Note 2:Retained earnings:

As at 30 June 1998 Rs. 160,000

As at 30 June 1999 Rs. 272,000

Required:

Draft the income statement and statement of retained earnings under the treatment specified

in lAS-8, for the relevant years.

PQ-9

Zahid, a chartered accountant, has recently joined DFL as deputy manager accounts.

Financial statements for the year ending June 30, 2014 are being finalized. Extracts of draft

statements are as follows:

Extracts – income statements

2013 2013

-----------------

Rs.’000-------------

Profit before interest and tax 33,200 24,500

Finance cost 3,200 2,250

Profit before tax 30,000 22,250

Tax [30%] 9,000 6,675

Profit after tax 21,000 15,575

Extracts – statement of changes in equity (retained earnings)

Rs.’000

Balance as at 01-07-12 82,250

Profit after tax 15,575

Balance as at 30-06-13 97,825

Profit after tax 21,000

Balance as at 30-06-14 118,825

CAF-7 Financial accounting and reporting II 188 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Zahid has discovered that on July 1, 2011 DFL sold a machine to a bank for Rs. 20 million

and leased it back for its remaining life of 8 years. A gain on disposal of Rs. 4 million was

recognized immediately on disposal. Subsequently lease payments were accounted for as

operating lease. Relevant details are as follows:

- Rs. 3.749 million Payable annually in advance

- Rs. 2 million payable in respect of bargain purchase option at end of lease term

- Implicit rate on lease was 15%.

Kashif, senior manager accounts, who is also a chartered accountant, is asking Zahid to

ignore this matter. Although Kashif admits his mistake as he was not updated with

accounting standards, but he emphasizes to conceal this issue as it may affect his reputation

before top management. Furthermore Zahid’s job confirmation depends upon Kashif’s

recommendation.

Required:

(a) Prepare revised extracts of financial statements after correction of above error.

(b) Prepare a note on lease obligation for inclusion in financial statements (comparative

figures not required).

(c) Discuss the ethical issues involved in above situation and what actions are available

for Zahid.

CAF-7 Financial accounting and reporting II 189 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Solution of Practice Questions

SOLUTION NO. PQ-1 Note: All figures are in million.

(a) Fine Fibre Limited

Statement of Changes in Equity

Retained earnings

Rs.

Balance at 1st July 2011 (105 – 82 + 15) 38

Add: Profit restated 2012 (W-2) 88

Less: Dividend (30 x 5 / 10) (15)

Balance at 30th June 2012 restated 111

Add: Profit 2013 92

Less: Dividend (30 x 4 / 10) (12)

Balance at 30th June 2013 191

(b) Correction of error note:

In the year 2012, depreciation was mistakenly accounted for as 21.8 million instead

of 12.8 million. Now it has been rectified by restating last year’s figures in

comparative column. Summary of changes made is as under:

Increase / (Decrease) in 2012

Rs.

Depreciation expenses (W-1) (9)

Deferred tax expenses (W-2) 3

Profit after tax 6

Retained earnings 6

Assembly plant (W-1) 9

Provision for deferred tax 3

{Working notes}

(W-1) Calculation of depreciation:

Details Actual Wrong Difference

Rs. Rs. Rs.

Assembly plant – Cost 80 80 -

Depreciation for 2011 (16) (16) -

64 64 -

Depreciation for 2012 12.8 21.8 9 Excess

51.2 42.2

Depreciation for 2013 10.24 8.44 1.8 Less

(W-2) Correction of profit:

Details 2012 2013

Rs. Rs.

Profit before tax (128 + 9) 137 (140 – 1.8) 138.2

Tax:

Current (36) (39)

Deferred (10 + 3.15) (13.15) (8 – 0.63) (7.37)

Corrected profit 87.85 91.83

Rounded 88 92

CAF-7 Financial accounting and reporting II 190 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

SOLUTION NO. PQ-2 Note: All figures are in million

Clay Pakistan Limited

Statement of Changes in Equity

for the year end 30 June 2011

Sh. capital Cap. res. Tran. res. Gen. res. Un-app. profit

Total

Balance on 01 July 2009 (vi) 9,400 3,210 750 8,905 5,410

27,675

Adjustment of changes in accounting policy (W-1) 14 14

Balance on 01 July 2009 restated 9,400 3,210 750 8,905 5,424

27,689

Revaluation surplus adjusted (iii) 1,769

1,769

Deferred tax on revaluation surplus (1,769 x 30%) (vii) (531)

(531)

Exchange difference on translation…. (i) 120 120

Net profit (W-1) 4,085

4,085

Transferred to general reserve (4,120 x 30%) (v) 1,236 (1,236) 0

Bonus shares issued (9,400 x 10%) (iv) 940 (940) 0

Dividend (9,400 x 25%) (iv) (2,350)

(2,350)

Balance on 30 June 2010 10,340 3,210 870 10,141 6,221

30,782

Revaluation surplus adjusted (iii) 1,483

1,483

Deferred tax on revaluation surplus (1,483 x 30%) (vii) (445)

(445)

Exchange difference on translation….. (i) 155 155

Net profit (W-1) 5,275

5,275

Transferred to general reserve (5,275 x 30%) (v) 1,583 (1,583) 0

Bonus shares issued (10,340 x 10%) (iv) 1,034 (1,034) 0

Final dividend for 2009-10 (10,340 x 20%) (iv) (2,068)

(2,068)

Interim dividend for 2010-11 (11,374 x 20%) (iv) (2,275)

(2,275)

Balance on 30 June 2011 11,374 3,210 1,025 11,724 5,574

32,907

{Working notes}

(W-1)

Effect on profit due to change in accounting policy:

30.06.2009 30.06.2010 30.06.2011

Increase by Rs. 20 million in year 30.06.2009 (ii) 20 (20)

Decrease by Rs. 30 million in year 30.06.2010 (ii) (30) 30

Increase by Rs. 20 million in year 30.06.2011 (ii) 20

Total profit effect 20 (50) 50

Tax deduction (30%) (vii) (6) 15 (15)

Total profit effect after tax 14 (35) 35

Profit after tax before adjustment (i) 4,120 5,240

Profit after tax after adjustment 4,085 5,275

SOLUTION NO.PQ-3

CAF-7 Financial accounting and reporting II 191 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

(i) Profit and Loss Account

2008 2007

Depreciation Expense (W-1) 1.03 1.40

Balance Sheet

2008 2007

Machine – Cost 10 10

Machine – Accumulated Depreciation (3.83) (2.80)

6.17 7.20

(ii) Profit & Loss Account

2008 2007

Depreciation Expense (W-2) 1.27 1.27

Balance Sheet

2008 2007

Machine – Cost 10 10

Machine – Accumulated Depreciation (W-2) (3.94) (2.67)

6.06 7.33

As the depreciation for 2007 has been recorded erroneously on the previous estimates, it

should be rectified by adjusting the comparative figures for 2007 only because error

occurred in that period. Therefore comparative figures for year 2007 have been restated as

per IAS -8 to rectify the error.

{Working notes}

(W-1)

10 - 3

Depreciation for a year = 5

= 1.40 per year

Depreciation for two years (2006 and 2007) = 1.40 x 2

= 2.80

Depreciation for 2008 (based on new estimates =

Cost - Accumulated Depreciation - New Salvage Value

Revised Life

10 - 2.8 - 1 *

= 6

= 1.03 per year

*(10 x 10 %) = 1

(W-2)

10 - 3

Dep. for first year (based on original estimates) = 5

= 1.40

Depreciation on new estimates =

Cost - Accumulated Depreciation - New Salvage Value

Revised Life

10 - 1.4 - 1 **

= 6

= 1.27 per year

**(10 x 10 %) = 0.86

SOLUTION NO.PQ-4

Mumtaz& Co.

CAF-7 Financial accounting and reporting II 192 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Profit & Loss Account

For the Year Ended 2004

(Restated)

2004 2003

Rs. Rs.

Sales 1,200,000 850,000

Cost of sales (W-1) (910,000) (645,000)

Gross profit 290,000 205,000

Selling and Admin. Expense(180,000) (127,500)

Profit before tax 110,000 77,500

Taxation @ 40% (44,000) (31,000)

Profit after tax 66,000 46,500

Mumtaz& Co.

Statement of Retained Earnings

For the Year Ended 2004

Rs.

Balance as at year ended 2002450,000

Add: Profit for 2003 46,500

Balance as at year ended 2003496,500

Add: Profit for 2004 66,000

Balance as at year ended 2004 562,500

Disclosures:

(a) Method of valuation of cost of inventories has been changed from LIFO to FIFO for

better presentation of inventories.

(b) As a result of change in policy, the closing stock recorded for the years 2004 and

2003 has resulted in understatement of Rs. 25,000 and Rs. 35,000 respectively.

Therefore by increasing the stocks, the cost of goods sold for the current year has

been increased by Rs. 10,000 and for the last year has been decreased by Rs.

35,000.

(c) Comparative information has been restated.

SOLUTION NO.PQ-5

(a) Plastic Card (Pvt.) Limited

Fixed Assets Schedule

Plant and Office

Cost: Land Building Vehicles

Machinery Equipment

3,500,00

As onJuly1, 2002 1,000,000 56,000,000 1,680,000 1,000,000

0

Additions /(Deletions) _______- _______- ________- _______- _______-

3,500,00

As onJune 30, 2003 1,000,000 56,000,000 1,680,000 1,000,000

0

Rate % - 5 10 10 20

Accumulated

Depreciation:

CAF-7 Financial accounting and reporting II 193 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

As onJuly1, 2002 - 175,000 5,600,000 168,000 200,000

Adjustments - - - -

For the Year _______- 166,250 5,040,000 151,200 160,000

As onJune 30, 2003 _______- 341,250 10,640,000 319,200 360,000

3,158,75

Net Book Value 1,000,000 45,360,000 1,360,800 640,000

0

There were two errors in the schedule i.e. mark up paid on lease of vehicles were capitalized

and the method followed for charging depreciation in 2003 was straight line method instead

of reducing balance method.

(b) Plastic Card (Pvt.) Limited

Profit and Loss Account for the year ended 2003 (Partial)

2003 2002

Rs. Rs.

Profit before tax 5,650,000 4,560,000

Add: Expenses overcharged 599,824 -

Less: Expenses Undercharged - (66,382)

6,249,824 4,493,618

Less: Tax @ 43% (2002 @ 45 %) (2,687,424) (2,022,128)

Net profit after tax 3,562,400 2,471,490

Plastic Card (Pvt.) Limited

Statement of Changes in Equity

Rs.

Balance at June 30, 2001 -

Add: Profit for the year – 2002 2,471,490

Balance at June 30, 2002 2,471,490

Add: Profit for the year – 20033,562,400

Balance at June 30, 2003 6,033,890

{Working notes}

(W-1)

Accumulated Depreciation – Vehicles

2001 Balance b/d -

2002 Balance c/d 200,000 2002 Depreciation 200,000

200,000 200,000

2002 Balance b/d 200,000

2003 Balance c/d 360,000 2003 Depreciation 160,000

360,000 360,000

(W-2)

Calculation of Correct Expenses for Year 2002

Mark – up not charged rather capitalized 82,977

Less: Depreciation on Vehicles charged in Excess (216,595 – 200,000)

(16,595)

Expenses undercharged in 200266,382

(W-3)

Calculation of Correct Expenses for Year 2003

Depreciation on all assets charged in excess (6,170,176 – 5,517,450) 652,726

CAF-7 Financial accounting and reporting II 194 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Less: Mark – up not charged rather capitalized (52,902)

Expenses overcharged in 2003599,824

SOLUTION NO.PQ-6

(i) Entries when books have not been closed for 2002:

Machinery 20,000

Accumulated depreciation 4,000

Retained Earnings 16,000

(Reversing the effect of charging machinery to expenses and also charging

depreciationexpense for year 2001 on straight line method.)

Depreciation 4,000

Accumulated depreciation 4,000

(Charging Depreciation for the year 2002 on straight line method)

(ii) Entries when books have been closed:

Machinery 20,000

Accumulated depreciation 8,000

Retained Earnings 12,000

(Rectification the effect of charging machinery to expenses and also charging

depreciationfor the years 2001 and 2002 on straight line.)

Note 1:Books closed means financial statements have been prepared and closing entries

have been recorded.

SOLUTION NO.PQ-7

(a) (i) The opening balance of retained earnings should be adjusted in the

statement of changes in equity. Comparative information should be restated,

unless it is impracticable to do so.

(ii) IAS 8 requires the disclosures of:

The nature of the fundamental error;

The amount of the correction for the current period and for each prior

period presented;

The fact that comparative information has been restated or that it is

impracticable to do so.

(b) Current Assets:

Rs.

Inventory (W-1) 4,249,800

Trade receivable (W-2) 2,660,000

Debit balance of account Payable 14,300

Prepayments (W-3) 748,400

Cash 940,000

{Working notes}

(W-1)

Correct Valuation of Closing Inventory

Rs.

As per given before adjustments4,190,000

Less:Reduction to NRV (6,200)

Add:Goods on sale or return basis 66,000

Correct valuation of closing inventory 4,249,800

CAF-7 Financial accounting and reporting II 195 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Journal Entries

Trading 6,200

Stock 6,200

(Stock costing 16,000 has been written down to NRV of 10,400 – 600 =

9,800)

Stock 66,000

Trading 66,000

(Goods on sale or return basis returned after balance sheet date)

(W-2)

Adjustments regarding Accounts Receivables

Rs. Rs.

As originally stated before adjustments 2,980,000

Less:Goods on sale or return basis (88,000)

Bad debts (92,000) (180,000)

2,800,000

Less:Provision for bad debts @ 5% of 2,800,000 (140,000)

2,660,000

Journal Entries

Sales 88,000

Accounts Receivables 88,000

(Goods on sales or return basis being reversed)

Bad debts 92,000

Trade Receivables 92,000

(Bad Debts being recorded)

Bad debts 140,000

Provision for doubtful debts 140,000

(Provision recorded @ 5% of Account Receivables)

(W-3)

Prepayments

As originally stated 770,000

Less: Commission Expenses (W-3.1) (21,600)

748,400

(W-3.1)

Profit bfore allowing commission

102

x2

Commission expense =

1,101,600

102

x2

=

= 21,600

Percentage

Note: We shall multiply the profit with fraction 100 + percentage when the

words “After Charging” are used.

Journal Entries

Commission expense 21,600

Prepayments 21,600

(Being the commission payable to manager recorded)

SOLUTION NO.PQ-8

Axis industries Limited

CAF-7 Financial accounting and reporting II 196 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Income Statement (Extract)

30.06.2000 30.06.1999

Rs. Rs.

Sales 832,000 588,000

Cost of sales (Note-1) (640,000) (480,000)

Pretax profit 192,000 108,000

Income tax @ 30% (57,600) (32,400)

Net profit after tax 134,400 75,600

Note to the income Statement

1040 litres of palm oil which was sold by the company during year 1999, was incorrectly

included in the closing inventory as at June 30, 1999, such quantity carried a financial impact

of Rs. 52,000. The error has now been corrected by increasing cost of goods sold for the

year ending 1999 by 52,000 and by decreasing the cost of goods sold for the year ending

2000 by 52,000.

Axis industries Limited

Statement of Retained Earnings

Share Retained

capital Earnings Total

Rs. Rs. Rs.

Balance as at 30-06-1998 - 160,000 160,000

Profit as restated for year ending 30.6.99 - 75,600 112,000

Balance as at 30-06-1999 - 235,600 272,000

Profit as restated for year ending 30.6.00 - 134,400 134,400

Balance as at 30-06-2000 - 370,000 370,000

SOLUTION NO.PQ-9

(a)

INCOME STATEMENT - Extracts

2014 2013

------- Rs.'000 ------

Restated

PBIT (W-

1) 34,949 26,249

Finance cost (W-2) (5,215) (4,491)

PBT 29,734 21,758

Tax 30% (8,920) (6,527)

PAT 20,814 15,231

SOCE - Extracts

Rs.'000

Balance as at 01-07-

12 82,250

CAF-7 Financial accounting and reporting II 197 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Adj. for prior year error (W-3) (3,282)

Balance as at 01-07-12 restated 78,968

PAT - restated 15,231

Balance as at 30-06-13 – restated 94,199

PAT 20,814

Balance as at 30-06-

14 115,013

W-1 PBIT 2014 2013

As per question 33,200 24,500

Gain on disposal [4,000 / 8] 500 500

Rental charged as expense 3,749 3,749

Depreciation on leased asset

[20,000 / 8] (2,500) (2,500)

34,949 26,249

W-2 Finance cost 2014 2013

As per question 3,200 2,250

finance charge [W-4] 2,015 2,241

5,215 4,491

W-3 Adj. for prior year error Rs.'000

Gain deferred (4,000)

Deferred gain amortized [4,000 /8] 500

Depreciation on leased asset

[20,000 / 8] (2,500)

Rental charged as expense 3,749

finance charge [W-4] (2,438)

(4,689)

Net of tax (3,282)

(b)

NOTES TO THE

ACCOUNTS

Lease obligation

Lease term is 8 years and instalment is payable annually on every July 1st. Implicit rate is

15%.

Reconciliation

PV of

MLP FC MLP

Not later than 1 year 3,749 2,015 1,734

Later than 1 year but not 16,996 5,298 11,698

CAF-7 Financial accounting and reporting II 198 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

later than 5 years

20,745 7,313 13,432

W-4 Lease schedule

Date Open. Bal. Payment Interest Principal Clos. Bal.

01-Jul-11 20,000 3,749 - 3,749 16,251

01-Jul-12 16,251 3,749 2,438 1,311 14,940

01-Jul-13 14,940 3,749 2,241 1,508 13,432

01-Jul-14 13,432 3,749 2,015 1,734 11,698

01-Jul-15 11,698 3,749 1,755 1,994 9,703

01-Jul-16 9,703 3,749 1,455 2,293 7,410

01-Jul-17 7,410 3,749 1,111 2,637 4,772

01-Jul-18 4,772 3,749 716 3,033 1,739

30-Jun-19 1,739 2,000 261 1,739 0

CAF-7 Financial accounting and reporting II 199 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Past Papers

PP-1

The following information pertains to draft financial statements of Pak Ocean Limited (POL)

for the year ended 31 December 2014.

(i)

2014 2013

------ Rs. in million ------

Profit after tax 78 52

Other comprehensive income 12 (5)

Incremental depreciation on revaluation

of property, plant and equipment 1.5 2.3

(ii) Installation of an assembly plant was completed in December 2012 at a cost of Rs. 60

million and it was ready for use on 1 February 2013. However, depreciation for the

year ended 31 December 2013 amounting to Rs. 4.5 million was worked out from the

date of production i.e. 1 April 2013. The mistake was corrected by adjusting the profit

and loss account for the year ended 31 December 2014.

(iii) Shareholders' equity as at 1 January 2013 was as follows:

Rs. in million

Share capital (Rs. 100 each) 200

Retained earnings 4

On 30 November 2014, POL issued 25% right shares to its ordinary shareholders at Rs. 120

per share.

(iv) Cash dividend and bonuses declared/paid during the last three years:

For the year ended Final *Interim

Cash Bonus Cash Bonus

31 December 2012 – 15% 16% –

31 December 2013 18% – 20% –

31 December 2014 – 25% – 10%

*Declared with half yearly accounts

Required:

Prepare Statement of Changes in Equity for the year ended 31 December 2014 in

accordance with the requirements of the Companies Ordinance, 1984 and International

Financial Reporting Standards. (Ignore taxation) (Spring 15, Q-4, Marks-15)

PP-2

The following information has been extracted from the draft financial statements of Himalaya

Woods Limited (HWL) for the year ended 30 June 2015:

CAF-7 Financial accounting and reporting II 200 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Statement of financial position as at 30 June 2015

Equity and liabilities 2015 2014 Assets 2015 2014

Rs. in million Rs. in million

Share capital (Rs. 100 2,500 2,500 Property, plant 4,261 3,773

each) and equipment

Retained earnings 2,450 2,058 Stock in trade 835 795

Trade and other payables 740 560 Trade debts - net 650 585

Taxation 70 52 Cash and bank 14 17

balances

5,760 5,170 5,760 5,170

Statement of comprehensive income for the year ended 30 June 2015

2015 2014

Rs. in million

Sales revenue 20,000 15,520

Cost of sales (14,000) (10,000)

Operating expenses (5,406) (4,764)

Taxation at 34% (202) (257)

Profit after taxation 392 499

Following matters are under consideration for finalisation of the financial statements:

(i) Previous year in June 2014, goods delivered on ‘sale or return basis’ were erroneously

recorded as sale at Rs. 35 million (cost plus 40%). In July 2014, 35% of these goods

were returned by the customers and debited to sales return account.

(ii) A customer owing Rs. 20 million as on 30 June 2015 was declared bankrupt on 1

August 2015. HWL estimates that 40% of the debt would be received on liquidation.

(iii) HWL maintains a provision for doubtful debts at 4% of trade debts.

(iv) Retained earnings balance as at 30 June 2013 amounted to Rs. 1,559 million.

Required:

In accordance with the requirements of International Financial Reporting Standards,

prepare the following:

(a) Statement of financial position as at 30 June 2015

(b) Statement of comprehensive income for the year ended 30 June 2015

(c) Statement of changes in equity for the year ended 30 June 2015 (Aut 15, Q-1, Marks-18)

(Show comparative figures. Ignore deferred tax implications and notes to the financial

statements)

PP-3

The following information has been taken from the financial statements of Asif Engineering

Limited (AEL) for the year ended 31 December 2015:

2015 (draft) 2014 2013

---------- Rs. in million ----------

Property, plant equipment 2,430 2,402 2,105

Stores and spares 73 80 70

Retained earnings as at 31 December 353 224 101

Net profit 129 123 112

CAF-7 Financial accounting and reporting II 201 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

In the above financial statements, AEL has recognised consumption of spare parts as

expense. AEL has now decided to change its above policy and classify consumption of

spares having useful life of more than one year as capital spares under property, plant and

equipment.

Following information pertains to capital spares consumed during the past three years:

Year ended Parts issued during the Useful life of the issued

year Rs. in million parts

31 December 2013 55 5 years

31 December 2014 39 3 years

31 December 2015 44 4 years

Depreciation on these parts is to be charged using straight line method over its useful life.

Required:

In accordance with the requirements of International Financial Reporting Standards, prepare

the revised extracts (including comparative figures) of the following:

(a) Statement of financial position as at 31 December 2015 (04)

(b) Statement of comprehensive income for the year ended 31 December 2015 (03)

(c) Statement of changes in equity for the year ended 31 December 2015 (03) (Ignore

taxation) (Spring 16, Q-7, Marks-10)

PP-4

Chand Paints Limited (CPL) is engaged in the manufacturing of chemicals and paints. In

April 2016 it was discovered that certain errors had been made in the financial statements

for the year ended 30 June 2015. The errors were corrected in 2016. The details are as

follows:

2016 (Draft) 2015 After 2015

correction Audited

of errors

-------- Rs. in million --------

Statement of comprehensive income

Sales tax, commission and discounts (7,939) (8,246) (7,916)

Cost of sales (45,508) (44,606) (44,633)

Selling and distribution expenses (2,940) (2,635) (2,441)

Administration expenses (2,356) (2,254) (2,149)

Other operating charges (495) (467) (515)

Other operating income 920 427 509

Profit for the year 4,089 3,723 4,359

Statement of financial position

Trade and other receivables 1,839 1,613 2,025

Trade and other payables 11,600 8,894 8,670

The share capital and un-appropriated profit of CPL as on 1 July 2014 was Rs. 10,400

million and Rs. 19,089 million respectively.

CAF-7 Financial accounting and reporting II 202 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

The details of dividend declared are as follows:

2016 2015

Cash dividend – Interim 10% 5%

– Final 15% 10%

Required:

(a) Prepare a correction of error note to be included in the financial statements for the year

ended 30 June 2016. (Ignore earnings per share and taxation) (10)

(b) Prepare the statement of changes in equity for the year ended 30 June 2016. (08)

(Aut 16, Q-4, Marks-18)

PP-5

Following information has been extracted from the draft financial statements of Marvellous

Limited (ML) for the year ended 30 June 2017:

Statement of financial position

2017 2016

Rs. in million

Property, plant and equipment 700 612

Retained earnings 275 240

Deferred tax liability 58 52

Provision for taxation 12 16

Statement of profit or loss

Profit before taxation 65 85

Taxation 30 25

Profit after taxation 35 60

The following matters are under consideration of the management:

It was identified that ML’s obligation to incur decommissioning cost related to a plant has not

been recognised. The plant was acquired on 1 July 2014 and had been depreciated on

straight line basis over a useful life of four years. The expected cost of decommissioning at

the end of the life is Rs. 50 million. Applicable discount rate is 8%.

In view of significant change in the expected pattern of economic benefits from an item of

the equipment, it has been decided to change the depreciation method from reducing

balance to straight line. The equipment was purchased on 1 July 2015 at a cost of Rs. 80

million having estimated useful life of 5 years and residual value of Rs. 16 million. The

depreciation at the rate of 27.5% on reducing balance method is included in the above draft

financial statements.

The following balances pertain to ML’s statement of financial position as on 30 June 2015:

CAF-7 Financial accounting and reporting II 203 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

Rs. in million

Property, plant and equipment 650

Retained earnings 180

Deferred tax liability 40

Provision for taxation 24

Applicable tax rate is 30%. Tax authorities consider decommissioning cost as an expense

when paid.

Required:

Prepare extracts from the following (including comparative figures) for the year ended

30 June 2017:

(a) Statement of financial position (08)

(b) Statement of profit or loss (03)

(c) Correction of error note (06) (Aut 17, Q-6, Marks-17)

PP-6

For the purpose of preparation of statement of changes in equity for the year ended 31

December 2017, Daffodil Limited (DL) has extracted the following information:

2017 2016 2015

Draft Audited Audited

Rs.in million

Net profit 650 318 214

Transfer to general reserves 112 - 141

Transfer of incremental depreciation - 49 55

Final cash dividend - - 7.5%

2017 2016 2015

Draft Audited Audited

Net profit 650 318 214

Transfer to general reserves 112 - 141

Transfer of incremental depreciation - 49 55

Final cash dividend - - 7.5%

Additional information:

(i) Details of share issues:

25% right shares were issued on 1 May 2016 at Rs. 18 per share. The market price

per share immediately before the entitlement date was also Rs. 18 per share.

A bonus issue of 10% was made on 1 April 2017 as final dividend for 2016.

50 million right shares were issued on 1 July 2017 at Rs. 15 per share. The market

price per share immediately before the entitlement date was Rs. 25 per share.

A bonus issue of 15% was made on 1 September 2017 as interim dividend.

CAF-7 Financial accounting and reporting II 204 Anjum Maqsood - ACA

Chapter - 9 IAS-8 Accounting policies, change in estimates and errors

(ii) After preparing draft financial statements, it was discovered that depreciation on a

plant costing Rs. 700 million has been charged @ 25% under reducing balance

method, from the date of commencement of manufacturing i.e. 1 July 2014. However,

the plant was available for use on 1 February 2014.

(iii) Share capital and reserves as at 31 December:

2015 2014

------ Rs. in million ------

Ordinary share capital (Rs. 10 each) 1,600 1,600

General reserves 1,850 1,709

Retained earnings 1,430 1,302

Required:

Prepare DL’s statement of changes in equity for the year ended 31 December 2017 along

with comparative figures. (Ignore taxation) (Spr 18, Q-1, Marks-14)

(a) Using the information given in Question no. 1 above, compute DL’s basic earnings per

share for the year ended 31 December 2017 along with the comparative figure. (08)

(b) Explain how dividend on preference shares is dealt with while computing basic EPS. (03)

(Spring 18, Q-2, Marks-08)

CAF-7 Financial accounting and reporting II 205 Anjum Maqsood - ACA

You might also like

- Chapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document49 pagesChapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (2)

- Theories of Crime CausationDocument59 pagesTheories of Crime CausationRey John Dizon88% (32)

- F.E. Campbell - Fetters Are Forever - HIT 180Document160 pagesF.E. Campbell - Fetters Are Forever - HIT 180HokusLocus63% (8)

- Ias 8 Accounting Policies, Change in Accounting Estimates and ErrorsDocument13 pagesIas 8 Accounting Policies, Change in Accounting Estimates and ErrorsSyed Munib AbdullahNo ratings yet

- Chapter 21 SolutionsDocument28 pagesChapter 21 SolutionsRachel RajanayagamNo ratings yet

- Shocking Psychological Studies and The Lessons They TeachDocument99 pagesShocking Psychological Studies and The Lessons They TeachArun Sharma100% (1)

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and Errorsmusic niNo ratings yet

- Accounting Policies, Changes in Estimates and ErrorsDocument91 pagesAccounting Policies, Changes in Estimates and Errorsnishania pillayNo ratings yet

- IAS8-Summary Notes PDFDocument8 pagesIAS8-Summary Notes PDFWaqas Younas BandukdaNo ratings yet

- Chapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesChapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsFerb CruzadaNo ratings yet

- Ias 8 - Review QuestionsDocument5 pagesIas 8 - Review QuestionssmsechuNo ratings yet

- Chapter 12 Accounting Policies, Estimate and ErrorsDocument4 pagesChapter 12 Accounting Policies, Estimate and ErrorsEllen MaskariñoNo ratings yet

- 11 Ias 8Document5 pages11 Ias 8Irtiza AbbasNo ratings yet

- Topic 6 MFRS 108 Changes in Acc Policies, Estimates, ErrorsDocument30 pagesTopic 6 MFRS 108 Changes in Acc Policies, Estimates, Errorsdini sofiaNo ratings yet

- Accounting ChangesDocument5 pagesAccounting Changeskty yjmNo ratings yet

- Conceptual Framework - PAS 8Document15 pagesConceptual Framework - PAS 8Dewdrop Mae RafananNo ratings yet

- Change in Accounting PolicyDocument5 pagesChange in Accounting PolicySandia EspejoNo ratings yet

- IAS 8 PPT FinalDocument19 pagesIAS 8 PPT Finaljaneth pallangyoNo ratings yet

- Module 6Document12 pagesModule 6Jomar Ramos QuinosNo ratings yet

- Exercise 6-1 Analyzing Discontinued OperationsDocument6 pagesExercise 6-1 Analyzing Discontinued OperationsHeldi MulyadiNo ratings yet

- Chapter 11 Acctg Policies Est. and Errors PAS 8 For MergeDocument5 pagesChapter 11 Acctg Policies Est. and Errors PAS 8 For MergeMicsjadeCastilloNo ratings yet

- Chapter 11 Accounting Policies PDFDocument8 pagesChapter 11 Accounting Policies PDFAthena LansangNo ratings yet

- Accounting Standard DiscosuresDocument24 pagesAccounting Standard DiscosuresplmahalakshmiNo ratings yet

- Module 6Document12 pagesModule 6Cha Eun WooNo ratings yet

- Section 10Document20 pagesSection 10Abata BageyuNo ratings yet

- Ias 8Document9 pagesIas 8Muhammad SaeedNo ratings yet

- Accounting Changes and ErrorsDocument31 pagesAccounting Changes and Errorslascona.christinerheaNo ratings yet

- Pas 8 SuperfinalDocument16 pagesPas 8 SuperfinalmattNo ratings yet

- Statement of Clhanges in EquityDocument21 pagesStatement of Clhanges in EquityBon juric Jr.No ratings yet

- Class 1 and 2 Chapter 3. Reporting Financial PerformanceDocument59 pagesClass 1 and 2 Chapter 3. Reporting Financial PerformanceTowhidul IslamNo ratings yet

- Income Statement and Related Information: Chapter ReviewDocument4 pagesIncome Statement and Related Information: Chapter ReviewTia WhoserNo ratings yet

- Unit Number/ Heading Learning OutcomesDocument10 pagesUnit Number/ Heading Learning OutcomesariesNo ratings yet

- Change in Accounting Policy, Estimates and Error PAS 8Document17 pagesChange in Accounting Policy, Estimates and Error PAS 8RNo ratings yet

- Accounting Standard (As) 5Document19 pagesAccounting Standard (As) 5Ashish NemaNo ratings yet

- (Acctg 112) Pas 8, 10, 12Document8 pages(Acctg 112) Pas 8, 10, 12Mae PandoraNo ratings yet

- 26 Accounting Policies Estimates and Errors s20 FinalDocument49 pages26 Accounting Policies Estimates and Errors s20 FinalMalcolmNo ratings yet

- Accounting policies, changes estimates and errors and disclosure (1)Document21 pagesAccounting policies, changes estimates and errors and disclosure (1)joehe2625No ratings yet

- AS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesDocument22 pagesAS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesbosskeyNo ratings yet

- PAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument37 pagesPAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsPeralta Renn JethroNo ratings yet

- Accounting Changes CH 22Document62 pagesAccounting Changes CH 22chloekim03No ratings yet

- IAS 8 Accounting Policies Changes in Accounting Estimates and Errors (December 2003)Document3 pagesIAS 8 Accounting Policies Changes in Accounting Estimates and Errors (December 2003)wenni89100% (3)

- 03-IAS 8 Accounting Policies, Changes in Estimates and Correction of ErrorsDocument20 pages03-IAS 8 Accounting Policies, Changes in Estimates and Correction of Errorsrfhunxaie100% (2)

- Accounting Changes and Prior Period Adjustments: REAC PHA-Finance Accounting BriefsDocument3 pagesAccounting Changes and Prior Period Adjustments: REAC PHA-Finance Accounting BriefsAnna Mae CortezNo ratings yet

- Accounting Changes and Error AnalysisDocument8 pagesAccounting Changes and Error AnalysisAlbert SteveNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument37 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita HassanNo ratings yet

- Resume ch04 AkmDocument9 pagesResume ch04 AkmRising PKN STANNo ratings yet

- 10accounting ChangesDocument31 pages10accounting ChangesLily DaniaNo ratings yet

- Accounting Theories and ProblemsDocument9 pagesAccounting Theories and ProblemsDonnelly Keith MumarNo ratings yet

- Accounting Changes and Errors: HapterDocument40 pagesAccounting Changes and Errors: HapterWilsonNo ratings yet

- Philippine Financial Reporting StandardsDocument9 pagesPhilippine Financial Reporting StandardsKristan John ZernaNo ratings yet

- Test 1 PreparationDocument11 pagesTest 1 PreparationSze ChristienyNo ratings yet

- Current Applicable International Accounting Standard (IAS) Under IASBDocument11 pagesCurrent Applicable International Accounting Standard (IAS) Under IASBEZEKIEL100% (1)

- Kieso Inter Ch22 - IfRS (Accounting Changes)Document59 pagesKieso Inter Ch22 - IfRS (Accounting Changes)Restika FajriNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument48 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsHồ Đan ThụcNo ratings yet

- Lecture Ias 8Document37 pagesLecture Ias 8SikderSharifNo ratings yet

- Advanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESDocument4 pagesAdvanced Accounting - DISCLOSURE OF ACCOUNTING POLICIESGedie RocamoraNo ratings yet

- Accounting Changes NotesDocument5 pagesAccounting Changes NotesfunkpopsicleNo ratings yet