Professional Documents

Culture Documents

Annexure To Form 16

Annexure To Form 16

Uploaded by

mohitverma.840Copyright:

Available Formats

You might also like

- T3TFT - Funds Transfer - R14 PDFDocument287 pagesT3TFT - Funds Transfer - R14 PDFHafsa Banu100% (3)

- Accounitng Answers Mid Term QuizDocument9 pagesAccounitng Answers Mid Term QuizWarda Tariq0% (1)

- Corporate Finance Formula SheetDocument9 pagesCorporate Finance Formula SheetWilliamNo ratings yet

- Cepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementDocument7 pagesCepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementSaurabh MahajanNo ratings yet

- Jay Cluster MethodologyDocument17 pagesJay Cluster MethodologylowtarhkNo ratings yet

- Cfa Level 1 Mock TestDocument71 pagesCfa Level 1 Mock TestJyoti Singh100% (1)

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- 2f10k 2022-23 1Document3 pages2f10k 2022-23 1Md shamirNo ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BVikram RaiNo ratings yet

- Annexure To Form 16 Part B (2020)Document3 pagesAnnexure To Form 16 Part B (2020)Dharmendra ParmarNo ratings yet

- FormANNX 2022 1Document3 pagesFormANNX 2022 1spider14No ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- R17 Acepa6021b 20-21Document1 pageR17 Acepa6021b 20-21rajeshre2No ratings yet

- Bob Form12baDocument1 pageBob Form12baruchi561No ratings yet

- 22 GST Council MeetDocument2 pages22 GST Council Meetkumar45caNo ratings yet

- 12BADocument1 page12BAmanas022No ratings yet

- 2f10k 2023-24 1Document3 pages2f10k 2023-24 1PRAMOD KUMAR SHARMANo ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- Form 16 Data 1 PDFDocument5 pagesForm 16 Data 1 PDFRISHABH JAINNo ratings yet

- 2009 16Document5 pages2009 16Atin SinghNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form No. 12ba: Declaration by EmployerDocument1 pageForm No. 12ba: Declaration by EmployerVaibhav Sharad DhandeNo ratings yet

- Soa 1709927089217Document5 pagesSoa 1709927089217Amit20099No ratings yet

- EA Form SEP 2023Document1 pageEA Form SEP 2023boyssss88No ratings yet

- Loan Account Statement For 453Dpffd078248Document3 pagesLoan Account Statement For 453Dpffd078248Rajan waghmareNo ratings yet

- Soa 1700217390953Document4 pagesSoa 1700217390953Tapas SinghNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- Statement 1577282810636 PDFDocument2 pagesStatement 1577282810636 PDFKumar ChaituNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Invetech Lighting PVT LTD Form 16Document5 pagesInvetech Lighting PVT LTD Form 16Saikiran SharonNo ratings yet

- Praveen B 21-22Document2 pagesPraveen B 21-22psyamala2004No ratings yet

- Loan Account Statement For 4K7Eplfv578671Document2 pagesLoan Account Statement For 4K7Eplfv578671Amar kumarNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesPersonal Note: This Is A System Generated Payslip, Does Not Require Any Signatureypfjcd8qq9No ratings yet

- EPSF FORM12BB 10006980 SignedDocument2 pagesEPSF FORM12BB 10006980 SignedVikas SoniNo ratings yet

- 406GDFFB883219 SoaDocument10 pages406GDFFB883219 SoaVishal Vijay SoniNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- EntityDocument3 pagesEntityMayankNo ratings yet

- Soa 1707625204911Document6 pagesSoa 1707625204911mayankmkg92No ratings yet

- Loan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 pagesLoan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Alexander SNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Daily Activity Statement: Mohammad Azam Bin MustapaDocument5 pagesDaily Activity Statement: Mohammad Azam Bin MustapaAzri LunduNo ratings yet

- Dec 2015Document3 pagesDec 2015sankara narayananNo ratings yet

- Income Tax Calculator FY 2022 23Document4 pagesIncome Tax Calculator FY 2022 23Vineet KumarNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- Apr22 Mar23 TaxsheetDocument3 pagesApr22 Mar23 TaxsheetKritika GuptaNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- Mahamaya Project V2Document6 pagesMahamaya Project V2Sumit AhujaNo ratings yet

- Rajpal Residence Address Proof Telephone BillDocument1 pageRajpal Residence Address Proof Telephone BillMONISH NAYARNo ratings yet

- Master File of CalculationDocument4 pagesMaster File of Calculationjitendriyasahoo994No ratings yet

- Account Usage and Recharge Statement From 01-May-2021 To 30-May-2021Document6 pagesAccount Usage and Recharge Statement From 01-May-2021 To 30-May-2021Mahesh KumarNo ratings yet

- Acc203 Tut On LiquidationDocument7 pagesAcc203 Tut On LiquidationShivanjani KumarNo ratings yet

- Worksheet Tools of Financial Statements of A FirmDocument9 pagesWorksheet Tools of Financial Statements of A FirmpuxvashuklaNo ratings yet

- Agra Chaat (3) (1) CmaDocument12 pagesAgra Chaat (3) (1) CmabhaveshNo ratings yet

- BS September 2023Document3 pagesBS September 2023rivafinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Profile On Granite CuttingDocument12 pagesProfile On Granite CuttingAnkit Morani100% (1)

- Seminar 11 QuestionsDocument3 pagesSeminar 11 QuestionsYong RenNo ratings yet

- Business Plan - SpaceDotWorks Coworking SDocument20 pagesBusiness Plan - SpaceDotWorks Coworking SRaghu BannurNo ratings yet

- SAP UnderstandingDocument5 pagesSAP UnderstandingSanchit BagaiNo ratings yet

- Business Model of Unilever IndonesiaDocument18 pagesBusiness Model of Unilever Indonesiayandhie57100% (2)

- Jawaban UAS Pajak Internasional 2Document4 pagesJawaban UAS Pajak Internasional 2Eko SiswantoNo ratings yet

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13api-253299751No ratings yet

- Civicfed 97 PDFDocument446 pagesCivicfed 97 PDFJames Bradley StoddartNo ratings yet

- 921-Economic Analysis Unit 1Document77 pages921-Economic Analysis Unit 1arulgeorgefdoNo ratings yet

- 15 Financial AccountsDocument111 pages15 Financial AccountsRenga Pandi100% (1)

- Practical Accounting 2 First Pre-Board ExaminationDocument15 pagesPractical Accounting 2 First Pre-Board ExaminationKaren Eloisse89% (9)

- Cash Management BLACKBOOKDocument56 pagesCash Management BLACKBOOKxerox 123No ratings yet

- Week 1 Topic Tutorial Solutions CB2100 - 1920ADocument6 pagesWeek 1 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- Merger and AcquisitionDocument42 pagesMerger and Acquisitionqari saib100% (1)

- Capital Structure Summary and Conclusions CHAPTER 17Document1 pageCapital Structure Summary and Conclusions CHAPTER 17ckkuteesaNo ratings yet

- Leverages NotesDocument9 pagesLeverages NotesAshwani ChouhanNo ratings yet

- Plant Design Costing RevisionDocument78 pagesPlant Design Costing RevisionLei YinNo ratings yet

- Tariff Notes - Atty CabanDocument14 pagesTariff Notes - Atty CabancH3RrY1007No ratings yet

- Partnership Operations Enabling AssessmentDocument2 pagesPartnership Operations Enabling AssessmentJoana TrinidadNo ratings yet

- Capital Budgeting: A Brief OverviewDocument14 pagesCapital Budgeting: A Brief OverviewJanica BerbaNo ratings yet

- Chemalite - A - UnsolvedDocument5 pagesChemalite - A - UnsolvedUru BhalodeNo ratings yet

- SM-2 - Lesson - 1 To 7 in EnglishDocument128 pagesSM-2 - Lesson - 1 To 7 in EnglishMayank RajputNo ratings yet

- LoegsiDocument1 pageLoegsiJeric Amboni De GuiaNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet

Annexure To Form 16

Annexure To Form 16

Uploaded by

mohitverma.840Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure To Form 16

Annexure To Form 16

Uploaded by

mohitverma.840Copyright:

Available Formats

02543949/ANYPV7025P Mohit Verma

Annexure to Form 16 Part B

2(f). Break up for 'Amount of any other exemption under section 10' to be filled in the table below

Particular's of Amount of any other exemption under section 10' INR

Previous Employment Exemption u/s 10 94416.00

10(k). Break up for 'Amount deductible under any other provision(s) of Chapter VI-A ' to be filled in the table below

Particular's of amount deductible under any other provision(s) of Chapter VI-A Gross Amount Qualifying Amount Deductible Amount

Place MUMBAI (Signature of person responsible for deduction of tax)

Date 10.04.2023 Full Name: CAWASI JOKHI

02543949/ANYPV7025P Mohit Verma

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisities, other fringe

benefits or amenities and profits in lieu of salary with value thereof

TATA CONSULTANCY SERVICES LTD.,9th Flr, Nirmal Bldg, Nariman Point,

1. Name and address of employer : Mumbai,400021,Maharashtra

2. TAN : MUMT11446B

3. TDS Assessment Range of the employer : ,,,,

4. Name, designation and Permanent Account Number or

Aadhaar Number of employee

: Mohit Verma,Assistant Consultant,02543949,ANYPV7025P

5. Is the employee a director or a person with substantial interest

in the company(where the employer is a company) :

6. Income under the head “Salaries” of the employee

(other than from perquisites)

: 755119.00

7. Financial year : 2022-2023

8. Valuation of Perquisites :

Amount of perquisite

Amount, if any, recovered

S. Value of perquisite as per chargeable to tax

Nature of perquisites (see rule 3) from the employee

No. (Rs.) Col. (3) - Col(4)

(Rs.)

(Rs.)

(1) (2) (3) (4) (5)

1. Accommodation 0.00 0.00 0.00

2. Cars/Other automotive 0.00 0.00 0.00

Sweeper, gardener, watchman or

3. 0.00 0.00 0.00

personal attendant

4. Gas, electricity, water 0.00 0.00 0.00

5. Interest free or concessional loans 0.00 0.00 0.00

6. Holiday expenses 0.00 0.00 0.00

7. Free or concessional travel 0.00 0.00 0.00

8. Free meals 0.00 0.00 0.00

9. Free education 0.00 0.00 0.00

10. Gifts, vouchers, etc. 0.00 0.00 0.00

11. Credit card expenses 0.00 0.00 0.00

12. Club expenses 0.00 0.00 0.00

13. Use of movable assets by employees 0.00 0.00 0.00

14. Transfer of assets to employees 0.00 0.00 0.00

15. Value of any other benefit/amenity/service/privilege 0.00 0.00 0.00

16. Stock options allotted or transferred by employer being

0.00 0.00 0.00

an eligible start-up referred to in section 80-IAC.

17. Stock options (non-qualified options) other than ESOP in

0.00 0.00 0.00

col 16 above.

18. Contribution by employer to fund and scheme taxable

under section 17(2)(vii). 0.00 0.00 0.00

19. Annual accretion by way of interest, dividend etc. to the

balance at the credit of fund and scheme referred to in 0.00 0.00 0.00

section 17(2)(vii) and taxable under section 17(2)(viia).

20. Other benefits or amenities 0.00 0.00 0.00

21. Total value of perquisites 0.00 0.00 0.00

22. Total value of profits in lieu of salary as per section 17(3) 0.00 0.00 0.00

Details of tax

(a) Tax deducted from salary of the employee under section 192(1) 39369.00

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0.00

(c) Total tax paid 39369.00

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, CAWASI JOKHI Son/daughter of BAHADUR JOKHI working as ASSISTANT GENERAL MANAGER (designation ) do hereby declare on behalf of

TATA CONSULTANCY SERVICES LTD. ( name of the employer ) that the information given above is based on the books of account , documents and

other relevant records or information available with us and the details of value of each such perquisite are in accordance with section 17 and rules

framed thereunder and that such information is true and correct.

Signature Not Verified

Signature of person responsible for deduction of tax

Digitally signed by CAWASI

Place : MUMBAI Full Name:CAWASI JOKHI BAHADUR JOKHI

Date : 10.04.2023 Designation:ASSISTANT GENERAL MANAGER Date: 2023.04.13 09:31:18 IST

02543949/ANYPV7025P Mohit Verma

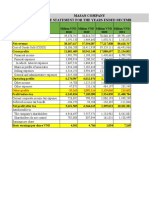

Annexure to Form No.16

Name: Mohit Verma Emp No.: 02543949

Particulars Amount(INR)

Emoluments paid

Basic Salary 48632.00

House Rent Allowance 34043.00

Leave Travel Allowance 4053.00

Previous Employment Salary u/s 17(1) 698511.00

Food Coupons 2054.00

Personal Allowance 102692.00

Variable Allowance 19854.00

Vehicle Maintenance 4232.00

City Allowance 4918.00

Perquisites

Gross emoluments 918988.00

Income from other sources

Income

Total income from other sources 0.00

Exemptions u/s 10

Allowance

House rent allowance under section 10(13A) 19453.00

Previous Employment Exemption u/s 10 94416.00

Total Exemption 113869.00

Date: 10.04.2023 Full Name: CAWASI JOKHI

Place:MUMBAI Designation: ASSISTANT GENERAL MANAGER

You might also like

- T3TFT - Funds Transfer - R14 PDFDocument287 pagesT3TFT - Funds Transfer - R14 PDFHafsa Banu100% (3)

- Accounitng Answers Mid Term QuizDocument9 pagesAccounitng Answers Mid Term QuizWarda Tariq0% (1)

- Corporate Finance Formula SheetDocument9 pagesCorporate Finance Formula SheetWilliamNo ratings yet

- Cepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementDocument7 pagesCepuros Foods Malaysia: Finding The Secret Sauce For Growth Student Spreadsheet SupplementSaurabh MahajanNo ratings yet

- Jay Cluster MethodologyDocument17 pagesJay Cluster MethodologylowtarhkNo ratings yet

- Cfa Level 1 Mock TestDocument71 pagesCfa Level 1 Mock TestJyoti Singh100% (1)

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- 2f10k 2022-23 1Document3 pages2f10k 2022-23 1Md shamirNo ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BVikram RaiNo ratings yet

- Annexure To Form 16 Part B (2020)Document3 pagesAnnexure To Form 16 Part B (2020)Dharmendra ParmarNo ratings yet

- FormANNX 2022 1Document3 pagesFormANNX 2022 1spider14No ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- R17 Acepa6021b 20-21Document1 pageR17 Acepa6021b 20-21rajeshre2No ratings yet

- Bob Form12baDocument1 pageBob Form12baruchi561No ratings yet

- 22 GST Council MeetDocument2 pages22 GST Council Meetkumar45caNo ratings yet

- 12BADocument1 page12BAmanas022No ratings yet

- 2f10k 2023-24 1Document3 pages2f10k 2023-24 1PRAMOD KUMAR SHARMANo ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- Form 16 Data 1 PDFDocument5 pagesForm 16 Data 1 PDFRISHABH JAINNo ratings yet

- 2009 16Document5 pages2009 16Atin SinghNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form No. 12ba: Declaration by EmployerDocument1 pageForm No. 12ba: Declaration by EmployerVaibhav Sharad DhandeNo ratings yet

- Soa 1709927089217Document5 pagesSoa 1709927089217Amit20099No ratings yet

- EA Form SEP 2023Document1 pageEA Form SEP 2023boyssss88No ratings yet

- Loan Account Statement For 453Dpffd078248Document3 pagesLoan Account Statement For 453Dpffd078248Rajan waghmareNo ratings yet

- Soa 1700217390953Document4 pagesSoa 1700217390953Tapas SinghNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- Statement 1577282810636 PDFDocument2 pagesStatement 1577282810636 PDFKumar ChaituNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Invetech Lighting PVT LTD Form 16Document5 pagesInvetech Lighting PVT LTD Form 16Saikiran SharonNo ratings yet

- Praveen B 21-22Document2 pagesPraveen B 21-22psyamala2004No ratings yet

- Loan Account Statement For 4K7Eplfv578671Document2 pagesLoan Account Statement For 4K7Eplfv578671Amar kumarNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesPersonal Note: This Is A System Generated Payslip, Does Not Require Any Signatureypfjcd8qq9No ratings yet

- EPSF FORM12BB 10006980 SignedDocument2 pagesEPSF FORM12BB 10006980 SignedVikas SoniNo ratings yet

- 406GDFFB883219 SoaDocument10 pages406GDFFB883219 SoaVishal Vijay SoniNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- EntityDocument3 pagesEntityMayankNo ratings yet

- Soa 1707625204911Document6 pagesSoa 1707625204911mayankmkg92No ratings yet

- Loan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 pagesLoan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Alexander SNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Daily Activity Statement: Mohammad Azam Bin MustapaDocument5 pagesDaily Activity Statement: Mohammad Azam Bin MustapaAzri LunduNo ratings yet

- Dec 2015Document3 pagesDec 2015sankara narayananNo ratings yet

- Income Tax Calculator FY 2022 23Document4 pagesIncome Tax Calculator FY 2022 23Vineet KumarNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- Apr22 Mar23 TaxsheetDocument3 pagesApr22 Mar23 TaxsheetKritika GuptaNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- Mahamaya Project V2Document6 pagesMahamaya Project V2Sumit AhujaNo ratings yet

- Rajpal Residence Address Proof Telephone BillDocument1 pageRajpal Residence Address Proof Telephone BillMONISH NAYARNo ratings yet

- Master File of CalculationDocument4 pagesMaster File of Calculationjitendriyasahoo994No ratings yet

- Account Usage and Recharge Statement From 01-May-2021 To 30-May-2021Document6 pagesAccount Usage and Recharge Statement From 01-May-2021 To 30-May-2021Mahesh KumarNo ratings yet

- Acc203 Tut On LiquidationDocument7 pagesAcc203 Tut On LiquidationShivanjani KumarNo ratings yet

- Worksheet Tools of Financial Statements of A FirmDocument9 pagesWorksheet Tools of Financial Statements of A FirmpuxvashuklaNo ratings yet

- Agra Chaat (3) (1) CmaDocument12 pagesAgra Chaat (3) (1) CmabhaveshNo ratings yet

- BS September 2023Document3 pagesBS September 2023rivafinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Profile On Granite CuttingDocument12 pagesProfile On Granite CuttingAnkit Morani100% (1)

- Seminar 11 QuestionsDocument3 pagesSeminar 11 QuestionsYong RenNo ratings yet

- Business Plan - SpaceDotWorks Coworking SDocument20 pagesBusiness Plan - SpaceDotWorks Coworking SRaghu BannurNo ratings yet

- SAP UnderstandingDocument5 pagesSAP UnderstandingSanchit BagaiNo ratings yet

- Business Model of Unilever IndonesiaDocument18 pagesBusiness Model of Unilever Indonesiayandhie57100% (2)

- Jawaban UAS Pajak Internasional 2Document4 pagesJawaban UAS Pajak Internasional 2Eko SiswantoNo ratings yet

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13api-253299751No ratings yet

- Civicfed 97 PDFDocument446 pagesCivicfed 97 PDFJames Bradley StoddartNo ratings yet

- 921-Economic Analysis Unit 1Document77 pages921-Economic Analysis Unit 1arulgeorgefdoNo ratings yet

- 15 Financial AccountsDocument111 pages15 Financial AccountsRenga Pandi100% (1)

- Practical Accounting 2 First Pre-Board ExaminationDocument15 pagesPractical Accounting 2 First Pre-Board ExaminationKaren Eloisse89% (9)

- Cash Management BLACKBOOKDocument56 pagesCash Management BLACKBOOKxerox 123No ratings yet

- Week 1 Topic Tutorial Solutions CB2100 - 1920ADocument6 pagesWeek 1 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- Merger and AcquisitionDocument42 pagesMerger and Acquisitionqari saib100% (1)

- Capital Structure Summary and Conclusions CHAPTER 17Document1 pageCapital Structure Summary and Conclusions CHAPTER 17ckkuteesaNo ratings yet

- Leverages NotesDocument9 pagesLeverages NotesAshwani ChouhanNo ratings yet

- Plant Design Costing RevisionDocument78 pagesPlant Design Costing RevisionLei YinNo ratings yet

- Tariff Notes - Atty CabanDocument14 pagesTariff Notes - Atty CabancH3RrY1007No ratings yet

- Partnership Operations Enabling AssessmentDocument2 pagesPartnership Operations Enabling AssessmentJoana TrinidadNo ratings yet

- Capital Budgeting: A Brief OverviewDocument14 pagesCapital Budgeting: A Brief OverviewJanica BerbaNo ratings yet

- Chemalite - A - UnsolvedDocument5 pagesChemalite - A - UnsolvedUru BhalodeNo ratings yet

- SM-2 - Lesson - 1 To 7 in EnglishDocument128 pagesSM-2 - Lesson - 1 To 7 in EnglishMayank RajputNo ratings yet

- LoegsiDocument1 pageLoegsiJeric Amboni De GuiaNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet