Professional Documents

Culture Documents

Project - Sinai Cement Co.

Project - Sinai Cement Co.

Uploaded by

samah.fathi3Copyright:

Available Formats

You might also like

- Finance - Merger and Acquisitions - Indian Scenarios 2010 Onwards - UpdatedDocument66 pagesFinance - Merger and Acquisitions - Indian Scenarios 2010 Onwards - UpdatedAshutosh Mate75% (4)

- Valuation Analysis For Robertson ToolDocument5 pagesValuation Analysis For Robertson ToolPedro José ZapataNo ratings yet

- Foundations of Financial Management Canadian 11th Edition Block Solutions ManualDocument39 pagesFoundations of Financial Management Canadian 11th Edition Block Solutions Manualchristinareedfkrbmpajxs100% (32)

- Assessing Martin Manufacturing's Current Financial PositionDocument4 pagesAssessing Martin Manufacturing's Current Financial PositionSean Chris ConsonNo ratings yet

- Following the Trend: Diversified Managed Futures TradingFrom EverandFollowing the Trend: Diversified Managed Futures TradingRating: 3.5 out of 5 stars3.5/5 (2)

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANNo ratings yet

- Economics - FE Review Problems and Solutions 2012Document154 pagesEconomics - FE Review Problems and Solutions 2012Blake Reeves50% (2)

- Abbot's Financial AnalysisDocument23 pagesAbbot's Financial AnalysisMonaaa100% (3)

- Break Your Analysis Into Evaluations of The Firm's Liquidity, Activity, Debt, Profitability, and MarketDocument2 pagesBreak Your Analysis Into Evaluations of The Firm's Liquidity, Activity, Debt, Profitability, and MarketSean Chris ConsonNo ratings yet

- Doing Business in IndiaDocument7 pagesDoing Business in IndiaBrian KuttikkatNo ratings yet

- Memo To Suppliers - Invoicing Requirements - 2019Document5 pagesMemo To Suppliers - Invoicing Requirements - 2019Mark MagallanesNo ratings yet

- Tokeny Solutions ONBOARDDocument2 pagesTokeny Solutions ONBOARDJosephine BonjourNo ratings yet

- Current Ratios: InferenceDocument15 pagesCurrent Ratios: InferencesweetyakkuNo ratings yet

- Profitability: 31-Dec Sales Ebitda Net Income EPS Euro M Euro M Euro M EuroDocument21 pagesProfitability: 31-Dec Sales Ebitda Net Income EPS Euro M Euro M Euro M Euroapi-19513024No ratings yet

- 2016-17 Revenue (In Rs CR) Net Profit (In Rs CR) EPS ROEDocument11 pages2016-17 Revenue (In Rs CR) Net Profit (In Rs CR) EPS ROEMOKSHA CHOUDHARYNo ratings yet

- Retail Company With Simple DCFDocument51 pagesRetail Company With Simple DCFJames Mitchell100% (1)

- Description: Tags: G5ravrdemonstrationDocument2 pagesDescription: Tags: G5ravrdemonstrationanon-61No ratings yet

- Integrative Case Track Software LTDDocument19 pagesIntegrative Case Track Software LTDDang DangNo ratings yet

- M.Sc. Microbiology Bio TechnologyDocument6 pagesM.Sc. Microbiology Bio Technologymmumullana0098No ratings yet

- Description: Tags: G5ravrdemonstrationDocument2 pagesDescription: Tags: G5ravrdemonstrationanon-202136No ratings yet

- C Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23Document325 pagesC Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23yash rajNo ratings yet

- Whirlpool EuropeDocument15 pagesWhirlpool EuropeMousumi GuhaNo ratings yet

- GraphDocument8 pagesGraphKumar AmitNo ratings yet

- Description: Tags: G3ravrdemonstrationDocument2 pagesDescription: Tags: G3ravrdemonstrationanon-186142No ratings yet

- ITC LTD.: Presented ByDocument12 pagesITC LTD.: Presented BypavanNo ratings yet

- Bài TậpDocument7 pagesBài TậpThùyy VyNo ratings yet

- Worksheet To Accompany Your Answer BookletDocument5 pagesWorksheet To Accompany Your Answer BookletSaksham GoyalNo ratings yet

- Horizontal Analysis / CommentsDocument6 pagesHorizontal Analysis / Commentsfarrukh_kanyalNo ratings yet

- New Microsoft Excel WorksheetDocument8 pagesNew Microsoft Excel WorksheetpavikuttyNo ratings yet

- Case 1 - Financial Manager & PolicyDocument16 pagesCase 1 - Financial Manager & PolicycatatankotakkuningNo ratings yet

- PitchbookDocument6 pagesPitchbookmaicoo.soledadNo ratings yet

- MyfileDocument1 pageMyfilevdkvaibhav100% (1)

- Description: Tags: G5ravrtrainingDocument4 pagesDescription: Tags: G5ravrtraininganon-318307No ratings yet

- How Was The WeatherDocument23 pagesHow Was The WeatherMonety AYUNo ratings yet

- Pitch BookDocument6 pagesPitch BookTaufan RamdhaniNo ratings yet

- Hero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersDocument35 pagesHero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersCharan KowtikwarNo ratings yet

- Graph of SailDocument12 pagesGraph of SailKshipra GoyalNo ratings yet

- Castelul MariaDocument10 pagesCastelul MariaIoana-Elis BocanaciuNo ratings yet

- 29 Apr 03 INCODocument8 pages29 Apr 03 INCOpd98004No ratings yet

- Forecasting Brigham Case SolutionDocument7 pagesForecasting Brigham Case SolutionShahid Mehmood100% (1)

- PitchbookDocument6 pagesPitchbookSAMEERNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Chapter - Iv Presentation and Analysis of DataDocument35 pagesChapter - Iv Presentation and Analysis of DataDinesh MjkNo ratings yet

- 3-Auto Di MicrografDocument28 pages3-Auto Di Micrografsuthir_msNo ratings yet

- Monmouth VfinalDocument6 pagesMonmouth VfinalAjax100% (1)

- ARM Investor BriefingDocument65 pagesARM Investor BriefingbnjiinuNo ratings yet

- Ratio Analysis:: Internship ReportDocument5 pagesRatio Analysis:: Internship ReportsahhhhhhhNo ratings yet

- Lenovo Intergration Plan Annual 2004 PresentationDocument26 pagesLenovo Intergration Plan Annual 2004 PresentationKelvin Lim Wei LiangNo ratings yet

- Capital Structure of Jindal Steel and PowerDocument2 pagesCapital Structure of Jindal Steel and PowerAshok VenkatNo ratings yet

- Culinary Cookware AI2Document14 pagesCulinary Cookware AI2Pranav SahilNo ratings yet

- 3 Du Pont Analysis of 3 Companies - TemplateDocument23 pages3 Du Pont Analysis of 3 Companies - Templateshubhangi.jain582No ratings yet

- Final PharmaDocument40 pagesFinal PharmakunalprasherNo ratings yet

- Nokia Results 2023 q2Document31 pagesNokia Results 2023 q2yalemorgan69No ratings yet

- RatiosDocument31 pagesRatiosAMegoz 25No ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Calculating Trend PercentageDocument2 pagesCalculating Trend PercentageSaravananSrvnNo ratings yet

- Blue Star - AnalystMeetPresentation06-07Document54 pagesBlue Star - AnalystMeetPresentation06-07hh.deepakNo ratings yet

- Tata Global Beverages LTDDocument3 pagesTata Global Beverages LTDKapil Singh RautelaNo ratings yet

- Whirlpool Europe Spreadsheet Supplement TVI 1Document6 pagesWhirlpool Europe Spreadsheet Supplement TVI 1Mousumi GuhaNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- Corporate Finance (Theory and Practice) CASE 1: Jones Electrical DistributionDocument6 pagesCorporate Finance (Theory and Practice) CASE 1: Jones Electrical Distributionabdulla mohammadNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- Chapter 9. Identifying Market Segments and Targets. Copyright 2016 Pearson Education Ltd. 9-1Document28 pagesChapter 9. Identifying Market Segments and Targets. Copyright 2016 Pearson Education Ltd. 9-1samah.fathi3No ratings yet

- Dr Farid shosha chapter seven هام ستةDocument53 pagesDr Farid shosha chapter seven هام ستةsamah.fathi3No ratings yet

- CH 26Document66 pagesCH 26samah.fathi3No ratings yet

- InflationDocument15 pagesInflationsamah.fathi3No ratings yet

- PovertyDocument10 pagesPovertysamah.fathi3No ratings yet

- Answers To Questions Chapter 1Document5 pagesAnswers To Questions Chapter 1samah.fathi3No ratings yet

- CH 10 PPTaccessibleDocument34 pagesCH 10 PPTaccessiblesamah.fathi3No ratings yet

- GDP and Growth (Autosaved)Document32 pagesGDP and Growth (Autosaved)samah.fathi3No ratings yet

- CH 14 PPTaccessibleDocument34 pagesCH 14 PPTaccessiblesamah.fathi3No ratings yet

- Report On Indian BankDocument27 pagesReport On Indian BankPoojaNo ratings yet

- Balance of PaymentDocument40 pagesBalance of PaymentgirishNo ratings yet

- Financial AspectDocument16 pagesFinancial AspectJezeree DichosoNo ratings yet

- Rice ParkDocument11 pagesRice ParkDeepthideepuNo ratings yet

- Cambridge Assessment International Education: Economics 0455/21 October/November 2019Document21 pagesCambridge Assessment International Education: Economics 0455/21 October/November 2019shrutisonibkn18No ratings yet

- Final Assesment: I. Problem SolvingDocument12 pagesFinal Assesment: I. Problem SolvingKaren Nicole Borreo MaddelaNo ratings yet

- Investors Perception Towards Stock MarketDocument2 pagesInvestors Perception Towards Stock MarketAkhil Anilkumar0% (1)

- Home Law Firms Legal Services Law & Practice Employment Students AssociationsDocument17 pagesHome Law Firms Legal Services Law & Practice Employment Students Associationsdeepak_vivNo ratings yet

- Chapter 6 QuestionsDocument8 pagesChapter 6 QuestionsJanelle Joyce Maranan DipasupilNo ratings yet

- Futurpreneur Cash Flow Template EN 09.08.2022 1Document10 pagesFuturpreneur Cash Flow Template EN 09.08.2022 1Alex VelascoNo ratings yet

- SBLC Terms & ProcedureDocument2 pagesSBLC Terms & ProcedureDima RajaNo ratings yet

- Auditor CV TemplateDocument2 pagesAuditor CV TemplateDaniel B Boy Nkrumah100% (2)

- 24 The GraduateDocument2 pages24 The GraduateW.J. ZondagNo ratings yet

- Prac I InvestmentsDocument16 pagesPrac I InvestmentsJohn PasquitoNo ratings yet

- New - Haven - FY 2015-16 Mayors Budget1Document419 pagesNew - Haven - FY 2015-16 Mayors Budget1Helen BennettNo ratings yet

- Indefinite Pronouns: Grammar WorksheetDocument6 pagesIndefinite Pronouns: Grammar Worksheetliceth marcela garcia baños100% (1)

- Qatar BanksDocument44 pagesQatar BanksShaik InayathNo ratings yet

- Marriage in Iowa Law - Complete ResultsDocument109 pagesMarriage in Iowa Law - Complete ResultsDavid ShaferNo ratings yet

- Capital Investment Factors - UST2021Document19 pagesCapital Investment Factors - UST2021Ey B0ssNo ratings yet

- A Balanced Scorecard For Small BusinessDocument8 pagesA Balanced Scorecard For Small BusinessmoussumiiNo ratings yet

- Financial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementDocument3 pagesFinancial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementJoje Sadili CostañosNo ratings yet

- Law of EquityDocument17 pagesLaw of EquityAnkitaSharma100% (2)

- International Monetary Asymmetries and The Central BankDocument31 pagesInternational Monetary Asymmetries and The Central BankJuan Carlos Lara GallegoNo ratings yet

- Sapm - 2 MarksDocument17 pagesSapm - 2 MarksA Senthilkumar100% (3)

Project - Sinai Cement Co.

Project - Sinai Cement Co.

Uploaded by

samah.fathi3Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project - Sinai Cement Co.

Project - Sinai Cement Co.

Uploaded by

samah.fathi3Copyright:

Available Formats

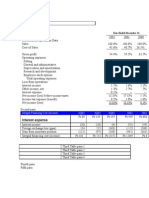

Sinai Cement Co. (S.A.

E)

Return Analysis 2002 2003 2004 Q2/05

Return on Assets (%) 2.85 4.87 11.16 8.84

Return on Assets (%)

12.00

10.00

8.00

6.00

4.00

2.00

0.00

2002 2003 2004 Q2/05

Return on Assets (%)

Returns on assets percentages decreased dramtically on 2004 and decresed in Q2 2005

Return Analysis 2002 2003 2004 Q2/05

Return on Equity (%) 6.52 7.61 15.34 11.75

Return on Equity (%)

18.00

16.00

14.00

12.00

10.00

8.00

6.00

4.00

2.00

0.00

2002 2003 2004 Q2/05

Return on Equity (%)

Return on Equity increasing recorded increment in 2004 and decreased in Q2/2005

Return Analysis 2002 2003 2004 Q2/05

Return on Sales(%) 9.05 14.61 24.59 35.35

Return on Sales(%)

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

2002 2003 2004 Q2/05

Return on Sales(%)

Return on sales percentages record increse specially in 2004 and Q2/05

0.00

2002 2003 2004 Q2/05

Return on Sales(%)

Return on sales percentages record increse specially in 2004 and Q2/05

Return Analysis 2002 2003 2004 Q2/05

Earnings per share (LE) 0.78 1.02 2.31 1.87

Earnings per share (LE)

2.50

2.00

1.50

1.00

0.50

0.00

2002 2003 2004 Q2/05

Earnings per share (LE)

Earnings per share recordes increase in 2202/2003/2004

and decreased in Q2/05

Efficiency Analysis 2002 2003 2004 Q2/05

Cost of Sales/Net Sales (%) 82.63 71.63 61.24 51.63

Cost of Sales/Net Sales (%)

90.00

80.00

70.00

60.00

50.00

40.00

30.00

20.00

10.00

0.00

2002 2003 2004 Q2/05

Cost of Sales/Net Sales (%)

Net sales increased i n 2002 and recorded decreasing in 2004 and Q2/05

Efficiency Analysis 2002 2003 2004 Q2/05

Total Asets Turnover 0.31 0.33 0.45 0.25

Total Asets Turnover

0.50

0.40

0.30

0.20

0.10

0.00

2002 2003 2004 Q2/05

Total Asets Turnover

0.30

0.20

0.10

0.00

2002 2003 2004 Q2/05

Total Asets Turnover

Records increase in 2003 & 2004 but the first 6 month of 2005 showing decrese

Liquidity Analysis 2002 2003 2004 Q2/05

Current Ratio(x) 0.58 1.35 1.87 2.88

Current Ratio(x)

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

2002 2003 2004 Q2/05

Current Ratio(x)

recorded increase i n 2002/2003/2004 and continued during Q2/05

Liquidity Analysis 2002 2003 2004 Q2/05

Quick Ratio (x) 0.36 1.00 1.44 2.16

Quick Ratio (x)

2.50

2.00

1.50

1.00

0.50

0.00

2002 2003 2004 Q2/05

Quick Ratio (x)

recorded increase i n 2002/2003/2004 and continued during Q2/05

Inventory Analysis 2002 2003 2004 Q2/05

Inventory Total Assets (%) 4.31 4.49 4.13 5.36

Inventory Total Assets (%)

6.00

5.00

4.00

3.00

2.00

1.00

0.00

2002 2003 2004 Q2/05

Inventory Total Assets (%)

5.00

4.00

3.00

2.00

1.00

0.00

2002 2003 2004 Q2/05

Inventory Total Assets (%)

Closer incresed percentage in 2002/2003/2004 and a higher decrease During Q2/2005

Inventory Analysis 2002 2003 2004 Q2/05

Inventory Current Assets (%) 37.52 25.92 23.21 24.99

Inventory Current Assets (%)

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

2002 2003 2004 Q2/05

Inventory Current Assets (%)

Current assets inventory recorded highest percentage in 2002 and continued to decrease till Q2/05

Inventory Analysis 2002 2003 2004 Q2/05

Inventory Net Sales (%) 13.71 13.47 9.10 21.45

Inventory Net Sales (%)

25.00

20.00

15.00

10.00

5.00

0.00

2002 2003 2004 Q2/05

Inventory Net Sales (%)

Inventory Net sales recorded low percentage in 2004 but a dramatic increase in Q2/05

Debt Analysis 2002 2003 2004 Q2/05

Debt Ratio (%) 38.55 25.29 18.06 17.34

Debt Ratio (%)

45.00

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

Debt Ratio (%)

45.00

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

2002 2003 2004 Q2/05

Debt Ratio (%)

Debt Ratio recorded decrease froon 2002 to Q2/05

Debt Analysis 2002 2003 2004 Q2/05

Long Term Debt/Equit (%) 83.60 36.14 24.43 23.05

Long Term Debt/Equit (%)

90.00

80.00

70.00

60.00

50.00

40.00

30.00

20.00

10.00

0.00

2002 2003 2004 Q2/05

Long Term Debt/Equit (%)

Long term debt/equity ratio recorded dramatic decrease in 2003 and continued to decrease till Q2/05

Turnover Ratio Analysis 2002 2003 2004 Q2/05

Inventory turnover (X) 6.03 5.32 6.73 2.41

Inventory turnover (X)

8.00

7.00

6.00

5.00

4.00

3.00

2.00

1.00

0.00

2002 2003 2004 Q2/05

Inventory turnover (X)

Inverntoy turnover shows almost closer percentages and decreased dramtically in Q2/05

Turnover Ratio Analysis 2002 2003 2004 Q2/05

Current asset turnover (x) 2.74 1.92 2.55 1.16

Current asset turnover (x)

3.00

2.50

2.00

1.50

1.00

0.50

0.00

Current asset turnover (x)

3.00

2.50

2.00

1.50

1.00

0.50

0.00

2002 2003 2004 Q2/05

Current asset turnover (x)

Current assrt turn over recorded decrease in 2003 and increased in 2004 then decreased with an

considerable difference in Q2/05

Turnover Ratio Analysis 2002 2003 2004 Q2/05

Working capital turnover (X) -3.75 7.44 5.48 1.78

Working capital turnover (X)

10.00

8.00

6.00

4.00

2.00

0.00

-2.00 2002 2003 2004 Q2/05

-4.00

-6.00

Working capital turnover (X)

Working capital turn over recorded decrease in 2002 and higher increase in 2003 then decreased in

2004 and dropped in Q2/05

Capital Structure Analysis 2002 2003 2004 Q2/05

Long term liab/total assets (%) 36.48 23.14 17.77 17.34

Long term liab/total assets (%)

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

2002 2003 2004 Q2/05

Long term liab/total assets

(%)

Higher increase in long term liab/total assets in 2002 then continued to decrease

Capital Structure Analysis 2002 2003 2004 Q2/05

Short term liab/total assets (%) 19.89 12.84 9.51 7.45

Short term liab/total assets (%)

25.00

20.00

15.00

10.00

5.00

Short term liab/total assets (%)

25.00

20.00

15.00

10.00

5.00

0.00

2002 2003 2004 Q2/05

Short term liab/total assets (%)

Short term liab./total assets decresed in 2003 and continued to decrease till Q2/2005

Capital Structure Analysis 2002 2003 2004 Q2/05

Equity/Total Assets (%) 43.63 64.02 72.73 75.22

Equity/Total Assets (%)

80.00

70.00

60.00

50.00

40.00

30.00

20.00

10.00

0.00

2002 2003 2004 Q2/05

Equity/Total Assets (%)

Equity/Total assets percentage recorded high percentage in Q2/05

You might also like

- Finance - Merger and Acquisitions - Indian Scenarios 2010 Onwards - UpdatedDocument66 pagesFinance - Merger and Acquisitions - Indian Scenarios 2010 Onwards - UpdatedAshutosh Mate75% (4)

- Valuation Analysis For Robertson ToolDocument5 pagesValuation Analysis For Robertson ToolPedro José ZapataNo ratings yet

- Foundations of Financial Management Canadian 11th Edition Block Solutions ManualDocument39 pagesFoundations of Financial Management Canadian 11th Edition Block Solutions Manualchristinareedfkrbmpajxs100% (32)

- Assessing Martin Manufacturing's Current Financial PositionDocument4 pagesAssessing Martin Manufacturing's Current Financial PositionSean Chris ConsonNo ratings yet

- Following the Trend: Diversified Managed Futures TradingFrom EverandFollowing the Trend: Diversified Managed Futures TradingRating: 3.5 out of 5 stars3.5/5 (2)

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANNo ratings yet

- Economics - FE Review Problems and Solutions 2012Document154 pagesEconomics - FE Review Problems and Solutions 2012Blake Reeves50% (2)

- Abbot's Financial AnalysisDocument23 pagesAbbot's Financial AnalysisMonaaa100% (3)

- Break Your Analysis Into Evaluations of The Firm's Liquidity, Activity, Debt, Profitability, and MarketDocument2 pagesBreak Your Analysis Into Evaluations of The Firm's Liquidity, Activity, Debt, Profitability, and MarketSean Chris ConsonNo ratings yet

- Doing Business in IndiaDocument7 pagesDoing Business in IndiaBrian KuttikkatNo ratings yet

- Memo To Suppliers - Invoicing Requirements - 2019Document5 pagesMemo To Suppliers - Invoicing Requirements - 2019Mark MagallanesNo ratings yet

- Tokeny Solutions ONBOARDDocument2 pagesTokeny Solutions ONBOARDJosephine BonjourNo ratings yet

- Current Ratios: InferenceDocument15 pagesCurrent Ratios: InferencesweetyakkuNo ratings yet

- Profitability: 31-Dec Sales Ebitda Net Income EPS Euro M Euro M Euro M EuroDocument21 pagesProfitability: 31-Dec Sales Ebitda Net Income EPS Euro M Euro M Euro M Euroapi-19513024No ratings yet

- 2016-17 Revenue (In Rs CR) Net Profit (In Rs CR) EPS ROEDocument11 pages2016-17 Revenue (In Rs CR) Net Profit (In Rs CR) EPS ROEMOKSHA CHOUDHARYNo ratings yet

- Retail Company With Simple DCFDocument51 pagesRetail Company With Simple DCFJames Mitchell100% (1)

- Description: Tags: G5ravrdemonstrationDocument2 pagesDescription: Tags: G5ravrdemonstrationanon-61No ratings yet

- Integrative Case Track Software LTDDocument19 pagesIntegrative Case Track Software LTDDang DangNo ratings yet

- M.Sc. Microbiology Bio TechnologyDocument6 pagesM.Sc. Microbiology Bio Technologymmumullana0098No ratings yet

- Description: Tags: G5ravrdemonstrationDocument2 pagesDescription: Tags: G5ravrdemonstrationanon-202136No ratings yet

- C Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23Document325 pagesC Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23yash rajNo ratings yet

- Whirlpool EuropeDocument15 pagesWhirlpool EuropeMousumi GuhaNo ratings yet

- GraphDocument8 pagesGraphKumar AmitNo ratings yet

- Description: Tags: G3ravrdemonstrationDocument2 pagesDescription: Tags: G3ravrdemonstrationanon-186142No ratings yet

- ITC LTD.: Presented ByDocument12 pagesITC LTD.: Presented BypavanNo ratings yet

- Bài TậpDocument7 pagesBài TậpThùyy VyNo ratings yet

- Worksheet To Accompany Your Answer BookletDocument5 pagesWorksheet To Accompany Your Answer BookletSaksham GoyalNo ratings yet

- Horizontal Analysis / CommentsDocument6 pagesHorizontal Analysis / Commentsfarrukh_kanyalNo ratings yet

- New Microsoft Excel WorksheetDocument8 pagesNew Microsoft Excel WorksheetpavikuttyNo ratings yet

- Case 1 - Financial Manager & PolicyDocument16 pagesCase 1 - Financial Manager & PolicycatatankotakkuningNo ratings yet

- PitchbookDocument6 pagesPitchbookmaicoo.soledadNo ratings yet

- MyfileDocument1 pageMyfilevdkvaibhav100% (1)

- Description: Tags: G5ravrtrainingDocument4 pagesDescription: Tags: G5ravrtraininganon-318307No ratings yet

- How Was The WeatherDocument23 pagesHow Was The WeatherMonety AYUNo ratings yet

- Pitch BookDocument6 pagesPitch BookTaufan RamdhaniNo ratings yet

- Hero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersDocument35 pagesHero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersCharan KowtikwarNo ratings yet

- Graph of SailDocument12 pagesGraph of SailKshipra GoyalNo ratings yet

- Castelul MariaDocument10 pagesCastelul MariaIoana-Elis BocanaciuNo ratings yet

- 29 Apr 03 INCODocument8 pages29 Apr 03 INCOpd98004No ratings yet

- Forecasting Brigham Case SolutionDocument7 pagesForecasting Brigham Case SolutionShahid Mehmood100% (1)

- PitchbookDocument6 pagesPitchbookSAMEERNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Chapter - Iv Presentation and Analysis of DataDocument35 pagesChapter - Iv Presentation and Analysis of DataDinesh MjkNo ratings yet

- 3-Auto Di MicrografDocument28 pages3-Auto Di Micrografsuthir_msNo ratings yet

- Monmouth VfinalDocument6 pagesMonmouth VfinalAjax100% (1)

- ARM Investor BriefingDocument65 pagesARM Investor BriefingbnjiinuNo ratings yet

- Ratio Analysis:: Internship ReportDocument5 pagesRatio Analysis:: Internship ReportsahhhhhhhNo ratings yet

- Lenovo Intergration Plan Annual 2004 PresentationDocument26 pagesLenovo Intergration Plan Annual 2004 PresentationKelvin Lim Wei LiangNo ratings yet

- Capital Structure of Jindal Steel and PowerDocument2 pagesCapital Structure of Jindal Steel and PowerAshok VenkatNo ratings yet

- Culinary Cookware AI2Document14 pagesCulinary Cookware AI2Pranav SahilNo ratings yet

- 3 Du Pont Analysis of 3 Companies - TemplateDocument23 pages3 Du Pont Analysis of 3 Companies - Templateshubhangi.jain582No ratings yet

- Final PharmaDocument40 pagesFinal PharmakunalprasherNo ratings yet

- Nokia Results 2023 q2Document31 pagesNokia Results 2023 q2yalemorgan69No ratings yet

- RatiosDocument31 pagesRatiosAMegoz 25No ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Calculating Trend PercentageDocument2 pagesCalculating Trend PercentageSaravananSrvnNo ratings yet

- Blue Star - AnalystMeetPresentation06-07Document54 pagesBlue Star - AnalystMeetPresentation06-07hh.deepakNo ratings yet

- Tata Global Beverages LTDDocument3 pagesTata Global Beverages LTDKapil Singh RautelaNo ratings yet

- Whirlpool Europe Spreadsheet Supplement TVI 1Document6 pagesWhirlpool Europe Spreadsheet Supplement TVI 1Mousumi GuhaNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- Corporate Finance (Theory and Practice) CASE 1: Jones Electrical DistributionDocument6 pagesCorporate Finance (Theory and Practice) CASE 1: Jones Electrical Distributionabdulla mohammadNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- Chapter 9. Identifying Market Segments and Targets. Copyright 2016 Pearson Education Ltd. 9-1Document28 pagesChapter 9. Identifying Market Segments and Targets. Copyright 2016 Pearson Education Ltd. 9-1samah.fathi3No ratings yet

- Dr Farid shosha chapter seven هام ستةDocument53 pagesDr Farid shosha chapter seven هام ستةsamah.fathi3No ratings yet

- CH 26Document66 pagesCH 26samah.fathi3No ratings yet

- InflationDocument15 pagesInflationsamah.fathi3No ratings yet

- PovertyDocument10 pagesPovertysamah.fathi3No ratings yet

- Answers To Questions Chapter 1Document5 pagesAnswers To Questions Chapter 1samah.fathi3No ratings yet

- CH 10 PPTaccessibleDocument34 pagesCH 10 PPTaccessiblesamah.fathi3No ratings yet

- GDP and Growth (Autosaved)Document32 pagesGDP and Growth (Autosaved)samah.fathi3No ratings yet

- CH 14 PPTaccessibleDocument34 pagesCH 14 PPTaccessiblesamah.fathi3No ratings yet

- Report On Indian BankDocument27 pagesReport On Indian BankPoojaNo ratings yet

- Balance of PaymentDocument40 pagesBalance of PaymentgirishNo ratings yet

- Financial AspectDocument16 pagesFinancial AspectJezeree DichosoNo ratings yet

- Rice ParkDocument11 pagesRice ParkDeepthideepuNo ratings yet

- Cambridge Assessment International Education: Economics 0455/21 October/November 2019Document21 pagesCambridge Assessment International Education: Economics 0455/21 October/November 2019shrutisonibkn18No ratings yet

- Final Assesment: I. Problem SolvingDocument12 pagesFinal Assesment: I. Problem SolvingKaren Nicole Borreo MaddelaNo ratings yet

- Investors Perception Towards Stock MarketDocument2 pagesInvestors Perception Towards Stock MarketAkhil Anilkumar0% (1)

- Home Law Firms Legal Services Law & Practice Employment Students AssociationsDocument17 pagesHome Law Firms Legal Services Law & Practice Employment Students Associationsdeepak_vivNo ratings yet

- Chapter 6 QuestionsDocument8 pagesChapter 6 QuestionsJanelle Joyce Maranan DipasupilNo ratings yet

- Futurpreneur Cash Flow Template EN 09.08.2022 1Document10 pagesFuturpreneur Cash Flow Template EN 09.08.2022 1Alex VelascoNo ratings yet

- SBLC Terms & ProcedureDocument2 pagesSBLC Terms & ProcedureDima RajaNo ratings yet

- Auditor CV TemplateDocument2 pagesAuditor CV TemplateDaniel B Boy Nkrumah100% (2)

- 24 The GraduateDocument2 pages24 The GraduateW.J. ZondagNo ratings yet

- Prac I InvestmentsDocument16 pagesPrac I InvestmentsJohn PasquitoNo ratings yet

- New - Haven - FY 2015-16 Mayors Budget1Document419 pagesNew - Haven - FY 2015-16 Mayors Budget1Helen BennettNo ratings yet

- Indefinite Pronouns: Grammar WorksheetDocument6 pagesIndefinite Pronouns: Grammar Worksheetliceth marcela garcia baños100% (1)

- Qatar BanksDocument44 pagesQatar BanksShaik InayathNo ratings yet

- Marriage in Iowa Law - Complete ResultsDocument109 pagesMarriage in Iowa Law - Complete ResultsDavid ShaferNo ratings yet

- Capital Investment Factors - UST2021Document19 pagesCapital Investment Factors - UST2021Ey B0ssNo ratings yet

- A Balanced Scorecard For Small BusinessDocument8 pagesA Balanced Scorecard For Small BusinessmoussumiiNo ratings yet

- Financial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementDocument3 pagesFinancial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementJoje Sadili CostañosNo ratings yet

- Law of EquityDocument17 pagesLaw of EquityAnkitaSharma100% (2)

- International Monetary Asymmetries and The Central BankDocument31 pagesInternational Monetary Asymmetries and The Central BankJuan Carlos Lara GallegoNo ratings yet

- Sapm - 2 MarksDocument17 pagesSapm - 2 MarksA Senthilkumar100% (3)