Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsGST 6 Marks Theory

GST 6 Marks Theory

Uploaded by

GybcCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Unit - 1 CS MCQDocument4 pagesUnit - 1 CS MCQGybcNo ratings yet

- Keaapplicationpd 3920190606937 23062024 171625Document5 pagesKeaapplicationpd 3920190606937 23062024 171625GybcNo ratings yet

- Career Insights Portfolio Management Prateek Agarwal 8th April 2021Document20 pagesCareer Insights Portfolio Management Prateek Agarwal 8th April 2021GybcNo ratings yet

- Unit-3 CS MCQDocument3 pagesUnit-3 CS MCQGybcNo ratings yet

- GST Model Question Paper 2Document14 pagesGST Model Question Paper 2GybcNo ratings yet

- CS (MCQ Qus) Unit 3Document6 pagesCS (MCQ Qus) Unit 3GybcNo ratings yet

- Kset English Jan 13 - 2024Document19 pagesKset English Jan 13 - 2024GybcNo ratings yet

- CS (MCQ Qus) Unit 2Document5 pagesCS (MCQ Qus) Unit 2GybcNo ratings yet

- 74781bos60495 Cp9u1Document36 pages74781bos60495 Cp9u1GybcNo ratings yet

- 69256asb55316 As28Document62 pages69256asb55316 As28GybcNo ratings yet

- Marginal & Process CostingDocument45 pagesMarginal & Process CostingGybcNo ratings yet

- KCV49 PJYC4 M0 DJ PJ 827Document26 pagesKCV49 PJYC4 M0 DJ PJ 827GybcNo ratings yet

GST 6 Marks Theory

GST 6 Marks Theory

Uploaded by

Gybc0 ratings0% found this document useful (0 votes)

10 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

10 views8 pagesGST 6 Marks Theory

GST 6 Marks Theory

Uploaded by

GybcCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 8

ra

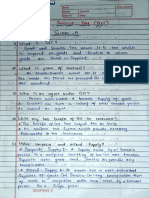

SECTION from business sources, and not on person

~ Answer any Three of the following :

Gx 5 = 15) 4

2) Explain the Concept and Principle of

GST?

Ans.: The Concept and Principles of GST are

as under =

1. Value Added Tax : GST is a Broad-based

value added tax levied on value added to

goods and/or services at each stage of

supply chain.

2. Destination based tax on consumption :

GST is the revenue of that state which has

jurisdiction over the place of consumption

of goods and/or services which is also

termed as place of supply.

Tax on Business Ac GST is a tax

on the consumption of products / services

hobby activities.

Continuous Chain of Tax Credits

available from producer se

provider's point upto the retailer),

consumer's level thus taxing only the vil

added at each stage of supply chain,

Burden Borne by Final Consumer : Oy),

the final consumer bears the GST charges

by the last supplier in supply chain as a

all the previous stages~ set off benefits are

available to the suppliers.

No Cascading of Taxes: As GST is

charged only on value added at each stage,

there is no cascading of taxes in this system

and it avoids double ti

—

6) Explain in brief Conditions for availing

Composition Scheme?

‘Ans.: The following conditions must be satisfied

order to opt for composition scheme :

a) No Input Tax Credit can be claimed by a

dealer opting for composition scheme.

b) The dealer cannot supply GST exempted

goods.

c) The taxpayer has to pay tax at normal rates

for transactions under the Reverse Charge

Mechanism.

4) Ifa taxable person has different segments of

businesses (such as textile, electronic,

accessories, groceries, etc.) under the same

PAN, they must register all such businesses

e)

8)

h)

under the scheme collect

the scheme.

The taxpayer has to ment

‘composition taxable person’ on every notice

or signboard displayed prominently at their

place of business.

The taxpayer has to mention the words

‘composition taxable p:rson’ on every bill of

supply issued by him.

As per the CGST (Amendment) act, 2018,

a manufacturer or trader can now also supply

services to an extent of ten percent of turnover

or Rs.5 lakhs.

The dealer is not allowed from carrying out

inter-state transactions.

y oF opt out of

m the words

SCTION 'B'

= Answer any Three of the following

(jx 5 = IS)

2) Mention the various components under

GST and also discuss them in brief.

Ans.:

CGST :

— It stands for Central Goods and Service

Tax which is levied and collected by Central

Government on intra-state supply of goods

and/or services

- It is governed by Central Goods and

Services Tax Act, 2017

SGST:

— It stands for State Goods and Service tax

which is levied and collected by respective

State Government on intra-state supply of

goods and/or services.

— Ibis govemed by State Goods and Services

Tax Act, 2017.

UTGST :

= It stands for Union Territories Goods and

Services Tax which is levied and collected

by Central Government on intra-state supply

of goods and/or services.

It is ge

Act, 2017

and Services

IGST

It stands for inte}

Tax which is levied and collected by on},

Central Government on inter-state Supply

grated Goods and Ser

of goods and/or services.

The tax so collected is then apportioney

between Central Government and respective

State Government where goods are

consumed.

It is governed by integrated Goods ang

Services Tax Act, 2017.

GST Compensation Cess

It is a compensation to States for loss of

revenue on account of introduction of GST

and is provided by Parliament, by law on

recommendation of GST Council for 5

years.

It is levied by Central Government on

notified goods only- on intra / inter-state

supply.

It is governed by GST (Compensation to

states) Cess Act, 2017.

SAP SERIES for B.Com. Gth Sem. As poy CBCS Syllabus

GOODS & SERVICES TAX |15

3) Discuss the functions of Common Gsr

portal / GSTN? -

‘Ans.: Common GST portal is a robust

settlement mechanicm amongst the States and

the Centre as GST is a destination-based tax.

jis a clearing house and it verifies the claims —

and inform the respective Governments to

transfer the funds. =

Thus, Common GST Electronic Portal —

wwwgstgov.in — is a website managed by

Goods and Services Network (GSTN). It -

establishes a uniform interface for tax payer —

and a common and shared IT infrastructure

between the Centre and States. =

The functions of Common GST portal/ -

TN include :

Facilitating registration

Forwarding the returns to Central and State

authorities

Computation and settlement of IGST

Matching for tax payment details with

banking network

Providing various MIS reports to the Central

and the State Governments based on the

taxpayer return information

Providing analysis of taxpayers’ profile

Running the matching engine for matching.

reversal and reclaim of input tax credit

For furnishing E-Way Bill

For generation of E-Invoice.

} eT EEE

———

( SECTION 'B'

_ answer any Three of the following

(3x 5 = 15)

2) Which are the commodities kept outside the

purview of GST?

OR

Supply of all goods and/or services is taxable

under GST. Discuss the validity of the

statement.

‘Ans. The statement is invalid due to the following

reasons =

we Supplies of all goods and/or services are

taxable under GST.

= except alcoholic liquor for human

consumption.

= Supply of following would be taxable with

effect from the date notified by Government

on recommendations of the GST Council :

— petroluem crude, ‘

= high speed diesel,

= motor spirit (petrol),

- natural gas and

- aviation turbine fueol,

3) What is.composition levy as per section 10

of CGST Act? Also state the threshold limit

‘for opting’ to pay tax under this scheme.

Ans.: Eligibility of Scheme : «

alternative method

© ‘The composition levy is

of levy of tax designed for small taxpayers

1 this scheme is

The option to pay tax unde

available u/s 10(1)/ 102A) of CGST Act to

a registered person whose aggregate turnover

year was not

in preceding financial

exceeding :

Under Section 10(1) of CGST Act:

— Rs.1.5 Crore in other than special category

states but including Assam, Himachal

Pradesh and Jammu & Kashmir and

— Rs. 75 lakhs in special category states

except Assam, Himachal Pradesh and

Jammu & Kashmir.

b) Under Section 10(2A) of CGST Act:

= Rs. 50 lakhs for person who are ineligible

to opt w/s 10(1).

© The benefit of composition scheme can be

availed upto the turnover of Rs. 1.5 Cr./ Rs.

75/Rs.50 lakh as the case may be in the

current financial year.

Objective : To bring simplicity and reduce

compliance cost for the small taxpayers.

Optional Scheme : This scheme is optional

and the eligible person opting this scheme can

pay tax at a prescribed percentage of his turnover

every quarter, instead of paying tax at normal

rate.

SECTION 'B'

Answer any Three of the following

(3 x 5 = 15)

yy Explain the significance of time of supply

under GST law. _

same can be paid to Government by the du

date prescribed with reference to the

ae ‘time of supply

& GST is leviable on supply of goods and/or © There are separate provisions for time

services. en supply for goods and services under sec

Time of supply indicates the point in time 12 and 13 of the CGST Act respec

when the liability to pay tax arises

© Though, the liability to pay the tax arises

at the time of supply, the payment of the

3) GST Rates applicable to goods.

Ans All goods are divided into 6 schedules for rate purpose as stated below :

Inter-state supply | Supply of goods Intra-state supply

Schedule IGST Rate GST Rate SGST Rate

(in %) (in %) (in %)

I 5 a5 2

I 12 6 6

Tl 18 9 9

Vv 28 14 14

Vv 3 15 aS

VI 0.25 0.125 0.125

empt from tax; Also some are liable for Nil rates. The GST is levied

t Some goods are ¢x'

le value of supply:

SCTION 'B!

Answer any Three of the following :

i (3.x $ = 15)

?) Mention the various components under GST.

and also discuss them in brief,

Ans.:

cost:

Tt stands for Central Goods and Service Tax

Which is levied and collected by Central

Goverment on inta-state supply of goods

and/or services

Its govemed by Central Goods and Services

Tax Act, 2017

SGST:

Tt stands for State

which is levied and

Goods and Service tax

collected by respective

State Government on intra-state supply of

B00ds and/or servi

It is govemed by

Tax Act, 2017

UTGST:

It stands. for Union Terttories. Goads and

Services Tax which is levied and collected

by Central Government on intr

of goods and/or services,

Its govemed by Union ‘Teritory Goods and

Services Tax Act, 2017

IGST;

It stands for integrated Goods and Service

Tax which is levied and collected by only

State Goods and Services

state supply

Central Government om mer

goods and/or services

~The tax s0 collected is the,

DD,

ANd t4,%

State Government where good es

are cgp

is govered by interred ga

Services Tax Act, 2017 wa

GST Compensation Coss;

Iis compensation to States 4

Fevenue on account of introdueti

and is provided by Parliament. »

between Central Governmen,

OF Jose

On Of Ge.

Ya g

Tecommendation of GST Couneit for§

Ts levied by Central Government on

foods only— on intra / inter-state

Yea

tgs

cml

Tis govemed by GST (Compe

states) Cess Act, 2017.

sation 1)

3) What is composition levy ay er section

COST Act? Also state the threshold init

Jor opting to pay tax under this scheme

Ans.: Eligibility of Scheme :

The composition levy

isan altemative mets

Of levy of tax designed for small texpayes

‘> The option to pay tax under this schem «

available ws 10(1) / 10(2A) of CGST Act

2 Tegistered person whose azgrepate tumover

in preceding financial

exceeding

a) Under Section 10(1) of CGST Acq;

Rs.1.5 Crore in other than speci) category

states but including Assam,

Year was not

Himachal

‘Guap SERIES for B.Com. 6th Sem. As per CBCS Syllabus GOODS & SERVICES TAX [51}

Pradesh and Jammu & Kashmir and 75/Rs.50 lakh as the case may be in the

— Rs. 75 lakhs in special category states current finaneial year.

except Assam, Himachal Pradesh and Objective: To bring simplicity and reduce

Jammu & Kashmir. | compliance cost for the small taxpayers

b) Under Section 10(2A) of CGST Act: Optional Scheme : This scheme is optional

= Rs. 50 lakhs for person who are ineligible and the eligible person opting this scheme can

to opt u/s 10(1). pay tax at a prescribed percentage of his tumover

> The benefit of composition scheme can be every quarter, instead of paying tax at normal

availed upto the turnover of Rs. 1.5 Cr./Rs. rate.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Unit - 1 CS MCQDocument4 pagesUnit - 1 CS MCQGybcNo ratings yet

- Keaapplicationpd 3920190606937 23062024 171625Document5 pagesKeaapplicationpd 3920190606937 23062024 171625GybcNo ratings yet

- Career Insights Portfolio Management Prateek Agarwal 8th April 2021Document20 pagesCareer Insights Portfolio Management Prateek Agarwal 8th April 2021GybcNo ratings yet

- Unit-3 CS MCQDocument3 pagesUnit-3 CS MCQGybcNo ratings yet

- GST Model Question Paper 2Document14 pagesGST Model Question Paper 2GybcNo ratings yet

- CS (MCQ Qus) Unit 3Document6 pagesCS (MCQ Qus) Unit 3GybcNo ratings yet

- Kset English Jan 13 - 2024Document19 pagesKset English Jan 13 - 2024GybcNo ratings yet

- CS (MCQ Qus) Unit 2Document5 pagesCS (MCQ Qus) Unit 2GybcNo ratings yet

- 74781bos60495 Cp9u1Document36 pages74781bos60495 Cp9u1GybcNo ratings yet

- 69256asb55316 As28Document62 pages69256asb55316 As28GybcNo ratings yet

- Marginal & Process CostingDocument45 pagesMarginal & Process CostingGybcNo ratings yet

- KCV49 PJYC4 M0 DJ PJ 827Document26 pagesKCV49 PJYC4 M0 DJ PJ 827GybcNo ratings yet