Professional Documents

Culture Documents

Answer - Exercise ABC Question 1 Atlantic Company

Answer - Exercise ABC Question 1 Atlantic Company

Uploaded by

Nurul QamariahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer - Exercise ABC Question 1 Atlantic Company

Answer - Exercise ABC Question 1 Atlantic Company

Uploaded by

Nurul QamariahCopyright:

Available Formats

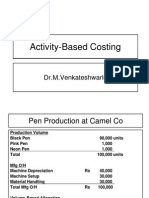

Answer Exercise ABC Question 1 Atlantic Company a) POHR: = RM900,000 (25,000 + 5,000) = RM30 per DLH b) Unit cost

st (Traditional): Products Model A Model B 40 30 12 12 30 30 RM82 RM72

Direct materials Direct labor Overhead : (RM30 x 1 hr) Total c) ABC overhead rates

Activity Cost Pools setting-up machines machining inspecting d) Overhead rates

Estimated Estimated use of cost Overhead drivers per activity RM300,000 1,500 setups 500,000 50,000 machine hours 100,000

ABC overhead rates RM200 per setup RM10 per machine hour 2,000 inspections RM50 per inspection

Model A Cost assigned setting-up machines: (RM200 @ 500; @1,000) Machining: (RM10 @ 30,000; @ 20,000) Inspecting: (RM50 @ 500; @ 1,500 Total Units produced OH cost per unit RM100,000

Model B Cost assigned RM200,000

300,000 200,000 25,000 RM425,000 25,000 RM17 75,000 RM475,000 5,000 RM95

e)

Unit cost under ABC & comparison wt traditional costing: Traditional 40 12 30 RM82 Model A ABC 40 12 17 RM69 Traditional 30 12 30 RM72 Model B ABC 30 12 95 RM137

Direct materials Direct labor Overhead Total product cost per unit

Question 2 Elektrik Antius a) Unit cost traditional POHR: = RM1,150,000 40,000 = RM28.75 per DLH Products PL ST RM120.00 RM140.00 20.00 45.00 57.50 RM197.50 86.25 RM271.25

Direct materials Direct labor (RM100,000/ 5,000) (RM450,000/10,000) Overhead (RM28.75 x 10,000) /5,000 ( RM28.75 x 30,000) / 10,000 Total b) Unit cost ABC Estimated Overhead Estimated use of cost drivers per activity RM300,000 6,000 240,000 2,000 330,000 300 280,000 1,400

Activity Cost Pools Machine setups Purchase ordering Product design Packing and shipping

ABC overhead rates RM50 per setup RM120 per purchase order RM1,100 per product design RM200 per shipment ST RM140.00 45.00

Product cost: Direct materials Direct labor Overhead: Machine setups: (RM50 * 4,000) / 5,000 (RM50 * 2,000) / 10,000 Purchase ordering: (RM120 * 1,200) / 5,000 (RM120 * 800) / 10,000 Product design: (RM1,100 * 200) / 5,000 (RM1,100 * 100) / 10,000 Packing and shipping: (RM200 * 800) / 5,000 (RM200 * 600) / 10,000 Overhead per unit Total unit cost

PL RM120.00 20.00 40.00

10.00 28.80 9.60 44.00 11.00 32.00 144.80 RM284.80 12.00 42.60 RM227.60

c) Product PL ST Traditional ABC RM197.50 * 1.25 = RM246.75 RM284.80 * 1.25 = RM356.00 RM271.50 * 1.25 = RM339.06 RM237.60 * 1.25 = RM284.50

ST is over-costed and overpriced. PL is under-costed and underpriced under traditional costing given the allocation basis used were not appropriate as they are basically unit related measures. d) ABC is more appropriate given the allocation basis involved unit and non-unit related measures. ST is high volume product hence, ST received more costs given traditional costing uses only volume related measures and product PL is a low volume product, hence it is undercosted given low volume produced. With ABC system, overhead costs will be allocated accordingly to the activity usage, hence there will be no product over-costed and under-costed under this method.

You might also like

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- ACCT 1003 Worksheet 1 Solutions2010 11 Revised 2Document5 pagesACCT 1003 Worksheet 1 Solutions2010 11 Revised 2Justine Powell100% (1)

- Mgt345 Om Mar2015 Part ADocument8 pagesMgt345 Om Mar2015 Part AYusuv Abdul Rashid100% (2)

- Cost Estimation For Mass Production Using Jigs and FixtureDocument9 pagesCost Estimation For Mass Production Using Jigs and FixturePraveen KumarNo ratings yet

- El PerplexionDocument6 pagesEl Perplexion123r12f1No ratings yet

- Jawab Tugas Standard Costing-2Document4 pagesJawab Tugas Standard Costing-2FitriNo ratings yet

- Ppce Unit-5Document21 pagesPpce Unit-5Jackson ..No ratings yet

- AMA Week 01 PUCK ExerciseDocument4 pagesAMA Week 01 PUCK ExerciseEmily FokNo ratings yet

- Revision Question Topic 3,4-AnswerDocument5 pagesRevision Question Topic 3,4-AnswerNur WahidaNo ratings yet

- Kelompok 11:: 1. Ahmad Fadli Nur H (201512117) 2. Muhammad Kafka 3. Isa Puji Lestari 4Document25 pagesKelompok 11:: 1. Ahmad Fadli Nur H (201512117) 2. Muhammad Kafka 3. Isa Puji Lestari 4Fadli AhmadNo ratings yet

- T (A) - CVP AnalysisDocument16 pagesT (A) - CVP AnalysisNavin El NinoNo ratings yet

- Cost Accounting Chapter 6Document18 pagesCost Accounting Chapter 6Raffy Roncales70% (10)

- F5 Solution 1 & 2Document2 pagesF5 Solution 1 & 2dy sovathNo ratings yet

- ABCDocument18 pagesABCRohit VarmaNo ratings yet

- Indicative Answers:: N12405 MAD II Seminar 3 Activity-Based CostingDocument2 pagesIndicative Answers:: N12405 MAD II Seminar 3 Activity-Based CostinganalsluttyNo ratings yet

- Chapter 13Document29 pagesChapter 13sweetwinkle09No ratings yet

- Tutorial Abc Management: Q1Andq2Document9 pagesTutorial Abc Management: Q1Andq2suharyati88No ratings yet

- AFAR First Preboard 93 - SolutionsDocument12 pagesAFAR First Preboard 93 - SolutionsEpfie SanchesNo ratings yet

- CH 44Document4 pagesCH 44Sadia MunawarNo ratings yet

- ABC SystemDocument11 pagesABC SystemSyarifatuz Zuhriyah UmarNo ratings yet

- Management Accounting 1 Group Assignment FIRST SEMESTER 2022 - 2121910004301Document12 pagesManagement Accounting 1 Group Assignment FIRST SEMESTER 2022 - 2121910004301Quế Phương NguyễnNo ratings yet

- Homework Chapter 5: Requirement 1: Manufacturing Cost Per Unit - TraditionalDocument2 pagesHomework Chapter 5: Requirement 1: Manufacturing Cost Per Unit - TraditionalMalene Mandrup TherkelsenNo ratings yet

- Answers To Cost Accounting Chapter 9Document6 pagesAnswers To Cost Accounting Chapter 9Raffy Roncales0% (1)

- University of Finance and MarketingDocument8 pagesUniversity of Finance and MarketingQuế Phương NguyễnNo ratings yet

- Problem 14-4 Shauton Company Product Costs From Traditional Costing SystemDocument4 pagesProblem 14-4 Shauton Company Product Costs From Traditional Costing SystemLarasAANo ratings yet

- APC 309 ABC Mock Exam Solution A and BDocument3 pagesAPC 309 ABC Mock Exam Solution A and BRunaway ShujiNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument12 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AHardin LavistreNo ratings yet

- Managerial Accounting-Solutions To Ch08Document4 pagesManagerial Accounting-Solutions To Ch08Mohammed HassanNo ratings yet

- Pricing Decisions and Cost ManagementDocument18 pagesPricing Decisions and Cost ManagementAmrit PrasadNo ratings yet

- Activity Based CostingDocument20 pagesActivity Based CostingArpit SahaiNo ratings yet

- Standard (I Unit Produced) ParticularsDocument11 pagesStandard (I Unit Produced) ParticularsForam Raval100% (1)

- Activity Based CostingDocument17 pagesActivity Based CostingRishabh HajelaNo ratings yet

- Calculation Cost For The Production of Sodium Carbonate: Preparation: Class: SubjectDocument10 pagesCalculation Cost For The Production of Sodium Carbonate: Preparation: Class: Subjectعبدالمحسن علي ENo ratings yet

- Assignment Question AccDocument5 pagesAssignment Question AccruqayyahqaisaraNo ratings yet

- Managerial Accounting ExamenDocument4 pagesManagerial Accounting Examenabalasa54100% (1)

- Assignment #2 DM&DL L Variance With SolutionDocument9 pagesAssignment #2 DM&DL L Variance With SolutionJeannet LagcoNo ratings yet

- UntitledDocument9 pagesUntitledBipin Kumar JhaNo ratings yet

- Engineering Management 3000/5039: Tutorial 2 - SolutionsDocument7 pagesEngineering Management 3000/5039: Tutorial 2 - SolutionsSahanNo ratings yet

- ABC - Practice Set Answer and SolutionDocument4 pagesABC - Practice Set Answer and SolutionYvone Ehnnery BumosaoNo ratings yet

- Engineering Estimate Semera New SS - RevisedDocument4 pagesEngineering Estimate Semera New SS - RevisedmichaelNo ratings yet

- E19-17 Allocation BaseDocument2 pagesE19-17 Allocation BaseHelplineNo ratings yet

- Practice Question On Absorption Abc MethodsDocument5 pagesPractice Question On Absorption Abc MethodsAshraf MahabubNo ratings yet

- REFERENCE: JUN2014/Q2/ACC280: Page/ Solution For Chapter 2Document7 pagesREFERENCE: JUN2014/Q2/ACC280: Page/ Solution For Chapter 2Eddie Edwansyah EidNo ratings yet

- Strategic Cost ManagementDocument5 pagesStrategic Cost Managementashwinimore811No ratings yet

- ABC Costing Autumn 19Document15 pagesABC Costing Autumn 19Tory IslamNo ratings yet

- Chapter 5 - ExercisesDocument6 pagesChapter 5 - Exercisesotaku25488No ratings yet

- Activity Based Costing SystemDocument18 pagesActivity Based Costing SystemMAXA FASHIONNo ratings yet

- Solution JUN 2018Document7 pagesSolution JUN 2018anis izzatiNo ratings yet

- Process Cost: Excel Professional ServicesDocument45 pagesProcess Cost: Excel Professional ServicesDiane PascualNo ratings yet

- Multiple Choice Questions - Theoretical: 1. C 5. B 9. A 2. B 6. C 10. C 3. B 7. A 11 A 4. B 8. D 12. CDocument18 pagesMultiple Choice Questions - Theoretical: 1. C 5. B 9. A 2. B 6. C 10. C 3. B 7. A 11 A 4. B 8. D 12. Csweetwinkle09No ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument13 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AMaica GarciaNo ratings yet

- Laboratory Exercises in Astronomy: Solutions and AnswersFrom EverandLaboratory Exercises in Astronomy: Solutions and AnswersNo ratings yet

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Advanced Modelling Techniques in Structural DesignFrom EverandAdvanced Modelling Techniques in Structural DesignRating: 5 out of 5 stars5/5 (3)

- Southern Marine Engineering Desk Reference: Second Edition Volume IFrom EverandSouthern Marine Engineering Desk Reference: Second Edition Volume INo ratings yet

- MAXON Cinema 4D R20: A Detailed Guide to Modeling, Texturing, Lighting, Rendering, and AnimationFrom EverandMAXON Cinema 4D R20: A Detailed Guide to Modeling, Texturing, Lighting, Rendering, and AnimationNo ratings yet

- Arens Chapter05Document39 pagesArens Chapter05Rolan_Goh_9039No ratings yet

- Best Resume Format Finance JobsDocument7 pagesBest Resume Format Finance Jobssbbftinbf100% (2)

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- CVP Tutorial SheetDocument4 pagesCVP Tutorial SheetDaneille Baker0% (1)

- Mgt101-15 - Accounting For InventoriesDocument69 pagesMgt101-15 - Accounting For InventoriesHaris AliNo ratings yet

- Keller CatalogDocument110 pagesKeller CatalogMilton MightyNo ratings yet

- PrefaceDocument16 pagesPrefaceNavaneeth RameshNo ratings yet

- Auditing Final Exam W 2010 - Model Answer PDFDocument16 pagesAuditing Final Exam W 2010 - Model Answer PDFMostafa Elgohary100% (3)

- Horngren Chapter 4 OutlineDocument30 pagesHorngren Chapter 4 OutlineHannahNo ratings yet

- Example 1: Floating To Fixed Interest Rate Swap (Designated Cash Flow Hedge)Document6 pagesExample 1: Floating To Fixed Interest Rate Swap (Designated Cash Flow Hedge)mikeokayNo ratings yet

- Pi Emotional Quotient Digital AgeDocument88 pagesPi Emotional Quotient Digital AgeThai Hoa Pham100% (1)

- DepreciationDocument4 pagesDepreciationeunwink eunwinkNo ratings yet

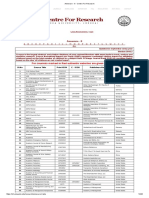

- Annexure - II - Centre For ResearchDocument243 pagesAnnexure - II - Centre For Researchrit686No ratings yet

- Cost Accounting ExamDocument29 pagesCost Accounting ExamErina AusriaNo ratings yet

- Examination Timetable: Important Note: Please Check Your Subject by Using TheDocument5 pagesExamination Timetable: Important Note: Please Check Your Subject by Using TheFrederick Goldwin SoegihartoNo ratings yet

- Exercise 17Document7 pagesExercise 17faye pantiNo ratings yet

- CRA Journal Entries Internal ReconstructionDocument6 pagesCRA Journal Entries Internal Reconstructioncharmi vaghelaNo ratings yet

- AP1: Cash and AccrualsDocument3 pagesAP1: Cash and AccrualsJelwin Enchong BautistaNo ratings yet

- AFAR-02 (Partnership Dissolution & Liquidation)Document15 pagesAFAR-02 (Partnership Dissolution & Liquidation)Jennelyn CapenditNo ratings yet

- CA Ipc Most Important Costing TheoryDocument52 pagesCA Ipc Most Important Costing TheoryAnupam BaliNo ratings yet

- Chapter 2 Differential Analysis The Key To Decision MakingDocument76 pagesChapter 2 Differential Analysis The Key To Decision MakingLiezel Vonne M. CaballeroNo ratings yet

- DocxDocument10 pagesDocxYukiNo ratings yet

- AFAR-18 (JIT, ABC, FOH - Service Cost Allocation)Document7 pagesAFAR-18 (JIT, ABC, FOH - Service Cost Allocation)Flores Renato Jr. S.No ratings yet

- Wan - Davi Journal 2015.pdf 856218388Document33 pagesWan - Davi Journal 2015.pdf 856218388Wan Desti TariniNo ratings yet

- Fasb 52 PDFDocument2 pagesFasb 52 PDFRachelleNo ratings yet

- ch08 Accounting For ReceivablesDocument75 pagesch08 Accounting For ReceivablesNisrina Ardyanti100% (1)

- 2nd Group - IASDocument63 pages2nd Group - IASmohihsanNo ratings yet

- The Major Differences Between U.S GAAP and IFRSDocument12 pagesThe Major Differences Between U.S GAAP and IFRSMega Pop LockerNo ratings yet