Professional Documents

Culture Documents

Ajustados P/BBG

Ajustados P/BBG

Uploaded by

LuluOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ajustados P/BBG

Ajustados P/BBG

Uploaded by

LuluCopyright:

Available Formats

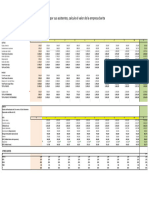

Análisis de informe financiero

Ticker: AAPL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Apple Inc

Registro: Más reciente

Ajustados p/BBG

Restated:2017 A Restated:2018 A Original:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Actual/Ú12M Estimación:2024 A Estimación:2025 A

Plazo termina 2017-9-30 2018-9-29 2019-9-28 2020-9-26 2021-9-25 2022-9-24 2023-9-30 2023-12-30 2024-9-30 2025-9-30

Ingreso 228,594,000.00 265,595,000.00 260,174,000.00 274,515,000.00 365,817,000.00 394,328,000.00 383,285,000.00 385,706,000.00 389,379,830.00 413,908,067.00

+ Ingresos de 228,594,000.00 265,595,000.00 260,174,000.00 274,515,000.00 365,817,000.00 394,328,000.00 383,285,000.00 385,706,000.00

servicios y ventas

- Coste de ingreso 141,048,000.00 163,756,000.00 161,782,000.00 169,559,000.00 212,981,000.00 223,546,000.00 214,137,000.00 212,035,000.00

+ Coste de bienes y 141,048,000.00 163,756,000.00 161,782,000.00 169,559,000.00 212,981,000.00 223,546,000.00 214,137,000.00 212,035,000.00

servicios

Beneficio bruto 87,546,000.00 101,839,000.00 98,392,000.00 104,956,000.00 152,836,000.00 170,782,000.00 169,148,000.00 173,671,000.00 178,001,095.49 189,031,814.20

+ Otros ingresos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

operacionales

- Gastos 26,842,000.00 31,177,000.00 34,462,000.00 38,668,000.00 43,887,000.00 51,345,000.00 54,847,000.00 55,013,000.00

operacionales

+ Ventas, generales 15,261,000.00 16,705,000.00 18,245,000.00 19,916,000.00 21,973,000.00 25,094,000.00 24,932,000.00 25,111,000.00

y admin

+ Investigación y 11,581,000.00 14,236,000.00 16,217,000.00 18,752,000.00 21,914,000.00 26,251,000.00 29,915,000.00 29,902,000.00

desarrollo

+ Otro gasto 0.00 236,000.00 0.00 0.00 0.00 0.00 0.00 0.00

operativo

Ingreso operacional 60,704,000.00 70,662,000.00 63,930,000.00 66,288,000.00 108,949,000.00 119,437,000.00 114,301,000.00 118,658,000.00 120,737,048.00 128,932,605.00

(pérdida)

- Ingreso (pérdida) no -2,646,000.00 -1,985,000.00 -1,838,000.00 -721,000.00 26,000.00 334,000.00 565,000.00 222,000.00

operacional

+ Gasto de -2,878,000.00 -2,446,000.00 -1,385,000.00 -890,000.00 -198,000.00 106,000.00 183,000.00

intereses, neto

+ Gastos de 2,323,000.00 3,240,000.00 3,576,000.00 2,873,000.00 2,645,000.00 2,931,000.00 3,933,000.00

intereses

- Ingreso de 5,201,000.00 5,686,000.00 4,961,000.00 3,763,000.00 2,843,000.00 2,825,000.00 3,750,000.00

intereses

+ (Plusvalía) pérdida 0.00 0.00 0.00 0.00 0.00 0.00 0.00

del tipo de cambio

+ Otro (ingreso) 232,000.00 461,000.00 -453,000.00 169,000.00 224,000.00 228,000.00 382,000.00 174,000.00

pérdida no op

Beneficios (pérdidas) 63,350,000.00 72,647,000.00 65,768,000.00 67,009,000.00 108,923,000.00 119,103,000.00 113,736,000.00 118,436,000.00 120,047,189.00 127,062,250.00

antes de impuestos,

ajustados

- Pérdida anormal -739,000.00 -256,000.00 31,000.00 -82,000.00 -284,000.00 0.00 0.00 0.00

+ Resolución jurídica -236,000.00

+ Inversiones no -99,000.00 -20,000.00 31,000.00 -82,000.00 -284,000.00

realizadas

+ Otros elementos -640,000.00

atípicos

Beneficios (pérdidas) 64,089,000.00 72,903,000.00 65,737,000.00 67,091,000.00 109,207,000.00 119,103,000.00 113,736,000.00 118,436,000.00 120,047,189.00 127,062,250.00

antes de impuestos,

GAAP

- Gasto de impuesto a 15,738,000.00 13,372,000.00 10,481,000.00 9,680,000.00 14,527,000.00 19,300,000.00 16,741,000.00 17,523,000.00

la renta (Beneficio)

+ Impuesto sobre la 9,772,000.00 45,962,000.00 10,821,000.00 9,895,000.00 19,301,000.00 18,405,000.00 19,765,000.00

renta actual

+ Impuesto sobre la 5,966,000.00 -32,590,000.00 -340,000.00 -215,000.00 -4,774,000.00 895,000.00 -3,024,000.00

renta diferido

Beneficios (pérdidas) 48,351,000.00 59,531,000.00 55,256,000.00 57,411,000.00 94,680,000.00 99,803,000.00 96,995,000.00 100,913,000.00 101,230,619.00 107,066,132.00

de operaciones

continuas

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 02/23/2024 12:22:12 1

Análisis de informe financiero

Ticker: AAPL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Apple Inc

Registro: Más reciente

Restated:2017 A Restated:2018 A Original:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Actual/Ú12M Estimación:2024 A Estimación:2025 A

Plazo termina 2017-9-30 2018-9-29 2019-9-28 2020-9-26 2021-9-25 2022-9-24 2023-9-30 2023-12-30 2024-9-30 2025-9-30

- Pérdidas 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(ganancias)

extraordinarias netas

+ Operaciones 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

discontinuas

+ PE y cambios 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

contables

Ingreso (pérdida) incl 48,351,000.00 59,531,000.00 55,256,000.00 57,411,000.00 94,680,000.00 99,803,000.00 96,995,000.00 100,913,000.00

MI

- Minoritarios 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Beneficio neto, GAAP 48,351,000.00 59,531,000.00 55,256,000.00 57,411,000.00 94,680,000.00 99,803,000.00 96,995,000.00 100,913,000.00 101,230,619.00 107,066,132.00

- Dividendos 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

preferentes

- Otros ajustes 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

beneficio neto 48,351,000.00 59,531,000.00 55,256,000.00 57,411,000.00 94,680,000.00 99,803,000.00 96,995,000.00 100,913,000.00 101,230,619.00 107,066,132.00

disponible a

accionistas comunes,

GAAP

Beneficio neto 47,870,650.00 59,337,720.00 55,280,490.00 57,346,220.00 94,455,640.00 99,803,000.00 96,995,000.00 100,913,000.00 101,230,619.00 107,066,132.00

disponible a cap

común, aj

Pérdidas atípicas -480,350.00 -193,280.00 24,490.00 -64,780.00 -224,360.00 0.00 0.00 0.00

netas (ganancias)

Pérdidas (ganancias) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

extraordinarias netas

Acciones promedio 20,868.97 19,821.51 18,471.34 17,352.12 16,701.27 16,215.96 15,744.23 15,509.76

básicas pond

BPA básicos, GAAP 2.32 3.00 2.99 3.31 5.67 6.15 6.16 6.46 6.60 7.17

Basic EPS from Cont 2.32 3.00 2.99 3.31 5.67 6.15 6.16 6.46 6.60 7.17

Ops, GAAP

BPA básicos de ops 2.29 2.99 2.99 3.30 5.66 6.15 6.16 6.46 6.60 7.17

cont, ajustados

Acciones diluidas 21,006.77 20,000.44 18,595.65 17,528.21 16,864.92 16,325.82 15,812.55 15,576.64

promedio pond

BPA diluidos, GAAP 2.30 2.98 2.97 3.28 5.61 6.11 6.13 6.42 6.60 7.17

Diluted EPS from Cont 2.30 2.98 2.97 3.28 5.61 6.11 6.13 6.42 6.60 7.17

Ops, GAAP

BPA diluidos de ops 2.28 2.97 2.97 3.28 5.60 6.11 6.13 6.42 6.60 7.17

cont, ajustados

Referencia

Norma de contabilidad US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP US GAAP

EBITDA 70,861,000.00 81,565,000.00 76,477,000.00 78,844,000.00 121,933,000.00 132,441,000.00 127,820,000.00 130,109,000.00 133,570,000.00 140,923,179.00

Margen EBITDA 31.00 30.71 29.39 28.72 33.33 33.59 33.35 33.73 34.30 34.05

(U12M)

EBITA 62,661,000.00 70,662,000.00 63,930,000.00 67,788,000.00 110,649,000.00 121,337,000.00 116,301,000.00 90,340,000.00

EBIT 60,704,000.00 70,662,000.00 63,930,000.00 66,288,000.00 108,949,000.00 119,437,000.00 114,301,000.00 118,658,000.00 120,737,048.00 128,932,605.00

Margen bruto 38.30 38.34 37.82 38.23 41.78 43.31 44.13 45.03 45.71 45.67

Margen operacional 26.56 26.61 24.57 24.15 29.78 30.29 29.82 30.76 31.01 31.15

Margen de beneficio 20.94 22.34 21.25 20.89 25.82 25.31 25.31 26.16 26.00 25.87

Ventas por empleado 1,858,487.80 2,012,083.33 1,899,080.29 1,867,448.98 2,375,435.06 2,404,439.02 2,380,652.17

Dividendos por acción 0.60 0.68 0.75 0.80 0.87 0.90 0.94 0.95 0.99 1.05

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 02/23/2024 12:22:12 2

Análisis de informe financiero

Ticker: AAPL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Apple Inc

Registro: Más reciente

Restated:2017 A Restated:2018 A Original:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Actual/Ú12M Estimación:2024 A Estimación:2025 A

Plazo termina 2017-9-30 2018-9-29 2019-9-28 2020-9-26 2021-9-25 2022-9-24 2023-9-30 2023-12-30 2024-9-30 2025-9-30

Dividendos ordinarios 12,521,380.80 13,478,625.44 13,853,502.00 13,794,934.61 14,446,600.28 14,594,366.70 14,799,577.14 14,864,680.06

totales en efectivo

Gasto de depreciación 8,200,000.00 10,903,000.00 12,547,000.00 11,056,000.00 11,284,000.00 11,104,000.00 11,519,000.00 8,553,000.00

Gasto de renta 1,100,000.00 1,200,000.00 1,300,000.00 10,800,000.00 14,600,000.00 16,800,000.00 15,900,000.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 02/23/2024 12:22:12 3

You might also like

- ExportFile LB 2Document4 pagesExportFile LB 2susilo fadhilNo ratings yet

- ExportFile LB 2Document4 pagesExportFile LB 2susilo fadhilNo ratings yet

- Jackson 5Document13 pagesJackson 5mariapocol202130548No ratings yet

- Balanza de Comprobacion 1Document1 pageBalanza de Comprobacion 1carlosalexismendiolaNo ratings yet

- Balanza de Comprobacion 1Document1 pageBalanza de Comprobacion 1carlosalexismendiolaNo ratings yet

- Rpta Caso PracticoDocument2 pagesRpta Caso PracticoNoelia SuclupeNo ratings yet

- Utilidades Azucareras 2023Document1 pageUtilidades Azucareras 2023Gustavo AnticonaNo ratings yet

- EL ULTIMO SAMURAI SAC.1xlsxDocument7 pagesEL ULTIMO SAMURAI SAC.1xlsxBECERRA GAVINO KAREN PAOLANo ratings yet

- DetraccionesDocument8 pagesDetraccionesLiz Atahuachi QuispeNo ratings yet

- Fungsional Okt OkeeDocument3 pagesFungsional Okt Okeesd inpres ParopoNo ratings yet

- KyleDocument4 pagesKyleJericho EstrellaNo ratings yet

- Finanzas Way2Document68 pagesFinanzas Way2dulceNo ratings yet

- Jawaban Praktikum Akl RahmaDocument7 pagesJawaban Praktikum Akl RahmaNur MayantiNo ratings yet

- SensibilidadDocument8 pagesSensibilidadwillian lozada tezenNo ratings yet

- Naki̇t Akiş Tablosu HazirlanişiDocument25 pagesNaki̇t Akiş Tablosu HazirlanişiEmrehan özNo ratings yet

- Renta 5taDocument2 pagesRenta 5taAndrea Arauco GonzalesNo ratings yet

- Hola KolaDocument2 pagesHola KolaWasif AhmedNo ratings yet

- Laporan Arus Kas Jawaban ExerciseDocument3 pagesLaporan Arus Kas Jawaban Exercisemuh.akbarNo ratings yet

- UntitledDocument1 pageUntitledJomayra RequenaNo ratings yet

- Contoh Rincian Realisasi Pendapatan Dan Belanja Jasa Puskesmas 9Document8 pagesContoh Rincian Realisasi Pendapatan Dan Belanja Jasa Puskesmas 9tovan aprilioNo ratings yet

- MATRICESDocument3 pagesMATRICESSERGIO DAMIAN SICAN AJINNo ratings yet

- Activo Circulante:: Efectivo Clientes InventariosDocument2 pagesActivo Circulante:: Efectivo Clientes InventariosRodrigo VegaNo ratings yet

- 14.working Capital ManagementDocument4 pages14.working Capital ManagementDAISYBELLE S. BAÑASNo ratings yet

- Cuadro de Gasttos Edificio Palatino Porr RUBROS 2023Document1 pageCuadro de Gasttos Edificio Palatino Porr RUBROS 2023sitec ingenieriaNo ratings yet

- Caso Semana 07Document4 pagesCaso Semana 07harold diego vasquezNo ratings yet

- Corrigé Exo LIASSE FISC 2022Document10 pagesCorrigé Exo LIASSE FISC 2022Hamid BoubidiNo ratings yet

- Práctica Valoración Flujos DescontadosDocument1 pagePráctica Valoración Flujos DescontadosADRIANA MICAELA ALMENDRAS MOLINANo ratings yet

- Total Aset 1,335,000.00 563,000.00 623,000.00 60,000.00Document9 pagesTotal Aset 1,335,000.00 563,000.00 623,000.00 60,000.00dalil aldaryNo ratings yet

- 07-10-23 Rentabilidad, RiesgoDocument2 pages07-10-23 Rentabilidad, RiesgoDIANA JACKELINE RAMOS CARTAGENANo ratings yet

- Mayor GeneralDocument5 pagesMayor Generalsonidos relajantesNo ratings yet

- Ejercicio 4Document10 pagesEjercicio 4Mariel García GarcíaNo ratings yet

- Ejercicio de Presupuesto de Produccion Helen FloresDocument16 pagesEjercicio de Presupuesto de Produccion Helen FloresAlexander Salas VeraNo ratings yet

- Trial BalanceDocument1 pageTrial Balancevannisa alliaNo ratings yet

- PRACTICA #01 - FORMULACION DEL FLUJO DE CAJA (DESARROLLADO) .Xlsx?embed 1Document2 pagesPRACTICA #01 - FORMULACION DEL FLUJO DE CAJA (DESARROLLADO) .Xlsx?embed 1pilar zeñaNo ratings yet

- SPJ SAMPAI MARET 2024Document5 pagesSPJ SAMPAI MARET 2024Liliana Henuk da CostaNo ratings yet

- Flujo de EfectivoDocument17 pagesFlujo de EfectivoLalo CTNo ratings yet

- Sistema de InventarioDocument5 pagesSistema de Inventarioangie lazoNo ratings yet

- ReportMayorBalancesDet MarzoDocument2 pagesReportMayorBalancesDet Marzoyonier yaset diusa bermonNo ratings yet

- CSWD Aip 2018 Superfinalafter CDCDocument79 pagesCSWD Aip 2018 Superfinalafter CDCIrish Joy Panes AlbiaNo ratings yet

- PRESUPUESTO DE EFECTIVO EMPRESA ESTILO 1 RepasoDocument6 pagesPRESUPUESTO DE EFECTIVO EMPRESA ESTILO 1 RepasoCarol MarielNo ratings yet

- Practica 2 Ejer 8,9,10Document11 pagesPractica 2 Ejer 8,9,10KATERINE RODRIGUEZ VILLARROELNo ratings yet

- Penyata Aliran TunaiDocument4 pagesPenyata Aliran TunaiMUHAMMAD AMALFI AUFA ASMADI AFFENDINo ratings yet

- WANABI Print - Rahmadini Cahya Ayu Salsabila - 1701622062 - UAS KOMPAK-Neraca Saldo-2014-01-01 - 2014-01-31Document1 pageWANABI Print - Rahmadini Cahya Ayu Salsabila - 1701622062 - UAS KOMPAK-Neraca Saldo-2014-01-01 - 2014-01-31pacar haechanNo ratings yet

- Rincian Dispo Fiks Bulan Agustus 2023Document2 pagesRincian Dispo Fiks Bulan Agustus 2023ZULKA EKA DEWI KANSILNo ratings yet

- FEN İŞLERİ MÜDÜRLÜĞÜ-tek Sayfa IçindeDocument1 pageFEN İŞLERİ MÜDÜRLÜĞÜ-tek Sayfa IçindeBafra OfsetNo ratings yet

- SHOPIEDocument1 pageSHOPIEMariaNo ratings yet

- Balanta PDFDocument2 pagesBalanta PDFPlus CompNo ratings yet

- Cocokan Draft Dan SPTDocument4 pagesCocokan Draft Dan SPTDani DeniNo ratings yet

- Afar AnswerDocument3 pagesAfar AnswerKrizza Mae MendozaNo ratings yet

- Reporte Neto A Pagar-20230731125027Document5 pagesReporte Neto A Pagar-20230731125027Artecsa ArtecsaNo ratings yet

- Taller Repaso 3-04-2024Document12 pagesTaller Repaso 3-04-2024Jeimy CartagenaNo ratings yet

- Sol - Casos Bal. ComprobaciónDocument6 pagesSol - Casos Bal. Comprobaciónjunior.olivos24No ratings yet

- Catatan Laporan Keuangan 2023 LangonDocument12 pagesCatatan Laporan Keuangan 2023 Langonfajar junaNo ratings yet

- Data Tabel Rasionalisasi Anggaran Setda Tahun 2020Document18 pagesData Tabel Rasionalisasi Anggaran Setda Tahun 2020mario180382No ratings yet

- ContaDocument22 pagesContammar95275No ratings yet

- Crismary Ron 28.387.990 CALCULOSDocument4 pagesCrismary Ron 28.387.990 CALCULOScrismary ronNo ratings yet

- Primer Caso Practico, Administracion de Presupuestos.Document13 pagesPrimer Caso Practico, Administracion de Presupuestos.Erick HernandezNo ratings yet

- No Le HayoDocument6 pagesNo Le HayoJonathan MejiaNo ratings yet