Professional Documents

Culture Documents

Super Project Slides

Super Project Slides

Uploaded by

p23ayushsCopyright:

Available Formats

You might also like

- 2024 Becker CPA Financial (FAR) NotesDocument51 pages2024 Becker CPA Financial (FAR) Notescraigsappletree100% (4)

- Capital Budgeting Sums-Doc For PDF (Encrypted)Document7 pagesCapital Budgeting Sums-Doc For PDF (Encrypted)Prasad GharatNo ratings yet

- SuperDocument30 pagesSuperAbhishek TiwariNo ratings yet

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Tire City SlidesDocument8 pagesTire City Slidesp23ayushsNo ratings yet

- The Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Document41 pagesThe Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Vaishali GuptaNo ratings yet

- Capital BudgetingDocument108 pagesCapital Budgetingdhanraj_aartiNo ratings yet

- FM L6 7 Investment RevDocument27 pagesFM L6 7 Investment RevANJALI SHARMANo ratings yet

- Capital BudgetingDocument18 pagesCapital BudgetingNilesh SondigalaNo ratings yet

- Capital Budgeting Techniques: Prof. Nidhi BandaruDocument28 pagesCapital Budgeting Techniques: Prof. Nidhi Bandaruhashmi4a4No ratings yet

- MBA Finance FAQsDocument2 pagesMBA Finance FAQsTosin GeorgeNo ratings yet

- Unit 5 Capital Budgeting TechniquesDocument37 pagesUnit 5 Capital Budgeting Techniquesayaankhan2307sreNo ratings yet

- Evaluating Business and Engineering Assets II: The Annual Worth Method and The Rate-of-ReturnDocument25 pagesEvaluating Business and Engineering Assets II: The Annual Worth Method and The Rate-of-ReturnJane Erestain BuenaobraNo ratings yet

- The AW Method and IRR Method (Week 9)Document4 pagesThe AW Method and IRR Method (Week 9)raymond moscosoNo ratings yet

- Capital Budgeting: Should We Build This Plant?Document33 pagesCapital Budgeting: Should We Build This Plant?Bhuvan SemwalNo ratings yet

- Economic Analysis For RoboticsDocument15 pagesEconomic Analysis For RoboticsAman SharmaNo ratings yet

- Chapter 9 Profitability Part 1Document13 pagesChapter 9 Profitability Part 1Subhadeep ChakrabartiNo ratings yet

- ITC CaseDocument5 pagesITC CaseAbhijeet GangulyNo ratings yet

- Internal Rate of ReturnDocument28 pagesInternal Rate of ReturnVaidyanathan Ravichandran100% (1)

- Techniques of Capital Budgeting: Investment Evaluation CriteriaDocument29 pagesTechniques of Capital Budgeting: Investment Evaluation CriteriaNaitik ModiNo ratings yet

- Assignment On FaseelDocument6 pagesAssignment On FaseelAbdul KhanNo ratings yet

- 03 - 20th Aug Capital Budgeting, 2019Document37 pages03 - 20th Aug Capital Budgeting, 2019anujNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- Project Appraisal - Investment Appraisal - 2023Document40 pagesProject Appraisal - Investment Appraisal - 2023ThaboNo ratings yet

- Accounting 9th Edition Horngren Solution ManualDocument19 pagesAccounting 9th Edition Horngren Solution ManualAsa100% (1)

- Risk in Capital BudgetingDocument18 pagesRisk in Capital BudgetingHaresh VermaNo ratings yet

- Methods of Project AppraisalDocument28 pagesMethods of Project AppraisalMîñåk ŞhïïNo ratings yet

- Appraisal Criteria - Capital BudgetingDocument50 pagesAppraisal Criteria - Capital BudgetingNitesh NagdevNo ratings yet

- Chapter - 8: Capital Budgeting DecisionsDocument45 pagesChapter - 8: Capital Budgeting DecisionsNirmal ThomasNo ratings yet

- Financial Analysis: Alka Assistant Director Power System Training Institute BangaloreDocument40 pagesFinancial Analysis: Alka Assistant Director Power System Training Institute Bangaloregaurang1111No ratings yet

- Capital Budgeting A Nice Finance Topic Helpful For Mba and Bba StudentsDocument39 pagesCapital Budgeting A Nice Finance Topic Helpful For Mba and Bba StudentsNimish KumarNo ratings yet

- Investment Appraisal and NPV AnalysisDocument4 pagesInvestment Appraisal and NPV Analysistran thanhNo ratings yet

- Economic PrinciplesDocument9 pagesEconomic PrinciplesLindsay BakerNo ratings yet

- Capital BudgetingDocument49 pagesCapital Budgetingthkrarun100No ratings yet

- Net Present Value and Other Investment CriteriaDocument23 pagesNet Present Value and Other Investment CriteriaHanniel Madramootoo100% (1)

- Profitability AnalysisDocument43 pagesProfitability AnalysisAvinash Iyer100% (1)

- 29th Aug 2023 Final Complex Investment DecisionsDocument15 pages29th Aug 2023 Final Complex Investment DecisionsKunal KadamNo ratings yet

- CIMA Paper P1: NotesDocument3 pagesCIMA Paper P1: NotesSajid AliNo ratings yet

- Profitabilty. AnalysisDocument35 pagesProfitabilty. AnalysisSidharth RazdanNo ratings yet

- Unwinding of DiscountDocument5 pagesUnwinding of Discountlavanya sNo ratings yet

- Capital Budgeting: Kiran ThapaDocument34 pagesCapital Budgeting: Kiran ThapaRajesh ShresthaNo ratings yet

- CH - 08 Cap BudgetingDocument54 pagesCH - 08 Cap BudgetingfoglaabhishekNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisMobin NasimNo ratings yet

- Rate of Return CalculationsDocument37 pagesRate of Return CalculationsSrushti MNo ratings yet

- Capital Budgeting - Adv IssuesDocument21 pagesCapital Budgeting - Adv IssuesdixitBhavak DixitNo ratings yet

- Capital Budgeting: BA 217: Financial ManagementDocument46 pagesCapital Budgeting: BA 217: Financial ManagementyanaNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisDejene HailuNo ratings yet

- Financial StatementDocument54 pagesFinancial StatementAlvin FelicianoNo ratings yet

- Capital BudgetingDocument30 pagesCapital BudgetingUmesh ChandraNo ratings yet

- Efa-Unit 5Document45 pagesEfa-Unit 5mandavillinagavenkatasriNo ratings yet

- Capital Budgeting - I: Gourav Vallabh Xlri JamshedpurDocument64 pagesCapital Budgeting - I: Gourav Vallabh Xlri JamshedpurSimran JainNo ratings yet

- Measuring Investment Returns: Stern School of BusinessDocument139 pagesMeasuring Investment Returns: Stern School of Businesssuhasshinde88No ratings yet

- Capital Budgeting 30032010Document18 pagesCapital Budgeting 30032010kkv_phani_varma5396No ratings yet

- FM Mod II-2Document10 pagesFM Mod II-2Irfanu NisaNo ratings yet

- Capitall Budgeting Unit 2Document70 pagesCapitall Budgeting Unit 2kdxpro22No ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingHannahbea LindoNo ratings yet

- Capital BudgetingDocument42 pagesCapital BudgetingPiyush ChitlangiaNo ratings yet

- 9 Capital BudgetingDocument6 pages9 Capital BudgetingRavichandran SeenivasanNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Sip ReportDocument52 pagesSip ReportRavi JoshiNo ratings yet

- 2024 GIO - APAC Report - Final - CompressedDocument24 pages2024 GIO - APAC Report - Final - Compressedbotoy26No ratings yet

- Komal SharmaDocument34 pagesKomal SharmaVini Balot0% (1)

- Financial Risk ND ProfitabilityDocument22 pagesFinancial Risk ND Profitabilitytungeena waseemNo ratings yet

- 18.functions of Commercial BanksDocument15 pages18.functions of Commercial BanksPraneeth KumarNo ratings yet

- This Study Resource Was: FinanceDocument4 pagesThis Study Resource Was: FinanceSIDDHARTH SETHI-DM 21DM198No ratings yet

- Transcript Orsted Q3 2023Document25 pagesTranscript Orsted Q3 2023shen.wangNo ratings yet

- Construction Sector Update - 141013Document32 pagesConstruction Sector Update - 141013Pinaki RoychowdhuryNo ratings yet

- Performance of Indian IPOs Listed in 2021Document11 pagesPerformance of Indian IPOs Listed in 2021REGI MEMANA VARUGHESENo ratings yet

- IsleX - Global Digital Liquidity (Presentation - Deck)Document26 pagesIsleX - Global Digital Liquidity (Presentation - Deck)Brian NiessenNo ratings yet

- Quotation: Syarikat Takaful Malaysia Keluarga Berhad (Head OfficeDocument5 pagesQuotation: Syarikat Takaful Malaysia Keluarga Berhad (Head OfficeakmabushNo ratings yet

- Lesson 3A. Investment On Securities - Please PrintDocument13 pagesLesson 3A. Investment On Securities - Please PrintHail DeityNo ratings yet

- Plumbing Arithmetic EconomyDocument9 pagesPlumbing Arithmetic EconomyAngelo Lirio InsigneNo ratings yet

- NPV and IRRDocument2 pagesNPV and IRRsaadhashmi97No ratings yet

- HW2 QDocument6 pagesHW2 Qtranthithanhhuong25110211No ratings yet

- Working CapitalDocument107 pagesWorking CapitalGanesh Nikhil100% (1)

- DK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsDocument67 pagesDK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsPython The SnakeNo ratings yet

- CapitalGain Summary Report - 1658151067650 - 11Document1 pageCapitalGain Summary Report - 1658151067650 - 11honey mittalNo ratings yet

- Dr. Ashfak ShikalgarDocument4 pagesDr. Ashfak Shikalgarravikiran1955No ratings yet

- TMFB TSC 2012 Prospectus PDFDocument83 pagesTMFB TSC 2012 Prospectus PDFMehboobElaheiNo ratings yet

- BUSANA1 Chapter 1: Simple Interest & Simple DiscountDocument28 pagesBUSANA1 Chapter 1: Simple Interest & Simple Discount7 bit88% (16)

- Inclusive Digital Financial Services A Reference Guide For RegulatorsDocument262 pagesInclusive Digital Financial Services A Reference Guide For Regulatorsunknown4080No ratings yet

- VXV DY23 LCD 47 C QGDocument2 pagesVXV DY23 LCD 47 C QGhp34thNo ratings yet

- AFM476 - Risk and Real OptionsDocument4 pagesAFM476 - Risk and Real OptionsJonah HuNo ratings yet

- Financial Manager: Typical Work ActivitiesDocument5 pagesFinancial Manager: Typical Work ActivitiesMansi ChughNo ratings yet

- 108A W23++Homework+8Document8 pages108A W23++Homework+8Julius SuhermanNo ratings yet

- Steen Stress IndicatorsDocument13 pagesSteen Stress IndicatorsZerohedgeNo ratings yet

- Terms and Conditions Person CustomerDocument40 pagesTerms and Conditions Person CustomerFotos LibresNo ratings yet

- Accounting Standards: Sub: Financial Reporting & AnalysisDocument13 pagesAccounting Standards: Sub: Financial Reporting & AnalysisDevasaya MitraNo ratings yet

Super Project Slides

Super Project Slides

Uploaded by

p23ayushsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Super Project Slides

Super Project Slides

Uploaded by

p23ayushsCopyright:

Available Formats

Super Project

Prof. Jayanth R. Varma

Indian Institute of Management, Ahmedabad

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 1/10

Approach

Work out the Base Case NPV under Exhibit 6 assumptions with only

minimal changes to obtain cash flows with correct timing.

Work out the NPV adjustment required for each issue mentioned

assuming that the argument is accepted:

• Test Marketing

• Jello facility usage

• Incremental SGA

• Cannibalization of Jello

Decide which adjustments are appropriate or partly appropriate

Arrive at final NPV after incorporating the accepted adjustments

We will use the idea of Value Additivity:

• NPV of the sum of two cashflow streams is the sum of the two NPVs

• Suppose we are given a sequence of cashflows 𝐴 and another sequence

of cashflows 𝐵. Then

• 𝑁 𝑃 𝑉 (𝐴 + 𝐵) = 𝑁 𝑃 𝑉 (𝐴) + 𝑁 𝑃 𝑉 (𝐵)

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 2/10

Base Case Analysis

Exhibit 6 is accounting oriented and not cash flow oriented.

• We will add back depreciation to convert the after tax profits into cash

flows

For terminal value, we will use the salvage value (Book Value from

Exhibit 6)

The ROFE of 20% is applied to pre-tax cashflows.

• We multiply this by 1 − 𝑡 to get a post-tax discount rate.

• Tax rate is 52%

• WACC is 9.6%

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 3/10

Timing Adjustments

Some cashflows are actually in 1967 (Year 0), but Exhibit 6 puts

these cashflows in 1968 (Year 1).

We use Exhibit 5 Estimated Expenditure Rate to move most of the

Capex to Year 0

• FY 1967 $160M

• FY 1968 $40M

Working Capital

• There can be a debate about whether Working Capital is required at

the beginning of the year or the end of the year.

• End of the year is a very common and convenient assumption and we

will use this.

Test Marketing is obviously 1967 (Year 0)

• This is relevant only if decide not to remove it entirely

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 4/10

Base Case NPV

Under these assumptions, the Base Case NPV works out to 214

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 5/10

Test Marketing

The Test Marketing costs are 360, but this is pre-tax

After tax, this amounts to be 173

Since this cash flow is in year 0, the NPV impact of removing this

item would also be 173.

Is it a sunk cost?

If so, how will you decide whether to do test marketing?

• In theory?

• In practice?

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 6/10

Jello Facilities Usage

Instead of allocation, let us think of cashflows

Jello facilities are “free” in the short run, but not in the long term.

Since Jello sales are growing at 40%, a new agglomerator and

building expansion will be needed soon

• But when?

• Year 1?

• Year 2?

Investment required is 453

• In say Year 1

• Depreciate using the same pattern as in Exhibit 6

• Salvage value = book value in Year 10

NPV is -255

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 7/10

Increased SGA (Alternative 3)

The average PBT in Alternative 2 was 211, but it is only 157 in

Alternative 3.

The change in average PBT is 54

Over the ten year period, the total change in PBT is 540 which is

therefore the total increase in SGA over the entire period.

But SGA goes up only in years 5-10.

The increase in SGA during each of these 6 years must be 90.0

After tax, this amounts to 43

The cash flows to be discounted are therefore:

• [0, 0, 0, 0, -43, -43, -43, -43, -43, -43]

The NPV works out to -132

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 8/10

Cannibalization

The Jello loss is computed in Exhibit, but this is a pre-tax figure

Multiplying by 1 − 𝑡 gives the after-tax numbers as

• [86, 96, 101, 106, 110, 110, 115, 115, 120, 120]

The NPV is 659

Some of this cannibalization would have happened anyway

• If you do not cannibalize yourself, somebody else will

We could therefore take say 50% as this as the loss attributable to the

project.

The Cannibalization adjustment is then 329

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 9/10

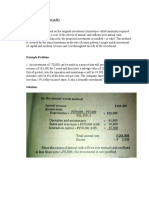

NPV after all adjustments

Base Case NPV = 214

Removal of test marketing expenses = 173

Accounting for usage of JellO facilities = -255

Adjustment for increase in SGA = -132

Cannibalization of JellO = 329

NPV after all adjustments = 329

©Prof. Jayanth R. Varma Indian Institute of Management, Ahmedabad 10/10

You might also like

- 2024 Becker CPA Financial (FAR) NotesDocument51 pages2024 Becker CPA Financial (FAR) Notescraigsappletree100% (4)

- Capital Budgeting Sums-Doc For PDF (Encrypted)Document7 pagesCapital Budgeting Sums-Doc For PDF (Encrypted)Prasad GharatNo ratings yet

- SuperDocument30 pagesSuperAbhishek TiwariNo ratings yet

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Tire City SlidesDocument8 pagesTire City Slidesp23ayushsNo ratings yet

- The Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Document41 pagesThe Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Vaishali GuptaNo ratings yet

- Capital BudgetingDocument108 pagesCapital Budgetingdhanraj_aartiNo ratings yet

- FM L6 7 Investment RevDocument27 pagesFM L6 7 Investment RevANJALI SHARMANo ratings yet

- Capital BudgetingDocument18 pagesCapital BudgetingNilesh SondigalaNo ratings yet

- Capital Budgeting Techniques: Prof. Nidhi BandaruDocument28 pagesCapital Budgeting Techniques: Prof. Nidhi Bandaruhashmi4a4No ratings yet

- MBA Finance FAQsDocument2 pagesMBA Finance FAQsTosin GeorgeNo ratings yet

- Unit 5 Capital Budgeting TechniquesDocument37 pagesUnit 5 Capital Budgeting Techniquesayaankhan2307sreNo ratings yet

- Evaluating Business and Engineering Assets II: The Annual Worth Method and The Rate-of-ReturnDocument25 pagesEvaluating Business and Engineering Assets II: The Annual Worth Method and The Rate-of-ReturnJane Erestain BuenaobraNo ratings yet

- The AW Method and IRR Method (Week 9)Document4 pagesThe AW Method and IRR Method (Week 9)raymond moscosoNo ratings yet

- Capital Budgeting: Should We Build This Plant?Document33 pagesCapital Budgeting: Should We Build This Plant?Bhuvan SemwalNo ratings yet

- Economic Analysis For RoboticsDocument15 pagesEconomic Analysis For RoboticsAman SharmaNo ratings yet

- Chapter 9 Profitability Part 1Document13 pagesChapter 9 Profitability Part 1Subhadeep ChakrabartiNo ratings yet

- ITC CaseDocument5 pagesITC CaseAbhijeet GangulyNo ratings yet

- Internal Rate of ReturnDocument28 pagesInternal Rate of ReturnVaidyanathan Ravichandran100% (1)

- Techniques of Capital Budgeting: Investment Evaluation CriteriaDocument29 pagesTechniques of Capital Budgeting: Investment Evaluation CriteriaNaitik ModiNo ratings yet

- Assignment On FaseelDocument6 pagesAssignment On FaseelAbdul KhanNo ratings yet

- 03 - 20th Aug Capital Budgeting, 2019Document37 pages03 - 20th Aug Capital Budgeting, 2019anujNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- Project Appraisal - Investment Appraisal - 2023Document40 pagesProject Appraisal - Investment Appraisal - 2023ThaboNo ratings yet

- Accounting 9th Edition Horngren Solution ManualDocument19 pagesAccounting 9th Edition Horngren Solution ManualAsa100% (1)

- Risk in Capital BudgetingDocument18 pagesRisk in Capital BudgetingHaresh VermaNo ratings yet

- Methods of Project AppraisalDocument28 pagesMethods of Project AppraisalMîñåk ŞhïïNo ratings yet

- Appraisal Criteria - Capital BudgetingDocument50 pagesAppraisal Criteria - Capital BudgetingNitesh NagdevNo ratings yet

- Chapter - 8: Capital Budgeting DecisionsDocument45 pagesChapter - 8: Capital Budgeting DecisionsNirmal ThomasNo ratings yet

- Financial Analysis: Alka Assistant Director Power System Training Institute BangaloreDocument40 pagesFinancial Analysis: Alka Assistant Director Power System Training Institute Bangaloregaurang1111No ratings yet

- Capital Budgeting A Nice Finance Topic Helpful For Mba and Bba StudentsDocument39 pagesCapital Budgeting A Nice Finance Topic Helpful For Mba and Bba StudentsNimish KumarNo ratings yet

- Investment Appraisal and NPV AnalysisDocument4 pagesInvestment Appraisal and NPV Analysistran thanhNo ratings yet

- Economic PrinciplesDocument9 pagesEconomic PrinciplesLindsay BakerNo ratings yet

- Capital BudgetingDocument49 pagesCapital Budgetingthkrarun100No ratings yet

- Net Present Value and Other Investment CriteriaDocument23 pagesNet Present Value and Other Investment CriteriaHanniel Madramootoo100% (1)

- Profitability AnalysisDocument43 pagesProfitability AnalysisAvinash Iyer100% (1)

- 29th Aug 2023 Final Complex Investment DecisionsDocument15 pages29th Aug 2023 Final Complex Investment DecisionsKunal KadamNo ratings yet

- CIMA Paper P1: NotesDocument3 pagesCIMA Paper P1: NotesSajid AliNo ratings yet

- Profitabilty. AnalysisDocument35 pagesProfitabilty. AnalysisSidharth RazdanNo ratings yet

- Unwinding of DiscountDocument5 pagesUnwinding of Discountlavanya sNo ratings yet

- Capital Budgeting: Kiran ThapaDocument34 pagesCapital Budgeting: Kiran ThapaRajesh ShresthaNo ratings yet

- CH - 08 Cap BudgetingDocument54 pagesCH - 08 Cap BudgetingfoglaabhishekNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisMobin NasimNo ratings yet

- Rate of Return CalculationsDocument37 pagesRate of Return CalculationsSrushti MNo ratings yet

- Capital Budgeting - Adv IssuesDocument21 pagesCapital Budgeting - Adv IssuesdixitBhavak DixitNo ratings yet

- Capital Budgeting: BA 217: Financial ManagementDocument46 pagesCapital Budgeting: BA 217: Financial ManagementyanaNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisDejene HailuNo ratings yet

- Financial StatementDocument54 pagesFinancial StatementAlvin FelicianoNo ratings yet

- Capital BudgetingDocument30 pagesCapital BudgetingUmesh ChandraNo ratings yet

- Efa-Unit 5Document45 pagesEfa-Unit 5mandavillinagavenkatasriNo ratings yet

- Capital Budgeting - I: Gourav Vallabh Xlri JamshedpurDocument64 pagesCapital Budgeting - I: Gourav Vallabh Xlri JamshedpurSimran JainNo ratings yet

- Measuring Investment Returns: Stern School of BusinessDocument139 pagesMeasuring Investment Returns: Stern School of Businesssuhasshinde88No ratings yet

- Capital Budgeting 30032010Document18 pagesCapital Budgeting 30032010kkv_phani_varma5396No ratings yet

- FM Mod II-2Document10 pagesFM Mod II-2Irfanu NisaNo ratings yet

- Capitall Budgeting Unit 2Document70 pagesCapitall Budgeting Unit 2kdxpro22No ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingHannahbea LindoNo ratings yet

- Capital BudgetingDocument42 pagesCapital BudgetingPiyush ChitlangiaNo ratings yet

- 9 Capital BudgetingDocument6 pages9 Capital BudgetingRavichandran SeenivasanNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Sip ReportDocument52 pagesSip ReportRavi JoshiNo ratings yet

- 2024 GIO - APAC Report - Final - CompressedDocument24 pages2024 GIO - APAC Report - Final - Compressedbotoy26No ratings yet

- Komal SharmaDocument34 pagesKomal SharmaVini Balot0% (1)

- Financial Risk ND ProfitabilityDocument22 pagesFinancial Risk ND Profitabilitytungeena waseemNo ratings yet

- 18.functions of Commercial BanksDocument15 pages18.functions of Commercial BanksPraneeth KumarNo ratings yet

- This Study Resource Was: FinanceDocument4 pagesThis Study Resource Was: FinanceSIDDHARTH SETHI-DM 21DM198No ratings yet

- Transcript Orsted Q3 2023Document25 pagesTranscript Orsted Q3 2023shen.wangNo ratings yet

- Construction Sector Update - 141013Document32 pagesConstruction Sector Update - 141013Pinaki RoychowdhuryNo ratings yet

- Performance of Indian IPOs Listed in 2021Document11 pagesPerformance of Indian IPOs Listed in 2021REGI MEMANA VARUGHESENo ratings yet

- IsleX - Global Digital Liquidity (Presentation - Deck)Document26 pagesIsleX - Global Digital Liquidity (Presentation - Deck)Brian NiessenNo ratings yet

- Quotation: Syarikat Takaful Malaysia Keluarga Berhad (Head OfficeDocument5 pagesQuotation: Syarikat Takaful Malaysia Keluarga Berhad (Head OfficeakmabushNo ratings yet

- Lesson 3A. Investment On Securities - Please PrintDocument13 pagesLesson 3A. Investment On Securities - Please PrintHail DeityNo ratings yet

- Plumbing Arithmetic EconomyDocument9 pagesPlumbing Arithmetic EconomyAngelo Lirio InsigneNo ratings yet

- NPV and IRRDocument2 pagesNPV and IRRsaadhashmi97No ratings yet

- HW2 QDocument6 pagesHW2 Qtranthithanhhuong25110211No ratings yet

- Working CapitalDocument107 pagesWorking CapitalGanesh Nikhil100% (1)

- DK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsDocument67 pagesDK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsPython The SnakeNo ratings yet

- CapitalGain Summary Report - 1658151067650 - 11Document1 pageCapitalGain Summary Report - 1658151067650 - 11honey mittalNo ratings yet

- Dr. Ashfak ShikalgarDocument4 pagesDr. Ashfak Shikalgarravikiran1955No ratings yet

- TMFB TSC 2012 Prospectus PDFDocument83 pagesTMFB TSC 2012 Prospectus PDFMehboobElaheiNo ratings yet

- BUSANA1 Chapter 1: Simple Interest & Simple DiscountDocument28 pagesBUSANA1 Chapter 1: Simple Interest & Simple Discount7 bit88% (16)

- Inclusive Digital Financial Services A Reference Guide For RegulatorsDocument262 pagesInclusive Digital Financial Services A Reference Guide For Regulatorsunknown4080No ratings yet

- VXV DY23 LCD 47 C QGDocument2 pagesVXV DY23 LCD 47 C QGhp34thNo ratings yet

- AFM476 - Risk and Real OptionsDocument4 pagesAFM476 - Risk and Real OptionsJonah HuNo ratings yet

- Financial Manager: Typical Work ActivitiesDocument5 pagesFinancial Manager: Typical Work ActivitiesMansi ChughNo ratings yet

- 108A W23++Homework+8Document8 pages108A W23++Homework+8Julius SuhermanNo ratings yet

- Steen Stress IndicatorsDocument13 pagesSteen Stress IndicatorsZerohedgeNo ratings yet

- Terms and Conditions Person CustomerDocument40 pagesTerms and Conditions Person CustomerFotos LibresNo ratings yet

- Accounting Standards: Sub: Financial Reporting & AnalysisDocument13 pagesAccounting Standards: Sub: Financial Reporting & AnalysisDevasaya MitraNo ratings yet