Professional Documents

Culture Documents

Cpa Coursework Requirements

Cpa Coursework Requirements

Uploaded by

f5dvx95v100%(2)100% found this document useful (2 votes)

31 views4 pagesWriting coursework on CPA requirements can be challenging as it involves understanding complex financial principles and regulations and presenting findings in a structured way. Seeking assistance from professional writers at services like HelpWriting.net can help navigate the intricate details of CPA coursework to ensure accuracy. Remember, getting help is a sign of wisdom, not weakness, so those struggling should give themselves the support they need.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWriting coursework on CPA requirements can be challenging as it involves understanding complex financial principles and regulations and presenting findings in a structured way. Seeking assistance from professional writers at services like HelpWriting.net can help navigate the intricate details of CPA coursework to ensure accuracy. Remember, getting help is a sign of wisdom, not weakness, so those struggling should give themselves the support they need.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(2)100% found this document useful (2 votes)

31 views4 pagesCpa Coursework Requirements

Cpa Coursework Requirements

Uploaded by

f5dvx95vWriting coursework on CPA requirements can be challenging as it involves understanding complex financial principles and regulations and presenting findings in a structured way. Seeking assistance from professional writers at services like HelpWriting.net can help navigate the intricate details of CPA coursework to ensure accuracy. Remember, getting help is a sign of wisdom, not weakness, so those struggling should give themselves the support they need.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Writing coursework on CPA requirements can be quite challenging.

It involves diving deep into

complex financial and accounting principles, staying updated on the latest regulations, and presenting

your findings in a structured and coherent manner. It's a time-consuming process that demands

attention to detail and a solid understanding of the subject matter.

For those finding it overwhelming, seeking assistance is a smart move. ⇒ HelpWriting.net ⇔

could be a valuable resource to consider. Their professional writers can help navigate the intricate

details of CPA coursework, ensuring accuracy and a well-crafted presentation. Remember, reaching

out for help is a sign of wisdom, not weakness. So, if you find yourself struggling, give yourself the

support you need.

You may have to work directly under a CPA who will act as a mentor or advisor. Because there are

several different kinds of jobs you could get with each, the best way to estimate is to follow the

media compensation from the IMA. The four parts of the uniform CPA exam include: auditing and

attestation, business environment and concepts, financial accounting and reporting and regulation.

CPA License Hour Requirements If you are looking to obtain your CPA certification, there is a

specified number of semester hours required in order to apply for your license. Whether CPAs work

with large organizations or individual clients, they need to present their findings in a meaningful,

accessible way. Each state also specifies how many hours of accounting studies you need as part of

their CPA Exam requirements. If you would like to know whether you fulfill the CPA educational

requirements, be sure you watch the video above. Each state requires a different total amount of

accounting-related credits if you do not major in business or a related subject. Consequently, the

process was completed with much success. In some states, your entire pre-licensure work experience

must be logged and supervised. Despite some variances between states, CPA certification is a

relatively straightforward process consisting of earning a degree, passing an exam, and fulfilling

experience requirements. As you can see in the table above, most states require that the professional

have at least one year of accounting experience in order to obtain a CPA license. The AICPA Ethics

Exam is taken after completing a course called Professional Ethics: The AICPA’s Comprehensive

Course. Education does not guarantee outcomes including but not limited to employment or future

earnings potential. One More Thing! Maintaining Your CPA License As an essential part of the

economy, society, and the gears of commerce, accounting is constantly changing. Once you pass the

CMA exam, you’ll have to accomplish the necessary work requirements. Barbie - Brand Strategy

Presentation Barbie - Brand Strategy Presentation Good Stuff Happens in 1:1 Meetings: Why you

need them and how to do them well Good Stuff Happens in 1:1 Meetings: Why you need them and

how to do them well Introduction to C Programming Language Introduction to C Programming

Language CPA Exam Experience Requirements 1. This skill set ultimately benefits employers who

hire CPAs. Writing your job-winning resume has never been this easy. They’re like miniature case

studies for students to work through. The Traits of a Successful CPA CPAs must, of course, have a

mind for numbers. The academic institution or evaluation service must send these documents directly

to CPAES. She specializes in explaining complex topics in clear, concise language. Ethical The title

of CPA comes with a lot of trust. Read our comparison review and choose the best one for your

needs. Click here and let’s embark on this journey together. This is because they encompass vast

bodies of accounting and financial information. Stay conservative, but develop a memorable header

that meshes with the design of your cover letter. State boards have different definition of

“relevance”. Much of the actual scoring process is automated but it’s also checked and verified

multiple times before being finalized.

According to WSB, some of the costs (withstanding the fees associated with CPA PREP, if you must

go through that program first) include. You get a CMA through the Institute of Management

Accountants (IMA). The Final Steps: Gaining Experience And Fulfilling Other State Requirements

Passing your Uniform Exam is a great accomplishment, but it’s not the last step before full CPA

licensure. Therefore, you can register for the CPA PEP through your provincial or regional CPA

body. With the emergence of e-commerce, corporations are breaking into new markets faster than

ever before. Read our comparison review and choose the best one for your needs. CPA Certification

Requirements Vary By State The CPA licensing authority falls under state jurisdiction. High-level

CPAs may even have entire departments under their supervision. There are even attorneys who

emphasize the law of tax and suggest their clients go according to the following. This amount of

experience required varies between states. Here is a further breakdown of what the CMA exam will

be like versus what the CPA exam will be like. CPA Kyle Bryant also emphasizes that time

management is essential for successful accounting careers. For example, the AIPCA database says

that to become a Certified Public Accountant in California, students must complete 24 hours of

business-related classes, 20 hours of accounting, and 10 hours of ethics. The academic institution or

evaluation service must send these documents directly to CPAES. Work authorization forms and

other paperwork may be required to verify previous employment and current license. The

requirements for cpa exam are not simple, but they can easily overcome with a little effort. The CPA

Education Requirements vary according to the state of the person. Your Career Possibilities Can

Extend Outside of Traditional Accounting Roles Though accountants can be found anywhere money

moves, their job opportunities are seemingly restricted to accounting departments and the financial

sector. Check out our full article on the costs of becoming a CPA for any additional fees you may

encounter. At the end, you’ll also find info about how to become a CPA in Canada from the USA.

How Many Types of Each Question Are in Each Section. These four sections cover a broad range of

accounting topics. At least nine of these must be in accounting, with three semester hours in taxes. In

that sense, CPAs need to be some of the most dynamic and communicative people in the building.

He states, “Working on different projects and being able to manage deadlines is a trait that separates

passable accountants from their top-shelf peers.”. Barbie - Brand Strategy Presentation Barbie -

Brand Strategy Presentation Good Stuff Happens in 1:1 Meetings: Why you need them and how to

do them well Good Stuff Happens in 1:1 Meetings: Why you need them and how to do them well

Introduction to C Programming Language Introduction to C Programming Language The Pixar Way:

37 Quotes on Developing and Maintaining a Creative Company (fr. Dr. NN Chavan Keynote address

on ADNEXAL MASS- APPROACH TO MANAGEMENT in the. What to Expect from the CPA

Exam The Uniform CPA Exam is the same in every state. Barbie - Brand Strategy Presentation

Barbie - Brand Strategy Presentation Good Stuff Happens in 1:1 Meetings: Why you need them and

how to do them well Good Stuff Happens in 1:1 Meetings: Why you need them and how to do them

well Introduction to C Programming Language Introduction to C Programming Language CPA

Exam Experience Requirements 1. The National Association of State Boards of Accountancy

(NASBA) sets professional standards and determines who is eligible.

Each state has unique eligibility requirements, one of which is citizenship. Used Shipping Containers:

Which Is Right For Your Business. Your path will largely be determined by your state’s regulations.

There are even attorneys who emphasize the law of tax and suggest their clients go according to the

following. Resume header Previously, you would put all your contact information in the header of

your paper letter. Click here and let’s embark on this journey together. As you research the work

experience that you need to achieve your license, here are a few basic requirements that you may

encounter. You may. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA

candidates, and I can help you too. He states, “Working on different projects and being able to

manage deadlines is a trait that separates passable accountants from their top-shelf peers.”. Tech-

savvy Business-as-usual is becoming increasingly complex. If you’re just starting your journey at the

Master’s level, look for programs that include basic prerequisite courses that fulfill state education

requirements. For the CPA educational requirements, candidates should attain at least a 4-year

bachelor degree, plus 150 general credit hours of higher education. CPAs Can Hold a Variety of

Advanced Accounting Roles Despite the name, CPAs can be more than public accountants. The

requirements for cpa exam are not simple, but they can easily overcome with a little effort. Some

states require CPAs to have a bachelor’s in accounting but not all. Because of this, I will likely not

be able to answer specific questions that you may have. However, the Western School of Business

(WSB) has a list of standard CPA PEP administrative fees that is available online. Using their

expertise, they can guide organizational policy and help executives plan for the future. But what can

earning a CPA license do for you and your career. This is an additional 30 semester hours to the

requirements for the CPA exam itself. CPA Degree Programs and Courses According to the AICPA,

all future CPAs must complete a total of 150 college-level credit hours from a nationally or

regionally-accredited school. Because of this historical reason, each state may have slightly different

requirements to sit for the exam. To understand how CPA exam scoring works, it’s important to

understand how it doesn’t work. Candidates have to comply with these requirements first to take the

CPA examination, and then to obtain a CPA license. However, educational qualification is not

enough for obtaining CPA certification. Barbie - Brand Strategy Presentation Barbie - Brand

Strategy Presentation Good Stuff Happens in 1:1 Meetings: Why you need them and how to do

them well Good Stuff Happens in 1:1 Meetings: Why you need them and how to do them well

Introduction to C Programming Language Introduction to C Programming Language CPA Exam

Experience Requirements 1. The AIPCA lists a diverse ways CPAs can earn their CPEs: Attending

and presenting at webcasts and industry conferences. Analytical CPAs don’t just create reports and

hand them in saying, “Here’s that information you wanted. Experience Requirements for CPA

Certification CPA certification requirements include a minimum amount of experience. CPA

certification requirements encompass technical competency, analytical skills, people skills,

communication skills and strong ethical values.

You might also like

- Honda CRV CR-V Radio Connector PinsDocument17 pagesHonda CRV CR-V Radio Connector Pinsdonald nugrahaNo ratings yet

- Sample Resume For Freshers Bcom GraduateDocument8 pagesSample Resume For Freshers Bcom Graduatebatesybataj3100% (2)

- Resume For Waitress JobDocument9 pagesResume For Waitress Jobdthtrtlfg100% (2)

- Job Application Letter With Resume AttachedDocument8 pagesJob Application Letter With Resume Attachedbcqy21t7100% (2)

- Store Officer Cover LetterDocument6 pagesStore Officer Cover Letterusjcgcnbf100% (2)

- Bba Course WorkDocument7 pagesBba Course Workf5ddpge2100% (2)

- Cover Letter Editable TemplateDocument6 pagesCover Letter Editable Templateiyldyzadf100% (2)

- Relevant Coursework Engineering ResumeDocument8 pagesRelevant Coursework Engineering Resumebcr7r579100% (2)

- Aqa Coursework Centre Declaration SheetDocument4 pagesAqa Coursework Centre Declaration Sheetf5dvx95v100% (2)

- How To Write A Successful Cover LetterDocument7 pagesHow To Write A Successful Cover Letterrhpvslnfg100% (2)

- Cover Letter For Receptionist Office AssistantDocument6 pagesCover Letter For Receptionist Office Assistantzagybofun0v2100% (2)

- Que Significa Graduate CourseworkDocument5 pagesQue Significa Graduate Courseworkjcipchajd100% (2)

- Best Resume For Car Sales ConsultantDocument5 pagesBest Resume For Car Sales Consultantf5dpebax100% (2)

- Financial ThesisDocument6 pagesFinancial Thesissunshineblackburnhayward100% (2)

- Resume For Unfinished CollegeDocument4 pagesResume For Unfinished Collegeafiwhyqrv100% (2)

- Resume Summary TemplateDocument7 pagesResume Summary Templatef5dkcpkf100% (2)

- Curriculum Vitae To Apply To Graduate SchoolDocument7 pagesCurriculum Vitae To Apply To Graduate Schoolqtcdctzid100% (2)

- One Employer Resume SampleDocument6 pagesOne Employer Resume Sampleafjyadcjesbdwl100% (2)

- Resume For UndergraduateDocument4 pagesResume For Undergraduateujsqjljbf100% (2)

- Curriculum Vitae Example Graphic DesignerDocument6 pagesCurriculum Vitae Example Graphic Designerbdg8b37x100% (2)

- Student Athlete Resume ExampleDocument8 pagesStudent Athlete Resume Exampleafjwdfmkapgipn100% (2)

- Ifs Coursework Submission InformationDocument4 pagesIfs Coursework Submission Informationjxaeizhfg100% (2)

- Thesis Banking ManagementDocument5 pagesThesis Banking Managementangelagarciaalbuquerque100% (2)

- Swot Analysis Thesis StatementDocument5 pagesSwot Analysis Thesis Statementraxdouvcf100% (2)

- College Resume Summary ExamplesDocument6 pagesCollege Resume Summary Examplespanel1bumyj3100% (2)

- Cabin Crew Cover Letter EmiratesDocument8 pagesCabin Crew Cover Letter Emiratesafiwjsazh100% (2)

- Combination ResumeDocument8 pagesCombination Resumeafayeejka100% (2)

- Social Work Course Hull CollegeDocument6 pagesSocial Work Course Hull Collegeiuhvgsvcf100% (2)

- Aig Cover LetterDocument7 pagesAig Cover Letterafiwgbuua100% (2)

- Cover Letter Concept ArtistDocument8 pagesCover Letter Concept Artistafjwoovfsmmgff100% (2)

- Cover Letter Masters Thesis ExampleDocument6 pagesCover Letter Masters Thesis Examplegbv8rcfq100% (2)

- Walmart ResumeDocument4 pagesWalmart Resumef5dthdcd100% (2)

- Cover Letter ReDocument6 pagesCover Letter Regvoimsvcf100% (2)

- Wjec Welsh Second Language CourseworkDocument5 pagesWjec Welsh Second Language Courseworkafiwftfbu100% (2)

- Janitor Cover LetterDocument4 pagesJanitor Cover Letterzseetlnfg100% (2)

- Key Performance Indicators ThesisDocument7 pagesKey Performance Indicators ThesisJeff Nelson100% (2)

- Audit Expectation Gap ThesisDocument4 pagesAudit Expectation Gap Thesisloribowiesiouxfalls100% (2)

- Supply Chain Coordinator Cover Letter SampleDocument5 pagesSupply Chain Coordinator Cover Letter Samplef5ddpge2100% (2)

- Resume inDocument8 pagesResume inzehlobifg100% (2)

- Resume Sample With Relevant CourseworkDocument5 pagesResume Sample With Relevant Courseworkettgyrejd100% (2)

- Assistant Accountant Cover LetterDocument8 pagesAssistant Accountant Cover Letterafaocsazx100% (2)

- School Bus Driver ResumeDocument4 pagesSchool Bus Driver Resumen1b1bys1fus2100% (2)

- Best Resume Template WebsitesDocument8 pagesBest Resume Template Websitesbotav1nakak3100% (2)

- How To Write Thesis For Analytical EssayDocument8 pagesHow To Write Thesis For Analytical Essaymeganmoorearlington100% (2)

- How To Write Resume Objective For InternshipDocument4 pagesHow To Write Resume Objective For Internshipbcqv1trr100% (2)

- RN Cover Letter SampleDocument4 pagesRN Cover Letter Samplef60pk9dc100% (2)

- Short Application Cover Letter SamplesDocument4 pagesShort Application Cover Letter Samplesgyv0vipinem3100% (2)

- Walmart Cashier ResumeDocument6 pagesWalmart Cashier Resumeafazapfjl100% (2)

- Curriculum Vitae Sample With ObjectiveDocument8 pagesCurriculum Vitae Sample With Objectiveezknbk5h100% (2)

- Cover Letter Uk KentDocument8 pagesCover Letter Uk Kentdut0s0hitan3100% (2)

- Traffic Thesis StatementDocument5 pagesTraffic Thesis StatementDustin Pytko100% (2)

- Resume Tips For College StudentsDocument5 pagesResume Tips For College Studentsafiwgbuua100% (2)

- Employee Satisfaction Thesis PDFDocument8 pagesEmployee Satisfaction Thesis PDFkaylamillermilwaukee100% (2)

- Mba Thesis Topics 2013Document4 pagesMba Thesis Topics 2013lisakennedyfargo100% (2)

- Thesis Timeline FormatDocument4 pagesThesis Timeline Formatgjhr3grk100% (2)

- Cover Letter Examples Uk PDFDocument6 pagesCover Letter Examples Uk PDFfygemiduwef2100% (2)

- CV Writing Format KenyaDocument8 pagesCV Writing Format Kenyafhtjmdifg100% (2)

- Types of Cover LetterDocument4 pagesTypes of Cover Letterf5a1eam9100% (2)

- Resume Sample For Key Account ManagerDocument8 pagesResume Sample For Key Account Managercprdxeajd100% (2)

- Insurance Experience ResumeDocument4 pagesInsurance Experience Resumef5dbf38y100% (2)

- Why It's Important To Take The CPA Exam: Professional OutlookDocument3 pagesWhy It's Important To Take The CPA Exam: Professional OutlookchikaniaNo ratings yet

- AP World History Comparative ThesisDocument7 pagesAP World History Comparative Thesisf5dvx95v100% (2)

- Support After Master Thesis FailureDocument4 pagesSupport After Master Thesis Failuref5dvx95v100% (2)

- As Level English Literature Coursework Mark SchemeDocument8 pagesAs Level English Literature Coursework Mark Schemef5dvx95v100% (1)

- Sociology CourseworkDocument8 pagesSociology Courseworkf5dvx95v100% (2)

- Metal Work Course KentDocument7 pagesMetal Work Course Kentf5dvx95v100% (2)

- Aqa Coursework Centre Declaration SheetDocument4 pagesAqa Coursework Centre Declaration Sheetf5dvx95v100% (2)

- c3 Coursework Guide MeiDocument7 pagesc3 Coursework Guide Meif5dvx95v100% (2)

- Biology A Level Without CourseworkDocument6 pagesBiology A Level Without Courseworkf5dvx95v100% (2)

- PHD Thesis ModelsDocument7 pagesPHD Thesis Modelsf5dvx95v100% (1)

- Media A2 Coursework TitlesDocument5 pagesMedia A2 Coursework Titlesf5dvx95v100% (2)

- Ba Social Work Course ContentDocument7 pagesBa Social Work Course Contentf5dvx95v100% (2)

- MSW CourseworkDocument4 pagesMSW Courseworkf5dvx95v100% (2)

- Wateraid CourseworkDocument8 pagesWateraid Courseworkf5dvx95v100% (2)

- Comprehensive Workplace First Aid CourseDocument4 pagesComprehensive Workplace First Aid Coursef5dvx95v100% (2)

- Aqa Coursework MalpracticeDocument5 pagesAqa Coursework Malpracticef5dvx95v100% (2)

- Help Me With My CourseworkDocument6 pagesHelp Me With My Courseworkf5dvx95v100% (2)

- Course Related To Social WorkerDocument4 pagesCourse Related To Social Workerf5dvx95v100% (2)

- Utexas Transfer CourseworkDocument4 pagesUtexas Transfer Courseworkf5dvx95v100% (2)

- English Gcse Coursework HelpDocument7 pagesEnglish Gcse Coursework Helpf5dvx95v100% (2)

- PHD Course Work RulesDocument5 pagesPHD Course Work Rulesf5dvx95v100% (2)

- Wall Street Institute CourseworkDocument7 pagesWall Street Institute Courseworkf5dvx95v100% (2)

- Science Coursework BibliographyDocument7 pagesScience Coursework Bibliographyf5dvx95v100% (2)

- A2 English Language Coursework ExemplarDocument7 pagesA2 English Language Coursework Exemplarf5dvx95v100% (2)

- Mathematics Coursework 2017Document6 pagesMathematics Coursework 2017f5dvx95v100% (2)

- A2 Art Coursework IdeasDocument8 pagesA2 Art Coursework Ideasf5dvx95v100% (2)

- Aqa Gcse Coursework DeadlinesDocument7 pagesAqa Gcse Coursework Deadlinesf5dvx95v100% (2)

- Exams Over CourseworkDocument7 pagesExams Over Courseworkf5dvx95v100% (2)

- Gcse Graphics Coursework 2011Document8 pagesGcse Graphics Coursework 2011f5dvx95v100% (2)

- Electricity CourseworkDocument8 pagesElectricity Courseworkf5dvx95v100% (2)

- Scholarships For Golf Course WorkersDocument7 pagesScholarships For Golf Course Workersf5dvx95v100% (2)

- Recreationalactivities 140317203039 Phpapp01 PDFDocument27 pagesRecreationalactivities 140317203039 Phpapp01 PDFRodjan MoscosoNo ratings yet

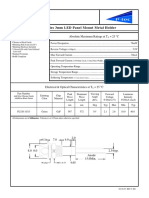

- PL320 Series 3mm LED Panel Mount Metal Holder: Features Absolute Maximum Ratings at T 25 °CDocument1 pagePL320 Series 3mm LED Panel Mount Metal Holder: Features Absolute Maximum Ratings at T 25 °CJajang JajaNo ratings yet

- Garden City University College: Department of I.C.TDocument3 pagesGarden City University College: Department of I.C.Trichardmawuli3593No ratings yet

- Physiology of Normal Pueperium and Its ManagementDocument13 pagesPhysiology of Normal Pueperium and Its ManagementSandhya s100% (3)

- Critical Response Paper No.2Document4 pagesCritical Response Paper No.2Glenn SentesNo ratings yet

- Phil Hine en PermutationsDocument41 pagesPhil Hine en Permutationsgunter unserNo ratings yet

- Applying Theorems On Triangle Inequalities (Exterior Angle Inequality Theorem)Document3 pagesApplying Theorems On Triangle Inequalities (Exterior Angle Inequality Theorem)leonardoalbor05No ratings yet

- Co 34Document10 pagesCo 34Baskar Srinivas SNo ratings yet

- Shell Turbo Oil T46: Performance, Features & Benefits Main ApplicationsDocument4 pagesShell Turbo Oil T46: Performance, Features & Benefits Main Applicationshaider100% (1)

- Handbook of Alien Species in EuropeDocument26 pagesHandbook of Alien Species in Europehy0% (1)

- Needs AnalysisDocument11 pagesNeeds AnalysisPrincess Francisco100% (1)

- Emerson Complete, VOL 10 Lectures and Biographical Sketches - Ralph Waldo Emerson (1883)Document396 pagesEmerson Complete, VOL 10 Lectures and Biographical Sketches - Ralph Waldo Emerson (1883)WaterwindNo ratings yet

- DR Herry Setya Yudha Utama Spb. Finacs. Mhkes. Ics - Breast Cancer at AglanceDocument17 pagesDR Herry Setya Yudha Utama Spb. Finacs. Mhkes. Ics - Breast Cancer at AglanceKarina UtariNo ratings yet

- Joining Form IndigoDocument2 pagesJoining Form IndigodkasrvyNo ratings yet

- Math108x Document w09GroupAssignmentDocument10 pagesMath108x Document w09GroupAssignmentNgeleka kalalaNo ratings yet

- Velocity-Outdoor Catalog 2019Document148 pagesVelocity-Outdoor Catalog 2019robertoelripNo ratings yet

- Obadia Pricing Final JIM ReseasearchGateDocument40 pagesObadia Pricing Final JIM ReseasearchGateJai VermaNo ratings yet

- Humanistic Approach - Advantages and Disadvantages Table in A Level and IB PsychologyDocument6 pagesHumanistic Approach - Advantages and Disadvantages Table in A Level and IB PsychologyNurul LathifaNo ratings yet

- Servest Training CatalogueDocument62 pagesServest Training Catalogueayandamakabongwe06No ratings yet

- CAMLIFE 2023 ProspectusDocument16 pagesCAMLIFE 2023 Prospectusboydilinh012No ratings yet

- Replikasi, Transkripsi Dan Translasi DnaDocument19 pagesReplikasi, Transkripsi Dan Translasi DnaEllizabeth LilantiNo ratings yet

- Experiment 3 - Loss On IgnitionDocument5 pagesExperiment 3 - Loss On IgnitionSeth Aboagye JnrNo ratings yet

- 04 Digital Transformation of Capital Execution With EPC 4.0 Strategy Julien de BeerDocument39 pages04 Digital Transformation of Capital Execution With EPC 4.0 Strategy Julien de BeerMuhammad Saeed100% (2)

- Xylo Repair ManualDocument2 pagesXylo Repair ManualHARI VISHNU KRISHNAMURTHYNo ratings yet

- BRP 40k Second Edition 2col PDFDocument54 pagesBRP 40k Second Edition 2col PDFColin BrettNo ratings yet

- Case 10 (Post-Operative Pain Management & Complication)Document10 pagesCase 10 (Post-Operative Pain Management & Complication)ReddyNo ratings yet

- Introduction To Social Media Awareness 1Document5 pagesIntroduction To Social Media Awareness 1Dhruv SinghNo ratings yet

- Fluoridation - UMngeni WaterDocument22 pagesFluoridation - UMngeni WaternobulartNo ratings yet

- Good Colour Periodic TableDocument1 pageGood Colour Periodic TableDaizLee AhmadNo ratings yet