Professional Documents

Culture Documents

Basket of Products

Basket of Products

Uploaded by

Jayasree Devulapalli0 ratings0% found this document useful (0 votes)

5 views3 pagesThis document provides interest rates for various retail housing and non-housing loan products offered by a bank. For housing loans like home loans and plot/construction loans, interest rates vary based on the loan amount, CIBIL score of the borrower between 8.35%-10.75%. Non-salaried and self-employed borrowers generally receive slightly higher rates. Interest rates for non-housing loans like personal loans depend on the CIBIL score, with rates ranging from 9.1%-9.25% for scores above 700.

Original Description:

Original Title

Basket of Products (8) (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides interest rates for various retail housing and non-housing loan products offered by a bank. For housing loans like home loans and plot/construction loans, interest rates vary based on the loan amount, CIBIL score of the borrower between 8.35%-10.75%. Non-salaried and self-employed borrowers generally receive slightly higher rates. Interest rates for non-housing loans like personal loans depend on the CIBIL score, with rates ranging from 9.1%-9.25% for scores above 700.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views3 pagesBasket of Products

Basket of Products

Uploaded by

Jayasree DevulapalliThis document provides interest rates for various retail housing and non-housing loan products offered by a bank. For housing loans like home loans and plot/construction loans, interest rates vary based on the loan amount, CIBIL score of the borrower between 8.35%-10.75%. Non-salaried and self-employed borrowers generally receive slightly higher rates. Interest rates for non-housing loans like personal loans depend on the CIBIL score, with rates ranging from 9.1%-9.25% for scores above 700.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

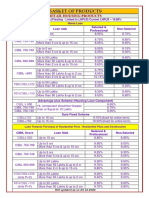

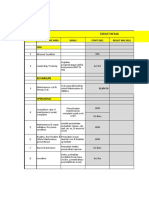

BASKET OF PRODUCTS - RETAIL HOUSING PRODUCTS

Rate of Interests (Floating - Linked to LHPLR) Current LHPLR – 17.05%

Home Loan (Griha Prakash) / Advantage Plus (Housing component for CIBIL ≥ 700)

Salaried &

CIBIL score Loan slab Non-Salaried

Professional

Up to 2 crs 8.60%

CIBIL ≥ 825 8.35%

More than 2 crs & up to 15 crs 8.80%

Up to 2 crs 8.60%

CIBIL 800-824 8.40%

More than 2 crs & up to 15 crs 8.80%

Up to 2 crs 8.60%

CIBIL 775-799 8.45%

More than 2 crs & up to 15 crs 8.80%

Up to 2 crs 8.50% 8.60%

CIBIL 750-774

More than 2 crs & up to 15 crs 8.70% 8.80%

Up to 2 crs 8.75% 8.85%

CIBIL 700-749

More than 2 crs & up to 15 crs 8.95% 9.05%

Up to 50 lakhs 9.55% 9.65%

CIBIL 600-699 More than 50 lakhs & up to 2 crs 9.75% 9.85%

More than 2 crs & up to 15 crs 9.90% 10.00%

Up to 50 lakhs 10.00% 10.10%

CIBIL <600 More than 50 lakhs & up to 2 crs 10.20% 10.30%

More than 2 crs & up to 5 crs 10.40% 10.50%

150≤CIBIL≤200 Up to 2 crs 8.75% 8.85%

101≤CIBIL<150 Up to 2 crs 9.25% 9.35%

Sure Fixed Scheme

CIBIL≥750 Up to 15 crs 10.00%(fixed for entire term)

CIBIL<750 Up to 15 crs 10.25%(fixed for entire term)

Loan Towards Purchase of Residential Plots / Residential Plots and Construction

Salaried &

CIBIL Score Loan Slab Non-Salaried

Professional

Up to 2 crs 8.80%

CIBIL ≥ 825 8.55%

More than 2 crs & up to 15 crs 9.00%

Up to 2 crs 8.80%

CIBIL 800-824 8.60%

More than 2 crs & up to 15 crs 9.00%

Up to 2 crs 8.80%

CIBIL 775-799 8.65%

More than 2 crs & up to 15 crs 9.00%

Up to 2 crs 8.70% 8.80%

CIBIL 750-774

More than 2 crs & up to 15 crs 8.90% 9.00%

Up to 2 crs 8.95% 9.05%

CIBIL 700-749

More than 2 crs & up to 15 crs 9.15% 9.25%

Up to 50 lakhs 9.75% 9.85%

CIBIL 650-699 More than 50 lakhs & up to 2 cr 9.95% 10.05%

More than 2 cr & up to 15 crs 10.10% 10.20%

150≤CIBIL≤200

Up to 2 crs 8.95% 9.05%

(only P+C)

101≤CIBIL<150

Up to 2 crs 9.45% 9.55%

(only P+C)

ROI updated as on 15.01.2024

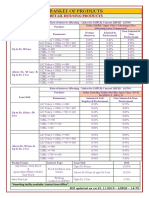

Griha Suvidha

Salaried &

CIBIL SCORE Loan slab Non-Salaried

Professional

More than 10 lakhs & up to 2 crs 8.85%

CIBIL ≥ 825 8.60%

More than 2 crs & up to 3 crs 9.05%

More than 10 lakhs & up to 2 crs 8.85%

CIBIL 800-824 8.65%

More than 2 crs & up to 3 crs 9.05%

More than 10 lakhs & up to 2 crs 8.85%

CIBIL 775-799 8.70%

More than 2 crs & up to 3 crs 9.05%

More than 10 lakhs & up to 2 crs 8.75% 8.85%

CIBIL 750-774

More than 2 crs & up to 3 crs 8.95% 9.05%

More than 10 lakhs & up to 2 crs 9.00% 9.10%

CIBIL 700-749

More than 2 crs & up to 3 crs 9.20% 9.30%

More than 10 lakhs & up to 50 lakhs 9.80% 9.90%

CIBIL 600-699 More than 50 lakhs & up to 2 crs 10.00% 10.10%

More than 2 cr & up to 3 crs 10.15% 10.25%

More than 10 lakhs & up to 50 lakhs 10.25% 10.35%

CIBIL< 600 More than 50 lakhs & up to 2 crs 10.45% 10.55%

More than 2 cr & up to 3 crs 10.65% 10.75%

150 ≤CIBIL≤200 More than 10 lakhs & up to 2 crs 9.00% 9.10%

101 ≤CIBIL<150 More than 10 lakhs & up to 2 crs 9.50% 9.60%

Griha Suvidha Asha (2 year ITR Self Employed or Class IV Salaried)

More than 10 lakhs & up to 2 crs 9.10%

CIBIL ≥ 825 8.85%

More than 2 crs & up to 3 crs 9.30%

More than 10 lakhs & up to 2 crs 9.10%

CIBIL 800-824 8.90%

More than 2 crs & up to 3 crs 9.30%

More than 10 lakhs & up to 2 crs 9.10%

CIBIL 775-799 8.95%

More than 2 crs & up to 3 crs 9.30%

More than 10 lakhs & up to 2 crs 9.00% 9.10%

CIBIL 750-774

More than 2 crs & up to 3 crs 9.20% 9.30%

More than 10 lakhs & up to 2 crs 9.25% 9.35%

CIBIL 700-749

More than 2 crs & up to 3 crs 9.45% 9.55%

More than 10 lakhs & up to 50 lakhs 10.05% 10.15%

CIBIL 650-699 More than 50 lakhs & up to 2 cr 10.25% 10.35%

More than 2 cr & up to 3 crs 10.40% 10.50%

150 ≤CIBIL≤200 More than 10 lakhs & up to 2 crs 9.25% 9.35%

101 ≤CIBIL<150 More than 10 lakhs & up to 2 crs 9.75% 9.85%

*Other conditions will be same as applicable to Griha Siddhi Product

** For P+C cases under Griha Suvidha, applicable ROI is 25 bps more than Griha Bhoomi & under Griha Suvidha

Asha(only for self Employed Borrowers), applicable ROI is 50 bps more than Griha Bhoomi.

Product Name Cibil Score Loan Slab ROI

750 & above 9.10%

New face Lift Up to 15 Crs

700-749 9.25%

ROI updated as on 15.01.2024

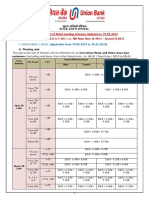

RETAIL NON HOUSING PRODUCTS

Rate of Interests (Floating - Linked to LHPLRNH) Current LHPLRNH – 17.15%

Product Name Interest Type/slab CIBIL score Rate of Interest

CIBIL ≥ 800 9.35%

Advantage Plus 800>CIBIL ≥ 750

Floating 9.45%

(Top up Component)

750>CIBIL ≥ 700 9.75%

CIBIL ≥ 750 9.50%

Griha Vikas/Griha Vikas

Floating

(Topup)/ New Griha 750>CIBIL ≥ 700 10.30%

Up to Rs 15 crs

Vikas (Facelift)

700>CIBIL ≥ 600 11.55%

CIBIL ≥ 750 9.75%

Rs. 10 lakhs & Upto Rs.

5 Crs

750>CIBIL ≥ 700 10.85%

MY Office

(For Individuals)

CIBIL ≥ 750 9.75%

Above Rs. 5 crs & Upto

Rs. 15 Crs

750>CIBIL ≥ 700 11.10%

MY Office Rs. 10 lakhs & Upto Rs.

NA 10.75%

(For Non-Individuals) 15 Crs

CIBIL≥ 750 10.25%

Rs. 10 lakhs & Upto Rs.

5 Crs

750>CIBIL ≥ 700 10.85%

MY Office-LAP

(For Individuals) CIBIL≥ 750 10.25%

Above Rs. 5 crs and Up

to Rs. 15 crs

750>CIBIL ≥ 700 11.10%

MY Office-LAP Rs. 10 lakhs & Upto Rs.

NA 11.25%

(For Non- Individuals) 15 Crs

CIBIL ≥ 750 9.90%

LRD

Up to Rs 15 crs

(For Individuals)

750>CIBIL ≥ 700 10.00%

Product Name Interest Type/slab Loam term Rate of Interest

Up to 7 years 10.25%

LRD Above 7 years & upto 12

Up to Rs 15 crs 10.50%

(For Non-Individuals) years

Above 12 years & upto 15

11.00%

years

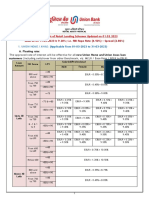

ROI updated as on 15.01.2024

Rewriting facility available for Housing & Non Housing individual loans. Contact Area Office.

* 1) In case of joints applicants, CIBIL score of applicant having highest score will be considered.

* 2) In Advantage Plus scheme, minimum loan is ₹10 lakhs and total loan exposure should not exceed 10 crs.

***********

You might also like

- Steady State Inverted FunnelDocument7 pagesSteady State Inverted FunnelramblingmanNo ratings yet

- ROPA Euro-Tiger V8-3 Englisch 2008Document20 pagesROPA Euro-Tiger V8-3 Englisch 2008hummerjoseNo ratings yet

- Basket of ProductsDocument3 pagesBasket of ProductsRAJAT CREATORSNo ratings yet

- BASKET OF PRODUCTS As On 21.11.19Document3 pagesBASKET OF PRODUCTS As On 21.11.19Virendra K VermaNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI OnretaillendingschemesSaran ManiNo ratings yet

- Campaign OfferDocument3 pagesCampaign OfferNeos EonsNo ratings yet

- Campaign OfferDocument2 pagesCampaign OfferAkhilNo ratings yet

- Retail Rate of Interest Updated 15122022Document10 pagesRetail Rate of Interest Updated 15122022srikarNo ratings yet

- Retail Rate of Interest Updated 15.05.23Document10 pagesRetail Rate of Interest Updated 15.05.23Mahammad sadik shaikNo ratings yet

- Retail Rate of Interest Updated 10012023Document10 pagesRetail Rate of Interest Updated 10012023monty chikNo ratings yet

- Retail Rate of Interest Updated 12112022Document10 pagesRetail Rate of Interest Updated 12112022Sravan Sneha TchaduvulaNo ratings yet

- Retail Rate of Interest Updated 07 09 2023Document9 pagesRetail Rate of Interest Updated 07 09 2023vikaspabuwalNo ratings yet

- FHO, CHI, WC, ASSURE, Coparison One PagerDocument1 pageFHO, CHI, WC, ASSURE, Coparison One PagerLakshmikanth SNo ratings yet

- Festive Campaign OfferDocument2 pagesFestive Campaign OfferShubhaNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- MRP May 2023Document3 pagesMRP May 2023princeNo ratings yet

- Chartered Accountant Meet Ao Nagpur Welcomes YouDocument15 pagesChartered Accountant Meet Ao Nagpur Welcomes YouEmmy RoyNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- 061022-Festive Campaign OfferDocument2 pages061022-Festive Campaign OfferDhanush ENo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesFayaz ShaikNo ratings yet

- Roi OnretaillendingschemesDocument9 pagesRoi OnretaillendingschemesRajdeep ChaudhariNo ratings yet

- Sbi Loan DataDocument1 pageSbi Loan DataWHITE DEVILNo ratings yet

- Roi OnretaillendingschemesDocument10 pagesRoi OnretaillendingschemesKarthik MestaNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Old Fee StructureDocument5 pagesOld Fee Structureab505450No ratings yet

- Oct To Dec: Running Collection (Net) With Above 65% Strike Including BlsDocument3 pagesOct To Dec: Running Collection (Net) With Above 65% Strike Including BlsSanket MargajNo ratings yet

- 250123-Festive Campaign Offer Wef 26.01.2023Document2 pages250123-Festive Campaign Offer Wef 26.01.2023CyrilRithikaNo ratings yet

- Contract Specifications - CommoditiesDocument18 pagesContract Specifications - CommoditiesMohitNo ratings yet

- Bidvest Investment AccountsDocument1 pageBidvest Investment Accountsshaunvdm777No ratings yet

- RBI ROI FormatDocument8 pagesRBI ROI Formatsrinivas.rmbaNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI Onretaillendingschemespassword123resetNo ratings yet

- Direct Imports To Kenya Previously Registered in KenyaDocument3 pagesDirect Imports To Kenya Previously Registered in KenyaisaacNo ratings yet

- Advisor Quarterly Contest - AMJ - 23-Launch-1Document5 pagesAdvisor Quarterly Contest - AMJ - 23-Launch-1abbai rNo ratings yet

- Rate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorDocument2 pagesRate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorAjoydeep DasNo ratings yet

- APC Incentive StructureDocument17 pagesAPC Incentive StructureMohd NaimNo ratings yet

- Rate of InterestDocument9 pagesRate of InterestUdaydeep SinghNo ratings yet

- KPI Eng - Mall RevisiDocument16 pagesKPI Eng - Mall Revisidimas bowoNo ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- P Seg Interest Rate From 15.12.2022Document2 pagesP Seg Interest Rate From 15.12.2022amitNo ratings yet

- Memory Capsule-MSME SchemesXDocument1 pageMemory Capsule-MSME SchemesXRohit KumarNo ratings yet

- Motor TariffsDocument3 pagesMotor Tariffskondareddy kusumaNo ratings yet

- TDS - Air Bubble SheetDocument2 pagesTDS - Air Bubble SheetJayant Kumar JhaNo ratings yet

- PNB Loan Interest Rate 04 - 08 - 2021Document9 pagesPNB Loan Interest Rate 04 - 08 - 2021Somasundaram MuthiahNo ratings yet

- Internal Reconstruction-Journal EntriesDocument25 pagesInternal Reconstruction-Journal EntriesParth GargNo ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- Abridged Motor Tariff With Revised TP Premium W.E.F. 01-04-2016Document2 pagesAbridged Motor Tariff With Revised TP Premium W.E.F. 01-04-2016nasireddyNo ratings yet

- India Budget Highlights Finance Bill, 2021Document861 pagesIndia Budget Highlights Finance Bill, 2021vaishnavi aNo ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- Financial Planning: Alqaab Arshad Amish Bhalla ShawezDocument6 pagesFinancial Planning: Alqaab Arshad Amish Bhalla ShawezAlqaab ArshadNo ratings yet

- Sugar Factory ModelDocument32 pagesSugar Factory ModelAKANSH ARORANo ratings yet

- Motor Cable Size & RatingDocument2 pagesMotor Cable Size & RatingGAGAN100% (1)

- PK Actual Rates For October 2019Document3 pagesPK Actual Rates For October 2019Awais KhalidNo ratings yet

- NagarnigamDocument15 pagesNagarnigamAkshay GianchandaniNo ratings yet

- Interest Rate W.E.F From 01.10.2019Document7 pagesInterest Rate W.E.F From 01.10.2019GaurangNo ratings yet

- Updated Roi 15.05.2024 To 30.06.2024Document1 pageUpdated Roi 15.05.2024 To 30.06.2024Divya MaheshNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- Proposal Current Rate Proposed Rate Increase in % Increase in PHPDocument4 pagesProposal Current Rate Proposed Rate Increase in % Increase in PHPAngelicaNo ratings yet

- Functions of Management PresentationDocument6 pagesFunctions of Management PresentationMarina LubkinaNo ratings yet

- Written Report For Ucsp: Biological and Cultural Evolution: From Australopithecus To Homo SapiensDocument10 pagesWritten Report For Ucsp: Biological and Cultural Evolution: From Australopithecus To Homo SapiensJustin Raton ManingoNo ratings yet

- Solution Manual For Living With Art 11Th Edition Mark Getlein 007337931X 9780073379319 Full Chapter PDFDocument28 pagesSolution Manual For Living With Art 11Th Edition Mark Getlein 007337931X 9780073379319 Full Chapter PDFjohn.burrington722100% (16)

- Example ReportDocument4 pagesExample ReportFirzanNo ratings yet

- Thesis On Climate Change and Agriculture in IndiaDocument8 pagesThesis On Climate Change and Agriculture in Indiabk4pfxb7100% (1)

- At The End of The Lesson The Students Are Expected To:: Dependent and Independent VariablesDocument9 pagesAt The End of The Lesson The Students Are Expected To:: Dependent and Independent VariablesYoo KeniNo ratings yet

- Make in India SpeechDocument1 pageMake in India SpeechRohith BalajiNo ratings yet

- The Future of AI in Medicine: A Perspective From A ChatbotDocument5 pagesThe Future of AI in Medicine: A Perspective From A Chatbotnmabestun1No ratings yet

- Jharkhand Academic Council ResultDocument1 pageJharkhand Academic Council ResultMd Ahmad RazaNo ratings yet

- Atmel 42738 TCPIP Server Client With CycloneTCP - AT16287 - ApplicationNote PDFDocument45 pagesAtmel 42738 TCPIP Server Client With CycloneTCP - AT16287 - ApplicationNote PDFIvan IvanovNo ratings yet

- Project-Based and Problem-Based LearningDocument3 pagesProject-Based and Problem-Based LearningPablo Bulac AtacadorNo ratings yet

- English 102Document4 pagesEnglish 102chiubrit100% (1)

- Impro-Visor Roadmap Tutorial by Robert KellerDocument40 pagesImpro-Visor Roadmap Tutorial by Robert Kellercbx78100% (1)

- Flexible Budgets and Performance AnalysisDocument37 pagesFlexible Budgets and Performance AnalysisSana IjazNo ratings yet

- E-Marking Notes On Physics HSSC I May 2018Document30 pagesE-Marking Notes On Physics HSSC I May 2018Hasnain AsifNo ratings yet

- Case Study - Creating A High Performance CultureDocument3 pagesCase Study - Creating A High Performance CulturesurangauorNo ratings yet

- Operating Instructions P30 P40 enDocument45 pagesOperating Instructions P30 P40 enadigorgan0% (1)

- Form 3575Document1 pageForm 3575c100% (1)

- ASTM (Berat Jenis Semen)Document2 pagesASTM (Berat Jenis Semen)Efri Dwiyanto100% (1)

- Unit 1 - Tutorial Sheet - STUDENT - SEM, Wed 3-5 PMDocument4 pagesUnit 1 - Tutorial Sheet - STUDENT - SEM, Wed 3-5 PMunknown find meNo ratings yet

- Family Case Study On The Billones Family 1Document63 pagesFamily Case Study On The Billones Family 1Ivy Mae DecenaNo ratings yet

- Service Excellence Through Customer Experience ManagementDocument10 pagesService Excellence Through Customer Experience ManagementGayatri Cahya KhairaniNo ratings yet

- 3M CatalogueDocument32 pages3M Cataloguefandi.azs37No ratings yet

- Beef Feedlot Management GuideDocument38 pagesBeef Feedlot Management GuideHassan Ali Khalid100% (2)

- Aviatin PowerpointDocument21 pagesAviatin PowerpointBeyanka CruickshankNo ratings yet

- CSS Syllabus 2023 PDF Download - FPSCDocument8 pagesCSS Syllabus 2023 PDF Download - FPSCshahid Ramzan0% (1)

- ProcessesValueStreams&Capabilities RosenDocument4 pagesProcessesValueStreams&Capabilities RosenAndré SousaNo ratings yet

- 8 PartsDocument32 pages8 PartsBappaditya AdhikaryNo ratings yet

- API Standard 607: Fire Test For Soft-Seated Quarter-Turn ValvesDocument2 pagesAPI Standard 607: Fire Test For Soft-Seated Quarter-Turn ValvesjasminneeNo ratings yet