Professional Documents

Culture Documents

Financial Forecasting and Planning Tut - 1

Financial Forecasting and Planning Tut - 1

Uploaded by

Sohad ElnagarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Forecasting and Planning Tut - 1

Financial Forecasting and Planning Tut - 1

Uploaded by

Sohad ElnagarCopyright:

Available Formats

Financial Forecasting and Planning Tut.

1. In 2018, Arab Co. reported sales of $35,500,000; cost of goods sold of $22,365,000; net

income of $4,082,500; current assets of $12,070,000; account receivables of $7,242,000;

inventory of $3,017,500; equity of $9,425,000. In 2019, sales increased by 25%.

Requires:

A) What is the level of account receivables in 2019?

B) What is the level of inventory in 2019?

Account receivables as percentage of sales in 2018 = 7,242,000 / 35,500,000 = 20.4%

Inventory as percentage of sales in 2018 = 3,017,500 / 35,500,000 = 8.5%

Sales in 2019 = 35,500,000 (1+25%) = $44,375,000

The level of account receivables in 2019 = 44,375,000 x 20.4% = $9,052,500

The level of inventory in 2019 = 44,375,000 x 8.5% = $3,771,875

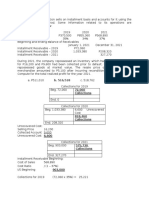

2. In 2019, Beta Co. reported sales of $650 million; current assets of $195 million; fixed assets

of $130 million; spontaneous liabilities of $117 million, bonds of $120 million; common

equity of $88 million; net income of $78 million. The firm maintains the profit margin in

2020 as in 2019, the firm’s dividend policy is to pay 70% of its net income as cash dividend.

Beta Co. expects that its sales will increase in 2020 by 20%.

Using the pro-forma technique to calculate the followings:

A) The AFN in 2020

B) The external AFN in 2020

C) If Beta co. will finance any external AFN by issuing common stocks, what is its common

equity in 2020?

D) If Beta co. will finance any external AFN by issuing bonds, what is its bonds in 2020?

Total assets in 2019 = 195 + 130 = $325 million

Total assets as percentage of sales in 2019 = 325 / 650 = 50%

Spontaneous liabilities as percentage of sales in 2019 = 117 / 650 = 18%

Increased in sales = 650 x 20% = $130 million

Sales in 2020 = 650 + 130 = $780 million

Profit margin in 2019 = 78 / 650 = 12%

Increased in assets (2020) = 130 x 50% = $65 million

Increased in spontaneous liabilities (2020) = 130 x 18% = $23.4 million

AFN in 2020 = 65 – 23.4 = $41.6 million

Net income in 2020 = 780 x 12% = $93.6 million

Retained earnings in 2020 = 93.6 (1-70%) = $28.08 million

External AFN = 41.6 – 28.08 = $13.52 million

Equity in 2020 = equity in 2019 + retained earnings inn 2020 + External AFN

Equity in 2020 = 88 + 28.08 +13.52 = $129.6 million

Bonds in 2020 = Bonds in 2019 + External AFN

Bonds in 2020 = 120 + 13.52 = $133.52 million

3. In the above exercise use the percentage of sales equation to calculate AFN and external

AFN

Total assets in 2019 = 195 + 130 = $325 million

Increased in sales = 650 x 20% = $130 million

Sales in 2020 = 650 + 130 = $780 million

Profit margin in 2019 = 78 / 650 = 12%

AFN = 130 130 = $41.6 million

EAFN = 130 130 780 12% 1 70%

EAFN = $13.52 million

You might also like

- Strategic Management 2nd Edition Rothaermel Test Bank 1Document128 pagesStrategic Management 2nd Edition Rothaermel Test Bank 1dorothyNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Assignment 12Document4 pagesAssignment 12Joey BuddyBossNo ratings yet

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- More Sample Exam Questions-Midterm2Document6 pagesMore Sample Exam Questions-Midterm2mehdiNo ratings yet

- Presentacion CapitalDocument11 pagesPresentacion CapitalLiliana Martínez LiraNo ratings yet

- MODULE 3 - Installment SalesDocument8 pagesMODULE 3 - Installment SalesEdison Salgado Castigador50% (2)

- 01 Installment SalesDocument5 pages01 Installment SalesPatríck Louie0% (1)

- MINI CASE CH 9Document7 pagesMINI CASE CH 9Samara SharinNo ratings yet

- Financial Analysis AppleDocument10 pagesFinancial Analysis AppleEléa LeconteNo ratings yet

- Mid PS3Document8 pagesMid PS3heyNo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- AC13.1.4 Module 1 QuizDocument5 pagesAC13.1.4 Module 1 QuizDianaNo ratings yet

- Prae03 HoDocument3 pagesPrae03 HoDiane MagnayeNo ratings yet

- Ics CW 1Document7 pagesIcs CW 1RAVEENA DEVI A/P VENGADESWARA RAONo ratings yet

- Lesson 05B. Inter-Company Transactions - A.TDocument8 pagesLesson 05B. Inter-Company Transactions - A.THayes HareNo ratings yet

- Installment Sales Multiple QuestionsDocument36 pagesInstallment Sales Multiple QuestionsTrixie CapisosNo ratings yet

- AFAR1 Seatwork On Installment SalesDocument4 pagesAFAR1 Seatwork On Installment SalesGoal Digger Squad VlogNo ratings yet

- Homework Notes Unit 1 MBA 615Document10 pagesHomework Notes Unit 1 MBA 615Kevin NyasogoNo ratings yet

- 07 Installment SalesDocument1 page07 Installment SalesGem Yiel33% (3)

- Calculating Profit - Extra ExercisesDocument4 pagesCalculating Profit - Extra ExercisesРустам РажабовNo ratings yet

- GB - Accounting and Financial Reporting ProjectDocument9 pagesGB - Accounting and Financial Reporting Projectshe.holmes.2004No ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Test Bank Advanced Accounting 3e by Jeter 06 ChapterDocument22 pagesTest Bank Advanced Accounting 3e by Jeter 06 ChapterNicolas ErnestoNo ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Consider The Following Information of Jones Corporation Over Four YearsDocument2 pagesConsider The Following Information of Jones Corporation Over Four Yearsproficient writersNo ratings yet

- B. 516,518 72,060 CollectionsDocument2 pagesB. 516,518 72,060 CollectionsMichelle Galapon LagunaNo ratings yet

- A. C. Fair Value After Reconditioning CostDocument3 pagesA. C. Fair Value After Reconditioning CostJamie RamosNo ratings yet

- Installment Sales - DiscussionDocument5 pagesInstallment Sales - DiscussionJustine SorizoNo ratings yet

- Error Correction - ExercisesDocument4 pagesError Correction - ExercisesDe Chavez May Ann M.No ratings yet

- Testbanks ROI, Residual Income, EVADocument42 pagesTestbanks ROI, Residual Income, EVAJadeNo ratings yet

- Instalment DISDocument4 pagesInstalment DISRenelyn David100% (1)

- ACT 205 Assignment - Spring 2019-20Document5 pagesACT 205 Assignment - Spring 2019-20Muhammad AhamdNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- M36 - Quizzer 3 PDFDocument4 pagesM36 - Quizzer 3 PDFJoshua DaarolNo ratings yet

- Ia 1 Setc Finalexam No AnswerDocument10 pagesIa 1 Setc Finalexam No Answerjulia4razo100% (1)

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.No ratings yet

- اسئلة عملى على شابتر 3Document2 pagesاسئلة عملى على شابتر 3Mahmoud Ayoub GodaNo ratings yet

- TB - Return On InvestmentDocument42 pagesTB - Return On InvestmentBusiness MatterNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument21 pagesResponsibility Acctg Transfer Pricing GP AnalysisApril JurialNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesIryne Kim PalatanNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- SolutionQuestionnaireUNIT 3 - 2020Document5 pagesSolutionQuestionnaireUNIT 3 - 2020LiNo ratings yet

- Problem IV ExamDocument2 pagesProblem IV ExamLJ AggabaoNo ratings yet

- AFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Document7 pagesAFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Shiela NacasiNo ratings yet

- Sol Installment SalesDocument16 pagesSol Installment SalesMaria Beatrice100% (1)

- Financial Analysis WADocument6 pagesFinancial Analysis WAVanessa HardjadinataNo ratings yet

- Assignment One StocksDocument7 pagesAssignment One StocksMelissaNo ratings yet

- Receivables Solution PDFDocument10 pagesReceivables Solution PDFbanannannaNo ratings yet

- Tugas AKL ANNISA SHABIRA 3111801029Document7 pagesTugas AKL ANNISA SHABIRA 3111801029annisa shabiraNo ratings yet

- Quiz Abc Next DueDocument3 pagesQuiz Abc Next DueMichaela CalbitazaNo ratings yet

- Alzona Corporation: General AssumptionsDocument2 pagesAlzona Corporation: General Assumptionschintan desaiNo ratings yet

- 16 Consolidation Subsequent To The Date of AcquisitionDocument3 pages16 Consolidation Subsequent To The Date of AcquisitionMila Casandra CastañedaNo ratings yet

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- B1.nov 2022 AnsDocument12 pagesB1.nov 2022 AnsAndrea NyerereNo ratings yet

- Assignment 5 Consolidation Intercompany Sale of MerchandiseDocument3 pagesAssignment 5 Consolidation Intercompany Sale of MerchandiseAivan De LeonNo ratings yet

- 8908 - Installment Consignment SalesDocument5 pages8908 - Installment Consignment Salesxara mizpahNo ratings yet

- Financial Accounting 3.2Document7 pagesFinancial Accounting 3.2Tawanda HerbertNo ratings yet

- Intax-Activity 1Document1 pageIntax-Activity 1Venus PalmencoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Extra Questions Related To Indices With SolutionsDocument7 pagesExtra Questions Related To Indices With SolutionsSohad ElnagarNo ratings yet

- Prepare Your Research InstrumentDocument18 pagesPrepare Your Research InstrumentSohad ElnagarNo ratings yet

- Marketing Research ProcessDocument24 pagesMarketing Research ProcessSohad ElnagarNo ratings yet

- Pol Sci Quiz Spring 2022Document4 pagesPol Sci Quiz Spring 2022Sohad ElnagarNo ratings yet

- Secondary ResearchDocument2 pagesSecondary ResearchSohad ElnagarNo ratings yet

- L1 Ethics Introduction@NU HUMA-102 Fa21Document6 pagesL1 Ethics Introduction@NU HUMA-102 Fa21Sohad ElnagarNo ratings yet

- Foreign Market QuizDocument2 pagesForeign Market QuizSohad ElnagarNo ratings yet

- Futures Business Modelsofan Io TenabledhealthcaresectorDocument17 pagesFutures Business Modelsofan Io TenabledhealthcaresectorSohad ElnagarNo ratings yet

- BusinessDocument23 pagesBusinessSohad ElnagarNo ratings yet

- QuestionsDocument4 pagesQuestionsSohad ElnagarNo ratings yet

- Finc301 T01Document27 pagesFinc301 T01Sohad ElnagarNo ratings yet

- Quiz LeverageDocument2 pagesQuiz LeverageSohad ElnagarNo ratings yet

- Mobile Car Wash & Detailing Project Part 2Document4 pagesMobile Car Wash & Detailing Project Part 2rama sportsNo ratings yet

- A Study of Financial Management in Small Scale Industries in IndiaDocument4 pagesA Study of Financial Management in Small Scale Industries in IndiaVinay Gowda D MNo ratings yet

- Kuis Manajemen Keuangan - Manajemen UIDocument16 pagesKuis Manajemen Keuangan - Manajemen UIjadwal SekjenNo ratings yet

- Manufacturing Update - January 2024Document29 pagesManufacturing Update - January 2024Kevin ParkerNo ratings yet

- Nestle Equity Research ReportDocument7 pagesNestle Equity Research Reportyadhu krishnaNo ratings yet

- In Person Week 9 10 Entrep Day 1 2Document14 pagesIn Person Week 9 10 Entrep Day 1 2arrowtachieNo ratings yet

- Gist of Adani Group's Rebuttal To Hindenburg ReportDocument6 pagesGist of Adani Group's Rebuttal To Hindenburg ReportRafay AnwarNo ratings yet

- Lecture 1 - The Investment EnvironmentDocument15 pagesLecture 1 - The Investment EnvironmentNurerwanayo AlineNo ratings yet

- Gohida Industrial PLC One YearDocument20 pagesGohida Industrial PLC One YearAbel GetachewNo ratings yet

- Sankalp Research Paper 2023Document22 pagesSankalp Research Paper 2023Shivansh SinghNo ratings yet

- Strategy Case Study AnsDocument3 pagesStrategy Case Study AnsyuvarajNo ratings yet

- DfadfdsDocument20 pagesDfadfdsK59 Vo Doan Hoang AnhNo ratings yet

- Economic Project On MoneyDocument14 pagesEconomic Project On MoneyAshutosh RathiNo ratings yet

- Indian Financial SystemDocument20 pagesIndian Financial SystemDivya JainNo ratings yet

- Flyer Produktu Bersicht Eigenkapitalfinanzierungen - De.enDocument2 pagesFlyer Produktu Bersicht Eigenkapitalfinanzierungen - De.enOmar SalahNo ratings yet

- RRL LegitDocument10 pagesRRL Legitjohn lloyd isagaNo ratings yet

- Accounting Training Manual and Solutions DBE PDFDocument239 pagesAccounting Training Manual and Solutions DBE PDFGift SphesihleeNo ratings yet

- 11.budgetory Control PrintableDocument32 pages11.budgetory Control Printablep99.subasNo ratings yet

- Igx 2024 AgendaDocument10 pagesIgx 2024 AgendaopzoutenNo ratings yet

- Registration of ChargesDocument76 pagesRegistration of ChargesAllur Sai Vijay KumarNo ratings yet

- Mercari Asia Limited: The Companies Act, 1994Document4 pagesMercari Asia Limited: The Companies Act, 1994Atiqur SobhanNo ratings yet

- TMC - Ultimate Financial Markets TradingDocument11 pagesTMC - Ultimate Financial Markets TradingmasakaswiftNo ratings yet

- Working Capital Management (Divya Jadi Booti)Document61 pagesWorking Capital Management (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Financial Management For Managers AssignmentDocument10 pagesFinancial Management For Managers AssignmentGlennard SamuelsNo ratings yet

- Unit III Business Plan Preparation Entrepreneurship DevelopmentDocument9 pagesUnit III Business Plan Preparation Entrepreneurship DevelopmentMARIDAYYA NAIDU BODAPATHRUNINo ratings yet

- Luxury Hotel Business Plan ExampleDocument77 pagesLuxury Hotel Business Plan Examplebenn mansourNo ratings yet

- Principles and Practice of Marketing 9Th Edition David Jobber All ChapterDocument67 pagesPrinciples and Practice of Marketing 9Th Edition David Jobber All Chapterbertha.padula133100% (6)

- Maxicare Health Corp - Enrollment - Batch1.07012022 - 100 - LatestDocument6,568 pagesMaxicare Health Corp - Enrollment - Batch1.07012022 - 100 - Latestgamingpurposes onlyNo ratings yet