Professional Documents

Culture Documents

S. Jogani Exports Private Limited

S. Jogani Exports Private Limited

Uploaded by

arc14consultantOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S. Jogani Exports Private Limited

S. Jogani Exports Private Limited

Uploaded by

arc14consultantCopyright:

Available Formats

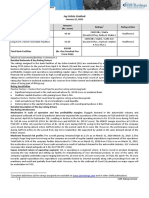

Press Release

S. Jogani Exports Private Limited

January 31, 2023

Facilities/Instruments Amount (₹ crore) Ratings1 Rating Action

Long Term Bank Facilities 70.00 Revised from CARE BBB; Stable

CARE BBB+; Stable

(Enhanced from 50.00) (Triple B; Outlook: Stable)

Revised from CARE BBB; Stable

Long Term / Short Term Bank CARE BBB+; Stable /

32.00 (Triple B; Outlook: Stable);

Facilities CARE A3+

ST rating assigned

3.00

Short Term Bank Facilities CARE A3+ Revised from CARE A3 (A Three)

(Reduced from 7.00)

Details of instruments/facilities in Annexure-1.

Rationale and key rating drivers

For arriving at the ratings, CARE has combined the financials of S. Jogani Exports Private Limited, M/s. S.Jogani Impex and M/s.

S.Jogani Gems due to the three entities (together referred to as the S. Jogani Group) being controlled by same promoter group

and the decision-making being centralized. The group has common finance and administration teams. Also, the group enjoys

business synergies with operations in same line of business.

The ratings may undergo a change in case of significant withdrawal of capital by the partners i.e. being more than the

envisaged levels in addition to the financial performance and other relevant factors.

The revision in the ratings assigned to the bank facilities of S. Jogani Exports Private Limited (SJEPL) factors in the

improvement in the scale of operations coupled with improvement in operating profitability margins resulting in higher cash

accruals. The growth in revenues is on the back of buoyancy in demand and recovery in retail off-take for cut and polished

diamonds (CPD)

in key G&J markets coupled with better realisations.

The ratings continue to factor in the group’s established presence in the CPD industry backed by the promoters' extensive

experience, diversified geographical presence, having well established clientele base, comfortable financial risk profile.

These rating strengths are however tempered by large working capital requirement, profit margins susceptible to the volatility

in the raw material prices amidst intense competition, foreign exchange fluctuations and partnership nature of two entities

within the group.

Rating sensitivities: Factors likely to lead to rating actions

Positive factors

• Sustained increase in the scale of operations of the combined entity around Rs2,500 crore and sustenance of the PBILDT

margins of over 6% leading to higher cash accruals.

Negative factors

• Deterioration in revenue below Rs. 700 crores and PBILDT margin falling below 4% on sustained basis

• Significantly large debt funded capex or leveraged acquisition, leading to sustained and major deterioration in its leverage

and debt coverage indicators

• Significant Elongation in operating cycle owing to any significant increase in receivables or inventory levels

• More than envisaged dividend payout or buy back (if any), withdrawals of capital or financial support by promoters, debt

funded capex weakening the financial risk profile especially liquidity.

Analytical approach: Combined

CARE has combined the financials of S. Jogani Exports Private Limited, M/s. S. Jogani Impex and M/s. S. Jogani Gems due to all

the three entities within the Group being controlled by same promoter group and the decision-making being centralized. The

group has common finance and administration teams. Also, the group enjoys business synergies with operations in same line of

business.

Key strengths

Established long track record and market presence backed by experienced promoters in the CPD industry

S. Jogani Group is largely into trading of cut and polished diamonds. Supported by more than three and half decades of vast

experience of the promoters, S. Jogani Group is having established presence in the domestic as well as international cut and

polished diamond markets. The operations of all the three entities are currently, managed by Mr. Shailesh J. Jogani along with

Mr. Sarju Jogani and Mr. Sanket Jogani. Furthermore, the promoters are well supported by a team of qualified professionals

having experience in the relevant fields.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

Diversified geographical presence along with well-established customer base

S.Jogani Group has vast global presence with clients based out of almost all the major gems and jewellery hubs in the world.

The Group derives around 59% of its overall revenues from domestic market while remaining 41% is derived from various

export markets across geographies. The main markets for their exports are based in multiple countries – with UAE being the

highest, followed by Hong Kong, Thailand and USA. The Group has a well-established clientele base within and outside India

and have maintained longstanding relations with customers as well as suppliers. The Group purchases from various sources

largely through secondary market. The top ten clients contributed around 44% of the overall revenues of the Group, thereby

indicating the presence of diversified customer base.

Improvement in operating performance

S. Jogani group reported ~27% jump in its total operating income from Rs.754.67 crore in FY21 to Rs.958.55 crores in FY22 on

the back of increased demand from both domestic as well as export markets. The increase in demand was seen robust from

UAE, USA, Thailand as well as within India in the post pandemic era is owing to pent-up demand and retail offtake owing to

increase in spending on the jewellery both from the fashion wear segment and bridal jewellery segment. Further, gradual

opening of the markets and removal of entry restrictions seeing a recovery from the Covid slump. Further in 9MFY23(From April

to December 2022), the DNJ Group has achieved total income of Rs.675.53 crore.

The operating margins of the S. Jogani Group continues to remain above average at 6.32% in FY22 vis-à-vis 5.79% in FY21.

Further PAT margins stood at 8.17% in FY22 vis-à-vis 3.61% in FY21. The improvement in PAT margins is owing to

improvement in PBILDT margins on the back of better realisations as well as owing to dividend received from the subsidiary

company. Consequently, the Group’s cash accruals have been on the higher side. The profit margins is expected to remain

robust. However, as the prices of CPD remain volatile, the sustainability of above average PBILDT margins in the CPD industry

remains to be seen and the same shall remain a key rating monitorable.

Comfortable financial risk profile

The group entity has comfortable financial risk profile marked by a healthy net worth position of around Rs.193.48 crore, lower

debt levels of Rs5.64 crore comprising of working capital borrowings, lower Total Outside Liabilities to Tangible Networth Ratio

of 0.45 times. Debt coverage indicators such as interest coverage ratio remained healthy at 56.56 times in FY22 as compared to

40.21 times in FY21 and Total debt to GCA remained comfortable at 0.07 times in FY22 as compared to 1.15 times in FY21.

Key weaknesses

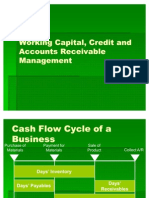

Large working capital requirement

As the Group is largely into trading of cut and polished diamonds, the inherent nature of the business is working capital

intensive. This is further supported by the fact that Gross current asset days of the group stood at around 94 days and with the

increase in business, the same is expected to increase further. This would result in higher working capital requirement. The

same is primarily due to higher collection period of around 52 days. However as on March 31 2022, the operating cycle of the

Group has been at around 49 days. With the increase in business, the working capital requirement is expected to remain large

and substantial increase in collection period or inventory holding period shall be key rating monitorable.

Profit margins remain susceptible to volatility in the prices of the diamonds and intense competition in the

industry

The Group procures rough diamonds largely from non – sight holding sources and other suppliers from the open market. The

major customers of the Group comprise wholesalers who in turn sell the polished diamonds to jewellery manufacturers. In order

to meet the requirement of CPD of end customers the group inherently maintains inventory of various sizes, cut, clarity, colour

etc which results in higher inventory. As the CPD market is fragmented, low entry barriers as it involves less capital and

minimum investment in technology, the competition becomes intense owing to presence of large number of players. Hence,

with relatively limited value addition the group’s profitability margins remain vulnerable to fluctuation in diamond prices. As

indicated India’s CPD market is highly fragmented with presence of numerous unorganized players apart from some very large

integrated G&J manufacturers leading to high level of competition. Thus, the Group’s profit margin also remain susceptible

towards prevailing intense competition in the industry.

Foreign exchange rate fluctuation risk

The Group derives around 41% of its overall revenues from the export sales. The group imports around 15% of its raw material

requirement which is processed on job work basis. Thus, foreign exchange fluctuation is naturally hedged to a certain extent.

However, any significant adverse movement in foreign currency may affect the profitability of the group in absence of any

hedging mechanism.

Partnership nature of the firm

Both M/s. S. Jogani Impex and M/s. S. Jogani Gems are operating as a partnership firm managed by Mr. Shailesh Jogani. The

credit risk profile of the firms is tempered by the constitution of the entity as there is an inherent risk of withdrawal of the

capital in a partnership firm.

2 CARE Ratings Ltd.

Press Release

Liquidity: Adequate

Liquidity is characterized by healthy level of accruals and no fixed repayment obligations. With a gearing of 0.03 times (for

combined entity) as of March 31, 2022, the issuer has sufficient gearing headroom, to raise additional debt if required. The

average working capital utilization of combined entity is at around 17% for the last 12 months i.e. January 2022 till December

2022. With lower utilisation of limits indicating of higher limits available for business use, low gearing and large net worth base

support its financial flexibility and provides the financial cushion available in case of any adverse conditions or downturn in the

business.

Applicable criteria

Policy on default recognition

Liquidity Analysis of Non-financial sector entities

Criteria on Assigning ‘Outlook’ or 'Rating Watch’ to Credit Ratings

Financial ratios - Non-Financial Sector

Short Term Instruments

Manufacturing Companies

Rating Methodology: Cut and Polished Diamond Industry

Rating Methodology: Consolidation

About the company

S. Jogani Exports Private Limited (SJEPL), the flagship company of the S.Jogani Group, started as a partnership firm in 1986

under the name of M/s S. Jogani & Co, it was later converted into a private limited company on 1st January 2008 under the

present name. The company is a closely held family concern and is involved in the trading of cut and polished diamonds. The

Group involving two other entities M/s. S, Jogani Impex and M/s. S. Jogani Gems are also in similar line of business.

The Group deals in cut and polished diamonds ranging from 10 cents to 1 carat. with utilization of 93.05% in FY21).

Manufacturing activity takes place only at Gujarat while Bhilai and Durgapur are trading depots.

S. Jogani Exports Pvt Ltd, M/s. S. Jogani Impex and M/s. S. Jogani Gems (Combined)

Brief Financials (₹ crore) 31-03-2021 (A) 31-03-2022 (A) 9MFY23 (Prov.)

Total operating income 754.67 958.55 675.53

PBILDT 43.70 60.55 NA

PAT 27.26 78.28 NA

Overall gearing (times) 0.29 0.03 NA

Interest coverage (times) 40.21 56.56 NA

A: Audited; Prov.: Provisional; 9MFY23 (period refers from April 01, 2022 to December 31, 2022); NA: Not Available

S. Jogani Exports Private Limited (Standalone)

Brief Financials (₹ crore) 31-03-2021 (A) 31-03-2022 (A) 9MFY23 (Prov.)

Total operating income 431.82 431.47 293.00

PBILDT 18.82 21.12 NA

PAT 10.93 52.46 NA

Overall gearing (times) 0.32 0.00 NA

Interest coverage (times) 17.73 26.84 NA

A: Audited; Prov.: Provisional; 9MFY23 (period refers from April 01, 2022 to December 31, 2022); NA: Not Available

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Disclosure of Interest of Independent/Non-Executive Directors of CARE: Not Applicable

Disclosure of Interest of Managing Director & CEO: Not Applicable

Rating history for last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of the covenants of the rated instruments/facilities is

given in Annexure-3

3 CARE Ratings Ltd.

Press Release

Complexity level of the various instruments rated: Annexure-4

Lender details: Annexure-5

Annexure-1: Details of instruments/facilities

Size of

Date of Coupon Maturity Rating Assigned

Name of the the

ISIN Issuance (DD- Rate Date (DD- along with Rating

Instrument Issue

MM-YYYY) (%) MM-YYYY) Outlook

(₹ crore)

Fund-based - LT-Post Shipment

- - - - 70.00 CARE BBB+; Stable

credit

LT/ST Fund-based/Non-fund-

CARE BBB+; Stable /

based-EPC / PCFC / FBP / FBD / - - - - 32.00

CARE A3+

WCDL / OD / BG / SBLC

Non-fund-based - ST-Forward

- - - - 3.00 CARE A3+

Contract

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. and and and and

Instrument/Bank Amount

No. Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹ crore)

in 2022- in 2021- in 2020- in 2019-

2023 2022 2021 2020

1)CARE

BBB; Stable

(02-Nov-21) 1)CARE

CARE

Fund-based - LT-Post BBB;

1 LT 70.00 BBB+; - -

Shipment credit 2)CARE Negative

Stable

BBB; (20-Mar-20)

Negative

(06-Apr-21)

1)CARE A3

(02-Nov-21)

Non-fund-based - ST- CARE 1)CARE A3

2 ST 3.00 - -

Forward Contract A3+ (20-Mar-20)

2)CARE A3

(06-Apr-21)

LT/ST Fund- CARE

based/Non-fund- BBB+;

3 based-EPC / PCFC / LT/ST* 32.00 Stable /

FBP / FBD / WCDL / CARE

OD / BG / SBLC A3+

*Long term/Short term.

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities

Name of the Instrument Detailed Explanation

A. Financial covenants

I – Financial Ratios for FY2022 ▪ Total Debt / TNW < 1.5

▪ Total Debt / EBITDA < 5.50

B. Non-financial covenants

I – Non-submission of required statements ▪ Non-submission of stock statements (delay beyond 25

days of the succeeding month to be considered as non-

submission) – Penal Interest @1% p.a.

▪ Non-submission of renewal data beyond three months

4 CARE Ratings Ltd.

Press Release

Name of the Instrument Detailed Explanation

A. Financial covenants

from the due date of renewal – Penal Interest @1% p.a.

▪ Non-compliance with covenants – Penal Interest @1%

p.a.

Annexure-4: Complexity level of the various instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Fund-based - LT-Post Shipment credit Simple

2 LT/ST Fund-based/Non-fund-based-EPC / PCFC / FBP / FBD / WCDL / OD / BG / SBLC Simple

3 Non-fund-based - ST-Forward Contract Simple

Annexure-5: Lender details

To view the lender wise details of bank facilities please click here

Note on the complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

5 CARE Ratings Ltd.

Press Release

Contact us

Media Contact

Name: Mradul Mishra

Phone: +91-22-6754 3573

E-mail: mradul.mishra@careedge.in

Analyst Contact

Name: Vikash Agarwal

Phone: +91-22-67543408

E-mail: vikash.agarwal@careedge.in

Relationship Contact

Name: Saikat Roy

Phone: 022-67543404/136

E-mail: saikat.roy@careedge.in

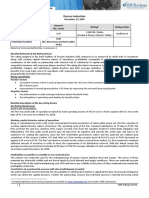

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

6 CARE Ratings Ltd.

You might also like

- Chapter 3 Homework Template 7.6 21Document27 pagesChapter 3 Homework Template 7.6 21Ahmed Mahmoud100% (1)

- Ramya Mba ProjectDocument103 pagesRamya Mba ProjectSudha Swetha100% (1)

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Shilchar Technologies LimitedDocument5 pagesShilchar Technologies Limitedjaikumar608jainNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- SVR Drugsprivate LimitedDocument4 pagesSVR Drugsprivate Limitedlalit rawatNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Divis Laboratories LimitedDocument7 pagesDivis Laboratories Limiteddivygupta198No ratings yet

- 3F Industries LimitedDocument5 pages3F Industries LimitedData CentrumNo ratings yet

- Coral AssociatesDocument5 pagesCoral AssociatesFunny CloudsNo ratings yet

- SMFG India Credit Company LimitedDocument9 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Indotech Transformers LimitedDocument7 pagesIndotech Transformers Limitedpiyush.kundraNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Microfinance Private LimitedDocument5 pagesMicrofinance Private LimitedsantoshbsantuNo ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Devyani Food Industries LimitedDocument7 pagesDevyani Food Industries LimitedRahulNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- Document Service V2Document8 pagesDocument Service V2ritika.choudharyNo ratings yet

- Poddar Diamonds Limited-09-29-2017Document4 pagesPoddar Diamonds Limited-09-29-2017tridev kant tripathiNo ratings yet

- Tab India Granites Private Limited-02-07-2020Document6 pagesTab India Granites Private Limited-02-07-2020Puneet367No ratings yet

- Vinati Organics Limited CARE Rating July 2017Document5 pagesVinati Organics Limited CARE Rating July 2017mgrreddyNo ratings yet

- Save Microfinance Private Limited: RatingsDocument4 pagesSave Microfinance Private Limited: RatingsSubhamNo ratings yet

- Bikanervala Foods - R - 22022019Document7 pagesBikanervala Foods - R - 22022019aman.raj2022No ratings yet

- Team Computers Private - R - 09102020Document8 pagesTeam Computers Private - R - 09102020DarshanNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Stove Kraft LimitedDocument7 pagesStove Kraft LimitedSiddharth Rai SuranaNo ratings yet

- Kanchan Oil Industries LimitedDocument4 pagesKanchan Oil Industries LimitedSam FireNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Home First Finance Company India LimitedDocument8 pagesHome First Finance Company India LimitedRAROLINKSNo ratings yet

- RR 20190917Document4 pagesRR 20190917omkarambale1No ratings yet

- AETHER Industries LTD - 2020 Credit RatingDocument5 pagesAETHER Industries LTD - 2020 Credit RatingEast West Strategic ConsultingNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Credit Rating Post March 2023Document26 pagesCredit Rating Post March 2023Sumiran BansalNo ratings yet

- Sanghi Jewellers PVT - R - 20102020Document7 pagesSanghi Jewellers PVT - R - 20102020DarshanNo ratings yet

- Thriveni Sainik Mining Private Limited 2023Document8 pagesThriveni Sainik Mining Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- Derewala Industries 6mar2020Document6 pagesDerewala Industries 6mar2020Mukul SoniNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- SGS Tekniks Manufacturing PVT LTDDocument7 pagesSGS Tekniks Manufacturing PVT LTDgcgary87No ratings yet

- Super Screws Private Limited: Summary of Rated InstrumentsDocument7 pagesSuper Screws Private Limited: Summary of Rated InstrumentsAnonymous bdUhUNm7JNo ratings yet

- Satya Stone Exports-01!24!2020Document4 pagesSatya Stone Exports-01!24!2020vasfee.7172No ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Samunnati Rating Rationale b764561b41Document8 pagesSamunnati Rating Rationale b764561b41PratyushNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Varsha Industries-R-19072018 PDFDocument7 pagesVarsha Industries-R-19072018 PDFKunal DamaniNo ratings yet

- Pon Pure Chemical - R-31082018Document8 pagesPon Pure Chemical - R-31082018Games ZoneNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Bagkiya Constructions Private Limited-RU-01!03!2024Document10 pagesBagkiya Constructions Private Limited-RU-01!03!2024arc14consultantNo ratings yet

- Jagdhatri Papers Private Limited-RU-01-03-2024Document10 pagesJagdhatri Papers Private Limited-RU-01-03-2024arc14consultantNo ratings yet

- Eauction Ludhiana PNB ENGLISH 11042016Document1 pageEauction Ludhiana PNB ENGLISH 11042016arc14consultantNo ratings yet

- Auction Notice 1685951975Document6 pagesAuction Notice 1685951975arc14consultantNo ratings yet

- Accounting Revision Notes 0452Document18 pagesAccounting Revision Notes 0452Hassan AsgharNo ratings yet

- Working Capital Management atDocument29 pagesWorking Capital Management atNavkesh GautamNo ratings yet

- Chapter 10 - Financial PlanningDocument69 pagesChapter 10 - Financial PlanningNgọc Trân Trần NguyễnNo ratings yet

- Bilawal Khan Assignment 2 23386 FCFF and Fcfe DG CementDocument5 pagesBilawal Khan Assignment 2 23386 FCFF and Fcfe DG CementBabar MairajNo ratings yet

- 1 Finance Project Report IMTDocument41 pages1 Finance Project Report IMTqueen8321100% (1)

- AFM Study Guide 2115Document15 pagesAFM Study Guide 2115RENJiiiNo ratings yet

- Problems Faced by Small Scale IndustriesDocument10 pagesProblems Faced by Small Scale IndustriesMd SharikNo ratings yet

- The Home Depot IncDocument12 pagesThe Home Depot IncKhushbooNo ratings yet

- Working Capital: in Small Scale IndustryDocument8 pagesWorking Capital: in Small Scale IndustryIrum KhanNo ratings yet

- Solvency Ratios: Debt-Equity RatioDocument5 pagesSolvency Ratios: Debt-Equity RatioShirsendu MondolNo ratings yet

- Week 8-Financial Analysis-S2 2015Document66 pagesWeek 8-Financial Analysis-S2 2015jp30ptt7No ratings yet

- Debt Free Cash FreeDocument21 pagesDebt Free Cash FreeAhmad BilalNo ratings yet

- ENT600 Blueprint FormatDocument20 pagesENT600 Blueprint FormatMujahid Addin100% (1)

- Assignment-1 Grp-3-3Document8 pagesAssignment-1 Grp-3-3Gaurang GawasNo ratings yet

- Horizontal Analysis United Plantation LatestDocument33 pagesHorizontal Analysis United Plantation Latestwawan100% (1)

- Financial Management Research Paper Financial Ratios of BritanniaDocument15 pagesFinancial Management Research Paper Financial Ratios of BritanniaShaik Noor Mohammed Ali Jinnah 19DBLAW036No ratings yet

- More Illustrative Problems: Illustration 1Document33 pagesMore Illustrative Problems: Illustration 1VEDANT BASNYATNo ratings yet

- Business Finance: Unit III: Financial Planning Tools & ConceptsDocument50 pagesBusiness Finance: Unit III: Financial Planning Tools & ConceptsKristel Anne Roquero BalisiNo ratings yet

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocument7 pagesSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNo ratings yet

- CCASBCP030Document64 pagesCCASBCP030Swati KaleNo ratings yet

- Cadbury India - R1 (Group-6)Document39 pagesCadbury India - R1 (Group-6)Radha ShekharNo ratings yet

- Working Capital, Credit and Accounts Receivable ManagementDocument31 pagesWorking Capital, Credit and Accounts Receivable ManagementAnkit AgarwalNo ratings yet

- Mercury Athletic FootwareDocument12 pagesMercury Athletic FootwareAnandNo ratings yet

- FRM CompleteDocument28 pagesFRM CompleteZaineb Mora SadikNo ratings yet

- Go Rural FM AssignmentDocument31 pagesGo Rural FM AssignmentHumphrey OsaigbeNo ratings yet

- Working Capital Management: Kiran ThapaDocument18 pagesWorking Capital Management: Kiran ThapaRajesh ShresthaNo ratings yet

- Techniques of Cash ManagementDocument18 pagesTechniques of Cash ManagementKrishna Chandran PallippuramNo ratings yet

- Chap 6 Notes AFMDocument30 pagesChap 6 Notes AFMAngel RubiosNo ratings yet