Professional Documents

Culture Documents

CHP 4 MCQ

CHP 4 MCQ

Uploaded by

skynemesis3Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHP 4 MCQ

CHP 4 MCQ

Uploaded by

skynemesis3Copyright:

Available Formats

Double Entry Book

10.34 is an Asset. Do you

Keeping

agree?

( a )Whi

bank balance

while to the bank

Q. 5. Bank overdraft is

a lLiability

overdoft is the

9mount payable by the firmn

balance is the

amount.since

oWned

the (c)

Yes, Bank Bank ( ) Con

Ans, he balnnce held.

than as8et.

drawn is more thus, it is an

lvingdeposited in the bank, (a)

that is

Book an asAet or income?

ls the balance of Petty Cash the firm.

(c)

6.

Balance of Pettv Cash Book is an asset for Wh

Ans, (i)

(a)

(Multiple Choice Questions (MCQs) ) (c)

Sclect the correct alternative: Si

i)

() Cash Book records all (b) cash and credit trangactions (a

(a) cash receipts and payments.

(d) cash payments.

(c) cash receipts.

Param, the entry will be recorded in the

(7) 1fRam has sold goods for cash to

(b) Sales Book.

(a) Cash Book.

(c) Journal Proper. (d) Petty Cash Book.

Objed

() Ravi has purchased goods for cash from Girish for ? 10,000. lt will be recorded in

(a) Cash Book. (6) Journal Book. 1. SE

(c) both Cash Book and Journal Book. (d) Petty Cash Book.

(iv) Mohit paid 9,800 in settlement of his account of ? 10,000. Discount Allowed

recorded in wil be

(a) Cash Book. (6) Journal Book.

(c) Both Cash Book and Journal.

(d) Petty Cash Book.

(v) Deposit of cash in bank is recorded in

(a) Debit of Bank Column and Credit of Cash

Column.

(6) Debit of Cash Column and Credit of Bank

(c) Debit of Cash Column and also Credit of

Column.

Cash Column.

(d) Debit of Bank Column and also

Credit Bank Column.

of

(vi) Withdrawal of Cash from Bank is recorded in 2.

(a) Debit of Bank Column and

Credit of Cash Column.

(6) Debit of Cash Column and

Credit of Bank Column.

(c) Debit of Cash

Column and also Credit of Cash

(d) Debit of Bank Column.

Column and also Credit of Bank

(vii) Balance in the Petty Cash Column.

Book is

(a) an expense.

(c) an asset. (b) a profit.

(viii) When a firmn (d) income.

maintains

(a) Purchases Book. Two-column Cash Book, it does not maintain

(c) Sales Book. (6) Journal Proper.

(d) Bank and Cash Accounts in the

Ledger

Purpose Bookss|-Cash Book

1

of the following is not

(i) Which recorded in the Cash Book?

(a) Credit Sales

(b) Cash Receipts

(c) Cash Payments

(d) Opening Cash Balance

atra entries on the debt side of the Cash

Book are posted to

(a) Debit of Bank Account in the Ledger. (6) Debit of Cash Account in the Ledger.

i) Credit of Cash Account in the Ledger. (d) Not posted in the Ledger.

(k) Which of the following is both a book of Journal and Ledger?

(a) Cash Book (6) General Journal

(c) Purchases Journal (d) SalesJournal

(xi) Simple Petty Cash Book is like a

(a) Cash Book. (6) Statement.

(c) Journal. (d) None of these.

[Ans.: () (a): (i) (a); (iii) (a); (iv) (b); (v) (c): (vi) (6);

(vii) (c); (viüi) (d); (ix) (a); () (d); (xi) (a); (xii) (b).]

Objective Type Questions

statements are True or False:

I. State whether the follouping Cash Book.

and payments are recorded in

Transa receipts contra entry.

Multipie Choice Questions (MCQs)

Select the correct alternative:

() In the Purchases Book, transactions recorded are

(a) cash purchases of goods dealt in, (6) credit purchases of goods dealt in.

(c) all purchases of goods dealt in. (d) purchase of anything.

(iü) The Sales Return Book records

(a) the return of goods purchased. (b) the return of goods sold on credit.

(c) the return of goods sold for cash. ay the return of anything sold.

(iii) The Sales Book

(a) is a part of the Journal. (6) is a part of the Ledger.

(c) is a part of the Balance Sheet. (d) is apart of the Trial Balance.

(iv) The total of the Sales Book is posted to

(a) debit of the Sales Account. (6) credit of the Sales Account.

(c) debit of the Customers' Account. (d) credit of Customers' Accounts.

PurposeBooksI|-Other Books 11.31

Special

The periodic total of Sales Return Journal is posted to the

() (a) Sales Account, (b) Goods Account.

(c) Sales Return Account. (d) Anyof these.

() Goods purchased for cash are recorded in the

(a) Purchases Book. (b) Cash Book.

c) Purehases Return Book. (d) Cash Book and Purchases Book.

( ) Total of these transactions is posted to Purchases Account

(a) Credit purchase of furniture. (6) Purchases Return.

(c) Credit purchase of goods. (d) Purchase of Stationery.

(i) Sale of business asset on credit is recorded in

(a) Sales Book. (6) Journal Proper.

(c) Special Journal. (d) Cash Book.

(ix) Opening entry is recorded

(a) in the beginning of the accounting year.

(6) at the end of the accounting year.

(c) in the middle of the accounting year.

(d) anytime during the year.

(x) Closing entries are passed

(a) in the beginning of the accounting year.

(6) at the end of the accounting year.

(c) in the middle of the accounting year.

(d) anytime during the year.

(xi) Which of the following transactions is entered into the Journal Proper?

(a) Cash Payment to an employee for expenses.

(6) Cash purchase of goods for resale.

(c) Correction of an error.

(d) Credit purchase of goods for resale.

(xii) Xreceived a cheque ofT 10,000 from Yin settlement of dues of 10.500. The cheque

was dishonoured. The reversal of discount allowed byX will be recorded in

(a) Cash Book. (b) Journal Proper.

(c) Ledger directly. (d) None of these.

[Ans.: () (b); (i) (6); (iii) (a); (iv) (6); (v) (c): (vi) (b);

(vi) (c); (viii) (6); (ix) (a); (x) (6); (xi) (c): (xii) (b).]

|Objective Type Questions

Double Entry Booki

Ke pings

12.40

QUESTIONS

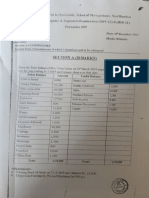

Multiple Choice Questions (MCQs)

Sclect the correct olternative:

() On intra-state (.e. withinthe state) purchase of goods, which of the following 6ST,

(b) SGST

(a) CGST

(d) SGST and IGST

(c) CGST and SGST

() On inter-state (ie., outside the state) purchase of goods, which of the following (;ST

(a) IGST (b) IGST and CGST

(d) SGST

(c) CGST

following accounts are dehit.n

(i) On intra-state purchase of goods, which of the

(a) Input IGST Account

Account

(6) Input CGST Account and Input SGST

Account

(c) Input IGST Account and Input CGST

Account

(d) Input IGST Account and Input SGST

account is credited?

(iv) On inter-state sale of goods, which of the following

(a) Output CGST Alc (6) Output IGST A/c

(c) Input IGST A/c (d) Output SGST Alc

(v) Input IGST is first set-off against

(a) Output IGST. (6) Output CGST.

(c) Output SGST. (d) Any of these.

(vi) Input CGST is first set-off against

(a) Output IGST. (b) Output CGST.

(c) Output SGST. (d) Any of these.

(vi) Input SGST is first set-off against

(a) Output IGST. (b) Output CGST.

(c) Output SGST. (d) Any of these.

it is set-off agans

(vii) If Input IGST, after setting-off against Output IGST, has balance,

(a) Output IGST. (6) Output CGST.

(c) Output SGST. (a) Any of these.

Output CGST, has balauit

(ix) If Input IGST, after setting-off against Output IGST and

it is set-off against

(a) Output IGST. (6) Output CGST.

(c) Output SGST. (d) Any of these.

(vi) (c): (vii) (0); (8)

[Ans.: (i) (c); (ii) (a); (ü)(6); (iv) (6); (v) (a): (vi) (b):

Objective Type Questions)

You might also like

- 1-8-09 - Patrick - Call - Revisited - Final - Version 1Document22 pages1-8-09 - Patrick - Call - Revisited - Final - Version 1api-1973110989% (18)

- Aml CFT NBI Training MaterialDocument52 pagesAml CFT NBI Training Materialdeep100% (2)

- Adobe Scan 19 Feb 2023Document7 pagesAdobe Scan 19 Feb 2023Aman JainNo ratings yet

- Exercise: Abiective Type Questions (Remembering & Understanding Based Questions)Document8 pagesExercise: Abiective Type Questions (Remembering & Understanding Based Questions)Mohd SaadNo ratings yet

- MCQS OF AccountingDocument5 pagesMCQS OF AccountingGulEFarisFarisNo ratings yet

- 1-Fundamentals of AccountingDocument23 pages1-Fundamentals of Accountingcrore patiNo ratings yet

- MoneyDocument6 pagesMoneyritoja770No ratings yet

- Cash QuizDocument6 pagesCash QuizGwen Cabarse PansoyNo ratings yet

- Cash Book MCQ QuestionsDocument1 pageCash Book MCQ QuestionsKunal KumarNo ratings yet

- CH 3 Eco ObjectivesDocument4 pagesCH 3 Eco ObjectivesnilakshimalekarNo ratings yet

- Money and Credit: 1. Objective QuestionsDocument4 pagesMoney and Credit: 1. Objective Questionsnisha sharmaNo ratings yet

- SKUAST Accounts Assistant 2022 PaperDocument9 pagesSKUAST Accounts Assistant 2022 PaperSahil SharmaNo ratings yet

- 11 Acc. MT 1Document7 pages11 Acc. MT 1Chirag KapoorNo ratings yet

- March 2022 Banking IIDocument3 pagesMarch 2022 Banking IISALMA ANSARINo ratings yet

- Bcom-3-Sem-Commerce-Company-Accounts-S-2019 - 2023-04-01T112847.188Document11 pagesBcom-3-Sem-Commerce-Company-Accounts-S-2019 - 2023-04-01T112847.188Sadhik LaluwaleNo ratings yet

- Paper 4Document6 pagesPaper 4subhamsen2366No ratings yet

- RKG Institute: B - 193, Sector - 52, NoidaDocument3 pagesRKG Institute: B - 193, Sector - 52, NoidaBHS PRAYAGRAJNo ratings yet

- CS Chapter 7 MCQ AnswersDocument2 pagesCS Chapter 7 MCQ Answerstkr4vwvmk6No ratings yet

- F Accountancy MS XI 2023-24Document9 pagesF Accountancy MS XI 2023-24bhaiyarakesh100% (1)

- 8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3Document112 pages8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3atsamitsingh01No ratings yet

- 111 0404Document36 pages111 0404api-27548664No ratings yet

- Paper5 Set1 ADocument17 pagesPaper5 Set1 ASanchit ShrivastavaNo ratings yet

- Basic Terms AccountsDocument3 pagesBasic Terms Accountsniyabiby08No ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec2017 - Set 1: Paper 5-Financial AccountingDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec2017 - Set 1: Paper 5-Financial Accountingpirates123No ratings yet

- 1st Test Money & BankingDocument4 pages1st Test Money & BankingIam EmraanNo ratings yet

- Chapter 3Document20 pagesChapter 3ddevilclouds2724No ratings yet

- Without: BusinessareDocument6 pagesWithout: BusinessareBoss GuptaNo ratings yet

- Principles of Accounts - Sir Eddie: Saraswati Vidya NiketanDocument5 pagesPrinciples of Accounts - Sir Eddie: Saraswati Vidya NiketanRafena MustaphaNo ratings yet

- SET A Class 11th Accountancy WPT - I 2Document5 pagesSET A Class 11th Accountancy WPT - I 2Shakshi ShudhNo ratings yet

- Accountancy Class 11th (Term I) : Time:90 MinutesDocument5 pagesAccountancy Class 11th (Term I) : Time:90 MinutesImran farhathNo ratings yet

- Account Q1Document47 pagesAccount Q1Saurabh KumarNo ratings yet

- All MCQs of Finnancial AccountingDocument13 pagesAll MCQs of Finnancial AccountingNoshair Ali100% (2)

- Eco 1srrrtDocument4 pagesEco 1srrrthunters gamersNo ratings yet

- CMA Intermediate Paper 5Document16 pagesCMA Intermediate Paper 5ramesh devarajuNo ratings yet

- Manthan Sachool QPDocument6 pagesManthan Sachool QPNancy ShangleNo ratings yet

- Grade 10 Poa MC 2018Document4 pagesGrade 10 Poa MC 2018Regina CunninghamNo ratings yet

- Questions Chapter 8Document19 pagesQuestions Chapter 8SA 10No ratings yet

- Hours) : - (L) : (Part-lI)Document11 pagesHours) : - (L) : (Part-lI)Sadhik LaluwaleNo ratings yet

- Company AccountsDocument9 pagesCompany AccountsRoma SarkateNo ratings yet

- 12th Accountancy One Word Question Paper With Answer Keys English Medium PDF DownloadDocument6 pages12th Accountancy One Word Question Paper With Answer Keys English Medium PDF Downloadskrockers9056No ratings yet

- BHU B.com 2020Document9 pagesBHU B.com 2020MD Sohail KhanNo ratings yet

- Worksheet 03Document4 pagesWorksheet 03LuckyNo ratings yet

- Money Supply SolutionDocument12 pagesMoney Supply SolutionAA BB MMNo ratings yet

- Copy of FARAP-4501 (Cash and Cash Equivalents)Document50 pagesCopy of FARAP-4501 (Cash and Cash Equivalents)Accounting StuffNo ratings yet

- MONEY AND CREDIT Worksheet - 1639023786Document11 pagesMONEY AND CREDIT Worksheet - 1639023786pratimaNo ratings yet

- 11th Accountancy Model Question PaperDocument12 pages11th Accountancy Model Question PaperArun RohillaNo ratings yet

- Journal, Ledger, Trail Balance and Finnancial Statement MCQsDocument5 pagesJournal, Ledger, Trail Balance and Finnancial Statement MCQsNoshair Ali100% (6)

- Objective Questions: Paymeni. ReceiptsDocument7 pagesObjective Questions: Paymeni. ReceiptsSakshi NagotkarNo ratings yet

- CHP 6 and 9 MCQDocument7 pagesCHP 6 and 9 MCQskynemesis3No ratings yet

- XII Economics Guess Paper - 1Document5 pagesXII Economics Guess Paper - 1kawaljeetsingh121666No ratings yet

- Model Test 15 - 20Document206 pagesModel Test 15 - 20theabhishekdahalNo ratings yet

- B.TECH IV-II FAPM (16MB4201) Unitwise Objective Questions Unit-IDocument16 pagesB.TECH IV-II FAPM (16MB4201) Unitwise Objective Questions Unit-IVin Ay ReddyNo ratings yet

- 21934mtp Cptvolu1 Part2Document194 pages21934mtp Cptvolu1 Part2arshNo ratings yet

- Mudio Islamic Examination Board (Mieb)Document5 pagesMudio Islamic Examination Board (Mieb)MmaryNo ratings yet

- Accountancy PaperDocument7 pagesAccountancy PaperPritika Ghai XI-Humanities RNNo ratings yet

- Instruments of Payments Past PapersDocument4 pagesInstruments of Payments Past Paperss83300437No ratings yet

- Jaiib Practice QuestionsDocument120 pagesJaiib Practice Questionsdivasg555No ratings yet

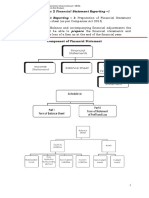

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- Part A Organisational Principles Section 1 The Nature of BusinessDocument3 pagesPart A Organisational Principles Section 1 The Nature of BusinessStateofMind HugoNo ratings yet

- 3B.B.a. Sem.-Ii CC-111 Principles of Economics (Macro)Document2 pages3B.B.a. Sem.-Ii CC-111 Principles of Economics (Macro)FGEFGNo ratings yet

- Theory Base of AccountingDocument4 pagesTheory Base of AccountingNoman AreebNo ratings yet

- Accounts TestDocument6 pagesAccounts Testwaqas malikNo ratings yet

- Chapter 8-Problem 6Document6 pagesChapter 8-Problem 6kakaoNo ratings yet

- Accounting ActivityDocument3 pagesAccounting ActivityKae Abegail GarciaNo ratings yet

- Capital & RevenueDocument14 pagesCapital & RevenueNeha KumariNo ratings yet

- Tally Erp 9 PDF Notes by Learn MoreDocument123 pagesTally Erp 9 PDF Notes by Learn MoreNaresh67% (3)

- Acc117 Test 2 QQ - Set 2Document5 pagesAcc117 Test 2 QQ - Set 2amymaisarah05No ratings yet

- Dwnload Full Financial Accounting 5th Edition Kemp Solutions Manual PDFDocument35 pagesDwnload Full Financial Accounting 5th Edition Kemp Solutions Manual PDFboredomake0ahb100% (17)

- FAR Post Employement Employee Benefits PDFDocument5 pagesFAR Post Employement Employee Benefits PDFJohn Marthin ReformaNo ratings yet

- Madelyn Rialubin Travel Agency Adjusting EntryDocument4 pagesMadelyn Rialubin Travel Agency Adjusting EntryClaud NineNo ratings yet

- Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17 Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Document38 pagesTest Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17 Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Karen CaelNo ratings yet

- SAP FI Certification Actual QuestionDocument4 pagesSAP FI Certification Actual QuestionkhalidmahmoodqumarNo ratings yet

- 4AC0 01 Que 20150107Document20 pages4AC0 01 Que 20150107anupama dissanaykeNo ratings yet

- Accounts Xerox Wala Question Paper 08-Jan-2022Document16 pagesAccounts Xerox Wala Question Paper 08-Jan-2022Aquila GodaboleNo ratings yet

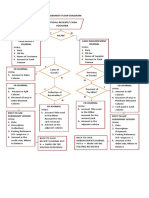

- Cash Receipt and Disbursement Flow Diagram Official Receipt/ Cash VoucherDocument2 pagesCash Receipt and Disbursement Flow Diagram Official Receipt/ Cash VoucherEzekiel LapitanNo ratings yet

- Unit 4 Subsidiary BookDocument17 pagesUnit 4 Subsidiary Bookkim kNo ratings yet

- Chapter 1 Introduction To AccountingDocument51 pagesChapter 1 Introduction To AccountingHeisei De LunaNo ratings yet

- Finance QuizDocument4 pagesFinance QuizAnantha NagNo ratings yet

- All Combined PDF'S PDFDocument489 pagesAll Combined PDF'S PDFshivom talrejaNo ratings yet

- Test Bank - Chapter10 Standard CostingDocument29 pagesTest Bank - Chapter10 Standard CostingGhaill CruzNo ratings yet

- General JournalDocument4 pagesGeneral JournalSaad KhanNo ratings yet

- Chap1 IBFDocument28 pagesChap1 IBFAnamika SonawaneNo ratings yet

- Errors, Correction, Control and Recon, ProvisionDocument11 pagesErrors, Correction, Control and Recon, ProvisionOwen Bawlor ManozNo ratings yet

- Intermediate Accounting 9th Edition Spiceland Solutions ManualDocument25 pagesIntermediate Accounting 9th Edition Spiceland Solutions ManualGregoryVasqueztkbn100% (56)

- FA1 1 3 Chapters PDFDocument35 pagesFA1 1 3 Chapters PDFJerlin PreethiNo ratings yet

- People Soft Bundle Release Note 9 Bundle20Document30 pagesPeople Soft Bundle Release Note 9 Bundle20rajiv_xguysNo ratings yet

- V Litton Worksheet AdjDocument1 pageV Litton Worksheet AdjDing Costa100% (1)

- FAR.2916 - Cash and Cash Equivalents.Document4 pagesFAR.2916 - Cash and Cash Equivalents.Eyes SawNo ratings yet