Professional Documents

Culture Documents

Finals Exam For Non-Accountants I

Finals Exam For Non-Accountants I

Uploaded by

Wycliffe Luther RosalesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finals Exam For Non-Accountants I

Finals Exam For Non-Accountants I

Uploaded by

Wycliffe Luther RosalesCopyright:

Available Formats

UNIVERSITY OF PANGASINAN – PEN

Accounting for Non – Accountants

Final Examination

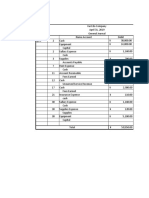

I. On each of the following transaction, provide the necessary journal entry.

a. Ramon contributed P30,000 cash to the business

b. The company purchased office supplies on account, P100,000

c. The company rendered service on cash basis, P50,000

d. The company borrowed P1,000,000 from a bank, evidenced by a promissory note

e. Conchito contributed an equipment costing P60,000 to the business

f. The company incurred salaries expense, P15,000

g. The company paid the incurred salaries from the above transaction

h. The company purchased inventory for P25,000, on account

i. The company paid the inventory purchased

j. Monthly rent of P5,000 was paid in cash

k. The company incurred utilities expense of P35,000

l. Incurred utilities expense from the above transaction was paid

m. The company rendered service on credit basis, P50,000

n. Collection of the receivable from the above transaction

o. Purchase of inventory costing P30,000, credit basis

p. Paid in cash the purchased inventory from transaction above

q. Sold goods costing P30,000 for P50,000 cash

ADJUSTING ENTRIES

Write the adjusting entries on the ff. information:

1. Expiration of Prepaid insurance under asset method

2. Office supplies consumption

4. Depreciation

5. Accrued interest income

6. Estimation of uncollectible accounts

7. Accrued rent income

8. Accrued salaries expense

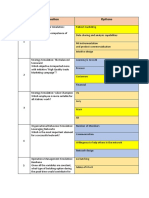

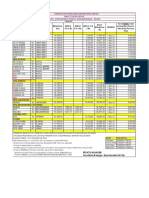

Given the following journal entries and adjusting entries, prepare a worksheet.

JOURNAL ENTRIES

a. Cash 100,000

Brownman Capital 100,000

b. Equipment 150,000

Corola Capital 150,000

c. Salaries expense 20,000

Cash 20,000

d. Prepaid insurance 10,000

Cash 10,000

e. Cash 100,500

Service revenue 100,500

f. Cash 50,000

Notes payable 50,000

ADJUSTING ENTRIES

a. Interest receivable 8,000

Interest income 8,000

b. Insurance expense 1,000

Prepaid insurance 1,000

c. Depreciation expense 5,000

Accumulated depreciation 5,000

You might also like

- Model QuestionsDocument2 pagesModel Questionspuneeth rajuNo ratings yet

- C. A Secured Claim of P450,000 and An Unsecured Claim of P50,000Document8 pagesC. A Secured Claim of P450,000 and An Unsecured Claim of P50,000renoNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- Questions SsDocument7 pagesQuestions SsAngelli Lamique100% (2)

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Practical Research 2 Week 3Document5 pagesPractical Research 2 Week 3Phoebe Rafunsel Sumbongan Juyad88% (25)

- Essay: Is Pakistan Ready For Digital RevolutionDocument3 pagesEssay: Is Pakistan Ready For Digital RevolutionSadia Wattoo100% (1)

- Basic Acctg PracticalDocument3 pagesBasic Acctg PracticalPatricia Camille Austria50% (2)

- Quitar Modo Retail SamsungDocument50 pagesQuitar Modo Retail SamsungCambios PereiraNo ratings yet

- This Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Document2 pagesThis Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Jamaica DavidNo ratings yet

- Accounting Process Practice ProblemDocument23 pagesAccounting Process Practice ProblemRenshey Cordova MacasNo ratings yet

- Accounting 1 ValeDocument13 pagesAccounting 1 ValeAhmadnur JulNo ratings yet

- NyayDocument3 pagesNyayJunneth Pearl HomocNo ratings yet

- Adjusting Entries Asnwer Key - in A NutshellDocument9 pagesAdjusting Entries Asnwer Key - in A NutshellKimberly G. EtangNo ratings yet

- Basic Acctg PracticalDocument3 pagesBasic Acctg PracticalPatricia Camille AustriaNo ratings yet

- Chapter4 IA Midterm BuenaventuraDocument10 pagesChapter4 IA Midterm BuenaventuraAnonnNo ratings yet

- Garcia Activity 2Document4 pagesGarcia Activity 2Joshua De VeraNo ratings yet

- Alternative Methods of Recording DeferralsDocument1 pageAlternative Methods of Recording DeferralsAngela Maxien De GuzmanNo ratings yet

- This Study Resource Was: Consignment SalesDocument3 pagesThis Study Resource Was: Consignment SalesKez MaxNo ratings yet

- ABM 1 Adjustments and WorksheetDocument4 pagesABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- Baysa ParcorChapter 1-5 Answer KeyDocument52 pagesBaysa ParcorChapter 1-5 Answer KeymoonjianneNo ratings yet

- Government Accounting Quiz 4 Write The Letter Pertaining To Best AnswerDocument6 pagesGovernment Accounting Quiz 4 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- APC Ch1solDocument7 pagesAPC Ch1solAnonymous LusWvyNo ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- P04b The Accounting Process Merchandising BusinessDocument36 pagesP04b The Accounting Process Merchandising BusinessKim Ignacio75% (8)

- P04b The Accounting Process Merchandising BusinessDocument36 pagesP04b The Accounting Process Merchandising BusinessDeul ErNo ratings yet

- P2104consignment Sales and Corporate Liquidationkey AnswersDocument4 pagesP2104consignment Sales and Corporate Liquidationkey AnswersJaneNo ratings yet

- Chapter 2 ExercisesDocument5 pagesChapter 2 ExercisesĐào Thị Minh ThuNo ratings yet

- Corporate Liquidation-ExercisesDocument5 pagesCorporate Liquidation-ExercisesGel Bert Jalando-onNo ratings yet

- Aucap2 Unit 5Document6 pagesAucap2 Unit 5Sel BarrantesNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- DrillDocument4 pagesDrillJEP WalwalNo ratings yet

- TAXATIONDocument10 pagesTAXATIONby ScribdNo ratings yet

- Afar 02: Corporate Liquidation: I. True or False - Theory of AccountsDocument5 pagesAfar 02: Corporate Liquidation: I. True or False - Theory of AccountsRoxell CaibogNo ratings yet

- Worksheet 1 DR CRDocument5 pagesWorksheet 1 DR CRMc Clent CervantesNo ratings yet

- Practical Accounting IIDocument19 pagesPractical Accounting IIChristine Nicole BacoNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Taxation 109Document2 pagesTaxation 109Bisag AsaNo ratings yet

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- Review Question 1Document8 pagesReview Question 1Krizah Marie CaballeroNo ratings yet

- ULO A Let's Analyze Activity 2: Submitted By: Sherry Rose M. OlimbaDocument2 pagesULO A Let's Analyze Activity 2: Submitted By: Sherry Rose M. OlimbaJeson MalinaoNo ratings yet

- 2021 - Basic Acctg ReviewDocument4 pages2021 - Basic Acctg ReviewAbegail DelacruzNo ratings yet

- 1.6.1 Quiz 3 Problems Accounting ProcessDocument4 pages1.6.1 Quiz 3 Problems Accounting ProcessyelenaNo ratings yet

- Chapter 3 ProblemDocument3 pagesChapter 3 ProblemErfel Al KitmaNo ratings yet

- Elimination Questions Elimination QuestionsDocument4 pagesElimination Questions Elimination QuestionsasffghjkNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Merhan, Vhilfrey S 2Nd Year BsaisDocument3 pagesMerhan, Vhilfrey S 2Nd Year BsaisvhuusbcNo ratings yet

- Cpar Practical Accounting II May 2012 Final Pre Board W AnswersDocument13 pagesCpar Practical Accounting II May 2012 Final Pre Board W Answersbobo kaNo ratings yet

- Activity2 JLTDocument4 pagesActivity2 JLTfaith fortunNo ratings yet

- Document 1 Hoem BranchDocument38 pagesDocument 1 Hoem BranchNadi HoodNo ratings yet

- Answer Is DDocument2 pagesAnswer Is DMariella Antonio-NarsicoNo ratings yet

- Multiple Choices QuestionsDocument7 pagesMultiple Choices QuestionsrenoNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- BookDocument4 pagesBook8wvy2ws7vcNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- AST FinalsDocument20 pagesAST FinalsMica Ella San DiegoNo ratings yet

- Business Blueprint: Thomas Curran & Gerhard KellerDocument8 pagesBusiness Blueprint: Thomas Curran & Gerhard KellerLUCAS GONÇALVES DE OLIVEIRANo ratings yet

- ENG DS 2361061-1 Te-Pclamp 0521Document6 pagesENG DS 2361061-1 Te-Pclamp 0521GeeNo ratings yet

- BA EndtermDocument15 pagesBA EndtermФариза МукаметкалиеваNo ratings yet

- VishalDocument4 pagesVishalashish ojhaNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument22 pagesInstructions / Checklist For Filling KYC FormRohit JadhavNo ratings yet

- Safety and Health in Textile by ILODocument270 pagesSafety and Health in Textile by ILOsalman114No ratings yet

- PAS 33 Test BankDocument4 pagesPAS 33 Test BankJake ScotNo ratings yet

- Financial Times Asia June 8 2019 PDFDocument60 pagesFinancial Times Asia June 8 2019 PDFHai AnhNo ratings yet

- BIR Form No. 2339 - June 2017 ENCSDocument1 pageBIR Form No. 2339 - June 2017 ENCSlegal.intern.maticlawofficeNo ratings yet

- Rev. F Title: Canadian Device License ProcedureDocument4 pagesRev. F Title: Canadian Device License ProcedureDhruvi KansaraNo ratings yet

- WI001204 - Lecture 8a KopieDocument20 pagesWI001204 - Lecture 8a KopieAnastasiia NosenkoNo ratings yet

- Grant Winning Business Plan Template 1Document5 pagesGrant Winning Business Plan Template 1OLUKUNLE OLANREWAJUNo ratings yet

- Isaac Ramdeen - Management of Business - Internal Assessment - CAPE 2023 - Unit #1Document40 pagesIsaac Ramdeen - Management of Business - Internal Assessment - CAPE 2023 - Unit #1Isaac RamdeenNo ratings yet

- Proposal Writing Student Training Manual PDF DownloadDocument63 pagesProposal Writing Student Training Manual PDF DownloadnzeeNo ratings yet

- Making Entrepreneurship Work For Small BusinessDocument2 pagesMaking Entrepreneurship Work For Small BusinessArcillas, Paloma C.No ratings yet

- Private Security ListDocument9 pagesPrivate Security ListEnrique AlonsoNo ratings yet

- Tutorial 8 - Stamp Duty and Leasing - 2022Document4 pagesTutorial 8 - Stamp Duty and Leasing - 2022Keat 98No ratings yet

- UpGrad+Simple+Guides +Financial+LeverageDocument4 pagesUpGrad+Simple+Guides +Financial+LeverageRakeshNo ratings yet

- Legal Counseling and Social Responsibility CASESDocument73 pagesLegal Counseling and Social Responsibility CASESMadeleine DinoNo ratings yet

- Matrikulasi Bahasa InggrisDocument5 pagesMatrikulasi Bahasa InggrisMr DAY DAYNo ratings yet

- Basic Information of Multi-National Company: Guided by Dr. Navjyot RavalDocument14 pagesBasic Information of Multi-National Company: Guided by Dr. Navjyot RavalAxay PatelNo ratings yet

- BiniDocument13 pagesBinibiniambrhane777No ratings yet

- Jawaban Latihan SoalDocument31 pagesJawaban Latihan SoalRizalMawardiNo ratings yet

- National Union of Workers in Hotel Restaurant and Allied Industries (NUWHRAIN - APL-IUF) v. Philippine Plaza Holdings, IncDocument3 pagesNational Union of Workers in Hotel Restaurant and Allied Industries (NUWHRAIN - APL-IUF) v. Philippine Plaza Holdings, IncKobe Lawrence VeneracionNo ratings yet

- HPCL - PRICE - LIST - EFF-01st Nov 2021Document1 pageHPCL - PRICE - LIST - EFF-01st Nov 2021Dinesh ReddyNo ratings yet

- Ial Economics Chapter 3Document5 pagesIal Economics Chapter 3Ansha Twilight14No ratings yet