Professional Documents

Culture Documents

73601bos59426 Inter p5q

73601bos59426 Inter p5q

Uploaded by

Kali KhannaCopyright:

Available Formats

You might also like

- Wherever He AintDocument6 pagesWherever He AintChiara Assetta0% (1)

- MCQ - Partnership CompiledDocument24 pagesMCQ - Partnership CompiledFrue Love100% (1)

- Bus TrustDocument56 pagesBus Trustaustex_1012799100% (6)

- LTD Digests - Castillo To Legarda Number 6 To 9Document9 pagesLTD Digests - Castillo To Legarda Number 6 To 9Bianca Viel Tombo CaligaganNo ratings yet

- CCC Insurance vs. KawasakiDocument6 pagesCCC Insurance vs. Kawasakibb yattyNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Adv Accounts - QuestionsDocument7 pagesAdv Accounts - QuestionsKhushi AggarwalNo ratings yet

- CA Inter Adv Account Q MTP 2 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 2 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Half Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIIDocument7 pagesHalf Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIImarudev nathawatNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- Intermediate Paper - 1 Advanced AccountingDocument9 pagesIntermediate Paper - 1 Advanced AccountingRishit PrakashNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- FR HandoutDocument67 pagesFR Handoutrolandamuh2023No ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MTP 14 28 Questions 1700718781Document5 pagesMTP 14 28 Questions 1700718781aim.cristiano1210No ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- ISC Accounts - 12th Solved Paper 2024Document24 pagesISC Accounts - 12th Solved Paper 2024asma.sageerNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- PYQ PartnershipDocument11 pagesPYQ Partnershipa86476007No ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- As GR 1 Ipcc Compiler 2015-18Document24 pagesAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOINo ratings yet

- FR - Questions 3Document6 pagesFR - Questions 36dzk78g2vyNo ratings yet

- Solution 5Document29 pagesSolution 5HariNo ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- MTP 11 1 Questions 1696062519Document6 pagesMTP 11 1 Questions 1696062519kabeeramitbarot96No ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- CA Inter Adv Account Q MTP 1 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 1 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- 03 QP - Prelims - 2021-22 - XII - AccountsDocument5 pages03 QP - Prelims - 2021-22 - XII - AccountsSharvari PatilNo ratings yet

- Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingPiyush AmbastaNo ratings yet

- 2BBL311 SEE IR Financial Accounting Dec 2017Document3 pages2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Aid To Accountants UDocument171 pagesAid To Accountants UPiya SabooNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- CA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)Document6 pagesCA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)PizzareadNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- Florentino vs. Supervalue GR 172384, Sept. 12, 2007Document5 pagesFlorentino vs. Supervalue GR 172384, Sept. 12, 2007FranzMordenoNo ratings yet

- Key PagesDocument5 pagesKey PagesmindianqueenNo ratings yet

- HOMEOWNERS ASSOCIATION OF TALAYAN VILLAGE INC. v. J.M. TUASONDocument2 pagesHOMEOWNERS ASSOCIATION OF TALAYAN VILLAGE INC. v. J.M. TUASONBernadette RacadioNo ratings yet

- Mortgage Amending AgreementDocument2 pagesMortgage Amending AgreementLegal Forms100% (2)

- Form 4A: Deed of Indemnity & SubrogationDocument3 pagesForm 4A: Deed of Indemnity & SubrogationHemant Singh SisodiyaNo ratings yet

- Macaura V Northern Assurance Company LTD PDFDocument9 pagesMacaura V Northern Assurance Company LTD PDFVishalNo ratings yet

- Dwnload Full Statistics A Tool For Social Research Canadian 3rd Edition Healey Test Bank PDFDocument18 pagesDwnload Full Statistics A Tool For Social Research Canadian 3rd Edition Healey Test Bank PDFgiaocleopatra192y100% (14)

- 7.30.22 Am Investments-In-Equity-InstrumentsDocument4 pages7.30.22 Am Investments-In-Equity-InstrumentsAether SkywardNo ratings yet

- Policy On Litigation: Background and PurposeDocument4 pagesPolicy On Litigation: Background and PurposeEink SimNo ratings yet

- (Law of Torts Including M.V. Act & Consumer Protection - LLB SEM - 1 (2018)Document2 pages(Law of Torts Including M.V. Act & Consumer Protection - LLB SEM - 1 (2018)Brexa QuantsNo ratings yet

- Spa HDMFDocument3 pagesSpa HDMFgerrymanderingNo ratings yet

- Solicitud Prestamo InglesDocument7 pagesSolicitud Prestamo InglesGrazyna PrzyborowskaNo ratings yet

- 2 Pre Start Meeting FormDocument9 pages2 Pre Start Meeting FormJenny DimaculanganNo ratings yet

- Prefi CorpoDocument52 pagesPrefi CorpoAndrei Jose V. LayeseNo ratings yet

- 5.bachrach VS Seifert 87 Phil 117Document1 page5.bachrach VS Seifert 87 Phil 117gokudera hayatoNo ratings yet

- Karie PropertyDocument2 pagesKarie PropertyCHRISNo ratings yet

- Ba 224. Chapter 1Document25 pagesBa 224. Chapter 1Reynadith VilladelgadoNo ratings yet

- People'S Trans East Asia Insurance Corporation, A.K.A. People'S General Insurance Corporation, Petitioner, vs. Doctors of New Millennium Holdings, Inc., RespondentDocument20 pagesPeople'S Trans East Asia Insurance Corporation, A.K.A. People'S General Insurance Corporation, Petitioner, vs. Doctors of New Millennium Holdings, Inc., RespondentdanexrainierNo ratings yet

- General Filing Instructions For Llcs and Professional LLCS: Pursuant To A.R.S. TITLE 29, CHAPTER 4Document4 pagesGeneral Filing Instructions For Llcs and Professional LLCS: Pursuant To A.R.S. TITLE 29, CHAPTER 4RocketLawyerNo ratings yet

- Equatorial V MayfairDocument3 pagesEquatorial V MayfairJulia Alexandra ChuNo ratings yet

- Sample House Help-Family Employment Agreement: Work Hours and DatesDocument3 pagesSample House Help-Family Employment Agreement: Work Hours and DatesKoffee FarmerNo ratings yet

- Stock Broking: Dr. Kamaljeet Kaur Assistant ProfessorDocument18 pagesStock Broking: Dr. Kamaljeet Kaur Assistant ProfessorSimran SainiNo ratings yet

- Attorney For Plaintiff, Paseo El Rio LLC: D AngelDocument15 pagesAttorney For Plaintiff, Paseo El Rio LLC: D AngelSarahNo ratings yet

- Daywalt vs. La Corporacion de Los Padres Agustinos RecoletosDocument9 pagesDaywalt vs. La Corporacion de Los Padres Agustinos Recoletosbingkydoodle1012No ratings yet

- Corporate Compliance Calendar October 2023Document24 pagesCorporate Compliance Calendar October 2023Sreenivasan KorappathNo ratings yet

73601bos59426 Inter p5q

73601bos59426 Inter p5q

Uploaded by

Kali KhannaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

73601bos59426 Inter p5q

73601bos59426 Inter p5q

Uploaded by

Kali KhannaCopyright:

Available Formats

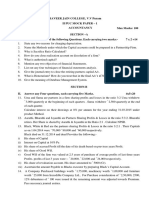

Test Series: April, 2023

MOCK TEST PAPER 2

INTERMEDIATE: GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

Time Allowed: 3 Hours Maximum Marks: 100

1. (a) PRZ & Sons Ltd. are Heavy Engineering contractors specializing in construction of dams.

From the records of the company, the following data is available pertaining to year ended

31st March, 2023:

(` crore)

Total Contract Price 2,400

Work Certified 1,250

Work pending certification 250

Estimated further cost to completion 1,750

Stage wise payments received 1,100

Progress payments in pipe line 300

Using the given data and applying the relevant Accounting Standard you are required to:

(i) Compute the amount of profit/loss for the year ended 31 st March, 2023.

(ii) Arrive at the contract work in progress as at the end of financial year 2022-23.

(iii) Determine the amount of revenue to be recognized out of the total contract value.

(iv) Work out the amount due from/to customers as at year end.

(b) S. Square Private Limited has taken machinery on finance lease from S.K. Ltd. The

information is as under:

Lease term = 4 years

Fair value at inception of lease = ` 20,00,000

Lease rent = ` 6,25,000 p.a. at the end of year

Guaranteed residual value = ` 1,25,000

Expected residual value = ` 3,75,000

Implicit interest rate = 15%

Discount rates for 1 st year, 2nd year, 3rd year and 4 th year are 0.8696, 0.7561, 0.6575 and

0.5718 respectively.

You are required to calculate the value of the lease liability as per AS-19 and also disclose

impact of this on Balance sheet and Profit & loss account at the end of year 1.

(c) Old Era Publication Publishes a popular monthly magazine on 15 th of every month. The

publication sells the advertising space on terms of 90% payable in advance and the balance

10% payable within 30 days of release of the publication. The space for March 2023 issue

of the magazine was sold in the month of February, 2023. The magazine was published as

1

© The Institute of Chartered Accountants of India

per schedule on 15 th of the month. The amount of ` 2,70,000 has been received upto

31st March, 2023 and ` 30,000 was received on 10 th April, 2023 for advertisement published

in the March issue of the publication.

Please advise the accountant the amount of revenue to be recognized in the context of the

provisions of AS 9 ‘Revenue Recognition’ during the year ending on 31 st March, 2023.

(d) An airline is required by law to overhaul its aircraft once in every five years. The pacific

Airlines which operate aircrafts does not provide any provision as required by law in its final

accounts. You are required to comment on the validity of the treatment done by the

company in line with the provisions of AS 29. (4 Parts x 5 Marks = 20 Marks)

2. (a) P, Q, R and S are sharing profits and losses in the ratio 3 : 3 : 2 : 1. Frauds committed by R

during the year were found out and it was decided to dissolve the partnership on

31st March, 2023 when their Balance Sheet was as under:

Equity & Liabilities Amount (`) Assets Amount (`)

Capitals: Building 1,90,000

P 1,50,000 Stock 1,30,000

Q 1,50,000 Investments 50,000

R - Debtors 70,000

S 60,000 Cash 30,000

General reserve 40,000 R’s capital 40,000

Trade creditors 80,000 (overdrawn)

Bills payable 30,000

5,10,000 5,10,000

Following information is given to you:

(i) A cheque for ` 7,000 received from debtor was not recorded in the books and was

misappropriated by R.

(ii) Investments costing ` 8,000 were sold by R at ` 11,000 and the funds transferred to

his personal account. This sale was omitted from the firm’s books.

(iii) A creditor agreed to take over investments of the book value of ` 9,000 at

` 13,000. The rest of the creditors were paid off at a discount of 5%.

(iv) The other assets realized as follows:

Building 110% of book value

Stock ` 1,20,000

Investments The rest of investments were sold at a profit of ` 7,000

Debtors The rest of the debtors were realized at a discount of 10%

(v) The bills payable were settled at a discount of ` 500.

(vi) The expenses of dissolution amounted to ` 8,000

(vii) It was found out that realization from R’s private assets would only be ` 7,000. It was

decided that deficiency arising due to him will be shared among the remaining partners

in the capital ratio (before transfer of General reserve).

Prepare Realization Account, Cash Account and Partners’ Capital Accounts. All workings

should part of your answer.

© The Institute of Chartered Accountants of India

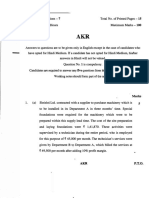

(b) Statement of interest on advances in respect of Performing assets and Non -Performing

Assets of Omega Bank is as follows:- (` in lakhs)

Performing Assets Non-Performing Assets

Interest Interest Interest Interest

earned received earned received

Cash credits and overdrafts 1800 1060 450 70

Term Loan 480 320 300 40

Bills purchased and discounted 700 550 350 36

Find out the income to be recognized for the year ended 31 st March, 2020.

(16 + 4 = 20 Marks)

3. (a) Sun and Neptune (both companies) had been carrying on business independently. They

agreed to amalgamate and form a new company Jupiter Ltd. with an authorised share

capital of ` 4,00,000 divided into 80,000 equity shares of ` 5 each. On 31 st March, 2023 Sun

and Neptune provide the following information:

Sun (`) Neptune (`)

Property, Plant & Equipment 6,35,000 3,65,000

Current Assets 3,27,000 1,67,750

9,62,000 5,32,750

Less: Current Liabilities (5,97,000) (1,80,250)

Representing Capital 3,65,000 3,52,500

Additional Information:

(a) Revalued figures of Fixed and Current assets were as follows:

Sun (`) Neptune (`)

Fixed Assets 7,10,000 3,90,000

Current Assets 2,99,500 1,57,750

(b) The debtors and creditors include ` 43,350 owed by Sun to Neptune.

The purchase consideration is satisfied by issue of the following shares and debentures.

(i) 60,000 equity shares of Jupiter Ltd. to Sun and Neptune in the proportion to the

profitability of their respective business based on the average net profit during the

last three years which were as follows:

Sun (`) Neptune (`)

2021 Profit 4,49,576 2,73,900

2022 (Loss)/Profit (2,500) 3,42,100

2023 Profit 3,77,924 3,59,000

(ii) 15% debentures in Jupiter Ltd. at par to provide an income equivalent to 8%

return business as on capital employed in their respective business as on

31st March, 2023 after revaluation of assets.

© The Institute of Chartered Accountants of India

You are required to :

(1) Compute the amount of debentures and shares to be issued to Sun and Neptune.

(2) A Balance sheet of Jupiter Ltd. showing the position immediately after amalgamation.

(b) Explain B List Contributories and the liability of contributories included in the list.

(16 + 4 = 20 Marks)

4. (a) The following is an extract from the Trial Balance of Jeevan Bank Ltd. as at

31st March, 2022:

Rebate on bills discounted as on 1-4- 2021 1,36,518 (Cr.)

Discount received 3,40,312 (Cr.)

Analysis of the bills discounted reveals as follows:

Amount (`) Due date

5,60,000 June 1, 2022

17,44,000 June 8, 2022

11,28,000 June 21, 2022

16,24,000 July 1, 2022

12,00,000 July 5, 2022

You are required to find out the amount of discount to be credited to Profit and Loss account

for the year ending 31 st March, 2022 and pass Journal Entries. The rate of discount may be

taken at 10% per annum.

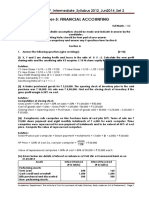

(b) While closing its books of account on 31 st March, 2023 a Non-Banking Finance Company

has classified its advances as follows:

` in lakhs

Standard assets 13,400

Sub-standard assets 670

Secured portions of doubtful debts:

− Up to one year 160

− one year to three years 45

− more than three years 20

Unsecured portions of doubtful debts 48

Loss assets 24

You are required to calculate the amount of provision, which must be made against the

advances as per the Non-Banking Financial Company –Systemically Important Non-Deposit

taking Company (Reserve Bank) Directions, 2016.

(c) SM Limited gives the following information as on 31st March, 2023:

`

Share capital

(60,000 Equity Shares of ` 10 Each) 6,00,000

Reserve & Surplus:

Security premium ` 70,000

General reserve ` 63,000

© The Institute of Chartered Accountants of India

Profit and Loss ` 1,40,000 2,73,000

Non-current liability:

9% debentures (secured) 3,00,000

Current Liabilities:

Term loan 40,000

Creditors 65,000

Provision for taxation 15,000

Property plant and equipment 6,00,000

Non-current investment 1,50,000

Current assets:

Stock ` 2,00,000

Debtors ` 2,60,000

Bank ` 83,000 5,43,000

The shareholders adopted the resolution on 31st March, 2023 to:

(i) Buy back 25% of the paid up capital @ ` 15 each.

(ii) Issue 10% debentures of ` 60,000 at a premium of 10% to finance the buyback of

shares.

(iii) Maintain a balance of ` 20,000 in General Reserve.

(iv) Sell investments worth ` 1,00,000 for ` 80,000.

(v) Buy back expenses were ` 2,000.

You are required to pass necessary journal entries to record the above transactions and

prepare Ledger account of Bank. (8 + 4 + 8 = 20 Marks)

5. On 31st March, 2023 H Ltd. and its subsidiary S Ltd. give the following information:

H Ltd. S Ltd.

` `

Shareholders' Fund:

Equity shares of ` 10 each 13,40,000 2,40,000

Reserves and Surplus 4,80,000 1,80,000

Profit & Loss Account 2,40,000 60,000

Secured Loans:

12% Debentures 1,00,000 -

Current Liabilities:

Trade Payables 2,00,000 1,22,000

Bank Overdraft 1,00,000 -

Bills Payable 60,000 14,800

Property, Plant & Equipment:

Machinery 7,20,000 2,16,000

Furniture 3,60,000 40,800

© The Institute of Chartered Accountants of India

Investments:

Investments in S Ltd. 3,84,000 -

(19,200 shares at ` 20 each)

Current Assets:

Inventories 6,00,000 2,00,000

Trade Receivables 3,00,000 90,000

Bill Receivables 1,00,000 30,000

Cash at Bank 56,000 40,000

The following information is also provided to you:

(a) H Ltd. purchased 19,200 shares of S Ltd. on 1 st April, 2022, when the balances of Reserves

& Surplus and Profit & Loss Account of S Ltd. stood at ` 60,000 and ` 36,000 respectively.

(b) Machinery (Book value ` 2,40,000) and Furniture (Book value ` 48,000) of S Ltd were

revalued at ` 3,60,000 and ` 36,000 respectively on 1 st April, 2022, for the purpose of fixing

the price of its shares. (Rates of depreciation computed on the basis of useful lives:

Machinery 10%, Furniture 15%).

(c) On 31st March, 2023, Bills payable of ` 12,000 shown in S Ltd.'s Balance Sheet had been

accepted in favour of H Ltd.

You are required to prepare Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd. as at

31st March, 2023. (20 Marks)

6. (a) During 2020-21, an enterprise incurred costs to develop and produce a routine low risk

computer software product, as follows:

Particular `

Completion of detailed program and design (Phase 1) 50,000

Coding and Testing (Phase 2) 40,000

Other coding costs (Phase 3 & 4) 63,000

Testing costs (Phase 3 & 4) 18,000

Product masters for training materials (Phase 5) 19,500

Packing the products (1,500 units) (Phase 6) 16,500

After completion of phase 2, it was established that the product is technically feasible for the

market. You are required to state how the above cost to be recognized in the books of

accounts as per AS 26.

(b) An earthquake destroyed a major warehouse of PQR Ltd. on 30.4.2021. The accounting

year of the company ended on 31.3.2021. The accounts were approved on 30.6.2021. The

loss from earthquake is estimated at ` 25 lakhs. State with reasons, whether the loss due to

earthquake is an adjusting or non-adjusting event and how the fact of loss is to be disclosed

by the company.

OR

A Company has an inter-segment transfer pricing policy of charging at cost less 5%. The

market prices are generally 20% above cost.

You are required to examine whether the policy adopted by the company is correct or not?

© The Institute of Chartered Accountants of India

(c) W, X, Y and Z hold equity share capital in the proportion of 40:30:10:20. A, B, C and D hold

preference share capital in the proportion of 30:40:20:10. You are required to find their

voting rights in case of resolution of winding up of the company if the paid up capital of the

company is ` 40 Lakh and Preference share capital is ` 20 Lakh.

(d) On 1st October, 2022, A Limited granted 25,000 Employees’ Stock Option at ` 70 per share.

The market price of share was ` 130 per share. The options were to be exercised between

1st December, 2022 and 31st March, 2023. The face value of shares is ` 10 each. The

employees exercised option for 18,000 shares only and the balance options lapsed. The

company closes its books of accounts on 31 st March every year.

Pass necessary journal entries with narration to record the transaction in the books of the

company. (4 Parts x 5 Marks = 20 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Wherever He AintDocument6 pagesWherever He AintChiara Assetta0% (1)

- MCQ - Partnership CompiledDocument24 pagesMCQ - Partnership CompiledFrue Love100% (1)

- Bus TrustDocument56 pagesBus Trustaustex_1012799100% (6)

- LTD Digests - Castillo To Legarda Number 6 To 9Document9 pagesLTD Digests - Castillo To Legarda Number 6 To 9Bianca Viel Tombo CaligaganNo ratings yet

- CCC Insurance vs. KawasakiDocument6 pagesCCC Insurance vs. Kawasakibb yattyNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Adv Accounts - QuestionsDocument7 pagesAdv Accounts - QuestionsKhushi AggarwalNo ratings yet

- CA Inter Adv Account Q MTP 2 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 2 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Half Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIIDocument7 pagesHalf Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIImarudev nathawatNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- Intermediate Paper - 1 Advanced AccountingDocument9 pagesIntermediate Paper - 1 Advanced AccountingRishit PrakashNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- FR HandoutDocument67 pagesFR Handoutrolandamuh2023No ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MTP 14 28 Questions 1700718781Document5 pagesMTP 14 28 Questions 1700718781aim.cristiano1210No ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- ISC Accounts - 12th Solved Paper 2024Document24 pagesISC Accounts - 12th Solved Paper 2024asma.sageerNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- PYQ PartnershipDocument11 pagesPYQ Partnershipa86476007No ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- As GR 1 Ipcc Compiler 2015-18Document24 pagesAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOINo ratings yet

- FR - Questions 3Document6 pagesFR - Questions 36dzk78g2vyNo ratings yet

- Solution 5Document29 pagesSolution 5HariNo ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- MTP 11 1 Questions 1696062519Document6 pagesMTP 11 1 Questions 1696062519kabeeramitbarot96No ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- CA Inter Adv Account Q MTP 1 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 1 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- 03 QP - Prelims - 2021-22 - XII - AccountsDocument5 pages03 QP - Prelims - 2021-22 - XII - AccountsSharvari PatilNo ratings yet

- Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingPiyush AmbastaNo ratings yet

- 2BBL311 SEE IR Financial Accounting Dec 2017Document3 pages2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Aid To Accountants UDocument171 pagesAid To Accountants UPiya SabooNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- CA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)Document6 pagesCA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)PizzareadNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- Florentino vs. Supervalue GR 172384, Sept. 12, 2007Document5 pagesFlorentino vs. Supervalue GR 172384, Sept. 12, 2007FranzMordenoNo ratings yet

- Key PagesDocument5 pagesKey PagesmindianqueenNo ratings yet

- HOMEOWNERS ASSOCIATION OF TALAYAN VILLAGE INC. v. J.M. TUASONDocument2 pagesHOMEOWNERS ASSOCIATION OF TALAYAN VILLAGE INC. v. J.M. TUASONBernadette RacadioNo ratings yet

- Mortgage Amending AgreementDocument2 pagesMortgage Amending AgreementLegal Forms100% (2)

- Form 4A: Deed of Indemnity & SubrogationDocument3 pagesForm 4A: Deed of Indemnity & SubrogationHemant Singh SisodiyaNo ratings yet

- Macaura V Northern Assurance Company LTD PDFDocument9 pagesMacaura V Northern Assurance Company LTD PDFVishalNo ratings yet

- Dwnload Full Statistics A Tool For Social Research Canadian 3rd Edition Healey Test Bank PDFDocument18 pagesDwnload Full Statistics A Tool For Social Research Canadian 3rd Edition Healey Test Bank PDFgiaocleopatra192y100% (14)

- 7.30.22 Am Investments-In-Equity-InstrumentsDocument4 pages7.30.22 Am Investments-In-Equity-InstrumentsAether SkywardNo ratings yet

- Policy On Litigation: Background and PurposeDocument4 pagesPolicy On Litigation: Background and PurposeEink SimNo ratings yet

- (Law of Torts Including M.V. Act & Consumer Protection - LLB SEM - 1 (2018)Document2 pages(Law of Torts Including M.V. Act & Consumer Protection - LLB SEM - 1 (2018)Brexa QuantsNo ratings yet

- Spa HDMFDocument3 pagesSpa HDMFgerrymanderingNo ratings yet

- Solicitud Prestamo InglesDocument7 pagesSolicitud Prestamo InglesGrazyna PrzyborowskaNo ratings yet

- 2 Pre Start Meeting FormDocument9 pages2 Pre Start Meeting FormJenny DimaculanganNo ratings yet

- Prefi CorpoDocument52 pagesPrefi CorpoAndrei Jose V. LayeseNo ratings yet

- 5.bachrach VS Seifert 87 Phil 117Document1 page5.bachrach VS Seifert 87 Phil 117gokudera hayatoNo ratings yet

- Karie PropertyDocument2 pagesKarie PropertyCHRISNo ratings yet

- Ba 224. Chapter 1Document25 pagesBa 224. Chapter 1Reynadith VilladelgadoNo ratings yet

- People'S Trans East Asia Insurance Corporation, A.K.A. People'S General Insurance Corporation, Petitioner, vs. Doctors of New Millennium Holdings, Inc., RespondentDocument20 pagesPeople'S Trans East Asia Insurance Corporation, A.K.A. People'S General Insurance Corporation, Petitioner, vs. Doctors of New Millennium Holdings, Inc., RespondentdanexrainierNo ratings yet

- General Filing Instructions For Llcs and Professional LLCS: Pursuant To A.R.S. TITLE 29, CHAPTER 4Document4 pagesGeneral Filing Instructions For Llcs and Professional LLCS: Pursuant To A.R.S. TITLE 29, CHAPTER 4RocketLawyerNo ratings yet

- Equatorial V MayfairDocument3 pagesEquatorial V MayfairJulia Alexandra ChuNo ratings yet

- Sample House Help-Family Employment Agreement: Work Hours and DatesDocument3 pagesSample House Help-Family Employment Agreement: Work Hours and DatesKoffee FarmerNo ratings yet

- Stock Broking: Dr. Kamaljeet Kaur Assistant ProfessorDocument18 pagesStock Broking: Dr. Kamaljeet Kaur Assistant ProfessorSimran SainiNo ratings yet

- Attorney For Plaintiff, Paseo El Rio LLC: D AngelDocument15 pagesAttorney For Plaintiff, Paseo El Rio LLC: D AngelSarahNo ratings yet

- Daywalt vs. La Corporacion de Los Padres Agustinos RecoletosDocument9 pagesDaywalt vs. La Corporacion de Los Padres Agustinos Recoletosbingkydoodle1012No ratings yet

- Corporate Compliance Calendar October 2023Document24 pagesCorporate Compliance Calendar October 2023Sreenivasan KorappathNo ratings yet