Professional Documents

Culture Documents

AFAR-03 (Corporate Liquidation)

AFAR-03 (Corporate Liquidation)

Uploaded by

Flores Renato Jr. S.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR-03 (Corporate Liquidation)

AFAR-03 (Corporate Liquidation)

Uploaded by

Flores Renato Jr. S.Copyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 46 October 2023 CPA Licensure Examination

AFAR-03

ADVANCED FINANCIAL ACCOUNTING & REPORTING (AFAR) A. DAYAG A. CRUZ

CORPORATE LIQUIDATION

Enterprises in Financial Difficulty. Business Failure is a common phenomenon in a free enterprise

company. It may be due to a variety of reasons such as incompetent management, poor operating

control, inadequate financing, fraud, or other unexpected adverse developments. Among the inevitable

symptoms of business failure is a shortage of funds or a lack of liquidity, which results in the enterprise’s

inability to meet its current obligations as they become due.

Liquidity. Liquidity refers mainly to a firm’s ability to meet its short-term obligations, while solvency relates

to the longer time span of obligation. Both of these situations are interrelated. An auditor who examines

the financial statements of an enterprise with a history of losses and resulting financial difficulties and which

may even be in default of loan agreement covenants must, at some point, evaluate the enterprise’s ability

to survive financially. If there is evidence that the ability of the enterprise to continue as a going concern

can no longer be safely assumed, the auditor may have to qualify his or her opinion, or, in some cases

disclaim an opinion.

Insolvency. A business enterprise can be insolvent in the conventional (or equity) sense when it is unable

to pay off its liabilities as they become due. The enterprise is insolvent in the legal sense when the financial

condition is such that the sum of the entity’s debts is greater than all of such entity’s property at fair

valuation. Thus, in the legal sense, an enterprise remains solvent as long as the fair value of its assets exceeds

its liabilities, even though the enterprise cannot meet its current maturing obligations because of an

insufficiency of liquid resources.

Liquidations. When the financial position of the debtor is such that it cannot resolve its financial

difficulties by any of the following quasi-reorganization, troubled-debt restructuring, and dacion-en-pago

accounting, the corporation will have to resort to liquidation. This process may be started by the debtor

filing a debtor’s voluntary petition or creditor’s involuntary petition.

Trustee in Bankruptcy. The duties of the trustee in liquidations are similar to those in reorganization

except that the focus is on a realization of assets and liquidation of liabilities rather than on preservation

and continuation of business. In addition, the trustee must assume control over the assets of the debtor,

convert assets into cash, and liquidate the business as expeditiously as is compatible with the best interests

of affected parties. In the course liquidation, the trustee may continue business activities, if that is in the

interest of an orderly liquidation.

Accounting and Reporting for Liquidation. The basic focus of accounting for a bankrupt is that of a

“quitting concern” rather than a “going concern,” which is the usual assumption in accounting. The

statement that has been devised for that purpose is the statement of affairs, which is hypothetical or pro-

forma in nature and which represents the best estimate on the outcome of the liquidation of a debtor’s

business.

Basic Reports Prepared in Corporate Liquidation:

1. Statement of Affairs. This statement is prepared as of a given point in time for a business enterprise

entering into the stage of liquidation. The purpose of this statement is to display the assets and

liabilities and of the debtor enterprise from a liquidation viewpoint, because liquidation is the

outcome of the bankruptcy proceedings. Thus, assets displayed in the statement of affairs are

valued at current fair values; carrying amounts are presented on a memorandum basis.

2. Statement of Realization and Liquidation. This is an activity statement that is intended to show

progress, i.e., actual transactions toward the liquidation of a debtor’s estate. Its original purpose is

to inform the bankruptcy court and interested creditors of the accomplishments of the trustee.

The Statement of Realization and Liquidation differs from the Statement of Affairs in the following respects:

1. The statement of realization and liquidation reports the actual liquidation results. In contrast, the

statement of affairs is of a pro-forma nature and is based on estimates rather than actual results.

2. The statement of realization and liquidation provides an ongoing reporting of the trustee’s activities

and is updated throughout the liquidation process. The statement of affairs is a summary of the

estimated results of a completed liquidation.

I

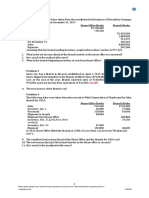

The unsecured creditors of Insolveca Corporation filed a petition on July 1, 20x8 to

force Insolveca Corporation into bankruptcy. The court order for relief was granted on

July 10 at which time an interim trustee was appointed to supervise liquidation of the

estate. A listing of assets and liabilities of Insolveca Corporation as of July 10,

20x8, along with estimated realizable values, is as follows:

Page 1 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

CORPORATE LIQUIDATION AFAR-03

Assets Book Value Estimated Realizable Values

Cash P 61,400 P 61,400

Accounts receivable 250,000 15% of the accounts receivable is

Allowance for D/A ( 20,000) estimated to be uncollectible

Inventories 420,000 Estimated selling price, P340,000

which will require additional

costs of P50,000

Prepaid expenses 40,000 ?

Investments 180,000 P110,000

Land 210,000 An offer of P500,000 has been

Buildings (net) 260,000 received for land and buildings

Machinery & equipment(net) 220,000 P53,900

Goodwill ___200,000 ?

Total Assets P1,821,400

Liabilities & Equity

Accounts payable P 670,000

Wages payable 3,400

Notes payable 160,000

Accrued interest- Notes 5,000

Mortgage payable, secured

by land and buildings 400,000

Capital stock 800,000

Additional paid-in capital 80,000

Deficit ( 297,000)

Total Liabilities & Equity P1,821,400

Additional information:

a. Patents completely written-off the books in past years but with a realizable value

of P10,000.

b. The books do not show the following accruals (unrecorded expenses/additional

liabilities):

Taxes…………………………………………………………………………………………P16,400

Interest on mortgage………………………………………………… 10,000

c. The investments have been pledged as security for holder of the notes

payable.

d. The trustee fees and other costs of liquidating the estate are estimated

to be P60,000.

Determine:

1. The total free assets should be:

a. P1,831,400 c. P717,800

b. 1,821,400 d. 638,000

2. The net free assets should be:

a. P717,800 c. P638,000

b. 698,000 d. 628,000

3. The estimated deficiency to unsecured creditors should be:

a. P87,000 c. P27,000

b. 47,800 d. 7,200

4. The expected recovery percentage of unsecured creditors should be:

a. 96.00% c. 88.00%

b. 95.00% d. 86.62%

5. The estimated payment to creditors should be:

Unsecured Creditors

Fully Secured Partially Secured With priority Without Priority

a. P 410,000 P 110,000 P 79,800 P638,000

b. 500,000 158,400 60,000 589,600

c. 410,000 165,000 79,800 670,000

d. 410,000 158,400 79,800 589,600

6. The estimated payment to creditors should be:

a. P1,324,800 c. P1,264,800

b. 1,308,000 d. 1,237,800

7. The estimated net gain or loss on asset realization should be:

a. P583,600 c. P670,000

b. 593,600 d. 680,000

8. The estimated net loss should be:

a. P583,600 c. P670,000

b. 593,600 d. 680,000

Page 2 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

CORPORATE LIQUIDATION AFAR-03

II

Parcincor Dissolved Corporation recently petitioned for bankruptcy on January 2022 and

is now in the process of preparing a statement of affairs. On March 31, 2022, the

trustee provided the following information about the corporation’s financial affairs

with the carrying values and estimated fair values of the company are as follows:

Assets: Carrying Value Fair value

Cash P 20,000 P 20,000

Accounts receivable – net 45,000 30,000

Inventories 60,000 35,000

Land 75,000 70,000

Building (net) 180,000 100,000

Equipment (net) _ 170,000 ___80,000

Total Assets P 550,000 P 335,000

Liabilities:

Accounts payable P 60,000

Wages payable (all have priority) 10,000

Taxes payable 10,000

Notes payable (secured by

receivables and inventory) 120,000

Interest on notes payable 6,000

Bonds payable (secured by land

and building) 150,000

Interest on bonds payable 7,000

Total liabilities P 363,000

Determine:

1. What is the total amount of unsecured claims?

a. P 93,000 b. P113,000 c. P 121,000 d. P126,000

2. What is the total amount of free assets?

a. P 28,000 b. P 93,000 c. P 113,000 d. P121,000

3. What amount expected to be available for general unsecured creditors/claims without

priority (net free assets):

a. P 93,000 b. P113,000 c. P 121,000 d. P 126,000

4. What is the estimated dividend percentage or the expected recovery per peso of

unsecured creditors:

a. 23% b. 68% c. 77% d. 93%

III

The following information was available on March 31, 20x3 for Bankreport ROLB, which

they cannot pay their liabilities when they are due:

Carrying Amounts

Cash P 16,000

Trade accounts receivable (net): Current fair

value equal to carrying amount 184,000

Inventories: Net realizable value, P72,000;

pledged on P84,000 of notes payable 156,000

Plant assets: Current fair value, P269,600;

pledged on mortgage notes payable 536,000

Accumulated depreciation of plant assets 108,000

Supplies: Current fair value, P6,000 8,000

Wages payable, all earned during March 23,200

Property taxes payable 4,800

Trade accounts payable 240,000

Notes payable, P84,000 secured by inventories 160,000

Mortgage payable, including accrued interest of P1,600 201,600

Common stock, P5 par 400,000

Deficit 237,600

Determine:

1. The estimated losses on realization of assets:

a. P 0 c. P 158,400

b. 84,000 d. 244,400

2. The estimated gains on realization of assets:

a. P 0 c. P 158,400

b. 84,000 d. 244,400

3. The expected recovery percentage of unsecured creditors:

a. 75% c. 78%

b. 78% d. 98%

4. The estimated deficiency to unsecured creditors:

a. P 86,000 c. P 70,000

b. 82,000 d. 54,000

Page 3 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

CORPORATE LIQUIDATION AFAR-03

IV – Statement of Realization and Liquidation and Statement of Estate Deficit

The Liquid Company had a very unstable financial condition caused by a deficiency of

liquid assets. On February 4, 20x8, the following information was available:

CASH P 112,000

Assets Not Realized:

Accounts Receivable… 80,000

Merchandise inventory… 160,000

Investment in common stock 26,400

Land 100,000

Buildings 60,000

Machinery and equipment 48,000

Liabilities Not Liquidated:

Notes Payable P 244,000

Accounts payable 288,000

Salaries and Wages 40,000

Taxes payable 8,000

Bank loan 180,000

Estate deficit ( 173,600)

During the six-month period ending July 31, 20x8, the trustee sold the Investment in

Common Stock for P26,000, realized P84,000 for the accounts receivable, sold the

merchandise for P152,000, and paid-off P26,000 of the bank loan and all liabilities

with priorities (salaries, and wages payable, taxes payable) as well as P7,440 for

estate administration expenses.

Determine:

1. The estate deficit, ending (July 31, 20x8) should be:

a. P161,760 c. P185,440

b. P178,000 d. P189,440

2. The net (gain)loss or realization and liquidation should be:

a. P11,840 loss c. P15,840 loss

b. P1,840 gain d. P4,400 loss

3. The cash balance, ending (July 31, 20x8) should be:

a. Zero c. P188,000

b. P185,440 d. P292,560

-end-

A life spent in making mistakes is not only more honorable but more meaningful than a life spent doing

nothing.

Life can only be understood backwards, but it must be lived forwards.

***Success is not a gift, it is a challenge to what you achieved***

***Achievement comes from the person who dares***

***To achieve all that is possible, we must attempt the impossible***

Success does not depend on what you achieved but on how you achieved it.

*Faith may be defined briefly as an illogical belief in the occurrence of the impossible.*

*Faith is a higher faculty than reason.*

*The secret of life is not just to live, but to have something worthwhile to

*Be not afraid of life. Believe that life is worth living and your belief will help create the fact.*

*Develop an attitude of gratitude, and give thanks for everything that happens to you, knowing that

every step forward is a step toward achieving something bigger and better than your current situation.*

*The remarkable thing we have is a choice every day regarding the attitude we will embrace for that

day. We cannot change our past... We cannot change the fact that people will act in a certain way. We

cannot change the inevitable.

The only thing we can do is play on the one string we have, and that is our attitude.*

GOD BLESS AS ALWAYS!!!

Page 4 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

CORPORATE LIQUIDATION AFAR-03

Problem I:

Solution to Problem I

1. (c) – 717,800

2. (c) – 638,000

3. (a) – 87,000

Free Assets

Assets Pledged To Fully Secured Creditors:

Land and Buildings ……………………………………………………….. P 500,000

Less: Mortgage Payable ……………………………………………..….P 400,000

Interest Payable…………………………………………………….. 10,000 410,000 P 90,000

Free Assets:

Cash……………………………………………………………………………….. 61,400

Accounts Rec. (85% x 250,000) ……………………………………… 212,500

Invent. (340,000 – 50,000)……………………………………………… 290,000

Prepaid expenses………………………………………………………….. 0

Machinery & Equipment……………………………………………….. 53,900

Goodwill………………………………………………………………………… 0

Additional assets/unrecorded assets: Patent……………….. 10,000

Total Free Assets……………………………………………….. P 717,800 (1)

Less: Unsecured Cred. With Priority

Wages Payable…………………………………………………………. P 3,400

Taxes Payable………………………………………………………….. 16,400

Administrative Expenses………………………………………… 60,000 79,800

Net Free Assets………………………………………………………………. P 638,000 (2)

Unsecured Creditors Without Priority:

Asset Pledged to Partially

Secured Creditors:

Investments……………………………………………………….. P 110,000

Less: Notes Payable……………………………………………. P 160,000

Interest Payable…………………………………………. 5,000 165,000 P 55,000

Unsecured Creditors Without Priority:

Accounts Payable………………………………………………... 670,000

Total Unsecured creditor Without Priority………………….. P 725,000

Estimated Deficiency to Unsecured Creditors……………… P 87,000 (3)

Alternative Approach to determine Estimated Deficiency to Unsecured Creditors:

Estimated (gain) loss on realization:

Accounts Receivable (230,000 – 212,500)………………………………………………… P 17,500

Inventory (290,000 – 420,000)…………………………………………………………………. 130,000

Prepaid expenses (0 – 40,000)…………………………………………………………………. 40,000

Investments (110,000 – 180,000)…………………………………………………………….. 70,000

Land and Buildings (500,000 – 470,000)………………………………………………….. (30,000)

Machinery and equipment (53,900 – 220,000)……………………………………….. 166,100

Goodwill (0 – 200,000)…………………………………………………………………………….. 200,200

Additional/unrecorded assets: Patent (10,000 – 0)…………………………………. (10,000)

Estimated net loss on asset realization (7)P583,600

Add: Unrecorded Expenses:

Taxes………………………………………………………………………… 16,400

Interest on Mortgage………………………………………………. 10,000

Estimated liquidating expenses (administrative exp.) 60,000 _86,400

Estimated Net Loss……………………………………………………………………….. (8) 670,000

Less: Stockholder’s Equity…………………………………………………………… 583,000

Estimated Deficiency to Unsecured Creditors…………………………….. (3) 87,000

4. (c) – 88% or P.88

Estimated Settlement per peso of Unsecured Creditors

Estimated Settlement per peso of

Unsecured Creditors / Est’d. Recovery = Net Free Assets / Total Unsecured Creditors

Percentage of Unsecured Creditors = P638,000 / P725,000 = 88% or P.88 : P1

5.

6. (d)

7. (a) – P583,600

8. (c) – P670,000

*The only way to find the limits of the possible is by going beyond them to the impossible.*

*Nothing great will ever be achieved without great mean, and men are great only if they are determined to be so.*

Page 5 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

CORPORATE LIQUIDATION AFAR-03

IV - Statement of Estate Deficit/Method 1: Statement of Realization and Liquidation

Estate deficit, beginning 173,600

Assets Realized: Sales Fair Value (Gain)

Price /Loss

Inventory 26,000 26,400 400

Accounts receivable 84,000 80,000 ( 4,000)

Merchandise inventory 152,000 160,000 __8,000 4,400

Liquidated:

PSCreditors-Bank loan………………… 26,000

Unsecured Creditors w/

Priority:

Salaries and Wages………… 40,000

Taxes……………………………… 8,000

74,000

Administrative Expenses…………… __7,440

Estate Deficit, ending………………………… 185,440

Method 2: Statement of Realization and Liquidation

Assets to be Realized: Assets to be Realized:

AR 80,000 Investment in C/S 26,000

MI 160,000 AR 84,000

Investment in C/S 26,400 MI 152,000

Land 100,000

Bldgs. 60,000 Assets Not Realized:

Machinery and Eqpt. 48,000 Land 100,000

Bldgs. 60,000

Assets Acquired -0- Machinery and Eqpt. 48,000

Liabilities Liquidated: Liabilities to be Liquidated:

Bank Loan 26,000 Notes Payable 244,000

Salaries and Wages 40,000 Accounts Payable 288,000

Taxes 8,000 Salaries and Wages 40,000

Taxes Payable 8,000

Bank Loans 180,000

Liabilities Not Liquidated Liabilities Incurred/Assumed -0-

Notes Payable 244,000

Accounts Payable 288,000

Bank Loans (180 – 26) 154,000

Supplementary Debit(s): Supplementary Credit(s):

Administrative Expense (excluding gains on Asset

(excluding losses on Assets Realized & Liabilities

Realized/write-offs & write-off) 7,440 settlement/liquidated) -0-

Totals 1,241,840 Totals 1,230,000

Net Loss 11,840

Method 3: Statement of Realization and Liquidation

Assets to be Realized: Assets to be Realized:

AR 80,000 Investment in C/S 26,000

MI 160,000 AR 84,000

Investment in C/S 26,400 MI 152,000

Land 100,000

Bldgs. 60,000 Assets Not Realized:

Machinery and Eqpt. 48,000 Land 100,000

Bldgs. 60,000

Assets Acquired -0- Machinery and Eqpt. 48,000

Liabilities Liquidated: Liabilities to be Liquidated:

Bank Loan 26,000 Notes Payable 244,000

Salaries and Wages 40,000 Accounts Payable 288,000

Taxes 8,000 Salaries and Wages 40,000

Administrative exp. – accrued 7,440 Taxes Payable 8,000

Bank Loans 180,000

Liabilities Not Liquidated Liabilities Incurred/Assumed

(accrual)

Notes Payable 244,000 Administrative expenses 7,440

Accounts Payable 288,000

Bank Loans (180 – 26) 154,000

Gain on realization: Losses on realization

AR (84,000 – 80,000) 4,000 Investment 400

MI 8,000

Totals 1,245,840 Totals 1,245,840

GOD BLESS AS ALWAYS!!!

Page 6 of 6 0915-2303213 www.resacpareview.com

You might also like

- DCF ModelDocument7 pagesDCF ModelSai Dinesh BilleNo ratings yet

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Document31 pagesQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNo ratings yet

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- JANBI Model Questions - Principles & Practices of Banking - 0Document8 pagesJANBI Model Questions - Principles & Practices of Banking - 0Biswajit Das0% (1)

- Summer Internship Project Prashant 1Document54 pagesSummer Internship Project Prashant 1prashant ganesh patil100% (3)

- AFAR 02 Corporate LiquidationDocument3 pagesAFAR 02 Corporate LiquidationPym-Kaytitinga St. Joseph ParishNo ratings yet

- D14Document12 pagesD14YaniNo ratings yet

- Aud2 CashDocument6 pagesAud2 CashMaryJoyBernalesNo ratings yet

- TTTDocument6 pagesTTTAngelika BalmeoNo ratings yet

- Chapter 1: Partnership: Part 1: Theory of AccountsDocument10 pagesChapter 1: Partnership: Part 1: Theory of AccountsKeay Parado0% (1)

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- ReportsDocument5 pagesReportsLeanne FaustinoNo ratings yet

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- Applied Auditing: With Comprehensive Review of Philippine Financial Reporting Standards (PFRSS)Document231 pagesApplied Auditing: With Comprehensive Review of Philippine Financial Reporting Standards (PFRSS)Irish Barcelon100% (1)

- Chapter 12Document10 pagesChapter 12GloowwjNo ratings yet

- Practice Set - Cost BehaviorDocument2 pagesPractice Set - Cost BehaviorPotie RhymeszNo ratings yet

- Problem 1: The Statement of Affairs: Straight ProblemsDocument5 pagesProblem 1: The Statement of Affairs: Straight ProblemsJemNo ratings yet

- AFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Document24 pagesAFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Prances ObiasNo ratings yet

- 05 Relevant Costing With Linear ProgrammingDocument9 pages05 Relevant Costing With Linear Programmingrandomlungs121223No ratings yet

- G.M4 HW GWDocument3 pagesG.M4 HW GWClint Agustin M. RoblesNo ratings yet

- Activity 1 Audit of Shareholders EquityDocument4 pagesActivity 1 Audit of Shareholders EquityAnna Carlaine PosadasNo ratings yet

- DrillDocument4 pagesDrillJEP WalwalNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- AP Preweek (B44)Document62 pagesAP Preweek (B44)LeiNo ratings yet

- Accounting For Special TransactionsDocument3 pagesAccounting For Special TransactionsnovyNo ratings yet

- Act 122 Final Exam 2021 NoneDocument13 pagesAct 122 Final Exam 2021 Nonemax pNo ratings yet

- 2402 Corporate LiquidationDocument7 pages2402 Corporate LiquidationFernando III PerezNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- Cases (Cabrera)Document5 pagesCases (Cabrera)Queenie100% (1)

- PDF Afar Week1 Compiled Questions CompressDocument78 pagesPDF Afar Week1 Compiled Questions CompressIo AyaNo ratings yet

- True/False: Variable Costing: A Tool For ManagementDocument174 pagesTrue/False: Variable Costing: A Tool For ManagementKianneNo ratings yet

- 03 Gross Profit AnalysisDocument5 pages03 Gross Profit AnalysisJunZon VelascoNo ratings yet

- Afar 2701 PartnershipDocument57 pagesAfar 2701 PartnershipJoshmyrrh Richwel GammadNo ratings yet

- CERTS - Revenue CycleDocument8 pagesCERTS - Revenue CycleralphalonzoNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- Partnership OperationDocument10 pagesPartnership OperationchristineNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Finals Part 1 Answers May 2019Document5 pagesFinals Part 1 Answers May 2019edwin_dauzNo ratings yet

- c2 2Document3 pagesc2 2Kath LeynesNo ratings yet

- Audit of Cash Consolidated Valix ProblemsDocument7 pagesAudit of Cash Consolidated Valix ProblemsJulie Mae Caling MalitNo ratings yet

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- Far 102 - Cash - Bank Reconciliation PDFDocument3 pagesFar 102 - Cash - Bank Reconciliation PDFPatty LapuzNo ratings yet

- Cash, Cash Equivalent and Bank ReconDocument7 pagesCash, Cash Equivalent and Bank ReconPrincess ReyesNo ratings yet

- Multiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)Document4 pagesMultiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)april bentadanNo ratings yet

- FINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToDocument2 pagesFINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToAlfred Valenzuela100% (1)

- RFBT Final Preboard QuestionsDocument15 pagesRFBT Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Blessed Me LordDocument168 pagesBlessed Me LordBoa HancockNo ratings yet

- Receipt and Disposition of InventoriesDocument5 pagesReceipt and Disposition of InventoriesWawex DavisNo ratings yet

- LTCCDocument2 pagesLTCCN JoNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Maricris Alilin100% (1)

- You Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123Document3 pagesYou Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123chiji chzzzmeowNo ratings yet

- Fundamentals of Assurance Services - Docx'Document8 pagesFundamentals of Assurance Services - Docx'jhell dela cruzNo ratings yet

- Special Transaction AssignmentDocument2 pagesSpecial Transaction Assignment수지No ratings yet

- AP.0101 Inventories CPART PDFDocument20 pagesAP.0101 Inventories CPART PDFMaeNo ratings yet

- FARAP 4702 ReceivablesDocument8 pagesFARAP 4702 Receivablesliberace cabreraNo ratings yet

- Resa Afar 1Document26 pagesResa Afar 1Princess JoannaNo ratings yet

- AFAR-03 (Corporate Liquidation)Document6 pagesAFAR-03 (Corporate Liquidation)Rayjhon CorpuzNo ratings yet

- AFAR 03 Corporate LiquidationDocument6 pagesAFAR 03 Corporate Liquidationmysweet surrenderNo ratings yet

- AFAR-04 (Construction Accounting)Document13 pagesAFAR-04 (Construction Accounting)Maricris Alilin100% (1)

- AFAR-01A (Supplemental Material To Partnership Accounting)Document2 pagesAFAR-01A (Supplemental Material To Partnership Accounting)Maricris AlilinNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Maricris Alilin100% (1)

- AFAR-02 (Partnership Dissolution & Liquidation)Document13 pagesAFAR-02 (Partnership Dissolution & Liquidation)Maricris AlilinNo ratings yet

- Snapshot of Franklin Templeton Mutual FundDocument11 pagesSnapshot of Franklin Templeton Mutual FundSaloni MalhotraNo ratings yet

- Devyani Employee FormDocument12 pagesDevyani Employee FormAbisekNo ratings yet

- The Medication Industry Has at Least Two Types of FirmsDocument1 pageThe Medication Industry Has at Least Two Types of FirmsTaimur TechnologistNo ratings yet

- The State of Bitcoin As CollateralDocument71 pagesThe State of Bitcoin As CollateralNikos IoannidisNo ratings yet

- Capital Investment DecisionsDocument23 pagesCapital Investment DecisionsLindinkosi MdluliNo ratings yet

- Chapter 5. INTRODUCTION TO VALUATION THE TIME VALUE OF MONEYDocument33 pagesChapter 5. INTRODUCTION TO VALUATION THE TIME VALUE OF MONEYChloe JtrNo ratings yet

- ReSA B43 AUD First PB Exam Questions Answers SolutionsDocument20 pagesReSA B43 AUD First PB Exam Questions Answers SolutionsLuna V100% (1)

- Session 2: Capital Investment Appraisal (An Introduction)Document41 pagesSession 2: Capital Investment Appraisal (An Introduction)ttzaxsanNo ratings yet

- 10 PpeDocument53 pages10 PpeSalsa Byla100% (1)

- Top 25 Valuation Interview Questions With Answers (Must Know!)Document19 pagesTop 25 Valuation Interview Questions With Answers (Must Know!)Łukasz MielcarekNo ratings yet

- Chapter 10Document32 pagesChapter 10REEMA BNo ratings yet

- Collapse of The LTCMDocument42 pagesCollapse of The LTCMPriya UpadhyayNo ratings yet

- Chapter 2 Problem 9 in Win Ballada ParcorDocument4 pagesChapter 2 Problem 9 in Win Ballada ParcorKatrina PetracheNo ratings yet

- Agora Swipe File 4Document12 pagesAgora Swipe File 4Justien BautistaNo ratings yet

- REIT NAV Model ExamplesDocument5 pagesREIT NAV Model Examplesmerag76668No ratings yet

- Brochure Internacional Ene2018 (v.2)Document27 pagesBrochure Internacional Ene2018 (v.2)Darío Guiñez ArenasNo ratings yet

- Rida Prihatni & Diena Noviarini: State University of Jakarta, Accounting Major, Faculty of Economics, IndonesiaDocument8 pagesRida Prihatni & Diena Noviarini: State University of Jakarta, Accounting Major, Faculty of Economics, IndonesiaTJPRC PublicationsNo ratings yet

- Project Report On DepositoryDocument1 pageProject Report On DepositorynehaugyalNo ratings yet

- Afar 2 Quizzes AcgsbdjxjcudhdhDocument27 pagesAfar 2 Quizzes Acgsbdjxjcudhdhrandomlungs121223No ratings yet

- Kohinoor Chemical Assumptions, ConstrainsDocument6 pagesKohinoor Chemical Assumptions, ConstrainsFYAJ ROHANNo ratings yet

- FM Ch7 Corporate FinancingDocument60 pagesFM Ch7 Corporate Financingtemesgen yohannesNo ratings yet

- Asignación 4 LSFPDocument6 pagesAsignación 4 LSFPElia SantanaNo ratings yet

- Mount Carmel School of Maria Aurora, Inc. Maria Aurora, 3202 AuroraDocument5 pagesMount Carmel School of Maria Aurora, Inc. Maria Aurora, 3202 AuroraZoe Vera S. AcainNo ratings yet

- Reaction Paper: Explained - The Stock Market - NetflixDocument2 pagesReaction Paper: Explained - The Stock Market - Netflixmary grace cornelioNo ratings yet

- VIAC Global 60 ENDocument2 pagesVIAC Global 60 ENJozef CulenNo ratings yet

- ar40771-LingBaoGold 2008Document137 pagesar40771-LingBaoGold 2008nikkei225traderNo ratings yet

- Soal Uts Lab Ak. KeuanganDocument3 pagesSoal Uts Lab Ak. KeuanganAltaf HauzanNo ratings yet