Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsReading in Philippine History 3

Reading in Philippine History 3

Uploaded by

lamiaamica.phThe document discusses the history of taxation in the Philippines from the Spanish period to present. It notes that under Spanish rule, taxes like tributes and cedulas personal were imposed and collected, often corruptly by local elites. Under American rule, the Internal Revenue Law of 1904 established various taxes including on alcohol, tobacco, and businesses. Post-war, tax collection remained poor due to issues like corruption. Recent reforms like the Expanded VAT Law of 2005 and Sin Tax Reform of 2012 have aimed to broaden the tax base and increase revenues to fund government services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Crisis Assessment Intervention and Prevention 2nd Edition Cherry Test BankDocument22 pagesCrisis Assessment Intervention and Prevention 2nd Edition Cherry Test Bankdolium.technic.1i5d67100% (36)

- Evolution of Philippine TaxationDocument27 pagesEvolution of Philippine TaxationShaina Guillermo Dulay91% (35)

- Philippine Taxation Under American PeriodDocument4 pagesPhilippine Taxation Under American PeriodRalph Jayson82% (28)

- Principles and Practice of Taxation Lecture NotesDocument20 pagesPrinciples and Practice of Taxation Lecture NotesSony Axle100% (11)

- Income TaxationDocument211 pagesIncome Taxationfritz100% (2)

- IBISWorld Executive Summary Landscaping Services in The USDocument6 pagesIBISWorld Executive Summary Landscaping Services in The USScott LeeNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- Fundamentals of TaxationDocument36 pagesFundamentals of TaxationAyesha Pahm100% (1)

- Module 14 RPHDocument9 pagesModule 14 RPHDavid Baquiran Opiña Jr.No ratings yet

- Philippine TaxationDocument24 pagesPhilippine TaxationJoshua DirectoNo ratings yet

- Taxation Is The Practice of Collecting TaxesDocument4 pagesTaxation Is The Practice of Collecting TaxesRai GauenNo ratings yet

- Taxation in The PhilippineDocument6 pagesTaxation in The PhilippineKrizialyn Jane OresteNo ratings yet

- Americans: The Nine Major Sources of RevenueDocument6 pagesAmericans: The Nine Major Sources of RevenueGonzales, Alethea I.No ratings yet

- Evolution of Philippine TaxationDocument20 pagesEvolution of Philippine TaxationJohara Bayabao100% (2)

- Evolution of Philippine TaxationDocument22 pagesEvolution of Philippine TaxationRaymart OsiaNo ratings yet

- Taxation 2Document40 pagesTaxation 2Ida Marie Lopena SajulanNo ratings yet

- TaxationDocument5 pagesTaxationChristian Kyle AlejandroNo ratings yet

- Taxation (20240601234025)Document36 pagesTaxation (20240601234025)Allen joshua MagallanesNo ratings yet

- Taxation PPT2Document28 pagesTaxation PPT2tesicojayson13No ratings yet

- Double TaxationDocument6 pagesDouble TaxationrobertNo ratings yet

- Taxation Under The AmericansDocument11 pagesTaxation Under The AmericansLilYanNo ratings yet

- What Are Taxes and Why Do We Pay ThemDocument8 pagesWhat Are Taxes and Why Do We Pay Themangelu abionNo ratings yet

- TAXATIONDocument17 pagesTAXATIONLamaire Abalos BatoyogNo ratings yet

- A, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of TraditionalDocument7 pagesA, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of Traditionalliya100% (1)

- GEC 2 Lesson 16Document3 pagesGEC 2 Lesson 16Lance Luis PredicalaNo ratings yet

- Taxation in PhilippineDocument11 pagesTaxation in PhilippineStephanie ManalastasNo ratings yet

- Chap3 of PFDocument4 pagesChap3 of PFNathNo ratings yet

- Local TaxationDocument29 pagesLocal Taxationdlo dphroNo ratings yet

- Principles of TaxationDocument12 pagesPrinciples of TaxationJan MarcNo ratings yet

- Evolution of Philippine TaxationDocument4 pagesEvolution of Philippine TaxationMay MayNo ratings yet

- Tax System of The Philippines - An AssessmentDocument13 pagesTax System of The Philippines - An Assessmentgblue12100% (1)

- Evolution of Philippine: AtionDocument15 pagesEvolution of Philippine: AtionRosabel Yanong TiguianNo ratings yet

- Riph Quiz ReviewerDocument13 pagesRiph Quiz Reviewer202320121No ratings yet

- Weeek 13Document26 pagesWeeek 13Jed Andrei MatadosNo ratings yet

- 05 Circuit Theorems & Equivalents (Midterm)Document5 pages05 Circuit Theorems & Equivalents (Midterm)TARA KAPENo ratings yet

- TaxationDocument9 pagesTaxationTeodulo VillasenorNo ratings yet

- Accounting Neri & LoiDocument120 pagesAccounting Neri & Loinerissa lopeNo ratings yet

- Taxation ModuleDocument4 pagesTaxation ModuleJefferson Ayubo BroncanoNo ratings yet

- What Is Taxation AutosavedDocument7 pagesWhat Is Taxation AutosavedMila Casandra CastañedaNo ratings yet

- Pre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraDocument4 pagesPre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraAbegael Joyce RiveraNo ratings yet

- Evolution of Philippine TaxationDocument26 pagesEvolution of Philippine TaxationAliza MorallosNo ratings yet

- Taxation 2nd PartDocument25 pagesTaxation 2nd Partairajoyminiano16No ratings yet

- Group 13Document21 pagesGroup 13itsmatet16No ratings yet

- Chapter 9 - Evolution of Taxation in The PhilippinesDocument4 pagesChapter 9 - Evolution of Taxation in The PhilippinestobiasninaarzelleNo ratings yet

- Word Eric It AssignDocument11 pagesWord Eric It Assigngatete samNo ratings yet

- Chapter 7 TaxationDocument5 pagesChapter 7 TaxationAljun MorilloNo ratings yet

- 21st Century Philippines 1Document11 pages21st Century Philippines 1Sheika Briones GalletaNo ratings yet

- TAXATIONDocument24 pagesTAXATIONGuo YageNo ratings yet

- The Philippine Tax System and Double TaxationDocument2 pagesThe Philippine Tax System and Double TaxationArnee Pantajo100% (3)

- Scribd File 1Document2 pagesScribd File 1John Russell GasangNo ratings yet

- Income and Business TaxationDocument138 pagesIncome and Business Taxationjustine reine cornico100% (1)

- System of Taxation in The PhilippinesDocument7 pagesSystem of Taxation in The PhilippinesdendenliberoNo ratings yet

- Evolution OF Philippine Taxation Evolution OF Philippine TaxationDocument6 pagesEvolution OF Philippine Taxation Evolution OF Philippine TaxationEunji eunNo ratings yet

- RPH Group 6Document39 pagesRPH Group 6Liza MaryNo ratings yet

- Income and Business TaxationDocument69 pagesIncome and Business TaxationRhealyn MarananNo ratings yet

- Module 7 LectureDocument8 pagesModule 7 LectureClarence AblazaNo ratings yet

- Business Taxation Notes Income Tax NotesDocument39 pagesBusiness Taxation Notes Income Tax NotesvidhyaaravinthanNo ratings yet

- Income TaxationDocument220 pagesIncome TaxationJoanna RojoNo ratings yet

- Readings in Philipinne HistorySemi Final OnlineDocument3 pagesReadings in Philipinne HistorySemi Final OnlineJaymee Andomang Os-agNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- Summary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookFrom EverandSummary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookNo ratings yet

- Cost Accounting by de Leon 2019 pt1Document6 pagesCost Accounting by de Leon 2019 pt1lamiaamica.phNo ratings yet

- Cost Accounting by de Leon 2019 pt2Document6 pagesCost Accounting by de Leon 2019 pt2lamiaamica.phNo ratings yet

- CONCEPTUAL FRAMEWORK-VALIX-2018pt3Document7 pagesCONCEPTUAL FRAMEWORK-VALIX-2018pt3lamiaamica.phNo ratings yet

- Uts 4Document4 pagesUts 4lamiaamica.phNo ratings yet

- Uts 5Document5 pagesUts 5lamiaamica.phNo ratings yet

- Uts 4Document2 pagesUts 4lamiaamica.phNo ratings yet

- Uts 2Document3 pagesUts 2lamiaamica.phNo ratings yet

- Reading in Philippine History 4Document2 pagesReading in Philippine History 4lamiaamica.phNo ratings yet

- Reading in Philippine History 2Document2 pagesReading in Philippine History 2lamiaamica.phNo ratings yet

- Reading in Philippine History 1Document2 pagesReading in Philippine History 1lamiaamica.phNo ratings yet

- CH47Document26 pagesCH47Hanna HellerNo ratings yet

- 2005 02 25 - DR1Document1 page2005 02 25 - DR1Zach EdwardsNo ratings yet

- Automatic Creation of PO in SAPDocument10 pagesAutomatic Creation of PO in SAPVishnu Kumar SNo ratings yet

- AA Soal Bedah SKL 2019 Ke 2Document4 pagesAA Soal Bedah SKL 2019 Ke 2fitrihidayatiNo ratings yet

- Code of Ethics and Professional ResponsibilityDocument6 pagesCode of Ethics and Professional ResponsibilityEunice Panopio LopezNo ratings yet

- Kaal ChakraDocument99 pagesKaal ChakraLordgrg GhotaneNo ratings yet

- ACTAEONDocument1 pageACTAEONLouphChristopherNo ratings yet

- The Silk Road: ¿What Is It?Document2 pagesThe Silk Road: ¿What Is It?Harold Stiven HERNANDEZ RAYONo ratings yet

- Trust Deed FormatDocument17 pagesTrust Deed Formatcpjamalu0% (1)

- Ratio and Proportion: Practice Batch SheetsDocument23 pagesRatio and Proportion: Practice Batch SheetsSahil SharmaNo ratings yet

- Evaluation Sheets For ResearchDocument6 pagesEvaluation Sheets For ResearchMa Maudie Arah O GarciaNo ratings yet

- Amit Varma NoticeDocument3 pagesAmit Varma NoticeparbatarvindNo ratings yet

- IBM Public Cloud Platform - Amigo2021Document24 pagesIBM Public Cloud Platform - Amigo2021Thai PhamNo ratings yet

- Bhim Yadav - Latest With Changes IncorporatedDocument38 pagesBhim Yadav - Latest With Changes IncorporatedvimalNo ratings yet

- Deirdre J. Wright, LICSW, ACSW P.O. Box 11302 Washington, DCDocument4 pagesDeirdre J. Wright, LICSW, ACSW P.O. Box 11302 Washington, DCdedeej100% (1)

- Triple Bottomline - ClassDocument11 pagesTriple Bottomline - ClassM ManjunathNo ratings yet

- Syllabus: SPED 120 Introduction To Special EducationDocument15 pagesSyllabus: SPED 120 Introduction To Special EducationMaridel Mugot-DuranNo ratings yet

- Hayakawa CO.,LTD.: TO: Dated: 08/01/19 Invoice No.: 190801421 1 / 1Document1 pageHayakawa CO.,LTD.: TO: Dated: 08/01/19 Invoice No.: 190801421 1 / 1Earl CharlesNo ratings yet

- 01-EIA Revised Procedural Manual Main Document - NewDocument57 pages01-EIA Revised Procedural Manual Main Document - NewJo Yabot100% (1)

- Adani Under Attack: Q&A With Finance Minister ON BUDGET 2023-24Document104 pagesAdani Under Attack: Q&A With Finance Minister ON BUDGET 2023-24Jorge Antonio PichardoNo ratings yet

- EAPP M3 QuizDocument2 pagesEAPP M3 QuizWinshel Peñas AñonuevoNo ratings yet

- Homework PET RP1EXBO (26:2)Document3 pagesHomework PET RP1EXBO (26:2)Vy ĐinhNo ratings yet

- BG Construction POW.R1V6Document13 pagesBG Construction POW.R1V6Deepum HalloomanNo ratings yet

- Integration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsDocument1 pageIntegration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsVladan KuzmanovicNo ratings yet

- G.R. No. 223844Document7 pagesG.R. No. 223844Faux LexieNo ratings yet

- Lataif Shah WallahDocument26 pagesLataif Shah WallahJohn MorrisNo ratings yet

- International Ticket SEAYLP 2017Document3 pagesInternational Ticket SEAYLP 2017AngelNo ratings yet

- Vietnam War AssignmentDocument4 pagesVietnam War Assignmentqaz333No ratings yet

Reading in Philippine History 3

Reading in Philippine History 3

Uploaded by

lamiaamica.ph0 ratings0% found this document useful (0 votes)

3 views2 pagesThe document discusses the history of taxation in the Philippines from the Spanish period to present. It notes that under Spanish rule, taxes like tributes and cedulas personal were imposed and collected, often corruptly by local elites. Under American rule, the Internal Revenue Law of 1904 established various taxes including on alcohol, tobacco, and businesses. Post-war, tax collection remained poor due to issues like corruption. Recent reforms like the Expanded VAT Law of 2005 and Sin Tax Reform of 2012 have aimed to broaden the tax base and increase revenues to fund government services.

Original Description:

READINGS IN PHILIPPINE HISTORY

Original Title

READING IN PHILIPPINE HISTORY 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the history of taxation in the Philippines from the Spanish period to present. It notes that under Spanish rule, taxes like tributes and cedulas personal were imposed and collected, often corruptly by local elites. Under American rule, the Internal Revenue Law of 1904 established various taxes including on alcohol, tobacco, and businesses. Post-war, tax collection remained poor due to issues like corruption. Recent reforms like the Expanded VAT Law of 2005 and Sin Tax Reform of 2012 have aimed to broaden the tax base and increase revenues to fund government services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesReading in Philippine History 3

Reading in Philippine History 3

Uploaded by

lamiaamica.phThe document discusses the history of taxation in the Philippines from the Spanish period to present. It notes that under Spanish rule, taxes like tributes and cedulas personal were imposed and collected, often corruptly by local elites. Under American rule, the Internal Revenue Law of 1904 established various taxes including on alcohol, tobacco, and businesses. Post-war, tax collection remained poor due to issues like corruption. Recent reforms like the Expanded VAT Law of 2005 and Sin Tax Reform of 2012 have aimed to broaden the tax base and increase revenues to fund government services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

It does not represent the will of the people because it was written by During President Elpidio Quirino’s term,

’s term, new tax measures were also passed, which

framers appointed by President Corazon Aquino and not elected by included higher corporate tax rates that increased government revenues- tax

the people. revenue in 1953 increased twofold compared to 1948, the year when Quirino first

assumed Presidency. The period of the post-war republic also saw a rise in

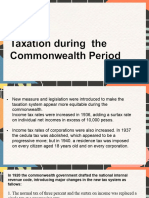

TOPIC 10: PHILIPPINE TAXATION corruption. From 1959 to 1968, Congress did not pass any tax legislation despite

History of Philippine Taxation important changes in the economy and the vested interests of Filipino businessmen

in Congress would manifest in many instances such as the rejection of taxes on

Taxation under the Spanish Period imports. Collection of taxes remained poor; tax structure was still problematic; and

much of public funds were lost to corruption, which left the government incapable

The Spaniards imposed the payment of tributos from the Filipinos. The purpose is

of funding projects geared toward development.

to generate resources to finance the maintenance of the islands, such as salaries of

government officials and expenses of the clergy. Exempted from payment of During the latter part of the Marcos’ years (1981-1985), the tax system was still

tributos were the principales: alcaldes, gobernadores, cabezas de barangay, heavily dependent on indirect taxes, which made up 70% of total tax collection.

soldiers, members of the civil guard, government officials and vagrants. In 1884, The tax system also remained unresponsive. Taxes grew at an average annual rate of

the payment of tribute was put to a stop and was replaced by a poll tax collected 15% and generated a low tax yield. Vice President Gloria Macapagal-Arroyo was

through certificate of identification called cedula personal. This is required from swept to power through another EDSA Revolution. As president, she undertook

every resident and must be carried while traveling. Unlike the tribute, the payment increased government spending without adjusting tax collections. This resulted in

of cedulas is by person, not by family. Payment of cedula is by person, not by family. large deficits from 2002 to 2004. The government had to look for additional sources

Payment of the cedula is according to income categories. Revenue collection of revenue, and in 2005, the Expanded Value-Added Tax (E-VAT) was signed into

greatly increased and became the main source of government income. The Chinese law as Republic Act 9337. This expanded the VAT base, subjecting to VAT energy

in the Philippines were also made to pay their discriminatory cedula which was products such as coal and petroleum products and electricity generation,

bigger than what the Filipinos paid. Taxation in the Philippines during the Spanish transmission, and distribution. In February 2006, the VAT tax rate was also

colonial period was characterized by the heavy burden placed on the Filipinos, and increased from 10% to 12%. As President Benigno Aquino III succeeded President

the corruption of the principals, or the fomer datus and local elites who were co- Arroyo in 2010, he promised that no new taxes would be imposed and additional

opted by the Spaniards. The principals who were given positions such as Cabezas de revenue would have to come from adjusting existing taxes. The administration

Barangay or Alcaldes in the local government were able to enrich themselves by ventured into the adjustment of excise tax on liquor and cigarettes or the Sin Tax

pocketing tributos and/or fallas, while the peasants were left to be abused. Reform. Republic Act 10351 was passed, and government revenues from alcohol

and tobacco excise taxes increased. The Sin Tax Reform was an exemplar on how

Taxation under the American Period

tax reform could impact social services as it allowed for the increase of the

The Internal Revenue of Law of 1904 was passed as a reaction to the problems of Department of Health Budget (triple in 2015) and free health insurance premiums

collecting land tax. It prescribed ten major sources of revenue: (1) licensed taxes for the poor people enrolled in PhilHealth increased (from 55.2 million in 2012 to

on firms dealing in alcoholic beverages and tobacco (2) excise taxes on alcoholic 515,4 million in 2015).

beverages and tobacco products (3) taxes on banks and bankers (4) document

What are taxes and why do we pay them?

stamp taxes (5) the cedula (6) taxes on insurance and insurance companies (7)

taxes on forest products (8) mining concessions (9) taxes on business and Taxes are funds used by the government to finance basic social services that are

manufacturing, and (10) occupational licenses. The cedula went through changes vital to the lives of citizens and economic growth. Every year, individuals and

in the new law as the rate was fixed per adult male, which resulted in a great corporations pay government taxes, which are used to fund expenditures. When

decline in revenues. In 1907, some provinces were authorized to double the fee for government spending exceeds revenue collected, a budget deficit occurs. The

the cedula to support the construction and maintenance of roads. government borrows money to cover this gap. The loans are later on added as

additional expenses for the country. According to the National Tax Research Center,

Post-war Period

taxes collected have not been enough to cover total government expenditures since

1998. The Tax Reform Act of 1997 identifies whose duty it is to pay taxes. It also D. Estate Tax - When a loved one passes away, the rightful beneficiary or heir

states the types of taxes that individuals and corporations have to pay. of his or her estate should pay this tax before the estate is transferred to

the heir's name.

Who pays?

E. Excise Tax - This is the tax imposed on goods produced for sale, and sold, in

The Tax Reform Act of 1997 says that the following have the duty to pay taxes in the

the country. An excise is considered an indirect tax, meaning the producer

country:

or seller is expected to recover the tax by raising prices of his or her

Citizens: a citizen of the Philippines residing in the country is taxable on all product. For instance, taxes imposed on "sin" products tobacco and

income derived from sources within and outside the Philippines alcohol are called excise taxes.

Nonresident citizens: a nonresident citizen is taxed on income derived F. Income Tax - This is tax on a person's income or profit arising from

from sources within the Philippines property, practice of profession, or conduct of trade or business.

Overseas contract workers: a citizen who is working and deriving income G. Percentage Tax - This is a business tax. It is imposed on persons who sell or

from abroad as an overseas contract worker is taxed only on income lease goods, properties or services in the course of their business, are not

derived from the Philippines VAT-registered, and whose gross annual sales and/or receipts do not

Alien individuals: resident and nonresident alien individuals are taxed only exceed P750,000.

on income derived from sources in the Philippines H. Value-Added Tax or VAT - A form of consumption tax that is imposed on a

Domestic corporation: a domestic corporation is taxable on all income product whenever value is added at a stage of production and at final sale.

derived from sources within and outside the Philippines It is an indirect tax; it is passed on to consumers.

Foreign corporation: whether or not engaged in trade or business in the I. Withholding Tax - Income tax that employers withhold from employees'

Philippines, a foreign corporation is taxable only on income derived from salaries, and pay directly to government.

sources within the Philippines

Local taxes

However, the BIR exempts some individuals from filing income tax returns, such as A. Basic Real Property Tax - This is tax on real properties that covers 6 classes:

minimum wage earners and those who are subject to "substituted filing". agricultural, commercial, industrial, residential, timberland and mineral.

According to the law, there are two basic types of taxes: national and local. B. Franchise Tax - LGUs may impose tax on a business franchise at a rate not

National taxes are those we pay to the government through the Bureau of Internal exceeding 50% of 1% of the gross annual receipts for the preceding

Revenue (BIR), while local taxes are the ones levied by local government units calendar year.

(LGUs). C. Business of Printing and Publication Tax - LGUs may collect tax from

printing or publication of books, cards, posters, tarpaulins, pamphlets,

National Taxes

and other published or printed materials.

A. Capital Gains Tax - This is the tax an individual or business pays for when D. Sand, Gravel and other Quarry Resources Tax - LGUs may collect not more

they sell an asset for profit. Capital gains are usually realized from the sale than 10% of fair market value in the locality per cubic meter of ordinary

of stocks, jewelry, property and other high-value goods. stones, sand, gravel, earth, and other quarry resources extracted from

B. Documentary Stamp Tax - This refers to tax on documents, loan public lands or from the beds of seas, lakes, rivers, streams, creeks, and

agreements and papers evidencing the sale or transfer of an obligation or other public waters.

ownership of a property. E. Professional Tax - This tax is imposed on persons engaged in the exercise or

C. Donor's Tax - Yes, even gifts and donations are taxed. Relief goods sent practice of their professions requiring government examination. Doctors,

during calamities are an example. Typhoon Yolanda was a different case, lawyers, engineers, and other professionals are covered by this tax.

however. BIR scrapped taxes on goods delivered to Yolanda-ravaged areas F. Amusement Tax - All forms of entertainment such as movies, plays and

as long as they were coursed through the proper government agencies. concerts are taxed. The tax is usually included in the admission price.

You might also like

- Crisis Assessment Intervention and Prevention 2nd Edition Cherry Test BankDocument22 pagesCrisis Assessment Intervention and Prevention 2nd Edition Cherry Test Bankdolium.technic.1i5d67100% (36)

- Evolution of Philippine TaxationDocument27 pagesEvolution of Philippine TaxationShaina Guillermo Dulay91% (35)

- Philippine Taxation Under American PeriodDocument4 pagesPhilippine Taxation Under American PeriodRalph Jayson82% (28)

- Principles and Practice of Taxation Lecture NotesDocument20 pagesPrinciples and Practice of Taxation Lecture NotesSony Axle100% (11)

- Income TaxationDocument211 pagesIncome Taxationfritz100% (2)

- IBISWorld Executive Summary Landscaping Services in The USDocument6 pagesIBISWorld Executive Summary Landscaping Services in The USScott LeeNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- Fundamentals of TaxationDocument36 pagesFundamentals of TaxationAyesha Pahm100% (1)

- Module 14 RPHDocument9 pagesModule 14 RPHDavid Baquiran Opiña Jr.No ratings yet

- Philippine TaxationDocument24 pagesPhilippine TaxationJoshua DirectoNo ratings yet

- Taxation Is The Practice of Collecting TaxesDocument4 pagesTaxation Is The Practice of Collecting TaxesRai GauenNo ratings yet

- Taxation in The PhilippineDocument6 pagesTaxation in The PhilippineKrizialyn Jane OresteNo ratings yet

- Americans: The Nine Major Sources of RevenueDocument6 pagesAmericans: The Nine Major Sources of RevenueGonzales, Alethea I.No ratings yet

- Evolution of Philippine TaxationDocument20 pagesEvolution of Philippine TaxationJohara Bayabao100% (2)

- Evolution of Philippine TaxationDocument22 pagesEvolution of Philippine TaxationRaymart OsiaNo ratings yet

- Taxation 2Document40 pagesTaxation 2Ida Marie Lopena SajulanNo ratings yet

- TaxationDocument5 pagesTaxationChristian Kyle AlejandroNo ratings yet

- Taxation (20240601234025)Document36 pagesTaxation (20240601234025)Allen joshua MagallanesNo ratings yet

- Taxation PPT2Document28 pagesTaxation PPT2tesicojayson13No ratings yet

- Double TaxationDocument6 pagesDouble TaxationrobertNo ratings yet

- Taxation Under The AmericansDocument11 pagesTaxation Under The AmericansLilYanNo ratings yet

- What Are Taxes and Why Do We Pay ThemDocument8 pagesWhat Are Taxes and Why Do We Pay Themangelu abionNo ratings yet

- TAXATIONDocument17 pagesTAXATIONLamaire Abalos BatoyogNo ratings yet

- A, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of TraditionalDocument7 pagesA, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of Traditionalliya100% (1)

- GEC 2 Lesson 16Document3 pagesGEC 2 Lesson 16Lance Luis PredicalaNo ratings yet

- Taxation in PhilippineDocument11 pagesTaxation in PhilippineStephanie ManalastasNo ratings yet

- Chap3 of PFDocument4 pagesChap3 of PFNathNo ratings yet

- Local TaxationDocument29 pagesLocal Taxationdlo dphroNo ratings yet

- Principles of TaxationDocument12 pagesPrinciples of TaxationJan MarcNo ratings yet

- Evolution of Philippine TaxationDocument4 pagesEvolution of Philippine TaxationMay MayNo ratings yet

- Tax System of The Philippines - An AssessmentDocument13 pagesTax System of The Philippines - An Assessmentgblue12100% (1)

- Evolution of Philippine: AtionDocument15 pagesEvolution of Philippine: AtionRosabel Yanong TiguianNo ratings yet

- Riph Quiz ReviewerDocument13 pagesRiph Quiz Reviewer202320121No ratings yet

- Weeek 13Document26 pagesWeeek 13Jed Andrei MatadosNo ratings yet

- 05 Circuit Theorems & Equivalents (Midterm)Document5 pages05 Circuit Theorems & Equivalents (Midterm)TARA KAPENo ratings yet

- TaxationDocument9 pagesTaxationTeodulo VillasenorNo ratings yet

- Accounting Neri & LoiDocument120 pagesAccounting Neri & Loinerissa lopeNo ratings yet

- Taxation ModuleDocument4 pagesTaxation ModuleJefferson Ayubo BroncanoNo ratings yet

- What Is Taxation AutosavedDocument7 pagesWhat Is Taxation AutosavedMila Casandra CastañedaNo ratings yet

- Pre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraDocument4 pagesPre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraAbegael Joyce RiveraNo ratings yet

- Evolution of Philippine TaxationDocument26 pagesEvolution of Philippine TaxationAliza MorallosNo ratings yet

- Taxation 2nd PartDocument25 pagesTaxation 2nd Partairajoyminiano16No ratings yet

- Group 13Document21 pagesGroup 13itsmatet16No ratings yet

- Chapter 9 - Evolution of Taxation in The PhilippinesDocument4 pagesChapter 9 - Evolution of Taxation in The PhilippinestobiasninaarzelleNo ratings yet

- Word Eric It AssignDocument11 pagesWord Eric It Assigngatete samNo ratings yet

- Chapter 7 TaxationDocument5 pagesChapter 7 TaxationAljun MorilloNo ratings yet

- 21st Century Philippines 1Document11 pages21st Century Philippines 1Sheika Briones GalletaNo ratings yet

- TAXATIONDocument24 pagesTAXATIONGuo YageNo ratings yet

- The Philippine Tax System and Double TaxationDocument2 pagesThe Philippine Tax System and Double TaxationArnee Pantajo100% (3)

- Scribd File 1Document2 pagesScribd File 1John Russell GasangNo ratings yet

- Income and Business TaxationDocument138 pagesIncome and Business Taxationjustine reine cornico100% (1)

- System of Taxation in The PhilippinesDocument7 pagesSystem of Taxation in The PhilippinesdendenliberoNo ratings yet

- Evolution OF Philippine Taxation Evolution OF Philippine TaxationDocument6 pagesEvolution OF Philippine Taxation Evolution OF Philippine TaxationEunji eunNo ratings yet

- RPH Group 6Document39 pagesRPH Group 6Liza MaryNo ratings yet

- Income and Business TaxationDocument69 pagesIncome and Business TaxationRhealyn MarananNo ratings yet

- Module 7 LectureDocument8 pagesModule 7 LectureClarence AblazaNo ratings yet

- Business Taxation Notes Income Tax NotesDocument39 pagesBusiness Taxation Notes Income Tax NotesvidhyaaravinthanNo ratings yet

- Income TaxationDocument220 pagesIncome TaxationJoanna RojoNo ratings yet

- Readings in Philipinne HistorySemi Final OnlineDocument3 pagesReadings in Philipinne HistorySemi Final OnlineJaymee Andomang Os-agNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- Summary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookFrom EverandSummary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookNo ratings yet

- Cost Accounting by de Leon 2019 pt1Document6 pagesCost Accounting by de Leon 2019 pt1lamiaamica.phNo ratings yet

- Cost Accounting by de Leon 2019 pt2Document6 pagesCost Accounting by de Leon 2019 pt2lamiaamica.phNo ratings yet

- CONCEPTUAL FRAMEWORK-VALIX-2018pt3Document7 pagesCONCEPTUAL FRAMEWORK-VALIX-2018pt3lamiaamica.phNo ratings yet

- Uts 4Document4 pagesUts 4lamiaamica.phNo ratings yet

- Uts 5Document5 pagesUts 5lamiaamica.phNo ratings yet

- Uts 4Document2 pagesUts 4lamiaamica.phNo ratings yet

- Uts 2Document3 pagesUts 2lamiaamica.phNo ratings yet

- Reading in Philippine History 4Document2 pagesReading in Philippine History 4lamiaamica.phNo ratings yet

- Reading in Philippine History 2Document2 pagesReading in Philippine History 2lamiaamica.phNo ratings yet

- Reading in Philippine History 1Document2 pagesReading in Philippine History 1lamiaamica.phNo ratings yet

- CH47Document26 pagesCH47Hanna HellerNo ratings yet

- 2005 02 25 - DR1Document1 page2005 02 25 - DR1Zach EdwardsNo ratings yet

- Automatic Creation of PO in SAPDocument10 pagesAutomatic Creation of PO in SAPVishnu Kumar SNo ratings yet

- AA Soal Bedah SKL 2019 Ke 2Document4 pagesAA Soal Bedah SKL 2019 Ke 2fitrihidayatiNo ratings yet

- Code of Ethics and Professional ResponsibilityDocument6 pagesCode of Ethics and Professional ResponsibilityEunice Panopio LopezNo ratings yet

- Kaal ChakraDocument99 pagesKaal ChakraLordgrg GhotaneNo ratings yet

- ACTAEONDocument1 pageACTAEONLouphChristopherNo ratings yet

- The Silk Road: ¿What Is It?Document2 pagesThe Silk Road: ¿What Is It?Harold Stiven HERNANDEZ RAYONo ratings yet

- Trust Deed FormatDocument17 pagesTrust Deed Formatcpjamalu0% (1)

- Ratio and Proportion: Practice Batch SheetsDocument23 pagesRatio and Proportion: Practice Batch SheetsSahil SharmaNo ratings yet

- Evaluation Sheets For ResearchDocument6 pagesEvaluation Sheets For ResearchMa Maudie Arah O GarciaNo ratings yet

- Amit Varma NoticeDocument3 pagesAmit Varma NoticeparbatarvindNo ratings yet

- IBM Public Cloud Platform - Amigo2021Document24 pagesIBM Public Cloud Platform - Amigo2021Thai PhamNo ratings yet

- Bhim Yadav - Latest With Changes IncorporatedDocument38 pagesBhim Yadav - Latest With Changes IncorporatedvimalNo ratings yet

- Deirdre J. Wright, LICSW, ACSW P.O. Box 11302 Washington, DCDocument4 pagesDeirdre J. Wright, LICSW, ACSW P.O. Box 11302 Washington, DCdedeej100% (1)

- Triple Bottomline - ClassDocument11 pagesTriple Bottomline - ClassM ManjunathNo ratings yet

- Syllabus: SPED 120 Introduction To Special EducationDocument15 pagesSyllabus: SPED 120 Introduction To Special EducationMaridel Mugot-DuranNo ratings yet

- Hayakawa CO.,LTD.: TO: Dated: 08/01/19 Invoice No.: 190801421 1 / 1Document1 pageHayakawa CO.,LTD.: TO: Dated: 08/01/19 Invoice No.: 190801421 1 / 1Earl CharlesNo ratings yet

- 01-EIA Revised Procedural Manual Main Document - NewDocument57 pages01-EIA Revised Procedural Manual Main Document - NewJo Yabot100% (1)

- Adani Under Attack: Q&A With Finance Minister ON BUDGET 2023-24Document104 pagesAdani Under Attack: Q&A With Finance Minister ON BUDGET 2023-24Jorge Antonio PichardoNo ratings yet

- EAPP M3 QuizDocument2 pagesEAPP M3 QuizWinshel Peñas AñonuevoNo ratings yet

- Homework PET RP1EXBO (26:2)Document3 pagesHomework PET RP1EXBO (26:2)Vy ĐinhNo ratings yet

- BG Construction POW.R1V6Document13 pagesBG Construction POW.R1V6Deepum HalloomanNo ratings yet

- Integration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsDocument1 pageIntegration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsVladan KuzmanovicNo ratings yet

- G.R. No. 223844Document7 pagesG.R. No. 223844Faux LexieNo ratings yet

- Lataif Shah WallahDocument26 pagesLataif Shah WallahJohn MorrisNo ratings yet

- International Ticket SEAYLP 2017Document3 pagesInternational Ticket SEAYLP 2017AngelNo ratings yet

- Vietnam War AssignmentDocument4 pagesVietnam War Assignmentqaz333No ratings yet