Professional Documents

Culture Documents

SaaS Friend or Foe

SaaS Friend or Foe

Uploaded by

filipesferrCopyright:

Available Formats

You might also like

- Packetstorm Google Dorks ListDocument476 pagesPacketstorm Google Dorks ListSteven Mason80% (5)

- Cloudstrat Case StudyDocument10 pagesCloudstrat Case StudyAbhirami PromodNo ratings yet

- Saasify - Software As A Service and The EnterpriseDocument9 pagesSaasify - Software As A Service and The EnterpriseCATechnologiesNo ratings yet

- Everything You Need To Know About SaaSDocument4 pagesEverything You Need To Know About SaaSSuntec SNo ratings yet

- S4 Hana Cloud ComputingDocument60 pagesS4 Hana Cloud Computingsatsap2000No ratings yet

- SaasDocument6 pagesSaasrameshkoutarapuNo ratings yet

- Saas NewDocument4 pagesSaas NewDmitry BolgarinNo ratings yet

- Dvdvsaas Opportunity For Indian ChannelsDocument10 pagesDvdvsaas Opportunity For Indian Channelsgraphicman1060No ratings yet

- Successfactors HCM: Mindlinks Training MaterialDocument38 pagesSuccessfactors HCM: Mindlinks Training MaterialTanmoy KonarNo ratings yet

- Unit 2 ... Cloud ComputingDocument11 pagesUnit 2 ... Cloud Computingali shanNo ratings yet

- What Is SaaS (Software As A Service) - JavatpointDocument5 pagesWhat Is SaaS (Software As A Service) - Javatpointmalikmalaika031No ratings yet

- Software Design On A SaaS PlatformDocument4 pagesSoftware Design On A SaaS Platformeyetea68No ratings yet

- How To Invest in Software As A Service (SaaS)Document16 pagesHow To Invest in Software As A Service (SaaS)Ferdous Quawser PathanNo ratings yet

- Saas Business Model For Software Enterprise: Hancheng LiaoDocument4 pagesSaas Business Model For Software Enterprise: Hancheng LiaodivNo ratings yet

- Saa SDocument4 pagesSaa SBhumika MhatreNo ratings yet

- SaaS Deepdive PDFDocument11 pagesSaaS Deepdive PDFHugo Francisco Leal ArandaNo ratings yet

- Week 1 Assignment Cloud ComputingDocument8 pagesWeek 1 Assignment Cloud ComputingperminusuhuruNo ratings yet

- Think Strategies SaaS PrimerDocument7 pagesThink Strategies SaaS PrimerJeff Kaplan100% (2)

- Boomi Whitepaper The Quest For Cloud Integration Strategy FinalDocument4 pagesBoomi Whitepaper The Quest For Cloud Integration Strategy Finalvikas tyagiNo ratings yet

- Understanding The Cloud Computing Stack SaaS, PaaS, IaaSDocument6 pagesUnderstanding The Cloud Computing Stack SaaS, PaaS, IaaSAlbertho StatesmanNo ratings yet

- Integration Appliances For SaaSDocument6 pagesIntegration Appliances For SaaSWaleed Qawasmi0% (1)

- Open Architecture For Developing Multitenant Software-as-a-Service ApplicationsDocument6 pagesOpen Architecture For Developing Multitenant Software-as-a-Service ApplicationsmemopenaNo ratings yet

- BAIN BRIEF The Cloud Reshapes The Business of Software PDFDocument8 pagesBAIN BRIEF The Cloud Reshapes The Business of Software PDFkumar_007111No ratings yet

- Best Practices For Adopting Saas: A Holistic Evaluation ApproachDocument8 pagesBest Practices For Adopting Saas: A Holistic Evaluation ApproachJohanne RuelNo ratings yet

- Week 1 Assignment CCDocument4 pagesWeek 1 Assignment CCperminusuhuruNo ratings yet

- SAAS.pptDocument32 pagesSAAS.pptTee ZeeNo ratings yet

- BCG Profiting From The Cloud Jun 2013 Tcm9-94926Document6 pagesBCG Profiting From The Cloud Jun 2013 Tcm9-94926Vinay KumarNo ratings yet

- Ebook ISV Five Steps To Modernizing Your DataDocument38 pagesEbook ISV Five Steps To Modernizing Your DatactheodoropoulosNo ratings yet

- Module 3 - Saas and PaasDocument27 pagesModule 3 - Saas and PaasnikhilNo ratings yet

- Cloud ComputingDocument8 pagesCloud ComputingArani NavaratnarajahNo ratings yet

- Accenture SaaS PoV March 2010Document4 pagesAccenture SaaS PoV March 2010Rob SwinkelsNo ratings yet

- Software As A Service (SaaS) - Definition and ExamplesDocument5 pagesSoftware As A Service (SaaS) - Definition and Examplesmalikmalaika031No ratings yet

- Документ Microsoft WordDocument11 pagesДокумент Microsoft Worddsns kdskdNo ratings yet

- Understanding SaaSDocument7 pagesUnderstanding SaaSJewels ShoppingNo ratings yet

- Saas 101 PDFDocument46 pagesSaas 101 PDFSankhadeep DebdasNo ratings yet

- Adopting Software-As-A-service vs. Traditional Erp SystemsDocument3 pagesAdopting Software-As-A-service vs. Traditional Erp SystemsrudiansenNo ratings yet

- Ecommerce Business: 24% of All Enterprise WorkloadsDocument9 pagesEcommerce Business: 24% of All Enterprise WorkloadsAkshay AnandNo ratings yet

- A New Approach To Software As Service CloudDocument4 pagesA New Approach To Software As Service CloudGurudatt KulkarniNo ratings yet

- Cloud-Saas LectureDocument17 pagesCloud-Saas LectureEbenezer Komla GavuaNo ratings yet

- Five Steps To Modernizing Your DataDocument38 pagesFive Steps To Modernizing Your Datahim2000himNo ratings yet

- DELA ROSA Advanced Database SystemDocument1 pageDELA ROSA Advanced Database SystemRostel dela RosaNo ratings yet

- Software As A Service and Database As A Service: ObjectivesDocument10 pagesSoftware As A Service and Database As A Service: Objectiveschirag patelNo ratings yet

- Cloud Computing - Threat or Opportunity For Vars & MSPS?: White PaperDocument20 pagesCloud Computing - Threat or Opportunity For Vars & MSPS?: White Papervgupta86No ratings yet

- Software As A ServiceDocument2 pagesSoftware As A Servicerapismart240No ratings yet

- Success FactorsDocument38 pagesSuccess FactorsDhanunjaya Naidu86% (7)

- Design and FabricationDocument8 pagesDesign and FabricationSuresh IndiaNo ratings yet

- Revionics - White.paper. (Software As A Service A Retailers)Document7 pagesRevionics - White.paper. (Software As A Service A Retailers)Souvik_DasNo ratings yet

- Egdor Transitioning Your Software Business To SaaSDocument6 pagesEgdor Transitioning Your Software Business To SaaSEgdor AccountingNo ratings yet

- Unit 2 Cloud Architecture Not of UseDocument51 pagesUnit 2 Cloud Architecture Not of UseAnonymous FKWVgNnSjo100% (1)

- Saas:: Describe The Difference Between Saas, Paas, and IaasDocument6 pagesSaas:: Describe The Difference Between Saas, Paas, and IaasnobiawahabNo ratings yet

- Retail Innovation at Speed & Cost: The Saas Technology TransformationDocument15 pagesRetail Innovation at Speed & Cost: The Saas Technology Transformationvpp.nitkNo ratings yet

- SaaS ArchitectureDocument20 pagesSaaS ArchitectureFirdausNo ratings yet

- WP SN Platform Technical OverviewDocument14 pagesWP SN Platform Technical Overviewapi-435424919No ratings yet

- Software As A ServiceDocument19 pagesSoftware As A ServiceSoniya VaswaniNo ratings yet

- SaaS: Everything You Need to Know About Building Successful SaaS Company in One Place.From EverandSaaS: Everything You Need to Know About Building Successful SaaS Company in One Place.No ratings yet

- SaaS Integration Build Vs BuyDocument5 pagesSaaS Integration Build Vs Buyalaric_nurmNo ratings yet

- Platform As A ServiceDocument7 pagesPlatform As A ServicechandraNo ratings yet

- Software As A Service (Saas)Document18 pagesSoftware As A Service (Saas)Aazam KhatriNo ratings yet

- Cloud Saas LectureeeDocument27 pagesCloud Saas LectureeeEbenezer Komla GavuaNo ratings yet

- HR in The CloudDocument5 pagesHR in The CloudShaun DunphyNo ratings yet

- WhitePaper SaaSHub Final 5Document7 pagesWhitePaper SaaSHub Final 5Spencer YangNo ratings yet

- IaaS vs. PaaS vs. SaaS - Here's What You Need To Know About EachDocument11 pagesIaaS vs. PaaS vs. SaaS - Here's What You Need To Know About EachMichael AtefNo ratings yet

- Web Technology SubmissionDocument65 pagesWeb Technology SubmissionSandip MouryaNo ratings yet

- Aws InfrastructureDocument13 pagesAws InfrastructurelabgibNo ratings yet

- Distributed Database Systems-Chhanda RayDocument271 pagesDistributed Database Systems-Chhanda RaySufyan HashmiNo ratings yet

- 19 Software Architecture BooksDocument5 pages19 Software Architecture BooksEjaz alamNo ratings yet

- 12c Data Guard Switchover Best Practices Using SQLPLUSDocument8 pages12c Data Guard Switchover Best Practices Using SQLPLUSMa GodfreyNo ratings yet

- Training Schedule Inixindo JKT S1 2017 Rev.1Document13 pagesTraining Schedule Inixindo JKT S1 2017 Rev.1Taufik Iqbal RNo ratings yet

- Abap Add On CertificateDocument9 pagesAbap Add On Certificatebskris8727No ratings yet

- IptvlistDocument3 pagesIptvlistJavier AuriazulNo ratings yet

- UniCenta OPOS Web Reports GuideDocument14 pagesUniCenta OPOS Web Reports GuideCarlos AmoresNo ratings yet

- Wasim Hassan Syed: Professional ExperienceDocument2 pagesWasim Hassan Syed: Professional ExperienceAshwani kumarNo ratings yet

- Wincommand Line CommandDocument4 pagesWincommand Line CommandforkrakNo ratings yet

- Lab 10 Usama KhanDocument7 pagesLab 10 Usama Khanbilawal khanNo ratings yet

- 507-Shashwat Tripathi Java Exp 3Document9 pages507-Shashwat Tripathi Java Exp 3rahul oswalNo ratings yet

- How To Create Custom ADM TemplatesDocument30 pagesHow To Create Custom ADM TemplatesTheSphinXNo ratings yet

- CYREBRO - Operations - Report - Apr 11 - 18, 2024Document1 pageCYREBRO - Operations - Report - Apr 11 - 18, 2024joel jorleNo ratings yet

- Library System UML DiagramsDocument10 pagesLibrary System UML DiagramsHamza AhmaduNo ratings yet

- Quality Manual: Qms Documentation StructureDocument2 pagesQuality Manual: Qms Documentation StructuremuthuselvanNo ratings yet

- McadDocument42 pagesMcadStephen EmmeNo ratings yet

- Live Python Training ContentDocument10 pagesLive Python Training ContentNivas V MNo ratings yet

- Narayanaswamy Natarajan: Narayan1990@ufl - EduDocument1 pageNarayanaswamy Natarajan: Narayan1990@ufl - Eduapi-347339927No ratings yet

- Research Paper Block ChainDocument9 pagesResearch Paper Block Chainharsh02royNo ratings yet

- CV Project ManagerDocument5 pagesCV Project ManagerShabbir HashmiNo ratings yet

- Structured & Object Oriented Analysis & Design Methodology - SOOADMDocument4 pagesStructured & Object Oriented Analysis & Design Methodology - SOOADMMasud PathanNo ratings yet

- Knockout JsDocument18 pagesKnockout JsBhavin RukhanaNo ratings yet

- Status Code: 14: File Write FailedDocument7 pagesStatus Code: 14: File Write Failedkusuresh09No ratings yet

- Tutorial Python SQLiteDocument16 pagesTutorial Python SQLitedielpardimNo ratings yet

- Assignment On ERPDocument3 pagesAssignment On ERPMithan BhowmickNo ratings yet

- Le Trong NhanDocument2 pagesLe Trong NhanNhânn LeeNo ratings yet

SaaS Friend or Foe

SaaS Friend or Foe

Uploaded by

filipesferrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SaaS Friend or Foe

SaaS Friend or Foe

Uploaded by

filipesferrCopyright:

Available Formats

NETWORK SERVICES

SaaS: Friend Or Foe?

Jeffrey M. Kaplan

Software-as-a-service that time were known as application service

providers (ASPs).

offerings are expanding, and The demise of these ASPs reinforced the

gaining more acceptance. apprehension that many companies, large and

small, have about entrusting their software

ow would you like to just stop deploying requirements to third parties. But there are impor-

H enterprise software, stop monitoring

application performance, and stop partici-

pating in the finger-pointing and second-

tant differences between today’s SaaS providers

and yesterday’s failed ASPs.

guessing which occurs when there are perfor- Learning From The Past

mance problems? That’s the basic attraction of Most of the ASPs failed because they couldn’t

software-as-a-service (SaaS). capture enough customers to offset the capital

Customers access SaaS applications and data costs of building out their hosting facilities. They

via the Web and essentially rent the application were trying to sell Web access to legacy applica-

from the SaaS provider on a per-user or per-month tions from the big software vendors, and they

basis. The SaaS provider is responsible for deliv- often used the same pricing model—the upfront,

ering, securing and managing the application, data perpetual software license. Companies were

and underlying infrastructure. understandably reluctant to purchase the same

SaaS sounds good, but you need to also con- applications under the same licensing terms, but

sider the main trade-off: Someone else will be from these untested service providers.

responsible for your organization’s application Many SaaS providers learned from the mis-

performance and for safeguarding your corporate takes of the ASPs. Instead of providing Web

data. Is your organization ready to make that kind access to resold enterprise software, SaaS

of trade-off? providers developed their own Web-based appli-

Many already have, by embracing SaaS solu- cations, taking full advantage of modern pro-

tions like Salesforce.com and NetSuite, which gramming tools and resources. Rather than build-

include customer relationship management ing out massive server and database farms, so that

(CRM), collaboration, salesforce automation, pro- each client has its own resources, SaaS providers

ductivity and even financial management applica- base their wares on a new design paradigm, the

tions. And, they are happy with their decisions, multi-tenant application and data architecture.

according to a 2006 survey by THINKstrategies Multi-tenancy makes serving multiple clients

and Cutter Consortium. We found more than 80 more scalable and cost-effective.

percent of the organizations that are currently Finally, today’s SaaS solutions are priced on a

using an SaaS solution are satisfied with it, are “pay-as-you-go” or annual subscription basis.

planning to expand their use of SaaS, and

are willing to recommend SaaS.

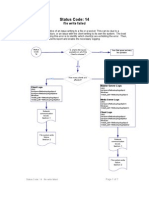

FIGURE 1 Is Your Organization Using

Jeff Kaplan is the These aren’t just small- and mid-size

Or Considering Software-As-A-Service?

managing director of business (SMBs), which were formerly

THINKstrategies thought to be the target market for SaaS. In Considering SaaS Not Considering SaaS

(www.thinkstrategies. fact, many Fortune 500 and Global 2000

com), specializing in companies have been early adopters.

43% 26%

IT service strategies, Despite the positive ratings from cur-

including managed rent SaaS customers, however, more than a

services, software-as- quarter of our survey respondents indicated

a-service (SaaS), out- they are still concerned about the reliabili- 31%

sourcing and utility ty, security and long-term financial viabili-

computing. He can be ty of today’s SaaS providers (Figure 1).

reached at 781-431- Some of these concerns are fallout from Currently Using SaaS

2690 and jkaplan@ the dot-com bust, which saw the disappear-

Source: 2006 THINKstrategies/Cutter Consortium Survey

thinkstrategies.com. ance of many SaaS predecessors, which at

48 BUSINESS COMMUNICATIONS REVIEW / JUNE 2007

This frees organizations from the perpetual license and WebEx Connect partnerships to develop a

and enables them to purchase access to applica- wider array of Web-based SaaS collaboration

tions and data storage as needed or “on demand.” applications and services.

SaaS providers also are making it easier for There are already hundreds of SaaS offerings Pay-as-you-go

customers to access and experience their applica- from scores of vendors, as you will see if you visit

tions by incorporating the collaboration features our SaaS directory site (www.saas-showplace. pricing frees the

found in popular social networking sites, such as com). More than 1,400 Web-based, on-demand enterprise from

Wikipedia.com, MySpace.com and Facebook. applications are listed there, in more than 80 cate-

com. Some may think such Web 2.0-type features gories. Among the newest SaaS offerings are host-

licenses and

and functions are irrelevant to corporate environ- ed versions of network and systems management infrastructure

ments, but the Harvard Business Review recently tools aimed toward the IT/network professional

upgrade costs

reported that more than 13 percent of companies (see “New SaaS Management Solutions”).

already are using wikis to encourage people to

contribute to online documents or collaborate on The Incumbents’ Challenge

other content, and instant messaging is now gen- At $50 to $150 per seat per year, SaaS offerings

erally accepted in many organizations. clearly cost less up front than many organizations

We ought to expect that Web-based collabora- would have to spend for comparable in-house

tion and communications tools and services will solutions. Like most lease vs. buy decisions, there

also become more acceptable. Most IT vendors is a break-even point for SaaS, generally around

are betting on this trend, and are looking for ways three years, but that depends on a number of fac-

to capitalize on it. A recent case in point is Cisco tors, including the application, the organization

Systems’ offer to purchase WebEx in March. Of and the degree to which it has already invested in

course Cisco could sell WebEx conferencing ser- related software licenses, server and networking

vices, but it could also use WebEx technologies infrastructure, floor space and personnel.

New SaaS Management Solutions

ome SaaS providers are targeting IT/ solutions via the SaaS model. (MSPs assume

S network professionals with hosted

management services. They figure that IT

departments will prefer SaaS solutions over the

the responsibility of managing the customer’s

IT functions, while SaaS providers supply the

software functionality which enables the

cost and complexity of traditional network and customer to perform the IT function itself.)

systems management products, for many of the Everdream services help IT/network

same reasons that individual business units and professionals automate asset and patch

small companies are using on-demand management, software compliance reporting

applications to replace traditional enterprise and uptime monitoring. Everdream’s platform

software from companies like Oracle and SAP. and user interface also integrate with

For instance, Klir Technologies has Salesforce.com’s service-desk and CRM

developed a portfolio of on-demand network solutions.

performance management services, including a Other examples include Triactive, offering a

free, single-user version called EXPRESS. combination of software distribution, asset and

Klir’s downloadable Analytics platform can be patch management, and ongoing monitoring

implemented quickly and can monitor network services, and Service-Now.com, which offers

devices in remote offices or centralized on-demand asset, configuration, change,

datacenters from a simple and secure Web release, incident and problem management

interface. It can view and analyze each services, along with a Web-based configuration

application’s impact on the network, including management database (CMDB).

top talkers and the heaviest users. It leverages Existing networking vendors are also

packet-sampling technologies in network getting into the SaaS act, with on-demand

equipment to monitor data flows via NetFlow remote IT support offerings. For example,

or sFlow. It also retains historical data for trend Cisco’s acquisition of WebEx could enable the

analysis, and offers pre-formatted reports to networking company to offer on-demand

evaluate key performance indicators (KPIs). remote access services on a subscription

Klir also has created a blog site for users to pricing basis to IT/network professionals who

share performance statistics, third-party must support dispersed workers and devices.

information and best practices to help them Citrix also offers GoToAssist, a remote tech

identify and resolve network performance support option, along with other on-demand

issues, and optimize the performance of their SaaS-type access and collaboration tools as

networks and applications. part of its CitrixOnline family of solutions. The

Another SaaS provider, Everdream, has company says CitrixOnline serves more than

transitioned from a managed service provider 20,000 businesses

(MSP) to selling desktop management

BUSINESS COMMUNICATIONS REVIEW / JUNE 2007 51

Generally speaking, however, the SaaS model risks that prospective customers associate with

appeals to many organizations because they don’t SaaS.

have to acquire additional servers or other net-

To compete with working devices to support the new SaaS applica- Why Companies Resist SaaS

tions. The money can then go to other uses. As more companies become interested in SaaS

SaaS, the older Others find that they can “out-task” selective alternatives, many also become concerned about

suppliers will functions with SaaS, which they prefer over nego- turning over their application performance and

tiating broader outsourcing agreements. Account- data management responsibilities to SaaS

need to revamp ability metrics are typically better with SaaS solu- providers. Some of these concerns are reasonable,

their business tions than with traditional outsourcing contracts, given a series of service disruptions which Sales-

because many SaaS developers build them into force.com experienced in late 2005 and early

models as well as

their offerings. They include activity reporting 2006, which prevented customers from accessing

their products mechanisms to demonstrate accountability and to the company’s on-demand customer relationship

provide an audit trail. These metrics are proving to management and salesforce automation applica-

be increasingly important given the growing num- tions. There is also concern about security threats

ber of government and industry compliance such as malicious Internet attacks or hackers pen-

requirements. etrating corporate data.

While SaaS economics are attractive to many However, since the Salesforce.com incidents

potential customers, and the annuity revenue more than a year ago, there have not been any ser-

model is appealing to software entrepreneurs, the vice issues which were significant enough to gen-

established software companies are understand- erate public attention. In fact, many SaaS

ably challenged by SaaS. They are used to charg- providers report 99+ percent availability and

ing upfront, perpetual license fees, plus charging claim better security records than most internal

for consulting to help companies adapt to their IT/network departments.

products, plus substantial maintenance fees to With SaaS solutions, it is arguably easier to

keep the applications up to date. To really compete protect against and resolve malicious intrusions or

in the SaaS market, they will have to re-architect internal bugs than with legacy solutions. The sin-

their applications, reshape their corporate cultures gle code base that underlies the SaaS multi-tenant

and restructure their revenue recognition and com- architecture and each customer’s “instance” only

mission models, so their salespeople will be as needs to be patched once—not once for every cus-

willing to sell the monthly subscriptions as the tomer’s individual hosted implementation. In con-

one-time big licenses. trast, patching is much more difficult for legacy

Although none of the incumbents has under- application vendors, who must offer patches for

taken such drastic measures, most have stopped all the versions of their software that they sell to

dissing the SaaS model and some are even begin- run on all the different operating systems within

ning to embrace it, at least indirectly. For example, their customer base. Moreover, legacy applica-

IBM has a growing collection of SaaS business tions are often customized by organizations to

partners (listed at www-19.lotus.com/wps/por- meet specific needs, making patch management

tal/showcase/saas), Microsoft has deals with BT, even more challenging.

NTT, Qwest and numerous other partners to deliv- End-user support issues have also proven to be

er various hosted Microsoft applications, and SAP less of a concern with SaaS solutions than with

promises a hosted version for small businesses legacy applications. The primary reasons are the

later this year. More specialized software vendors, single code base and multi-tenant architecture of

such as Business Objects in the business intelli- SaaS solutions, which make it easier for the SaaS

gence sector, are also adding on-demand solutions provider to respond to a set of common problems

to their application portfolios. rather than have to diagnose customer-specific

Microsoft’s Bill Gates recognized the magni- application issues. In addition, the user-friendly

tude of the SaaS threat in 2005. In an internal interfaces and workflow designs of SaaS solutions

memo which became public, he wrote, “This com- more closely match today’s business processes

ing ‘services wave’ will be very disruptive…. Ser- than do traditional, legacy applications, which

vices designed to scale to tens or hundreds of mil- were often designed to accommodate IT require-

lions will dramatically change the nature and cost ments rather than to meet end-user needs.

of software solutions deliverable to enterprises or End-user support is also easier with SaaS than

small businesses.” with legacy applications, because the SaaS

Microsoft’s CEO, Steve Ballmer, acknowl- provider is the “one throat to choke.” With in-

edged the appeal of SaaS when he recently told a house legacy solutions, application performance

gathering of public sector CIOs that 80 percent of problems often led to finger-pointing between the

their organizations would be using SaaS solutions IT/network and application development teams

by the end of the decade. Of course, SaaS requires a reliable Internet

For Ballmer’s prediction to come true, both the connection to access the Web-based service, and

incumbents and the newcomer SaaS competitors SaaS providers should offer service level agree-

will have to overcome some real and perceived ments (SLAs) which guarantee service availabili-

52 BUSINESS COMMUNICATIONS REVIEW / JUNE 2007

ty, security and privacy. Prospective customers their systems and networks. As a result, they do

should carefully examine these SLA terms and not use all their licensed “seats” or software

conditions. Also make sure that the SaaS opera- capacity, and they fail to achieve the expected

tions, or that of the SaaS service delivery partner, ROI. SaaS solutions

are certified as conforming to the Statement on Whether your company is an early SaaS

Auditing Standard (SaS) 70 standards of the adopter or a doubter, you can hardly ignore the are arguably

American Institute of Certified Public Accoun- growing number of vendors who are following easier to patch,

tants (AICPA). SaS 70 is a professional standard successful pioneers like Salesforce.com and Net-

used by a service auditor to assess the internal Suite into the SaaS market. Nor will IT/network

because of their

controls of a service organization. professionals be able to disregard SaaS as individ- single code base

SaaS providers typically offer user portals, ual end-users or entire business units adopt a

and multi-tenant

which enable administrators to track service widening array of on-demand applications to sat-

records and utilization levels and permit self-pro- isfy their day-to-day needs. architecture

visioning of additional seat licenses. For example, Rather than allow SaaS adoption to continue to

Salesforce.com responded to its aforementioned permeate an organization in an unplanned and

service delivery issues by establishing a public unregulated fashion, IT/network professionals

website called trust.salesforce.com, where anyone should view SaaS as an opportunity rather than a

can see the SaaS provider’s current and historical threat. SaaS can reduce the hassles of deploying

application availability and performance records. and maintaining common business applications.

Data storage, backup and recovery service SaaS can convert capital expenditures into

companies, such as Iron Mountain, are also offer- variable business expenses. SaaS can place the

ing technology escrow agreements which ensure burden for day-to-day application availability and

that a copy of the customer’s proprietary data and performance on the application provider rather

the SaaS provider’s source code and intellectual than on the in-house staff, and can free IT/network

property are securely housed in a third-party loca- professionals to focus on more strategic initia-

tion. Of course, it is important to carefully exam- tives. And a growing number of SaaS solutions

ine the terms and conditions, and clearly under- can make it easier for IT/network professionals to

stand how proprietary data can be retrieved. perform their responsibilities successfully

Perhaps the best safeguard against poor SaaS

services is the pay-as-you-go pricing model,

which lets customers terminate their subscription Companies Mentioned In This Article

and take their business elsewhere. This pressures

the SaaS providers to consistently and reliably AICPA (www.aicpa.org)

deliver high-quality on-demand applications. AMR Research (www.amrresearch.com)

BT (www.bt.com)

Conclusion Business Objects

SaaS offerings let organizations of all sizes test

and adopt new applications much more quickly (www.businessobjects.com)

than they could with legacy software. If these new Citrix (www.citrix.com)

applications are used for faster handling of cus- Cutter Consortium (www.cutter.com)

tomer service, improved collaboration among Everdream (www.everdream.com)

team members and quicker time to market, then Facebook (www.facebook.com)

they will also help organizations squeeze greater

IBM (www.ibm.com)

productivity from their increasingly dispersed

workers and business partners. Iron Mountain (www.ironmountain.com)

By comparison, traditional software projects Klir Technologies (www.klir.com)

are notoriously slow and prone to cost overruns. Microsoft (www.microsoft.com)

As a result, almost a third (31.1 percent) are can- MySpace (www.myspace.com)

celled before they are completed and, of those pro- NetSuite (www.netsuite.com)

jects which are completed, more than half (52.7

percent) take twice as long or cost twice as much NIST (www.nist.gov)

as originally expected, according to the U.S. Gov- NTT (www.ntt.com)

ernment Accountability Office and the National Qwest (www.qwest.com)

Institute of Standards and Technology. For those Salesforce.com (www.salesforce.com)

software applications which are deployed, the SAP (www.sap.com)

maintenance and management costs can be as

Service-Now.com (www.service-now.com)

much as ten times the original license fee, accord-

ing to AMR Research. Triactive (www.triactive.com)

Compounding the cost inefficiencies of legacy US GAO (www.usgao.gov)

applications is the fact that many organizations WebEx (www.webex.com)

over-provision their enterprise software in the Wikipedia (www.wikipedia.org)

same way they have historically over-provisioned

BUSINESS COMMUNICATIONS REVIEW / JUNE 2007 53

You might also like

- Packetstorm Google Dorks ListDocument476 pagesPacketstorm Google Dorks ListSteven Mason80% (5)

- Cloudstrat Case StudyDocument10 pagesCloudstrat Case StudyAbhirami PromodNo ratings yet

- Saasify - Software As A Service and The EnterpriseDocument9 pagesSaasify - Software As A Service and The EnterpriseCATechnologiesNo ratings yet

- Everything You Need To Know About SaaSDocument4 pagesEverything You Need To Know About SaaSSuntec SNo ratings yet

- S4 Hana Cloud ComputingDocument60 pagesS4 Hana Cloud Computingsatsap2000No ratings yet

- SaasDocument6 pagesSaasrameshkoutarapuNo ratings yet

- Saas NewDocument4 pagesSaas NewDmitry BolgarinNo ratings yet

- Dvdvsaas Opportunity For Indian ChannelsDocument10 pagesDvdvsaas Opportunity For Indian Channelsgraphicman1060No ratings yet

- Successfactors HCM: Mindlinks Training MaterialDocument38 pagesSuccessfactors HCM: Mindlinks Training MaterialTanmoy KonarNo ratings yet

- Unit 2 ... Cloud ComputingDocument11 pagesUnit 2 ... Cloud Computingali shanNo ratings yet

- What Is SaaS (Software As A Service) - JavatpointDocument5 pagesWhat Is SaaS (Software As A Service) - Javatpointmalikmalaika031No ratings yet

- Software Design On A SaaS PlatformDocument4 pagesSoftware Design On A SaaS Platformeyetea68No ratings yet

- How To Invest in Software As A Service (SaaS)Document16 pagesHow To Invest in Software As A Service (SaaS)Ferdous Quawser PathanNo ratings yet

- Saas Business Model For Software Enterprise: Hancheng LiaoDocument4 pagesSaas Business Model For Software Enterprise: Hancheng LiaodivNo ratings yet

- Saa SDocument4 pagesSaa SBhumika MhatreNo ratings yet

- SaaS Deepdive PDFDocument11 pagesSaaS Deepdive PDFHugo Francisco Leal ArandaNo ratings yet

- Week 1 Assignment Cloud ComputingDocument8 pagesWeek 1 Assignment Cloud ComputingperminusuhuruNo ratings yet

- Think Strategies SaaS PrimerDocument7 pagesThink Strategies SaaS PrimerJeff Kaplan100% (2)

- Boomi Whitepaper The Quest For Cloud Integration Strategy FinalDocument4 pagesBoomi Whitepaper The Quest For Cloud Integration Strategy Finalvikas tyagiNo ratings yet

- Understanding The Cloud Computing Stack SaaS, PaaS, IaaSDocument6 pagesUnderstanding The Cloud Computing Stack SaaS, PaaS, IaaSAlbertho StatesmanNo ratings yet

- Integration Appliances For SaaSDocument6 pagesIntegration Appliances For SaaSWaleed Qawasmi0% (1)

- Open Architecture For Developing Multitenant Software-as-a-Service ApplicationsDocument6 pagesOpen Architecture For Developing Multitenant Software-as-a-Service ApplicationsmemopenaNo ratings yet

- BAIN BRIEF The Cloud Reshapes The Business of Software PDFDocument8 pagesBAIN BRIEF The Cloud Reshapes The Business of Software PDFkumar_007111No ratings yet

- Best Practices For Adopting Saas: A Holistic Evaluation ApproachDocument8 pagesBest Practices For Adopting Saas: A Holistic Evaluation ApproachJohanne RuelNo ratings yet

- Week 1 Assignment CCDocument4 pagesWeek 1 Assignment CCperminusuhuruNo ratings yet

- SAAS.pptDocument32 pagesSAAS.pptTee ZeeNo ratings yet

- BCG Profiting From The Cloud Jun 2013 Tcm9-94926Document6 pagesBCG Profiting From The Cloud Jun 2013 Tcm9-94926Vinay KumarNo ratings yet

- Ebook ISV Five Steps To Modernizing Your DataDocument38 pagesEbook ISV Five Steps To Modernizing Your DatactheodoropoulosNo ratings yet

- Module 3 - Saas and PaasDocument27 pagesModule 3 - Saas and PaasnikhilNo ratings yet

- Cloud ComputingDocument8 pagesCloud ComputingArani NavaratnarajahNo ratings yet

- Accenture SaaS PoV March 2010Document4 pagesAccenture SaaS PoV March 2010Rob SwinkelsNo ratings yet

- Software As A Service (SaaS) - Definition and ExamplesDocument5 pagesSoftware As A Service (SaaS) - Definition and Examplesmalikmalaika031No ratings yet

- Документ Microsoft WordDocument11 pagesДокумент Microsoft Worddsns kdskdNo ratings yet

- Understanding SaaSDocument7 pagesUnderstanding SaaSJewels ShoppingNo ratings yet

- Saas 101 PDFDocument46 pagesSaas 101 PDFSankhadeep DebdasNo ratings yet

- Adopting Software-As-A-service vs. Traditional Erp SystemsDocument3 pagesAdopting Software-As-A-service vs. Traditional Erp SystemsrudiansenNo ratings yet

- Ecommerce Business: 24% of All Enterprise WorkloadsDocument9 pagesEcommerce Business: 24% of All Enterprise WorkloadsAkshay AnandNo ratings yet

- A New Approach To Software As Service CloudDocument4 pagesA New Approach To Software As Service CloudGurudatt KulkarniNo ratings yet

- Cloud-Saas LectureDocument17 pagesCloud-Saas LectureEbenezer Komla GavuaNo ratings yet

- Five Steps To Modernizing Your DataDocument38 pagesFive Steps To Modernizing Your Datahim2000himNo ratings yet

- DELA ROSA Advanced Database SystemDocument1 pageDELA ROSA Advanced Database SystemRostel dela RosaNo ratings yet

- Software As A Service and Database As A Service: ObjectivesDocument10 pagesSoftware As A Service and Database As A Service: Objectiveschirag patelNo ratings yet

- Cloud Computing - Threat or Opportunity For Vars & MSPS?: White PaperDocument20 pagesCloud Computing - Threat or Opportunity For Vars & MSPS?: White Papervgupta86No ratings yet

- Software As A ServiceDocument2 pagesSoftware As A Servicerapismart240No ratings yet

- Success FactorsDocument38 pagesSuccess FactorsDhanunjaya Naidu86% (7)

- Design and FabricationDocument8 pagesDesign and FabricationSuresh IndiaNo ratings yet

- Revionics - White.paper. (Software As A Service A Retailers)Document7 pagesRevionics - White.paper. (Software As A Service A Retailers)Souvik_DasNo ratings yet

- Egdor Transitioning Your Software Business To SaaSDocument6 pagesEgdor Transitioning Your Software Business To SaaSEgdor AccountingNo ratings yet

- Unit 2 Cloud Architecture Not of UseDocument51 pagesUnit 2 Cloud Architecture Not of UseAnonymous FKWVgNnSjo100% (1)

- Saas:: Describe The Difference Between Saas, Paas, and IaasDocument6 pagesSaas:: Describe The Difference Between Saas, Paas, and IaasnobiawahabNo ratings yet

- Retail Innovation at Speed & Cost: The Saas Technology TransformationDocument15 pagesRetail Innovation at Speed & Cost: The Saas Technology Transformationvpp.nitkNo ratings yet

- SaaS ArchitectureDocument20 pagesSaaS ArchitectureFirdausNo ratings yet

- WP SN Platform Technical OverviewDocument14 pagesWP SN Platform Technical Overviewapi-435424919No ratings yet

- Software As A ServiceDocument19 pagesSoftware As A ServiceSoniya VaswaniNo ratings yet

- SaaS: Everything You Need to Know About Building Successful SaaS Company in One Place.From EverandSaaS: Everything You Need to Know About Building Successful SaaS Company in One Place.No ratings yet

- SaaS Integration Build Vs BuyDocument5 pagesSaaS Integration Build Vs Buyalaric_nurmNo ratings yet

- Platform As A ServiceDocument7 pagesPlatform As A ServicechandraNo ratings yet

- Software As A Service (Saas)Document18 pagesSoftware As A Service (Saas)Aazam KhatriNo ratings yet

- Cloud Saas LectureeeDocument27 pagesCloud Saas LectureeeEbenezer Komla GavuaNo ratings yet

- HR in The CloudDocument5 pagesHR in The CloudShaun DunphyNo ratings yet

- WhitePaper SaaSHub Final 5Document7 pagesWhitePaper SaaSHub Final 5Spencer YangNo ratings yet

- IaaS vs. PaaS vs. SaaS - Here's What You Need To Know About EachDocument11 pagesIaaS vs. PaaS vs. SaaS - Here's What You Need To Know About EachMichael AtefNo ratings yet

- Web Technology SubmissionDocument65 pagesWeb Technology SubmissionSandip MouryaNo ratings yet

- Aws InfrastructureDocument13 pagesAws InfrastructurelabgibNo ratings yet

- Distributed Database Systems-Chhanda RayDocument271 pagesDistributed Database Systems-Chhanda RaySufyan HashmiNo ratings yet

- 19 Software Architecture BooksDocument5 pages19 Software Architecture BooksEjaz alamNo ratings yet

- 12c Data Guard Switchover Best Practices Using SQLPLUSDocument8 pages12c Data Guard Switchover Best Practices Using SQLPLUSMa GodfreyNo ratings yet

- Training Schedule Inixindo JKT S1 2017 Rev.1Document13 pagesTraining Schedule Inixindo JKT S1 2017 Rev.1Taufik Iqbal RNo ratings yet

- Abap Add On CertificateDocument9 pagesAbap Add On Certificatebskris8727No ratings yet

- IptvlistDocument3 pagesIptvlistJavier AuriazulNo ratings yet

- UniCenta OPOS Web Reports GuideDocument14 pagesUniCenta OPOS Web Reports GuideCarlos AmoresNo ratings yet

- Wasim Hassan Syed: Professional ExperienceDocument2 pagesWasim Hassan Syed: Professional ExperienceAshwani kumarNo ratings yet

- Wincommand Line CommandDocument4 pagesWincommand Line CommandforkrakNo ratings yet

- Lab 10 Usama KhanDocument7 pagesLab 10 Usama Khanbilawal khanNo ratings yet

- 507-Shashwat Tripathi Java Exp 3Document9 pages507-Shashwat Tripathi Java Exp 3rahul oswalNo ratings yet

- How To Create Custom ADM TemplatesDocument30 pagesHow To Create Custom ADM TemplatesTheSphinXNo ratings yet

- CYREBRO - Operations - Report - Apr 11 - 18, 2024Document1 pageCYREBRO - Operations - Report - Apr 11 - 18, 2024joel jorleNo ratings yet

- Library System UML DiagramsDocument10 pagesLibrary System UML DiagramsHamza AhmaduNo ratings yet

- Quality Manual: Qms Documentation StructureDocument2 pagesQuality Manual: Qms Documentation StructuremuthuselvanNo ratings yet

- McadDocument42 pagesMcadStephen EmmeNo ratings yet

- Live Python Training ContentDocument10 pagesLive Python Training ContentNivas V MNo ratings yet

- Narayanaswamy Natarajan: Narayan1990@ufl - EduDocument1 pageNarayanaswamy Natarajan: Narayan1990@ufl - Eduapi-347339927No ratings yet

- Research Paper Block ChainDocument9 pagesResearch Paper Block Chainharsh02royNo ratings yet

- CV Project ManagerDocument5 pagesCV Project ManagerShabbir HashmiNo ratings yet

- Structured & Object Oriented Analysis & Design Methodology - SOOADMDocument4 pagesStructured & Object Oriented Analysis & Design Methodology - SOOADMMasud PathanNo ratings yet

- Knockout JsDocument18 pagesKnockout JsBhavin RukhanaNo ratings yet

- Status Code: 14: File Write FailedDocument7 pagesStatus Code: 14: File Write Failedkusuresh09No ratings yet

- Tutorial Python SQLiteDocument16 pagesTutorial Python SQLitedielpardimNo ratings yet

- Assignment On ERPDocument3 pagesAssignment On ERPMithan BhowmickNo ratings yet

- Le Trong NhanDocument2 pagesLe Trong NhanNhânn LeeNo ratings yet