Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsTax Saving Option

Tax Saving Option

Uploaded by

Alias DThis document provides a template for claiming tax deductions and exemptions under various sections of the Indian Income Tax Act. It lists deductions that can be claimed under Section 80C for items like EPF contributions, life insurance premiums, tuition fees, and more. It also lists additional deductions available under Sections 80CCD, 80CCG, and various chapters of Section 80 including 80D, 80DD, 80E, 80G, 80GG, 80U, and 80TTA. Taxpayers are to fill in the actual amounts being claimed under each eligible deduction within the specified limits.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Other 80 C Deductions: 11. Total Income or Taxable Income (8-10)Document1 pageOther 80 C Deductions: 11. Total Income or Taxable Income (8-10)Anandraojs JsNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- April May June July August September October November December January February March Bonus Other EarningsDocument8 pagesApril May June July August September October November December January February March Bonus Other EarningsdpsukhejaNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document11 pagesIncome Tax Calculator Fy 2020 21 v1nach.nachiketNo ratings yet

- Deduction ProvisionsDocument11 pagesDeduction ProvisionsdevasrisaivNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- DeductionsDocument7 pagesDeductionsManjeet KaurNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document11 pagesIncome Tax Calculator Fy 2021 22 v2yuvirocksNo ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- VRS NotesDocument82 pagesVRS NotesrisingiocmNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- On Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMDocument11 pagesOn Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMMudasir LoneNo ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- 15.deductions From Gross Total IncomeDocument5 pages15.deductions From Gross Total IncomeDEV BHARGAVANo ratings yet

- 2009 Tax Calculator-1Document2 pages2009 Tax Calculator-1Sandip S NagareNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Taxation Law - TheoryDocument29 pagesTaxation Law - TheorySrinivas NuluNo ratings yet

- Section 80P - Deduction For Co-Operative SocietiesDocument15 pagesSection 80P - Deduction For Co-Operative SocietiesSURESHNo ratings yet

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- DeductionsDocument7 pagesDeductionsAnurag BishtNo ratings yet

- Income Tax CalculatorDocument5 pagesIncome Tax CalculatordevanbongiriNo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- OthInvestment Declaration Help Document F Y 2021-22-1Document12 pagesOthInvestment Declaration Help Document F Y 2021-22-1Gurprit SinghNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Chapter 6A DeductionsDocument5 pagesChapter 6A Deductionsa.santhosh5453No ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- ItfjfygjDocument3 pagesItfjfygjKrishna GNo ratings yet

- Income Tax 2008-09Document10 pagesIncome Tax 2008-09mohan9813032985@yahoo.com100% (16)

- UNION BUDGET-2010-2011: Vision & ObjectiveDocument32 pagesUNION BUDGET-2010-2011: Vision & ObjectivemanishgondhalekarNo ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- Income TaxDocument5 pagesIncome TaxAshish NarulaNo ratings yet

- Trick To Remember Section 80 Deductions - Mnemonic Codes - FinAppDocument8 pagesTrick To Remember Section 80 Deductions - Mnemonic Codes - FinAppsusantaNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDocument8 pagesInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaNo ratings yet

- I PSF 202223Document5 pagesI PSF 202223shyamcaclassesNo ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Document6 pagesLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Deductions Under Chapter VI CalculatorDocument2 pagesDeductions Under Chapter VI CalculatorAjay PratapNo ratings yet

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocument25 pages7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiNo ratings yet

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocument2 pagesEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

Tax Saving Option

Tax Saving Option

Uploaded by

Alias D0 ratings0% found this document useful (0 votes)

6 views2 pagesThis document provides a template for claiming tax deductions and exemptions under various sections of the Indian Income Tax Act. It lists deductions that can be claimed under Section 80C for items like EPF contributions, life insurance premiums, tuition fees, and more. It also lists additional deductions available under Sections 80CCD, 80CCG, and various chapters of Section 80 including 80D, 80DD, 80E, 80G, 80GG, 80U, and 80TTA. Taxpayers are to fill in the actual amounts being claimed under each eligible deduction within the specified limits.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a template for claiming tax deductions and exemptions under various sections of the Indian Income Tax Act. It lists deductions that can be claimed under Section 80C for items like EPF contributions, life insurance premiums, tuition fees, and more. It also lists additional deductions available under Sections 80CCD, 80CCG, and various chapters of Section 80 including 80D, 80DD, 80E, 80G, 80GG, 80U, and 80TTA. Taxpayers are to fill in the actual amounts being claimed under each eligible deduction within the specified limits.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views2 pagesTax Saving Option

Tax Saving Option

Uploaded by

Alias DThis document provides a template for claiming tax deductions and exemptions under various sections of the Indian Income Tax Act. It lists deductions that can be claimed under Section 80C for items like EPF contributions, life insurance premiums, tuition fees, and more. It also lists additional deductions available under Sections 80CCD, 80CCG, and various chapters of Section 80 including 80D, 80DD, 80E, 80G, 80GG, 80U, and 80TTA. Taxpayers are to fill in the actual amounts being claimed under each eligible deduction within the specified limits.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

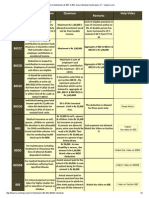

Insert figures below and get tax exempted as per section 80

Particulars

Less: Deduction under Sec 80C (Max Rs.1,50,000/-)

A. EPF & VPF Contribution

B. Public Provident Fund (PPF)

C. Senior Citizen’s Saving Scheme (SCSS)

D. N.S.C (Investment + accrued Interest before Maturity Year)

E. Tax Saving Fixed Deposit (5 Years and above)

F. Tax Savings Bonds

G. E.L.S.S (Tax Saving Mutual Fund)

H. Life Insurance Premiums

I. New Pension Scheme (NPS) (u/s 80CCC)

J. Pension Plan from Insurance Companies/Mutual Funds (u/s 80CCC)

K. 80 CCD Central Govt. Employees Pension Plan (u/s 80CCD)

L. Housing. Loan (Principal Repayment)

M. Sukanya Samriddhi Account

N. Stamp Duty & Registration Charges

O. Tuition fees for 2 children

Less: Additional Deduction under Sec 80CCD NPS (Max Rs 50,000/-)

Less: Deduction under RGESS Sec 80CCG (Max Rs. 50,000/-)

Less: Deduction under chapter VI A

A. 80 D Medical Insurance premiums (for Self )

B. 80 D Medical Insurance premiums (for Parents)

C. 80 E Int Paid on Education Loan

D. 80 DD Medical Treatment of handicapped Dependent

E. 80DDB Expenditure on Selected Medical Treatment for self/ dependent

F. 80G, 80GGA, 80GGC Donation to approved funds

G. 80GG For Rent in case of NO HRA Component (Budget 2016)

H. 80U For Physically Disable Assesse

I. 80TTA (Rs 50,000 for Senior Citizens & Rs 10,000 for others) (Budget 2018)

Total

Financialcontrol.in

Amont to be

filled as Limit

actual

0

0

0

0

0

0

0

0

0

0

0 0

You might also like

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Other 80 C Deductions: 11. Total Income or Taxable Income (8-10)Document1 pageOther 80 C Deductions: 11. Total Income or Taxable Income (8-10)Anandraojs JsNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- April May June July August September October November December January February March Bonus Other EarningsDocument8 pagesApril May June July August September October November December January February March Bonus Other EarningsdpsukhejaNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document11 pagesIncome Tax Calculator Fy 2020 21 v1nach.nachiketNo ratings yet

- Deduction ProvisionsDocument11 pagesDeduction ProvisionsdevasrisaivNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- DeductionsDocument7 pagesDeductionsManjeet KaurNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document11 pagesIncome Tax Calculator Fy 2021 22 v2yuvirocksNo ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- VRS NotesDocument82 pagesVRS NotesrisingiocmNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- On Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMDocument11 pagesOn Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMMudasir LoneNo ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- 15.deductions From Gross Total IncomeDocument5 pages15.deductions From Gross Total IncomeDEV BHARGAVANo ratings yet

- 2009 Tax Calculator-1Document2 pages2009 Tax Calculator-1Sandip S NagareNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Taxation Law - TheoryDocument29 pagesTaxation Law - TheorySrinivas NuluNo ratings yet

- Section 80P - Deduction For Co-Operative SocietiesDocument15 pagesSection 80P - Deduction For Co-Operative SocietiesSURESHNo ratings yet

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- DeductionsDocument7 pagesDeductionsAnurag BishtNo ratings yet

- Income Tax CalculatorDocument5 pagesIncome Tax CalculatordevanbongiriNo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- OthInvestment Declaration Help Document F Y 2021-22-1Document12 pagesOthInvestment Declaration Help Document F Y 2021-22-1Gurprit SinghNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Chapter 6A DeductionsDocument5 pagesChapter 6A Deductionsa.santhosh5453No ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- ItfjfygjDocument3 pagesItfjfygjKrishna GNo ratings yet

- Income Tax 2008-09Document10 pagesIncome Tax 2008-09mohan9813032985@yahoo.com100% (16)

- UNION BUDGET-2010-2011: Vision & ObjectiveDocument32 pagesUNION BUDGET-2010-2011: Vision & ObjectivemanishgondhalekarNo ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- Income TaxDocument5 pagesIncome TaxAshish NarulaNo ratings yet

- Trick To Remember Section 80 Deductions - Mnemonic Codes - FinAppDocument8 pagesTrick To Remember Section 80 Deductions - Mnemonic Codes - FinAppsusantaNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDocument8 pagesInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaNo ratings yet

- I PSF 202223Document5 pagesI PSF 202223shyamcaclassesNo ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Document6 pagesLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Deductions Under Chapter VI CalculatorDocument2 pagesDeductions Under Chapter VI CalculatorAjay PratapNo ratings yet

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocument25 pages7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiNo ratings yet

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocument2 pagesEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet