Professional Documents

Culture Documents

MA2 Mock 1-As - 2023-24

MA2 Mock 1-As - 2023-24

Uploaded by

daniel.maina2005Copyright:

Available Formats

You might also like

- 4 V's of OperationDocument6 pages4 V's of OperationRahul Agarwal85% (20)

- MA2 Mock 2-As - 2023-24Document8 pagesMA2 Mock 2-As - 2023-24daniel.maina2005No ratings yet

- Lazada Group Assignment 1 Business ReportDocument37 pagesLazada Group Assignment 1 Business ReportAmieNo ratings yet

- Solution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadDocument25 pagesSolution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadGaryLeemtno100% (49)

- Manac Quiz 2 With AnswersDocument4 pagesManac Quiz 2 With AnswersReymilyn Sanchez78% (9)

- Brazil Localization WorkshopDocument211 pagesBrazil Localization Workshoprobertoabe100% (2)

- Business Plan of Manufacturing Air PurifiersDocument7 pagesBusiness Plan of Manufacturing Air PurifiersSakshi BaiwalNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11jasperkennedy089% (28)

- Exhibit 4-5 Chan Audio Company: Current RatioDocument35 pagesExhibit 4-5 Chan Audio Company: Current Ratiofokica840% (1)

- ACCA F5 Course Notes PDFDocument330 pagesACCA F5 Course Notes PDFAmanda7100% (1)

- PM IPRO Mock 1 Sol.Document15 pagesPM IPRO Mock 1 Sol.SHIVAM BARANWALNo ratings yet

- F5 - IPRO - Mock 1 - AnswersDocument16 pagesF5 - IPRO - Mock 1 - AnswersYashna SohawonNo ratings yet

- ACCA F5 Course NotesDocument273 pagesACCA F5 Course NotesLinkon Peter50% (2)

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument34 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsGuinevereNo ratings yet

- Managerial Accounting 6th Edition Jiambalvo Solutions ManualDocument24 pagesManagerial Accounting 6th Edition Jiambalvo Solutions Manualgenevievetruong9ajpr100% (30)

- F2 Mock Answers 1Document16 pagesF2 Mock Answers 1ShruthiNo ratings yet

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- 4.basics of Marginal Costing-SN FoundationDocument22 pages4.basics of Marginal Costing-SN FoundationHasim SaiyedNo ratings yet

- Chapter 2 Cost Concepts and Design Economics PART 2 With AssignmentDocument30 pagesChapter 2 Cost Concepts and Design Economics PART 2 With AssignmentrplagrosaNo ratings yet

- CVP, Variable Costing and Absorption CostingDocument7 pagesCVP, Variable Costing and Absorption CostingHannah Vaniza NapolesNo ratings yet

- Managerial Accounting 5th Edition Jiambalvo Solutions ManualDocument25 pagesManagerial Accounting 5th Edition Jiambalvo Solutions Manualnhattranel7k1100% (31)

- MA and FMA Full Specimen Exam AnswersDocument14 pagesMA and FMA Full Specimen Exam AnswersLanre OdubanjoNo ratings yet

- Break - Even Analysis Exercises: On Contributi Ts Fixed CosDocument7 pagesBreak - Even Analysis Exercises: On Contributi Ts Fixed Cospunte77No ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11Document44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11kkamjonginnNo ratings yet

- Ac 202 Answers NewDocument8 pagesAc 202 Answers NewSashia HassanNo ratings yet

- HorngrenIMA14eSM ch13Document73 pagesHorngrenIMA14eSM ch13Piyal Hossain100% (1)

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument39 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsElijah MontefalcoNo ratings yet

- Answers: K Aplan P Ublish in GDocument16 pagesAnswers: K Aplan P Ublish in GqqqNo ratings yet

- Past Year 2019 Sem 2 Ans (ZW)Document4 pagesPast Year 2019 Sem 2 Ans (ZW)zhaoweiNo ratings yet

- Cost Based PricingDocument5 pagesCost Based PricingShivany GuerreroNo ratings yet

- Short-Run CostDocument24 pagesShort-Run CostLinh PhamNo ratings yet

- 07 CostDocument45 pages07 CostBhaskar KondaNo ratings yet

- Absorption and Variable Costing, and Inventory Management: Discussion QuestionsDocument28 pagesAbsorption and Variable Costing, and Inventory Management: Discussion QuestionsParth GandhiNo ratings yet

- Chapter 4 ACCA F2Document7 pagesChapter 4 ACCA F2siksha100% (1)

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- F2 Mock Answers 2Document17 pagesF2 Mock Answers 2ShruthiNo ratings yet

- Variable vs. Absorption CostingDocument21 pagesVariable vs. Absorption Costingsgulay117No ratings yet

- COMA Mid Term - 2022-23 V1 - SolutionsDocument6 pagesCOMA Mid Term - 2022-23 V1 - SolutionssurajNo ratings yet

- ACCT 401 CH 8 EXE TEXTBOOK AnswersDocument30 pagesACCT 401 CH 8 EXE TEXTBOOK Answersmohammed azizNo ratings yet

- 017 - CAMIST - SamplePaper - A - Amndd - HS - PP 329-344 - BW - SecDocument16 pages017 - CAMIST - SamplePaper - A - Amndd - HS - PP 329-344 - BW - Secsumaiazerin101No ratings yet

- FinanceDocument8 pagesFinanceJøÿå BhardwajNo ratings yet

- Ebook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFDocument51 pagesEbook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFxaviaalexandrawp86i100% (14)

- Marginal Costing NotesDocument7 pagesMarginal Costing NotesJul 480weshNo ratings yet

- Lecture 5Document39 pagesLecture 5Shixi ZhuNo ratings yet

- CH 04Document40 pagesCH 04thrust_xone100% (1)

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDocument36 pagesSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th Editionsaxonic.hamose0p9698% (53)

- MA and FMA Full Specimen Exam Answers - 2Document14 pagesMA and FMA Full Specimen Exam Answers - 2zunndraaNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Product Cost/ Profit 4,275,000 3,225,000Document4 pagesProduct Cost/ Profit 4,275,000 3,225,000odutola odunayoNo ratings yet

- ASAL Business CB Chapter 31 AnswersDocument12 pagesASAL Business CB Chapter 31 Answers-shinagami-No ratings yet

- Chapter 8 MowenDocument25 pagesChapter 8 MowenRosamae PialaneNo ratings yet

- Final ExamDocument9 pagesFinal ExamWaizin KyawNo ratings yet

- ACT202 - Chapter 6Document38 pagesACT202 - Chapter 6arafkhan1623No ratings yet

- Act 202 Chapter 6Document40 pagesAct 202 Chapter 6Shaon KhanNo ratings yet

- Account StatementDocument100 pagesAccount StatementGhulam HussainNo ratings yet

- Week 9 - 10 - OverheadDocument44 pagesWeek 9 - 10 - OverheadMohammad EhsanNo ratings yet

- Lecture 6 - ABC Costing RevisedDocument22 pagesLecture 6 - ABC Costing RevisedMJ jNo ratings yet

- Unit 1 - Capital Budgeting PDFDocument48 pagesUnit 1 - Capital Budgeting PDFDharaneeshwar SKNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- BOB Finance & Credit Specialist Officer SII Model Question Paper 4Document147 pagesBOB Finance & Credit Specialist Officer SII Model Question Paper 4Pranav KumarNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Faith and Reason 7 - The Bible (III, IV) - Properties, InterpretationDocument40 pagesFaith and Reason 7 - The Bible (III, IV) - Properties, Interpretationdaniel.maina2005No ratings yet

- Bfs&Bcom Measure of DispersionDocument32 pagesBfs&Bcom Measure of Dispersiondaniel.maina2005No ratings yet

- 2.manufacturing Accounts IllustrationDocument2 pages2.manufacturing Accounts Illustrationdaniel.maina2005No ratings yet

- Agan BCM 1201 Jan March 2024 Course Outline and Delivery Plan W Agan-1Document6 pagesAgan BCM 1201 Jan March 2024 Course Outline and Delivery Plan W Agan-1daniel.maina2005No ratings yet

- Accounting For Companies-1Document50 pagesAccounting For Companies-1daniel.maina2005No ratings yet

- 2023 24 MA2 AQB OT Set 2 QuestionsDocument12 pages2023 24 MA2 AQB OT Set 2 Questionsdaniel.maina2005No ratings yet

- Assignment 3 MRP Roll Inc V 001233438Document3 pagesAssignment 3 MRP Roll Inc V 001233438Sunayana ThakurNo ratings yet

- Budgeting PDFDocument28 pagesBudgeting PDFreenza velascoNo ratings yet

- Impact of SAP Implementation On RetailDocument40 pagesImpact of SAP Implementation On RetailParijatNo ratings yet

- EOQ Vs EPQDocument18 pagesEOQ Vs EPQParidhi Aggarwal100% (1)

- What Is ASRSDocument7 pagesWhat Is ASRSAzri Lundu0% (1)

- Working Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerDocument83 pagesWorking Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerPranay Jindal71% (7)

- Achieving Operational Excellence and Customer Intimacy Enterprise ApplicationsDocument46 pagesAchieving Operational Excellence and Customer Intimacy Enterprise ApplicationsHitesh BhardwajNo ratings yet

- Apparel Manufacturing: Business SolutionDocument13 pagesApparel Manufacturing: Business SolutionSachin PilaniwalaNo ratings yet

- Operations Management: William J. StevensonDocument30 pagesOperations Management: William J. StevensonTarkeshwar ThakurNo ratings yet

- Gopi Inventory-ManagementDocument9 pagesGopi Inventory-Managementvasantawada Gopi krishnaNo ratings yet

- GIMPA-CILT Competitive AdvantageDocument12 pagesGIMPA-CILT Competitive AdvantageSamuel Kwame YeboahNo ratings yet

- Sapphire Group 4Document32 pagesSapphire Group 4Ahsan AnsariNo ratings yet

- Services Retailing AND LOGISTIICSDocument47 pagesServices Retailing AND LOGISTIICSPink100% (2)

- Past Paper Erp ShortDocument6 pagesPast Paper Erp Shortrumi noorNo ratings yet

- Financial Analysis - ITC - AsimBhawsinghka PDFDocument13 pagesFinancial Analysis - ITC - AsimBhawsinghka PDFAsim BhawsinghkaNo ratings yet

- Bharath Electronics ReportDocument72 pagesBharath Electronics ReportSathyanarayana SrsNo ratings yet

- I. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 9, 2020. (2 Pts Each)Document9 pagesI. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 9, 2020. (2 Pts Each)Hazel Seguerra BicadaNo ratings yet

- Costing UG v2012EE PDFDocument124 pagesCosting UG v2012EE PDFKumarNo ratings yet

- Financial Analysis of Habib Bank LimitedDocument27 pagesFinancial Analysis of Habib Bank LimitedRabab Ali50% (2)

- 2.lean Production and Agile Manufacturing PDFDocument16 pages2.lean Production and Agile Manufacturing PDFMahmoud Zregat0% (1)

- Design Phase Financial Organizational StructureDocument22 pagesDesign Phase Financial Organizational Structureranga2702No ratings yet

- SUPPLY CHAIN MANAGEMENT (LinkedIn Learning)Document5 pagesSUPPLY CHAIN MANAGEMENT (LinkedIn Learning)Floretta FellingNo ratings yet

- CT DrugstoreDocument6 pagesCT DrugstoreRomar MedeloNo ratings yet

- Working Capital of Borrower-Bank of BarodaDocument82 pagesWorking Capital of Borrower-Bank of BarodaRaj KopadeNo ratings yet

- Funda 2Document20 pagesFunda 2Lorraine Miralles67% (3)

MA2 Mock 1-As - 2023-24

MA2 Mock 1-As - 2023-24

Uploaded by

daniel.maina2005Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MA2 Mock 1-As - 2023-24

MA2 Mock 1-As - 2023-24

Uploaded by

daniel.maina2005Copyright:

Available Formats

Foundations level

Managing Costs and

Finance

(MA2)

Mock Exam 1

Answers

©2023 ACCA. All rights reserved

Item Answer/Justification

1 B Customer feedback

A Marketing manager needs information relevant to their job – information about customer

satisfaction is vital to the decisions made by the marketing team.

Raw materials and plant and machinery information are essential for production team

managers, and cash flow management is crucial to the Treasury and Finance teams.

2 D Sales staff have targets for customer discounts

Competing products can affect demand for the product.

More efficient production will result in a favourable variance – but this is still an inaccuracy

in the budget.

Tighter regulations will result in higher costs.

If they are part of an agreed target, customer discounts will be included in the budget.

3 D User-targeted

Information specifically designed for management must be targeted at the user.

There is no need for information to be wide-ranging, consistent or complex if those are not

what the user requires.

4 18

Machine operators’ wages $1,500

Materials $300

Total $1,800 for 100 units $18 each

5 C Change suddenly then remain stable over a range of activity levels

A stepped cost is fixed for a specific range of activity, then jumps when the activity level

increases to a particular value – for example, an additional operator will be needed every

time the calls in a call centre go up by 1,000 a week.

6 $250

We can use the high-low method to estimate the fixed and variable elements.

37 units – 10 units= 27 units

$2,100 – $750=$1,350/27 = $50 variable cost

10 units × $50 = $500 variable costs

The total cost for 10 units is $750

Fixed cost = $750 – $500 = $250

7 Budgeted vs actual results Bar chart

Sales by region Pie chart

A bar chart is used to show comparative data and is suitable for showing budgeted vs actual

results.

A pie chart shows data proportionally and is therefore appropriate for showing sales by

region.

A flow chart shows a process from input to output.

© ACCA. All rights reserved. 2

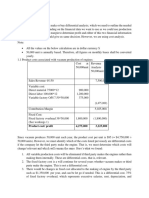

8 $16,175

FIFO assumes that we issue the earliest inventory first

Issue value:

First 150 units for $7,900

Next 100 units for $5,700

Remainder 50 units

= $10,300 / 200 × 50

= $2,575

Total issue value is $16,175

9 D Materials are issued at the current market price

LIFO (Last In First Out) means that the most recent inventory purchase price is used in the

cost of sales.

10 A 43,700 kg

Re-order level

= max usage × max lead time

= 3,100 × 7

= 21,700kg

Max level

= reorder level + reorder quantity – (minimum usage × minimum lead time)

= 21,700 + 30,000 – (2000 × 4)

= 43,700kg

11 C Returns from production

Units

Opening balance 4,982

Receipts 2,197

Issues 2,040

Closing balance 5,139

The count of 5,431 is higher than the book quantity, so only unrecorded returns from

production seem likely.

12 A (Fixed costs + target profit) / contribution per unit

B calculates target sales revenue.

C calculates the selling price.

D calculates the target selling price.

13 C 106%

Capacity utilisation ratio

= actual hours worked/hours budgeted × 100

= 530/500

= 106%

14

Factory rent

Factory cleaner’s wages

An indirect cost cannot be traced back to a cost unit. Therefore, factory rent and the

cleaner’s wages are indirect costs. The clothing and the stuffing are direct materials used

to produce bears and dolls.

15 $17,000

Annual depreciation $

= (cost – residual value) / useful life

= (100,000-15,000) / 5

= 17,000

© ACCA. All rights reserved. 3

16 A Photocopier lease

The costs of cleaning the factory, factory maintenance and depreciation of machinery are

all directly attributable to production. Photocopier lease is not a production cost.

17 A 26.58%

Selling price

= cost × (100 + mark-up)%

Cost = $2,765

Mark-up $

= 3,500 – 2,765 = 735

Mark-up %

= 735 / 2,765

= 26.58%

18 D $0.90

Costs

= 100+40+20+ (100 × (40/20))

= 360

Unit costs

= 360/ (100/0.25)

= $0.90

19 A The product is unique to each customer

A business will use job costing if the output is unique for each customer.

If large numbers of standard items are being produced, then batch costing might be more

appropriate.

Process costing might be more appropriate if there is no clearly defined unit.

20 A $2.50

Cost per service unit

= total costs per period / number of service units.

Total cost

= 5,625 + 1,300 + 1,550 + 525 + 375

= $9,375.

Mark-up 100% so the total selling price of 7,500 sandwiches = 9,375 +9,375 = $18,750.

One sandwich costs 18,750/7,500 = $2.50

21

Perishability

Inconsistency

Tangibility: No, services are not physical

Perishability: Services cannot be stored for future use

Separability: No, the service provider cannot be separated from the service

Inconsistency: Each instance of the service is unique

22 B Machine hours for cost centre A and labour hours for cost centre B

Cost centre A is machine intensive, so the absorption rate should be based on machine

hours. Cost centre B is labour-intensive, so the absorption rate should be based on labour

hours.

© ACCA. All rights reserved. 4

23 Charging whole cost items to a cost centre or cost unit Allocation

Spreading costs over cost centres on a fair basis Apportionment

Allocation: Whole cost items are overheads (indirect costs) that can be entirely related to

a single cost centre.

Apportionment: Common costs need to be shared among different cost centres.

24 $443,750

In the direct method, we only reapportion overheads to the production departments; we

ignore the time spent on the other service cost centres.

Service department A

Total number of employees in the production departments = 90 + 110 = 200

Reapportioned to Production 1 = 90 / 200 × $125,000 = $56,250

Service department B

Total number of machine hours in the production departments = 56 + 104 = 160

Reapportioned to Production 1 = 56 / 160 × $250,000 = $87,500

Total overhead cost to Production 1 = $300,000 + $56,250 + $87,500 = $443,750

25 A $1,375 under absorption

Overheads absorbed = $5.50 × 11,250 = $61,875

Actual overheads = $63,250.

Therefore overheads have been under-absorbed by $63,250 – $61,875 = $1,375

26 B

The break-even point is where contribution equals fixed costs, so the answer is B.

27 B Absorption costing includes all the costs of production

All production costs are included in absorption costing inventory valuation.

28

Production is continuous

Production simultaneously produces multiple products

Products are made to individual customer specifications Process costing is appropriate

where production is continuous and more than one product or by-product may be produced.

29 C The efficiency at which an investment may be converted to cash.

An investment is deemed liquid if it can be readily converted into cash, usually with minimal

loss of value.

30 C $131,250

Cost per unit

= total inputs/total outputs

=350,000/80,000

= $4.375 per kg

Product B

= 30,000 × $4.375

= $131,250

© ACCA. All rights reserved. 5

31 B AA & B

A Sales $

= 50,000 × 25

= 1,250,000

B Sales $

= 30,000 × 30

= 900,000

AA extra revenue $

= (48,000 × 40) – 1,250,000 – 200,000

= 470,000

BB extra revenue $

= (25,000 × 40) – 900,000 – 175,000

= (75,000)

Since further processing product A into AA results in a positive revenue flow, AA should be

produced.

Since further processing of B into BB results in a negative revenue flow, B should not be

processed further.

32 22,000

Breakeven point

= Fixed costs / contribution per unit

= 99,000 / (7.5 – 3)

= 22,000

The breakeven point is 22,000 units.

33 D

Loss occurs when total costs exceed sales revenue. The area where this happens on the

graph is D.

34 B 5,772

Number of units

= (Fixed cost + target profit) / contribution per unit

= ($17,000 + $3,200) / $3.50

= 5,771.43

This is rounded up to 5,772 units, as selling 5,771 units would give a profit of $3,198.50,

less than the target.

35 20,000

Target sales volume

= (Fixed costs + target profit) / contribution per unit

(360,000 + 140,000) / (45 – 20)

= 20,000

36 B $3,000

The relevant labour cost using available spare capacity is nil if it’s already paid. As there

are 100 hours of excess capacity, we need only calculate the cost of 200 hours.

200 hours at time and half: $15 × 200 = $3,000

200 hours at agency rate: $20 = $4,000

As it is cheaper to pay labour to do overtime than to hire agency labour, the relevant cost

is $3,000.

37 54,636

S = P(1+r)n

S = 50,000(1.03)3

S = 54,636

© ACCA. All rights reserved. 6

38 C $23.91m

PV = $5m × 5.582 = $27.91m

NPV =27.91 – 4m = $23.91m

39 D 9.8%

IRR = r + (r − r )

= 0.05 + (8975 / (8975 – (-400)) × (0.1 – 0.05)

= 9.8%

40 A

A business would choose project A because it has the highest IRR and NPV. Note also that

the NPV method is superior to other forms of project appraisal.

41 B Current assets less current liabilities

Working capital is the net amount of all current assets, so working capital is left when all

liabilities have been paid.

42 $307,750

Of the sales made in October, 90% are credit sales; 75% of credit sales will be paid in

two months (i.e. December).

$300,000 × 90% × 75% = $202,500

Of the sales made in November, 90% are credit sales; 25% of credit sales will be paid in

one month (i.e. December).

$290,000 × 90% × 25% = $65,250

Of the sales made in December, 10% are cash sales, so receipts are immediate. $400,000

× 10% = $40,000

Total receipts in December = $202,500 + $65,250 + $40,000 = $307,750

43 B Trying to negotiate better terms with suppliers

Before seeking financing, a business should try to arrange discounts with suppliers, or

longer terms, to improve cash flow.

Postponing payment of staff wages is not a viable option. (may result in legal penalties)

If customers are given longer to pay, the business will wait longer to receive cash, which is

detrimental to cash flow.

Paying cash for purchases means making payments immediately, which would also be

detrimental to cash flow.

44 Boom Decrease cash

Slump Increase cash

Recovery Decrease cash

Recession Increase cash

In a boom or a recovery, when the economy is performing well, businesses should decrease

the amount of cash they hold and invest it profitably.

Businesses should increase their cash reserves to reduce bankruptcy risk in a slump or

recession when the economy is performing poorly,

45 D Purchase payment for non-current assets and payments received

Both the cost of non-current assets and payments received items involve the movement of

cash.

© ACCA. All rights reserved. 7

46 C $15,663

Year Sales Trend

$

20X1 16,000

15,750

20X2 15,500 15,813

15,875

20X3 16,250 15,938

16,000

20X4 15,750 15,663

15,325

20X5 14,900 15,588

15,850

20X6 16,800

47 C 0.85

The seasonal variation = S = A / T

Year Quarter Actual Average Trend S=A/T

20X1 Q1 50

Q2 75 165 55 1.36

Q3 40 140 47 0.85

Q4 25 118 39 0.64

20X2 Q1 53

S = 40 / 47 = 0.85

48 C Sales volume has decreased

Sales volumes decreasing will give rise to lower receipts from customers.

49 C Sale value of by-products reduces costs apportioned to joint products

The sale value of by-products reduces costs apportioned to joint products.

50 B Y, Z, X

For max demand:

Labour requirement = 250 + 750 + 800 = 1,800

Material requirement = 750 + 1,000 + 600 = 2,350 kg

Material is the limiting factor.

Contribution/kg

X = 25/1.5 = 16.67 (third)

Y = 22/1 = 22 (first)

Z = 15/0.75 = 20 (second)

Products should be prioritised for production by the highest contribution per limiting factor

first.

© ACCA. All rights reserved. 8

You might also like

- 4 V's of OperationDocument6 pages4 V's of OperationRahul Agarwal85% (20)

- MA2 Mock 2-As - 2023-24Document8 pagesMA2 Mock 2-As - 2023-24daniel.maina2005No ratings yet

- Lazada Group Assignment 1 Business ReportDocument37 pagesLazada Group Assignment 1 Business ReportAmieNo ratings yet

- Solution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadDocument25 pagesSolution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadGaryLeemtno100% (49)

- Manac Quiz 2 With AnswersDocument4 pagesManac Quiz 2 With AnswersReymilyn Sanchez78% (9)

- Brazil Localization WorkshopDocument211 pagesBrazil Localization Workshoprobertoabe100% (2)

- Business Plan of Manufacturing Air PurifiersDocument7 pagesBusiness Plan of Manufacturing Air PurifiersSakshi BaiwalNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11jasperkennedy089% (28)

- Exhibit 4-5 Chan Audio Company: Current RatioDocument35 pagesExhibit 4-5 Chan Audio Company: Current Ratiofokica840% (1)

- ACCA F5 Course Notes PDFDocument330 pagesACCA F5 Course Notes PDFAmanda7100% (1)

- PM IPRO Mock 1 Sol.Document15 pagesPM IPRO Mock 1 Sol.SHIVAM BARANWALNo ratings yet

- F5 - IPRO - Mock 1 - AnswersDocument16 pagesF5 - IPRO - Mock 1 - AnswersYashna SohawonNo ratings yet

- ACCA F5 Course NotesDocument273 pagesACCA F5 Course NotesLinkon Peter50% (2)

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument34 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsGuinevereNo ratings yet

- Managerial Accounting 6th Edition Jiambalvo Solutions ManualDocument24 pagesManagerial Accounting 6th Edition Jiambalvo Solutions Manualgenevievetruong9ajpr100% (30)

- F2 Mock Answers 1Document16 pagesF2 Mock Answers 1ShruthiNo ratings yet

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- 4.basics of Marginal Costing-SN FoundationDocument22 pages4.basics of Marginal Costing-SN FoundationHasim SaiyedNo ratings yet

- Chapter 2 Cost Concepts and Design Economics PART 2 With AssignmentDocument30 pagesChapter 2 Cost Concepts and Design Economics PART 2 With AssignmentrplagrosaNo ratings yet

- CVP, Variable Costing and Absorption CostingDocument7 pagesCVP, Variable Costing and Absorption CostingHannah Vaniza NapolesNo ratings yet

- Managerial Accounting 5th Edition Jiambalvo Solutions ManualDocument25 pagesManagerial Accounting 5th Edition Jiambalvo Solutions Manualnhattranel7k1100% (31)

- MA and FMA Full Specimen Exam AnswersDocument14 pagesMA and FMA Full Specimen Exam AnswersLanre OdubanjoNo ratings yet

- Break - Even Analysis Exercises: On Contributi Ts Fixed CosDocument7 pagesBreak - Even Analysis Exercises: On Contributi Ts Fixed Cospunte77No ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11Document44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11kkamjonginnNo ratings yet

- Ac 202 Answers NewDocument8 pagesAc 202 Answers NewSashia HassanNo ratings yet

- HorngrenIMA14eSM ch13Document73 pagesHorngrenIMA14eSM ch13Piyal Hossain100% (1)

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument39 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsElijah MontefalcoNo ratings yet

- Answers: K Aplan P Ublish in GDocument16 pagesAnswers: K Aplan P Ublish in GqqqNo ratings yet

- Past Year 2019 Sem 2 Ans (ZW)Document4 pagesPast Year 2019 Sem 2 Ans (ZW)zhaoweiNo ratings yet

- Cost Based PricingDocument5 pagesCost Based PricingShivany GuerreroNo ratings yet

- Short-Run CostDocument24 pagesShort-Run CostLinh PhamNo ratings yet

- 07 CostDocument45 pages07 CostBhaskar KondaNo ratings yet

- Absorption and Variable Costing, and Inventory Management: Discussion QuestionsDocument28 pagesAbsorption and Variable Costing, and Inventory Management: Discussion QuestionsParth GandhiNo ratings yet

- Chapter 4 ACCA F2Document7 pagesChapter 4 ACCA F2siksha100% (1)

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- F2 Mock Answers 2Document17 pagesF2 Mock Answers 2ShruthiNo ratings yet

- Variable vs. Absorption CostingDocument21 pagesVariable vs. Absorption Costingsgulay117No ratings yet

- COMA Mid Term - 2022-23 V1 - SolutionsDocument6 pagesCOMA Mid Term - 2022-23 V1 - SolutionssurajNo ratings yet

- ACCT 401 CH 8 EXE TEXTBOOK AnswersDocument30 pagesACCT 401 CH 8 EXE TEXTBOOK Answersmohammed azizNo ratings yet

- 017 - CAMIST - SamplePaper - A - Amndd - HS - PP 329-344 - BW - SecDocument16 pages017 - CAMIST - SamplePaper - A - Amndd - HS - PP 329-344 - BW - Secsumaiazerin101No ratings yet

- FinanceDocument8 pagesFinanceJøÿå BhardwajNo ratings yet

- Ebook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFDocument51 pagesEbook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFxaviaalexandrawp86i100% (14)

- Marginal Costing NotesDocument7 pagesMarginal Costing NotesJul 480weshNo ratings yet

- Lecture 5Document39 pagesLecture 5Shixi ZhuNo ratings yet

- CH 04Document40 pagesCH 04thrust_xone100% (1)

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDocument36 pagesSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th Editionsaxonic.hamose0p9698% (53)

- MA and FMA Full Specimen Exam Answers - 2Document14 pagesMA and FMA Full Specimen Exam Answers - 2zunndraaNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Product Cost/ Profit 4,275,000 3,225,000Document4 pagesProduct Cost/ Profit 4,275,000 3,225,000odutola odunayoNo ratings yet

- ASAL Business CB Chapter 31 AnswersDocument12 pagesASAL Business CB Chapter 31 Answers-shinagami-No ratings yet

- Chapter 8 MowenDocument25 pagesChapter 8 MowenRosamae PialaneNo ratings yet

- Final ExamDocument9 pagesFinal ExamWaizin KyawNo ratings yet

- ACT202 - Chapter 6Document38 pagesACT202 - Chapter 6arafkhan1623No ratings yet

- Act 202 Chapter 6Document40 pagesAct 202 Chapter 6Shaon KhanNo ratings yet

- Account StatementDocument100 pagesAccount StatementGhulam HussainNo ratings yet

- Week 9 - 10 - OverheadDocument44 pagesWeek 9 - 10 - OverheadMohammad EhsanNo ratings yet

- Lecture 6 - ABC Costing RevisedDocument22 pagesLecture 6 - ABC Costing RevisedMJ jNo ratings yet

- Unit 1 - Capital Budgeting PDFDocument48 pagesUnit 1 - Capital Budgeting PDFDharaneeshwar SKNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- BOB Finance & Credit Specialist Officer SII Model Question Paper 4Document147 pagesBOB Finance & Credit Specialist Officer SII Model Question Paper 4Pranav KumarNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Faith and Reason 7 - The Bible (III, IV) - Properties, InterpretationDocument40 pagesFaith and Reason 7 - The Bible (III, IV) - Properties, Interpretationdaniel.maina2005No ratings yet

- Bfs&Bcom Measure of DispersionDocument32 pagesBfs&Bcom Measure of Dispersiondaniel.maina2005No ratings yet

- 2.manufacturing Accounts IllustrationDocument2 pages2.manufacturing Accounts Illustrationdaniel.maina2005No ratings yet

- Agan BCM 1201 Jan March 2024 Course Outline and Delivery Plan W Agan-1Document6 pagesAgan BCM 1201 Jan March 2024 Course Outline and Delivery Plan W Agan-1daniel.maina2005No ratings yet

- Accounting For Companies-1Document50 pagesAccounting For Companies-1daniel.maina2005No ratings yet

- 2023 24 MA2 AQB OT Set 2 QuestionsDocument12 pages2023 24 MA2 AQB OT Set 2 Questionsdaniel.maina2005No ratings yet

- Assignment 3 MRP Roll Inc V 001233438Document3 pagesAssignment 3 MRP Roll Inc V 001233438Sunayana ThakurNo ratings yet

- Budgeting PDFDocument28 pagesBudgeting PDFreenza velascoNo ratings yet

- Impact of SAP Implementation On RetailDocument40 pagesImpact of SAP Implementation On RetailParijatNo ratings yet

- EOQ Vs EPQDocument18 pagesEOQ Vs EPQParidhi Aggarwal100% (1)

- What Is ASRSDocument7 pagesWhat Is ASRSAzri Lundu0% (1)

- Working Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerDocument83 pagesWorking Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerPranay Jindal71% (7)

- Achieving Operational Excellence and Customer Intimacy Enterprise ApplicationsDocument46 pagesAchieving Operational Excellence and Customer Intimacy Enterprise ApplicationsHitesh BhardwajNo ratings yet

- Apparel Manufacturing: Business SolutionDocument13 pagesApparel Manufacturing: Business SolutionSachin PilaniwalaNo ratings yet

- Operations Management: William J. StevensonDocument30 pagesOperations Management: William J. StevensonTarkeshwar ThakurNo ratings yet

- Gopi Inventory-ManagementDocument9 pagesGopi Inventory-Managementvasantawada Gopi krishnaNo ratings yet

- GIMPA-CILT Competitive AdvantageDocument12 pagesGIMPA-CILT Competitive AdvantageSamuel Kwame YeboahNo ratings yet

- Sapphire Group 4Document32 pagesSapphire Group 4Ahsan AnsariNo ratings yet

- Services Retailing AND LOGISTIICSDocument47 pagesServices Retailing AND LOGISTIICSPink100% (2)

- Past Paper Erp ShortDocument6 pagesPast Paper Erp Shortrumi noorNo ratings yet

- Financial Analysis - ITC - AsimBhawsinghka PDFDocument13 pagesFinancial Analysis - ITC - AsimBhawsinghka PDFAsim BhawsinghkaNo ratings yet

- Bharath Electronics ReportDocument72 pagesBharath Electronics ReportSathyanarayana SrsNo ratings yet

- I. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 9, 2020. (2 Pts Each)Document9 pagesI. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 9, 2020. (2 Pts Each)Hazel Seguerra BicadaNo ratings yet

- Costing UG v2012EE PDFDocument124 pagesCosting UG v2012EE PDFKumarNo ratings yet

- Financial Analysis of Habib Bank LimitedDocument27 pagesFinancial Analysis of Habib Bank LimitedRabab Ali50% (2)

- 2.lean Production and Agile Manufacturing PDFDocument16 pages2.lean Production and Agile Manufacturing PDFMahmoud Zregat0% (1)

- Design Phase Financial Organizational StructureDocument22 pagesDesign Phase Financial Organizational Structureranga2702No ratings yet

- SUPPLY CHAIN MANAGEMENT (LinkedIn Learning)Document5 pagesSUPPLY CHAIN MANAGEMENT (LinkedIn Learning)Floretta FellingNo ratings yet

- CT DrugstoreDocument6 pagesCT DrugstoreRomar MedeloNo ratings yet

- Working Capital of Borrower-Bank of BarodaDocument82 pagesWorking Capital of Borrower-Bank of BarodaRaj KopadeNo ratings yet

- Funda 2Document20 pagesFunda 2Lorraine Miralles67% (3)