Professional Documents

Culture Documents

Accounting Information System Performance Task Week 6

Accounting Information System Performance Task Week 6

Uploaded by

Cristel Ann Dotimas0 ratings0% found this document useful (0 votes)

8 views1 pageThis document is from Tarlac Christian College and contains a Bible verse about studying the word of God. It provides the name and course information for a student, Cristel Ann L. Dotimas, along with a performance task assignment on credit instruments from Chapter 4. The assignment contains 12 review questions about the definition and types of credit instruments such as promissory notes, bonds, stocks, and checks.

Original Description:

Original Title

Accounting-Information-System-Performance-Task-Week-6

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is from Tarlac Christian College and contains a Bible verse about studying the word of God. It provides the name and course information for a student, Cristel Ann L. Dotimas, along with a performance task assignment on credit instruments from Chapter 4. The assignment contains 12 review questions about the definition and types of credit instruments such as promissory notes, bonds, stocks, and checks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views1 pageAccounting Information System Performance Task Week 6

Accounting Information System Performance Task Week 6

Uploaded by

Cristel Ann DotimasThis document is from Tarlac Christian College and contains a Bible verse about studying the word of God. It provides the name and course information for a student, Cristel Ann L. Dotimas, along with a performance task assignment on credit instruments from Chapter 4. The assignment contains 12 review questions about the definition and types of credit instruments such as promissory notes, bonds, stocks, and checks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

TARLAC CHRISTIAN COLLEGE

5085 Buno Matatalaib, Tarlac City

STUDY TO SHEW THYSELF APPROVED UNTO GOD,

A workman that needeth not to be ashamed, rightly dividing the word of

truth. (II Timothy 2:15)

Name: CRISTEL ANN L. DOTIMAS Score:

Course/Year: BSA-2 Date:

Performance Task (Week 6)

Chapter 4 – Credit Instruments

II. Review Questions

1. What is a credit instrument?

A credit instrument is like an "I owe you" note. It's a promise to pay back money you

borrow. Imagine you need $100. A credit instrument would say, "I promise to pay back $100

by June 1st." It's a way to get money now and pay it back later.

2. What are the characteristics of credit instruments?

Credit instruments have a few parts. First, they say how much money is borrowed. Then,

they talk about when the money needs to be paid back. Sometimes, they also mention how

much extra money (interest) needs to be paid. They also say who is borrowing and who is

lending the money.

3. What are some of the functions of credit instruments?

Credit instruments help people and businesses get money when they need it. They also help

move money around. For example, if you need to buy something from another country, a

credit instrument can help you pay for it.

4. What are the two classifications of credit instruments?

Credit instruments are classified as negotiable or non-negotiable. Negotiable means they can

be transferred to someone else. Non-negotiable means they can't be transferred.

5. What are the kinds of bonds?

Bonds are like loans you give to companies or governments. There are different types of

bonds. Some are from companies (corporate bonds), and others are from governments

(government bonds).

6. What are the advantages of bonds?

Bonds can give you regular payments, like interest. They are often seen as safer than stocks

because if a company goes broke, bondholders get paid before stockholders.

7. What are the kinds of stocks?

Stocks are like owning a piece of a company. There are common stocks, which let you vote

on company decisions, and preferred stocks, which give you priority in getting paid.

8. What are commercial credit instruments?

Commercial credit instruments are used in business deals. They include things like bills of

exchange and promissory notes.

9. What is a cheque?

A cheque is a written order to a bank to pay someone a certain amount of money from your

account.

10. What are the kinds of cheques?

There are two main types of cheques: bearer cheques, which anyone can cash, and order

cheques, which are only for specific people.

11. What are the types of bills of exchange?

Bills of exchange are like IOUs used in trade or for loans. There are different types, like

trade bills and accommodation bills.

12. How are credit instruments negotiated?

Credit instruments can be transferred by signing them over to someone else or by giving

them to someone else.

You might also like

- Lesson 6 - CreditDocument52 pagesLesson 6 - CreditDianne Joy MempinNo ratings yet

- Cargo Arrival NoticeDocument2 pagesCargo Arrival NoticeSanjay RathodNo ratings yet

- Secret Service Enhanced Fin Powers Forest Go 2 2004Document10 pagesSecret Service Enhanced Fin Powers Forest Go 2 2004dfokzr50% (2)

- Unit 3 Microeconomics Chapter 17 Money and Banking Chapter 18 Workers Chapter 19 Trade UnionsDocument94 pagesUnit 3 Microeconomics Chapter 17 Money and Banking Chapter 18 Workers Chapter 19 Trade Unionseren parkNo ratings yet

- Midterm Money and BankingDocument18 pagesMidterm Money and BankingRuslan MagamedovNo ratings yet

- Money and Banking, IG - 1Document26 pagesMoney and Banking, IG - 1ANSHIKA CHAUHAN100% (1)

- Money and Banking-WPS OfficeDocument8 pagesMoney and Banking-WPS Officemuskansajid517No ratings yet

- CBSE Class 10 EconomicsDocument4 pagesCBSE Class 10 EconomicsVishal DeyNo ratings yet

- Presentation On Money & BankingDocument15 pagesPresentation On Money & BankingRahul VyasNo ratings yet

- FM 303 Chapter 1Document9 pagesFM 303 Chapter 1Eve HittyNo ratings yet

- Functions of MoneyDocument7 pagesFunctions of MoneyShayan YasirNo ratings yet

- Quiz 3 MidtermDocument4 pagesQuiz 3 MidtermAlicia Dawn A. OlimbaNo ratings yet

- Quiz 3 MidtermDocument4 pagesQuiz 3 MidtermAlicia Dawn A. OlimbaNo ratings yet

- Financial Literacy Scavenger HuntDocument3 pagesFinancial Literacy Scavenger HuntDIEGO ALEJANDRO VELEZ AQUINONo ratings yet

- Classical Neoclassical Economics Mainstream Economics Bank Deposits Loans Heterodox Economists Assets Liabilities Savers BorrowersDocument20 pagesClassical Neoclassical Economics Mainstream Economics Bank Deposits Loans Heterodox Economists Assets Liabilities Savers BorrowersKajal ChaudharyNo ratings yet

- Support Guide01BF Wk02Document28 pagesSupport Guide01BF Wk02ranbr17No ratings yet

- POB Notes For Revision: Asif MohammedDocument67 pagesPOB Notes For Revision: Asif MohammedFreakshow38No ratings yet

- What Is Asset ManagementDocument7 pagesWhat Is Asset ManagementAhyessa GetesNo ratings yet

- What Is Money?: BarterDocument7 pagesWhat Is Money?: BarterHassan NisarNo ratings yet

- Money and Credit Class 10 Notes CBSE Economics Chapter 3 (PDF)Document9 pagesMoney and Credit Class 10 Notes CBSE Economics Chapter 3 (PDF)jangdesarthakNo ratings yet

- 2Document7 pages2Anitej SinghNo ratings yet

- Kel. 1 BankDocument10 pagesKel. 1 BankAnita AnandaNo ratings yet

- Felicia Irene Week 9Document20 pagesFelicia Irene Week 9felicia ireneNo ratings yet

- Hidayatullah National Law University Raipur, Chhattisgarh: Economics ProjectDocument19 pagesHidayatullah National Law University Raipur, Chhattisgarh: Economics ProjectShikha SidarNo ratings yet

- Bonds and Debentures As Per Companies Act 1973Document12 pagesBonds and Debentures As Per Companies Act 1973Sonal Pawar100% (1)

- GB - 3-11thDocument15 pagesGB - 3-11thanonymouslegionn665No ratings yet

- CRC11A1 Chapter 1Document18 pagesCRC11A1 Chapter 1Shelly nomakhosi MsizaNo ratings yet

- 1 Meaning Classification Nature and Function of CreditDocument7 pages1 Meaning Classification Nature and Function of CreditMartije MonesaNo ratings yet

- Chapter 16 IGCSEDocument74 pagesChapter 16 IGCSEtaj qaiserNo ratings yet

- 1LMD - Test 03 - Types of Financial Institutions 2nd VersionDocument4 pages1LMD - Test 03 - Types of Financial Institutions 2nd Versionimen DEBBANo ratings yet

- Parkinmacro8 (25) 1200Document20 pagesParkinmacro8 (25) 1200nikowawa100% (1)

- Canilang, Julius Ceasar Duarte, Mary Lyn Flores, John Robin: Name: Betiola, Rachelle AnnDocument8 pagesCanilang, Julius Ceasar Duarte, Mary Lyn Flores, John Robin: Name: Betiola, Rachelle AnnMary Lyn DuarteNo ratings yet

- Macroeconomics Parkin 11th Edition Solutions ManualDocument20 pagesMacroeconomics Parkin 11th Edition Solutions ManualEricaGatespxje100% (45)

- College of Management: Capiz State UniversityDocument10 pagesCollege of Management: Capiz State UniversityLenlyn SalvadorNo ratings yet

- Slide For StudentDocument37 pagesSlide For StudentLan AnhNo ratings yet

- Account, Money and Capital MarketDocument3 pagesAccount, Money and Capital Marketrao hafeezNo ratings yet

- Notes - Money & Credit - Class X - EconomicsDocument9 pagesNotes - Money & Credit - Class X - EconomicsabhinavsinghbaliyanraghuvanshiNo ratings yet

- 1 - Financial DecisionsDocument9 pages1 - Financial DecisionsByamaka ObedNo ratings yet

- Fundamental of Financial Markets & Institutions: Preston University IslamabadDocument4 pagesFundamental of Financial Markets & Institutions: Preston University Islamabadjuni26287No ratings yet

- Economics ChapDocument8 pagesEconomics ChapJose J OlickalNo ratings yet

- Chapter - 5: MoneyDocument16 pagesChapter - 5: MoneyBeing NarratedNo ratings yet

- Macroeconomics Module 5Document6 pagesMacroeconomics Module 5Jonnel GadinganNo ratings yet

- TA Chuyên NgànhDocument10 pagesTA Chuyên NgànhChan NuckNo ratings yet

- CIE IGCSE Unit 3.1 - Money and Banking - Miss PatelDocument31 pagesCIE IGCSE Unit 3.1 - Money and Banking - Miss PatelJingyao HanNo ratings yet

- DEvelop Understanding of Consumer Debt and CrditDocument44 pagesDEvelop Understanding of Consumer Debt and CrditAbel Zegeye100% (5)

- Gold StandardDocument6 pagesGold StandardYonatan TekleNo ratings yet

- Digital LendingpdfDocument36 pagesDigital Lendingpdflucifer smithNo ratings yet

- Banking LawDocument13 pagesBanking Lawprithvi yadavNo ratings yet

- Macroeconomics 11th Edition Parkin Solutions ManualDocument21 pagesMacroeconomics 11th Edition Parkin Solutions Manualdencuongpow5100% (23)

- What Is A Bank?Document6 pagesWhat Is A Bank?Bhabani Sankar DashNo ratings yet

- Chapter2. Financial Inst&capital ArketsDocument12 pagesChapter2. Financial Inst&capital Arketsnewaybeyene5No ratings yet

- 5fb8aa157f899075e8d880ef 5e9a092ba8446510cc99fb5a 1615282586341 1636704765310Document11 pages5fb8aa157f899075e8d880ef 5e9a092ba8446510cc99fb5a 1615282586341 1636704765310ZULNo ratings yet

- Banking Principles and ProceduresDocument39 pagesBanking Principles and ProceduresEyob FekaduNo ratings yet

- Ch-5 MONEYDocument6 pagesCh-5 MONEYYoshita ShahNo ratings yet

- Revise-BANKS AND CREDIT INSTITUTIONS - sv1.0Document10 pagesRevise-BANKS AND CREDIT INSTITUTIONS - sv1.0k60.2112340010No ratings yet

- Commercial Bank - Chapter #1Document4 pagesCommercial Bank - Chapter #1Tito R. GarcíaNo ratings yet

- MONEYDocument4 pagesMONEYanuj65019No ratings yet

- Lesson 1Document4 pagesLesson 1Angelica MagdaraogNo ratings yet

- Objectives: Barter SystemDocument5 pagesObjectives: Barter SystemAmit MittalNo ratings yet

- Lu 2 - CH14Document50 pagesLu 2 - CH14bison3216No ratings yet

- Tax On Certain Passive IncomeDocument2 pagesTax On Certain Passive IncomeCristel Ann DotimasNo ratings yet

- TH 221 Activity 5Document1 pageTH 221 Activity 5Cristel Ann DotimasNo ratings yet

- Groupwork 3 Week 6Document1 pageGroupwork 3 Week 6Cristel Ann DotimasNo ratings yet

- A4-Week-7 ETHICSDocument1 pageA4-Week-7 ETHICSCristel Ann DotimasNo ratings yet

- A-4-Week-7 HBODocument2 pagesA-4-Week-7 HBOCristel Ann DotimasNo ratings yet

- Ais Week 4Document2 pagesAis Week 4Cristel Ann DotimasNo ratings yet

- Bank of America V Associated Citizens Bank (Lacurom)Document2 pagesBank of America V Associated Citizens Bank (Lacurom)Kako Schulze Cojuangco100% (1)

- Internship Report On Muslim Commercial Bank: Sehrish KhalidDocument67 pagesInternship Report On Muslim Commercial Bank: Sehrish KhalidSana JavaidNo ratings yet

- 2negotiable InstrumentDocument8 pages2negotiable Instrumenttanjimalomturjo1No ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- Section 43B (H) Boon BaneDocument60 pagesSection 43B (H) Boon BanespacenscapearchitectsNo ratings yet

- Shubham MoreDocument60 pagesShubham MoreNagesh MoreNo ratings yet

- Casino Opening and Closing Procedures 2017Document4 pagesCasino Opening and Closing Procedures 2017Angela BrownNo ratings yet

- AuditingDocument33 pagesAuditingbajujuNo ratings yet

- International Gcse: Mark Scheme Maximum Mark: 80Document40 pagesInternational Gcse: Mark Scheme Maximum Mark: 80Y_Bomb0% (1)

- Oracle AR Interview QuestionsDocument10 pagesOracle AR Interview QuestionsMrityunjay Kant AggarwalNo ratings yet

- Your Vodafone Bill: ImmediateDocument2 pagesYour Vodafone Bill: ImmediateSharan BasuNo ratings yet

- 1.kobank Application Form (Pls Print in Color)Document1 page1.kobank Application Form (Pls Print in Color)api-19759090No ratings yet

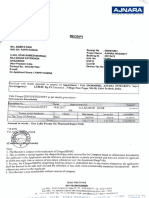

- Ajnara: ReceiptDocument1 pageAjnara: ReceiptTarasha 4everNo ratings yet

- TitleDocument4 pagesTitlekaran kheraNo ratings yet

- Llorente vs. Star City Pty Limited, 928 SCRA 525, January 15, 2020Document29 pagesLlorente vs. Star City Pty Limited, 928 SCRA 525, January 15, 2020alvindadacayNo ratings yet

- In Re Clifton J SpearsDocument9 pagesIn Re Clifton J SpearswstNo ratings yet

- Booking Form AuditoriumDocument2 pagesBooking Form AuditoriumAnirudh SabooNo ratings yet

- Form 1196 - Sponsoring Overseas Employees To Work Temporarily in AustraliaDocument14 pagesForm 1196 - Sponsoring Overseas Employees To Work Temporarily in Australiadotnet4No ratings yet

- Https WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFDocument1 pageHttps WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFSyed HanafieNo ratings yet

- Municipal Committee Safidon: Tender Document FORDocument19 pagesMunicipal Committee Safidon: Tender Document FORShashikant GaurNo ratings yet

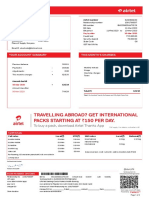

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesBASHARAT KHANNo ratings yet

- Fees Structure For 2020: P. O. BOX 46988 (00100) NAIROBI, Kenya TEL 020 2112655 (Ngong/Rd) or 020 2112657 (Karen)Document2 pagesFees Structure For 2020: P. O. BOX 46988 (00100) NAIROBI, Kenya TEL 020 2112655 (Ngong/Rd) or 020 2112657 (Karen)ericm100% (1)

- 1410160576Document2 pages1410160576UdkxkNo ratings yet

- Airline-Reservation-System VB & MisDocument58 pagesAirline-Reservation-System VB & MisSatish Singh ॐ100% (5)

- Banking - Class November 10Document5 pagesBanking - Class November 10Andrea PonceNo ratings yet

- 2012 Bar ExaminationsDocument182 pages2012 Bar ExaminationsLarry BugaringNo ratings yet

- Your Visa Card Statement: From Overseas Tel 44 1226 261 010Document3 pagesYour Visa Card Statement: From Overseas Tel 44 1226 261 010Toni MirosanuNo ratings yet

- Advanced Education-Standard Internal FormsDocument646 pagesAdvanced Education-Standard Internal FormsUnited Conservative Party CaucusNo ratings yet