Professional Documents

Culture Documents

1a. Salary (GHS) - Solved

1a. Salary (GHS) - Solved

Uploaded by

kinzaafatima220 ratings0% found this document useful (0 votes)

7 views3 pagesMr. A worked as an assistant manager and received various compensation packages in tax year 2024, including a basic salary of Rs. 40,000 per month, a one-time bonus of Rs. 50,000, and overtime of Rs. 20,000 for the year. He also received benefits such as a free refrigerator, company vehicle and driver, rent-free accommodation, and a medical allowance. When he resigned, he received a golden handshake of Rs. 1,000,000. The document provides details of Mr. A's compensation and calculates his tax liability for 2024.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMr. A worked as an assistant manager and received various compensation packages in tax year 2024, including a basic salary of Rs. 40,000 per month, a one-time bonus of Rs. 50,000, and overtime of Rs. 20,000 for the year. He also received benefits such as a free refrigerator, company vehicle and driver, rent-free accommodation, and a medical allowance. When he resigned, he received a golden handshake of Rs. 1,000,000. The document provides details of Mr. A's compensation and calculates his tax liability for 2024.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views3 pages1a. Salary (GHS) - Solved

1a. Salary (GHS) - Solved

Uploaded by

kinzaafatima22Mr. A worked as an assistant manager and received various compensation packages in tax year 2024, including a basic salary of Rs. 40,000 per month, a one-time bonus of Rs. 50,000, and overtime of Rs. 20,000 for the year. He also received benefits such as a free refrigerator, company vehicle and driver, rent-free accommodation, and a medical allowance. When he resigned, he received a golden handshake of Rs. 1,000,000. The document provides details of Mr. A's compensation and calculates his tax liability for 2024.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Mr. A worked in a company as assistant manager accounts.

For the tax year 2024 his salary package was as follows:

Basic Salary 40,000 Per Month

Bonus 50,000 Onetime

Overtime 20,000 For the year

Refrigerator provided free of cost

- Market Value 50,000

Company maintained Vehicle (For personal use)

- Cost of Vehicle 1,200,000

- Salary Of Driver paid by employer 10,000 Per Month

Rent Free Accommodation

- Market Rent 15,000 Per Month

Medical Allowance 5,000 Per Month

At the end of tax year Mr.A resigned from job and was paid 1,000,000 as golden

handshake.

Calculate the tax liability of Mr. A for tax year 2024.

PREVIOUS YEARS DATA:

YEAR TAX Liability TAXABLE Income

2021 2,500 700,000

2022 5,000 800,000

2023 7,500 900,000

SOLUTION:

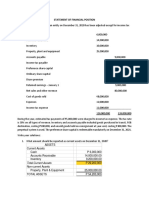

Computation of tax liability of Mr.A for tax year 2024 under NTR:

Income from salary (N-1) 1,844,000

Taxable income 1,844,000

Tax liability 144,700

(N-1)

Basic salary 360,000

Bonus 50,000

Over time 20,000

Gift 50,000

Conveyance 120,000

Driver 120,000

RFA 180,000

Medical allowance 24000

G.H.S 1000,000

1,844,000

Method 2:

Computation of tax liability of Mr.A for tax year

2024 under N.T.R:

Income from salary (N-1) 844000

Taxable income 844000

Tax liability 23900

UNDER S.T.R

1000,000 X Average rate = 7.77%

Total tax liability =7777+23900 = 31677

You might also like

- Compiled Exercises FAR 1Document59 pagesCompiled Exercises FAR 1KianJohnCentenoTurico100% (7)

- 2023-Quiz (Income From Salary)Document7 pages2023-Quiz (Income From Salary)SunnyNo ratings yet

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- PGP I 2021 Fra Quiz 1Document3 pagesPGP I 2021 Fra Quiz 1Pulkit SethiaNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Discussions Updated 24.03Document28 pagesDiscussions Updated 24.03rajawatswadheentaNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Suggested Nov 2019Document23 pagesSuggested Nov 2019just Konkan thingsNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Audit of CoE, CB, AB, SES and PPE - SW10Document8 pagesAudit of CoE, CB, AB, SES and PPE - SW10d.pagkatoytoyNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- Tax Unit 2Document70 pagesTax Unit 2avinash.as106No ratings yet

- ERROR CORRECTION Answer PDFDocument3 pagesERROR CORRECTION Answer PDFreenza velasco100% (2)

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Accounting Methods and Installment ReportingDocument40 pagesAccounting Methods and Installment ReportingKatherine EderosasNo ratings yet

- DeanDocument16 pagesDeanJames De TorresNo ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- Prevalidation TaxDocument5 pagesPrevalidation TaxJon Dumagil Inocentes, CPANo ratings yet

- Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Document3 pagesUse The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Irvin LevieNo ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Thor Semiconductor Is An Exporter of Transistors To The United StatesDocument6 pagesThor Semiconductor Is An Exporter of Transistors To The United StatesSophia KeratinNo ratings yet

- Income-Taxation CompressDocument27 pagesIncome-Taxation CompressRochel Ada-olNo ratings yet

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- AUDI315 Problems - Employee Benefits and Deferred TaxesDocument3 pagesAUDI315 Problems - Employee Benefits and Deferred TaxesRinoah Mae OlorosoNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Accounting For Taxes Employee BenefitsDocument6 pagesAccounting For Taxes Employee BenefitsBess Tuico MasanqueNo ratings yet

- Quizzz Intac 3Document10 pagesQuizzz Intac 3lana del reyNo ratings yet

- Lecfor12 19 20Document8 pagesLecfor12 19 20Laong laanNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- IA3 - REVIEWER - Internediate 3Document38 pagesIA3 - REVIEWER - Internediate 3Mujahad QuirinoNo ratings yet

- Assessment of FIrms AssignmentDocument8 pagesAssessment of FIrms Assignmentsuhask890No ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- CamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Document9 pagesCamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Soeung SereyvanttanaNo ratings yet

- Eyatid 06activity1Document2 pagesEyatid 06activity1Allan vincent EyatidNo ratings yet

- Inclusions To Gross Income Illustrative ExamplesDocument5 pagesInclusions To Gross Income Illustrative ExamplesMary Rose CredoNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Special Allowable Itemized DeductionsDocument13 pagesSpecial Allowable Itemized DeductionsSandia EspejoNo ratings yet

- Problem Quiz On IntermediateDocument3 pagesProblem Quiz On IntermediateReginald ValenciaNo ratings yet

- Tax July 21 SugesstedDocument28 pagesTax July 21 SugesstedShailjaNo ratings yet

- Accounting For Income and Deferred TaxesDocument3 pagesAccounting For Income and Deferred TaxesChesterTVNo ratings yet

- Far First PB 1017Document25 pagesFar First PB 1017Din Rose Gonzales100% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet