Professional Documents

Culture Documents

C 592

C 592

Uploaded by

rishi rai saxenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C 592

C 592

Uploaded by

rishi rai saxenaCopyright:

Available Formats

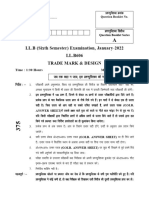

Paper Code: C-592

Roll Number:

EXAMINATION: Nov-Dec 2022

B.Com. (HONOURS) ACCOUNTS PART-III (Semester-V)

Subject: Commerce Paper: Honours-II

Title: Indirect Taxes - Goods and Service Tax

Maximum Marks: 150 Duration: 3 hrs. (Part-A: 20 min. and Part-B & C: 2:40 hrs.)

Note: All questions are compulsory. Distribution of marks is given in the relevant section. In the question paper do not write

anything other than roll number.

lHkh iz'u vfuok;Z gSaA vadksa dk forj.k lEcfU/kr [k.Mksa esa fn;k x;k gSA iz’ui= esa vuqØekad ds vfrfjDr dqN Hkh uk fy[ksaA

PART - A

(MULTIPLE CHOICE QUESTIONS)

Note: Separate OMR Sheet for marking the correct options of multiple choice question paper is provided. Mark your option

on the OMR Sheet by properly darkening the circle.

cgqfodYih; iz’uksa ds lgh fodYi vafdr djus ds fy;s i`Fkd OMR Sheet nh xbZ gSA vius fodYi blh 'khV ij iw.kZ :i ls xksys

dks Hkj dj vafdr djsaA

Marks: 30 (20 questions of 1.5 marks each)

A-01: Which is the commodity kept outside the purview of GST?

th-,l-Vh- ls ckgj dkSu&lh oLrq@eky gS\

(A) Tobacco and tobacco product rEckdw ,oa rEckdw mRikn

(B) Petroleum product isVªksfy;e mRikn

(C) Edible oil [kk|&rsy

(D) Domestic LPG ?kjsyw LPG

A-02: Which tax is levied in case of intra-state supply?

jkT; ds vUnj iwfrZ ij dkSu&lk dj mn~xzg.kh; gS\

(A) CGST (B) SGST (C) CGST and SGST (D) IGST

A-03: What is time of supply of goods?

eky dh iwfrZ dk le; dc gksrk gS\

(A) Date of issue of invoice chtd fuxZeu dh frfFk ij

(B) Date of receipt of consideration by the supplier iwfrZdrkZ }kjk izfrQy izkIr gksus dh frfFk ij

(C) Date of dispatch of goods eky ds izs"k.k dh frfFk ij

(D) Earlier of (A) and (B) (A) ,oa (B) esa tks igys gks

A-04: Which of the following taxes will be levied on imports?

vk;kr ij fuEukafdr esa ls dkSu&lk dj ykxw gS\

(A) CGST (B) SGST (C) IGST (D) CGST and SGST

A-05: The time limit to pay the value of supply with taxes to avail the input tax credit?

buiqV VSDl ØsfMV dh miyfC/k ds fy, dj lfgr iwfrZ ds ewY; ds Hkwxrku dh le; lhek gS\

(A) Three months rhu ekg

(B) Six months N% ekg

(C) One hundred and eighty days 180 fnu

(D) Till the date of filling of Annual return okf"kZd fooj.kh izLrqr djus rd

A-06: What is the validity of the registration certificate?

iath;u izek.k&i= dh oS/krk fdruh gS\

Number of Printed Pages: 6 1 Date, Day: 1-12-2022

Paper Code: C-592

(A) One year ,d o"kZ (B) No validity dksbZ oS/krk ugha

(C) Valid till it is cancelled fujLrhdj.k rd oS/k (D) Five year ik¡p o"kZ

A-07: Which of these registers/ledgers are maintained online?

buesa ls dkSu jftLVj@ystj vkWu ykbu vuqjf{kr fd;k tkrk gS\

(A) Tax liability register dj nkf;Ro jftLVj

(B) Credit ledger ØsfMV ystj

(C) Cash ledger dS’k ystj

(D) All of the above mi;qZDr lHkh

A-08: Balance in electronic credit ledger can be utilized against which liability?

bysDVkWfud ØsfMV ystj esa ’ks"k jkf’k dk mi;ksx fdl ns;rk ds fo:) fd;k tk ldrk gS\

(A) Output tax payable ns; vkmViqV VSDl (B) Interest C;kt

(C) Penalty vFkZn.M (D) All of the above mi;qZDr lHkh

A-09: Tax invoice must be issued by:

dj chtd dk fuxZeu vo’; fd;k tk,xk%

(A) Every supplier izR;sd iwfrZdrkZ }kjk

(B) Every taxable person izR;sd djnkrk O;fDr }kjk

(C) Registered persons not paying tax under composition scheme

iathd`r O;fDr ds }kjk ¼dEiksth’ku Ldhe ds rgr VSDl ugha pqdk jgs O;fDr½

(D) All of the above mi;qZDr lHkh

A-10: An invoice must be issued:

chtd vo’; fuxZfer fd;k tk,xk%

(A) At the time of removal of goods eky dh fudklh ds le;

(B) on transfer of risks and rewards of the goods to the recipient

eky esa tksf[ke ,oa ykHk dk izkid dks vUrj.k ij

(C) On receipt o payment for the supply iwfrZ dk Hkqxrku izkIr gksus ij

(D) Earliest of the above dates mi;qZDr esa tks lcls igys gks

A-11: The receipt voucher must contain:

fdlh izkfIr okmpj esa vo’; of.kZr gks%

(A) Details of goods or services eky ;k lsokvksa ds fooj.k

(B) Invoice reference chtd dk lanHkZ

(C) Full value of supply iwfrZ dk iwjk ewY;

(D) None of the above mi;qZDr esa ls dksbZ ugha

A-12: The tax invoice should be issued the date of supply of service:

dj chtd dk fuxZeu lsok iwfrZ dh frfFk ls gksuk pkfg,A

(A) Within 30 days from 30 fnu ds vanj (B) Within 1 month from ,d ekg ds vanj

(C) Within 15 days from 15 fnu ds vanj (D) On or before date of payment lsok iw.kZ gksus ij

A-13: Accounts are required to be maintained in:

[kkrksa dk vuqj{k.k fdl :i esa gksrk gS\

(A) Manual form ekuoh; :i esa

(B) Electronic form bysDVªkWfud :i esa

(C) Manual and electronic form ekuoh; ,oa bysDVªkfud :i esa

(D) Manual or electronic form ekuoh; ;k bysDVªkWfud :i esa

Number of Printed Pages: 6 2 Date, Day: 1-12-2022

Paper Code: C-592

A-14: Input Tax Credit is available to whom in case of job-worker?

tkWc&odZj dks Hksts x, buiqV~l ij buiqV ØsfMV fdls feyrh gS\

(A) Job-worker tkWc&odZj (B) Principal iz/kku

(C) Recipient izkIrdrkZ (D) All of the above mi;qZDr lHkh

A-15: Place of supply of food taken onboard at Delhi for an aircraft departing from Delhi to Bengaluru via

Hyderabad is:

fnYyh ls csaxyq: mM+ku ok;k gSnjkckn ds le; gokbZ tgkt esa Hkkstu dks fnYyh esa miyC/k djkus ij] iwfrZ dk

LFkku gS%

(A) Address of the aircraft mentioned on the invoice of the supplier

iwfrZdrkZ ds chtd esa mfYyf[kr gokbZ tgkt dk irk

(B) Delhi fnYyh

(C) Jaipur t;iqj

(D) Hyderabad gSnjkckn

A-16: Input tax credit on capital goods and inputs can be availed in one installment or in multiple instalments?

iwathxr eky vkSj buiqV VSDl ØsfMV ,d fdLr@cgqfdLrksa esa miyC/k gksrh gS\

(A) In thirty six instalments NÙkhl fdLrksa esa

(B) In twelve instalments ckjg fdLrksa esa

(C) In one instalments ,d fdLr esa

(D) In six instalments N% fdLrksa esa

A-17: Banking Company or Financial institution have an option of claiming.

cSafdax dEiuh ;k foÙkh; laLFkku dks nkok djus dk fuEu fodYi izkIr gS%

(A) Eligible credit or 50% credit xzkgk ØsfMV ;k 50 izfr’kr ØsfMV

(B) Only 50% credit dsoy 50 izfr’kr ØsfMV

(C) Only eligible credit dsoy xzkgk ØsfMV

(D) Eligible credit and 50% credit xzkgk ØsfMV ,oa 50 izfr’kr ØsfMV

A-18: Which supply falls under ‘Reverse Charge’?

izfrykseh izHkkj ds v/khu dkSu&lh iwfrZ;ka vkrh gS\

(A) Notified categories of goods and services eky ,oa lsokvksa dh vf/klwfpr Jsf.k;ka

(B) Inward supply from unregistered dealer viathd`r O;kikjh ls vkUrfjd iwfrZ

(C) Both of the above mi;qZDr lHkh

(D) None of the above mi;qZDr esa ls dksbZ ugha

A-19: Supply of goods to SEZ units is treated as …….. in the hands of supplier.

SEZ bdkbZ dks iwfrZ dks iwfrZdrkZ ds fy, ---------- ekuk tkrk gSA

(A) Exempt supply-Reversal of credit djeqDr iwfrZ&ØsfMV dh okilh

(B) Deemed taxable supply-No reversal of credit ekuh xbZ dj ;ksX; iwfrZ&ØsfMV dh okilh ugha

(C) Export of supplies fu;kZfrr iwfrZ

(D) Non-taxable supply-outside the scope of GST xSj dj ;ksX; iwfrZ GST ds {ks= ls ckgj

A-20: Zero rated supply includes”

’kwU; nj iwfrZ esa ’kkfey gS%

(A) Export of goods/services eky@lsokvksa dk fu;kZr

(B) Supply o goods/services to a SEZ developer/ unit SEZ fodkldrkZ@bdkbZ dks

(C) Supply of goods/series by a SEZ developer/unit SEZ fodkldrkZ@bdkbZ }kjk eky@lsokvksa dh iwfrZ

(D) Both (A) and (B) (A) ,oa (B) nksuksa

Number of Printed Pages: 6 3 Date, Day: 1-12-2022

Paper Code: C-592

PART - B

(SHORT ANSWER TYPE QUESTIONS)

Marks: 32 (4 questions of 8 marks each)

B-01: What is meant by job-work under G.S.T.? What is the procedure under job-work?

th-,l-Vh- ds v/khu ^tkWc&odZ* dk D;k vk’k; gS\ tkWc&odZ laca/kh izfØ;k D;k gS\

Or/vFkok

What is Tax invoice? Explain along with its contents, timing and manner of issuance.

dj chtd D;k gS\ mldh fo"k;&oLrq] le; ,oa fuxZeu dh i)fr lfgr le>kb,A

B-02: Who is liable for payment of G.S.T.? What are the main features of payment of tax mechanism?

th-,l-Vh- ds Hkqxrku ds fy, dkSu nk;h gS\ dj Hkqxrku O;oLFkk dh D;k eq[; fo’ks"krk,a gS\

Or/vFkok

What are the advantages and disadvantages of G.S.T.? Also explain its features.

th-,l-Vh- ds D;k&D;k xq.k vkSj nks"k gS\ lkFk gh bldh fo’ks"krk,a Hkh crkb,A

B-03: What is composite and mixed supply? How would tax liability be determined in such cases?

la;qDr ,oa fefJr iwfrZ D;k gS\ ,sls ekeys esa dj nkf;Ro dk fu/kkZj.k fdl izdkj fd;k tkrk gS\

Or/vFkok

What are the provisions related to buy and collection of G.S.T.?

th-,l-Vh- dh mxkgh ,oa laxzg.k laca/kh D;k izko/kku gS\

B-04: Morarka Tiles supplied supplied 5,00,000 tiles to its whole sale dealers on following terms:

eksjjdk VkbYl }kjk fuEu ’krksZa ij 5]00]000 VkbYl dh iwfrZ Fkksd forjd dks dh tkrh gS%

(i) Transaction value of per tile @ Rs. 18 Rs. 48,000

izfr VkbYl dk O;ogkj ewY; @ :-18 Rs. 48,000

(ii) Transaction Expenses ifjogu O;; Nil

(iii) Trade discount @10% on transaction value

O;kikfjd cV~Vk O;ogkj ewY; ij 10 izfr’kr dh nj ls

(iv) Packing iSfdax Rs. 35,000

(v) Design charges fMtkbu O;; Rs. 20,800

Calculate the amount of GST payable by the supplier, if rate of tax is 18%. Cement used for

manufacturing of tiles worth Rs.25 lakh (included GST Rs.2,00,000). Besides, concrete and sand

Rs.5 lakh were also used, but no tax payable there on. During the tiles production GST Rs.18,500 has

been paid to service providers for design, advertising and telephone.

iwfrZdrkZ }kjk Hkqxrku dh tkus okyh th-,l-Vh- dh nj 18 izfr’kr gS] ns; th-,l-Vh- dh x.kuk djsaA VkbYl

fuekZ.k esa iz;qDr lhesaV dk ewY; :-25 yk[k ¼:-2]00]000 th-,l-Vh- ds ’kkfey gS½A blds vfrfjDr :- 5 yk[k

ewY; dh fxV~Vh ,oa jsr iz;qDr gqbZA ftl ij dksbZ th-,l-Vh- ns; ugha gSA

VkbYl fuekZ.k ds nkSjku fMtkbu] foKkiu] VsyhQksu vkfn lsokvksa ds fy, lsok iznkrkvksa dks :- 18]500 th-,l-Vh-

pqdk;k x;kA

Or/vFkok

What do you mean by ‘Customs Duty’? Write nature and types of customs duty in India.

lhek ’kqYd ls vkidk D;k vfHkizk; gS\ Hkkjr esa lhek ’kqYd dh izd`fr ,oa izdkj fyf[k,A

Number of Printed Pages: 6 4 Date, Day: 1-12-2022

Paper Code: C-592

PART -C

(ESSAY TYPE QUESTIONS)

Marks: 88 (4 questions of 22 marks each)

C-01: An Indian importer imported raw materials for 5000 dollars. Following informations are available:

,d Hkkjrh; vk;krd us 5000 MkWyj dk dPpk eky vk;kr fd;kA blds laca/k esa fuEukafdr tkudkjh izkIr gS%

(i) Packing charges of goods 120 dollars

oLrqvksa ds iSfdax ds O;; 120 MkWyj

(ii) Goods were stuffed in container (returnable) price of the container is 400 dollars

oLrq,a okilh ;ksX; d.Vsuj esa Hksth x;h] ftudk ewY; 400 MkWyj FkkA

(iii) Insurance premium 50 dollars

chek izhfe;e 50 MkWyj

(iv) Sea freight 160 dollars

leqnzh HkkM+k 160 MkWyjA

(v) Importer had paid commission of 100 dollars to a broker who arranged the transaction.

vk;krd us nyky dks 100 MkWyj deh’ku fn;k] ftlus ;g lkSnk djok;k gSA

(vi) Dollar rate is Rs.60=1 dollar

1 MkWyj dh fofue; nj 60:- gSA

(vii) Basic customs duty is 10%

lhek ’kqYd 10 izfr’kr yxrk gSA

(viii) Integrated Tax u/s 3(7) of CTA, 1975 @12%

CTA 1975 dh /kkjk 3¼7½ ds v/khu baVhxzsVsM VSDl @12 izfr’kr

(xi) Ignore GST compensation cess.

th-,l-Vh- {kfriwfrZ midj dks NksM+ nsA

Find out the assessable value of imported goods and customs duty payable.

vk;kfrr eky dk dj ;ksX; ewY; ,oa ns; lhek ’kqYd fudkfy,A

Or/vFkok

What is the procedure for registration? Explain the consequences of non-registration.

iathdj.k dh D;k izfØ;k gS\ viathdj.k ds D;k ifj.kke gS\

C-02: Write short note on:

laf{kIr fVIi.kh fyf[k,%

(a) Input tax credit (ITC) buiqV VSDl ØsfMV

(b) Eligibility and conditions for Input Tax Credit buiqV VSDl ØsfMV dh xzkgkrk ,oa ’krsZa

(c) Input Tax Credit in case of capital goods iwathxr eky ds laca/k esa buiqV VSDl ØsfMV

(d) Set-off of Input Tax Credit buiqV VSDl ØsfMV dk lsV&vkWQ

(e) Input Tax Credit availability by a banking company/NBFC

cSafdax @xSj&cSafdax foÙkh; dEiuh }kjk buiqV VSDl ØsfMV dh miyC/krk

(f) Utilisation of Input Tax Credit buiqV VSDl ØsfMV dk mi;ksx

Or/vFkok

From the following particulars, calculate invoice value under GST:

Purchase of raw materials within the state Rs.67,200 (including of 12% GST) excise duty @12%, VAT

12.5%. Profit margin Rs. 9,500. Manufacturing expenses Rs.3,500 wages 5,000, storage cost Rs.6000,

consultation fees Rs.2500, CGST @ 6% and SGST @6%.

fuEukafdr lwpukvksa ls th-,l-Vh- ds v/khu chtd ewY; dh x.kuk dhft,%

Number of Printed Pages: 6 5 Date, Day: 1-12-2022

Paper Code: C-592

jkT; ds vUnj dPps eky dk Ø; 67]200:- ¼12 izfr’kr GST lfgr½ mRikn ’kqYd 12 izfr’kr] oSV 12-5

izfr’kr] ykHk ekftZu 9]500:-] fuekZ.kh O;; 3]500:-] Je 5000:-] laxzg.k ykxr 6]000:-] ijke’kZ ’kqYd

2]500:- CGST 6 izfr’kr ,oa SGST @ 6 izfr’krA

C-03: What does Scrutiny of Returns’ mean under GST law?

fooj.kh dh LØwfVuh vFkok LØwfVuh fu/kkZj.k dk GST fo/kku esa D;k vk’k; gS\

Or/vFkok

Write short note on:

laf{kIr fVIi.kh fyf[k,%

(a) Tax invoice by input service distributer buiqV lsok forjd dk dj&chtd

(b) Bill of supply iwfrZ fcy

(c) Receipt voucher izkfIr jlhn

(d) Audit of accounts [kkrksa dk vads{k.k

(e) Retention of Accounts and Records [kkrksa ,oa fjdkWb~Zl dk /kkj.k

C-04: Explain the different methods of determination of imported goods under customs valuation Rules 2007

(Determination of price of imported goods).

lhek 'kqYd ewY;kadu fu;e 2007 ¼vk;kfrr eky dk ewY; fu/kkZj.k½ ds vUrxZr vk;kfrr eky ds ewY;kadu dh

fofHkUu fof/k;ksa dks le>kb,A

Or/vFkok

What is the time of supply and when it is taxable? Explain the effects of change in rates of tax on time of

supply.

iwfrZ dk le; D;k gksrk gS vkSj ;g dc dj;ksX; gS\ iwfrZ ds le; ij dj dh njksa esa ifjorZu dk izHkko le>kb,A

The End

Number of Printed Pages: 6 6 Date, Day: 1-12-2022

fo’ks"k Vhi% osclkbV ij izdkf’kr ikVZ&, dh dqta h ds lanHkZ esa fdlh izdkj dh folaxfr gksus ij fo|kFkhZ viuk izfrosnu ijh{kk fu;a=d dks osclkbV

ij izdkf’kr frfFk ls vkxkeh rhu dk;Zfnolksa esa izLrqr dj ldrs gSaA blds i'pkr~ izLrqr izfrosnuksa ij fopkj fd;k tkuk laHko ugha gksxkA

ijh{kk fu;a=d

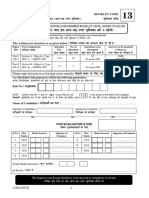

Key to Part-A

(Objective Type Questions)

Paper Code: C-592

Question Answer Key

A-01: B

A-02: C

A-03: D

A-04: C

A-05: C

A-06: C

A-07: D

A-08: A

A-09: C

A-10: A

A-11: A

A-12: A

A-13: D

A-14: B

A-15: B

A-16: C

A-17: A

A-18: C

A-19: C

A-20: D

You might also like

- SHHDRDocument5 pagesSHHDRFhfdNo ratings yet

- Part - ADocument5 pagesPart - Arishi rai saxenaNo ratings yet

- BSEB Class 12 Accountancy (I.Com.) Annual Question Paper 2022Document46 pagesBSEB Class 12 Accountancy (I.Com.) Annual Question Paper 2022Aargya Soni (Shubham)No ratings yet

- @legalglossary - LLB 6th Sem Taxtion LawDocument28 pages@legalglossary - LLB 6th Sem Taxtion Lawrishavh yadavNo ratings yet

- Subject: Paper:: Part - ADocument4 pagesSubject: Paper:: Part - Arishi rai saxenaNo ratings yet

- Part - A: Subject: PaperDocument4 pagesPart - A: Subject: Paperrishi rai saxenaNo ratings yet

- Part - ADocument5 pagesPart - AShaneNo ratings yet

- C 695Document5 pagesC 695rishi rai saxenaNo ratings yet

- Part - A: Paper: SubjectDocument4 pagesPart - A: Paper: Subjectrishi rai saxenaNo ratings yet

- 356-Bba 603N - (A)Document24 pages356-Bba 603N - (A)Vikas PatelNo ratings yet

- Commerce 115Document40 pagesCommerce 115IAS 2025No ratings yet

- 2017 MNG AccDocument5 pages2017 MNG AccLYKAN SAMANo ratings yet

- Bcom Vi Sem Accounting Indirect Tax May 2018Document5 pagesBcom Vi Sem Accounting Indirect Tax May 2018virat kohliNo ratings yet

- Export Import Documentation and Logistics AssignmentDocument8 pagesExport Import Documentation and Logistics AssignmentSekla ShaqdieselNo ratings yet

- Question Bank Ist Sem (APPL ECO)Document94 pagesQuestion Bank Ist Sem (APPL ECO)Dhananjaya MnNo ratings yet

- Indirect Taxes: (K.M V Olrqfu"B Á'UDocument41 pagesIndirect Taxes: (K.M V Olrqfu"B Á'UMohitraheja007No ratings yet

- Class 12 Accountancy Practice Paper 01Document36 pagesClass 12 Accountancy Practice Paper 01Tanishq TayalNo ratings yet

- B Com Vi June 2021Document21 pagesB Com Vi June 2021Shivani SharmaNo ratings yet

- E-113, M. Com. (III Sem) Paper III ADVANCE COST ACCOUNTINGDocument19 pagesE-113, M. Com. (III Sem) Paper III ADVANCE COST ACCOUNTINGgaming liveNo ratings yet

- 11th Accountancy Previous Year Que. PaperDocument15 pages11th Accountancy Previous Year Que. PaperShivendu Vats Shivendu VatsNo ratings yet

- Model Paper: D (KK D (KK D (KK D (KK D (KK - Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKLDocument39 pagesModel Paper: D (KK D (KK D (KK D (KK D (KK - Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKLTezendra SinghNo ratings yet

- CD-2044 - 20200712101026 Durg University QPDocument8 pagesCD-2044 - 20200712101026 Durg University QPManohar SumathiNo ratings yet

- 6th JPSC 2016 Mains GS VDocument6 pages6th JPSC 2016 Mains GS VAmar SawriNo ratings yet

- 2017 Ent SkillDocument5 pages2017 Ent SkillLYKAN SAMANo ratings yet

- Sambhav uOCoXPnuuHVhScSDocument3 pagesSambhav uOCoXPnuuHVhScSdevianila562No ratings yet

- @legalglossary - LLB 6th Sem Trademarks LawDocument32 pages@legalglossary - LLB 6th Sem Trademarks Lawemailmeankushshukla1No ratings yet

- Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL : Code No. 1008Document16 pagesYs (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL : Code No. 1008Anil Kumar Anil KumarNo ratings yet

- Corporate Accounting: (K.M& V Olrqfu"B Á'UDocument42 pagesCorporate Accounting: (K.M& V Olrqfu"B Á'UVarathajayasudha JeganathanNo ratings yet

- SPMM 2006Document11 pagesSPMM 2006Amit KumarNo ratings yet

- Class 11 Economics Practice Paper 01Document32 pagesClass 11 Economics Practice Paper 01Nirjala TiwariNo ratings yet

- Accountancy B 2018Document13 pagesAccountancy B 2018Sachin KumarNo ratings yet

- BEZA Application FormDocument4 pagesBEZA Application FormAli SarwarNo ratings yet

- BCOM Part-III Assignment Question-2021 For Examination-2022Document2 pagesBCOM Part-III Assignment Question-2021 For Examination-2022Himanshu SharmaNo ratings yet

- Examdays Admissions - EntreoreneurshipDocument156 pagesExamdays Admissions - EntreoreneurshiprangersuhaibNo ratings yet

- Commerce - Complete Mock Test For Prctice Boost Your Preperation Downlaod PDF-1559047519345Document32 pagesCommerce - Complete Mock Test For Prctice Boost Your Preperation Downlaod PDF-1559047519345Aman AgarwalNo ratings yet

- MCM 103Document12 pagesMCM 103Khushi PalNo ratings yet

- QuestionDocument13 pagesQuestionvitocorleone7240No ratings yet

- HKKX&: Part-Ii (Ii) Iqflrdk DKSMDocument28 pagesHKKX&: Part-Ii (Ii) Iqflrdk DKSMRahz KrNo ratings yet

- Esic Udc: Previous Year PaperDocument14 pagesEsic Udc: Previous Year Paperrvshjha191No ratings yet

- 379-Bca 603N - (B)Document24 pages379-Bca 603N - (B)Tejas SinghNo ratings yet

- Accountancy 3608 CDocument13 pagesAccountancy 3608 CKaran KaranNo ratings yet

- Lakshya-26 (F) (02.12.2023)Document16 pagesLakshya-26 (F) (02.12.2023)vkallbookNo ratings yet

- Updated MCQ Booklet SO Part-IDocument573 pagesUpdated MCQ Booklet SO Part-IpunithupcharNo ratings yet

- Income Tax Calculator F.Y.12-13Document4 pagesIncome Tax Calculator F.Y.12-13reamer27No ratings yet

- 1675167739Document14 pages1675167739Shashank KNo ratings yet

- MQP Eco 28 09 2023Document5 pagesMQP Eco 28 09 2023ksagroup894No ratings yet

- CD-2043 - 20200712100403 Durg University QPDocument11 pagesCD-2043 - 20200712100403 Durg University QPManohar SumathiNo ratings yet

- Land Law BALLB-908-ADocument24 pagesLand Law BALLB-908-AAshish ShuklaNo ratings yet

- ITI P - 4 2022 - CompDocument27 pagesITI P - 4 2022 - CompYogendra MishraNo ratings yet

- CPWA Code MCQDocument43 pagesCPWA Code MCQSamrat Mukherjee100% (3)

- CPT Question Paper December 2016 With Answer Key PDFDocument28 pagesCPT Question Paper December 2016 With Answer Key PDFSarthak LakhaniNo ratings yet

- Utilization Form 42 I - Twarit 23-24 - V Sabha - SaidrajaDocument1 pageUtilization Form 42 I - Twarit 23-24 - V Sabha - Saidrajaaniruddhia4mNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument3 pages© The Institute of Chartered Accountants of IndiaDeepak KumarNo ratings yet

- Ldce - Fasp - 08 PDFDocument9 pagesLdce - Fasp - 08 PDFDinesh Talele86% (7)

- ExportImportProceduresDocumentation MB085 QuestionDocument17 pagesExportImportProceduresDocumentation MB085 QuestionAiDLo33% (6)

- Ldce - Fasp - 06 PDFDocument8 pagesLdce - Fasp - 06 PDFDinesh Talele100% (4)

- Bcom 4 Sem Corporate Accounting 2 12293 2020Document7 pagesBcom 4 Sem Corporate Accounting 2 12293 2020deepaksingh260503No ratings yet

- FinalDocument1 pageFinalvinovionNo ratings yet

- Aap Bhi Topper Ban Sakte Hain: Medhavi Ank Prarpt Karne Ke TipsFrom EverandAap Bhi Topper Ban Sakte Hain: Medhavi Ank Prarpt Karne Ke TipsNo ratings yet

- Advertisement and Sales Management DSE (C)Document3 pagesAdvertisement and Sales Management DSE (C)rishi rai saxenaNo ratings yet

- 300+ TOP Event Management MCQs and Answers Quiz Exam 2023Document14 pages300+ TOP Event Management MCQs and Answers Quiz Exam 2023rishi rai saxenaNo ratings yet

- Dse (Ii) 691 (B)Document3 pagesDse (Ii) 691 (B)rishi rai saxenaNo ratings yet

- Subject: Paper:: Part - ADocument4 pagesSubject: Paper:: Part - Arishi rai saxenaNo ratings yet

- Part - A: Subject: PaperDocument4 pagesPart - A: Subject: Paperrishi rai saxenaNo ratings yet

- Part - ADocument5 pagesPart - Arishi rai saxenaNo ratings yet

- Statement 65336126Document1 pageStatement 65336126Ana iriany NamantarNo ratings yet

- Super Chem: Certified That The Particulars Given Above Are True and CorrectDocument1 pageSuper Chem: Certified That The Particulars Given Above Are True and CorrectAman PrajapatiNo ratings yet

- 12.2 Patches Released After RUP 10 Released On 20-Aug-2017Document12 pages12.2 Patches Released After RUP 10 Released On 20-Aug-2017Srinivas GirnalaNo ratings yet

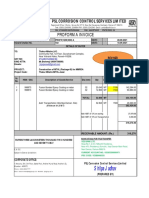

- Shilpa Jadhav: Proforma InvoiceDocument1 pageShilpa Jadhav: Proforma InvoiceShilpa JadhavNo ratings yet

- SS Flat RateDocument1 pageSS Flat RaterohitNo ratings yet

- Desai Brothers LTD 104 20-09-2021Document1 pageDesai Brothers LTD 104 20-09-2021Pragnesh PrajapatiNo ratings yet

- Room Bill DemoDocument4 pagesRoom Bill DemoHotel Aditya Mansingh InnNo ratings yet

- Haritha Hotel SiddipetDocument1 pageHaritha Hotel SiddipetAditya SharmaNo ratings yet

- Day AlanDocument1 pageDay AlanTechnetNo ratings yet

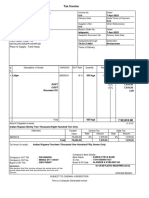

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountBilal Ahmed MultaniNo ratings yet

- GST Bill For BVVPDocument1 pageGST Bill For BVVPUddhava Priya DasNo ratings yet

- Inv-0059 Sri Maheshwari EngineeringDocument1 pageInv-0059 Sri Maheshwari EngineeringSRIKAR DHANOORINo ratings yet

- Od429799850322298400 1Document1 pageOd429799850322298400 1kt897022No ratings yet

- Invoice: Gopro Tech SolutionsDocument1 pageInvoice: Gopro Tech Solutionsmohammad sohelNo ratings yet

- Kumari Traders: GSTIN: 36BEEPY7841Q1ZJ Tax InvoiceDocument1 pageKumari Traders: GSTIN: 36BEEPY7841Q1ZJ Tax Invoicetaruniconstructions0926No ratings yet

- Anwar Invoice 1Document4 pagesAnwar Invoice 1Unni KrishnanNo ratings yet

- Bill FormetDocument1 pageBill Formetshuklavishal135No ratings yet

- RptSaleInvoiceByBundelDetails - 2022-03-28T223440.333Document1 pageRptSaleInvoiceByBundelDetails - 2022-03-28T223440.333Mahdi omerNo ratings yet

- Tachyon Communications PVT LTDDocument1 pageTachyon Communications PVT LTD5647-sumit-11e UpadhyayNo ratings yet

- Goods and Services Tax-A.P.pdf00Document2 pagesGoods and Services Tax-A.P.pdf00Manoj Digi LoansNo ratings yet

- Order 1696151852963Document1 pageOrder 1696151852963trichysayeeNo ratings yet

- DBT 112 2021 - 22Document1 pageDBT 112 2021 - 22omkar daveNo ratings yet

- Ilovepdf MergedDocument10 pagesIlovepdf Mergedjeeson thekkekaraNo ratings yet

- Flipkart Labels 14 Apr 2023 10 13Document1 pageFlipkart Labels 14 Apr 2023 10 13Sahil KochharNo ratings yet

- E-Way Bill SystemDocument1 pageE-Way Bill SystemHasannoor malikNo ratings yet

- Invoice 252541 PDFDocument1 pageInvoice 252541 PDFManju NathNo ratings yet

- Job Work Challan: Aadinath Industries (111341) C-11/2, Wazirpur Industrial Area Delhi DL - Delhi 110052Document1 pageJob Work Challan: Aadinath Industries (111341) C-11/2, Wazirpur Industrial Area Delhi DL - Delhi 110052Anshu SinghNo ratings yet

- OD223485816626172000Document1 pageOD223485816626172000Mahipal SinghNo ratings yet

- Anokita Thar N2G32130Document1 pageAnokita Thar N2G32130prashant singhNo ratings yet

- E-Way Bill - 020Document1 pageE-Way Bill - 020Kartik DharammaliNo ratings yet