Professional Documents

Culture Documents

Extra Credit

Extra Credit

Uploaded by

irenemutheu660 ratings0% found this document useful (0 votes)

4 views3 pagesJoe and Mary Smith filed a joint tax return for 2018. Joe owns a plumbing business that generated $265,000 in gross receipts. He deducted $88,000 in wages and various business expenses. The couple also owns a vacation rental property. They received $35,125 in rental income but deducted expenses and depreciation. They sold assets including a home, stock, and vacant lot, realizing capital gains. Their taxable income will be calculated based on wages, business income, rental income, capital gains, and other items like dividends and interest, accounting for applicable deductions and limitations.

Original Description:

Original Title

Extra Credit (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJoe and Mary Smith filed a joint tax return for 2018. Joe owns a plumbing business that generated $265,000 in gross receipts. He deducted $88,000 in wages and various business expenses. The couple also owns a vacation rental property. They received $35,125 in rental income but deducted expenses and depreciation. They sold assets including a home, stock, and vacant lot, realizing capital gains. Their taxable income will be calculated based on wages, business income, rental income, capital gains, and other items like dividends and interest, accounting for applicable deductions and limitations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views3 pagesExtra Credit

Extra Credit

Uploaded by

irenemutheu66Joe and Mary Smith filed a joint tax return for 2018. Joe owns a plumbing business that generated $265,000 in gross receipts. He deducted $88,000 in wages and various business expenses. The couple also owns a vacation rental property. They received $35,125 in rental income but deducted expenses and depreciation. They sold assets including a home, stock, and vacant lot, realizing capital gains. Their taxable income will be calculated based on wages, business income, rental income, capital gains, and other items like dividends and interest, accounting for applicable deductions and limitations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

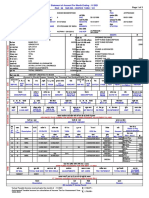

Joe & Mary Smith It’s All You CPA

2018 Income Tax Organizer

Joe & Mary Smith Married 5 years

Children: Little Susie – Born November 15, 2018

Filing Status Joint return in 2017

Annual Support: Mary’s Mother

Sole Support of Mother

Lives in a Senior Care Home 4 Blocks from Joe & Mary

Mary’s Wages: $42,000, Insurance Sales

Joe’s profession: Sole Proprietor

Plumbing Express

2018 Revenue & Deductions

Gross Receipts 265,000

Wages 88,000

Office Supplies 4,250

Meals with Clients 2,600

Golf & Client Entertainment 2,000

Country Club Dues 4,100

Plumbing supplies 36,750

Miles Driven to job sites 12,625

My plumbing equipment cost me $52,000.

Home office used? Yes, I use a converted bedroom, It’s 300 square feet.

My Total Home is 2,000 square feet

Mortgage Interest 12,500

Gardening & Maintenance 3,500

Depreciation 4,000

Real Estate Property Taxes 8,000

Homeowners association fees 1,200

Joe & Mary Rental

Big Bear Cabin rented 125 days, used personal 20 days

Rental Income 35,125

Interest 12,500

Taxes 8,600

Maintenance & Repair 4,000

Supplies 2,500

Depreciation 22,000

Mileage driven to Residence to collect rent, hire contractors 3,500

Estimated hours managing rental 350

Gains & Losses

1. We sold our first home $425,000 on March 3

Original Purchase date 2/5/2015

Purchased for $165,000

Remodeled bathrooms 22,000 in 2016

2. Sold stock in Ford Motor Co 5,000 share @ $8 per share

Purchased 2/2/16 for $60,000

3. Sold vacant lot

Inherited from grandparents Feb 1 2018

Sold September 18, 2018

Grandparents’ original purchased $5,000

FMV when the trust transferred $125,000

Sale price $135,000

Sales commissions $5,000

Other Items affecting Joe & Mary’s tax calculation:

1. Dividends from Ford Stock $250

2. No other itemized deductions

3. Interest from Municipal Bonds $1,000

4. Mary won an exacta at Santa Anita $520

Calculate AGI and Taxable Income for Joe & Mary.

Show ALL calculations, limitations, phase-outs, etc. that affect your calculations or that are effected

by your calculations

Your tax calculation should be summarized as follows

Extra points if you complete using EXCEL

Wages

Dividends & Interest Income

Income from Trade or Business

Rental Income

Capital Gain or Loss

Other Income:

GROSS INCOME

AGI Adjustment “Above the Line” [Name/Description]

ADJUSTED GROSS INCOME

Itemized or Standard Deduction

Qualified Business Income Deduction

TAXABLE INCOME

Nontaxable, deferred, excluded income, gains Losses:

1

2

3

You might also like

- Chart of Accounts - BakeryDocument2 pagesChart of Accounts - BakeryPeter West75% (16)

- Canadian Tax Principles, 2019-2020 Edition Clarence Byrd Ida Chen Test Bank and Solution ManualDocument9 pagesCanadian Tax Principles, 2019-2020 Edition Clarence Byrd Ida Chen Test Bank and Solution ManualAdam Kramer0% (2)

- Group Work FA 1Document5 pagesGroup Work FA 1Phan Đỗ QuỳnhNo ratings yet

- Topic 4 Class ExerciseDocument5 pagesTopic 4 Class ExerciseAzim OthmanNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- Problem and Chart of AccountsDocument2 pagesProblem and Chart of AccountsRey Joyce AbuelNo ratings yet

- 7P&l and BS - CLASS 8 - MAR 2-2024-Class FileDocument1 page7P&l and BS - CLASS 8 - MAR 2-2024-Class FilenuvvenuvvenuvveNo ratings yet

- Finalterm Examination: Unfair Means in Completing ItDocument4 pagesFinalterm Examination: Unfair Means in Completing ItMuhammad Abdullah SaniNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Worksheet Page 176-177Document8 pagesWorksheet Page 176-177rainellagmendozaNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- FA Mid 2022Document5 pagesFA Mid 2022Saransh KansalNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Principles of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceDocument2 pagesPrinciples of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceCindy SweNo ratings yet

- ACCT3050 Comprehensive Question Graded (20%) Updated 28 March 2021Document3 pagesACCT3050 Comprehensive Question Graded (20%) Updated 28 March 2021TashaNo ratings yet

- ABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationDocument10 pagesABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationHuilunNgoNo ratings yet

- Activity in FABM 2Document2 pagesActivity in FABM 2CHERIE MAY ANGEL QUITORIANONo ratings yet

- Financial Statements (Basic)Document7 pagesFinancial Statements (Basic)Mohamed MubarakNo ratings yet

- Financial Statement Assignment 1Document3 pagesFinancial Statement Assignment 1tahasafdari772No ratings yet

- Last Term RevisionDocument2 pagesLast Term RevisionNgoc Huỳnh HyNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Illustrative Problems Chap13-BDocument8 pagesIllustrative Problems Chap13-BNikki GarciaNo ratings yet

- 2017 S2 (final) (尊孔)Document5 pages2017 S2 (final) (尊孔)Khor Xing TienNo ratings yet

- Completing The Accounting Cycle - Merchandising YtDocument1 pageCompleting The Accounting Cycle - Merchandising YtGoogle UserNo ratings yet

- HW 3Document4 pagesHW 3Rakhimjon BakhromovNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Final AccountsDocument7 pagesIgcse - Extented Tutoring - 2023 - 2024 - Final AccountsMUSTHARI KHANNo ratings yet

- ExercisesDocument3 pagesExercisesThiều Xuân LamNo ratings yet

- 13 Single Entry and Incomplete Records Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records Additional ExercisesAditya Hemani100% (1)

- September 22nd 2005 (KB)Document4 pagesSeptember 22nd 2005 (KB)nic tNo ratings yet

- Lat. Soal Completing Accounting Cycle 1Document1 pageLat. Soal Completing Accounting Cycle 1Cindy Cornelia Wahyu WardaniNo ratings yet

- Practice Qns - Final AccountsDocument13 pagesPractice Qns - Final Accountscaphoenix mvpaNo ratings yet

- HMGT2280 Chapter 4 HomeworkDocument7 pagesHMGT2280 Chapter 4 HomeworkAdrizal MatorangNo ratings yet

- Reynadya Farissa 2201749614 LA86Document3 pagesReynadya Farissa 2201749614 LA86Nurlela SafitriNo ratings yet

- Do It 2Document2 pagesDo It 2Khanh QuyenNo ratings yet

- Exhibit 7. Revenue and Expense RecognitionDocument6 pagesExhibit 7. Revenue and Expense RecognitionЭниЭ.No ratings yet

- Fin 533Document11 pagesFin 533FATIMAH MOHAMAD ISANo ratings yet

- Fundamentals of Accounting - Accruals Amd PrepaymentsDocument5 pagesFundamentals of Accounting - Accruals Amd PrepaymentsRealGenius (Carl)No ratings yet

- ACCT1101 Week 5 Practical SolutionsDocument8 pagesACCT1101 Week 5 Practical SolutionskyleNo ratings yet

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulNo ratings yet

- Quiz # 2 NewsDocument20 pagesQuiz # 2 NewsSaram NadeemNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- Accounting Fundamentals - PWS - 7Document11 pagesAccounting Fundamentals - PWS - 7Meet PatelNo ratings yet

- 11 Accountancy t2 Sp01Document19 pages11 Accountancy t2 Sp01Lakshy BishtNo ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- FNSBKG404 5Document4 pagesFNSBKG404 5natty100% (1)

- Tutorial AdjustmentDocument13 pagesTutorial AdjustmentnoorhanaNo ratings yet

- Revision Question Computer ScienceDocument1 pageRevision Question Computer ScienceIGO SAUCENo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- Acct 4Document6 pagesAcct 4Mopur NELLORENo ratings yet

- Accounting Chapter 6Document2 pagesAccounting Chapter 6Kelvin Rex SumayaoNo ratings yet

- EAB Case StudyDocument13 pagesEAB Case StudyVipin VipsNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- New Microsoft Word Document (5) BDocument5 pagesNew Microsoft Word Document (5) BoctoNo ratings yet

- Final Accounts - Extra Questionis 1Document2 pagesFinal Accounts - Extra Questionis 1MUSTHARI KHANNo ratings yet

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- Chapter 3 Practice KEYDocument19 pagesChapter 3 Practice KEYmartinmuebejayiNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Taxation Ii CatiiDocument2 pagesTaxation Ii Catiiirenemutheu66No ratings yet

- WhatsApp Chat With +90 532 412 32 01Document30 pagesWhatsApp Chat With +90 532 412 32 01irenemutheu66No ratings yet

- Important Semester Dates201819RDocument5 pagesImportant Semester Dates201819Rirenemutheu66No ratings yet

- 2024 VacancysDocument7 pages2024 Vacancysirenemutheu66No ratings yet

- BML 103 Cat Jan - Apr 2024Document3 pagesBML 103 Cat Jan - Apr 2024irenemutheu66No ratings yet

- Nairobi Pick Up PointsDocument6 pagesNairobi Pick Up Pointsirenemutheu66No ratings yet

- BML 103 Wba Jan - Apr 2024Document3 pagesBML 103 Wba Jan - Apr 2024irenemutheu66No ratings yet

- CLBS Financial Statement 1Document6 pagesCLBS Financial Statement 1Peter Cranzo MeisterNo ratings yet

- Wipro Consumer Care: Merchandising For Success: Submitted By: Group 9Document6 pagesWipro Consumer Care: Merchandising For Success: Submitted By: Group 9TryNo ratings yet

- Best Ice Cream Business Plan WTH Financials PDFDocument11 pagesBest Ice Cream Business Plan WTH Financials PDFNishat Nabila80% (15)

- Tax Quiz 2Document6 pagesTax Quiz 2Scri BidNo ratings yet

- Solved For Many Years MR K The President of KJ IncDocument1 pageSolved For Many Years MR K The President of KJ IncAnbu jaromiaNo ratings yet

- Ujikom PT Cahaya 18-19Document37 pagesUjikom PT Cahaya 18-19Jessyca GunawanNo ratings yet

- BSU Income Tax Course Syllabus v2Document8 pagesBSU Income Tax Course Syllabus v2Memey C.No ratings yet

- SanchayapatraDocument3 pagesSanchayapatraMD. NASIF HOSSAIN IMONNo ratings yet

- Auditing and Taxation: B) Sec 2Document7 pagesAuditing and Taxation: B) Sec 2Kadam KartikeshNo ratings yet

- Albanese Company, Spa Worksheet (Partial) For The Month Ended April 30, 2017Document17 pagesAlbanese Company, Spa Worksheet (Partial) For The Month Ended April 30, 2017Mayang RijanieNo ratings yet

- Developer X Project: Real Estate Finance Feasibility StudyDocument6 pagesDeveloper X Project: Real Estate Finance Feasibility StudyM Juniar Revanska KusumaNo ratings yet

- Statement of Account For Month Ending: 11/2021 PAO: 56 SUS NO.: 0937012 TASK: 101Document4 pagesStatement of Account For Month Ending: 11/2021 PAO: 56 SUS NO.: 0937012 TASK: 101Dragon GamersNo ratings yet

- Deliverables Template - AuditDocument3 pagesDeliverables Template - AuditShivaniNo ratings yet

- Rebates and Releifs Page 415 To 418Document4 pagesRebates and Releifs Page 415 To 418Nitin RajNo ratings yet

- POA Assignment Week 4Document16 pagesPOA Assignment Week 4Rara Rarara30No ratings yet

- Intacc - PrelimDocument10 pagesIntacc - PrelimRenalyn ParasNo ratings yet

- 7tax Administration LectureDocument48 pages7tax Administration LectureHawa MudalaNo ratings yet

- Quiz 2 Business TaxDocument28 pagesQuiz 2 Business Taxmikheal beyberNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Question Bank GSTDocument6 pagesQuestion Bank GSThimanshuNo ratings yet

- 23061100002934ICIC ChallanReceiptDocument2 pages23061100002934ICIC ChallanReceiptSamyak DahaleNo ratings yet

- Problem 1: Activity 1: PPEDocument6 pagesProblem 1: Activity 1: PPELyka Nicole DoradoNo ratings yet

- Appendix-I Application Form For Empanelment of Valuers PDFDocument2 pagesAppendix-I Application Form For Empanelment of Valuers PDFSanskar GuptaNo ratings yet

- CBDT Clarifies Doubts On Account of New TCS Provisions - Taxguru - inDocument2 pagesCBDT Clarifies Doubts On Account of New TCS Provisions - Taxguru - inVivek AgarwalNo ratings yet

- Set VIDocument2 pagesSet VIArihant DagaNo ratings yet

- Name: Waleed Zahid Roll No: F18-1010 BS Accounting&Finance 6 Assignment No 1 Submitted To: Sir Atif Attique SiddiquiDocument5 pagesName: Waleed Zahid Roll No: F18-1010 BS Accounting&Finance 6 Assignment No 1 Submitted To: Sir Atif Attique SiddiquiFurqan AhmedNo ratings yet

- Tax Invoice: Madimack Pty LTD 19 Tarra Cres Dee Why NSW 2099Document1 pageTax Invoice: Madimack Pty LTD 19 Tarra Cres Dee Why NSW 2099Mildred PagsNo ratings yet

- Filing of Returns and PaymentDocument10 pagesFiling of Returns and PaymentOmie Jehan Hadji-AzisNo ratings yet