Professional Documents

Culture Documents

11.1 Mezzanine Finance Solved

11.1 Mezzanine Finance Solved

Uploaded by

Shubhangi JainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11.1 Mezzanine Finance Solved

11.1 Mezzanine Finance Solved

Uploaded by

Shubhangi JainCopyright:

Available Formats

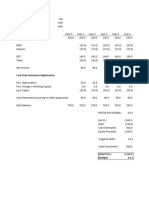

An income producing commercial property is being financed based on the following assumptions.

Acquisition Price 15 Euro Million

Net Operating Income 0.8 Euro Million

Annual increae in NOI 3%

Annual increase in property va 3%

It is assumed that the property's lease contract will end after 6 years and it will also be sold by the end of 6th year. The proposed capital

structure & financing cost are follows:

Capital Structure

Loan to Payment Equity-

Value Cash in Kind Kicker

(LTV) Interest (PIK) (EK)

Senior Debt 65% 5%

Mezzanine 20% 5% 3% 50%

The mezzanine debt terms incorporate cash interest component of 5%, PIK interest of 3% and an equity kicker paid at the end & calculated

as follows:

Mezzanine debt x [50% x excess IRR of operating cashflows over IRR of senior debt x 6 years]

Q. Estimate the Cash Flows, Cash on Cash Return & IRR of Senior debt holders, Mezzanine debt holders & Equity holders.

Soln

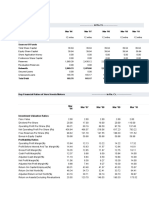

Euro million 0 1 2 3 4 5 6 COC IRR

Property

NOI 0.80 0.82 0.85 0.87 0.90 0.93

Investment -15 17.91

Net Cash Flow (15.00) 0.80 0.82 0.85 0.87 0.90 18.84 1.54 8.33%

Senior Debt

Principal (9.75) 9.75

Interest 0.49 0.49 0.49 0.49 0.49 0.49

Cashflow to Senior Debt (9.75) 0.49 0.49 0.49 0.49 0.49 10.24 1.30 5.00%

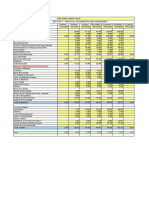

Mezzanine Debt

Accreted Value

Beginning value 3.00 3.00 3.09 3.18 3.28 3.38 3.48

Accrued PIK interest 0.09 0.09 0.10 0.10 0.10 0.10

End value 3.00 3.09 3.18 3.28 3.38 3.48 3.58

Cashflows

Principal (3.00) 3.00

Cash Interest 0.15 0.15 0.16 0.16 0.17 0.17

PIK Interest 0.58

Equity Kicker 0.30

Cashflows to Mezzanine (3.00) 0.15 0.15 0.16 0.16 0.17 4.06 1.62 9.23%

Cashflows to Equity (2.25) 0.16 0.18 0.20 0.22 0.24 4.54 2.47 18.47%

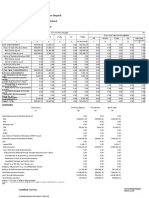

Without Mezzanine Finance

Senior Debt LTV 70%

Senior Debt

Principal (10.50) 10.50

Interest 0.53 0.53 0.53 0.53 0.53 0.53

Cashflow to Senior Debt (10.50) 0.53 0.53 0.53 0.53 0.53 11.03 1.30 5.00%

Cashflows to Equity (4.50) 0.28 0.30 0.32 0.35 0.38 7.81 2.10 14.72%

IRR to equity is increasing by adding mezzanine bcoz

mezzanine allows you to take more leverage

since you get more leverage your actual returns turn out to be high

You might also like

- Sell Sell SellDocument826 pagesSell Sell SellWannaride100% (3)

- Survey of Accounting 7th Edition Warren Solutions ManualDocument8 pagesSurvey of Accounting 7th Edition Warren Solutions ManualLukeCamerondepo100% (35)

- Fundamentals of Financial Management-1.Briarcliff Stove Company-13 Capital Budgeting TechniquesDocument1 pageFundamentals of Financial Management-1.Briarcliff Stove Company-13 Capital Budgeting TechniquesRajib Dahal83% (6)

- BBA II Chapter 2 Sale of Partnership ProblemsDocument14 pagesBBA II Chapter 2 Sale of Partnership ProblemsSiddharth SalgaonkarNo ratings yet

- How Does Debt Affect CPKDocument14 pagesHow Does Debt Affect CPKLâm Thanh Huyền Nguyễn100% (1)

- CRBV Kohler Case - Group 6Document14 pagesCRBV Kohler Case - Group 6amitsuchi100% (4)

- Accountancy Class 11: by DR Vinod KumarDocument2 pagesAccountancy Class 11: by DR Vinod KumarAayush Mehra33% (3)

- Financial Planning and ForecastingDocument3 pagesFinancial Planning and ForecastingPrima FacieNo ratings yet

- Acme Sol - For StudentsDocument9 pagesAcme Sol - For StudentsBarsha MahapatraNo ratings yet

- Cma DataDocument9 pagesCma Datapk9079885245No ratings yet

- CH 8 Valuasi SahamDocument6 pagesCH 8 Valuasi SahamWANDA MAULIDIA PUSPITA DEWINo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsdeepNo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda MotorsMehul ShuklaNo ratings yet

- ECF 1 AsthaDocument6 pagesECF 1 Asthaasthapatel.akpNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Registered Office Registrar & Share Transfer AgentDocument5 pagesRegistered Office Registrar & Share Transfer AgentmanishshettiNo ratings yet

- Rafeeqa Begum (DPR)Document13 pagesRafeeqa Begum (DPR)syedNo ratings yet

- Balance Sheet of TCM: - in Rs. Cr.Document5 pagesBalance Sheet of TCM: - in Rs. Cr.Steffi GonsalvesNo ratings yet

- CMADocument12 pagesCMADhruv ChandwaniNo ratings yet

- Balance Sheet: StandaloneDocument9 pagesBalance Sheet: StandaloneKabita BuragohainNo ratings yet

- Rdy Mad e Pmegp 10 LacsDocument13 pagesRdy Mad e Pmegp 10 LacssyedNo ratings yet

- Sample Final ExamDocument7 pagesSample Final Examanony88No ratings yet

- CMA Data Analysis - BranchDocument9 pagesCMA Data Analysis - BranchKunal SinghNo ratings yet

- AnswersDocument7 pagesAnswersClarisse AlimotNo ratings yet

- WC 4.5 TL .50 WalnutDocument13 pagesWC 4.5 TL .50 WalnutsyedNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Department: Department of Education (Deped) Agency: Office of The Secretary Operating Unit: Hingyon National High School Organization Code 07 001 0914136 Fund Cluster: 01 Regular Agency FundDocument6 pagesDepartment: Department of Education (Deped) Agency: Office of The Secretary Operating Unit: Hingyon National High School Organization Code 07 001 0914136 Fund Cluster: 01 Regular Agency FundErleen T GuimbunganNo ratings yet

- 6 XFL 1621587920041Document79 pages6 XFL 1621587920041Gajendra AudichyaNo ratings yet

- Airan RatioDocument2 pagesAiran RatiomilanNo ratings yet

- Free Cash Flow vs. Cash Flows To Shareholders: Cost of Equity 12%Document3 pagesFree Cash Flow vs. Cash Flows To Shareholders: Cost of Equity 12%Sandeep ChowdhuryNo ratings yet

- FINANCE TEAM PROJECT - Ratio CalculationsDocument2 pagesFINANCE TEAM PROJECT - Ratio CalculationsMOHAMED JALEEL MOHAMED SIDDEEKNo ratings yet

- Inputs (Billions) Year Free Cash FlowDocument5 pagesInputs (Billions) Year Free Cash FlowBenny OngNo ratings yet

- Memory Plus Gold For Mas5Document8 pagesMemory Plus Gold For Mas5Ashianna KimNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsUday KumarNo ratings yet

- Bank StatementDocument23 pagesBank StatementsuyashamNo ratings yet

- NLP My NotesDocument16 pagesNLP My NotesLương NguyễnNo ratings yet

- 16 - Manju - Infosys Technolgy Ltd.Document15 pages16 - Manju - Infosys Technolgy Ltd.rajat_singlaNo ratings yet

- Afa Assignment: Ratio AnalysisDocument7 pagesAfa Assignment: Ratio AnalysisKathir VelNo ratings yet

- Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06: Sunil Agro Foods Ltd. Income StatementDocument2 pagesMar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06: Sunil Agro Foods Ltd. Income StatementRahul RanjanNo ratings yet

- SafariDocument49 pagesSafariwafaNo ratings yet

- Industry: Finance - Small: Print CloseDocument1 pageIndustry: Finance - Small: Print Closeaaron chenNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalK08Ahmar JafriNo ratings yet

- Free Cash Flow Initial Equity Dividend Change in Cash BalanceDocument6 pagesFree Cash Flow Initial Equity Dividend Change in Cash BalanceAbhinav SinhaNo ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- Finacial Ratio Mar 21Document9 pagesFinacial Ratio Mar 21VishNo ratings yet

- Final Report - Financial ModelDocument10 pagesFinal Report - Financial ModelDrishti SrivatavaNo ratings yet

- ITSDIDocument19 pagesITSDISubrat RathNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelTrần Bảo YếnNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelSatyam MohlaNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelTrần Bảo YếnNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelviktorNo ratings yet

- Andhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsDocument6 pagesAndhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsAbhishek OjhaNo ratings yet

- FINACIALDocument1 pageFINACIALPrakash GuptaNo ratings yet

- Real Options Exercis - WeGig-2Document17 pagesReal Options Exercis - WeGig-2Anirudh SinghNo ratings yet

- Moneycontrol 1Document1 pageMoneycontrol 1dakshdudeNo ratings yet

- Chappan Bhog 26.11.2018Document6 pagesChappan Bhog 26.11.2018PRAHARSHITANo ratings yet

- Plantilla de Creigthons 2018Document15 pagesPlantilla de Creigthons 2018MariotelliNo ratings yet

- Cost of CapitalDocument16 pagesCost of Capital0241ASHAYNo ratings yet

- BondDocument9 pagesBondpurviNo ratings yet

- Ratio Analysis As On Return Related: Cipla LTDDocument16 pagesRatio Analysis As On Return Related: Cipla LTDAsif AminNo ratings yet

- Accounting For ManagementDocument26 pagesAccounting For Managementdheivayani kNo ratings yet

- Q2 Presentation 2018-19Document14 pagesQ2 Presentation 2018-19Archana patilNo ratings yet

- INfyDocument14 pagesINfyswaroop shettyNo ratings yet

- CApital Structure by Faraz ShahidDocument29 pagesCApital Structure by Faraz ShahidFaraz ShahidNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- 8-9. Equity Linked NotesDocument7 pages8-9. Equity Linked NotesShubhangi JainNo ratings yet

- 8-9. Equity Linked Notes SolvedDocument9 pages8-9. Equity Linked Notes SolvedShubhangi JainNo ratings yet

- Description Interest Rate Remaining Term Current Principal BalanceDocument23 pagesDescription Interest Rate Remaining Term Current Principal BalanceShubhangi JainNo ratings yet

- Retirement Plan WorkingsDocument13 pagesRetirement Plan WorkingsShubhangi JainNo ratings yet

- BNYMellonDocument6 pagesBNYMellonShubhangi JainNo ratings yet

- XLS EngDocument4 pagesXLS EngShubhangi JainNo ratings yet

- Reading 56 Option Replication Using Put-Call ParityDocument6 pagesReading 56 Option Replication Using Put-Call ParityNeerajNo ratings yet

- Selected & Annotated FRM 2010 Questions: Valuation & Risk Models: Hull, Chapters 11,13 & 17Document36 pagesSelected & Annotated FRM 2010 Questions: Valuation & Risk Models: Hull, Chapters 11,13 & 17BhabaniParidaNo ratings yet

- SRC, Ppsa, LocDocument7 pagesSRC, Ppsa, LocKLNo ratings yet

- Topic: Accounting EnvironmentDocument24 pagesTopic: Accounting Environmentsdae_hoNo ratings yet

- Module 9 - Statement of Cash Flows Part 2Document14 pagesModule 9 - Statement of Cash Flows Part 2Geneen LouiseNo ratings yet

- Apuntes de Introducción A La MicroeconomíaDocument31 pagesApuntes de Introducción A La MicroeconomíaJose Carlo BermudezNo ratings yet

- Sem Iii Sybcom Finacc Mang AccDocument6 pagesSem Iii Sybcom Finacc Mang AccKishori KumariNo ratings yet

- Account 12th ClassDocument4 pagesAccount 12th ClassMandeep KaurNo ratings yet

- Valuation of SecurityDocument3 pagesValuation of SecurityAshwin Krishna PrasadNo ratings yet

- SodapdfDocument8 pagesSodapdfr6540073No ratings yet

- Question Bank - Multiple Choice Questions (MCQS) : Unit 1: Indian Financial SystemDocument41 pagesQuestion Bank - Multiple Choice Questions (MCQS) : Unit 1: Indian Financial Systempriyanka chawlaNo ratings yet

- 0901d19680cb452b PDF Preview MediumDocument611 pages0901d19680cb452b PDF Preview Mediumgangadhar singhNo ratings yet

- Cash Flow Statement1Document2 pagesCash Flow Statement1Mila Mercado0% (1)

- 6 CorporateDocument16 pages6 CorporateMoriko Mayhon100% (2)

- CFA FlyerDocument2 pagesCFA FlyeranonmonkNo ratings yet

- Faq Tradesuite Repo UsDocument5 pagesFaq Tradesuite Repo UsGurupraNo ratings yet

- Chapter 3 Review QuizDocument1 pageChapter 3 Review QuizA. ZNo ratings yet

- Google Form Model A.A University 1Document96 pagesGoogle Form Model A.A University 1Tesfu HettoNo ratings yet

- Reading 32 - Market Based ValuationDocument20 pagesReading 32 - Market Based ValuationZawad47 AhaNo ratings yet

- 1) Abn Amro BankDocument7 pages1) Abn Amro BankAbhi MaheshwariNo ratings yet

- International Financial Statement Analysis: BU7504 Trinity Business School Caroline Kirrane, CFA, MBADocument31 pagesInternational Financial Statement Analysis: BU7504 Trinity Business School Caroline Kirrane, CFA, MBAJingquan (Adele) ZhaoNo ratings yet

- Banana Leaf Catering FSDocument2 pagesBanana Leaf Catering FSLeslie CastilloNo ratings yet

- Richeek Lab Keshav KababistanDocument12 pagesRicheek Lab Keshav Kababistanyogesh.jangraaNo ratings yet

- FAR - Region 11Document30 pagesFAR - Region 11joan CadenaNo ratings yet

- Optimal Pricing Decision in A Multi-Channel Supply Chain With A Revenue-Sharing ContractDocument36 pagesOptimal Pricing Decision in A Multi-Channel Supply Chain With A Revenue-Sharing ContractSamNo ratings yet