Professional Documents

Culture Documents

Forex Exercises With Translation

Forex Exercises With Translation

Uploaded by

Viky Rose EballeCopyright:

Available Formats

You might also like

- Keith J Cunningham - Financial LiteracyDocument5 pagesKeith J Cunningham - Financial Literacykoetjinsiong100% (4)

- NoticetheseDocument4 pagesNoticetheseZeepDeetusNo ratings yet

- Recording Transactions: Using The Method of Journal EntriesDocument50 pagesRecording Transactions: Using The Method of Journal EntriesHasanAbdullah100% (1)

- Test Bank For Financial Statement Analysis and Security Valuation 5th Edition PenmanDocument14 pagesTest Bank For Financial Statement Analysis and Security Valuation 5th Edition PenmanDhoni Khan100% (3)

- Terang JayaDocument1 pageTerang JayaAdis GresiaNo ratings yet

- ACC51112 - Responsibility Accounting QuizzerDocument12 pagesACC51112 - Responsibility Accounting QuizzerjasNo ratings yet

- Chapter 10 Effects of Changes in Forex RatesDocument16 pagesChapter 10 Effects of Changes in Forex RatesJeeramel TorresNo ratings yet

- Use The Following Information For The Next Three Questions:: Activity 3.2Document2 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Tine Vasiana DuermeNo ratings yet

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- Business Structure in BDDocument32 pagesBusiness Structure in BDMd. Tareq AzizNo ratings yet

- Paper LBO Model Example - Street of WallsDocument6 pagesPaper LBO Model Example - Street of WallsAndrewNo ratings yet

- Exercise 4. Perez Company Had The Following Transactions During JanuaryDocument3 pagesExercise 4. Perez Company Had The Following Transactions During JanuaryLysss EpssssNo ratings yet

- The Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Document3 pagesThe Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Cyrine Miwa RodriguezNo ratings yet

- Two Ways of Conducting Foreign ActivitiesDocument7 pagesTwo Ways of Conducting Foreign ActivitiesJustine VeralloNo ratings yet

- Law NotesDocument1 pageLaw NotesGem YielNo ratings yet

- Arendain Tp4 FinanceDocument4 pagesArendain Tp4 FinanceMgrace arendaknNo ratings yet

- Problem X: Date of Transaction (12/1/20x4) P .0095 Balance Sheet Date (12/31/20x4) .0096Document26 pagesProblem X: Date of Transaction (12/1/20x4) P .0095 Balance Sheet Date (12/31/20x4) .0096Love FreddyNo ratings yet

- Acg5205 Solutions Ch.11 - Christensen 12eDocument8 pagesAcg5205 Solutions Ch.11 - Christensen 12eRyan NguyenNo ratings yet

- Problem XDocument30 pagesProblem XLove FreddyNo ratings yet

- 16Document23 pages16Alex liao0% (1)

- Solution To Problems - Chapter 9Document25 pagesSolution To Problems - Chapter 9GFGSHSNo ratings yet

- Dayag 9Document2 pagesDayag 9dmangiginNo ratings yet

- baitap-sinhvien-IAS 21Document12 pagesbaitap-sinhvien-IAS 21tonight752No ratings yet

- Assignment FM I (2020)Document11 pagesAssignment FM I (2020)ShaggYNo ratings yet

- Chapter 7 Homework ADocument2 pagesChapter 7 Homework ALong BuiNo ratings yet

- Chapter 3 - Analysis and Interpretation of Financial StatementsDocument21 pagesChapter 3 - Analysis and Interpretation of Financial StatementsFahad Asghar100% (1)

- Financial Management 2Document22 pagesFinancial Management 2Win BerAngelNo ratings yet

- Solman Effects of Changes in ForEx RatesDocument21 pagesSolman Effects of Changes in ForEx RatesMIMI LANo ratings yet

- Module 7 - Prob A-C Valuation and Concepts AnswersDocument2 pagesModule 7 - Prob A-C Valuation and Concepts Answersvenice cambryNo ratings yet

- Chapter 16 Problem2 New PDFDocument5 pagesChapter 16 Problem2 New PDFBernadette Joyce ManjaresNo ratings yet

- Foreign Currency Transactions and DerivativesDocument4 pagesForeign Currency Transactions and Derivativesmartinfaith958No ratings yet

- Chapter 20Document12 pagesChapter 20FireBNo ratings yet

- Fabozzi Handbook Fixed Income 7th EditionDocument2 pagesFabozzi Handbook Fixed Income 7th EditionBhagyeshGhagiNo ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentrupokNo ratings yet

- Appendix D - Answers To Self-Test Problems PDFDocument32 pagesAppendix D - Answers To Self-Test Problems PDFgmcrinaNo ratings yet

- Sol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsDocument19 pagesSol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Kelompok 1 (Intan)Document14 pagesKelompok 1 (Intan)Amanda VeronikaNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Financial Analysis TechniquesDocument40 pagesFinancial Analysis TechniquesPASCA/51421220048/SULTHAN MUHAMMADNo ratings yet

- Financial Accounting - Tugas 2 - 9 Oktober 2019Document3 pagesFinancial Accounting - Tugas 2 - 9 Oktober 2019AlfiyanNo ratings yet

- Nudjpia Far and Afar Solutions - Conceptual FrameworkDocument1 pageNudjpia Far and Afar Solutions - Conceptual FrameworkKyla Artuz Dela CruzNo ratings yet

- HO 6 Financial PlanningDocument2 pagesHO 6 Financial PlanningChintiaNo ratings yet

- IFR - Tutorial W4 - Extra ExerciseDocument2 pagesIFR - Tutorial W4 - Extra Exercises.h.j.braamhaarNo ratings yet

- Translation Adjustment OCI - Prac ProbDocument1 pageTranslation Adjustment OCI - Prac ProbJasper Andrew AdjaraniNo ratings yet

- Translation ExposureDocument12 pagesTranslation ExposureArunVellaiyappanNo ratings yet

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- Session 9 Flexible Budgets and Variance AnalysesDocument98 pagesSession 9 Flexible Budgets and Variance Analyseschloe lamxdNo ratings yet

- Chapter 21 - Teachers Manual - Aa Part 2 PDFDocument23 pagesChapter 21 - Teachers Manual - Aa Part 2 PDFSheed ChiuNo ratings yet

- ACC 3003 - Final Exam Revision - SolutionDocument22 pagesACC 3003 - Final Exam Revision - Solutionfalnuaimi001No ratings yet

- AC5001 _ Mid pracDocument8 pagesAC5001 _ Mid pracNguyễn Minh HạnhNo ratings yet

- Chapter 7 Accounting For Foreign Currency TransactionsDocument5 pagesChapter 7 Accounting For Foreign Currency TransactionsMixx MineNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- ACC 3003 - ReviewDocument22 pagesACC 3003 - Reviewfalnuaimi001No ratings yet

- NIIF 9 Ejercicios EspanolDocument21 pagesNIIF 9 Ejercicios EspanolVicenteMoralesLeRoyNo ratings yet

- Goodwill P 180,000Document31 pagesGoodwill P 180,000Love FreddyNo ratings yet

- Quiz 1 in Ia3Document6 pagesQuiz 1 in Ia3Dorothy NadelaNo ratings yet

- How To Read Financial Statement PDFDocument31 pagesHow To Read Financial Statement PDFMazen AlbsharaNo ratings yet

- Ia 3Document2 pagesIa 3Charisse Ahnne TosloladoNo ratings yet

- Worksheets For The Financial Rosetta StoneDocument4 pagesWorksheets For The Financial Rosetta StonemeNo ratings yet

- Financial Management 1 ProblemsDocument12 pagesFinancial Management 1 ProblemsXytusNo ratings yet

- Tugas Plant Asset - Winda Gokma Fransiska Purba - 4112311090Document13 pagesTugas Plant Asset - Winda Gokma Fransiska Purba - 4112311090Winda FransiskaNo ratings yet

- 9.IAS-21 Individual Entity LevelDocument12 pages9.IAS-21 Individual Entity LevelRana Ammar waheedNo ratings yet

- Foreign Currency TransactionsDocument14 pagesForeign Currency TransactionsXavier AresNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- AgricultureDocument4 pagesAgricultureViky Rose EballeNo ratings yet

- RP - Financial Asset FVPL FvociDocument3 pagesRP - Financial Asset FVPL FvociViky Rose EballeNo ratings yet

- IntangiblesDocument2 pagesIntangiblesViky Rose EballeNo ratings yet

- Property Plant and Equipment PT 2Document2 pagesProperty Plant and Equipment PT 2Viky Rose EballeNo ratings yet

- RP - Working Capital Audit 2Document2 pagesRP - Working Capital Audit 2Viky Rose EballeNo ratings yet

- LiabilitiesDocument5 pagesLiabilitiesViky Rose EballeNo ratings yet

- RP - Working Capital AuditDocument7 pagesRP - Working Capital AuditViky Rose EballeNo ratings yet

- Property Plant and Equipment PT 1Document3 pagesProperty Plant and Equipment PT 1Viky Rose EballeNo ratings yet

- RP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationDocument5 pagesRP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationViky Rose EballeNo ratings yet

- RP Doubtful AccountsDocument6 pagesRP Doubtful AccountsViky Rose EballeNo ratings yet

- RP Error and CorrectionDocument3 pagesRP Error and CorrectionViky Rose EballeNo ratings yet

- Quiz 1 - Attempt Review IASDocument7 pagesQuiz 1 - Attempt Review IASViky Rose EballeNo ratings yet

- Study Guide On PSADocument5 pagesStudy Guide On PSAViky Rose EballeNo ratings yet

- First Semester 2023 ACC 311 ClasslistpdfDocument1 pageFirst Semester 2023 ACC 311 ClasslistpdfViky Rose EballeNo ratings yet

- A Title-PageDocument3 pagesA Title-PageViky Rose EballeNo ratings yet

- Test Bank Law On Sales - CompressDocument7 pagesTest Bank Law On Sales - CompressViky Rose EballeNo ratings yet

- Economic Inequality in The PhilippinesDocument2 pagesEconomic Inequality in The PhilippinesViky Rose EballeNo ratings yet

- LECTURE 2 Statement of Comprehensive IncomeDocument12 pagesLECTURE 2 Statement of Comprehensive IncomeViky Rose EballeNo ratings yet

- EGYPT Group 9Document8 pagesEGYPT Group 9Viky Rose EballeNo ratings yet

- Finals Test BanksDocument3 pagesFinals Test BanksViky Rose EballeNo ratings yet

- Business Budget: FundingDocument4 pagesBusiness Budget: FundingMae Anne Yabut Roque-CunananNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- WPC Assignment - FM CaseDocument6 pagesWPC Assignment - FM CaseAhmed AliNo ratings yet

- Financial Statements-Ceres Gardening CompanyDocument9 pagesFinancial Statements-Ceres Gardening CompanyHarshit MalviyaNo ratings yet

- Sample Export Distribution Agreement - Jun 08Document20 pagesSample Export Distribution Agreement - Jun 08Martin WadsworthNo ratings yet

- HFM CashFlow CalculationDocument15 pagesHFM CashFlow CalculationAmit Sharma100% (3)

- Accounting Mid TermDocument9 pagesAccounting Mid TermSaad MaqboolNo ratings yet

- Week15 - Fundamentals of AccountingDocument5 pagesWeek15 - Fundamentals of AccountingShiene MedrianoNo ratings yet

- Suzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsDocument3 pagesSuzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsM Bilal KNo ratings yet

- Accf3114 9Document10 pagesAccf3114 9Krishna 11No ratings yet

- LAPD-CGT-G01 - Comprehensive Guide To Capital Gains Tax PDFDocument938 pagesLAPD-CGT-G01 - Comprehensive Guide To Capital Gains Tax PDFKriben RaoNo ratings yet

- Chapter 10 State and Local Government ExpendituresDocument34 pagesChapter 10 State and Local Government ExpendituresGabriel RegoNo ratings yet

- CIR V GR. No 140230Document3 pagesCIR V GR. No 140230Joyjoy C LbanezNo ratings yet

- Credit Rating Report - 2021Document19 pagesCredit Rating Report - 2021MonirNo ratings yet

- Ce 351 A2Document12 pagesCe 351 A2IsraelNo ratings yet

- Review The Financial Statements and Related Notes of Starbucks inDocument1 pageReview The Financial Statements and Related Notes of Starbucks inFreelance WorkerNo ratings yet

- A Company Is An Artificial Person Created by LawDocument5 pagesA Company Is An Artificial Person Created by LawNeelabhNo ratings yet

- Gross Income (Tax)Document52 pagesGross Income (Tax)HOOPE JISONNo ratings yet

- Kimberley Hoff PAR711 JDF 1111 Sworn Financial StatementDocument7 pagesKimberley Hoff PAR711 JDF 1111 Sworn Financial StatementlegalparaeagleNo ratings yet

- System of Cess in India: What Is A Cess?Document6 pagesSystem of Cess in India: What Is A Cess?Srikanth RollaNo ratings yet

- Data For FROM 1701Document3 pagesData For FROM 1701April Jane YadaoNo ratings yet

- Inequality Could Be Lower Than You ThinkDocument4 pagesInequality Could Be Lower Than You ThinkPRANAY GOYALNo ratings yet

Forex Exercises With Translation

Forex Exercises With Translation

Uploaded by

Viky Rose EballeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forex Exercises With Translation

Forex Exercises With Translation

Uploaded by

Viky Rose EballeCopyright:

Available Formats

1. On November 29, 20x1, ABC Co.

placed a non-cancellable purchase order for the importation of

a machine with a purchase price of €20,000 from a company based in France. The contract term

is FOB shipping point. The machine was shipped on December 1, 20x1 and was received by ABC

on December 15, 20x1. The purchase price was settled on January 3, 20x2.

The following are the exchange rates:

November 29, 20x1………………………………………..₱55:€1

December 1, 20x1………………………………………….₱58:€1

December 15, 20x1………………………………………..₱57:€1

December 31, 20x1………………………………………..₱60:€1

January 3, 20x2…………………………………………….₱61:€1

Requirement: Provide the journal entries.

1. Solution:

Nov. 29,

No entry

20x1

Dec. 1, 20x1 Machine (€20,000 x P58) 1,160,000

Accounts payable 1,160,000

to record the purchase of machine on an FOB shipping

point term

Dec. 15, Accounts payable 20,000

20x1 Foreign exchange gain* 20,000

to recognize FOREX gain on the exchange difference

*Accounts payable – Dec. 15, 20x1 (€20,000 x P57) P1,140,000

Accounts payable – Dec. 1, 20x1 (€20,000 x P58) 1,160,000

Decrease in accounts payable – FOREX gain P 20,000

Dec. 31, Foreign exchange loss* 60,000

20x1 Accounts payable 60,000

to recognize FOREX loss on the exchange difference

* Accounts payable – Dec. 31, 20x1 (€20,000 x P60) P1,200,000

Accounts payable – Dec. 15, 20x1 (€20,000 x P57) 1,140,000

Increase in accounts payable – FOREX loss P 60,000

Total net foreign exchange loss recognized in 20x1 is P40,000 (60,000 loss – 20,000 gain).

Jan. 3, 20x2 Accounts payable 1,200,000

Foreign exchange loss (squeeze) 20,000

Cash in bank (€20,000 x P61) 1,220,000

to record the settlement of the purchase transaction

The foreign exchange loss of P20,000 is recognized in profit or loss in 20x2.

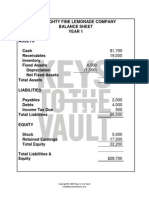

Use the following information for the next three questions:

Entity A has just started its operations on January 1, 20x1. On this date, Entity A’s equity consisted

of ₱2M share capital, which were issued also on this date. Entity A’s functional currency is the

Philippine peso (₱). However, it wishes to present its 20x1 financial statements into Japanese yen (¥).

The following information was gathered on December 31, 20x1, after a year of operations.

Total assets ₱10M

Total liabilities ₱5M

Share capital 2M

Retained earnings 3M

Total liabilities and equity ₱10M

Income ₱7M

Expenses (4M)

Profit ₱3M

Relevant exchange rates:

January 1, 20x1 (historical rate for the share capital) ₱1: ¥2

Average rate ₱1: ¥3

December 31, 20x1 (closing rate) ₱1: ¥4

2. How much is the translated total assets?

a. ¥40M

b. ¥36M

c. ¥20M

d. ¥18M

3. How much is the translated total equity?

a. ¥40M

b. ¥36M

c. ¥20M

d. ¥18M

4. How much is the translated profit or loss?

a. ¥9M

b. ¥7M

c. ¥6M

d. ¥12M

Translation:

in pesos rates in yens

Total assets ₱10M ¥4 (CR) ¥40M

Total liabilities ₱5M ¥4 (CR) ¥20M

Share capital 2M ¥2 (HR) 4M

Retained earnings 3M (see below) 9M

Exchange differences / Translation Adj. (g/l) - (squeeze) 7M

Total liabilities and equity ₱10M ¥40M

Income ₱7M ¥3 (AR) ¥21M

Expenses (4M) ¥3 (AR) (12M)

Profit ₱3M ¥3 (AR) ¥9M

Translated total assets 40M – translated total liabilities 20M = translated total equity 20M

Retained earnings is translated as follows:

in pesos rate in yens

Retained earnings, beginning 0 (not applicable) 0 (a)

Profit 3M 3 9M

Retained earnings, end. 3M 9M

Entity A has no beginning retained earnings because it has just started operations during the year. In

(a)

the case of a non-newly formed entity, the amount to be included here would be the translated retained

earnings from the preceding year.

After translating all the amounts, the exchange difference is simply “squeezed” as the balancing

figure between ‘total assets’ and ‘total liabilities and equity.’ This is computed as follows: (¥40M

total assets – ¥20 total liabilities – ¥4M share capital – ¥9 retained earnings) = ¥7 exchange difference –

gain (credit).

The exchange difference can also be reconciled as follows:

1) Translation of opening net assets

Equity, Jan. 1 - at opening rate (₱2M x ¥2) ¥4M

Equity, Jan. 1 - at closing rate (₱2M x ¥4) 8M

Increase in opening net assets – gain 4M

Cumulative translation gain, Jan. 1 (a) 0

2) Translation of changes in net assets during the period:

Profit or loss:

Profit - at average rate (₱3M x ¥3) 9M

Profit - at closing rate (₱3M x ¥4) 12M

Increase in profit – gain 3M

Exchange difference - gain ¥7M

(a) See explanation on retained earnings above.

You might also like

- Keith J Cunningham - Financial LiteracyDocument5 pagesKeith J Cunningham - Financial Literacykoetjinsiong100% (4)

- NoticetheseDocument4 pagesNoticetheseZeepDeetusNo ratings yet

- Recording Transactions: Using The Method of Journal EntriesDocument50 pagesRecording Transactions: Using The Method of Journal EntriesHasanAbdullah100% (1)

- Test Bank For Financial Statement Analysis and Security Valuation 5th Edition PenmanDocument14 pagesTest Bank For Financial Statement Analysis and Security Valuation 5th Edition PenmanDhoni Khan100% (3)

- Terang JayaDocument1 pageTerang JayaAdis GresiaNo ratings yet

- ACC51112 - Responsibility Accounting QuizzerDocument12 pagesACC51112 - Responsibility Accounting QuizzerjasNo ratings yet

- Chapter 10 Effects of Changes in Forex RatesDocument16 pagesChapter 10 Effects of Changes in Forex RatesJeeramel TorresNo ratings yet

- Use The Following Information For The Next Three Questions:: Activity 3.2Document2 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Tine Vasiana DuermeNo ratings yet

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- Business Structure in BDDocument32 pagesBusiness Structure in BDMd. Tareq AzizNo ratings yet

- Paper LBO Model Example - Street of WallsDocument6 pagesPaper LBO Model Example - Street of WallsAndrewNo ratings yet

- Exercise 4. Perez Company Had The Following Transactions During JanuaryDocument3 pagesExercise 4. Perez Company Had The Following Transactions During JanuaryLysss EpssssNo ratings yet

- The Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Document3 pagesThe Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Cyrine Miwa RodriguezNo ratings yet

- Two Ways of Conducting Foreign ActivitiesDocument7 pagesTwo Ways of Conducting Foreign ActivitiesJustine VeralloNo ratings yet

- Law NotesDocument1 pageLaw NotesGem YielNo ratings yet

- Arendain Tp4 FinanceDocument4 pagesArendain Tp4 FinanceMgrace arendaknNo ratings yet

- Problem X: Date of Transaction (12/1/20x4) P .0095 Balance Sheet Date (12/31/20x4) .0096Document26 pagesProblem X: Date of Transaction (12/1/20x4) P .0095 Balance Sheet Date (12/31/20x4) .0096Love FreddyNo ratings yet

- Acg5205 Solutions Ch.11 - Christensen 12eDocument8 pagesAcg5205 Solutions Ch.11 - Christensen 12eRyan NguyenNo ratings yet

- Problem XDocument30 pagesProblem XLove FreddyNo ratings yet

- 16Document23 pages16Alex liao0% (1)

- Solution To Problems - Chapter 9Document25 pagesSolution To Problems - Chapter 9GFGSHSNo ratings yet

- Dayag 9Document2 pagesDayag 9dmangiginNo ratings yet

- baitap-sinhvien-IAS 21Document12 pagesbaitap-sinhvien-IAS 21tonight752No ratings yet

- Assignment FM I (2020)Document11 pagesAssignment FM I (2020)ShaggYNo ratings yet

- Chapter 7 Homework ADocument2 pagesChapter 7 Homework ALong BuiNo ratings yet

- Chapter 3 - Analysis and Interpretation of Financial StatementsDocument21 pagesChapter 3 - Analysis and Interpretation of Financial StatementsFahad Asghar100% (1)

- Financial Management 2Document22 pagesFinancial Management 2Win BerAngelNo ratings yet

- Solman Effects of Changes in ForEx RatesDocument21 pagesSolman Effects of Changes in ForEx RatesMIMI LANo ratings yet

- Module 7 - Prob A-C Valuation and Concepts AnswersDocument2 pagesModule 7 - Prob A-C Valuation and Concepts Answersvenice cambryNo ratings yet

- Chapter 16 Problem2 New PDFDocument5 pagesChapter 16 Problem2 New PDFBernadette Joyce ManjaresNo ratings yet

- Foreign Currency Transactions and DerivativesDocument4 pagesForeign Currency Transactions and Derivativesmartinfaith958No ratings yet

- Chapter 20Document12 pagesChapter 20FireBNo ratings yet

- Fabozzi Handbook Fixed Income 7th EditionDocument2 pagesFabozzi Handbook Fixed Income 7th EditionBhagyeshGhagiNo ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentrupokNo ratings yet

- Appendix D - Answers To Self-Test Problems PDFDocument32 pagesAppendix D - Answers To Self-Test Problems PDFgmcrinaNo ratings yet

- Sol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsDocument19 pagesSol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Kelompok 1 (Intan)Document14 pagesKelompok 1 (Intan)Amanda VeronikaNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Financial Analysis TechniquesDocument40 pagesFinancial Analysis TechniquesPASCA/51421220048/SULTHAN MUHAMMADNo ratings yet

- Financial Accounting - Tugas 2 - 9 Oktober 2019Document3 pagesFinancial Accounting - Tugas 2 - 9 Oktober 2019AlfiyanNo ratings yet

- Nudjpia Far and Afar Solutions - Conceptual FrameworkDocument1 pageNudjpia Far and Afar Solutions - Conceptual FrameworkKyla Artuz Dela CruzNo ratings yet

- HO 6 Financial PlanningDocument2 pagesHO 6 Financial PlanningChintiaNo ratings yet

- IFR - Tutorial W4 - Extra ExerciseDocument2 pagesIFR - Tutorial W4 - Extra Exercises.h.j.braamhaarNo ratings yet

- Translation Adjustment OCI - Prac ProbDocument1 pageTranslation Adjustment OCI - Prac ProbJasper Andrew AdjaraniNo ratings yet

- Translation ExposureDocument12 pagesTranslation ExposureArunVellaiyappanNo ratings yet

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- Session 9 Flexible Budgets and Variance AnalysesDocument98 pagesSession 9 Flexible Budgets and Variance Analyseschloe lamxdNo ratings yet

- Chapter 21 - Teachers Manual - Aa Part 2 PDFDocument23 pagesChapter 21 - Teachers Manual - Aa Part 2 PDFSheed ChiuNo ratings yet

- ACC 3003 - Final Exam Revision - SolutionDocument22 pagesACC 3003 - Final Exam Revision - Solutionfalnuaimi001No ratings yet

- AC5001 _ Mid pracDocument8 pagesAC5001 _ Mid pracNguyễn Minh HạnhNo ratings yet

- Chapter 7 Accounting For Foreign Currency TransactionsDocument5 pagesChapter 7 Accounting For Foreign Currency TransactionsMixx MineNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- ACC 3003 - ReviewDocument22 pagesACC 3003 - Reviewfalnuaimi001No ratings yet

- NIIF 9 Ejercicios EspanolDocument21 pagesNIIF 9 Ejercicios EspanolVicenteMoralesLeRoyNo ratings yet

- Goodwill P 180,000Document31 pagesGoodwill P 180,000Love FreddyNo ratings yet

- Quiz 1 in Ia3Document6 pagesQuiz 1 in Ia3Dorothy NadelaNo ratings yet

- How To Read Financial Statement PDFDocument31 pagesHow To Read Financial Statement PDFMazen AlbsharaNo ratings yet

- Ia 3Document2 pagesIa 3Charisse Ahnne TosloladoNo ratings yet

- Worksheets For The Financial Rosetta StoneDocument4 pagesWorksheets For The Financial Rosetta StonemeNo ratings yet

- Financial Management 1 ProblemsDocument12 pagesFinancial Management 1 ProblemsXytusNo ratings yet

- Tugas Plant Asset - Winda Gokma Fransiska Purba - 4112311090Document13 pagesTugas Plant Asset - Winda Gokma Fransiska Purba - 4112311090Winda FransiskaNo ratings yet

- 9.IAS-21 Individual Entity LevelDocument12 pages9.IAS-21 Individual Entity LevelRana Ammar waheedNo ratings yet

- Foreign Currency TransactionsDocument14 pagesForeign Currency TransactionsXavier AresNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- AgricultureDocument4 pagesAgricultureViky Rose EballeNo ratings yet

- RP - Financial Asset FVPL FvociDocument3 pagesRP - Financial Asset FVPL FvociViky Rose EballeNo ratings yet

- IntangiblesDocument2 pagesIntangiblesViky Rose EballeNo ratings yet

- Property Plant and Equipment PT 2Document2 pagesProperty Plant and Equipment PT 2Viky Rose EballeNo ratings yet

- RP - Working Capital Audit 2Document2 pagesRP - Working Capital Audit 2Viky Rose EballeNo ratings yet

- LiabilitiesDocument5 pagesLiabilitiesViky Rose EballeNo ratings yet

- RP - Working Capital AuditDocument7 pagesRP - Working Capital AuditViky Rose EballeNo ratings yet

- Property Plant and Equipment PT 1Document3 pagesProperty Plant and Equipment PT 1Viky Rose EballeNo ratings yet

- RP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationDocument5 pagesRP Land-Building-Machinery Gov-Grant Borrowing-Cost DepreciationViky Rose EballeNo ratings yet

- RP Doubtful AccountsDocument6 pagesRP Doubtful AccountsViky Rose EballeNo ratings yet

- RP Error and CorrectionDocument3 pagesRP Error and CorrectionViky Rose EballeNo ratings yet

- Quiz 1 - Attempt Review IASDocument7 pagesQuiz 1 - Attempt Review IASViky Rose EballeNo ratings yet

- Study Guide On PSADocument5 pagesStudy Guide On PSAViky Rose EballeNo ratings yet

- First Semester 2023 ACC 311 ClasslistpdfDocument1 pageFirst Semester 2023 ACC 311 ClasslistpdfViky Rose EballeNo ratings yet

- A Title-PageDocument3 pagesA Title-PageViky Rose EballeNo ratings yet

- Test Bank Law On Sales - CompressDocument7 pagesTest Bank Law On Sales - CompressViky Rose EballeNo ratings yet

- Economic Inequality in The PhilippinesDocument2 pagesEconomic Inequality in The PhilippinesViky Rose EballeNo ratings yet

- LECTURE 2 Statement of Comprehensive IncomeDocument12 pagesLECTURE 2 Statement of Comprehensive IncomeViky Rose EballeNo ratings yet

- EGYPT Group 9Document8 pagesEGYPT Group 9Viky Rose EballeNo ratings yet

- Finals Test BanksDocument3 pagesFinals Test BanksViky Rose EballeNo ratings yet

- Business Budget: FundingDocument4 pagesBusiness Budget: FundingMae Anne Yabut Roque-CunananNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- WPC Assignment - FM CaseDocument6 pagesWPC Assignment - FM CaseAhmed AliNo ratings yet

- Financial Statements-Ceres Gardening CompanyDocument9 pagesFinancial Statements-Ceres Gardening CompanyHarshit MalviyaNo ratings yet

- Sample Export Distribution Agreement - Jun 08Document20 pagesSample Export Distribution Agreement - Jun 08Martin WadsworthNo ratings yet

- HFM CashFlow CalculationDocument15 pagesHFM CashFlow CalculationAmit Sharma100% (3)

- Accounting Mid TermDocument9 pagesAccounting Mid TermSaad MaqboolNo ratings yet

- Week15 - Fundamentals of AccountingDocument5 pagesWeek15 - Fundamentals of AccountingShiene MedrianoNo ratings yet

- Suzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsDocument3 pagesSuzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsM Bilal KNo ratings yet

- Accf3114 9Document10 pagesAccf3114 9Krishna 11No ratings yet

- LAPD-CGT-G01 - Comprehensive Guide To Capital Gains Tax PDFDocument938 pagesLAPD-CGT-G01 - Comprehensive Guide To Capital Gains Tax PDFKriben RaoNo ratings yet

- Chapter 10 State and Local Government ExpendituresDocument34 pagesChapter 10 State and Local Government ExpendituresGabriel RegoNo ratings yet

- CIR V GR. No 140230Document3 pagesCIR V GR. No 140230Joyjoy C LbanezNo ratings yet

- Credit Rating Report - 2021Document19 pagesCredit Rating Report - 2021MonirNo ratings yet

- Ce 351 A2Document12 pagesCe 351 A2IsraelNo ratings yet

- Review The Financial Statements and Related Notes of Starbucks inDocument1 pageReview The Financial Statements and Related Notes of Starbucks inFreelance WorkerNo ratings yet

- A Company Is An Artificial Person Created by LawDocument5 pagesA Company Is An Artificial Person Created by LawNeelabhNo ratings yet

- Gross Income (Tax)Document52 pagesGross Income (Tax)HOOPE JISONNo ratings yet

- Kimberley Hoff PAR711 JDF 1111 Sworn Financial StatementDocument7 pagesKimberley Hoff PAR711 JDF 1111 Sworn Financial StatementlegalparaeagleNo ratings yet

- System of Cess in India: What Is A Cess?Document6 pagesSystem of Cess in India: What Is A Cess?Srikanth RollaNo ratings yet

- Data For FROM 1701Document3 pagesData For FROM 1701April Jane YadaoNo ratings yet

- Inequality Could Be Lower Than You ThinkDocument4 pagesInequality Could Be Lower Than You ThinkPRANAY GOYALNo ratings yet