Professional Documents

Culture Documents

Polity

Polity

Uploaded by

Bindu Rajashekar0 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesPolity

Polity

Uploaded by

Bindu RajashekarCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

National Commission for SCs

Establishment of council Working of the council

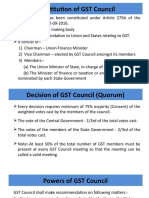

The smooth and efficient administration of this tax Decision taken at its meeting

requires co-operation and coordination between One-half of the total number of members of

Vision and mission of the council the centre and the states. In order to facilitates this the Council is the quorum for conducting a

Council is to be guided by the need for a harmonised consultation, process the amendment provided for meeting.

structure of GST and the development of a harmonised the establishment of GST Council. Every decision of the Council is to be taken

national market for goods and services. This 279A – empowers the president that by a majority of not less than three-fourths of

The Council has to determine the procedure in the President shall, within sixty days from the the weighted votes of the members present

performance of its functions. commencement of the Constitution (One Hundred

and voting at the meeting.

V: To establish the highest standards of co-operative and First Amendment) Act, 2016, by order,

Principles followed while taking decisions:

federation in the functioning of the Council, which is the constitute a Council to be called the Goods and

Services Tax Council. (Presidential order issued The vote of the central government shall

first constitutional federal body vested with powers to take

on 15 September 2016) have a weightage one-third of the total votes

all major decisions relating to GST

Council is located at New Delhi. cast in that meeting.

M: Evolving by a process of wider consultation, a GST

The Union Revenue Secretary3 acts as the ex- The votes of all the state governments

structure, which is information technology driven and user

officio Secretary to the Council. Department of combined shall have weightage of two-thirds

friendly

Revenue, the Ministry of Finance, GOI of the total votes cast in that meeting.

Decision will become invalid if :

any vacancy or defect in the constitution of

Composition of the council the Council; or

Goods and Service

It is the joint forum of the centre and the states consists of any defect in the appointment of a person as

The Union Finance Minister as the Chairperson Tax Council a member of the Council; or

The Union Minister of State in-charge of Revenue any procedural irregularity of the Council not

(101st CAA, 2016) affecting the merits of the case

or Finance

The Minister in-charge of Finance or Taxation or Inserted new Art - 279A

any other Minister nominated by each state

government Functions of the council:

The members of the Council from the states have to choose The taxes, cesses and surcharges levied by the centre, the

one amongst themselves to be the Vice-Chairperson of the states and the local bodies that would get merged in GST In addition,

Council. They can also decide his term. goods and services that may be subjected to GST or The Council shall recommend the date on which

The Union Cabinet also decided to include the Chairperson exempted from GST the GST may be levied on petroleum crude, high

of the Central Board of Excise and Customs (CBEC) as a Model GST Laws, principles of levy, apportionment of speed diesel, motor spirit (petrol), natural gas and

permanent invitee (non-voting) to all proceedings of the GST levied on supplies in the course of inter-state trade aviation turbine fuel.

Council or commerce and the principles that govern the place of Establish mechanism during the disputes between

supply centre and states

e threshold limit of turnover below which goods and Recommend the compensation to the states for

services may be exempted from GST loss of revenue arising on account of introduction

rates including floor rates with bands of GST of GST for a period of five years. Based on

special rate or rates for a specified period to raise recomm parliament determines the compensation.

additional resources during any natural calamity or Acc parliament enacted the law in 2017. (The

disaster Goods and Services Tax (Compensation to States)

Act, 2017)

Special provision with respect to the states of Arunachal

Pradesh, Assam, Jammu and Kashmir4 , Manipur,

Meghalaya, Mizoram, Nagaland, Sikkim, Tripura,

You might also like

- 13 Southern Cross Cement Corporation v. Cement Manufacturers Association of The PhilippinesDocument3 pages13 Southern Cross Cement Corporation v. Cement Manufacturers Association of The PhilippinesMarc Yu100% (2)

- Project Proposal On Shallow Wells in Wakiso District 30th May 2019Document24 pagesProject Proposal On Shallow Wells in Wakiso District 30th May 2019dennis100% (4)

- Background of The Goods and Services Tax CouncilDocument3 pagesBackground of The Goods and Services Tax CouncilPranay VermaNo ratings yet

- GST Council - StudyDocument3 pagesGST Council - Studyahil XO1BDNo ratings yet

- GST CouncilDocument2 pagesGST CouncilMilind SwaroopNo ratings yet

- GSTC & GSTNDocument8 pagesGSTC & GSTNvarunagarwalNo ratings yet

- Prashant: Bba Z3 Subject: GST (Goods & Services Tax) Presentation Topic: GST COUNCILDocument9 pagesPrashant: Bba Z3 Subject: GST (Goods & Services Tax) Presentation Topic: GST COUNCILPrashant JiNo ratings yet

- GST Status As On 1st May 2017Document43 pagesGST Status As On 1st May 2017kumar45caNo ratings yet

- Universityof Lucknow Faculty of Law: SESSION 2020-21 Assignment of Taxation Law Topic-Gst CouncilDocument6 pagesUniversityof Lucknow Faculty of Law: SESSION 2020-21 Assignment of Taxation Law Topic-Gst CouncilGoldi SinghNo ratings yet

- TaxmannAnalysis - 49th GST Council MeetingDocument17 pagesTaxmannAnalysis - 49th GST Council MeetingAli AyubNo ratings yet

- The GST Council and Five Next Steps For The GST V BhaskarDocument4 pagesThe GST Council and Five Next Steps For The GST V Bhaskarpartha_pbhNo ratings yet

- Intro To GST 09.11Document18 pagesIntro To GST 09.11aashrit sukhijaNo ratings yet

- Is Article 279 A of The 101st Constitutional Amendment Constitutional ValidDocument6 pagesIs Article 279 A of The 101st Constitutional Amendment Constitutional Validaniket chaudharyNo ratings yet

- Signed Minutes - 35th GST Council MeetingDocument76 pagesSigned Minutes - 35th GST Council Meetingvinod.sale1No ratings yet

- Sem. Subject: GST & Indirect Tax (Core - 14) : Unit - 4 Syllabus: GST Council and Regulatory FrameworkDocument7 pagesSem. Subject: GST & Indirect Tax (Core - 14) : Unit - 4 Syllabus: GST Council and Regulatory FrameworkAnwesha HotaNo ratings yet

- Detailed Presentation On GST by CBECDocument43 pagesDetailed Presentation On GST by CBECRajat GoyalNo ratings yet

- Week - 15Document3 pagesWeek - 15Vijayant DalalNo ratings yet

- Constitution of GSTDocument8 pagesConstitution of GSTGauharNo ratings yet

- GST Doc 2Document44 pagesGST Doc 2Mitesh AherNo ratings yet

- GSTDocument5 pagesGSTSourav KaranthNo ratings yet

- GST CouncilDocument3 pagesGST Councilaniket singhNo ratings yet

- Mandate of GST CouncilDocument4 pagesMandate of GST CouncilDevil DemonNo ratings yet

- Gstconference NoticeDocument4 pagesGstconference NoticegauravNo ratings yet

- Model Answer ScriptDocument9 pagesModel Answer ScriptPresidency UniversityNo ratings yet

- Goods and Services Tax Council Article-279ADocument5 pagesGoods and Services Tax Council Article-279Asuyash dugarNo ratings yet

- Powers TaxationDocument17 pagesPowers TaxationRakesh SettNo ratings yet

- GST Concept Status Ason 03062017 PDFDocument15 pagesGST Concept Status Ason 03062017 PDFAarti MoreNo ratings yet

- GST - Uniting India: CA. Rajendra Kumar P, FCA, Chartered AccountantDocument3 pagesGST - Uniting India: CA. Rajendra Kumar P, FCA, Chartered AccountantMuhammed Aslam NVNo ratings yet

- K Vaitheeswaran CTC GST Jaipur 9 1 2020Document37 pagesK Vaitheeswaran CTC GST Jaipur 9 1 2020Shayan ZafarNo ratings yet

- GST Council: MR Aditya Vikram Advocate Visiting Faculty in Bharti College, DU & IITM College, IP UniversityDocument9 pagesGST Council: MR Aditya Vikram Advocate Visiting Faculty in Bharti College, DU & IITM College, IP UniversityNavendu ShuklaNo ratings yet

- Constitutional BodiesDocument5 pagesConstitutional BodiesTushar SanwareyNo ratings yet

- GST Concept and StatusDocument11 pagesGST Concept and Statusichchhit srivastavaNo ratings yet

- Utw Chap7 eDocument14 pagesUtw Chap7 easdfNo ratings yet

- Law of Taxation - GST CouncilDocument22 pagesLaw of Taxation - GST CouncilSRILAKSHMI GHATENo ratings yet

- Raus CSP21T2S CA APR MAY 20Document39 pagesRaus CSP21T2S CA APR MAY 20Mohit YadavNo ratings yet

- Supreme Court May 2022Document4 pagesSupreme Court May 2022Blue StarNo ratings yet

- Unit - 1 GSTDocument40 pagesUnit - 1 GSTKhushi GuptaNo ratings yet

- Interest Sec 50 GSTPWDocument2 pagesInterest Sec 50 GSTPWaekurnoolNo ratings yet

- GST Unit 1 ADocument39 pagesGST Unit 1 AMukul BhatnagarNo ratings yet

- Legislative Brief: The Constitution (122 Amendment) Bill, 2014 (GST)Document6 pagesLegislative Brief: The Constitution (122 Amendment) Bill, 2014 (GST)chiranjeeb mitraNo ratings yet

- GST NotesDocument18 pagesGST NotesNasmaNo ratings yet

- Haroon End Term TaxationDocument8 pagesHaroon End Term TaxationYusuf KhanNo ratings yet

- SM GSTDocument12 pagesSM GSTPranav TejaNo ratings yet

- IF10514Document3 pagesIF10514chichponkli24No ratings yet

- GOE6783 Tax Harmonization RatesDocument8 pagesGOE6783 Tax Harmonization RatesScribdTranslationsNo ratings yet

- Budget Circular No 2023 1 Dated November 10 2023Document10 pagesBudget Circular No 2023 1 Dated November 10 2023erica pejiNo ratings yet

- GST - Concept & Status: For Departmental Officers OnlyDocument7 pagesGST - Concept & Status: For Departmental Officers Onlypatelpratik1972No ratings yet

- Presentation On GSTDocument24 pagesPresentation On GSTsajidneki365No ratings yet

- 01032018-GST Concept and StatusDocument16 pages01032018-GST Concept and StatusGanesh AnantharamNo ratings yet

- GST Question BankDocument359 pagesGST Question BankSiddhesh Kamat AzrekarNo ratings yet

- The Organization: The WTO Is Member-Driven', With Decisions Taken by Consensus Among All Member GovernmentsDocument12 pagesThe Organization: The WTO Is Member-Driven', With Decisions Taken by Consensus Among All Member GovernmentsanhariswarieyaningsiNo ratings yet

- GST - Concept & Status - May, 2016: For Departmental Officers OnlyDocument6 pagesGST - Concept & Status - May, 2016: For Departmental Officers Onlydroy21No ratings yet

- GST Question Bank - by CA Yachana Mutha BhuratDocument349 pagesGST Question Bank - by CA Yachana Mutha BhuratP LAVANYA100% (1)

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxGANGARAJU NALINo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxTEst User 44452No ratings yet

- Economic and Political Weekly Economic and Political WeeklyDocument6 pagesEconomic and Political Weekly Economic and Political WeeklyindianbooksNo ratings yet

- GST Definition, Objective, Framework, Action Plan, GST ScopeDocument8 pagesGST Definition, Objective, Framework, Action Plan, GST ScopeKATNo ratings yet

- Income Tax Authority 1Document18 pagesIncome Tax Authority 1Debapom PurkayasthaNo ratings yet

- Gpo Riddick 1992 34Document141 pagesGpo Riddick 1992 34Jake Dan-AzumiNo ratings yet

- Tio v. VRBDocument13 pagesTio v. VRBAnjela ChingNo ratings yet

- International LawDocument2 pagesInternational LawFelix DiazNo ratings yet

- Foun 1301 Course OutlineDocument10 pagesFoun 1301 Course OutlineMatram StudiosNo ratings yet

- CSWDO Citizens Charter 3rd EditionDocument52 pagesCSWDO Citizens Charter 3rd EditionToram JumskieNo ratings yet

- Assignment 1Document2 pagesAssignment 1AMCLET Criminology Free Online ReviewNo ratings yet

- Towards A Governance Dashboard For Smart Cities InitiativesDocument6 pagesTowards A Governance Dashboard For Smart Cities Initiatives吳 澍 WU SU F74056297No ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountBilal Ahmed MultaniNo ratings yet

- Ebook Handbook of Energy and Environmental Security PDF Full Chapter PDFDocument67 pagesEbook Handbook of Energy and Environmental Security PDF Full Chapter PDFsteven.moreno836100% (36)

- PDF Corporate Power and Regulation Consumers and The Environment in The European Union Sandra Eckert Ebook Full ChapterDocument53 pagesPDF Corporate Power and Regulation Consumers and The Environment in The European Union Sandra Eckert Ebook Full Chapterbill.leverette595100% (3)

- Lecture 1 Business Ethics, Corporate Governance & CSRDocument27 pagesLecture 1 Business Ethics, Corporate Governance & CSRLivingstone CaesarNo ratings yet

- Heidelberg Cement Sustainability ReportDocument52 pagesHeidelberg Cement Sustainability ReportCSRMedia NetworkNo ratings yet

- Professional Code For The Financial Services IndustryDocument21 pagesProfessional Code For The Financial Services IndustryMubarakNo ratings yet

- Horizon Scanning in GovernmentDocument36 pagesHorizon Scanning in Governmentchorpharn4269No ratings yet

- SGC Implementing GuidelinesDocument44 pagesSGC Implementing GuidelinesJay Tiongson100% (1)

- Sona Koyo Steering Systems LimitedDocument21 pagesSona Koyo Steering Systems LimitedTyagi Munda AnkushNo ratings yet

- Globalization and The Challenges of Public Administration Governance by Globalization and The Challenges of Public Administration GovernanceDocument10 pagesGlobalization and The Challenges of Public Administration Governance by Globalization and The Challenges of Public Administration Governancevivek kumar singhNo ratings yet

- Ai Decolonial ManyfestoDocument2 pagesAi Decolonial ManyfestoArata MatsudaNo ratings yet

- WFP2023Document36 pagesWFP2023Fallucky SantiagoNo ratings yet

- M.A Public AdministrationDocument19 pagesM.A Public AdministrationSimi JainNo ratings yet

- Paper1: SECTION-A: Q1 (Compulsory) Answer The Following Questions in About 150 Words Each: 10 X 5 50 MarksDocument6 pagesPaper1: SECTION-A: Q1 (Compulsory) Answer The Following Questions in About 150 Words Each: 10 X 5 50 MarksHarsha DeepakNo ratings yet

- The Political Regime of France Syllabus 2022-2023Document3 pagesThe Political Regime of France Syllabus 2022-2023ABI DASOLANo ratings yet

- Political and Institutional Transformation in Environmental GovernanceDocument16 pagesPolitical and Institutional Transformation in Environmental GovernanceHevah SalicNo ratings yet

- The Role of The Media in Conflict, Peace-Building, and International RelationsDocument12 pagesThe Role of The Media in Conflict, Peace-Building, and International RelationsLia LiloenNo ratings yet

- 2021 Revised Implementing Rules and Regulations of Republic Act No. 9904Document40 pages2021 Revised Implementing Rules and Regulations of Republic Act No. 9904leawisokaNo ratings yet

- The Citizenship (Amendment) Act, 2003Document7 pagesThe Citizenship (Amendment) Act, 2003my.pdffiles.inNo ratings yet

- Chapter 2 Changing Environment in OrganizationDocument27 pagesChapter 2 Changing Environment in OrganizationKim RavanzoNo ratings yet

- Citizen Engagement in Public Service DeliveryDocument13 pagesCitizen Engagement in Public Service DeliveryAngelica De Castro ObianoNo ratings yet

- On Career As A Company Secretary - 12.02.2024Document16 pagesOn Career As A Company Secretary - 12.02.2024kumar_anil666No ratings yet

- ERP Life CycleDocument9 pagesERP Life CycleChintu Sisodia100% (1)

- GovernanceDocument10 pagesGovernanceJesseca Jean Aguilar SepilloNo ratings yet