Professional Documents

Culture Documents

Course Syllabus - 0

Course Syllabus - 0

Uploaded by

lilienesieraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Course Syllabus - 0

Course Syllabus - 0

Uploaded by

lilienesieraCopyright:

Available Formats

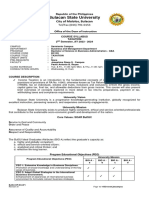

Department of Accounting Education

ACC 212 – Course Syllabus

COURSE INFORMATION

1. Course Number : ACC 212

2. Course Name: : Financial Markets

3. Course Description : This course gives the importance of an efficient financial system; types of financial

markets and how it works; how stock market operates and in what way that one can

earn from it; apply strategies in trading stocks virtually; apply commonly used

techniques in assessing investment under uncertainty; quantify risk and analyze risk-

return relationship and Capital Asset Pricing Model (CAPM) concepts in evaluating

investments.

4. Pre-requisite : ACC 124

5. Co-requisite : None

6. Credit : 3.0 units

7. Class Schedule : 6 hours per week (1 term)

PROGRAM EDUCATIONAL OBJECTIVES (PEO) OF BSA:

Three to five years after graduation, the BSA graduates are expected to:

1. Demonstrate technical and professional competence in the practice of the profession: private,

government, academe, and public accounting.

2. Involve in continuing professional development through participation to trainings, seminars,

conferences, and further studies.

ALIGNMENT OF GRADUATE ATTRIBUTES (GAS) AND PEOS TO SOS

SO A B C D E F G H I J K L M N O P Q R S T

Galing ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓

Graduate Gawa ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓

Attributes Gawi ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓

Gana ✓ ✓ ✓ ✓ ✓

Program PEO1 ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓

Educational

PEO2 ✓ ✓ ✓

Objectives

COURSE OUTCOMES (CO) OF ACC 212 AND THEIR LINKS TO SO

SO

Upon completion of the course, the BSA students are expected to:

A B C D E F G H I J

Explain the importance of financial markets for business

CO 1 I E I I I E

firms both in their investment and financing needs.

Apply the concepts related to investing in the stock market

CO 2 I E I I I E

by performing virtual stock trading.

Evaluate investment opportunities using techniques in

CO 3 making decisions under uncertainty and in consideration of I E I I I E

the risk and return concept.

SO

Upon completion of the course, the BSA students are expected to:

K L M N O P Q R S T

Explain the importance of financial markets for business

CO 1 I I D D I I

firms both in their investment and financing needs.

Apply the concepts related to investing in the stock market

CO 2 I I D D I I

by performing virtual stock trading.

Evaluate investment opportunities using techniques in

CO 3 making decisions under uncertainty and in consideration of I I D D I I

the risk and return concept.

Legend:

I = Upon attainment of this CO, students will have been introduced to the SO.

E = Upon attainment of this CO, students will have enabled themselves to attain the SO.

D = Upon attainment of this CO, students will have demonstrated partly or fully the SO.

ACC 212 – Financial

Revision no.: 3 Effectivity: August 7, 2023 Page 1 of 6

Markets

Department of Accounting Education

ACC 212 – Course Syllabus

University Vision, Mission, Philosophy, Graduate Attributes, Program Educational Objectives (PEO)

Values, and Competencies

Vision: The University of Mindanao envisions to be a leading 1. Demonstrate technical and professional

globally engaged university creating sustainable impact in society. competence in the practice of the

profession: private, government, academe,

Mission: The University of Mindanao seeks to provide a dynamic and public accounting.

learning environment through the highest standard of instruction,

research, extension, and production in a private non-sectarian 2. Involve in continuing professional

institution committed to democratizing access to education. development through participation to

trainings, seminars, conferences, and further

Educational Philosophy: Transformative education through

studies.

polishing diamonds in the rough.

Values: Excellence, Honesty and Integrity, Innovation, and

Teamwork.

Graduate Attributes: Galing, Gawa, Gawi, at Gana

Core Competency: Quality, affordable and open education

Student Outcomes (SO)

SOa. Articulate and discuss the latest developments in the specific field of

practice. (PQF level 6 descriptor)

SOb. Effectively communicate orally and in writing using both English and

Filipino.

SOc. Work effectively and independently in multi-disciplinary and multi-

cultural teams. (PQF level 6 descriptor)

SOd. Act in recognition of professional, social and ethical responsibility. Course Outcome (CO)

SOe. Preserve and promote Filipino historical and cultural heritage.

SOf. Describe the basic functions of management such as planning,

organizing, leading and controlling.

SOg. Identify and describe the basic concepts that underlie each of the

functional areas of business (marketing, finance, human resources

management, production and operations management, information

technology and strategic management) and employ these concepts in

1. Explain the importance of financial

various business situations. markets for business firms both in their

SOh. Select the proper decision-making tools to critically, analytically and investment and financing needs.

creatively solve problems and drive results.

SOi. Express clearly and communicate effectively with stakeholders both in

oral and written forms. 2. Apply the concepts related to

SOj. Apply information and communication technology (ICT) skills as investing in the stock market by

required by the business environment.

SOk. Work effectively with other stakeholders and manage conflict in the performing virtual stock trading.

workplace.

SOl. Organize and lead groups to plan and implement business related 3. Evaluate investment opportunities

activities.

SOm. Demonstrate corporate citizenship and social responsibility; and using techniques in making decisions

SOn. Exercise high personal moral and ethical standards. under uncertainty and in consideration

SOo. Resolve business issues and problems, with a global perspective and

particular emphasis on matters confronting financial statement preparers

of the risk and return concept.

and users, using their knowledge and technical proficiency in the areas of

financial accounting and reporting, cost accounting and management,

management accounting, auditing, taxation and accounting information

systems.

SOp. Conduct accounting research through independent studies of relevant

literature and appropriate use of accounting theory and methodologies.

SOq. Employ technology as a business tool in capturing financial and non-

financial information, generating reports and making decisions.

SOr. Apply knowledge and skills that will enable them to successfully

respond to various types of assessments (including professional licensure

and certifications).

SOs. Maintain a professional commitment to good corporate citizenship,

social responsibility and ethical practice when performing functions as a

professional accountant.

SOt. Participate in various types of employment, development activities, and

public discourses, particularly in response to the needs of the communities.

one serves.

ACC 212 – Financial

Revision no.: 3 Effectivity: August 7, 2023 Page 2 of 6

Markets

Department of Accounting Education

ACC 212 – Course Syllabus

CO AND ASSESSMENT TASK ALIGNMENT

Assessment Task

CO Assessment

Theory-based Practice-based Coverage

Schedule

1. Explain the importance of financial • Efficient Financial

Multiple Choice

markets for business firms both in System

Questions (40 points) - First Exam

their investment and financing • Types of Financial

100%

needs. Market

• Stock Market

2. Apply the concepts related to Multiple Choice

• Strategies for

investing in the stock market by Questions (40 points) - Second Exam

performing virtual

performing virtual stock trading. 100%

stock trading.

• Commonly used

Multiple Choice techniques in

Questions – 10 Theories assessing investment

and 10 Problems (40 - Third Exam under uncertainty.

3. Evaluate investment opportunities points) • Degree of Operating

using techniques in making 100% Leverage and

decisions under uncertainty and in

Financial Leverage

consideration of the risk and return

concept.

Multiple Choice • All Topics

Questions (60 points) - Final Exam

100%

*Final assessment will be a comprehensive examination (from first topic to the last) in an MCQ

ASSESSMENT TASK DETAILS (THEORY-BASED)

Assessment Assessment

Coverage Details

Schedule Task

You are expected to discuss the importance of an efficient financial system and the

• Efficient role of financial markets in the investment and financing needs of business firms. You

Financial are also to identify the different types of financial markets and their suitability based

System MCQ (100% of on the circumstances that the business is in.

First Exam

• Types of the exam)

Financial Integration:

Market ▪ SDG – Decent Work and Economic Growth, Systems Thinking, Strategic

▪ 21st Century Skills (GA) – Initiative, Information literacy, Critical thinking

• Stock

Market You are expected to identify different terminologies commonly used in trading the

• Strategies stock market needed to be able to execute virtual trading.

Second for MCQ (100% of

Exam performing the exam) Integration:

virtual ▪ SDG – Decent Work and Economic Growth, No Poverty, Strategic

stock ▪ 21st Century Skills (GA) – Initiative, Information literacy, Critical thinking

trading.

• Commonly

used

techniques

in

You are expected to apply the commonly used techniques in assessing investment

assessing

under uncertainty. You are also expected to apply concepts of the degree of operating

investment

leverage and financial leverage in assessing investment opportunities.

under MCQ (100% of

Third Exam

uncertainty. the exam)

Integration:

• Degree of

▪ SDG – Critical Thinking, Strategic, Integrated Problem Solving

Operating

▪ 21st Century Skills (GA) – Critical thinking, Initiative, Productivity

Leverage

and

Financial

Leverage

This assessment task is designed for you to demonstrate a comprehensive

All Topics understanding of the principles, theories and key concepts of financial markets.

MCQ (100% of

Final Exam

the exam) Integration:

▪ SDG – Critical Thinking, Strategic, Integrated Problem Solving

▪ 21st Century Skills (GA) – Critical thinking, Initiative, Productivity

ACC 212 – Financial

Revision no.: 3 Effectivity: August 7, 2023 Page 3 of 6

Markets

Department of Accounting Education

ACC 212 – Course Syllabus

ASSESSMENT TASK DETAILS (PRACTICE/PERFORMANCE-BASED)

Assessment Assessment

Coverage Details

Schedule Task

First Exam No performance-based assessment task

Second

No performance-based assessment task

Exam

Third Exam No performance-based assessment task

Final Exam No performance-based assessment task

COURSE OUTLINE AND TIME FRAME

TIME

TOPICS FOR FIRST EXAMINATION Teaching Learning Activities RESOURCES

FRAME

➢ Orientation on Classroom and ➢ Lecture/Discussion

University Policies as well as Grading ➢ Assignment using Quipper

System LMS

➢ Quiz using online platforms

➢ Discussion of VMV, PEO, SO, and CO

➢ Efficient Financial System

• Financial System

• Functions of Financial System

Week 1 • Services Provided by Financial System

to Week • Three main components of financial

3 system

• How financial system works

➢ Types of Financial Market

• Financial Market and their economic

functions.

• Market participants

• Types of financial markets

TOPICS FOR SECOND EXAMINATION

➢ Stock Market ➢ Lecture/Discussion Kiyosaki, R. T. (2017). Rich

• The stock market ➢ Oral presentation dad poor dad (2nd ed.). Plata

• Primary stock market ➢ Assignment using Quipper Publishing.

• Secondary stock market LMS

• Stock market as an investment ➢ Quiz using online platforms

opportunity. ➢ Virtual Stock Trading

• Stock market participants.

• Types of stocks.

• The Philippine Stock Exchange

Week 4 (PSE)

to Week • How to invest in the stock market.

5

➢ Strategies in performing virtual stock

trading

• The basics of stock investing

• Understanding the trading interface.

• Selecting the company to invest in

• Placing an order

• How to virtually trade in the stock

market

TOPICS FOR THIRD EXAMINATION

ACC 212 – Financial

Revision no.: 3 Effectivity: August 7, 2023 Page 4 of 6

Markets

Department of Accounting Education

ACC 212 – Course Syllabus

➢ Commonly used techniques in ➢ Lecture/Discussion

assessing investment under ➢ Oral presentation

uncertainty. ➢ Assignment using Quipper

▪ Risk management LMS

▪ Risk Management process. ➢ Quiz using online platforms

▪ Elements of risk management ➢ Problem Solving

➢ Case Study

▪ Potential risk treatments

▪ Investment risks

▪ Most used techniques and

Week 6 models in assessing investment

to Week alternatives under risk or

7 uncertainty.

➢ Degree of Operating Leverage and

Financial Leverage.

▪ Leverage in business.

▪ Operating leverage

▪ Financial leverage

▪ Degree of financial leverage

▪ Combining Operating and

Financial Leverage

➢ Quantify Risk and Risk-Return ➢ Lecture/Discussion

Concept ➢ Oral presentation

• Basic risk and return concept. ➢ Assignment using

• Risk and return relationship Quipper

• Using probability and probability ➢ Quiz using online

distribution in evaluating platforms

investments ➢ Problem solving

• Standard deviation and Coefficient ➢ Seatwork

of Variation

• Portfolio risk

Week 8

• Risk preferences

to Week

• Risk and return portfolio

9

➢ Capital Asset Pricing Model (CAPM)

concepts in Evaluation Investments.

• Capital Asset Pricing Model (CAPM)

• Effect of Diversification on

systematic and unsystematic risk.

• Beta coefficient concept.

• Portfolio beta coefficient

• Security Market Line (SML)

• Concerns about CAPM.

TEXTBOOK

Cabrera, M. E., Cabrera, G. A., & Cabrera, B. A. (2022). Financial Markets and Institution. Manila, Philippines: GIC

Enterprises & Co., Inc.. 2019-2020 ed.

REFERENCES

a. Cabrera, M. E., & Cabrera, G. A. (2019). Financial management : comprehensive volume. Manila, Philippines : GIC

Enterprises & Co., Inc.. 2019-2020 ed.

b. Cecchetti, S., Schoenholtz, K., & Stern, L. (2021). Money, banking, and financial markets. Dubuque, Iowa : McGraw-

Hill Education.Sixth Edition

c. Saunders, A., & Cornett M. (2019). Financial markets and institutions. New York : McGraw-Hill Education.Seventeenth

edition.

d. Ross, S., Westerfield, R., & Jordan, B. (2019). Fundamentals of corporate finance .New York, NY : McGraw-Hill

Education. Twelfth edition.

e. Brealey, R., Myers, S., & Marcus, J. (2018) .Fundamentals of Corporate Finance.New York, NY : McGraw-Hill

Education.Ninth edition

f. Kiyosaki, R. T. (2017). Rich dad poor dad (2nd ed.). Plata Publishing.

ACC 212 – Financial

Revision no.: 3 Effectivity: August 7, 2023 Page 5 of 6

Markets

Department of Accounting Education

ACC 212 – Course Syllabus

ASSESSMENT AND FEEDBACK PLAN

Course Outcomes/Weight Feedback Method

Assessment Task

1 2 3

Quiz 5% LMS

Oral Recitation ✓ ✓ ✓ In-person

In-person

MCQ 10% (Exam 1) 10% (Exam 2) 10% (Exam 3)

Problem Solving 5% In-person/Rubrics

LMS Activity ✓ ✓ ✓ LMS

Comprehensive Exam 40% (Exam 4) In-person

Virtual Stock Trading Diary 20% Rubrics

*Base-15 grading system

POLICIES AND GUIDELINES

1. Attendance is counted from the first regular class meeting.

2. A validated student identification card must always be worn by all students while attending classes.

3. Cheating, plagiarism, and all forms of academic dishonesty are expressly forbidden in this course, and by the

university’s Policy on Academic Integrity. Examples of such violations include but are not limited to:

a. collusion, purchasing, or commissioning assessment task/research paper.

b. copying verbatim from a research article/book/journal/etc.

c. copying verbatim from generative AI, such as ChatGPT.

d. falsifying or inventing any information, data, or citation; and

e. false representation.

4. Valid examination permits are necessary for taking the examinations as scheduled.

5. Base-15 grading policy should be observed. Students who obtained failing scores in major examinations are

recommended to attend tutorial classes or any intervention program; and

6. For other policies and guidelines, refer to Student Handbook.

Prepared by: Reviewed by:

MARY CRIS L. LUZADA, MSA, CPA JOE MARI N. FLORES, MSA, CPA

Faculty Member BSA, Program Head

References Reviewed by: Recommending Approval:

CLARISSA R. DONAYRE, MSLS GINA FE G. ISRAEL, EdD

Chief, Learning and Information Center Dean of College

Approved by:

PEDRITO M. CASTILLO II, EdD

VP, Institute of Pedagogical Advancement and Competitiveness

ACC 212 – Financial

Revision no.: 3 Effectivity: August 7, 2023 Page 6 of 6

Markets

You might also like

- The Impact of Forward and Backward Integration On Microsoft S Performance and Sustainability in AmericaDocument32 pagesThe Impact of Forward and Backward Integration On Microsoft S Performance and Sustainability in Americakariuki josephNo ratings yet

- Syllabus ACP 312 Accounting For Business CombinationsDocument9 pagesSyllabus ACP 312 Accounting For Business CombinationsirahQNo ratings yet

- Course Syllabus International Business and TradeDocument11 pagesCourse Syllabus International Business and TradeCharmaine ShaninaNo ratings yet

- Course Syllabus Business FinanceDocument11 pagesCourse Syllabus Business FinanceCharmaine Shanina100% (1)

- Financial Analysis and Reporting SyllabusDocument9 pagesFinancial Analysis and Reporting SyllabusJpoy Rivera100% (4)

- 2021-09-01 Elle UKDocument224 pages2021-09-01 Elle UKLilith100% (2)

- ACC 213 Strategic Cost Management Rev. 0 1st Sem SY 2019-2020Document9 pagesACC 213 Strategic Cost Management Rev. 0 1st Sem SY 2019-2020Jel-Anndrei LopezNo ratings yet

- ACC 213 Strategic Cost Management Rev. 0 1st Sem SY 2019-2020Document9 pagesACC 213 Strategic Cost Management Rev. 0 1st Sem SY 2019-2020Rogel DolinoNo ratings yet

- Workday Interviews Q & ADocument155 pagesWorkday Interviews Q & AMahesh Chikoti56% (9)

- Examination 680Document22 pagesExamination 680Maha Al AmadNo ratings yet

- Acc 226Document6 pagesAcc 226Lyncee BallescasNo ratings yet

- ACC 227 Rev 3.0 SyllabusDocument6 pagesACC 227 Rev 3.0 SyllabusAngel Nhova Pepito OmalayNo ratings yet

- ACC 225 Business Laws and Regulations SyllabusDocument15 pagesACC 225 Business Laws and Regulations Syllabusmarites yuNo ratings yet

- Acc 111Document11 pagesAcc 111Jhanna Vee DamaleNo ratings yet

- BSA ACC-223 Syllabus Rev2Document7 pagesBSA ACC-223 Syllabus Rev2Roy CastardoNo ratings yet

- Department of Business Administration FIN 414 - Course SyllabusDocument9 pagesDepartment of Business Administration FIN 414 - Course SyllabusJessa EspinosaNo ratings yet

- xACC 213Document10 pagesxACC 213CharlesNo ratings yet

- Partnership and CorporationDocument9 pagesPartnership and CorporationjaxxNo ratings yet

- College of Business Administration Education GE 11 - Course SyllabusDocument10 pagesCollege of Business Administration Education GE 11 - Course SyllabusLovelyBabes LagudNo ratings yet

- ACC 225 Business Laws and Regulations Rev. 1 1st Sem SY 2020-2021 FINALDocument13 pagesACC 225 Business Laws and Regulations Rev. 1 1st Sem SY 2020-2021 FINALFRAULIEN GLINKA FANUGAONo ratings yet

- Taxation Syllabus 01-14-2024 SignedDocument6 pagesTaxation Syllabus 01-14-2024 SignedLiezel Jane Ambay IbañezNo ratings yet

- ACC 227 Rev 3.0Document6 pagesACC 227 Rev 3.0Ailyn BenogsudanNo ratings yet

- BSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Document15 pagesBSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Trisha AlmiranteNo ratings yet

- SYLLABUS. BSE FINANCIAL MNGT OkDocument8 pagesSYLLABUS. BSE FINANCIAL MNGT Okkram nhojNo ratings yet

- Course Syllabus Managerial AccountingDocument10 pagesCourse Syllabus Managerial AccountingCharmaine Shanina100% (1)

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- Department of Accounting Education ACP 312 - Course SyllabusDocument12 pagesDepartment of Accounting Education ACP 312 - Course Syllabusalmira garciaNo ratings yet

- Acctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingDocument19 pagesAcctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingVivian TamerayNo ratings yet

- BSA2 - ACC 227 Law On Other Business TransactionsDocument8 pagesBSA2 - ACC 227 Law On Other Business TransactionsKing Alfred CarmeloNo ratings yet

- BMGT28 Income and Taxation Syllabus 2022 23 PDFDocument9 pagesBMGT28 Income and Taxation Syllabus 2022 23 PDFFRANCO, Monique P.No ratings yet

- Acctg 201A Course GuideDocument13 pagesAcctg 201A Course GuideDomingo Bay-anNo ratings yet

- SMS MBA FT&PT Syllabus 2021 2 1 1Document20 pagesSMS MBA FT&PT Syllabus 2021 2 1 1Jerom JosephNo ratings yet

- Course Number: FINMGT6 Course Description: Investment and Portfolio Management Effectivity: 1st Semester 2015-2016 Date Revised: December, 2015 Page 1 of 11Document11 pagesCourse Number: FINMGT6 Course Description: Investment and Portfolio Management Effectivity: 1st Semester 2015-2016 Date Revised: December, 2015 Page 1 of 11WilsonNo ratings yet

- Overview: Overview:: Service Management Program Syllabi Course Syllabus and OutlineDocument16 pagesOverview: Overview:: Service Management Program Syllabi Course Syllabus and Outlinebillie's cometNo ratings yet

- BSA ACC-124 Syllabus Rev1Document8 pagesBSA ACC-124 Syllabus Rev1Angel Nhova Pepito OmalayNo ratings yet

- College of Accountancy Course Guide For Auditing 2A: Course Content and Learning PlanDocument6 pagesCollege of Accountancy Course Guide For Auditing 2A: Course Content and Learning PlanDomingo Bay-anNo ratings yet

- Course Information: Department of Accounting Education BE 313 - Course SyllabusDocument7 pagesCourse Information: Department of Accounting Education BE 313 - Course SyllabusCharles D. FloresNo ratings yet

- Department of Accounting Education ACC 111 - Course SyllabusDocument10 pagesDepartment of Accounting Education ACC 111 - Course Syllabuslhyn JasarenoNo ratings yet

- Syllabus - ACP 313 - Accounting For Government and Not-for-Profit OrganizationsDocument9 pagesSyllabus - ACP 313 - Accounting For Government and Not-for-Profit OrganizationsexquisiteNo ratings yet

- ACC 225 Rev 3.0Document6 pagesACC 225 Rev 3.0Angel Nhova Pepito OmalayNo ratings yet

- ACC 324 - L Statistical Analysis With Computer ApplicationDocument13 pagesACC 324 - L Statistical Analysis With Computer ApplicationMariel CadayonaNo ratings yet

- Syllabus Cost PDFDocument4 pagesSyllabus Cost PDFRongNo ratings yet

- OBE Syllabus Financial Management San Francisco CollegeDocument4 pagesOBE Syllabus Financial Management San Francisco CollegeJerome SaavedraNo ratings yet

- GBP Course Handout AY2021-22 - HDocument30 pagesGBP Course Handout AY2021-22 - HShanthan ReddyNo ratings yet

- 2020 FMGT 1013 - Financial Management RevisedDocument9 pages2020 FMGT 1013 - Financial Management RevisedYANIII12345No ratings yet

- JMC Guidelines and Template For Compendium 2Document63 pagesJMC Guidelines and Template For Compendium 2kingsters zabateNo ratings yet

- ACCBP 100 Course Syllabus PDFDocument7 pagesACCBP 100 Course Syllabus PDFLambaco Earl AdamNo ratings yet

- MA Masters SyllabusDocument12 pagesMA Masters SyllabusRock BottomNo ratings yet

- 61586811a21c532176c80b34-1633183887-GE 11.esignature - BADocument8 pages61586811a21c532176c80b34-1633183887-GE 11.esignature - BAAldvin Jan AlcasidNo ratings yet

- Course Syllabus: Fall 2021Document7 pagesCourse Syllabus: Fall 2021Karim GhaddarNo ratings yet

- Syllabus - ACCBP 100 CompleteDocument10 pagesSyllabus - ACCBP 100 CompleteCleah WaskinNo ratings yet

- College of Accountancy Course Guide For Auditing 1 (Audit 1)Document8 pagesCollege of Accountancy Course Guide For Auditing 1 (Audit 1)Domingo Bay-anNo ratings yet

- CIS Diploma SyllabusDocument21 pagesCIS Diploma Syllabusejogheneta0% (1)

- JMC Guidelines and Template For Compendium 2 1Document63 pagesJMC Guidelines and Template For Compendium 2 1kingsters zabateNo ratings yet

- 2022 2023 - Fina 6027Document8 pages2022 2023 - Fina 6027Shanawaz KhanNo ratings yet

- Business ValuationsDocument5 pagesBusiness ValuationsCarrots TopNo ratings yet

- JMC Guidelines and Template For Compendium 2Document65 pagesJMC Guidelines and Template For Compendium 2kingsters zabateNo ratings yet

- ACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Document12 pagesACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Jerah TorrejosNo ratings yet

- M17 MCom Prosp 07072022Document17 pagesM17 MCom Prosp 07072022ganesh sonkarNo ratings yet

- Syllabus IY2589Document2 pagesSyllabus IY2589Maaz KhanNo ratings yet

- Annexure-129 Updated BBA (FIA) Revised Syllabus 2019 (Final)Document120 pagesAnnexure-129 Updated BBA (FIA) Revised Syllabus 2019 (Final)Tihor LuharNo ratings yet

- 2022 2023 - Innv 6001Document8 pages2022 2023 - Innv 6001Shanawaz KhanNo ratings yet

- 12 x10 Financial Statement AnalysisDocument23 pages12 x10 Financial Statement AnalysislilienesieraNo ratings yet

- SIM - Static and Flexible Budgeting - 0Document3 pagesSIM - Static and Flexible Budgeting - 0lilienesieraNo ratings yet

- Davao Del NorteDocument250 pagesDavao Del NortelilienesieraNo ratings yet

- ULOb - Risk Exposure, General Controls, Application Controls - 0Document8 pagesULOb - Risk Exposure, General Controls, Application Controls - 0lilienesieraNo ratings yet

- SIM - CVP Analysis and Profit Planning - 0Document9 pagesSIM - CVP Analysis and Profit Planning - 0lilienesieraNo ratings yet

- Share Based Compensation - Share Options - PPT - 0Document41 pagesShare Based Compensation - Share Options - PPT - 0lilienesieraNo ratings yet

- Intangible Assets - 0Document16 pagesIntangible Assets - 0lilienesieraNo ratings yet

- ULOc 0Document22 pagesULOc 0lilienesieraNo ratings yet

- Debt Restructure - SIM - 0Document14 pagesDebt Restructure - SIM - 0lilienesieraNo ratings yet

- Shareholder's Equity-Basic Concepts of Corporation - 0Document12 pagesShareholder's Equity-Basic Concepts of Corporation - 0lilienesieraNo ratings yet

- ULOb - Degree of Operating and Financial Leverage-SIM - 0Document11 pagesULOb - Degree of Operating and Financial Leverage-SIM - 0lilienesieraNo ratings yet

- SHE - Treasury Shares, Right Issue, Share Split With Warrants - 0Document50 pagesSHE - Treasury Shares, Right Issue, Share Split With Warrants - 0lilienesieraNo ratings yet

- ACC 213 - Handout 02 - Standard Costing and Variance Analysis - 0Document2 pagesACC 213 - Handout 02 - Standard Costing and Variance Analysis - 0lilienesieraNo ratings yet

- CVP Analysis and Profit Planning Problems - 0Document28 pagesCVP Analysis and Profit Planning Problems - 0lilienesieraNo ratings yet

- SIM - Standard Costing and Variance Analysis - 0Document18 pagesSIM - Standard Costing and Variance Analysis - 0lilienesieraNo ratings yet

- Patent and Trademark - 0Document10 pagesPatent and Trademark - 0lilienesieraNo ratings yet

- Brand Experience and Consumers Willingness To PayDocument8 pagesBrand Experience and Consumers Willingness To PayAshutosh KNo ratings yet

- USSEC 2021 Global Soy Foods Market OverviewDocument73 pagesUSSEC 2021 Global Soy Foods Market OverviewgiangNo ratings yet

- Chapter 2 - Corporate Governance Review QuestionsDocument3 pagesChapter 2 - Corporate Governance Review QuestionsMarienella MarollanoNo ratings yet

- Analysis of RAFFLES MEDICAL GROUPDocument2 pagesAnalysis of RAFFLES MEDICAL GROUPNickNo ratings yet

- Ratio Analysis 2022Document113 pagesRatio Analysis 2022Shiny JalliNo ratings yet

- Building ValuationDocument1 pageBuilding ValuationJegan KrishnaNo ratings yet

- Carrier Capacity and Commitment: Susan Beaver & Caleb Warner July 29, 2013Document20 pagesCarrier Capacity and Commitment: Susan Beaver & Caleb Warner July 29, 2013Jakkana PremNo ratings yet

- Apple+Case+Study 1294 AkjeDocument3 pagesApple+Case+Study 1294 AkjeInstallment4u PakistanNo ratings yet

- Question 89: Basic Consolidation: Total Assets Equity and LiabilitiesDocument4 pagesQuestion 89: Basic Consolidation: Total Assets Equity and Liabilitiessagar khadkaNo ratings yet

- A Study On Recruitment and Selection ProcessDocument101 pagesA Study On Recruitment and Selection Processshalini TripathiNo ratings yet

- Leistritz Pump TechnologyDocument9 pagesLeistritz Pump Technologykexin behNo ratings yet

- NPSHa Calculation SpreadsheetDocument3 pagesNPSHa Calculation Spreadsheetprasad durgaNo ratings yet

- Analisa Kelayakan Usaha Budidaya Teripang (Holothuroidea) Di Distrik Samate, Kabupaten Raja AmpatDocument5 pagesAnalisa Kelayakan Usaha Budidaya Teripang (Holothuroidea) Di Distrik Samate, Kabupaten Raja Ampatsamsul rahayaanNo ratings yet

- Analysis of Financial Statements: Chapter No.07Document56 pagesAnalysis of Financial Statements: Chapter No.07Blue StoneNo ratings yet

- Wealth DynamX Blueprint To Financial FreedomDocument10 pagesWealth DynamX Blueprint To Financial FreedomJoseAlicea0% (1)

- Online ChallanDocument1 pageOnline ChallanKalpesh DeoraNo ratings yet

- Software Requirement SpecificationsDocument6 pagesSoftware Requirement Specificationsnaresh1No ratings yet

- Information Systems For ManagersDocument9 pagesInformation Systems For ManagersBijesh SiwachNo ratings yet

- A. Identify The Weaknesses in Supremo's Internal Control Concerning The Purchases and Payments FunctionsDocument1 pageA. Identify The Weaknesses in Supremo's Internal Control Concerning The Purchases and Payments FunctionsTrâm LêNo ratings yet

- Question 1. (12 Marks) : Module #3: Sampling Distributions, Estimates, and Hypothesis TestingDocument11 pagesQuestion 1. (12 Marks) : Module #3: Sampling Distributions, Estimates, and Hypothesis TestingSagar AggarwalNo ratings yet

- Methodology of Installation of FencingDocument3 pagesMethodology of Installation of FencingA MakkiNo ratings yet

- Cover LetterDocument3 pagesCover LetterMaykel Mapute MonsendoNo ratings yet

- SM Presentation On Garment IndustryDocument14 pagesSM Presentation On Garment IndustrytariqueshadabNo ratings yet

- ArthikDisha IT Cal FY 2023 24 AY 2024 25Document6 pagesArthikDisha IT Cal FY 2023 24 AY 2024 25SridharNo ratings yet

- 100 Tasks SimpleDocument17 pages100 Tasks Simplekenneth cheungNo ratings yet

- Itu Publications For Vessels Operating in Port LimitDocument6 pagesItu Publications For Vessels Operating in Port LimitVM ExportNo ratings yet