Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsMGG - Pivotal SPAC Sponsor Case May20

MGG - Pivotal SPAC Sponsor Case May20

Uploaded by

waichew92Pivotal Acquisition Corporation is a NYSE-listed SPAC that raised $230 million in an IPO to acquire a private company. The Sponsor invested $6.375 million for shares and warrants. If no acquisition occurs within 18 months, the capital is returned to shareholders and the Sponsor loses its investment. With a successful $10 stock price acquisition, the Sponsor would realize a 10x return, while a $15 stock price would yield an 18x return. Risks include losing the at-risk capital if no deal transpires and potential dilution of Sponsor shares and warrants to complete an acquisition.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Petroleum Economics PDFDocument156 pagesPetroleum Economics PDFZeljko Belosic100% (2)

- Programmatic Ad Industry PresentationDocument11 pagesProgrammatic Ad Industry Presentationakashwatwani8067No ratings yet

- From Competitive Advantage To Corporate StrategyDocument3 pagesFrom Competitive Advantage To Corporate StrategyAnubhav Aggarwal0% (1)

- U-12 Strategic PlanningDocument41 pagesU-12 Strategic PlanningMalik Khurram Shahzad Awan75% (4)

- 31 The Upscaling Business of Private EquityDocument12 pages31 The Upscaling Business of Private EquityCritiNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildStory pizzieNo ratings yet

- INFO UBS - SPACs - Investment Considerations BDocument19 pagesINFO UBS - SPACs - Investment Considerations BPer HuberNo ratings yet

- Graf Industrial Corp.Document165 pagesGraf Industrial Corp.vicr100No ratings yet

- Listing On SGXDocument28 pagesListing On SGXjsikparkNo ratings yet

- Week 8 Long Term Financing - EquityDocument30 pagesWeek 8 Long Term Financing - EquityAmelia MatherNo ratings yet

- IBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalDocument66 pagesIBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalAbhinandanNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- Pengantar Akuntansi Ii 3 SKS: Minggu 11Document49 pagesPengantar Akuntansi Ii 3 SKS: Minggu 11Nabila SyahlaNo ratings yet

- Analyzing Investing Activities: Intercorporate InvestmentsDocument38 pagesAnalyzing Investing Activities: Intercorporate Investmentsshldhy100% (1)

- M&A NotesDocument22 pagesM&A NotesБота ОмароваNo ratings yet

- What Is Leveraged Buyout and How Does It Works?Document4 pagesWhat Is Leveraged Buyout and How Does It Works?Keval ShahNo ratings yet

- Dividend Policy and Retained EarningDocument28 pagesDividend Policy and Retained EarningMd Abusaied AsikNo ratings yet

- Mergers and Other Forms of Corporate RestructuringDocument47 pagesMergers and Other Forms of Corporate Restructuringaftab_sweet3024No ratings yet

- Understanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Document17 pagesUnderstanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Dharmik SolankiNo ratings yet

- Part 4 Chapter 10 11 12 FmiDocument76 pagesPart 4 Chapter 10 11 12 FmiEffie Erica MacachorNo ratings yet

- Mergers, Corporate Restructuring, and More: Changing The Size of The Firm QuicklyDocument49 pagesMergers, Corporate Restructuring, and More: Changing The Size of The Firm QuicklyCarlosNo ratings yet

- Venture CapitalDocument42 pagesVenture CapitalKellaNo ratings yet

- Topic 9 - 29 - M&ADocument24 pagesTopic 9 - 29 - M&APhí Thị Hoàng HàNo ratings yet

- Private Equity ExitsDocument42 pagesPrivate Equity Exitsharshit.dwivedi320No ratings yet

- Corporate Finance-Lecture 10Document11 pagesCorporate Finance-Lecture 10Sadia AbidNo ratings yet

- Ipo Process PDFDocument80 pagesIpo Process PDFvinodvarghese123100% (1)

- FM-Sessions 23 - 24 Dividend Policy-CompleteDocument72 pagesFM-Sessions 23 - 24 Dividend Policy-CompleteSaadat ShaikhNo ratings yet

- A Study On Investor Preferences Towards Various Mutual FundsDocument122 pagesA Study On Investor Preferences Towards Various Mutual FundsAnkit Agarwal60% (5)

- Investment Banking and The Public Sale of Equity Securities: Financial Management, 3eDocument35 pagesInvestment Banking and The Public Sale of Equity Securities: Financial Management, 3eEman ChristiantoNo ratings yet

- Bodie - Essentials - of - Investments - 11e - Chapter03 - PPT MOD - Fall2020Document74 pagesBodie - Essentials - of - Investments - 11e - Chapter03 - PPT MOD - Fall2020Anthony SukkarNo ratings yet

- Pimco Global Bond FundDocument5 pagesPimco Global Bond FundKelvin TanNo ratings yet

- Mutual Funds: PRELIM ModuleDocument11 pagesMutual Funds: PRELIM ModulejchazneyNo ratings yet

- Topic 2 - StocksDocument51 pagesTopic 2 - StocksMahmoud AbdullahNo ratings yet

- Advanced Corporate Finance Chapter 19Document35 pagesAdvanced Corporate Finance Chapter 19laurenNo ratings yet

- Owl Rock Capital Corporation: Quarterly Earnings PresentationDocument18 pagesOwl Rock Capital Corporation: Quarterly Earnings PresentationMiguel RamosNo ratings yet

- Sample Term Sheet: Series A Convertible Preferred Stock FinancingDocument2 pagesSample Term Sheet: Series A Convertible Preferred Stock FinancingJennifer LeeNo ratings yet

- Private EquityDocument9 pagesPrivate Equitysv798dctq9No ratings yet

- PDS-SIA Aug19Document6 pagesPDS-SIA Aug19seadeco1991No ratings yet

- Tfef One Pager Nov 2019 PDFDocument2 pagesTfef One Pager Nov 2019 PDFABDUL MALIKNo ratings yet

- Private Equity StructureDocument5 pagesPrivate Equity StructurebasanisujithkumarNo ratings yet

- AAM - BRIC Advantage 2019-2Document3 pagesAAM - BRIC Advantage 2019-2ag rNo ratings yet

- Investment Banking - Key Issues & StrategiesDocument58 pagesInvestment Banking - Key Issues & StrategiesYusra Rehman KhanNo ratings yet

- Chap 005Document41 pagesChap 005Loser Neet100% (1)

- Corporate FinanceDocument66 pagesCorporate FinanceRobin SrivastavaNo ratings yet

- Corporate Finance V2Document80 pagesCorporate Finance V2sukeshNo ratings yet

- Public Equity: When A Firm Goes Public, It Issues Stock in The Primary Market in Exchange For CashDocument17 pagesPublic Equity: When A Firm Goes Public, It Issues Stock in The Primary Market in Exchange For CashBrandon LumibaoNo ratings yet

- Spin OffDocument8 pagesSpin OffSangram PandaNo ratings yet

- Are Investors Absolutely Necessary For Startups SurvivalDocument11 pagesAre Investors Absolutely Necessary For Startups SurvivalTrue046No ratings yet

- Computation of Impact On EPS and Market Price3.3Document16 pagesComputation of Impact On EPS and Market Price3.3Shailav SahNo ratings yet

- Chap 6 Dividend Decision RevisedDocument49 pagesChap 6 Dividend Decision RevisedGizachew AlazarNo ratings yet

- Buyback (Suraj JK)Document30 pagesBuyback (Suraj JK)Siddharth BhagatNo ratings yet

- Buyback (Suraj JK)Document30 pagesBuyback (Suraj JK)Siddharth BhagatNo ratings yet

- CHP 10 - Long Term Financing DecisionsDocument15 pagesCHP 10 - Long Term Financing DecisionsHarvey AguilarNo ratings yet

- Building Wealth2018 JTBDocument34 pagesBuilding Wealth2018 JTBNicole OfalsaNo ratings yet

- Distributions To Shareholders: Dividends and Share RepurchasesDocument33 pagesDistributions To Shareholders: Dividends and Share RepurchasesPrincess EngresoNo ratings yet

- Types of Equity Schemes: SEBI Regulations Permit Exit Load Upto 7% of NAV. in Practice, The Load Is Much LowerDocument2 pagesTypes of Equity Schemes: SEBI Regulations Permit Exit Load Upto 7% of NAV. in Practice, The Load Is Much LowerSaurabh SinghNo ratings yet

- Private EquityDocument25 pagesPrivate EquityAman SinghNo ratings yet

- Financial Services 1Document21 pagesFinancial Services 1JEFFERSON OPSIMANo ratings yet

- DG19.Credit Oppotunities FundDocument14 pagesDG19.Credit Oppotunities FundMikhail RadomyselskiyNo ratings yet

- LECTURE 8 - Mergers - AcquisitionDocument34 pagesLECTURE 8 - Mergers - AcquisitionYvonneNo ratings yet

- Julius Csurgo Creative Capital VenturesDocument38 pagesJulius Csurgo Creative Capital VenturesmergerlawassociatesNo ratings yet

- Chapter 14 Ef4331Document19 pagesChapter 14 Ef4331c wan cheungNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Business ResumeDocument2 pagesBusiness ResumeŠejlaNo ratings yet

- For Wipro CompetitionDocument4 pagesFor Wipro CompetitionNitin MadhukarNo ratings yet

- Profile Word FileDocument20 pagesProfile Word Filepawanagrawal83No ratings yet

- Ramco Cements LimitedDocument20 pagesRamco Cements Limitedshubham loyaNo ratings yet

- Newell CorporationDocument5 pagesNewell CorporationAshutosh K TripathyNo ratings yet

- Consumer Behaviour Towards Confectionery Industry With Respect To Lotte India Co. Ltd.Document19 pagesConsumer Behaviour Towards Confectionery Industry With Respect To Lotte India Co. Ltd.Tanay SamantaNo ratings yet

- F6mys 2013 Dec QDocument16 pagesF6mys 2013 Dec Qsyed6143No ratings yet

- Equity Valuation Dissertation TopicsDocument5 pagesEquity Valuation Dissertation TopicsSomeoneToWriteMyPaperForMeEvansville100% (1)

- BNPParibasDocument31 pagesBNPParibasHm VikramNo ratings yet

- Kindred Investor PresentationDocument37 pagesKindred Investor Presentationdarkmagician3839151No ratings yet

- B2Gold Corp Initation Raymend JamesDocument35 pagesB2Gold Corp Initation Raymend Jamesexaltedangel09No ratings yet

- CFA Level 2, June, 2017 - Formula SheetDocument34 pagesCFA Level 2, June, 2017 - Formula Sheetpuneetgupta316230891% (11)

- CaseDocument8 pagesCaseKiran RimalNo ratings yet

- Dolan Et Al. v. Altice USA Inc. Et Al. - Verified ComplaintDocument347 pagesDolan Et Al. v. Altice USA Inc. Et Al. - Verified ComplaintAnonymous g2k2l9b100% (1)

- Konsult Casebook 2016Document101 pagesKonsult Casebook 2016Ag PradhiNo ratings yet

- Summary - Corporate Banking and Credit Analysis - Ugo Rigoni e Caterina CrucianiDocument76 pagesSummary - Corporate Banking and Credit Analysis - Ugo Rigoni e Caterina CrucianiMax KatzensternNo ratings yet

- External Growth of A Business - 1.5Document3 pagesExternal Growth of A Business - 1.5vaanya guptaNo ratings yet

- 152276Document73 pages152276Shofiana IfadaNo ratings yet

- Crux Casebook 2024Document381 pagesCrux Casebook 2024Harshit SharmaNo ratings yet

- Mauboussin - The Importance of ExpectationsDocument17 pagesMauboussin - The Importance of Expectationsjockxyz100% (1)

- Article Deloitte One SizeDocument4 pagesArticle Deloitte One Sizedavidlaval79No ratings yet

- A2 Markets MergersDocument8 pagesA2 Markets MergersTamani MoyoNo ratings yet

- EPM - Performance Evaluation ParametersDocument30 pagesEPM - Performance Evaluation ParametersKhushali OzaNo ratings yet

- Consulting Cases 1Document11 pagesConsulting Cases 1M8R_606115976No ratings yet

- 2017 2 22-wk8Document332 pages2017 2 22-wk8Jed FanNo ratings yet

- Hexpol AR 2008 PDFDocument116 pagesHexpol AR 2008 PDFMunchin RopaNo ratings yet

MGG - Pivotal SPAC Sponsor Case May20

MGG - Pivotal SPAC Sponsor Case May20

Uploaded by

waichew920 ratings0% found this document useful (0 votes)

4 views1 pagePivotal Acquisition Corporation is a NYSE-listed SPAC that raised $230 million in an IPO to acquire a private company. The Sponsor invested $6.375 million for shares and warrants. If no acquisition occurs within 18 months, the capital is returned to shareholders and the Sponsor loses its investment. With a successful $10 stock price acquisition, the Sponsor would realize a 10x return, while a $15 stock price would yield an 18x return. Risks include losing the at-risk capital if no deal transpires and potential dilution of Sponsor shares and warrants to complete an acquisition.

Original Description:

Original Title

MGG_Pivotal SPAC Sponsor Case May20

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPivotal Acquisition Corporation is a NYSE-listed SPAC that raised $230 million in an IPO to acquire a private company. The Sponsor invested $6.375 million for shares and warrants. If no acquisition occurs within 18 months, the capital is returned to shareholders and the Sponsor loses its investment. With a successful $10 stock price acquisition, the Sponsor would realize a 10x return, while a $15 stock price would yield an 18x return. Risks include losing the at-risk capital if no deal transpires and potential dilution of Sponsor shares and warrants to complete an acquisition.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageMGG - Pivotal SPAC Sponsor Case May20

MGG - Pivotal SPAC Sponsor Case May20

Uploaded by

waichew92Pivotal Acquisition Corporation is a NYSE-listed SPAC that raised $230 million in an IPO to acquire a private company. The Sponsor invested $6.375 million for shares and warrants. If no acquisition occurs within 18 months, the capital is returned to shareholders and the Sponsor loses its investment. With a successful $10 stock price acquisition, the Sponsor would realize a 10x return, while a $15 stock price would yield an 18x return. Risks include losing the at-risk capital if no deal transpires and potential dilution of Sponsor shares and warrants to complete an acquisition.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

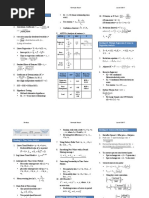

Pivotal Acquisition Corporation

Background Pivotal Acquisition’s IPO Terms

■ Pivotal Acquisition Corporation (“Pivotal” or the “Company”) is a NYSE-listed, publicly-traded Special SPONSOR INVESTMENT: $6.35MM in exchange for 6.35MM warrants ($1.00 / warrant)

Purpose Acquisition Company (“SPAC”) created by MGG and Mr. Jonathan Ledecky (collectively, the

SPONSOR SHARES: $25,000 in exchange for 5.75MM common shares

“Sponsor”)

IPO RAISE: $230MM via sale of 23MM units for $10.00 / unit

■ Pivotal Acquisition went public for the purpose of acquiring a private company in North America

(including, but not limited to) in industries ripe for disruption from continuously evolving digital TICKERS (UNIT / STOCK / WARRANT): PVT.U / PVT / PVT.WS – all listed on the NYSE

technology and the resulting shift in distribution patterns in consumer purchase behavior (i.e.

UNIT STRUCTURE: 1 share / 1 warrant

consumer, media / entertainment, etc.)

• Convert at a 1-to-1 ratio ($11.50 strike / $18.00 call)

■ Pivotal Acquisition raised $230MM in capital via an IPO listing on January 31, 2019 and has the • 5 year duration post merger

WARRANT TERMS:

ability to raise additional capital through the issuance of equity and debt securities to be used for • Exercisable later of 30 days after the business combination close or

12 months from closing of the IPO

merger consideration and as growth capital for the acquired business

ACQUISITION PERIOD: 18 months from January 31, 2019

■ In conjunction with the SPAC formation and public listing, the Sponsor contributed $6.375 million in

exchange for 5.75 million common shares (20.0% of initial outstanding shares) and 6.35 million

Illustrative Sponsor Economics*

warrants (MGG received half of such shares and warrants)

Initial Investment No Acquisition Base Case Upside Case

■ Please see “Investment Risks” below. Rather than allocate this initial SPAC investment to all MGG

- $230MM SPAC IPO - No acquisition occurs in - Stock Price = $10.00 - Stock Price = $15.00

funds, MGG is offering a co-invest opportunity on the same terms in the Sponsor “At-Risk” - 23MM units sold to 18 months (not including - Sponsor shares represent - Sponsor shares represent

public extensions) $57.5MM of value $86.25MM of value

investment - 5.75MM shares issued to - SPAC IPO capital is - Sponsor warrants worth - Sponsor warrants worth

Sponsor returned to its approx. $6.35MM approx. $28.6MM

Investment Thesis - Sponsor made $6.375MM

at-risk investment

shareholders - MOIC: 10.0x - MOIC: 18.0x

■ Robust M&A Experience $180.0

• Mr. Ledecky is an M&A professional and has acquired more than 500 businesses in his career

$160.0

• Since the IPO launch on January 31, 2019, Pivotal has sourced over 20 investment opportunities

$140.0

■ Proven SPAC Operator

$114.85

• Mr. Ledecky has extensive SPAC experience including founding Endeavor Acquisition, which $120.0

conducted an extremely successful business combination with American Apparel in 2007

$100.0 $28.60

• Mr. Ledecky was the founder of U.S. Office Products, one of the fastest start-up entrants in the $63.85

history of the Fortune 500 with sales in excess of $3BN within three years $80.0

$6.35 $6.35

$60.0

Investment Risks

$40.0 $86.25

■ Binary Nature of “At-Risk” Capital Sponsor loses

$57.50 its risk capital $57.50

• If an acquisition does not occur in an 18 month period (not including potential extensions) $20.0 with no value

from January 31, 2019, then the current offering is deemed worthless with zero recovery value retained

and all of the “At-Risk” capital will be lost $0.0

($6.38) ($6.38) Acquisition complete (w/o any reduction

■ Potential for Reduction of Sponsor’s Shares and Warrants -$20.0 in Sponsor’s shares or warrants)

• In order to consummate an acquisition, there may be economic concessions made that will At-Risk Capital Value of Sponsor Shares Value of Sponsor Warrants

reduce the Sponsor’s share and warrant ownership thus decreasing potential returns * MGG would receive half the upside.

Note: Assumes each warrant has $1.00 of time value

• Sponsor’s shares will be subject to a standard lock-up post-transaction

FOR QUALIFIED INVESTORS ONLY 1

You might also like

- Petroleum Economics PDFDocument156 pagesPetroleum Economics PDFZeljko Belosic100% (2)

- Programmatic Ad Industry PresentationDocument11 pagesProgrammatic Ad Industry Presentationakashwatwani8067No ratings yet

- From Competitive Advantage To Corporate StrategyDocument3 pagesFrom Competitive Advantage To Corporate StrategyAnubhav Aggarwal0% (1)

- U-12 Strategic PlanningDocument41 pagesU-12 Strategic PlanningMalik Khurram Shahzad Awan75% (4)

- 31 The Upscaling Business of Private EquityDocument12 pages31 The Upscaling Business of Private EquityCritiNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildStory pizzieNo ratings yet

- INFO UBS - SPACs - Investment Considerations BDocument19 pagesINFO UBS - SPACs - Investment Considerations BPer HuberNo ratings yet

- Graf Industrial Corp.Document165 pagesGraf Industrial Corp.vicr100No ratings yet

- Listing On SGXDocument28 pagesListing On SGXjsikparkNo ratings yet

- Week 8 Long Term Financing - EquityDocument30 pagesWeek 8 Long Term Financing - EquityAmelia MatherNo ratings yet

- IBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalDocument66 pagesIBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalAbhinandanNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- Pengantar Akuntansi Ii 3 SKS: Minggu 11Document49 pagesPengantar Akuntansi Ii 3 SKS: Minggu 11Nabila SyahlaNo ratings yet

- Analyzing Investing Activities: Intercorporate InvestmentsDocument38 pagesAnalyzing Investing Activities: Intercorporate Investmentsshldhy100% (1)

- M&A NotesDocument22 pagesM&A NotesБота ОмароваNo ratings yet

- What Is Leveraged Buyout and How Does It Works?Document4 pagesWhat Is Leveraged Buyout and How Does It Works?Keval ShahNo ratings yet

- Dividend Policy and Retained EarningDocument28 pagesDividend Policy and Retained EarningMd Abusaied AsikNo ratings yet

- Mergers and Other Forms of Corporate RestructuringDocument47 pagesMergers and Other Forms of Corporate Restructuringaftab_sweet3024No ratings yet

- Understanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Document17 pagesUnderstanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Dharmik SolankiNo ratings yet

- Part 4 Chapter 10 11 12 FmiDocument76 pagesPart 4 Chapter 10 11 12 FmiEffie Erica MacachorNo ratings yet

- Mergers, Corporate Restructuring, and More: Changing The Size of The Firm QuicklyDocument49 pagesMergers, Corporate Restructuring, and More: Changing The Size of The Firm QuicklyCarlosNo ratings yet

- Venture CapitalDocument42 pagesVenture CapitalKellaNo ratings yet

- Topic 9 - 29 - M&ADocument24 pagesTopic 9 - 29 - M&APhí Thị Hoàng HàNo ratings yet

- Private Equity ExitsDocument42 pagesPrivate Equity Exitsharshit.dwivedi320No ratings yet

- Corporate Finance-Lecture 10Document11 pagesCorporate Finance-Lecture 10Sadia AbidNo ratings yet

- Ipo Process PDFDocument80 pagesIpo Process PDFvinodvarghese123100% (1)

- FM-Sessions 23 - 24 Dividend Policy-CompleteDocument72 pagesFM-Sessions 23 - 24 Dividend Policy-CompleteSaadat ShaikhNo ratings yet

- A Study On Investor Preferences Towards Various Mutual FundsDocument122 pagesA Study On Investor Preferences Towards Various Mutual FundsAnkit Agarwal60% (5)

- Investment Banking and The Public Sale of Equity Securities: Financial Management, 3eDocument35 pagesInvestment Banking and The Public Sale of Equity Securities: Financial Management, 3eEman ChristiantoNo ratings yet

- Bodie - Essentials - of - Investments - 11e - Chapter03 - PPT MOD - Fall2020Document74 pagesBodie - Essentials - of - Investments - 11e - Chapter03 - PPT MOD - Fall2020Anthony SukkarNo ratings yet

- Pimco Global Bond FundDocument5 pagesPimco Global Bond FundKelvin TanNo ratings yet

- Mutual Funds: PRELIM ModuleDocument11 pagesMutual Funds: PRELIM ModulejchazneyNo ratings yet

- Topic 2 - StocksDocument51 pagesTopic 2 - StocksMahmoud AbdullahNo ratings yet

- Advanced Corporate Finance Chapter 19Document35 pagesAdvanced Corporate Finance Chapter 19laurenNo ratings yet

- Owl Rock Capital Corporation: Quarterly Earnings PresentationDocument18 pagesOwl Rock Capital Corporation: Quarterly Earnings PresentationMiguel RamosNo ratings yet

- Sample Term Sheet: Series A Convertible Preferred Stock FinancingDocument2 pagesSample Term Sheet: Series A Convertible Preferred Stock FinancingJennifer LeeNo ratings yet

- Private EquityDocument9 pagesPrivate Equitysv798dctq9No ratings yet

- PDS-SIA Aug19Document6 pagesPDS-SIA Aug19seadeco1991No ratings yet

- Tfef One Pager Nov 2019 PDFDocument2 pagesTfef One Pager Nov 2019 PDFABDUL MALIKNo ratings yet

- Private Equity StructureDocument5 pagesPrivate Equity StructurebasanisujithkumarNo ratings yet

- AAM - BRIC Advantage 2019-2Document3 pagesAAM - BRIC Advantage 2019-2ag rNo ratings yet

- Investment Banking - Key Issues & StrategiesDocument58 pagesInvestment Banking - Key Issues & StrategiesYusra Rehman KhanNo ratings yet

- Chap 005Document41 pagesChap 005Loser Neet100% (1)

- Corporate FinanceDocument66 pagesCorporate FinanceRobin SrivastavaNo ratings yet

- Corporate Finance V2Document80 pagesCorporate Finance V2sukeshNo ratings yet

- Public Equity: When A Firm Goes Public, It Issues Stock in The Primary Market in Exchange For CashDocument17 pagesPublic Equity: When A Firm Goes Public, It Issues Stock in The Primary Market in Exchange For CashBrandon LumibaoNo ratings yet

- Spin OffDocument8 pagesSpin OffSangram PandaNo ratings yet

- Are Investors Absolutely Necessary For Startups SurvivalDocument11 pagesAre Investors Absolutely Necessary For Startups SurvivalTrue046No ratings yet

- Computation of Impact On EPS and Market Price3.3Document16 pagesComputation of Impact On EPS and Market Price3.3Shailav SahNo ratings yet

- Chap 6 Dividend Decision RevisedDocument49 pagesChap 6 Dividend Decision RevisedGizachew AlazarNo ratings yet

- Buyback (Suraj JK)Document30 pagesBuyback (Suraj JK)Siddharth BhagatNo ratings yet

- Buyback (Suraj JK)Document30 pagesBuyback (Suraj JK)Siddharth BhagatNo ratings yet

- CHP 10 - Long Term Financing DecisionsDocument15 pagesCHP 10 - Long Term Financing DecisionsHarvey AguilarNo ratings yet

- Building Wealth2018 JTBDocument34 pagesBuilding Wealth2018 JTBNicole OfalsaNo ratings yet

- Distributions To Shareholders: Dividends and Share RepurchasesDocument33 pagesDistributions To Shareholders: Dividends and Share RepurchasesPrincess EngresoNo ratings yet

- Types of Equity Schemes: SEBI Regulations Permit Exit Load Upto 7% of NAV. in Practice, The Load Is Much LowerDocument2 pagesTypes of Equity Schemes: SEBI Regulations Permit Exit Load Upto 7% of NAV. in Practice, The Load Is Much LowerSaurabh SinghNo ratings yet

- Private EquityDocument25 pagesPrivate EquityAman SinghNo ratings yet

- Financial Services 1Document21 pagesFinancial Services 1JEFFERSON OPSIMANo ratings yet

- DG19.Credit Oppotunities FundDocument14 pagesDG19.Credit Oppotunities FundMikhail RadomyselskiyNo ratings yet

- LECTURE 8 - Mergers - AcquisitionDocument34 pagesLECTURE 8 - Mergers - AcquisitionYvonneNo ratings yet

- Julius Csurgo Creative Capital VenturesDocument38 pagesJulius Csurgo Creative Capital VenturesmergerlawassociatesNo ratings yet

- Chapter 14 Ef4331Document19 pagesChapter 14 Ef4331c wan cheungNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Business ResumeDocument2 pagesBusiness ResumeŠejlaNo ratings yet

- For Wipro CompetitionDocument4 pagesFor Wipro CompetitionNitin MadhukarNo ratings yet

- Profile Word FileDocument20 pagesProfile Word Filepawanagrawal83No ratings yet

- Ramco Cements LimitedDocument20 pagesRamco Cements Limitedshubham loyaNo ratings yet

- Newell CorporationDocument5 pagesNewell CorporationAshutosh K TripathyNo ratings yet

- Consumer Behaviour Towards Confectionery Industry With Respect To Lotte India Co. Ltd.Document19 pagesConsumer Behaviour Towards Confectionery Industry With Respect To Lotte India Co. Ltd.Tanay SamantaNo ratings yet

- F6mys 2013 Dec QDocument16 pagesF6mys 2013 Dec Qsyed6143No ratings yet

- Equity Valuation Dissertation TopicsDocument5 pagesEquity Valuation Dissertation TopicsSomeoneToWriteMyPaperForMeEvansville100% (1)

- BNPParibasDocument31 pagesBNPParibasHm VikramNo ratings yet

- Kindred Investor PresentationDocument37 pagesKindred Investor Presentationdarkmagician3839151No ratings yet

- B2Gold Corp Initation Raymend JamesDocument35 pagesB2Gold Corp Initation Raymend Jamesexaltedangel09No ratings yet

- CFA Level 2, June, 2017 - Formula SheetDocument34 pagesCFA Level 2, June, 2017 - Formula Sheetpuneetgupta316230891% (11)

- CaseDocument8 pagesCaseKiran RimalNo ratings yet

- Dolan Et Al. v. Altice USA Inc. Et Al. - Verified ComplaintDocument347 pagesDolan Et Al. v. Altice USA Inc. Et Al. - Verified ComplaintAnonymous g2k2l9b100% (1)

- Konsult Casebook 2016Document101 pagesKonsult Casebook 2016Ag PradhiNo ratings yet

- Summary - Corporate Banking and Credit Analysis - Ugo Rigoni e Caterina CrucianiDocument76 pagesSummary - Corporate Banking and Credit Analysis - Ugo Rigoni e Caterina CrucianiMax KatzensternNo ratings yet

- External Growth of A Business - 1.5Document3 pagesExternal Growth of A Business - 1.5vaanya guptaNo ratings yet

- 152276Document73 pages152276Shofiana IfadaNo ratings yet

- Crux Casebook 2024Document381 pagesCrux Casebook 2024Harshit SharmaNo ratings yet

- Mauboussin - The Importance of ExpectationsDocument17 pagesMauboussin - The Importance of Expectationsjockxyz100% (1)

- Article Deloitte One SizeDocument4 pagesArticle Deloitte One Sizedavidlaval79No ratings yet

- A2 Markets MergersDocument8 pagesA2 Markets MergersTamani MoyoNo ratings yet

- EPM - Performance Evaluation ParametersDocument30 pagesEPM - Performance Evaluation ParametersKhushali OzaNo ratings yet

- Consulting Cases 1Document11 pagesConsulting Cases 1M8R_606115976No ratings yet

- 2017 2 22-wk8Document332 pages2017 2 22-wk8Jed FanNo ratings yet

- Hexpol AR 2008 PDFDocument116 pagesHexpol AR 2008 PDFMunchin RopaNo ratings yet