Professional Documents

Culture Documents

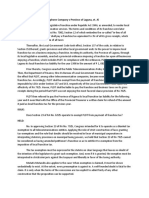

Manila Electric Company v. Province of Laguna

Manila Electric Company v. Province of Laguna

Uploaded by

Rukmini Dasi Rosemary GuevaraCopyright:

Available Formats

You might also like

- Sample WRIT OF HABEAS DATADocument5 pagesSample WRIT OF HABEAS DATAYon ComiaNo ratings yet

- WarrantDocument31 pagesWarrantRoyshad100% (4)

- 08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Document2 pages08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Rem SerranoNo ratings yet

- Obligations ND ContractsDocument14 pagesObligations ND ContractsRamil F. De JesusNo ratings yet

- Manila Electric V Province of LagunaDocument12 pagesManila Electric V Province of LagunamehNo ratings yet

- Manila Electric Vs Province of LagunaDocument3 pagesManila Electric Vs Province of LagunaJohnde MartinezNo ratings yet

- MERALCO V Province of LagunaDocument2 pagesMERALCO V Province of LagunaJaz Sumalinog100% (1)

- CombinedDocument242 pagesCombinedLord AumarNo ratings yet

- Tax Exemptions - Meralco V Province of Laguna (Utility - Franchise or Contractual)Document1 pageTax Exemptions - Meralco V Province of Laguna (Utility - Franchise or Contractual)Kevin G. Perez100% (1)

- Lanao Del Norte Electric Cooperative v. Provincial Government of Lanao Del NorteDocument2 pagesLanao Del Norte Electric Cooperative v. Provincial Government of Lanao Del NorteLucas MenteNo ratings yet

- Manila Electric Company vs. Province of Laguna, 306 SCRA 750, May 05, 1999 PDFDocument27 pagesManila Electric Company vs. Province of Laguna, 306 SCRA 750, May 05, 1999 PDFJane BandojaNo ratings yet

- Manila Electric Company V Province of Laguna, G.R. No. 131359, 05 May 1999Document2 pagesManila Electric Company V Province of Laguna, G.R. No. 131359, 05 May 1999keitosan21422No ratings yet

- Philippine Long Distance Telephone Company, Inc. Vs PDFDocument8 pagesPhilippine Long Distance Telephone Company, Inc. Vs PDFChristian Joe QuimioNo ratings yet

- Manila Electric Co Vs Province of Laguna - G.R. No. 131359. May 5, 1999Document6 pagesManila Electric Co Vs Province of Laguna - G.R. No. 131359. May 5, 1999Ebbe DyNo ratings yet

- G.R No. L - 131359Document2 pagesG.R No. L - 131359HanilavMoraNo ratings yet

- Province of Misamis v. CEPALCODocument2 pagesProvince of Misamis v. CEPALCOGabe RuaroNo ratings yet

- PLDT vs. DavaoDocument5 pagesPLDT vs. DavaoLeonardo De CaprioNo ratings yet

- Meralco vs. Province of Laguna, 306 SCRA 750Document6 pagesMeralco vs. Province of Laguna, 306 SCRA 750Machida AbrahamNo ratings yet

- FEU TAX Case Digest Taxation Law Cases Penned by J Perlas BernabeDocument19 pagesFEU TAX Case Digest Taxation Law Cases Penned by J Perlas BernabeRiel Picardal-VillalonNo ratings yet

- Admin Case Digest Compilation - Paolo JavierDocument90 pagesAdmin Case Digest Compilation - Paolo JavierPJ JavierNo ratings yet

- Misamis Oriental Vs Cagayan ElectricDocument7 pagesMisamis Oriental Vs Cagayan ElectricJovhilmar E. BrinquezNo ratings yet

- City of Iriga v. CAMSURELCODocument6 pagesCity of Iriga v. CAMSURELCOEvelyn TocgongnaNo ratings yet

- Meralco VS LagunaDocument1 pageMeralco VS LagunaRussell Stanley Que GeronimoNo ratings yet

- MERALCO V Province of Laguna G.R. No. 131359. May 5, 1999Document4 pagesMERALCO V Province of Laguna G.R. No. 131359. May 5, 1999MWinbee VisitacionNo ratings yet

- Manila Electric Company Vs CirDocument1 pageManila Electric Company Vs CirKateBarrionEspinosaNo ratings yet

- PLDT vs. Province of Laguna, G.R. No. 151899Document5 pagesPLDT vs. Province of Laguna, G.R. No. 151899Ronz RoganNo ratings yet

- PLDT v. City of DavaoDocument3 pagesPLDT v. City of Davaonino_herreraiiiNo ratings yet

- PLDT v. LagunaDocument1 pagePLDT v. LagunaReinier Jeffrey Abdon100% (2)

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOGarp BarrocaNo ratings yet

- Supreme CourtDocument6 pagesSupreme CourtZander Alexis BonnevieNo ratings yet

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOYani Ramos100% (1)

- Meralco v. Province of LagunaDocument1 pageMeralco v. Province of LagunaRolando Mauring ReubalNo ratings yet

- PLDT vs. City of Davao (G.R. No. 143867, March 25, 2003)Document22 pagesPLDT vs. City of Davao (G.R. No. 143867, March 25, 2003)red gynNo ratings yet

- City Government of San Pablo, Laguna v. Reyes 305 SCRA 353Document11 pagesCity Government of San Pablo, Laguna v. Reyes 305 SCRA 353Jessica Melle GaliasNo ratings yet

- PLDT StatconDocument1 pagePLDT StatconJoshua Anthony TrinanesNo ratings yet

- Batangas Power Corporation v. Batangas CityDocument3 pagesBatangas Power Corporation v. Batangas CityTippy Dos SantosNo ratings yet

- Refund CTW Put X Only Not Present Evidence To ProveDocument7 pagesRefund CTW Put X Only Not Present Evidence To ProveRegina CoeliNo ratings yet

- Province of Misamis Oriental V CepalcoDocument1 pageProvince of Misamis Oriental V CepalcoRhea Barroga100% (1)

- City of Iriga vs. CASURECO Franchise TaxDocument15 pagesCity of Iriga vs. CASURECO Franchise TaxChatNo ratings yet

- Smart Communications, Inc. vs. City of Davao, G.R. No. 155491, 16 September 2008Document4 pagesSmart Communications, Inc. vs. City of Davao, G.R. No. 155491, 16 September 2008JuliaNo ratings yet

- Present:: Garcia, J.Document30 pagesPresent:: Garcia, J.Kim BarriosNo ratings yet

- Tax 1 Digest CompilationDocument13 pagesTax 1 Digest CompilationxyrakrezelNo ratings yet

- City Government of San Pablo, Laguna Vs Reyes DegestDocument2 pagesCity Government of San Pablo, Laguna Vs Reyes DegestCybelShepheredSarolMalagaNo ratings yet

- MERALCO VS PROVINCE OF LAGUNA DigestedDocument3 pagesMERALCO VS PROVINCE OF LAGUNA DigestedSuzyNo ratings yet

- Taxation 2 Case DigestDocument27 pagesTaxation 2 Case DigestThalia SalvadorNo ratings yet

- Digital Telecom PhilsDocument4 pagesDigital Telecom PhilsjmNo ratings yet

- 16 (D) Manila Electric Company vs. Province of LagunaDocument2 pages16 (D) Manila Electric Company vs. Province of LagunaGoodyNo ratings yet

- PLDT Vs Laguna Exclusion Vs ExemptionDocument9 pagesPLDT Vs Laguna Exclusion Vs ExemptionThremzone17No ratings yet

- MISAMIS ORIENTAL vs. Cagayan ElectricDocument1 pageMISAMIS ORIENTAL vs. Cagayan ElectricAj MangaliagNo ratings yet

- Bacani and Matoto Vs National Coconut CorporationDocument90 pagesBacani and Matoto Vs National Coconut CorporationPJ JavierNo ratings yet

- PLDT Vs Province of LagunaDocument3 pagesPLDT Vs Province of LagunaBryan Jay NuiqueNo ratings yet

- 50-Meralco Vs Province of LagunaDocument2 pages50-Meralco Vs Province of LagunaKris GrubaNo ratings yet

- Province of Misor vs. Cepalco 181 Scra 38Document8 pagesProvince of Misor vs. Cepalco 181 Scra 38John BernalNo ratings yet

- Meralco vs. Province of Laguna DigestDocument3 pagesMeralco vs. Province of Laguna DigestMa Gabriellen Quijada-Tabuñag100% (2)

- Tax 1 Case Digests New June 24 2014Document2 pagesTax 1 Case Digests New June 24 2014kanariNo ratings yet

- MILAOR+ +Province+of+Tarlac+vs.+AlcantaraDocument3 pagesMILAOR+ +Province+of+Tarlac+vs.+AlcantaraAndrea MilaorNo ratings yet

- Brye Dongz-Manila Electric Co, Inc. vs. Province of LagunaDocument3 pagesBrye Dongz-Manila Electric Co, Inc. vs. Province of LagunaKath Leen100% (1)

- Guide Notes On Local Government TaxationDocument36 pagesGuide Notes On Local Government TaxationAlexine Ali BangcolaNo ratings yet

- 1 - City Government of San Pablo Laguna Vs ReyesDocument6 pages1 - City Government of San Pablo Laguna Vs ReyesAnonymous CWcXthhZgxNo ratings yet

- Napocor Vs City CabanatuanDocument2 pagesNapocor Vs City Cabanatuanhime mejNo ratings yet

- Summary of Christoph Mlinarchik's Government Contracts in Plain EnglishFrom EverandSummary of Christoph Mlinarchik's Government Contracts in Plain EnglishNo ratings yet

- People v. MartiDocument2 pagesPeople v. MartiRukmini Dasi Rosemary GuevaraNo ratings yet

- Mendoza v. COMELECDocument2 pagesMendoza v. COMELECRukmini Dasi Rosemary GuevaraNo ratings yet

- People vs. Yambot, 343 SCRA 20, G.R. No. 120350 October 13, 2000Document3 pagesPeople vs. Yambot, 343 SCRA 20, G.R. No. 120350 October 13, 2000Rukmini Dasi Rosemary GuevaraNo ratings yet

- Villa Ignacio v. Gutierrez GR No 93092Document2 pagesVilla Ignacio v. Gutierrez GR No 93092Rukmini Dasi Rosemary GuevaraNo ratings yet

- Yrasuegui v. Philippine AirlinesDocument2 pagesYrasuegui v. Philippine AirlinesRukmini Dasi Rosemary GuevaraNo ratings yet

- Agabon vs. NLRCDocument3 pagesAgabon vs. NLRCRukmini Dasi Rosemary GuevaraNo ratings yet

- 038 JUSAY Municipality of Parañaque v. VM Realty CorporationDocument2 pages038 JUSAY Municipality of Parañaque v. VM Realty CorporationRukmini Dasi Rosemary GuevaraNo ratings yet

- Dela Cruz v. People of The PhilippinesDocument2 pagesDela Cruz v. People of The PhilippinesRukmini Dasi Rosemary GuevaraNo ratings yet

- 199 BONBON Apo Fruits Corporation vs. Land Bank of The Philippines, 859 SCRA 620, G.R. Nos. 217985-86 March 21, 2018Document2 pages199 BONBON Apo Fruits Corporation vs. Land Bank of The Philippines, 859 SCRA 620, G.R. Nos. 217985-86 March 21, 2018Rukmini Dasi Rosemary GuevaraNo ratings yet

- 205 FACTOR Knecht vs. Court of AppealsDocument4 pages205 FACTOR Knecht vs. Court of AppealsRukmini Dasi Rosemary GuevaraNo ratings yet

- Angeles University Foundation vs. City of Angeles, 675 SCRA 359, G.R. No. 189999Document2 pagesAngeles University Foundation vs. City of Angeles, 675 SCRA 359, G.R. No. 189999Rukmini Dasi Rosemary GuevaraNo ratings yet

- LBP v. DalautaDocument2 pagesLBP v. DalautaRukmini Dasi Rosemary GuevaraNo ratings yet

- The Manila Banking Corporation v. BCDADocument2 pagesThe Manila Banking Corporation v. BCDARukmini Dasi Rosemary GuevaraNo ratings yet

- COCOFED v. RepublicDocument2 pagesCOCOFED v. RepublicRukmini Dasi Rosemary GuevaraNo ratings yet

- LBP v. DalautaDocument2 pagesLBP v. DalautaRukmini Dasi Rosemary GuevaraNo ratings yet

- Manapat vs. CADocument2 pagesManapat vs. CARukmini Dasi Rosemary GuevaraNo ratings yet

- Yared vs. Land Bank of The Philippines, 853 SCRA 28, G.R. No. 213945 January 24, 2018Document2 pagesYared vs. Land Bank of The Philippines, 853 SCRA 28, G.R. No. 213945 January 24, 2018Rukmini Dasi Rosemary GuevaraNo ratings yet

- Evasco vs. MontanezDocument1 pageEvasco vs. MontanezRukmini Dasi Rosemary GuevaraNo ratings yet

- JUSAY Gaanan v. IACDocument2 pagesJUSAY Gaanan v. IACRukmini Dasi Rosemary GuevaraNo ratings yet

- 437 TAN Republic V Go Pei HungDocument2 pages437 TAN Republic V Go Pei HungRukmini Dasi Rosemary GuevaraNo ratings yet

- Re - Application For Admission To The Philippine Bar Vicente D. ChingDocument2 pagesRe - Application For Admission To The Philippine Bar Vicente D. ChingRukmini Dasi Rosemary GuevaraNo ratings yet

- IDEALS vs. PowerDocument2 pagesIDEALS vs. PowerRukmini Dasi Rosemary GuevaraNo ratings yet

- Tan v. CrisologoDocument2 pagesTan v. CrisologoRukmini Dasi Rosemary GuevaraNo ratings yet

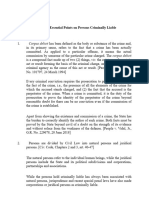

- Essential Points On Stages of ExecutionDocument7 pagesEssential Points On Stages of ExecutionRukmini Dasi Rosemary GuevaraNo ratings yet

- TRINIDAD CIR V AlgueDocument2 pagesTRINIDAD CIR V AlgueRukmini Dasi Rosemary GuevaraNo ratings yet

- Gancayco v. City Government of Quezon CityDocument2 pagesGancayco v. City Government of Quezon CityRukmini Dasi Rosemary GuevaraNo ratings yet

- Samahan NG Mga Progresibong Kabataan (SPARK) V QCDocument3 pagesSamahan NG Mga Progresibong Kabataan (SPARK) V QCRukmini Dasi Rosemary GuevaraNo ratings yet

- Alib vs. Labayen, 360 SCRA 29, A.M. No. RTJ-00-1576 June 28, 2001Document2 pagesAlib vs. Labayen, 360 SCRA 29, A.M. No. RTJ-00-1576 June 28, 2001Rukmini Dasi Rosemary GuevaraNo ratings yet

- Lto v. City of ButuanDocument2 pagesLto v. City of ButuanRukmini Dasi Rosemary GuevaraNo ratings yet

- Essential Points On Persons Criminally LiableDocument12 pagesEssential Points On Persons Criminally LiableRukmini Dasi Rosemary GuevaraNo ratings yet

- Summer Reading List 7th Grade CivicsDocument2 pagesSummer Reading List 7th Grade Civicsapi-325990854No ratings yet

- 9-11 Truth Why Did They Do ItDocument52 pages9-11 Truth Why Did They Do ItLisa Montgomery100% (1)

- Copyreading Symbols. Write A Slug Line and Printer's DirectionDocument2 pagesCopyreading Symbols. Write A Slug Line and Printer's DirectionPauline Karen Macaisa-ConcepcionNo ratings yet

- Medford City Council Agenda October 23, 2012Document4 pagesMedford City Council Agenda October 23, 2012Medford Public Schools and City of Medford, MANo ratings yet

- TAX II - Finals Reviewer - 3B ALSDocument168 pagesTAX II - Finals Reviewer - 3B ALSAgnes Bianca MendozaNo ratings yet

- SAP Pocessing ClassesDocument30 pagesSAP Pocessing ClassesAlessandro Lincoln100% (2)

- Frenzel v. Catito, G.R. No. 143958, July 11, 2003, 406 SCRA 55Document14 pagesFrenzel v. Catito, G.R. No. 143958, July 11, 2003, 406 SCRA 55TENsai1986No ratings yet

- 17 (5) Health InsuranceDocument3 pages17 (5) Health Insuranceashim1No ratings yet

- Privacy in Cyberspace - PresentationDocument23 pagesPrivacy in Cyberspace - PresentationDinesh RamNo ratings yet

- Code of Etiquette For The Use of The National Flag of Trinidad and TobagoDocument3 pagesCode of Etiquette For The Use of The National Flag of Trinidad and TobagosilkcottonjumbieNo ratings yet

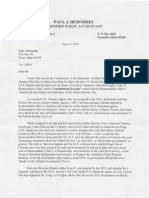

- Letter From Mr. Paul DesfossesDocument2 pagesLetter From Mr. Paul DesfossesPhilHart0% (1)

- Answers 1601Document6 pagesAnswers 1601Raeesa ShaikNo ratings yet

- Self-Determination Baguio DeclarationDocument4 pagesSelf-Determination Baguio DeclarationMay Frances CalsiyaoNo ratings yet

- Law & History in Colonial IndiaDocument22 pagesLaw & History in Colonial IndiaPunishk HandaNo ratings yet

- 2CL BRAGANCIA (Sec C) - CASE DIGEST (Gudani V Senga)Document4 pages2CL BRAGANCIA (Sec C) - CASE DIGEST (Gudani V Senga)Ian Joseph BraganciaNo ratings yet

- General Credit Corp V AlsonsDocument4 pagesGeneral Credit Corp V AlsonsDominic EstremosNo ratings yet

- STEP HK Update of The Trust Laws of Hong KongDocument3 pagesSTEP HK Update of The Trust Laws of Hong KongMaggie Sze Tin LeeNo ratings yet

- %program Files%/Microsoft SQL Server Compact Edition/v4.0Document3 pages%program Files%/Microsoft SQL Server Compact Edition/v4.0Meghan WoodsNo ratings yet

- Evidence Cases AssignedDocument6 pagesEvidence Cases AssignedDominic EmbodoNo ratings yet

- Woodrick V WoodDocument1 pageWoodrick V WoodMissPardisNo ratings yet

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument6 pagesUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Case 2:04-cv-08425 Trial Day 7 Vol 2Document59 pagesCase 2:04-cv-08425 Trial Day 7 Vol 2Equality Case FilesNo ratings yet

- Distinguish Corporation Aggregate From Corporation SoleDocument6 pagesDistinguish Corporation Aggregate From Corporation SolePatatas SayoteNo ratings yet

- 15 - Chapter 9 PDFDocument17 pages15 - Chapter 9 PDFNiyati BagweNo ratings yet

- Raghava Menon Son of Kasturi ... Vs Kuttappan Nair, Proprietor, ... On 29 March, 1962Document4 pagesRaghava Menon Son of Kasturi ... Vs Kuttappan Nair, Proprietor, ... On 29 March, 1962Ismail AliNo ratings yet

- The Crooks Who Refuse To Implement The Global Currency ResetTwitter4.13.19Document35 pagesThe Crooks Who Refuse To Implement The Global Currency ResetTwitter4.13.19Anonymous rv0urXXjNo ratings yet

Manila Electric Company v. Province of Laguna

Manila Electric Company v. Province of Laguna

Uploaded by

Rukmini Dasi Rosemary GuevaraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manila Electric Company v. Province of Laguna

Manila Electric Company v. Province of Laguna

Uploaded by

Rukmini Dasi Rosemary GuevaraCopyright:

Available Formats

Manila Electric Company v. Province of Laguna acting on its private capacity in entering said contracts with other parties.

May 5, 1999 | Vitug, J. | Contract Clause

In the case provided, franchise tax exemptions are considered as different

PETITIONER: Manila Electric Company from contractual tax exemptions. The validity of said ruling is based on Sec.

RESPONDENT: Province of Laguna and Benito Balazo, in his capacity as 11, Art. XII of the Constitution, citing that franchises are subject to

Provincial Treasurer of Laguna amendments by the government, including the removal of franchise tax

exemptions.

SUMMARY: MERALCO was granted franchises to operate across different

municipalities in Laguna. However, the introduction of RA 7160 gave way for

the municipalities to levy franchise taxes from MERALCO for their source of

revenue.

The Court ruled that the levying of taxes does not constitute a violation of the

non-impairment clause as franchise tax exemptions are different from

contractual tax exemptions.

DOCTRINE: Contract Clause – Franchise tax exemptions are deemed to be

different from contractual tax exemptions; hence, they are not subject to the non-

impairment clause.

FACTS:

1. Franchise was granted for MERALCO to operate across certain

municipalities of Laguna. The National Electrification Administration has

also granted MERALCO with a franchise to operate in Calamba, Laguna.

2. Through RA 7160, LGUs were allowed to levy taxes as sources of revenue.

Hence, Laguna Provincial Ordinance No. 01-92 was implemented. Sec.

2.09 sought a Franchise Tax on businesses.

3. Demand letter was sent to MERALCO, but their response was that the said

payment for tax is already included in the fees incurred for obtaining the

franchise.

4. Claim for refund was denied by Governor of Laguna. RTC sided with said

decision.

ISSUE/s:

1. WoN the franchise tax imposed against MERALCO is violative of the non-

impairment clause - NO

RULING:

WHEREFORE, the instant petition is hereby DISMISSED. No costs. SO

ORDERED.

RATIO:

1. The Court ruled that the government has the authority to withdraw

privileges from businesses, such as tax exemptions. The Court also cited

that the non-impairment clause is only valid whenever the government is

You might also like

- Sample WRIT OF HABEAS DATADocument5 pagesSample WRIT OF HABEAS DATAYon ComiaNo ratings yet

- WarrantDocument31 pagesWarrantRoyshad100% (4)

- 08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Document2 pages08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Rem SerranoNo ratings yet

- Obligations ND ContractsDocument14 pagesObligations ND ContractsRamil F. De JesusNo ratings yet

- Manila Electric V Province of LagunaDocument12 pagesManila Electric V Province of LagunamehNo ratings yet

- Manila Electric Vs Province of LagunaDocument3 pagesManila Electric Vs Province of LagunaJohnde MartinezNo ratings yet

- MERALCO V Province of LagunaDocument2 pagesMERALCO V Province of LagunaJaz Sumalinog100% (1)

- CombinedDocument242 pagesCombinedLord AumarNo ratings yet

- Tax Exemptions - Meralco V Province of Laguna (Utility - Franchise or Contractual)Document1 pageTax Exemptions - Meralco V Province of Laguna (Utility - Franchise or Contractual)Kevin G. Perez100% (1)

- Lanao Del Norte Electric Cooperative v. Provincial Government of Lanao Del NorteDocument2 pagesLanao Del Norte Electric Cooperative v. Provincial Government of Lanao Del NorteLucas MenteNo ratings yet

- Manila Electric Company vs. Province of Laguna, 306 SCRA 750, May 05, 1999 PDFDocument27 pagesManila Electric Company vs. Province of Laguna, 306 SCRA 750, May 05, 1999 PDFJane BandojaNo ratings yet

- Manila Electric Company V Province of Laguna, G.R. No. 131359, 05 May 1999Document2 pagesManila Electric Company V Province of Laguna, G.R. No. 131359, 05 May 1999keitosan21422No ratings yet

- Philippine Long Distance Telephone Company, Inc. Vs PDFDocument8 pagesPhilippine Long Distance Telephone Company, Inc. Vs PDFChristian Joe QuimioNo ratings yet

- Manila Electric Co Vs Province of Laguna - G.R. No. 131359. May 5, 1999Document6 pagesManila Electric Co Vs Province of Laguna - G.R. No. 131359. May 5, 1999Ebbe DyNo ratings yet

- G.R No. L - 131359Document2 pagesG.R No. L - 131359HanilavMoraNo ratings yet

- Province of Misamis v. CEPALCODocument2 pagesProvince of Misamis v. CEPALCOGabe RuaroNo ratings yet

- PLDT vs. DavaoDocument5 pagesPLDT vs. DavaoLeonardo De CaprioNo ratings yet

- Meralco vs. Province of Laguna, 306 SCRA 750Document6 pagesMeralco vs. Province of Laguna, 306 SCRA 750Machida AbrahamNo ratings yet

- FEU TAX Case Digest Taxation Law Cases Penned by J Perlas BernabeDocument19 pagesFEU TAX Case Digest Taxation Law Cases Penned by J Perlas BernabeRiel Picardal-VillalonNo ratings yet

- Admin Case Digest Compilation - Paolo JavierDocument90 pagesAdmin Case Digest Compilation - Paolo JavierPJ JavierNo ratings yet

- Misamis Oriental Vs Cagayan ElectricDocument7 pagesMisamis Oriental Vs Cagayan ElectricJovhilmar E. BrinquezNo ratings yet

- City of Iriga v. CAMSURELCODocument6 pagesCity of Iriga v. CAMSURELCOEvelyn TocgongnaNo ratings yet

- Meralco VS LagunaDocument1 pageMeralco VS LagunaRussell Stanley Que GeronimoNo ratings yet

- MERALCO V Province of Laguna G.R. No. 131359. May 5, 1999Document4 pagesMERALCO V Province of Laguna G.R. No. 131359. May 5, 1999MWinbee VisitacionNo ratings yet

- Manila Electric Company Vs CirDocument1 pageManila Electric Company Vs CirKateBarrionEspinosaNo ratings yet

- PLDT vs. Province of Laguna, G.R. No. 151899Document5 pagesPLDT vs. Province of Laguna, G.R. No. 151899Ronz RoganNo ratings yet

- PLDT v. City of DavaoDocument3 pagesPLDT v. City of Davaonino_herreraiiiNo ratings yet

- PLDT v. LagunaDocument1 pagePLDT v. LagunaReinier Jeffrey Abdon100% (2)

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOGarp BarrocaNo ratings yet

- Supreme CourtDocument6 pagesSupreme CourtZander Alexis BonnevieNo ratings yet

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOYani Ramos100% (1)

- Meralco v. Province of LagunaDocument1 pageMeralco v. Province of LagunaRolando Mauring ReubalNo ratings yet

- PLDT vs. City of Davao (G.R. No. 143867, March 25, 2003)Document22 pagesPLDT vs. City of Davao (G.R. No. 143867, March 25, 2003)red gynNo ratings yet

- City Government of San Pablo, Laguna v. Reyes 305 SCRA 353Document11 pagesCity Government of San Pablo, Laguna v. Reyes 305 SCRA 353Jessica Melle GaliasNo ratings yet

- PLDT StatconDocument1 pagePLDT StatconJoshua Anthony TrinanesNo ratings yet

- Batangas Power Corporation v. Batangas CityDocument3 pagesBatangas Power Corporation v. Batangas CityTippy Dos SantosNo ratings yet

- Refund CTW Put X Only Not Present Evidence To ProveDocument7 pagesRefund CTW Put X Only Not Present Evidence To ProveRegina CoeliNo ratings yet

- Province of Misamis Oriental V CepalcoDocument1 pageProvince of Misamis Oriental V CepalcoRhea Barroga100% (1)

- City of Iriga vs. CASURECO Franchise TaxDocument15 pagesCity of Iriga vs. CASURECO Franchise TaxChatNo ratings yet

- Smart Communications, Inc. vs. City of Davao, G.R. No. 155491, 16 September 2008Document4 pagesSmart Communications, Inc. vs. City of Davao, G.R. No. 155491, 16 September 2008JuliaNo ratings yet

- Present:: Garcia, J.Document30 pagesPresent:: Garcia, J.Kim BarriosNo ratings yet

- Tax 1 Digest CompilationDocument13 pagesTax 1 Digest CompilationxyrakrezelNo ratings yet

- City Government of San Pablo, Laguna Vs Reyes DegestDocument2 pagesCity Government of San Pablo, Laguna Vs Reyes DegestCybelShepheredSarolMalagaNo ratings yet

- MERALCO VS PROVINCE OF LAGUNA DigestedDocument3 pagesMERALCO VS PROVINCE OF LAGUNA DigestedSuzyNo ratings yet

- Taxation 2 Case DigestDocument27 pagesTaxation 2 Case DigestThalia SalvadorNo ratings yet

- Digital Telecom PhilsDocument4 pagesDigital Telecom PhilsjmNo ratings yet

- 16 (D) Manila Electric Company vs. Province of LagunaDocument2 pages16 (D) Manila Electric Company vs. Province of LagunaGoodyNo ratings yet

- PLDT Vs Laguna Exclusion Vs ExemptionDocument9 pagesPLDT Vs Laguna Exclusion Vs ExemptionThremzone17No ratings yet

- MISAMIS ORIENTAL vs. Cagayan ElectricDocument1 pageMISAMIS ORIENTAL vs. Cagayan ElectricAj MangaliagNo ratings yet

- Bacani and Matoto Vs National Coconut CorporationDocument90 pagesBacani and Matoto Vs National Coconut CorporationPJ JavierNo ratings yet

- PLDT Vs Province of LagunaDocument3 pagesPLDT Vs Province of LagunaBryan Jay NuiqueNo ratings yet

- 50-Meralco Vs Province of LagunaDocument2 pages50-Meralco Vs Province of LagunaKris GrubaNo ratings yet

- Province of Misor vs. Cepalco 181 Scra 38Document8 pagesProvince of Misor vs. Cepalco 181 Scra 38John BernalNo ratings yet

- Meralco vs. Province of Laguna DigestDocument3 pagesMeralco vs. Province of Laguna DigestMa Gabriellen Quijada-Tabuñag100% (2)

- Tax 1 Case Digests New June 24 2014Document2 pagesTax 1 Case Digests New June 24 2014kanariNo ratings yet

- MILAOR+ +Province+of+Tarlac+vs.+AlcantaraDocument3 pagesMILAOR+ +Province+of+Tarlac+vs.+AlcantaraAndrea MilaorNo ratings yet

- Brye Dongz-Manila Electric Co, Inc. vs. Province of LagunaDocument3 pagesBrye Dongz-Manila Electric Co, Inc. vs. Province of LagunaKath Leen100% (1)

- Guide Notes On Local Government TaxationDocument36 pagesGuide Notes On Local Government TaxationAlexine Ali BangcolaNo ratings yet

- 1 - City Government of San Pablo Laguna Vs ReyesDocument6 pages1 - City Government of San Pablo Laguna Vs ReyesAnonymous CWcXthhZgxNo ratings yet

- Napocor Vs City CabanatuanDocument2 pagesNapocor Vs City Cabanatuanhime mejNo ratings yet

- Summary of Christoph Mlinarchik's Government Contracts in Plain EnglishFrom EverandSummary of Christoph Mlinarchik's Government Contracts in Plain EnglishNo ratings yet

- People v. MartiDocument2 pagesPeople v. MartiRukmini Dasi Rosemary GuevaraNo ratings yet

- Mendoza v. COMELECDocument2 pagesMendoza v. COMELECRukmini Dasi Rosemary GuevaraNo ratings yet

- People vs. Yambot, 343 SCRA 20, G.R. No. 120350 October 13, 2000Document3 pagesPeople vs. Yambot, 343 SCRA 20, G.R. No. 120350 October 13, 2000Rukmini Dasi Rosemary GuevaraNo ratings yet

- Villa Ignacio v. Gutierrez GR No 93092Document2 pagesVilla Ignacio v. Gutierrez GR No 93092Rukmini Dasi Rosemary GuevaraNo ratings yet

- Yrasuegui v. Philippine AirlinesDocument2 pagesYrasuegui v. Philippine AirlinesRukmini Dasi Rosemary GuevaraNo ratings yet

- Agabon vs. NLRCDocument3 pagesAgabon vs. NLRCRukmini Dasi Rosemary GuevaraNo ratings yet

- 038 JUSAY Municipality of Parañaque v. VM Realty CorporationDocument2 pages038 JUSAY Municipality of Parañaque v. VM Realty CorporationRukmini Dasi Rosemary GuevaraNo ratings yet

- Dela Cruz v. People of The PhilippinesDocument2 pagesDela Cruz v. People of The PhilippinesRukmini Dasi Rosemary GuevaraNo ratings yet

- 199 BONBON Apo Fruits Corporation vs. Land Bank of The Philippines, 859 SCRA 620, G.R. Nos. 217985-86 March 21, 2018Document2 pages199 BONBON Apo Fruits Corporation vs. Land Bank of The Philippines, 859 SCRA 620, G.R. Nos. 217985-86 March 21, 2018Rukmini Dasi Rosemary GuevaraNo ratings yet

- 205 FACTOR Knecht vs. Court of AppealsDocument4 pages205 FACTOR Knecht vs. Court of AppealsRukmini Dasi Rosemary GuevaraNo ratings yet

- Angeles University Foundation vs. City of Angeles, 675 SCRA 359, G.R. No. 189999Document2 pagesAngeles University Foundation vs. City of Angeles, 675 SCRA 359, G.R. No. 189999Rukmini Dasi Rosemary GuevaraNo ratings yet

- LBP v. DalautaDocument2 pagesLBP v. DalautaRukmini Dasi Rosemary GuevaraNo ratings yet

- The Manila Banking Corporation v. BCDADocument2 pagesThe Manila Banking Corporation v. BCDARukmini Dasi Rosemary GuevaraNo ratings yet

- COCOFED v. RepublicDocument2 pagesCOCOFED v. RepublicRukmini Dasi Rosemary GuevaraNo ratings yet

- LBP v. DalautaDocument2 pagesLBP v. DalautaRukmini Dasi Rosemary GuevaraNo ratings yet

- Manapat vs. CADocument2 pagesManapat vs. CARukmini Dasi Rosemary GuevaraNo ratings yet

- Yared vs. Land Bank of The Philippines, 853 SCRA 28, G.R. No. 213945 January 24, 2018Document2 pagesYared vs. Land Bank of The Philippines, 853 SCRA 28, G.R. No. 213945 January 24, 2018Rukmini Dasi Rosemary GuevaraNo ratings yet

- Evasco vs. MontanezDocument1 pageEvasco vs. MontanezRukmini Dasi Rosemary GuevaraNo ratings yet

- JUSAY Gaanan v. IACDocument2 pagesJUSAY Gaanan v. IACRukmini Dasi Rosemary GuevaraNo ratings yet

- 437 TAN Republic V Go Pei HungDocument2 pages437 TAN Republic V Go Pei HungRukmini Dasi Rosemary GuevaraNo ratings yet

- Re - Application For Admission To The Philippine Bar Vicente D. ChingDocument2 pagesRe - Application For Admission To The Philippine Bar Vicente D. ChingRukmini Dasi Rosemary GuevaraNo ratings yet

- IDEALS vs. PowerDocument2 pagesIDEALS vs. PowerRukmini Dasi Rosemary GuevaraNo ratings yet

- Tan v. CrisologoDocument2 pagesTan v. CrisologoRukmini Dasi Rosemary GuevaraNo ratings yet

- Essential Points On Stages of ExecutionDocument7 pagesEssential Points On Stages of ExecutionRukmini Dasi Rosemary GuevaraNo ratings yet

- TRINIDAD CIR V AlgueDocument2 pagesTRINIDAD CIR V AlgueRukmini Dasi Rosemary GuevaraNo ratings yet

- Gancayco v. City Government of Quezon CityDocument2 pagesGancayco v. City Government of Quezon CityRukmini Dasi Rosemary GuevaraNo ratings yet

- Samahan NG Mga Progresibong Kabataan (SPARK) V QCDocument3 pagesSamahan NG Mga Progresibong Kabataan (SPARK) V QCRukmini Dasi Rosemary GuevaraNo ratings yet

- Alib vs. Labayen, 360 SCRA 29, A.M. No. RTJ-00-1576 June 28, 2001Document2 pagesAlib vs. Labayen, 360 SCRA 29, A.M. No. RTJ-00-1576 June 28, 2001Rukmini Dasi Rosemary GuevaraNo ratings yet

- Lto v. City of ButuanDocument2 pagesLto v. City of ButuanRukmini Dasi Rosemary GuevaraNo ratings yet

- Essential Points On Persons Criminally LiableDocument12 pagesEssential Points On Persons Criminally LiableRukmini Dasi Rosemary GuevaraNo ratings yet

- Summer Reading List 7th Grade CivicsDocument2 pagesSummer Reading List 7th Grade Civicsapi-325990854No ratings yet

- 9-11 Truth Why Did They Do ItDocument52 pages9-11 Truth Why Did They Do ItLisa Montgomery100% (1)

- Copyreading Symbols. Write A Slug Line and Printer's DirectionDocument2 pagesCopyreading Symbols. Write A Slug Line and Printer's DirectionPauline Karen Macaisa-ConcepcionNo ratings yet

- Medford City Council Agenda October 23, 2012Document4 pagesMedford City Council Agenda October 23, 2012Medford Public Schools and City of Medford, MANo ratings yet

- TAX II - Finals Reviewer - 3B ALSDocument168 pagesTAX II - Finals Reviewer - 3B ALSAgnes Bianca MendozaNo ratings yet

- SAP Pocessing ClassesDocument30 pagesSAP Pocessing ClassesAlessandro Lincoln100% (2)

- Frenzel v. Catito, G.R. No. 143958, July 11, 2003, 406 SCRA 55Document14 pagesFrenzel v. Catito, G.R. No. 143958, July 11, 2003, 406 SCRA 55TENsai1986No ratings yet

- 17 (5) Health InsuranceDocument3 pages17 (5) Health Insuranceashim1No ratings yet

- Privacy in Cyberspace - PresentationDocument23 pagesPrivacy in Cyberspace - PresentationDinesh RamNo ratings yet

- Code of Etiquette For The Use of The National Flag of Trinidad and TobagoDocument3 pagesCode of Etiquette For The Use of The National Flag of Trinidad and TobagosilkcottonjumbieNo ratings yet

- Letter From Mr. Paul DesfossesDocument2 pagesLetter From Mr. Paul DesfossesPhilHart0% (1)

- Answers 1601Document6 pagesAnswers 1601Raeesa ShaikNo ratings yet

- Self-Determination Baguio DeclarationDocument4 pagesSelf-Determination Baguio DeclarationMay Frances CalsiyaoNo ratings yet

- Law & History in Colonial IndiaDocument22 pagesLaw & History in Colonial IndiaPunishk HandaNo ratings yet

- 2CL BRAGANCIA (Sec C) - CASE DIGEST (Gudani V Senga)Document4 pages2CL BRAGANCIA (Sec C) - CASE DIGEST (Gudani V Senga)Ian Joseph BraganciaNo ratings yet

- General Credit Corp V AlsonsDocument4 pagesGeneral Credit Corp V AlsonsDominic EstremosNo ratings yet

- STEP HK Update of The Trust Laws of Hong KongDocument3 pagesSTEP HK Update of The Trust Laws of Hong KongMaggie Sze Tin LeeNo ratings yet

- %program Files%/Microsoft SQL Server Compact Edition/v4.0Document3 pages%program Files%/Microsoft SQL Server Compact Edition/v4.0Meghan WoodsNo ratings yet

- Evidence Cases AssignedDocument6 pagesEvidence Cases AssignedDominic EmbodoNo ratings yet

- Woodrick V WoodDocument1 pageWoodrick V WoodMissPardisNo ratings yet

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument6 pagesUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Case 2:04-cv-08425 Trial Day 7 Vol 2Document59 pagesCase 2:04-cv-08425 Trial Day 7 Vol 2Equality Case FilesNo ratings yet

- Distinguish Corporation Aggregate From Corporation SoleDocument6 pagesDistinguish Corporation Aggregate From Corporation SolePatatas SayoteNo ratings yet

- 15 - Chapter 9 PDFDocument17 pages15 - Chapter 9 PDFNiyati BagweNo ratings yet

- Raghava Menon Son of Kasturi ... Vs Kuttappan Nair, Proprietor, ... On 29 March, 1962Document4 pagesRaghava Menon Son of Kasturi ... Vs Kuttappan Nair, Proprietor, ... On 29 March, 1962Ismail AliNo ratings yet

- The Crooks Who Refuse To Implement The Global Currency ResetTwitter4.13.19Document35 pagesThe Crooks Who Refuse To Implement The Global Currency ResetTwitter4.13.19Anonymous rv0urXXjNo ratings yet