Professional Documents

Culture Documents

Financial One Pager

Financial One Pager

Uploaded by

lildude84678Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial One Pager

Financial One Pager

Uploaded by

lildude84678Copyright:

Available Formats

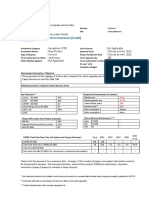

AM Whitefield

Prime Tech Park Investment Opportunity in Bengaluru

Mature Commercial Asset, High Rentals, Stable Tenant, and Industry-best IRR

Starting Investment

Entry Yield 9% Target IRR 16.07% Multiplier 1.8

25 lakhs

ASSET OVERVIEW:

AM Whitefield, a part of a Grade A commercial building spanning 9 floors, presents a prime

investment opportunity on the 5th floor with a total development area of 32,300 sqft. Situated in

a well-established tech hub, this investment gem is home to a marquee tenant of over 5 years,

with a recently renewed lease in 2022 and thoughtfully designed interiors indicating a commitment to

stay. The strategic advantage of the newly started purple metro line connecting Bengaluru's western

suburb to the tech hub enhances the appeal of this location, preparing for a surge in property value.

Plus, with a negotiated price below the market value, AM Whitefield promises potential for significant

appreciations.

Project Information

Location Whitefield Type Commercial

Floor 5th Floor Area 32,300 sfqt

TENANT PROFILE

An American MNC headquartered in Michigan holding a distinguished track record in its

segment. The company has a spotlight clientele of 40+ Fortune 500 firms and strong financials

in FY22. With specialization in convergence of digital engineering, embeded systems, and

software technologies, the tenant has 50+ IP assets to its name, achieved by 1200 global engineers

across 10+ global offices.

SOME NOTABLE CLIENTS OF THE TENANT

DEVELOPER HIGHLIGHTS

Total Projects Notable Track Record FY22 Financial

Residential-43 INR 3066 cr revenue

Rich Legacy

Office Space-22 EBITDA INR 833 cr

Diverse Presence

Retail-4 Among Top 3 Builders Collections

In Bengaluru Collections INR 4083 cr

Hospitality-13 Well Established

CRE Portfolio

ASSET CASHFLOW SNAPSHOT

Projections for Individuals

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Investment 25,00,000 - - - - -

Total Rent 1,75,045 1,78,171 1,87,548 1,98,645 2,08,577

Credit

Car Park Rent 7,742 7,935 8,332 8,535 8,535

Rental Topup 33,000 12,500 - - -

Interest on

9,282 9,282 9,282 9,282 9,282

deposits

Gross Yield 2,25,070 2,07,889 2,05,163 2,16,463 2,26,395

Management

-25,000 -25,000 -25,000 -25,000 -25,000

fee

Debit

Property tax

-7,460 -7,460 -7,460 -7,460 -7,460

& Others

Surplus

- - - - 1,323

Reserves

Returns

Sale

Proceeds - - - - 36,73,320

(incl deposits)

Net Cash Flow* -25,00,000 1,92,610 1,75,429 1,72,703 1,84,003 38,68,579

Note: Additional top up added for the first 2 years as a special offer for initial customers.

Property tax and other expenses were assumed to remain constant in the subsequent years.

In the cash flow projections, a 20% fee over a hurdle rate of 12% IRR will be applicable at the time of exit.

RENTAL YIELD GROWTH

Growth Yield

9.40%

9.20%

9.00%

8.80%

8.60%

9.06%

8.40%

9.00% 8.66%

8.20%

8.32% 8.21%

8.00%

7.80%

7.60%

Year 1 Year 2 Year 3 Year 4 Year 5

Rental top ups considered for year 1 and year 2 for early investors only.

FEES

1% asset management fee, 20% performance fee on the differential after crossing the Target/hurdle rate of 12%.

To Know More About

Start a conversation

with our investment advisors

You might also like

- Sample of Plumbing Contract and Material Supply Agreement PDFDocument2 pagesSample of Plumbing Contract and Material Supply Agreement PDFEmomotimi Waratimi71% (7)

- The Rise and Fall of The Montana FreemenDocument30 pagesThe Rise and Fall of The Montana FreemenB Cross Junior100% (1)

- Internship Report On District Comptroller of Accounts HaripurDocument75 pagesInternship Report On District Comptroller of Accounts HaripurFaisal AwanNo ratings yet

- E210 (13.64%) (E210-Il)Document1 pageE210 (13.64%) (E210-Il)FurqanNo ratings yet

- Nazarenus College and Hospital Foundation Inc. College of Radiologic TechnologyDocument4 pagesNazarenus College and Hospital Foundation Inc. College of Radiologic TechnologyLalaine De JesusNo ratings yet

- San Clemente Palace 2Document19 pagesSan Clemente Palace 2liubomyr1romanivNo ratings yet

- Thanking You.: Sub: Subex Limited "The Company"-Investor Presentation On February 10, 2020Document33 pagesThanking You.: Sub: Subex Limited "The Company"-Investor Presentation On February 10, 2020Awadhesh Kumar KureelNo ratings yet

- Media Release RIL Q1 FY2023 24Document40 pagesMedia Release RIL Q1 FY2023 24Amit KumarNo ratings yet

- Carpentry Pro Plan v1664134062229Document30 pagesCarpentry Pro Plan v1664134062229jweremaNo ratings yet

- KPITTECH 03082020160338 KPITInvestorUpdateSEuploadDocument28 pagesKPITTECH 03082020160338 KPITInvestorUpdateSEuploadSreenivasulu Reddy SanamNo ratings yet

- Sime Darby 2021Document32 pagesSime Darby 2021Che Muhd. HanifNo ratings yet

- TTR Ideals Brazil Handbook 2022Document257 pagesTTR Ideals Brazil Handbook 2022Alexandre GoncalvesNo ratings yet

- Performing While Transforming: First Quarter 2021Document39 pagesPerforming While Transforming: First Quarter 2021bpsolarNo ratings yet

- RIL SegmentsDocument47 pagesRIL Segmentsdeepsinghrawat06No ratings yet

- Intellect/SEC!1.019-20 November 04, 2019Document37 pagesIntellect/SEC!1.019-20 November 04, 2019Lina GómezNo ratings yet

- q2 2023 Fact SheetslDocument2 pagesq2 2023 Fact SheetslAsus 2023No ratings yet

- 2023 Q3 LANXESS Results Presentation - FinalDocument29 pages2023 Q3 LANXESS Results Presentation - FinalnloucaNo ratings yet

- Ajmera Realty and Infra LTD Analyst MeetingDocument7 pagesAjmera Realty and Infra LTD Analyst Meetingarunohri2017No ratings yet

- AOP Sales - 23.12.2017Document12 pagesAOP Sales - 23.12.2017Rubayat MatinNo ratings yet

- Institute of Rural Management Anand: 1. Non-Current AssetsDocument5 pagesInstitute of Rural Management Anand: 1. Non-Current AssetsDharampreet SinghNo ratings yet

- PRESTIGE Annualreport-Fy-2021-2022Document308 pagesPRESTIGE Annualreport-Fy-2021-2022Ajit PatelNo ratings yet

- Annual Report 2017 - ABB PDFDocument156 pagesAnnual Report 2017 - ABB PDFPranav Nandkumar KaleNo ratings yet

- Valuation: © The Institute of Chartered Accountants of IndiaDocument72 pagesValuation: © The Institute of Chartered Accountants of IndiaNmNo ratings yet

- Cover PageDocument209 pagesCover PageABHISHREE JAINNo ratings yet

- Media Release RIL Q3 FY23 20012023Document38 pagesMedia Release RIL Q3 FY23 20012023Riya ThakurNo ratings yet

- RTX Q2 2023 Press Release FinalDocument17 pagesRTX Q2 2023 Press Release FinalZerohedgeNo ratings yet

- ProblemDocument6 pagesProblemTina AntonyNo ratings yet

- Q2 FY24 Investor Presentation FINALDocument45 pagesQ2 FY24 Investor Presentation FINALDMT IPONo ratings yet

- Estimating Cash Flows Worksheet-StudentsDocument20 pagesEstimating Cash Flows Worksheet-StudentsTanya JunejaNo ratings yet

- Investor Presentation Q2FY20 PDFDocument78 pagesInvestor Presentation Q2FY20 PDFbharath reddyNo ratings yet

- 219680Document22 pages219680wajahatwajahat07No ratings yet

- 'KQHK NhikoyhDocument12 pages'KQHK NhikoyhGiri BabaNo ratings yet

- Kim's Value Profit and Loss Account Notes Operating Capacity 1 2 3Document10 pagesKim's Value Profit and Loss Account Notes Operating Capacity 1 2 3sulthanhakimNo ratings yet

- Financial and Operating ResultsDocument9 pagesFinancial and Operating ResultsLizNo ratings yet

- Media Release RIL Q3 FY2023 24 Financial and Operational PerformanceDocument39 pagesMedia Release RIL Q3 FY2023 24 Financial and Operational PerformanceAmit KumarNo ratings yet

- Accf3114 8Document7 pagesAccf3114 8Krishna 11No ratings yet

- Investors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02Document19 pagesInvestors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02miteshpathNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- TSLA Q2 2023 UpdateDocument27 pagesTSLA Q2 2023 UpdateSimon Alvarez100% (1)

- Tugas Valuasi Asii An Juni AstriandariDocument8 pagesTugas Valuasi Asii An Juni AstriandarigunawanwiyogosNo ratings yet

- Off Balance Sheet Financing For UAE Properties: February 2011Document14 pagesOff Balance Sheet Financing For UAE Properties: February 2011Rashdan IbrahimNo ratings yet

- GAR39 14 11 2022 Performance Update 3Q2022Document5 pagesGAR39 14 11 2022 Performance Update 3Q2022Devina Ratna DewiNo ratings yet

- Diwali Dhamaka 2020Document25 pagesDiwali Dhamaka 2020Prachi PatwariNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Ssi Securities Corporation 4Q2020 Earnings ReleaseDocument11 pagesSsi Securities Corporation 4Q2020 Earnings ReleaseHoàng HiệpNo ratings yet

- Introduction To Business Finance Feasibility Plan of Skydiving in KarachiDocument18 pagesIntroduction To Business Finance Feasibility Plan of Skydiving in KarachiAsad HaiderNo ratings yet

- Results Presentaion SEP19Document13 pagesResults Presentaion SEP19ahmed.haseebNo ratings yet

- Advanced Financial Management (Singapore) : Thursday 4 June 2009Document13 pagesAdvanced Financial Management (Singapore) : Thursday 4 June 2009Lim CZNo ratings yet

- Investment Decision QuestionsDocument44 pagesInvestment Decision QuestionsAkash JhaNo ratings yet

- Utkarsh DraftDocument15 pagesUtkarsh DraftshubhenduNo ratings yet

- Technipfmc q1 2023 Earnings SlidesDocument18 pagesTechnipfmc q1 2023 Earnings SlidesThiago Ribeiro da SilvaNo ratings yet

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- Question June - 2010Document8 pagesQuestion June - 2010pawan kumar MaheshwariNo ratings yet

- Valuations Remvest - ScenarioDocument6 pagesValuations Remvest - ScenarioMoses Nhlanhla MasekoNo ratings yet

- Economic Aspects On Condensate To Gasoline Invesment ProjectDocument23 pagesEconomic Aspects On Condensate To Gasoline Invesment Projectsbjtcms98No ratings yet

- Toyota Pakistan Ibf WordDocument20 pagesToyota Pakistan Ibf Wordifrahri123No ratings yet

- Ar Engro2009Document554 pagesAr Engro2009Faryal ArifNo ratings yet

- BFD Merged Q Tahapopatia +923453086312Document96 pagesBFD Merged Q Tahapopatia +923453086312Abdul BasitNo ratings yet

- Singapore POST Capex - Docx Final 2022Document3 pagesSingapore POST Capex - Docx Final 2022Jonathan SulaimanNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Special Economic Zones for Shared Prosperity: Brunei Darussalam–Indonesia–Malaysia–Philippines East ASEAN Growth AreaFrom EverandSpecial Economic Zones for Shared Prosperity: Brunei Darussalam–Indonesia–Malaysia–Philippines East ASEAN Growth AreaNo ratings yet

- Senior Contract Engineer: Job Description Job TitleDocument2 pagesSenior Contract Engineer: Job Description Job Titlemaxwell marshallNo ratings yet

- Mock 11618 1625343729246Document12 pagesMock 11618 1625343729246Amar JindamNo ratings yet

- Notice of Motion 2Document3 pagesNotice of Motion 2Varsha MangtaniNo ratings yet

- PM CARES FUND Range-2 VijayawadaDocument2 pagesPM CARES FUND Range-2 VijayawadaK PUNNA REDDYNo ratings yet

- OesDocument44 pagesOesLincoln TeamNo ratings yet

- C04A Tender Clarification - Expansion Reinforcing BandDocument2 pagesC04A Tender Clarification - Expansion Reinforcing BandGabriel LimNo ratings yet

- Interprime 160Document0 pagesInterprime 160Mehman NasibovNo ratings yet

- Waqas Flour MillDocument81 pagesWaqas Flour MillBilal Khan67% (6)

- Ce303 HW1 PDFDocument2 pagesCe303 HW1 PDFالبرت آينشتاينNo ratings yet

- TPD1008SA F High-Side Power SwitchDocument11 pagesTPD1008SA F High-Side Power SwitchOlga PlohotnichenkoNo ratings yet

- Sample Complaint To Renew Judgment Under CCP Section 337.5 (B)Document3 pagesSample Complaint To Renew Judgment Under CCP Section 337.5 (B)Stan BurmanNo ratings yet

- CC Debugger Quick Start Guide ( - Texas Instruments, IncorporatedDocument3 pagesCC Debugger Quick Start Guide ( - Texas Instruments, IncorporatedRaul RiveroNo ratings yet

- Terms AirdropDocument19 pagesTerms Airdropaj4642825No ratings yet

- Murat Halstead - The Story of Cuba (1896)Document596 pagesMurat Halstead - The Story of Cuba (1896)chyoungNo ratings yet

- Clients and The Building Construction Team Types of Clients and Market SourcesDocument12 pagesClients and The Building Construction Team Types of Clients and Market SourcesRediet BogaleNo ratings yet

- Accounting & Finance For Bankers-Jaiib-Module D: SBLC RanchiDocument41 pagesAccounting & Finance For Bankers-Jaiib-Module D: SBLC RanchiAmit MakwanaNo ratings yet

- Bachelor of Management With Honours (Bim)Document18 pagesBachelor of Management With Honours (Bim)Aizat AhmadNo ratings yet

- Logical FallaciesDocument15 pagesLogical Fallaciesamin jamalNo ratings yet

- Fintech EcosystemDocument31 pagesFintech EcosystemMEENUNo ratings yet

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- Trial Memorandum 2023 DraftDocument22 pagesTrial Memorandum 2023 DraftGleim Brean EranNo ratings yet

- Bismillahir Rahmanir Rahim.: Mr. SpeakerDocument17 pagesBismillahir Rahmanir Rahim.: Mr. SpeakerShahidul Islam ChowdhuryNo ratings yet

- Re-Alllignment Resolution-Sk TeppengDocument2 pagesRe-Alllignment Resolution-Sk TeppengLikey PromiseNo ratings yet

- Aerospace Material Specification-AMS 2759 - Heat Treating - ChemistryDocument1 pageAerospace Material Specification-AMS 2759 - Heat Treating - ChemistryGym BuddyNo ratings yet

- MODULE - Tittle 6 of RPC Book IIDocument2 pagesMODULE - Tittle 6 of RPC Book IIChan Gileo Billy ENo ratings yet