Professional Documents

Culture Documents

Exemption of Duly Registered Cooperatives

Exemption of Duly Registered Cooperatives

Uploaded by

Rheneir MoraCopyright:

Available Formats

You might also like

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Session 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsDocument55 pagesSession 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsRheneir Mora100% (1)

- Module 05 - Fundamental Principles of Local TaxationDocument25 pagesModule 05 - Fundamental Principles of Local TaxationKyla Shmily GonzagaNo ratings yet

- Co Performer AgreementDocument2 pagesCo Performer AgreementDori s SylvanNo ratings yet

- Legal Opinion: For The WeekDocument11 pagesLegal Opinion: For The WeekQhyle MiguelNo ratings yet

- Petition For Recognition of The Exemption of The GSIS From Payment of Legal Fees, 612 SCRA 193 (2010) PDFDocument12 pagesPetition For Recognition of The Exemption of The GSIS From Payment of Legal Fees, 612 SCRA 193 (2010) PDFDenise CruzNo ratings yet

- With Both Members and Non-MembersDocument2 pagesWith Both Members and Non-MembersJing SagittariusNo ratings yet

- RFBT - CooperativesDocument16 pagesRFBT - CooperativesBruegas, Elaiza Rein A.No ratings yet

- Revenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Document13 pagesRevenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Cuayo JuicoNo ratings yet

- G.R. No. 172087Document12 pagesG.R. No. 172087monica may ramosNo ratings yet

- I. RR 4-11 Violates The Following Provisions of The NIRCDocument5 pagesI. RR 4-11 Violates The Following Provisions of The NIRCGabriel EmersonNo ratings yet

- That Stock Dividends Are Property and Not Income, and Hence That The Tax Here in Question Is A Property and Not An Income Tax (Rubio vs. CIR)Document16 pagesThat Stock Dividends Are Property and Not Income, and Hence That The Tax Here in Question Is A Property and Not An Income Tax (Rubio vs. CIR)Geralyn GabrielNo ratings yet

- 10 City Government of San Pablo V ReyesDocument2 pages10 City Government of San Pablo V ReyesJamaica Cabildo ManaligodNo ratings yet

- Manila Electric Co. vs. Province of Laguna 131359 May 5, 1999Document2 pagesManila Electric Co. vs. Province of Laguna 131359 May 5, 1999Law StudentNo ratings yet

- Local TaxationDocument57 pagesLocal TaxationJesterNo ratings yet

- Pepsi-Cola Bottling Co. v. City of Butuan Concepcion G.R. No. L-22814, August 28, 1968Document4 pagesPepsi-Cola Bottling Co. v. City of Butuan Concepcion G.R. No. L-22814, August 28, 1968Jean Jamailah TomugdanNo ratings yet

- RP-Japan Tax Treaty - AmendmentDocument3 pagesRP-Japan Tax Treaty - AmendmentVernadeth de CastroNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument14 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL Exclusivesbce14No ratings yet

- Republic Act No. 10022 Section 7. Section 10 of Republic Act No. 8042, As Amended, Is Hereby Amended ToDocument4 pagesRepublic Act No. 10022 Section 7. Section 10 of Republic Act No. 8042, As Amended, Is Hereby Amended TonoonalawNo ratings yet

- Kalakalan 20Document2 pagesKalakalan 20Benitez GheroldNo ratings yet

- Public Notice On WHT 3Document9 pagesPublic Notice On WHT 3AdiNo ratings yet

- Pagcor V BirDocument14 pagesPagcor V BirPatricia Anne GonzalesNo ratings yet

- BIR TAX CODE Other Percentage TaxesDocument7 pagesBIR TAX CODE Other Percentage TaxesGenie Mae LopezNo ratings yet

- Fundamental Principles of Local TaxationDocument25 pagesFundamental Principles of Local TaxationKrizzy PatenioNo ratings yet

- B. PAGCOR v. BIR (Non-Impairment Clause) PDFDocument14 pagesB. PAGCOR v. BIR (Non-Impairment Clause) PDFKaloi GarciaNo ratings yet

- 2016 Tax Bar ExaminationsDocument19 pages2016 Tax Bar Examinations涛 明 灵No ratings yet

- Train 2 - Trabaho BillDocument54 pagesTrain 2 - Trabaho Billjohn allen MarillaNo ratings yet

- PAGCOR Vs BIRDocument14 pagesPAGCOR Vs BIRGladys BantilanNo ratings yet

- Other Percentage TaxDocument5 pagesOther Percentage TaxMGVMonNo ratings yet

- The Republic of The Philippines, Its Agencies andDocument1 pageThe Republic of The Philippines, Its Agencies andDfc DarNo ratings yet

- B. Section 14 of R.A. 9167 Constitutes An Undue Limitation of The Taxing Power of LgusDocument4 pagesB. Section 14 of R.A. 9167 Constitutes An Undue Limitation of The Taxing Power of LgusNika RojasNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- PLDT v. City of DavaoDocument3 pagesPLDT v. City of Davaonino_herreraiiiNo ratings yet

- Date Kind of Investment Principal Income Earned 15% TaxDocument5 pagesDate Kind of Investment Principal Income Earned 15% TaxDhin CaragNo ratings yet

- 90-17 Cpar - Local Government TaxesDocument37 pages90-17 Cpar - Local Government TaxesJellah NavarroNo ratings yet

- LGT DoctrinesDocument7 pagesLGT DoctrinesBernadetteNo ratings yet

- Taxation Case Digest Local TaxationDocument8 pagesTaxation Case Digest Local TaxationYsabelleNo ratings yet

- Taxation Reviewer - Local TaxationDocument34 pagesTaxation Reviewer - Local TaxationFelixberto Jr. BaisNo ratings yet

- Nature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawDocument6 pagesNature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawFranco David BaratetaNo ratings yet

- Notes On Local Taxation Latest Compilation Base On 2023 Bar SyllabusDocument37 pagesNotes On Local Taxation Latest Compilation Base On 2023 Bar SyllabusCastillo Mike Martin DomiderNo ratings yet

- RA 6810 Magna Carta For Countryside and Barangay Business Enterprises Kalakalan 20Document4 pagesRA 6810 Magna Carta For Countryside and Barangay Business Enterprises Kalakalan 20Tribung ManggugubatNo ratings yet

- 2019 Ust Pre Week Taxation LawDocument36 pages2019 Ust Pre Week Taxation Lawdublin80% (20)

- Quezon City v. ABS-CBN Broadcasting Corp., G.R. No. 166408, (October 6, 2008), 588 PHIL 785-809)Document6 pagesQuezon City v. ABS-CBN Broadcasting Corp., G.R. No. 166408, (October 6, 2008), 588 PHIL 785-809)Cristine BilocuraNo ratings yet

- Train 2 - Trabaho Bill Update - AllenDocument42 pagesTrain 2 - Trabaho Bill Update - Allenjohn allen MarillaNo ratings yet

- Manila Electric Company vs. Province of Laguna G.R. No. 131359 May 5, 1999 FactsDocument13 pagesManila Electric Company vs. Province of Laguna G.R. No. 131359 May 5, 1999 FactsLei MorteraNo ratings yet

- National Power Corporation Vs City of Cabanatuan, GRDocument4 pagesNational Power Corporation Vs City of Cabanatuan, GRDon Michael ManiegoNo ratings yet

- 38213-2003-BIR Ruling DA-196-03Document5 pages38213-2003-BIR Ruling DA-196-03Riz Marcos0% (1)

- NPC V Cabanatuan DigestsDocument2 pagesNPC V Cabanatuan Digestspinkblush717100% (1)

- NPC V Cabanatuan DigestsDocument2 pagesNPC V Cabanatuan Digestspinkblush717No ratings yet

- Bir Ruling No. 313-15Document4 pagesBir Ruling No. 313-15Stacy Lyn LiongNo ratings yet

- G.R. No. 149110 April 9, 2003 National Power Corporation, Petitioner, CITY OF CABANATUAN, Respondent. PUNO, J.Document12 pagesG.R. No. 149110 April 9, 2003 National Power Corporation, Petitioner, CITY OF CABANATUAN, Respondent. PUNO, J.Samuel John CahimatNo ratings yet

- MERALCO Vs Prov of LagunaDocument3 pagesMERALCO Vs Prov of LagunaAnton SingeNo ratings yet

- RP-Japan Protocol - 2008Document5 pagesRP-Japan Protocol - 2008Hazel PangandianNo ratings yet

- Meralco v. Prov of LagunaDocument2 pagesMeralco v. Prov of LagunaJoms TenezaNo ratings yet

- Bir Ruling 2021 - DST On Loan Exemption by PezaDocument5 pagesBir Ruling 2021 - DST On Loan Exemption by Pezajohn allen MarillaNo ratings yet

- Possibilities in Taxation For 2016 Mock Bar and Beyond - Atty. Roberto Bobby LockDocument74 pagesPossibilities in Taxation For 2016 Mock Bar and Beyond - Atty. Roberto Bobby LockHilikus IncubusNo ratings yet

- LRT V BIRDocument9 pagesLRT V BIRJN CENo ratings yet

- 04 City of San Pablo vs. ReyesDocument3 pages04 City of San Pablo vs. Reyeslenard5No ratings yet

- Gsis Vs City Treasurer of ManilaDocument5 pagesGsis Vs City Treasurer of ManilaYani RamosNo ratings yet

- LGT - CollectionDocument3 pagesLGT - CollectionKezNo ratings yet

- NAPOCOR Vs Cabanatuan City DigestDocument3 pagesNAPOCOR Vs Cabanatuan City DigestcrapshoxNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- Peach Confirmation QQ5775Document3 pagesPeach Confirmation QQ5775Rheneir MoraNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- Fun Golf SolicitationDocument2 pagesFun Golf SolicitationRheneir MoraNo ratings yet

- Cebu Pacific Air MoraDocument4 pagesCebu Pacific Air MoraRheneir MoraNo ratings yet

- CVR-16 InviteDocument3 pagesCVR-16 InviteRheneir MoraNo ratings yet

- 1MSADocument1 page1MSARheneir MoraNo ratings yet

- Electronic Ticket Receipt 26MAR For RHENEIR PARAN MORADocument3 pagesElectronic Ticket Receipt 26MAR For RHENEIR PARAN MORARheneir MoraNo ratings yet

- Peach Confirmation EU88X5Document3 pagesPeach Confirmation EU88X5Rheneir MoraNo ratings yet

- Differences PFRSDocument11 pagesDifferences PFRSRheneir MoraNo ratings yet

- CVR16 PresentationDocument8 pagesCVR16 PresentationRheneir MoraNo ratings yet

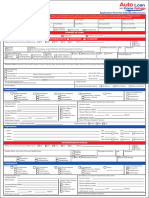

- New Auto-Loan-Application-Form - IndividualDocument2 pagesNew Auto-Loan-Application-Form - IndividualRheneir MoraNo ratings yet

- 1702EX2020Document5 pages1702EX2020Rheneir MoraNo ratings yet

- SourceTech Consultancy LLCDocument11 pagesSourceTech Consultancy LLCRheneir MoraNo ratings yet

- Certificate SphinxDocument1 pageCertificate SphinxRheneir MoraNo ratings yet

- PAREB AMLC Online Registration System GuideDocument72 pagesPAREB AMLC Online Registration System GuideRheneir MoraNo ratings yet

- 49 Insights July 2022Document41 pages49 Insights July 2022Rheneir MoraNo ratings yet

- MS Call CardsDocument3 pagesMS Call CardsRheneir MoraNo ratings yet

- 2019notice New Forms and Pre EvaluationDocument29 pages2019notice New Forms and Pre EvaluationRheneir MoraNo ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- Talisay Central Eagles ClubDocument5 pagesTalisay Central Eagles ClubRheneir Mora0% (1)

- 77th ANC CebuDocument7 pages77th ANC CebuRheneir MoraNo ratings yet

- Amcham Phil. Membership SurveyDocument2 pagesAmcham Phil. Membership SurveyRheneir Mora100% (1)

- Session 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureDocument18 pagesSession 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureRheneir MoraNo ratings yet

- Session 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationDocument23 pagesSession 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationRheneir MoraNo ratings yet

- Session 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualDocument12 pagesSession 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualRheneir MoraNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- Session 2 - QAR Audit Methodology Manual - IsQMDocument49 pagesSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNo ratings yet

- Session 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditDocument34 pagesSession 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditRheneir MoraNo ratings yet

- Loan (Solar) Application Form - SidbiDocument5 pagesLoan (Solar) Application Form - SidbiPalaniswamy KNo ratings yet

- Dr. Md. Anowar Hossain Bhuiyan: The Law of ContractDocument25 pagesDr. Md. Anowar Hossain Bhuiyan: The Law of Contractsanzida akterNo ratings yet

- Standard MoA For OJT Template FinalOct 4 2022 2Document9 pagesStandard MoA For OJT Template FinalOct 4 2022 2jemelle chavezNo ratings yet

- 03 M#conflict of Laws VDocument32 pages03 M#conflict of Laws VFelipe FernandezNo ratings yet

- What Are The Directive Principles of State Policy?Document8 pagesWhat Are The Directive Principles of State Policy?Swami NathanNo ratings yet

- Contract of IndemnityDocument3 pagesContract of IndemnityAdan HoodaNo ratings yet

- Law 3100 Tutorial 3 AnswerDocument3 pagesLaw 3100 Tutorial 3 AnsweryeeeeeqiNo ratings yet

- Marvelous Presentation: in Collaboration WithDocument53 pagesMarvelous Presentation: in Collaboration WithAudey PabalateNo ratings yet

- Weekly Kalinisan Day OrdinanceDocument1 pageWeekly Kalinisan Day OrdinanceGervin Meine VidadNo ratings yet

- Ass#2-THC8-Mestiola, Krishalyn AudreyDocument2 pagesAss#2-THC8-Mestiola, Krishalyn AudreyKrishalyn Audrey MestiolaNo ratings yet

- Statcon CasesDocument22 pagesStatcon CasesJoahnna Paula CorpuzNo ratings yet

- U.S. Motion and Amicus BriefDocument16 pagesU.S. Motion and Amicus BriefWIS Digital News StaffNo ratings yet

- Right and Liabilities of Landlord and TenantDocument29 pagesRight and Liabilities of Landlord and TenantNorfadzilah Abd WahabNo ratings yet

- Globalization and Multi-Level Governance of EnviroDocument510 pagesGlobalization and Multi-Level Governance of EnviroVicko TNo ratings yet

- Introduction To Trademarks ActDocument4 pagesIntroduction To Trademarks Actnokav64141No ratings yet

- 3 - Land RegistrationDocument17 pages3 - Land RegistrationnicholasNo ratings yet

- Fia Rally Star - Asn Selections Consent Form: GlossaryDocument5 pagesFia Rally Star - Asn Selections Consent Form: Glossaryszakiso 2016No ratings yet

- NOTES - Pre-Need Code of The Philippines (Pre-Need) PDFDocument3 pagesNOTES - Pre-Need Code of The Philippines (Pre-Need) PDFJUAN MIGUEL GUZMAN100% (1)

- Module 1, General ProvisionsDocument3 pagesModule 1, General ProvisionsClariza SalesNo ratings yet

- Dissertation Topics 2020 21Document10 pagesDissertation Topics 2020 21all brandsNo ratings yet

- GOA Victory Suddaby Preliminary Injunction Nov 7 2022 1Document184 pagesGOA Victory Suddaby Preliminary Injunction Nov 7 2022 1AmmoLand Shooting Sports NewsNo ratings yet

- Respondent 17th Surana & Surana National Corporate Law Moot Court-2019Document26 pagesRespondent 17th Surana & Surana National Corporate Law Moot Court-2019AyushNo ratings yet

- Chap 5Document17 pagesChap 5sagar chettryNo ratings yet

- Venecijanska Kosovo Konfiskacija ImovineDocument19 pagesVenecijanska Kosovo Konfiskacija ImovineSrdjan BrajovicNo ratings yet

- Anak Mindanao Party-List Group v. Executive Secretary, G.R. No. 166052, 29 August 2007Document10 pagesAnak Mindanao Party-List Group v. Executive Secretary, G.R. No. 166052, 29 August 2007Arvhie SantosNo ratings yet

- Hubbard - Sophisticated Robots Draft 1Document58 pagesHubbard - Sophisticated Robots Draft 1Mac Norhen E. BornalesNo ratings yet

- Assignment ON Conditions and Warranties: Special ContractDocument14 pagesAssignment ON Conditions and Warranties: Special ContractsandeepNo ratings yet

- Definitions: Prevention, Prohibition and Redressal of Complaints On Sexual Harassment at Workplace (Posh)Document7 pagesDefinitions: Prevention, Prohibition and Redressal of Complaints On Sexual Harassment at Workplace (Posh)Akash KumarNo ratings yet

- Foreign Exchange Regulation ActDocument13 pagesForeign Exchange Regulation ActpavanbatteNo ratings yet

Exemption of Duly Registered Cooperatives

Exemption of Duly Registered Cooperatives

Uploaded by

Rheneir MoraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exemption of Duly Registered Cooperatives

Exemption of Duly Registered Cooperatives

Uploaded by

Rheneir MoraCopyright:

Available Formats

February 1, 2017

DILG MEMORANDUM CIRCULAR NO. 016-17

EXEMPTION OF DULY REGISTERED COOPERATIVES FROM PAYMENT OF

APPLICABLE TAXES, FEES AND CHARGES

1.0 Background

Under Article 2 of the "Philippine Cooperative Code of 2008," it is the

policy of the State to foster the creation and growth of cooperative as a

practical vehicle for promoting self-reliance and harnessing people power

towards the attainment of economic development and social justice.

2.0 Purpose

The purpose of this policy is to emphasize the exemption of duly

registered cooperatives from payment of applicable taxes, fees and charges.

3.0 Legal Compliance

This Circular is based on the following laws: HTcADC

3.1. Republic Act No. 9520, Philippine Cooperative Code of 2008;

3.2. Republic Act No. 7160, Local Government Code of 1991;

3.3. Memorandum Circular No. 2010-120 dated October 20, 2010.

4.0 Scope/Coverage

All Provincial Governors, City and Municipal Mayors, Punong Barangays,

DILG Regional Directors, ARMM Regional Governor, and all others concerned

5.0 Policy Content and Guidelines

5.1 Under the Philippine Cooperative Code of 2008

The Bureau of Local Government Finance Memorandum Circular No.

31-2009 as reiterated in DILG MC No. 2010-120, clearly laid down the

exemptions from local taxes and fees of cooperatives based on the following

Articles of the Philippine Cooperative Code of 2008, to wit:

Art. 60. Tax Treatment of Cooperative . — Duly registered

cooperatives under this Code which do not transact any business with

non-members or the article shall be governed by the succeeding

section.

ART. 61. Tax and Other Exemptions . Cooperatives

transacting business with both members and non-members shall not

be subjected to tax on their transactions with members. In relation to

this, the transactions of members with the cooperative shall not be

subject to any taxes and fees, including not limited to final taxes on

members' deposits and documentary tax. Notwithstanding the

provisions of any law or regulation to the contrary, such cooperatives

dealing with nonmembers shall enjoy the following tax exemptions:

CAIHTE

"(1) Cooperatives with accumulated reserves

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

and undivided net savings of not more than Ten million

pesos (P10,000,000.00) shall be exempt from all national,

city, provincial, municipal or barangay taxes of whatever

name and nature. Such cooperatives shall be exempt

from customs duties, advance sales or compensating

taxes on their importation of machineries, equipment and

spare parts used by them and which are not available

locally a certified by the Department of Trade and

Industry (DTI). All tax free importations shall not be sold

nor the beneficial ownership thereof be transferred to any

person until after five (5) years, otherwise, the

cooperative and the transferee or assignee shall be

solidarily liable to pay twice the amount of the imposed

tax and/or duties.

xxx xxx xxx

"(3) All cooperatives, regardless of the amount

of accumulated reserves and undivided net savings shall

be exempt from payment of local taxes and taxes on

transactions with banks and insurance companies:

Provided, That all sales or services rendered for non-

members shall be subject to the applicable percentage

taxes sales made by producers, marketing or service

cooperatives: Provided further, That nothing in this article

shall preclude the examination of the books of accounts

or other accounting records of the cooperative by duly

authorized internal revenue officers for internal revenue

tax purposes only, after previous authorization by the

Authority.DETACa

The direct/indirect circumvention of Article 60 and

61 of RA 9520 by public officials/employees is punishable

by fine or imprisonment, or both as provided under

Section 140 thereof:

Article 140. Penal Provisions. — The following

acts or omissions affecting cooperatives are hereby

prohibited:

xxx xxx xxx

The Authority may motu proprio, initiate complaints

for violations of this provisions.

xxx xxx xxx

"(3) Direct or indirect violation or circumvention

of the provisions of Articles 60 and 61 of this Code

committee by any public official or employee of any

bureau, office or agency of the government that deprives,

diminishes or in any manner hinders or restricts any duly

registered cooperative from the full enjoyment of the

exemption from the payment of the taxes, fees and

charges enumerated therein, shall upon conviction, suffer

a penalty of not less than one (1) year but not more than

five (5) years imprisonment or a fine in the amount of not

less than Five thousand pesos (P5,000.00) or both at the

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

discretion of the court and shall further be disqualified to

hold any other office;

xxx xxx xxx

"In case of violation of any provision of this Code,

the individual or individuals, and in the case of

organizations or government agencies, its officers, and

directors shall, upon conviction by a Court, each suffer a

penalty of not less than two (2) years but not more than

five (5) years imprisonment or a fine in the amount of not

less than Twenty thousand pesos (P20,000.00), or both at

the discretion of the court. In the case of a public official

or employee, the offender shall upon conviction, suffer

the accessory penalty of temporary absolute

disqualification.

5.2 Under the Local Government Code of 1991

The intent to exempt CDA-registered cooperatives from local taxes,

fees, and charges is reiterated under Section 133 (n) of the Code, which

enumerates the common limitations on the taxing powers of local

government units, to wit:

Section 133. Common Limitations on the Taxing Powers of

Local Government Units. — Unless otherwise provided herein, the

exercise of the taxing powers of provinces, cities, municipalities, and

barangays shall not extend to the levy of the following:

xxx xxx xxx

(n) Taxes, fees, or charges, on Countryside and Barangay

Business Enterprises and cooperatives duly registered under R.A. No.

6810 and Republic Act Numbered Sixty-nine hundred thirty-eight

(R.A. No. 6938) otherwise known as the "Cooperative Code of the

Philippines" respectively

5.3 Under DILG MC No. 2010-120 aDSIHc

The DILG MC No. 2010-120 emphasized the exemption of duly

registered cooperatives from payment of applicable taxes, fees and charges

subject to compliance with BLGF MC No. 31-2009, which requires

cooperatives transacting with both members and non-members to perform

the following:

1. Obtain or secure a Mayor's permit and pay the commensurate

cost of regulation, inspection and surveillance of the operation of

its business but not exceeding One Thousand Pesos

(PhP1,000.00);

2. Secure a Community Tax Certificate, as juridical entity and pay

the basic tax of Five Hundred Pesos (PhP500.00); and

3. Pay service charges or rentals for the use of property and

equipment or public utilities owned by the local government such

as charges for actual water consumption, electric power, toll fees

for the use of public roads and bridges, and the like.

6.0 Penal Provisions

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

Non-compliance with the above-cited provisions of laws, rules and

regulations shall be dealt with in accordance with pertinent laws, rules and

regulations.

7.0 References

7.1. Republic Act No. 9520, Philippine Cooperative Code of 2008;

7.2. Republic Act No. 7160, Local Government Code of 1991;

7.3. Memorandum Circular No. 2010-120 dated October 20, 2010;

7.4. DILG Legal Opinion No. 36 S. 2015.

8.0 Repealing Clause

All DILG Memorandum Circulars inconsistent herewith, in part or in full,

are hereby modified, revoked, or repealed accordingly.

9.0 Effectivity

This Memorandum Circular shall take effect immediately.

10.0 Approving Authority

(SGD.) ISMAEL D. SUENO

Secretary

11.0 Feedback

For related queries, kindly contact the Policy Compliance Monitoring

Division of the Bureau of Local Government Supervision at Tel. Nos. (02) 928

9181 or (02) 925 0351 or at email address at pfrt.blgs@gmail.com. ETHIDa

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Session 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsDocument55 pagesSession 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsRheneir Mora100% (1)

- Module 05 - Fundamental Principles of Local TaxationDocument25 pagesModule 05 - Fundamental Principles of Local TaxationKyla Shmily GonzagaNo ratings yet

- Co Performer AgreementDocument2 pagesCo Performer AgreementDori s SylvanNo ratings yet

- Legal Opinion: For The WeekDocument11 pagesLegal Opinion: For The WeekQhyle MiguelNo ratings yet

- Petition For Recognition of The Exemption of The GSIS From Payment of Legal Fees, 612 SCRA 193 (2010) PDFDocument12 pagesPetition For Recognition of The Exemption of The GSIS From Payment of Legal Fees, 612 SCRA 193 (2010) PDFDenise CruzNo ratings yet

- With Both Members and Non-MembersDocument2 pagesWith Both Members and Non-MembersJing SagittariusNo ratings yet

- RFBT - CooperativesDocument16 pagesRFBT - CooperativesBruegas, Elaiza Rein A.No ratings yet

- Revenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Document13 pagesRevenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Cuayo JuicoNo ratings yet

- G.R. No. 172087Document12 pagesG.R. No. 172087monica may ramosNo ratings yet

- I. RR 4-11 Violates The Following Provisions of The NIRCDocument5 pagesI. RR 4-11 Violates The Following Provisions of The NIRCGabriel EmersonNo ratings yet

- That Stock Dividends Are Property and Not Income, and Hence That The Tax Here in Question Is A Property and Not An Income Tax (Rubio vs. CIR)Document16 pagesThat Stock Dividends Are Property and Not Income, and Hence That The Tax Here in Question Is A Property and Not An Income Tax (Rubio vs. CIR)Geralyn GabrielNo ratings yet

- 10 City Government of San Pablo V ReyesDocument2 pages10 City Government of San Pablo V ReyesJamaica Cabildo ManaligodNo ratings yet

- Manila Electric Co. vs. Province of Laguna 131359 May 5, 1999Document2 pagesManila Electric Co. vs. Province of Laguna 131359 May 5, 1999Law StudentNo ratings yet

- Local TaxationDocument57 pagesLocal TaxationJesterNo ratings yet

- Pepsi-Cola Bottling Co. v. City of Butuan Concepcion G.R. No. L-22814, August 28, 1968Document4 pagesPepsi-Cola Bottling Co. v. City of Butuan Concepcion G.R. No. L-22814, August 28, 1968Jean Jamailah TomugdanNo ratings yet

- RP-Japan Tax Treaty - AmendmentDocument3 pagesRP-Japan Tax Treaty - AmendmentVernadeth de CastroNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument14 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL Exclusivesbce14No ratings yet

- Republic Act No. 10022 Section 7. Section 10 of Republic Act No. 8042, As Amended, Is Hereby Amended ToDocument4 pagesRepublic Act No. 10022 Section 7. Section 10 of Republic Act No. 8042, As Amended, Is Hereby Amended TonoonalawNo ratings yet

- Kalakalan 20Document2 pagesKalakalan 20Benitez GheroldNo ratings yet

- Public Notice On WHT 3Document9 pagesPublic Notice On WHT 3AdiNo ratings yet

- Pagcor V BirDocument14 pagesPagcor V BirPatricia Anne GonzalesNo ratings yet

- BIR TAX CODE Other Percentage TaxesDocument7 pagesBIR TAX CODE Other Percentage TaxesGenie Mae LopezNo ratings yet

- Fundamental Principles of Local TaxationDocument25 pagesFundamental Principles of Local TaxationKrizzy PatenioNo ratings yet

- B. PAGCOR v. BIR (Non-Impairment Clause) PDFDocument14 pagesB. PAGCOR v. BIR (Non-Impairment Clause) PDFKaloi GarciaNo ratings yet

- 2016 Tax Bar ExaminationsDocument19 pages2016 Tax Bar Examinations涛 明 灵No ratings yet

- Train 2 - Trabaho BillDocument54 pagesTrain 2 - Trabaho Billjohn allen MarillaNo ratings yet

- PAGCOR Vs BIRDocument14 pagesPAGCOR Vs BIRGladys BantilanNo ratings yet

- Other Percentage TaxDocument5 pagesOther Percentage TaxMGVMonNo ratings yet

- The Republic of The Philippines, Its Agencies andDocument1 pageThe Republic of The Philippines, Its Agencies andDfc DarNo ratings yet

- B. Section 14 of R.A. 9167 Constitutes An Undue Limitation of The Taxing Power of LgusDocument4 pagesB. Section 14 of R.A. 9167 Constitutes An Undue Limitation of The Taxing Power of LgusNika RojasNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- PLDT v. City of DavaoDocument3 pagesPLDT v. City of Davaonino_herreraiiiNo ratings yet

- Date Kind of Investment Principal Income Earned 15% TaxDocument5 pagesDate Kind of Investment Principal Income Earned 15% TaxDhin CaragNo ratings yet

- 90-17 Cpar - Local Government TaxesDocument37 pages90-17 Cpar - Local Government TaxesJellah NavarroNo ratings yet

- LGT DoctrinesDocument7 pagesLGT DoctrinesBernadetteNo ratings yet

- Taxation Case Digest Local TaxationDocument8 pagesTaxation Case Digest Local TaxationYsabelleNo ratings yet

- Taxation Reviewer - Local TaxationDocument34 pagesTaxation Reviewer - Local TaxationFelixberto Jr. BaisNo ratings yet

- Nature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawDocument6 pagesNature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawFranco David BaratetaNo ratings yet

- Notes On Local Taxation Latest Compilation Base On 2023 Bar SyllabusDocument37 pagesNotes On Local Taxation Latest Compilation Base On 2023 Bar SyllabusCastillo Mike Martin DomiderNo ratings yet

- RA 6810 Magna Carta For Countryside and Barangay Business Enterprises Kalakalan 20Document4 pagesRA 6810 Magna Carta For Countryside and Barangay Business Enterprises Kalakalan 20Tribung ManggugubatNo ratings yet

- 2019 Ust Pre Week Taxation LawDocument36 pages2019 Ust Pre Week Taxation Lawdublin80% (20)

- Quezon City v. ABS-CBN Broadcasting Corp., G.R. No. 166408, (October 6, 2008), 588 PHIL 785-809)Document6 pagesQuezon City v. ABS-CBN Broadcasting Corp., G.R. No. 166408, (October 6, 2008), 588 PHIL 785-809)Cristine BilocuraNo ratings yet

- Train 2 - Trabaho Bill Update - AllenDocument42 pagesTrain 2 - Trabaho Bill Update - Allenjohn allen MarillaNo ratings yet

- Manila Electric Company vs. Province of Laguna G.R. No. 131359 May 5, 1999 FactsDocument13 pagesManila Electric Company vs. Province of Laguna G.R. No. 131359 May 5, 1999 FactsLei MorteraNo ratings yet

- National Power Corporation Vs City of Cabanatuan, GRDocument4 pagesNational Power Corporation Vs City of Cabanatuan, GRDon Michael ManiegoNo ratings yet

- 38213-2003-BIR Ruling DA-196-03Document5 pages38213-2003-BIR Ruling DA-196-03Riz Marcos0% (1)

- NPC V Cabanatuan DigestsDocument2 pagesNPC V Cabanatuan Digestspinkblush717100% (1)

- NPC V Cabanatuan DigestsDocument2 pagesNPC V Cabanatuan Digestspinkblush717No ratings yet

- Bir Ruling No. 313-15Document4 pagesBir Ruling No. 313-15Stacy Lyn LiongNo ratings yet

- G.R. No. 149110 April 9, 2003 National Power Corporation, Petitioner, CITY OF CABANATUAN, Respondent. PUNO, J.Document12 pagesG.R. No. 149110 April 9, 2003 National Power Corporation, Petitioner, CITY OF CABANATUAN, Respondent. PUNO, J.Samuel John CahimatNo ratings yet

- MERALCO Vs Prov of LagunaDocument3 pagesMERALCO Vs Prov of LagunaAnton SingeNo ratings yet

- RP-Japan Protocol - 2008Document5 pagesRP-Japan Protocol - 2008Hazel PangandianNo ratings yet

- Meralco v. Prov of LagunaDocument2 pagesMeralco v. Prov of LagunaJoms TenezaNo ratings yet

- Bir Ruling 2021 - DST On Loan Exemption by PezaDocument5 pagesBir Ruling 2021 - DST On Loan Exemption by Pezajohn allen MarillaNo ratings yet

- Possibilities in Taxation For 2016 Mock Bar and Beyond - Atty. Roberto Bobby LockDocument74 pagesPossibilities in Taxation For 2016 Mock Bar and Beyond - Atty. Roberto Bobby LockHilikus IncubusNo ratings yet

- LRT V BIRDocument9 pagesLRT V BIRJN CENo ratings yet

- 04 City of San Pablo vs. ReyesDocument3 pages04 City of San Pablo vs. Reyeslenard5No ratings yet

- Gsis Vs City Treasurer of ManilaDocument5 pagesGsis Vs City Treasurer of ManilaYani RamosNo ratings yet

- LGT - CollectionDocument3 pagesLGT - CollectionKezNo ratings yet

- NAPOCOR Vs Cabanatuan City DigestDocument3 pagesNAPOCOR Vs Cabanatuan City DigestcrapshoxNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- Peach Confirmation QQ5775Document3 pagesPeach Confirmation QQ5775Rheneir MoraNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- Fun Golf SolicitationDocument2 pagesFun Golf SolicitationRheneir MoraNo ratings yet

- Cebu Pacific Air MoraDocument4 pagesCebu Pacific Air MoraRheneir MoraNo ratings yet

- CVR-16 InviteDocument3 pagesCVR-16 InviteRheneir MoraNo ratings yet

- 1MSADocument1 page1MSARheneir MoraNo ratings yet

- Electronic Ticket Receipt 26MAR For RHENEIR PARAN MORADocument3 pagesElectronic Ticket Receipt 26MAR For RHENEIR PARAN MORARheneir MoraNo ratings yet

- Peach Confirmation EU88X5Document3 pagesPeach Confirmation EU88X5Rheneir MoraNo ratings yet

- Differences PFRSDocument11 pagesDifferences PFRSRheneir MoraNo ratings yet

- CVR16 PresentationDocument8 pagesCVR16 PresentationRheneir MoraNo ratings yet

- New Auto-Loan-Application-Form - IndividualDocument2 pagesNew Auto-Loan-Application-Form - IndividualRheneir MoraNo ratings yet

- 1702EX2020Document5 pages1702EX2020Rheneir MoraNo ratings yet

- SourceTech Consultancy LLCDocument11 pagesSourceTech Consultancy LLCRheneir MoraNo ratings yet

- Certificate SphinxDocument1 pageCertificate SphinxRheneir MoraNo ratings yet

- PAREB AMLC Online Registration System GuideDocument72 pagesPAREB AMLC Online Registration System GuideRheneir MoraNo ratings yet

- 49 Insights July 2022Document41 pages49 Insights July 2022Rheneir MoraNo ratings yet

- MS Call CardsDocument3 pagesMS Call CardsRheneir MoraNo ratings yet

- 2019notice New Forms and Pre EvaluationDocument29 pages2019notice New Forms and Pre EvaluationRheneir MoraNo ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- Talisay Central Eagles ClubDocument5 pagesTalisay Central Eagles ClubRheneir Mora0% (1)

- 77th ANC CebuDocument7 pages77th ANC CebuRheneir MoraNo ratings yet

- Amcham Phil. Membership SurveyDocument2 pagesAmcham Phil. Membership SurveyRheneir Mora100% (1)

- Session 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureDocument18 pagesSession 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureRheneir MoraNo ratings yet

- Session 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationDocument23 pagesSession 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationRheneir MoraNo ratings yet

- Session 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualDocument12 pagesSession 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualRheneir MoraNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- Session 2 - QAR Audit Methodology Manual - IsQMDocument49 pagesSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNo ratings yet

- Session 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditDocument34 pagesSession 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditRheneir MoraNo ratings yet

- Loan (Solar) Application Form - SidbiDocument5 pagesLoan (Solar) Application Form - SidbiPalaniswamy KNo ratings yet

- Dr. Md. Anowar Hossain Bhuiyan: The Law of ContractDocument25 pagesDr. Md. Anowar Hossain Bhuiyan: The Law of Contractsanzida akterNo ratings yet

- Standard MoA For OJT Template FinalOct 4 2022 2Document9 pagesStandard MoA For OJT Template FinalOct 4 2022 2jemelle chavezNo ratings yet

- 03 M#conflict of Laws VDocument32 pages03 M#conflict of Laws VFelipe FernandezNo ratings yet

- What Are The Directive Principles of State Policy?Document8 pagesWhat Are The Directive Principles of State Policy?Swami NathanNo ratings yet

- Contract of IndemnityDocument3 pagesContract of IndemnityAdan HoodaNo ratings yet

- Law 3100 Tutorial 3 AnswerDocument3 pagesLaw 3100 Tutorial 3 AnsweryeeeeeqiNo ratings yet

- Marvelous Presentation: in Collaboration WithDocument53 pagesMarvelous Presentation: in Collaboration WithAudey PabalateNo ratings yet

- Weekly Kalinisan Day OrdinanceDocument1 pageWeekly Kalinisan Day OrdinanceGervin Meine VidadNo ratings yet

- Ass#2-THC8-Mestiola, Krishalyn AudreyDocument2 pagesAss#2-THC8-Mestiola, Krishalyn AudreyKrishalyn Audrey MestiolaNo ratings yet

- Statcon CasesDocument22 pagesStatcon CasesJoahnna Paula CorpuzNo ratings yet

- U.S. Motion and Amicus BriefDocument16 pagesU.S. Motion and Amicus BriefWIS Digital News StaffNo ratings yet

- Right and Liabilities of Landlord and TenantDocument29 pagesRight and Liabilities of Landlord and TenantNorfadzilah Abd WahabNo ratings yet

- Globalization and Multi-Level Governance of EnviroDocument510 pagesGlobalization and Multi-Level Governance of EnviroVicko TNo ratings yet

- Introduction To Trademarks ActDocument4 pagesIntroduction To Trademarks Actnokav64141No ratings yet

- 3 - Land RegistrationDocument17 pages3 - Land RegistrationnicholasNo ratings yet

- Fia Rally Star - Asn Selections Consent Form: GlossaryDocument5 pagesFia Rally Star - Asn Selections Consent Form: Glossaryszakiso 2016No ratings yet

- NOTES - Pre-Need Code of The Philippines (Pre-Need) PDFDocument3 pagesNOTES - Pre-Need Code of The Philippines (Pre-Need) PDFJUAN MIGUEL GUZMAN100% (1)

- Module 1, General ProvisionsDocument3 pagesModule 1, General ProvisionsClariza SalesNo ratings yet

- Dissertation Topics 2020 21Document10 pagesDissertation Topics 2020 21all brandsNo ratings yet

- GOA Victory Suddaby Preliminary Injunction Nov 7 2022 1Document184 pagesGOA Victory Suddaby Preliminary Injunction Nov 7 2022 1AmmoLand Shooting Sports NewsNo ratings yet

- Respondent 17th Surana & Surana National Corporate Law Moot Court-2019Document26 pagesRespondent 17th Surana & Surana National Corporate Law Moot Court-2019AyushNo ratings yet

- Chap 5Document17 pagesChap 5sagar chettryNo ratings yet

- Venecijanska Kosovo Konfiskacija ImovineDocument19 pagesVenecijanska Kosovo Konfiskacija ImovineSrdjan BrajovicNo ratings yet

- Anak Mindanao Party-List Group v. Executive Secretary, G.R. No. 166052, 29 August 2007Document10 pagesAnak Mindanao Party-List Group v. Executive Secretary, G.R. No. 166052, 29 August 2007Arvhie SantosNo ratings yet

- Hubbard - Sophisticated Robots Draft 1Document58 pagesHubbard - Sophisticated Robots Draft 1Mac Norhen E. BornalesNo ratings yet

- Assignment ON Conditions and Warranties: Special ContractDocument14 pagesAssignment ON Conditions and Warranties: Special ContractsandeepNo ratings yet

- Definitions: Prevention, Prohibition and Redressal of Complaints On Sexual Harassment at Workplace (Posh)Document7 pagesDefinitions: Prevention, Prohibition and Redressal of Complaints On Sexual Harassment at Workplace (Posh)Akash KumarNo ratings yet

- Foreign Exchange Regulation ActDocument13 pagesForeign Exchange Regulation ActpavanbatteNo ratings yet