Professional Documents

Culture Documents

Acctg 1 11 101 Final Exam

Acctg 1 11 101 Final Exam

Uploaded by

Michael John DayondonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctg 1 11 101 Final Exam

Acctg 1 11 101 Final Exam

Uploaded by

Michael John DayondonCopyright:

Available Formats

ACCTG 1/11/101 FINAL EXAMINATION

Instructor: Michael John V. Dayondon

Name: _______________________________

Section:__________Score:_____

Test I Problem Solving: Show your solutions all in good forms. Focus on your

own business. Huwag maging Daniel Padilla.

PROBLEM 1

At the end of November, Bonggo Business Inc. consisted of 50 vehicles purchased at P150,000

each and has a standard selling price of P230,000. During the month of December, the following

merchandising transactions occurred:

Dec. 2

Purchased 10 vehicles on account for P1,500,000 from Auto-Auto Company, terms 2/10, n/30.

Dec. 3

Paid freight costs of P50,000 on vehicles purchased from Auto-Auto Company.

Dec. 5

Sold 20 vehicles on account to Megalodon Whale Trading for P230,000 each, terms n/30.

Dec. 9

Received P300,000 credit for 2 unrepairable vehicles returned to Auto-Auto Company.

Dec. 11

Paid outstanding liability to Auto-Auto Company.

Dec. 14

Received full payment from Megalodon Whale Trading.

Dec. 18

Sold 15 vehicles on account to Moon Trading Grocery, P3,450,000, terms n/60.

Dec. 19

Purchased 5 vehicles on account for P150,000 each from General Truckers Co., terms, 1/10,

n/30.

Dec. 24

Received payment worth 70% of outstanding collectibles from Moon Trading Grocery.

Dec. 30

Paid General Truckers Co. in full.

Requirements:

1. Prepare for Journal Entries using Periodic Inventory Method.

2. Prepare for Cost of Goods Sold Computation

3. Compute for the Remaining Vehicles as of the end of December.

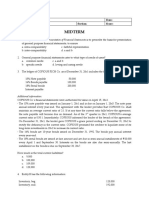

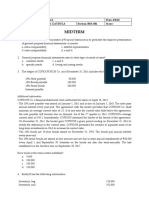

Problem 2

Data related to COGS, an expense account, are presented below.

Purchase Discount 2,000.00 Freight-In 7,000.00

Beginning Inventory 100,000.00 Freight-Out 5,000.00

Ending Inventory 70,000.00 Sales 212,500.00

Purchase Rets. & Allow. 10,000.00 Purchases 60,000.00

Determine the following:

1. Cost of Goods Available for Sales

2. Net Purchases

3. Cost of Goods Sold

4. Cost of Goods Purchased

5. Net Sales

Problem 3

Presented below is the financial information of Papasakaya Hardware for the year 2021, 2022,

and 2023. Fill in the missing amounts.

2021 2022 2023

Beginning Inventory 100,000 ? 80,000

Purchases ? 320,000 240,000

Purchase Rets. & Allow. 6,000 ? 24,000

Purchase Discounts 4,000 8,000 ?

Net Purchases ? 300,000 ?

Freight-In 5,000 ? 20,000

Cost of Goods Purchased ? 315,000 ?

Cost of Goods Available for Sale ? 365,000 300,000

Ending Inventory 50,000 80,000 ?

Cost of Goods Sold 105,000 ? 205,000

Problem 4

Presented below is the financial data of UntaMakapasa Veterinary Supplies related to the

Statement of Financial Performance for the year 2019, 2020, 2021, and 2022. Determine the

missing amounts.

2019 2020 2021 2022

Net Sales ? 200,000 180,000 320,000

Cost of Goods Sold 60,000 ? 120,000 ?

Gross Profit ? 90,000 ? ?

Operating Expenses 30,000 ? 40,000 60,000

Net Income/ (Net Loss) 10,000 40,000 ? 90,000

Test II Multiple Choice Questions: Encircle your best choice. Select only one

answer among the choices. Do not collect and collect before you select. Ano ka

artista?

1. When comparing a retail business to a service business, the financial statement that changes

the least is the

a. Balance Sheet

b. Income Statement

c. Statement of Changes in Owner’s Equity

d. Statement of Cash Flow

2. Which account is not classified as selling expense?

a. Sales Salaries

b. Transportation-out

c. Sales Discount

d. Advertising Expense

3. If the buyer is to pay the transportation costs of delivering merchandise, delivery terms are

a. FOB Shipping Point

b. FOB Destination

c. FOB n/30

d. FOB Buyer

4. A sales invoice included the following information: Merchandise Price, P4,000; Transportation,

P300; terms 1/10, n/eom, FOB Shipping Point. Assuming that a credit for merchandise

returned of P600 is granted prior to payment, that the transportation is prepaid by the seller,

and that the invoice is paid within the discount period, what is the amount of cash received by

the seller?

a. P3,366

b. P3,400

c. P3,666

d. P3,950

5. A retailer purchases merchandise with a catalog list price of P10,000. The retailer receives a

25% trade discount and credit terms of 2/10, n/30. What amount should the retailer debit to

the Merchandise Inventory account?

a. P7,500

b. P10,000

c. P9,800

d. P7,350

You might also like

- Summative Test-FABM2 2018-2019Document2 pagesSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- Fundamentals of Accountancy, Business, and Management 2: ExpectationDocument131 pagesFundamentals of Accountancy, Business, and Management 2: ExpectationAngela Garcia100% (1)

- Company Law 1-6 BinderDocument147 pagesCompany Law 1-6 BinderNapoa Sandow100% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Syllabus MGMT S-2790 Private Equity Summer 2019 DRAFT 02-15Document8 pagesSyllabus MGMT S-2790 Private Equity Summer 2019 DRAFT 02-15veda20No ratings yet

- FABM 2 3.ACT SCIdocxDocument10 pagesFABM 2 3.ACT SCIdocxMaryPher CadioganNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-Mail: - Inventory (Pas 2)Document10 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-Mail: - Inventory (Pas 2)Snow TurnerNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Exercise 2 Income Statement - MerchandisingzzzsDocument2 pagesExercise 2 Income Statement - MerchandisingzzzsMarc Viduya0% (1)

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Audit of Inventory - Illustrative ProblemsDocument3 pagesAudit of Inventory - Illustrative ProblemsTEOPE, EMERLIZA DE CASTRONo ratings yet

- Financial Accounting P 1 Quiz 3 KeyDocument6 pagesFinancial Accounting P 1 Quiz 3 KeyJei CincoNo ratings yet

- BSA 2C InventoriesDocument36 pagesBSA 2C InventoriesAudrey BienNo ratings yet

- Intermediate Accounting 1 Inventories - AssignmentDocument3 pagesIntermediate Accounting 1 Inventories - AssignmentGabriel Adrian Obungen0% (1)

- Intermediate Accounting 1 Inventories - Assignment A. Supply The Missing AmountsDocument5 pagesIntermediate Accounting 1 Inventories - Assignment A. Supply The Missing AmountsGabriel Adrian ObungenNo ratings yet

- Model Exam Work Out FADocument5 pagesModel Exam Work Out FAnewaybeyene5No ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- Inventories (Problems)Document6 pagesInventories (Problems)IAN PADAYOGDOGNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- 3b79070f9fdf9cd3f1dc5d6aeda6e1c3Document3 pages3b79070f9fdf9cd3f1dc5d6aeda6e1c3Vivian TamerayNo ratings yet

- Intermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreDocument19 pagesIntermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreMay Ramos100% (2)

- MQ 1 Inventories Ak PDFDocument4 pagesMQ 1 Inventories Ak PDFJuliana ChengNo ratings yet

- Institute of Business Management: Important AssignmentDocument5 pagesInstitute of Business Management: Important AssignmentShaheer KhurramNo ratings yet

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument18 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreAnirban Roy ChowdhuryNo ratings yet

- Quiz Inventory-Fa1Document9 pagesQuiz Inventory-Fa1penny coronado100% (1)

- SDocument18 pagesSdebate dd0% (1)

- Exam 2Document19 pagesExam 2SHE50% (2)

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- MCQs Problems For Merchandising Business - For UploadDocument8 pagesMCQs Problems For Merchandising Business - For UploadIrish Trisha PerezNo ratings yet

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument16 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreShane TorrieNo ratings yet

- Sheet (8) Intermediate Accounting: InventoriesDocument12 pagesSheet (8) Intermediate Accounting: Inventoriesmagdy kamelNo ratings yet

- AccountancyDocument16 pagesAccountancyevangiebalunsat9No ratings yet

- Aud 1 Questions - InventoriesDocument5 pagesAud 1 Questions - InventoriesXcyron Estrada - BSANo ratings yet

- Cdee#2Document2 pagesCdee#2ሔርሞን ይድነቃቸውNo ratings yet

- Inventory 2021Document8 pagesInventory 2021RHENNA MAY RISCEL OPEÑANo ratings yet

- Reviewer FAR3Document17 pagesReviewer FAR3AnonymousWriter34870% (10)

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- Quiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresDocument8 pagesQuiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresCassandra MarieNo ratings yet

- University of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Document3 pagesUniversity of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Justine JaymaNo ratings yet

- Midterm Exam - LUNADocument22 pagesMidterm Exam - LUNAJoyce LunaNo ratings yet

- Finals Quiz #2 Soce, Soci, Ahfs and Do Multiple Choice: Account Title AmountDocument3 pagesFinals Quiz #2 Soce, Soci, Ahfs and Do Multiple Choice: Account Title AmountNew TonNo ratings yet

- Inventories - SolutionDocument2 pagesInventories - SolutionKyla De LunaNo ratings yet

- Chapter 5 Question ReviewDocument10 pagesChapter 5 Question ReviewRoting EnomarNo ratings yet

- Chapter 5 Exercises-Exercise BankDocument9 pagesChapter 5 Exercises-Exercise BankPATRICIUS ALAN WIRAYUDHA KUSUMNo ratings yet

- KALBARYONISHERLY2Document8 pagesKALBARYONISHERLY2De MarcusNo ratings yet

- (02B) Inventories Assignment 02Document3 pages(02B) Inventories Assignment 02Mary Queen ElumbaringNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Inventories Set 2 - Online Quiz - 3.24.20Document5 pagesInventories Set 2 - Online Quiz - 3.24.20Danielle Millen AntonioNo ratings yet

- AC191 Autumn 2011 FINALDocument9 pagesAC191 Autumn 2011 FINALgerlaniamelgacoNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- Level 1 Mock Quali Q and AsDocument31 pagesLevel 1 Mock Quali Q and AsJ A M A I C ANo ratings yet

- College of Accountancy and Business Administration: Quiz: Intermediate Accounting 1Document5 pagesCollege of Accountancy and Business Administration: Quiz: Intermediate Accounting 1BSA 1BRICHELL ASHLEY M. PAGADUANNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 1 (A01) - Overview of Inventories 3.0Document4 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 1 (A01) - Overview of Inventories 3.0Lorraine Joy AbanillaNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Abm003 PT1Document2 pagesAbm003 PT1Ma. Cristina CaraldeNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- 8 Inventory EstimationDocument3 pages8 Inventory EstimationJorufel PapasinNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Abm 2 Final ExaminationDocument1 pageAbm 2 Final ExaminationMichael John DayondonNo ratings yet

- BKPNG Activity 1.2Document4 pagesBKPNG Activity 1.2Michael John DayondonNo ratings yet

- Abm 1 Quiz No 1Document1 pageAbm 1 Quiz No 1Michael John DayondonNo ratings yet

- BKPNG Activity 2Document4 pagesBKPNG Activity 2Michael John DayondonNo ratings yet

- Withholding Tax RatesDocument5 pagesWithholding Tax RatesMary Ann castroNo ratings yet

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Aud Application 2 - Handout 4 Gov. Grant (UST)Document2 pagesAud Application 2 - Handout 4 Gov. Grant (UST)RNo ratings yet

- Chapter 7Document15 pagesChapter 7Jaren Ann DeangNo ratings yet

- Articles of AssociationDocument20 pagesArticles of AssociationUdayan YadavNo ratings yet

- FINAL 99.1 1st SamplexDocument6 pagesFINAL 99.1 1st SamplexMelissa FelicianoNo ratings yet

- Budgetary Control and Responsibilty AccountingDocument34 pagesBudgetary Control and Responsibilty Accountingtentoone50% (4)

- Bad DebtsDocument17 pagesBad DebtsArshad ChaudharyNo ratings yet

- Section 34 To 43 Corporation CodeDocument5 pagesSection 34 To 43 Corporation CodeArfil Sta Ana YongcoNo ratings yet

- 12 Substantive Tests of InvestmentsDocument18 pages12 Substantive Tests of Investmentsashley100% (2)

- FIOF Fund Fact Sheet - February 2023Document2 pagesFIOF Fund Fact Sheet - February 2023DahamNo ratings yet

- 001 - CHAPTER 00 - Introduction To Class PDFDocument12 pages001 - CHAPTER 00 - Introduction To Class PDFIFRS LabNo ratings yet

- C.8 SOLUTIONS (Problems I - IX)Document9 pagesC.8 SOLUTIONS (Problems I - IX)Bianca AcoymoNo ratings yet

- Tyshchenko 2162Document4 pagesTyshchenko 2162NabhanNo ratings yet

- Corporate GovernanceDocument13 pagesCorporate GovernanceAhmad BadrusNo ratings yet

- CONTEX vs. CIRDocument3 pagesCONTEX vs. CIRAnneNo ratings yet

- Interest Rate FuturesDocument103 pagesInterest Rate FuturesSumit SinghNo ratings yet

- Business Finance 12th Edition by Graham PeirsonDocument792 pagesBusiness Finance 12th Edition by Graham PeirsonRico YuNo ratings yet

- Chapter 15: Partnerships - Formation, Operations, and Changes in Ownership InterestsDocument42 pagesChapter 15: Partnerships - Formation, Operations, and Changes in Ownership InterestsKoko D'DemonsongNo ratings yet

- P 2-47 Entries Debit Credit Types of Account Increase/ DecreaseDocument4 pagesP 2-47 Entries Debit Credit Types of Account Increase/ DecreaseTayaban Van GihNo ratings yet

- Balance SheetDocument32 pagesBalance SheetJanine padronesNo ratings yet

- SOAL UTS MK 2020-2021 HarmonoDocument5 pagesSOAL UTS MK 2020-2021 HarmonoAulia Khoirun NisaNo ratings yet

- Multiple Choice QuestionsDocument10 pagesMultiple Choice QuestionsnicahNo ratings yet

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- CIMA F2 2020 NotesDocument140 pagesCIMA F2 2020 NotesJonathan Gill100% (1)

- ACCO 30023 - Accounting For Business Combination (IM)Document74 pagesACCO 30023 - Accounting For Business Combination (IM)rachel banana hammockNo ratings yet

- Retire Rich in 30 DaysDocument85 pagesRetire Rich in 30 DaysYanti RocketleavesNo ratings yet