Professional Documents

Culture Documents

Comprehensive Word Problem 1

Comprehensive Word Problem 1

Uploaded by

Jan Russel RamosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comprehensive Word Problem 1

Comprehensive Word Problem 1

Uploaded by

Jan Russel RamosCopyright:

Available Formats

COMPREHENSIVE WORD PROBLEM 2

Dr. John Carlos, upon completing a residency program at Harvard Medical Center, established a

medical practice in San Pablo, Laguna. During October 2020, the first month of operations, the following

transactions occurred:

Oct. 01 Dr. John Carlos transferred P250,000 from his personal checking account to a bank

account, Dr. John Carlos, M.D.

01 A medical clinic, P1,000,000 and land P250,000 were acquired by paying P50,000 in cash

and issuing a 5-year, 20% note payable (interest is payable every 6 months) for the

P1,200,000 balance.

01 Acquired medical equipment costing P420,000 and medical supplies amounting to

P39,000 by paying P59,000 cash and issuing a 24% note payable, maturing in 6 months,

for the P400,000 balance.

02 Acquired “all-in-one” insurance for a year P20,000.

04 Received cash from patients amounting to P117,000.

07 Bought medical supplies on account from San Pablo Supply, P17,000.

10 Paid salaries of nurses and office staff, P73,000.

12 Received P90,000 from the Laguna Experimental Drug Center for research to be

conducted by Dr. John Carlos over the next 3 months.

18 Billed patients P317,000 for services rendered.

21 Paid P23,000 for repairs to the medical equipment.

23 Paid telephone bill, P3,000.

24 Bought medical equipment on account from Dr. De Leon, P45,000.

25 Collected P113,000 from patients billed on the 18th.

27 Paid 13,000 on account to San Pablo Supply.

30 Withdrew P200,000 cash from the medical practice.

30 Paid P15,000 dues to the Laguna Medical Association.

REQUIRED:

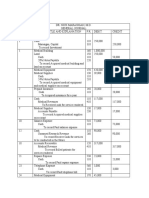

1. Record the transactions for the month of October in a journal (page 1).

2. Post the entries to the ledger using the following accounts and account numbers:

Account No. Account No.

Cash 110 John Carlos, Capital 310

Accounts Receivable 120 John Carlos, Withdrawals 320

Medical Supplies 130 Income Summary 330

Prepaid Insurance 140 Medical Revenues 410

Land 150 Research Revenues 420

Medical Building 160 Salaries Expense 510

Accumulated Depreciation- Medical Insurance Expense 520

Building 165 Repairs Expense 530

Medical Equipment 170 Supplies Expense 540

Accumulated Depreciation – Medical Association Due Expense 550

Equipment 175 Telephone Expense 560

24% Note Payable 210 Depreciation Expense- Building 570

20% Note Payable 220 Depreciation Expense-Equipt. 580

Accounts Payable 230 Interest Expense 590

Salaries Payable 240

Interest Payable 250

Unearned Research Revenue 260

3. Prepare a Trial Balance.

4. Prepare and complete the 10-column worksheet using the following information:

a. Insurance for one month has expired.

b. Medical supplies on hand at month-end amounted to P21,000.

c. Depreciation on the medical building and on the medical equipment is P5,000 and P9,000

respectively.

d. Unearned research revenues in the amount of P30,000 have been earned.

e. Salaries of P51,000 have accrued.

f. Interest on the 20% and 24% notes are P20,000 and P8,000 , respectively.

5. Prepare the following financial Statements:

a. Income Statement

b. Statement of Changes in Equity

c. Balance Sheet

d. Statement of Cash Flows.

6. Record the adjusting and closing entries in the journal (page 2) and post the entries to the

ledger.

7. Prepare a post-closing trial balance.

8. Prepare the salaries and interest reversing entries in the journal (page 3) and post them to the

ledger.

9.

You might also like

- AccountingDocument15 pagesAccountingBianca Jane Maaliw76% (38)

- Prepare Journal Entries 2Document1 pagePrepare Journal Entries 2Rie CabigonNo ratings yet

- Far 101 - Financial Accounting Process PDFDocument4 pagesFar 101 - Financial Accounting Process PDFReyn Saplad Perales100% (1)

- FINAL - Accounting - 2016Document1 pageFINAL - Accounting - 2016Jason Yara0% (1)

- Accounting Cycle PDFDocument5 pagesAccounting Cycle PDFSim PackNo ratings yet

- 7.1 Completing The Cycle SampleDocument4 pages7.1 Completing The Cycle SampleKena Montes Dela PeñaNo ratings yet

- FAR 1 - Journal EntriesDocument3 pagesFAR 1 - Journal EntriesAnime LoverNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Accounting CycleDocument2 pagesAccounting Cyclewonderer mystery60% (5)

- ASSIGNMENT 4 Analyses of TransactionsDocument11 pagesASSIGNMENT 4 Analyses of Transactionsaaf100% (3)

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Practical Accounting 2Document16 pagesPractical Accounting 2Rowena NijNo ratings yet

- Chapter 3 ProblemsDocument7 pagesChapter 3 ProblemsShaila MarceloNo ratings yet

- CFA Level 1Document90 pagesCFA Level 1imran0104100% (2)

- Big Ptask - Accounting CycleDocument2 pagesBig Ptask - Accounting CycleAkane HitomiNo ratings yet

- Exercise 05 (Individual Graded)Document2 pagesExercise 05 (Individual Graded)nininini2923No ratings yet

- Activity 03 - Recording Business Transactions SADFDFDocument2 pagesActivity 03 - Recording Business Transactions SADFDFAeron RungduenNo ratings yet

- PT 4th Quarter Student Copy 2022 2023Document1 pagePT 4th Quarter Student Copy 2022 2023Primi LyNo ratings yet

- Comprehensive Assessment 1 and 2Document3 pagesComprehensive Assessment 1 and 2Kurt NicolasNo ratings yet

- Review TestDocument1 pageReview TestKristine Joy Mendoza InciongNo ratings yet

- Problem 8 ACCA101Document28 pagesProblem 8 ACCA101Nicole FidelsonNo ratings yet

- AIS Activity No. 2 Journalizing Using Peachtree and Generation FSDocument2 pagesAIS Activity No. 2 Journalizing Using Peachtree and Generation FSShaira UntalanNo ratings yet

- Final 2nd MeetingDocument1 pageFinal 2nd MeetingChristopher CristobalNo ratings yet

- Antonio WorksheetDocument7 pagesAntonio WorksheetAntonNo ratings yet

- AIS Journal Entries and Adjusting EntriesDocument2 pagesAIS Journal Entries and Adjusting EntriesIeva Francheska Agustin83% (6)

- Prepare Journal Entries, Ledger and Trial Balance For The Following TransactionsDocument1 pagePrepare Journal Entries, Ledger and Trial Balance For The Following TransactionsRie Cabigon0% (1)

- Week 1 AccountingDocument5 pagesWeek 1 AccountingWawie Cañete50% (2)

- Practical Accouniting ProblemsDocument3 pagesPractical Accouniting ProblemsMichelle ValeNo ratings yet

- Family Medical Clinic: Chapter 4: Problem 7Document17 pagesFamily Medical Clinic: Chapter 4: Problem 7MilrosePaulinePascuaGuda0% (1)

- Compehensive Problem 8Document19 pagesCompehensive Problem 8Trisha Gaile R. RañosaNo ratings yet

- Journalizing (Doctora) Dr. MarasiganDocument10 pagesJournalizing (Doctora) Dr. Marasigankianna doctoraNo ratings yet

- Assignment PR 8Document22 pagesAssignment PR 8Margarette Novem T. PaulinNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesAdrianIlaganNo ratings yet

- Quiz NPO Multiple ChoiceDocument4 pagesQuiz NPO Multiple ChoiceLJ Aggabao0% (1)

- Accounting 1 ValeDocument13 pagesAccounting 1 ValeAhmadnur JulNo ratings yet

- Chart of AccountsDocument6 pagesChart of AccountsDonna Lyn Boncodin100% (1)

- Fabm 2 Quiz 1Document2 pagesFabm 2 Quiz 1Jenny HermosadoNo ratings yet

- Additional InformationDocument2 pagesAdditional InformationKailaNo ratings yet

- YAWAKADocument24 pagesYAWAKADaniel Gabriel PunoNo ratings yet

- Marasigan TransactionDocument20 pagesMarasigan TransactionE.D.J100% (2)

- ACTG123 (DR Nickmarasigan)Document24 pagesACTG123 (DR Nickmarasigan)Regine BungcalonNo ratings yet

- Activity Sheet 7.problem Set Service Concern-SheldonDocument10 pagesActivity Sheet 7.problem Set Service Concern-SheldonAngela BantayNo ratings yet

- Hospitals: Accounting For NposDocument59 pagesHospitals: Accounting For Nposx SeiraNo ratings yet

- ActivityDocument2 pagesActivityAoi RainNo ratings yet

- Final Examination-Fundamentals of Accounting-1Document3 pagesFinal Examination-Fundamentals of Accounting-1Junnelle MidayNo ratings yet

- SkillsDocument1 pageSkillsMrsjiNo ratings yet

- Accounting For Special TransactionsDocument9 pagesAccounting For Special TransactionsHelix HederaNo ratings yet

- Answer Keyto CQDocument7 pagesAnswer Keyto CQVivian MonteclaroNo ratings yet

- Reviewer For FinalsDocument18 pagesReviewer For FinalsjhannashantiNo ratings yet

- Problem 3-7:worksheet PreparationDocument3 pagesProblem 3-7:worksheet PreparationMaria Erica AligamNo ratings yet

- Assignment Module 5Document2 pagesAssignment Module 5Hazel Jane MejiaNo ratings yet

- Problem Solving No. 3: 75% Passing GradeDocument1 pageProblem Solving No. 3: 75% Passing GradeLizanne GauranaNo ratings yet

- COMPREHENSIVE-PROBLEM - AnswerDocument11 pagesCOMPREHENSIVE-PROBLEM - AnswerVivian MonteclaroNo ratings yet

- Illustrative Examples Accounting For Health Care Providers-HospitalsDocument2 pagesIllustrative Examples Accounting For Health Care Providers-HospitalsLa MarieNo ratings yet

- Module 4 Post TaskDocument1 pageModule 4 Post TaskSHANE MIJARESNo ratings yet

- Bookeeping Double Entry SystemDocument16 pagesBookeeping Double Entry SystemPhilpNil8000No ratings yet

- ACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Document3 pagesACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Zyrille Corrine GironNo ratings yet

- Itc14 mcp23Document8 pagesItc14 mcp23Lee TeukNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- The COVID-19 Impact on Philippine Business: Key Findings from the Enterprise SurveyFrom EverandThe COVID-19 Impact on Philippine Business: Key Findings from the Enterprise SurveyRating: 5 out of 5 stars5/5 (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Open-Concept TheoryDocument11 pagesOpen-Concept TheoryAprilNo ratings yet

- Lesson 2 - The Nature of ArtDocument40 pagesLesson 2 - The Nature of ArtAprilNo ratings yet

- InformationDocument5 pagesInformationAprilNo ratings yet

- Intro To BadmintonDocument5 pagesIntro To BadmintonAprilNo ratings yet

- CH 05Document38 pagesCH 05Nhok NeoNo ratings yet

- Differentiate Between Operating, Investing, and Financing ActivitiesDocument5 pagesDifferentiate Between Operating, Investing, and Financing ActivitiessanyaNo ratings yet

- Full Download Entrepreneurial Finance 6th Edition Leach Solutions ManualDocument35 pagesFull Download Entrepreneurial Finance 6th Edition Leach Solutions Manualcoctilesoldnyg2rr100% (32)

- Working Capital ManagementDocument10 pagesWorking Capital ManagementHarshit GoyalNo ratings yet

- Chapter 8 Audit of Intangible AssetsDocument12 pagesChapter 8 Audit of Intangible AssetsMarkie GrabilloNo ratings yet

- Data MigrationDocument29 pagesData MigrationAhmed SamirNo ratings yet

- Divya Garg - PWM End Term ReportDocument36 pagesDivya Garg - PWM End Term ReportLovekeshSachdevaNo ratings yet

- Chapter 1 Audit of Cash and Cash EquivalentsDocument129 pagesChapter 1 Audit of Cash and Cash Equivalentsyen claveNo ratings yet

- Lecture 1-Introduction To Applied Office AccountingDocument15 pagesLecture 1-Introduction To Applied Office AccountingMary De JesusNo ratings yet

- Bcacctg2 - Module 1 Topic 3 (Revised)Document15 pagesBcacctg2 - Module 1 Topic 3 (Revised)Kristine LeiNo ratings yet

- Finance STPDocument30 pagesFinance STPayushithakur918No ratings yet

- Assignment 9Document3 pagesAssignment 9nina0301No ratings yet

- Financial AccountingDocument416 pagesFinancial AccountingSamuel Kamau100% (3)

- CCL Products India: PrintDocument2 pagesCCL Products India: PrintSaurabh RajNo ratings yet

- IAS 36-Impairment: Nguyễn Đình Hoàng UyênDocument31 pagesIAS 36-Impairment: Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- Thermo Fisher Acquires Life Technologies Finance ModelDocument19 pagesThermo Fisher Acquires Life Technologies Finance Modelvardhan0% (2)

- Balance SheetDocument15 pagesBalance SheetBhumit GalaNo ratings yet

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- Cfs Direct Method - IaDocument35 pagesCfs Direct Method - IaCanny TrầnNo ratings yet

- FIGLDocument55 pagesFIGLOkikiri Omeiza RabiuNo ratings yet

- Хариу HW2 ACC732Document6 pagesХариу HW2 ACC732ZayaNo ratings yet

- Peran AP Terhadap Kelancaran Pembayaran Tagian Supplier Di Pesona Tugu Hotel YogyakartaDocument6 pagesPeran AP Terhadap Kelancaran Pembayaran Tagian Supplier Di Pesona Tugu Hotel YogyakartaalidunNo ratings yet

- Salini Relazione Dic 2013 PDFDocument307 pagesSalini Relazione Dic 2013 PDFCalin CalinNo ratings yet

- The Repayment of The Loan Depends Upon The BorrowerDocument4 pagesThe Repayment of The Loan Depends Upon The BorrowerSadia Rahman100% (1)

- FLOP Balance SheetDocument51 pagesFLOP Balance SheetFRANK R DIMICHELENo ratings yet

- Unit 2: Financial Analysis 2.0 Aims and ObjectivesDocument13 pagesUnit 2: Financial Analysis 2.0 Aims and ObjectiveshabtamuNo ratings yet

- Meghna Cement Mills 2009Document50 pagesMeghna Cement Mills 2009panna000% (1)

- Blackline For Oracle: Transform Your Financial CloseDocument24 pagesBlackline For Oracle: Transform Your Financial ClosesriramNo ratings yet