Professional Documents

Culture Documents

Problem 7 34

Problem 7 34

Uploaded by

rpztxCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 7 34

Problem 7 34

Uploaded by

rpztxCopyright:

Available Formats

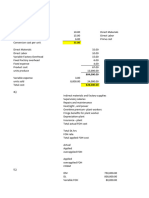

Problem 7-34 Physical Units Method, Relative Sales-Value-at-Split-off Method,

Net Realizable Value Method, Decision Making

1 Joint processing cost

a. Relative sales-value-at-split-off-method

Total Joint Cost 1,000,000

Fully

Monthly Sales Value % of total Allocated

Product Processed

output at Split-Off market value Joint Cost

Sales Price

Studs 75,000 8 600,000 46% 461,538

Decorative 5,000 60 300,000 23% 230,769

Posts 20,000 20 400,000 31% 307,692

Total 100,000 1,300,000 100% 1,000,000

b. Physical units method

Total Joint Cost 1,000,000

Monthly Allocated

Product % of Unit

output Joint Cost

Studs 75,000 75% 750,000

Decorative 5,000 5% 50,000

Posts 20,000 20% 200,000

Total 100,000 1,000,000

c. Estimated NRV Method

Total Joint Cost 1,000,000

Further processing only for Decorative

Output loss 10% 4,500

Add. Cost 100,000

Add. Cost / unit 22.22

% of

Fully Hypo. Hypo. hypo.

Processed Market Market market Allocated Joint

Product Sales Price Add. Cost Price Units Value value Cost

Studs 8 - 8 75,000 600,000 44% 444,444.44

Decorative 100 22.22 77.78 4,500 350,000 26% 259,259.26

Posts 20 - 20 20,000 400,000 30% 296,296.30

Total 99,500 1,350,000 100% 1,000,000.00

Compare processing the decorative pieces

2 further as it presently does,

with selling the rough-cut product immediately at split-off.

Selling at Split-Off Selling at Further Process

Units 5,000 Units 4,500

Price 60 Price 100

Sales 300,000 Sales before Add. Cost 450,000

Add. Cost (100,000)

Sales at Further Process 350,000

Sales after additional processes are higher than sales without additional processes amounted to 50.000.

Hence, the company can consider carrying out additional processes.

You might also like

- Camelback Cost Management AnalysisDocument23 pagesCamelback Cost Management AnalysisVidya Sagar Ch100% (2)

- FINMAN Decision AnalysisDocument5 pagesFINMAN Decision AnalysisTrish GarridoNo ratings yet

- Problem 16-27 Joint-Cost Allocation, Sales Value, Physical Measure, and NRV MethodsDocument8 pagesProblem 16-27 Joint-Cost Allocation, Sales Value, Physical Measure, and NRV MethodsVon Andrei MedinaNo ratings yet

- HW 6 - CH 11 W SolutionsDocument22 pagesHW 6 - CH 11 W Solutionsman ibeNo ratings yet

- Chapter 10 Tute Solutions PDFDocument7 pagesChapter 10 Tute Solutions PDFAi Tien TranNo ratings yet

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- WP Assignment Week 3 HM 73.9 & Soal EmasDocument5 pagesWP Assignment Week 3 HM 73.9 & Soal EmasIndahna SulfaNo ratings yet

- SCM 2nd RecitDocument5 pagesSCM 2nd RecitMaxine ConstantinoNo ratings yet

- Lecture 7Document14 pagesLecture 7marwanfathy002No ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- Average Payable 365 Average Payable Period Annual Purchase Average Inventory 365 Inventory Holding Period Cogs Average Receivable 365 Receivable Collection Period Annual SalesDocument10 pagesAverage Payable 365 Average Payable Period Annual Purchase Average Inventory 365 Inventory Holding Period Cogs Average Receivable 365 Receivable Collection Period Annual SalessajedulNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- AML-Excercise Week 3 (Reviandi Ramadhan)Document9 pagesAML-Excercise Week 3 (Reviandi Ramadhan)reviandiramadhanNo ratings yet

- See Zhao Wei U2003083Document5 pagesSee Zhao Wei U2003083zhaoweiNo ratings yet

- PRACTICAL CASES 28 and 29Document5 pagesPRACTICAL CASES 28 and 29loliNo ratings yet

- Dente Q2Document3 pagesDente Q2hanna fhaye denteNo ratings yet

- Classic Pen Working HandoutsDocument1 pageClassic Pen Working HandoutsTushar DuaNo ratings yet

- Conviser Company: Joint Cost Product C Product L Product T TotalDocument6 pagesConviser Company: Joint Cost Product C Product L Product T TotalKiyo KoNo ratings yet

- Relevant CostingDocument23 pagesRelevant CostingEy GuanlaoNo ratings yet

- Chapter 1-3Document21 pagesChapter 1-3Alexsandra GarciaNo ratings yet

- Bill Assignment Report PDFDocument9 pagesBill Assignment Report PDFAJAY KUMARNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- Absorption & Marginal Costing-1Document6 pagesAbsorption & Marginal Costing-1田淼No ratings yet

- Lesson 2: Relevant Costs For Decision MakingDocument41 pagesLesson 2: Relevant Costs For Decision MakingChuah Chong AnnNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- Unit - Ii Cost and Management AccountingDocument17 pagesUnit - Ii Cost and Management AccountingRamakrishna RoshanNo ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- Lec 05Document6 pagesLec 05Muhammad HusnainNo ratings yet

- Mô HìnhDocument7 pagesMô HìnhThanh Tâm Lê ThịNo ratings yet

- Basic Cost Accounting DefinitionsDocument8 pagesBasic Cost Accounting Definitionsbritonkariuki97No ratings yet

- Lecture 4Document33 pagesLecture 4api-3767414No ratings yet

- Oss Profit Retail Inventory MethodDocument4 pagesOss Profit Retail Inventory MethodLily of the ValleyNo ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Costing By-Product and Joint ProductsDocument34 pagesCosting By-Product and Joint ProductsArika KameliaNo ratings yet

- Assignment7 - CostAcc - Re Do Exercise - VanessaDocument5 pagesAssignment7 - CostAcc - Re Do Exercise - VanessaVanessa vnssNo ratings yet

- Assignment On BudgetingDocument5 pagesAssignment On BudgetingRameshNo ratings yet

- Multi Product Break Even Analysis - Excel Tutorials - Subscribe Excel A-Z...Document2 pagesMulti Product Break Even Analysis - Excel Tutorials - Subscribe Excel A-Z...sharjeelraja876No ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- Assignment 1-1Document19 pagesAssignment 1-1mishal zikriaNo ratings yet

- ManAcc W4 WritingDocument5 pagesManAcc W4 WritingtahazamzamNo ratings yet

- Cost Volume Profit (CVP) AnalysisDocument40 pagesCost Volume Profit (CVP) AnalysisAnne PrestosaNo ratings yet

- Acct7 Additional CVPDocument7 pagesAcct7 Additional CVPKylabsssNo ratings yet

- Materi Ch16 Akuntansi Biaya PerhitunganDocument10 pagesMateri Ch16 Akuntansi Biaya Perhitunganhayin santosoNo ratings yet

- 16-3 CCDocument13 pages16-3 CCdebapriya sarkarNo ratings yet

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet

- Bill French Case Study SolutionsDocument8 pagesBill French Case Study SolutionsMurat Kalender100% (1)

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- Solution Pricing DecisionDocument2 pagesSolution Pricing DecisionAnn SalazarNo ratings yet

- Management Accounting: Wilkerson Company Case Group 5Document5 pagesManagement Accounting: Wilkerson Company Case Group 5YATIN BAJAJNo ratings yet

- 6 - Joint Costs and By-ProductsDocument6 pages6 - Joint Costs and By-ProductsKaryl FailmaNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Acccob3 HW2Document24 pagesAcccob3 HW2Reshawn Kimi SantosNo ratings yet

- 16-1 Hospital Supply CaseDocument9 pages16-1 Hospital Supply CaseDeep GandhiNo ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- Problem 5-51 BlocherDocument2 pagesProblem 5-51 BlocherAlif ArmadanaNo ratings yet

- CPRDocument1 pageCPRLaiba OwaisNo ratings yet

- Spreadsheet ProjectDocument12 pagesSpreadsheet ProjectNiyathiNo ratings yet

- 4791 PDFDocument4 pages4791 PDFDHANKAR TRANSPORT COMPANYNo ratings yet

- HISD Public Facilities Corp. Bond Issuance Official StatementDocument185 pagesHISD Public Facilities Corp. Bond Issuance Official StatementTexas WatchdogNo ratings yet

- Target CostingDocument3 pagesTarget CostingAsad EjazNo ratings yet

- Case 1 United Products, Inc.: Teaching NotesDocument56 pagesCase 1 United Products, Inc.: Teaching Notesjmukerje60% (5)

- BorosoftDocument4 pagesBorosoftajgiganiNo ratings yet

- How Costly Is ProectionismDocument23 pagesHow Costly Is ProectionismCamilla ALTIERINo ratings yet

- Mango Export Guide FinalDocument97 pagesMango Export Guide FinalvenkatryedullaNo ratings yet

- Flow ChartDocument20 pagesFlow ChartVivek SinghNo ratings yet

- Sample Tender DocumentDocument228 pagesSample Tender DocumentAnas100% (1)

- Elasticity of DemandDocument39 pagesElasticity of Demandarpit_is_dube6986% (7)

- Ynthetic UEL: Using The Karrick Process To Turn Coal Into Fuel and ElectricityDocument5 pagesYnthetic UEL: Using The Karrick Process To Turn Coal Into Fuel and ElectricityBen RossNo ratings yet

- UST Golden Notes 2011 - Persons and Family RelationsDocument27 pagesUST Golden Notes 2011 - Persons and Family RelationsElisa Dela FuenteNo ratings yet

- RD THDocument2 pagesRD THNatala WillzNo ratings yet

- RPT 2023 Mathematics Year 6 DLPDocument7 pagesRPT 2023 Mathematics Year 6 DLPSARUVASAN A/L S. RAJOO KPM-GuruNo ratings yet

- Okoruwa 1 PDFDocument18 pagesOkoruwa 1 PDFMihai SchiopuNo ratings yet

- Allied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionDocument23 pagesAllied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionAsad Sheikh89% (19)

- Identifying Anti-Trust Market Geroski Et GriffithDocument18 pagesIdentifying Anti-Trust Market Geroski Et GriffithSalas KaNo ratings yet

- Currency Swaps: 180 Days Per PeriodDocument6 pagesCurrency Swaps: 180 Days Per PeriodAngelica MaeNo ratings yet

- Midterm Examination: Financial Management IDocument3 pagesMidterm Examination: Financial Management IROB101512No ratings yet

- 5 AmalgamationDocument52 pages5 AmalgamationsmartshivenduNo ratings yet

- AccountingDocument9 pagesAccountingButternut23No ratings yet

- Mini CasesDocument16 pagesMini CasesManoj BhoyeNo ratings yet

- Chile Utilities - 2014.10.13 - Better Outlook For 2014-15 Ice-Melting SeasonDocument15 pagesChile Utilities - 2014.10.13 - Better Outlook For 2014-15 Ice-Melting SeasonPaola NajeraNo ratings yet

- Black Monday: By: Rehan Ur Rahim Sohaib Ahmed Usama Akram Hassan AkhtarDocument17 pagesBlack Monday: By: Rehan Ur Rahim Sohaib Ahmed Usama Akram Hassan AkhtarHassan AkhtarNo ratings yet

- ch7s 0-2Document31 pagesch7s 0-2AdamNo ratings yet

- 23 MergersDocument44 pages23 MergerssiaapaNo ratings yet

- Game TheoryDocument155 pagesGame TheoryAnand Kr100% (1)

- Solution Manual Audit Chapter 17Document17 pagesSolution Manual Audit Chapter 17Elisabet Erika PurnamaNo ratings yet