Professional Documents

Culture Documents

Auditing & Corporate Governance (BCOM)

Auditing & Corporate Governance (BCOM)

Uploaded by

Soumya LathaCopyright:

Available Formats

You might also like

- PIMCO COF IV Marketing Deck - Israel - 03232023 - 5732Document64 pagesPIMCO COF IV Marketing Deck - Israel - 03232023 - 5732moshe2mosheNo ratings yet

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- The World Nuclear Supply Chain: Outlook 2030 (2014)Document198 pagesThe World Nuclear Supply Chain: Outlook 2030 (2014)Greg KaserNo ratings yet

- Atal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Document2 pagesAtal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Rising Star CSC67% (3)

- Solution - Numericals Market Structure PDFDocument4 pagesSolution - Numericals Market Structure PDFpiyush kumarNo ratings yet

- Standard Purchase Agreement For Real Estate - BPDocument2 pagesStandard Purchase Agreement For Real Estate - BPMJ Aramburo100% (1)

- LU292 - ExternalvsInternalAuditsDocument1 pageLU292 - ExternalvsInternalAuditsAna LemosNo ratings yet

- Chapter 02 AnsDocument9 pagesChapter 02 AnsDave Manalo100% (1)

- Lesson 5 - Audit Planning PDFDocument4 pagesLesson 5 - Audit Planning PDFAllaina Uy BerbanoNo ratings yet

- Chapter 3 General Types of Audit - PPT 123915218Document32 pagesChapter 3 General Types of Audit - PPT 123915218Clar Aaron Bautista100% (2)

- Unit - 3: 1.preparation Before The Commencement of AuditDocument12 pagesUnit - 3: 1.preparation Before The Commencement of AuditNaga Raju DudalaNo ratings yet

- Chapt. 2 - The Professional StandardsDocument31 pagesChapt. 2 - The Professional StandardsJanna Hazel Villarino VillanuevaNo ratings yet

- Audit PlanningDocument21 pagesAudit Planningablay logeneNo ratings yet

- Lesson 5 - Audit PlanningDocument4 pagesLesson 5 - Audit PlanningAllaina Uy BerbanoNo ratings yet

- Auditing and Corporate Governance-JurazDocument47 pagesAuditing and Corporate Governance-JurazShami100% (3)

- Auditing Full Notes Auditing Full NotesDocument15 pagesAuditing Full Notes Auditing Full NotesMonikamit Tushir67% (3)

- 2017-1 Acct7103 01 L-BB PDFDocument7 pages2017-1 Acct7103 01 L-BB PDFStephanie XieNo ratings yet

- Auditing NotesDocument9 pagesAuditing NotesShubham Khess100% (1)

- PrologueDocument4 pagesPrologueVivek SuranaNo ratings yet

- Audit Management: Gede Leo Nadi Danuarta Kevin Harijanto Caren Angellina MimakiDocument15 pagesAudit Management: Gede Leo Nadi Danuarta Kevin Harijanto Caren Angellina MimakiLeo DanuartaNo ratings yet

- Aud1206 Operation Auditing Midterm ReviewerDocument3 pagesAud1206 Operation Auditing Midterm ReviewerJazmine Arianne DalayNo ratings yet

- Chater OneDocument12 pagesChater OneFasiko AsmaroNo ratings yet

- Cost 1 Chapter OneDocument12 pagesCost 1 Chapter Onealemuayalew01No ratings yet

- AUD 0 - (Compilation Report)Document21 pagesAUD 0 - (Compilation Report)Angela Miles DizonNo ratings yet

- Chapter 1: Auditing and Internal ControlDocument19 pagesChapter 1: Auditing and Internal ControlJeriel Andrei RomasantaNo ratings yet

- Revision Week: Auditing and Assurance 2 21 Mar 2019Document56 pagesRevision Week: Auditing and Assurance 2 21 Mar 2019Fatimah AzzahraNo ratings yet

- Auditing - Introduction To Auditing NotesDocument2 pagesAuditing - Introduction To Auditing NotesCharlize Natalie ReodicaNo ratings yet

- Michel Audit ManajemenDocument15 pagesMichel Audit ManajemenLeo DanuartaNo ratings yet

- TugasDocument11 pagesTugasSarah Sri KurniasihNo ratings yet

- Auditing For Non-AccountantsDocument229 pagesAuditing For Non-AccountantsRheneir Mora100% (2)

- Chapter TwoDocument38 pagesChapter TwoGemechu GuduNo ratings yet

- 74949bos60526 cp16Document37 pages74949bos60526 cp16Shivam KumarNo ratings yet

- Lesson 2 - Audit PlanningDocument24 pagesLesson 2 - Audit PlanningrylNo ratings yet

- QMS Internal Auditor TrainingDocument43 pagesQMS Internal Auditor TrainingJan Francis Wilson MapacpacNo ratings yet

- Course OutlineDocument3 pagesCourse Outlinefekadegebretsadik478729No ratings yet

- Audit and Assuarance C1Document62 pagesAudit and Assuarance C1Phạm Mình CongNo ratings yet

- Overview of The Audit Process and Pre Engagement Activities AsuncionDocument7 pagesOverview of The Audit Process and Pre Engagement Activities AsunciontjasonkiddNo ratings yet

- Part 2 For StudentsDocument34 pagesPart 2 For StudentsLea JoaquinNo ratings yet

- LECTURE 2 - Chapter 3 - AUDIT PLANING & TYPES OF AUDIT TESTSDocument34 pagesLECTURE 2 - Chapter 3 - AUDIT PLANING & TYPES OF AUDIT TESTSamyNo ratings yet

- 1498721945audit JoinerDocument70 pages1498721945audit JoinerRockNo ratings yet

- 1 - Overview of AuditingDocument13 pages1 - Overview of AuditingZooeyNo ratings yet

- Auditing Theory Cabrera 2010 Chapter 03Document8 pagesAuditing Theory Cabrera 2010 Chapter 03Squishy potatoNo ratings yet

- General Types of Audit: Review QuestionsDocument8 pagesGeneral Types of Audit: Review QuestionsUnnamed homosapienNo ratings yet

- Assets Increase Decrease Liabilities Decrease Increase Equity Decrease Increase Expense Increase Decrease Income/revenue Decrease IncreaseDocument25 pagesAssets Increase Decrease Liabilities Decrease Increase Equity Decrease Increase Expense Increase Decrease Income/revenue Decrease IncreaseJerome Eziekel Posada PanaliganNo ratings yet

- Bir Letter of IntentDocument8 pagesBir Letter of IntentHarvey RiveraNo ratings yet

- ACCA TTT 2020 - Audit and Assurance - KeypointDocument83 pagesACCA TTT 2020 - Audit and Assurance - Keypointyen294No ratings yet

- Sarah Sri Kurniasih - C1I021010 - Assignment Summary Topik Chapter 1-6Document13 pagesSarah Sri Kurniasih - C1I021010 - Assignment Summary Topik Chapter 1-6Sarah Sri KurniasihNo ratings yet

- PowerPoint PresentationDocument15 pagesPowerPoint PresentationMOHAMAD AMIRUL AINAN BIN BASHIR AHMAD MoeNo ratings yet

- Chapter 1Document34 pagesChapter 1Nurfatihah YusuffNo ratings yet

- Auditing Theory Cabrera 2010 Chap 2Document8 pagesAuditing Theory Cabrera 2010 Chap 2Squishy potatoNo ratings yet

- Chapter 03 AnsDocument7 pagesChapter 03 AnsDave ManaloNo ratings yet

- Unit 1 - Introduction To AuditingDocument14 pagesUnit 1 - Introduction To AuditingHitesh VNo ratings yet

- Unit 1 Introduction To AuditingDocument36 pagesUnit 1 Introduction To AuditingDeepanshu PorwalNo ratings yet

- Auditing Assignment 2Document5 pagesAuditing Assignment 2Harshit VaishyaNo ratings yet

- Chapter 4 - Controls: External Audit EngagementDocument9 pagesChapter 4 - Controls: External Audit EngagementSanjeev JayaratnaNo ratings yet

- Accounting and Assurance Principles Notes - Sir PerlasDocument7 pagesAccounting and Assurance Principles Notes - Sir PerlasScarlet DragonNo ratings yet

- Aud CisDocument5 pagesAud Cisgerald paduaNo ratings yet

- AUD 0 - (Compilation Report)Document22 pagesAUD 0 - (Compilation Report)Angela Miles DizonNo ratings yet

- ACCT3101 期末双面notes (双面打印,每面8页,必须彩印)Document18 pagesACCT3101 期末双面notes (双面打印,每面8页,必须彩印)Stephanie XieNo ratings yet

- Auditing Internal Control LectureDocument35 pagesAuditing Internal Control LectureSamsam RaufNo ratings yet

- Acctg. Major 6 - Auditing and Internal ControlDocument12 pagesAcctg. Major 6 - Auditing and Internal ControlTrayle HeartNo ratings yet

- PPT 01Document36 pagesPPT 01Diaz Hesron Deo SimorangkirNo ratings yet

- Unit 2 Audit Planning and ProgrammeDocument37 pagesUnit 2 Audit Planning and ProgrammeDeepanshu PorwalNo ratings yet

- ACAUD 3149 TOPIC 1 Overview of The Audit ProcessDocument2 pagesACAUD 3149 TOPIC 1 Overview of The Audit ProcessCazia Mei JoverNo ratings yet

- Audit Procedure: UNIT-2Document31 pagesAudit Procedure: UNIT-2Ahmad HassanNo ratings yet

- Cash Flow Part 2 To 7 Term 2 Sunil PandaDocument35 pagesCash Flow Part 2 To 7 Term 2 Sunil PandaAnupama SinghNo ratings yet

- Structure and Operations of Farmer Producer Company in India With Special Reference To The State of KeralaDocument8 pagesStructure and Operations of Farmer Producer Company in India With Special Reference To The State of KeralaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

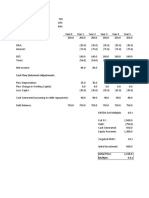

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelTrần Bảo YếnNo ratings yet

- Chapter 10 Goods Market Is LMDocument6 pagesChapter 10 Goods Market Is LMmulengaadamson00No ratings yet

- Inventory Management FinalDocument32 pagesInventory Management Finaljessa rodene franciscoNo ratings yet

- Lecture 4 - Project Management IDocument3 pagesLecture 4 - Project Management IcliffNo ratings yet

- Batteries Company, Oil and Gas Company, Manufacturing Company DUBAIDocument28 pagesBatteries Company, Oil and Gas Company, Manufacturing Company DUBAIPacific HRNo ratings yet

- Pinto pm5 Tif 03Document23 pagesPinto pm5 Tif 03Salem BawazirNo ratings yet

- Group 7 Transfer PricingDocument18 pagesGroup 7 Transfer PricingMD Hafizul Islam HafizNo ratings yet

- Module 1 - Consumer BehaviourDocument17 pagesModule 1 - Consumer BehaviourPrashansa SumanNo ratings yet

- The Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaDocument56 pagesThe Relationship Between The Usage of Xero Accounting Software and The Intellectual Capital of The Selected Companies in PampangaAlvin GalangNo ratings yet

- Depreciation ExerciseDocument7 pagesDepreciation ExerciseMuskan LohariwalNo ratings yet

- Penn World Table, Version 9.1: When Using These Data, Please Refer To The Following PaperDocument20 pagesPenn World Table, Version 9.1: When Using These Data, Please Refer To The Following PaperGloria Angelica ROJAS PENANo ratings yet

- Evaluation of Change in Credit PolicyDocument5 pagesEvaluation of Change in Credit PolicyJhunorlando DisonoNo ratings yet

- Lifelines of National EconomyDocument6 pagesLifelines of National EconomyjeffreyNo ratings yet

- Blockchain in Real Estate DevelopmentDocument6 pagesBlockchain in Real Estate DevelopmentKashishNo ratings yet

- The Economist 20 AprilDocument332 pagesThe Economist 20 AprilUsama hameed0% (1)

- CONSO FS Cost MethodDocument21 pagesCONSO FS Cost MethodMaurice AgbayaniNo ratings yet

- AEC MANUAL Class NotesDocument65 pagesAEC MANUAL Class NotesManimegalai.VNo ratings yet

- Ritesh Agarwal - WikipediaDocument30 pagesRitesh Agarwal - Wikipediapproject345No ratings yet

- 07 - Strategies For Competing in International MarketsDocument39 pages07 - Strategies For Competing in International MarketsJohnny RamonNo ratings yet

- Effects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Document82 pagesEffects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Rubie Grace ManaigNo ratings yet

- Chapter 2Document19 pagesChapter 2Kingsley AddaeNo ratings yet

- BAM 101 Introduction To Business Administration (Shakshi Shakshi)Document10 pagesBAM 101 Introduction To Business Administration (Shakshi Shakshi)shakshiNo ratings yet

- Final Report - BhoomitDocument70 pagesFinal Report - BhoomitShubham SuryavanshiNo ratings yet

Auditing & Corporate Governance (BCOM)

Auditing & Corporate Governance (BCOM)

Uploaded by

Soumya LathaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing & Corporate Governance (BCOM)

Auditing & Corporate Governance (BCOM)

Uploaded by

Soumya LathaCopyright:

Available Formats

AUDITING AND CORPORATE GOVERNANCE (BCOM)

Module I Advantages of auditing Qualities and qualification of a professional Audit working papers

Reasons for the development of professional ◆ Advantages to the business auditor Audit working papers are the documents which

audit 1. Helps in detecting and preventing errors. Professional qualification record during the course of audit. It is also

1. Renaissance 2. Introduction of double entry. 2. Helps in detecting and preventing frauds. The auditor must pass Chartered Accountant called audit files.

3. Industrial revolution. 4. Introduction of statutory 3. It ensure accuracy of books of accounts. examination conducted by ICAI. Content of audit working paper

audit. 5. Companies act, 1956. 6. International 4. It ensure authenticity and reliability of final Professional qualities 1. The trail balance 2. Schedule of debtors and

standard for accounting and auditing. 7. Court accounts. 5. It can enjoy reputation and • Knowledge of theory and practice of creditors 3. Schedule of investment 4.

judgements 8. Computer accounting. 9. Auditing goodwill of business. accountancy • Knowledge of commercial law Depreciation statement 5. Bank reconciliation

practices. 10 SEBI Act 11. Corporate governance. ◆ Advantages to the owner • Knowledge of techniques of audit • Knowledge statement 6. A draft of final account

12. Emergence of multinational companies. 1. Sole trade can rely on the audited financial of management accounting • Knowledge of cost Advantages/aim/purpose of audit working

13. Globalization. 14. Nano technology. statement. 2. Auditing assure proper mainten- accounting • Knowledge of economics papers

15. Independence of auditor. 16. Removal of ance of accounts of joint stock company Knowledge of mathematics and statistics 1. It is necessary for audit report. 2. It is a guide

restrictions on taking up audit work in US. 17. Right 3. It helps valuation of assets in admission, • Knowledge of industrial management for subsequent audit. 3. It is a valuable

to information Act. 18. The companies Act, 2013. retirement, and death of a partner. 4. Auditor Personal qualities documentary evidence. 4. It helps in

Auditing helps the management to improve functioning • Honesty • Ability to work hard • Impartial coordinating audit work. 5. It helps in controlling

The international auditing practice committee of business. • Courage and ability • Ability to communicate audit work 6. Its a historical record of work done

defines, “the independent examination of an entity, ◆ Advantages to the Society • Commonsense • Ability to maintain secrets Types of audit working papers/ files

whether profit oriented or not, irrespective of its 1. Audited statement of accounts is more • Cautious and vigilant • Ability to trace fact and 1. Permanent file

size or legal form when such an examination is reliable to creditors. 2. Income tax authority figures • Tactful • Inquisitive it is a permanent audit file of the client. It gives

conducted with a view to expressing an opinion consider audited accounts to be reliable. Audit assurance standard brief history of previous audit of the client.

thereon.” 3. Audited accounts of company create a Auditing standards means the measure and 2. Annual file

Difference between audit and book keeping confidence in the mind of investors. 4. Easily quality of audit performed by an auditor. Annual file contains details of the current years

Auditing Book keeping calculate purchase consideration on the basis General auditing standards audit program. It is also called current files.

of audited accounts. Personal Standards Standards of Audit programme

It is verification of It is the art of

Disadvantages / Limitations of auditing standard of field reporting It is a written and predetermined plan of action

accuracy of entries recording daily

1. It is costly. 2. Loss of initiative. 3. It is s work for conducting an audit.

made in the books transactions in the

mechanical. 4. Possibility of alteration. Technical Planning Conformity Types of audit programme

of accounts books of accounts

5. Impossibility of checking all transactions. standard and with accepted 1. Fixed audit programme

It is done by auditors It is done by book

6. Unsuitable for small concern 7. Rely on and supervision accounting It is a pre-planned and detailed programme of

keepers

experts proficiency principles audit. It is also called fixed or pre-determined

It is retrospective. It is of the current

Auditor as a watch dog not a bloodhound Independ Evaluation Consistency audit programme.

period

An auditor is appointed by the shareholders in ence in of internal in applicati-on 2. Flexible audit programme

It is analytical in It is constructive in case of a limited company. He is expected to An audit programme that can be changed as per

mental control of accounting

approach approach play the role of watch dog for shareholders. the need, time, nature of business and auditing

attitude principles

Auditors are Book keepers are His duty is verification not detection. If he finds standard is called flexible audit programme.

Due Sufficient Adequacy of

outsiders paid employees something suspicious he should raise to the Advantages and disadvantages of audit

professio competent information

It is at the It is a continuous shareholders. evidence programme

nal care disclosure

completion of year process In case of frauds and errors the auditor has the Advantages Disadvantages

Basic principles of auditing

Difference between auditing and accountancy duty of reasonable care only. Watch dog It defines duties of Out of date and

Basic principles of auditing are the set of rules

Auditing Accounting concept limit the scope of the audit, that it is clerk clearly useless

according to which the books of accounts of a

Where accounting Where book keeping merely verification of accounts and does not firm should be audited. It defends the Unable to cover all

ends, auditing ends. Accounting deeply cover the object of detection and • Integrity, Objectivity and independence auditor the point

begins begins prevention of fraud. To assess the cost Hurry in

• Confidentiality • Skills and competence

It is done by auditor It is done by Investigation • Documentation • Planning of audit of audit completion

accountant Investigation means an act of detailed • Audit evidence • Accounting system and internal Timely completion Not suitable for all

Auditor is an Accountant is a examination of books and accounts and control • Audit conclusion and reporting of audit types of firms

independent person permanent financial position of a business firm.

General basic principles of auditing It helps to new No chance to use

employee Objects/ purpose of investigation

• Principles of objectivity • Principles of audit staff intelligence

An auditor is An accountant is 1. When the proprietor suspects fraud 2. When materiality • Principles of independence• Effective control Rigidity

remunerated in the remunerated in the a person intend to purchase business. 3. When Principles of full disclosure • Principles of over audit staff

form of form of salary a person wishes to purchase share of a professional ethics Tick mark

professional fee company. 4. When a person wishes to lend

Basic concepts of auditing Tick marks are the symbols used during the

Auditing was a Accounting is a money to a business. 5. It maybe conducted • Evidence • Due audit care • Fare Presentation course of audit, which indicates how much of

luxury concept necessity on behalf of income tax authority.

• Independence • Ethical conduct audit works are done.

Difference between auditing and investigation Audit techniques

Objects of audit Test checking

Primary object Auditing Investigation Audit techniques are the devices, which are It means to select and examine a representative

To ensure the accounts reveal a true and fair view The purpose of The purpose of adopted in applying the basic principles and sample from a large number of similar items.

of business and its transactions. audit is to investigation varies auditing standards. Routine checking

Subsidiary objects determine true from business to Important audit techniques The process of checking posting, casting

a. Detection and prevention of errors. and fair view business 1. Vouching 2. Confirmation 3. Reconciliation balancing in ledger and subsidiary books are

b. Detection and prevention of frauds. The audit relates Investigation 4. Analysis of financial statements 5. Physical done in a routine manner are called routine

A) Detection and prevention of errors to checking of all relates to critical examination 6. Test checking 7. Scanning checking.

Errors in accounting are books and checking of 8. Verification of the posting 9. Enquiry Surprise check

a) Errors of omission records particular records Audit planning It is a technique used by an auditor. He pays

Errors of omission arises when a transaction is Auditing is Investigation is not Pre-arranging and coordinating the work of audit surprise visit to the client office and make

wholly or partly omitted being properly recorded in compulsory compulsory of a client is called audit planning. surprise checking on certain important items.

the books. The auditing is The investigation is Preliminary steps involved in audit planning Audit classification

b) Errors of commission conducted conducted after • Letter of appointment • Letter of engagement • • Audit on the basis of organizational structure

It arises when a transaction has been recorded and before the the auditing of Study nature, scope, duties • Acquire knowledge • Audit on the basis of degree of independence

wrongly entered in the original entry ledger due to investigation of accounts about business and its nature • Verification of • Audit on the basis of conduct of audit • Audit

negligence. accounts legal documents • He should obtain the list of all on the basis of specific objectives • New

c) Compensating error The person who The person who books maintained in the office. • If it is not a new generation audits

A compensating error is one which is counter conduct auditing conduct audit • Examine the accounting system • Internal Audit on the basis of organization structure

balanced by another error. is called auditor investigation called check system • Duties of the members of the Statutory audit

d) Errors of principles investigator client staff • List of principal officials• Instruction It is a legally required audit to present the fair

It arises when entries are recorded by violating The Qualification There is no specific to the client • Preparation of an audit program picture of the financial health of the

fundamental principles of accounting. of auditor is qualification for • System audit • Distribution of audit work organisation. It is a compulsory audit. Following

B) Detection and prevention of frauds chartered investigator • Preparation and submission of audit report are the undertakings in which statutory audit is

Fraud means false representation or making a accountant Audit note book compulsory

wrong entry intentionally to defraud somebody. It has a narrow It has a wide scope It is a register or dairy maintained by audit clerk a) Joint stock companies b) Banking companies

Types of fraud scope during the course of audit. It is also called audit c) Insurance companies d) Cooperative

Misappropriation of cash. Auditing is done Investigation can memorandum. societies e) Public charitable companies

Computer related fraud. at the end of the done over a period Advantages of audit note book Private audit

Functions of audit financial year of years 1. It helps to prepare audit report. 2. It is a tool for Private audit refers to the audit of accounts of

1. To ascertain system of accounting of the measuring efficiency of an audit. 3. It is a guide private business enterprises. It is not

organization. 2. To examine arithmetic accuracy of for subsequent audit. 4. It is an evidence for compulsory audit. It includes

records. 3. To assess the quality of internal future. 5. It avoid repetition of work. a) Sole trader b) Partnership c) Private

controls. 4. To verify physical assets and inventory. Disadvantages of audit note book individual

5. To make recommendations for improvement. 1. It create misunderstanding between client and

6. To determine compliances with policies and audit staff. 2. It create faultfinding attitude in the

procedures. mind of audit staff. 3. If it is not properly

maintained it considered as evidence for auditors

negligence.

ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ

AUDITING AND CORPORATE GOVERNANCE (BCOM)

Difference between company and partnership audit Audit based on special objectives Essentials of valid voucher Verification of various types of assets

Company Audit Partnership audit 1. Management audit 1. The authority of the voucher. 2. The authenticity of ◆ Cash in hand

It is compulsory It is not compulsory It is the systematic evaluation of the performance of the voucher. 3. The genuineness of the voucher. 4. The • Auditor use cash weighing machine to count cash. • He

The power, duties Defined as per management of an enterprise. It is the critical review accuracy of the voucher. 5. The correctness of the should count cash, stamps, IOU in hand. • He should check

and rights of auditor agreement. of all aspects and process of management. voucher. 6. Proper classification of accounts in to remittance from branches. • He should check purpose of

defined in 2. Cost audit capital and revenue. holding large cash balances. • Documentary evidences

companies act Cost audit is the verification of the correctness of While examine the vouchers following points must be should be verified in case of cash in transit.

Auditor is appointed Auditor is appoi-nted cost records with a view to ascertain the cost of paid special attention ◆ Cash at bank

by members by partners product. 1. All the vouchers are consecutively numbered and • Auditor should verify pass book with cash book. • He should

3. Cash audit arrange serially. 2. He should examine the date of the compare pass book with BRS. • He should obtain certificate

It is done year after It is done at discretion

year of partners It is a type of audit under which only cash vouchers. 3. He should see that information in the regarding bank balances. • He should see outstanding

transactions are audited. voucher is fully self-explanatory. 4. He should see that cheque are genuine.

The auditor must be Auditor need not hold

4. Special audit voucher is related to business in the name of the firm. ◆ Loans advanced

qualified u/s 226 of those

It is a type of audit conducted by the central 5. He should see that each voucher is original in face. 6. • He should examine loans granted through loan agreements.

companies act qualifications

government for some special objectives. The person He should accept voucher in printed form. 7. He should • He should see that loan amounts are confirmed by the

Auditor reports to Auditor reports to the

who conduct special audit is called special auditor. not accept voucher in over writing or erasure. 8. He borrower • He should examine the mortgage deal. • He should

the members partners

5. Operation audit should complete vouching work in a one siting. 9. He determine adequacy of security offered. • He should see

Government audit

It is a part of management audit. It is usually should not take help of client staff for vouching.10. He there is no change in loan agreement terms.

◆ Bills receivable

It means audit of accounts of government

conducted by external auditor known as management should see that every voucher is passed in the order by

department and offices, government companies and

consulting services. responsible officer. • He should get a list of total bills receivable. • He should see

government statutory corporations.

6. Efficiency audit Vouching of cash book that bills are properly drawn, accepted. • He should see that

Objectives of government audit

It is a type of audit conducted for the purpose of Vouching of cash book means checking of cash bills are subsequently matured. • He should enquire from the

• To ensure every payment is made as per rules. • To

increasing efficiency of the firm. It is an aid to receipts and cash payments with supporting bank regarding bills sent for collection.

◆ Debtors

ensure expenditure sanctioned by competent

management. documents.

authority. • To ensure payment made to the right

7. Detailed audit Vouching of purchase ledger • He should obtain duly certified list of debtors. • He should

person. • To verify payment made is duly entered in

It referred as continuous audit, running audit or The auditor has to check and verify the following in scrutinize accuracy of debtors list. • He should verify actual

proper books. • To verify system of granting travel

complete audit. Under this type of audit, the auditor case of purchase ledger: existence of debtors. • Sales ledger balance should be

allowances to employees. • To verify system of

checks detail all books of accounts with regular • Record of all purchase orders. • Verification of checked with debtor’s ledger.• He should see debtors shown

granting daily allowances to employees. • To ensure

intervals. quantity, price and payment terms of purchase invoice. on balance sheet are recovered. • He should see adequate

expenditure is classified into capital and revenue. • To

8. Propriety audit • Verification about goods are actually received. • provision made for bad debt.

◆ Stock in trade (Inventory)

verify existence of stock and store.

It is a part of management audit. It is treated as high Verification about proper recording of purchase bill.•

Audit on the basis of degree of independence

form of audit. Auditor should verify statement of accounts of • Auditor should examine internal check system in operation.

Independent audit

9. Performance audit suppliers. • He should check stock sheet with stock register. • He

It is also called external audit. The audit of account of

It is a part of management audit. In this type of audit, Vouching of purchase return book should examine management control of issue of stock. • He

the firm is conducted by independent professionally

auditor evaluate the performance of the firm. The auditor needs to verify following points in case of should check totals, balances and extensions of stock

qualified auditors.

10. Regulatory audit vouching of purchase return books: sheets. • He should check physical existence of stock in

Internal audit

It is conducted by private business firm. The main • He should compare credit notes with purchase return hand.

◆ Free hold property

It is an independent review of operation and other

object is to see whether every transaction is approved book. • He should examine goods outward book. • He

records of the firm.

and sanctioned by competent authority. should check entries in the purchase returns journal. • • He should verify legal existence of title deeds relating to

Audit on the basis of conduct of audit

11. Vouch and post audit He should check heavy returns at the start or end of the land. • He must verify both ownership and possession of the

1. Continuous audit

It is a diversion of detailed audit. It is a detailed year. • He should check the totals and postings to client. • He should compare ledger account with balance

It is a statutory audit. This audit is done by

examination of all transaction by auditor with the purchase returns and suppliers accounts. sheet. • He should verify deed, purchase agreement, lease

professionally qualified auditors. It is a detailed

preparation of original entry till it has been posted. Vouching of credit sales or sales book agreement etc. • He should examine brokers notes,

examination of all transactions.

New Generation audit (Recent trends in auditing) The auditor should vouch credit sales in the following auctioneers accounts etc.

◆ Plant and machinery

Advantages of continues audit

1. Inflation audit manner:

Detailed checking • Up to date accounting records •

It is the audit related to inflation accounting. The • He should apply test check. • He should check some • He should obtain schedule of plant and machinery certified

Efficient audit • Greater moral check

accounting effect of change in prices is known as invoices with orders and outward entries. by responsible officer. • He should verify adequacy of

• Preparation of interim audit • Early finalization of

inflation accounting. • He should confirm sales of capital items not included depreciation. • He should see same method of depreciation

accounts • Suggestion from auditor

2. Human resource audit in the sales. • He should confirm trade discount allowed follow year after year.

◆ Motor vehicle

Disadvantages of continues audit

It is the process of evaluating human resources is not included in sales ac. • He should send accounts

• Alteration of figures • Involves much time

programs and practices. statements to customers. • He should confirm goods • He should verify vehicle are registered in the name of client.

• Expensive • Dislocation of client work

3. Social audit on consignment is not included in sales. • He should • He should get schedule of all motor vehicles owned by the

• Mechanical • Losing the thread of the work

It is the way of measuring, understanding and check cancelled invoice against duplicate invoice copy. company. • He should see that adequate depreciation is

2. Final audit

reporting an organization’s social and ethical Vouching of sales returns provided for vehicles. • He should see that vehicles are

The final audit take place only after the end of the

performance. The auditor should vouch sales return in the following shown in balance sheet separately at cost less depreciation.

◆ Copyright

trading period. All the transactions for the whole year

4. Energy audit manner:

completely recorded and balanced.

It is an inspection survey and analysis of energy flows • He should vouch sales returns entries with stock • He should verify copy right agreement. • He should obtain

Advantages of final audit

for energy conservation. register. • He should verify the copy of the credit note schedule of copyright. • He should see that copyright are

• Less audit cost • Take only reasonable time

5. Peer review issued to customer. • He should check posting from shown in balance sheet separately at cost less depreciation.

◆ Goodwill

• Not mechanical • No dislocation in the work of client

It is a supervision audit. It is an audit of auditor’s sales returns book to customer ledger. • He should

• Not require large audit staff

performance. verify customer returns at the start and end of the year. • He should verify purchases agreement to ascertain value of

Disadvantages of final audit

6. Forensic audit Verification of assets and liabilities goodwill. • He should see written off in accordance with

• Suitable for small firms only • More depend ontest

It is a detailed examination and evaluation of financial It means examination of establishing truth as existence, resolution of board.

◆ Loose tools

checking • Errors and fraud remains • Unhealthy delay

and non-financial records to collect evidences that ownership, possession and valuation of assets and

in report time • Does not help preparation of interim

can be used in a court of law. liabilities in the balance sheet. • He should obtain loose tools register. • He should verify

accounts

7. Environment audit Difference between vouching and verification receipts of issue of loos tools. • He should see that loos tools

3. Balance sheet audit

It is a type of audit which provides an assessment of Vouching Verification are shown in balance sheet separately at cost less

It is a type of audit. In this type auditor verify balance

environmental performance of a business or It examine all the It examine assets and depreciation.

◆ Live stock

sheet items such as capital, liabilities, reserves,

organisation. business transactio- liabilities

Provisions, assets and other items given in the

Module II ns recorded in the appearing in the • He should obtained schedule of livestock. • He should

balance sheet.

Vouching original entry balance sheet compare livestock register with schedule. • He should verify

4. Interim audit

It means a careful examination of the original It is based on It is based on both livestock are revalued annually.

It is a type of audit conducted in between two annual

documentary evidence such as invoice, receipts, documentary physical & docume- Verification of various types of liabilities

◆ Sundry creditors

meetings.

minutes, contracts etc. evidence ntary evidence

Advantages of interim audit

Objectives of vouching Work done by junior Work done by auditor • He should obtain schedule of creditors from management. •

1. Easy to find out interim results. 2. It helps to

1. To ensure transactions pertain to the business staff himself He should compare creditor amount with balance of creditor

declare interim dividend. 3. Errors and frauds are

only. 2. To detection and prevention of errors and It is not include It include valuation of ledger. • He should verify purchase and purchase return

quickly detected. 4. It imposes moral check as the

frauds. 3. It pertains to the year under audit. 4. The book• He should verify goods inward book

valuation of assets assets

◆ Bills payable

client staff. 5. Final audit can be completed quickly.

Disadvantages of interim audit transactions are properly authorized and are genuine. It take place first It take place after

5. No transaction has been omitted in the books. • He should verify bills payable from bills payable book.

1. More expensive. 2. Dislocation of work of client vouching

Vouchers • He should examine the bills payable retired under rebate.

It is continuous and It is one at the end of

◆ Bank overdraft

staff. 3. It required more detailed and exhaustive

checking. 4. It creates additional work of audit. 5. It is Vouchers is documentary evidence, in support of throughout the year the year

transactions in the books of accounts. • He should verify overdraft agreement with bank. • He should

easy to alter already audited figures. 6. Suitable for Objectives of verification of assets and liabilities

Types of vouchers check the pass book and cash book.• He should verify

large firms only. 1. To ensure assets and liabilities shown in the balance

1. Primary vouchers whether overdraft is secured or unsecured.

◆ Loans

5. Occasional audit sheet actually exist. 2. To satisfy that auditor assets

If the sole trader or partners conduct an audit for a Primary vouchers are original vouchers. They are and liabilities are properly valued. 3. To ensure that

written or printed, or typed evidence in original. • He should verify loan agreement. • He should see that loans

specific object on special occasion such audit are assets are actually the properties of business. 4. To

Example: Cash memos, Invoices. Pay in slip and advances shown in balance sheet. • He should verify

called occasional audit. ensure liabilities are actually held. 5. To verify that they

2. Secondary vouchers whether loan is secured or unsecured.

◆ Debentures

6. Partial audit are free from any mortgage. 6. To see that assets and

It is a type of audit, which is carried out in respect of When original voucher is not available copy of the liabilities are properly classified. 7. To detect fraud and

original evidences are produced in support or • He should verify memorandum and articles of the company.

specified aspect of books of accounts of the business check arithmetical accuracy of posting.

subsidiary evidence such vouchers are called • He should verify debenture trust deed. • He should obtain a

7. Standard audit

secondary or collateral vouchers. certificate from debenture holders to verify amount of

It is a type of audit rarely conducted in business firms.

Example: Bank reconciliation statement, copy of sales debenture issued

Under this type certain items in the accounts are

thoroughly scrutinized and analyzed. memo.

ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ

AUDITING AND CORPORATE GOVERNANCE (BCOM)

Valuation of assets and liabilities Module III Internal check regarding cash transactions Rights and powers of an auditor

It means estimation of various assets and liabilities. Internal control ◆ Cash receipts 1. Right to access books of accounts and vouchers.

It is the duty of the auditor to confirm assets and It is an overall control system of the internal • There should be separate cashier to deal with 2. Right to visit branches. 3. Right to obtain

liabilities appear in the balance sheet in fair value. management. In this system number of checks and cash receipts. • Cash received should be entered information and explanation. 4. Right to correct

Valuation of different assets control exercised in the business to ensure its efficient through a rough cash book. • All receipts should wrong statement. 5. Right to have legal and

◆ Fixed assets and profitable working of the firm. be banked daily •BRS should prepared to reconcile technical advice. 6. Right to be indemnified. 7. Right

They are acquired for permanent use of business. Internal audit cash and bank transactions.• All unused receipt to receive remuneration. 8. Right to sign the audit

The utility of this asset is for long period. Eg: Plant, It is an independent review of operation and other book should be kept by responsible officer • There report. 9. Right to receive notice and attend general

machinery, land, building, motor records of the firm. should be separate arrangement for custody of meeting.

vehicle, furniture etc. Objectives of internal audit B/R. • All cash receipts should be acknowledge by Duties of an auditor

• Fixed asset valued at cost less than reasonable 1. To ensure efficient conduct of business. 2. It is an printed receipts. Statutory duties

depreciation.• Provision for depreciation on fixed independent review of operational performance. ◆ Cash payments 1. Duty to make enquires. 2. Duty to report on

asset is necessary. 3. Completeness and accuracy of final accounts. 4. To • There should be a separate paying cashier. • He accounts audited by him. 3. Duty to report for

◆ Current assets keep control overall activities of the organization. should not have access to the ledgers. • In case prospectus. 4. Duty to certify declaration of clarity.

They are acquired for resale or converting them into 5. To verify organizations policies and procedures. 6. To of petty transactions, impressed system is 5. Duty to assist inspectors. 6. Duty to assist public

cash. They are purchased for a short period. Eg: keep a checks on errors. followed. • Petty cash payment must made to the prosecutors. 7. Duty according to the direction of

Stock, debtors, bills receivables, cash in hand, cash Features of internal audit petty cashier only. • All payments Is to be made central government.

in bank 1. It is compulsory. 2. It is continuous audit. 3. It is by proper authority. • Acknowledgement shall be Duties arising out of common law

• Cash and bank balance no valuation required suitable for large business organizations. 4. It is obtained for all payments made. • All cancelled 1. To ascertain unutilized capacities of the industry.

• Debtors are valued at book value.• Provisions for generally conducted by own employees of the firm 5. Its cheques must be destroyed • Unused cheque 2. Extent of over stocking stores. 3. Position of

bad and doubtful debts proceed for book debt. object is vary from business to business. 6. It is book should be kept under lock and key. current assets.

• Raw material valued in FIFO and LIFO method. conducted to ascertain internal control system. ◆ Petty cash Duties arising out of professional etiquette

• Closing stock valued at cost or market price, Advantages / Merits / Benefits of internal audit • Separate person appointed for dealing petty 1. Auditor should carry his duty to public interest.

whichever is lower. 1. Helps to identify accounting errors. 2. It makewinds cash payments. • Petty cash book should kept on 2. Auditor must be honest, competent and

◆ Intangible assets final audit easier. 3. It helps to maintain better impressed system. •Petty cash book maintained independent. 3. He should disclose all material facts

Intangible assets are those assets which cannot be management. 4. It promotes proper use of resources. on analytical form. • No petty cash payments related to firm. 4. He should strictly follow rules

seen or touched. They are not visible in physical 5. It increases efficiency of the firm made without proper voucher. • Petty cashier formulated by ICAI.

form. Eg: Goodwill, copyright, patent, trademark. Disadvantages / Demerits of internal audit should not give any amount other than imprest Duties imposed by court

• These assets are shown at cost price. • These 1. It is not useful for external reporting 2. It is not system. • All vouchers must be properly filed and 1. It is the duty of the auditor to check stock

assets treated as fixed assets for the purpose of suitable for small firms. 3. It is expensive. 4. It is time kept under the custody of petty cashier. properly. 2. He should perform his duties with

valuation. consuming. 5. It involves chances of errors. ◆ Cash sales proper care and skill. 3. He should examine the

◆ Wasting assets Difference between internal check and internal audit a) Sales over the counter terms of debenture trust deed. 4. He should

Wasting assets are fixed in nature which are Internal check Internal audit • Separate salesman should be appointed for physically count cash on the last day of financial

depleted gradually in process of earning income. Eh: The work of one clerk is The work of one clerk each counter. • A specific number may be allotted year.

Mines, quarries, oil wells, etc. • Wasting assets are automatically checked checked by another for every salesman. • Different numbers should be Liabilities of an auditor

shown in original cost in balance sheet • Provision is by another after the former has used for different counters. • Each salesman Civil liability

made for depreciation and depletion. at the same time. completed the work. should be provided with sales memo book. 1. Liability for negligence 2. Liability for

◆ Fictitious assets It minimize errors and It detect errors and • Sales memo provided different counters of misfeasance

Fictitious assets are huge revenue expenditure that frauds. frauds. different colors. • The sales memo prepared by Liabilities under companies Act

has been capitalized with the object of spreading the counter sales man should be checked by 1. Liabilities for misstatement in the prospectus

No separate staff Specially appointed.

amount to number of years. Eg: Special another officials. • Total amount of cash sales 2. Untrue statement in prospectus 3. Failure to

appointed

advertisement cost, preliminary expenses, should be entered in the general cash book. assist investigation 4. Failure to return property,

It is for internal It is for top

debenture discount. • These have no exchange b) Sales by travelling agent books or papers 5. Penalty for falsification of assets

management management.

value • Every year, a portion of these expenditure are • He should not allowed to collect cash from 6. Penalty for deliberate act of commission or

It is treated as an It treated

written off in P&L ac. customers. • He should not allowed to meet any omission

instant audit management audit.

Valuation of different liabilities expense in connection with sales. • Final receipts Criminal liability

◆ Current liabilities

Itis a continues process It is done periodically

of cash collected should issue by head office. • 1. Falsification of any books or material 2. Liability

These are the liabilities of the business, which are Internal check The head office should be informed about for frauds

short term liabilities. They are settled with a period Internal check simply refers to an arrangement of balance over due by customers. • Reminder to the Audit report

of one year. Eg: Creditors, Bills payable, outstanding transactional work amongst the members of the staff. customer should be sent by head office.• He It is a written document which present the purpose,

expenses. Objectives of internal check should be instructed to submit periodical scope and result of the audit.

◆ Fixed Liabilities 1. It is the division of work among the staff. 2. It prevent statements of sales. • He should not be allowed Qualities of a good audit report/ Characteristics

These are the liabilities of the business, which are errors and frauds.3. Errors and frauds are automatically to continue work for a long period in the same 1. It should be based on fact. 2. It should not be

long term liabilities. They are to be settled in long discovered. 4. Work of one staff automatically checked area brief and not lengthy. 3. It should be free from

term basis. Eg; long term loans, long term deposits by another. 5. No staff allowed to do any single work. c) Postal sales/ sales under mail order business mistakes. 4. It should express the opinion of the

accepted. Advantages of internal check • There should be separate section in sales auditor. 5. It should exhibit true financial position of

◆ Contingent liabilities Advantages to the owners department to deal with postal transactions. the company 6.it should reflect the result ofthe audit

These are liabilities which are not actual liabilities, 1. It provide accurate and reliable accounting records. • Separate VPP register should be maintained. Content of audit report

but which may become an actual liability on 2. It leads to better efficiency and economy in operation. • Proper records should be maintained for goods • If Identification of financial statement being

happening or non-happening of a future event. Advantages to the business returned by customers. • Total amount received in audited. • If proper books of account have been

Contingent liabilities 1. Division of work 2. Early detection of errors and a day should deposited into bank •A proper officer kept. • If accounts of branches have been audited.

A contingent liability is one, which is not a real frauds 3. Preparation of final accounts 4. Fixation of should check VPP register frequently. • Order • If balance sheet are in agreement with books of

liability but it will became an actual liability on responsibility 5. Makes audit work easy received for postal sales should be properly filed. accounts. • If any other statement included as

happening or non-happening of an event. Advantages to the auditor d) Online trading required by government. • Certificate of corporate

Characteristics of contingent liability 1. No need for detailed checking 2.Rely on test checking •Auditor verify the list of all. •Close examination of governance.

• Uncertain • Conditional • It involves additional Disadvantages/ limitations of internal check credit money register. • Verify amount of e-money Types of audit report

expenditure • Actual liability on happening of an 1. Not suitable for all firms 2. Sacrifice the quality of received. 1. Clean report

event • It may be a past or possible future act work 3. Tends to slacken efforts 4. It create chaos and Internal check regarding purchase return If the auditor satisfy the affair of the company and

Window dressing disorder 5. Risky for auditor • A separate return outward book is maintained. the fairness of the final accounts of the company,

It means manipulation done by the management of Essentials of good internal check system/ How to plan • Record return of goods to supplier’s in return the auditor issue clean report. It is also called

the company in the financial statements in order to a good internal check system? / Principles of internal outward book. • A statement should prepared by positive, unqualified and conventional report.

present more favorable picture of the company. check system stores department for goods return. • Purchase 2. Qualified report

Window dressing done through following ways 1. The system should be practical and simple. 2. The department should check goods and prepare If the auditor does not satisfy the affair of the

• Increase the inventory value. • Postponement of system should be economical. 3. The system should be advice notice. • All incoming credit notes should company and the fairness of the final accounts of

purchase of fixed assets. • Selling a fixed asset or carefully designed and suitable to nature of business. be numbered and stamped. • Responsible officer the company, the auditor issue qualified report. It is

cash. • Paying of current liabilities. • Considering 4. Careful selection and proper training should be should examine the credit note. also called negative report.

short term liabilities as long term. provided. 5. Division of work among staff should be Internal check regarding credit sales Audit certificate

Difference between verification and valuation allowed. 6. Rotation of employees should be made. • There should a separate department to deals It is a certificate of truth of the statement that the

7. Proper register should be provides. 8. Annual stock with credit sales.• All orders received should be auditor makes. It is a written confirmation of the

Verification Valuation

verification should be done. 9. The internal check numbered. • All orders received should record accuracy of affairs of the company.

Verification includes Valuation is a part of

system should be flexible. 10.Budgetary control system orders receivable book. • Separate record is Audit committee

valuation verification

should be established. maintained for different orders. • Credit sales is Audit committee is an independent committee

Auditor verify Ensure value of

Difference between audit report and audit certificate allowed only for minimum period. • A copy of cash formed with the board of directors of the company

existence of assets assets shown in the

Audit report Audit certificate order should be send to dispatch section. to oversee financial reporting and disclosure.

balance sheet are

It is an expression of It is a certificate of truth • The entries should be made in sales day book. Role of auditor in audit committee

correct

opinion of financial • Sales day book should be checked by • Implementation of accounting policies and

It is done by the It is done by

statements responsible officer. practices. • To make suggestion for strengthening

auditor management team

It is based on facts, It based on fact, figures Internal check regarding sales return internal control system. • Provide requirements and

It is made at the end It is made

estimates and supported by • All goods returned should be recorded in goods issue certificate of governance. • Assisting

of the year throughout the year

assumptions documentary evidence inward book. • All sales return are approved by management for better standard of governance.

It is the final work It is the initial work

It is only a test not It is a guarantee of truth responsible officer. • Credit note should be

The auditor is In this case there is

guarantee prepared and signed by responsible officer. • The

guarantee in the no such guarantee

The scope of report is The scope is limited. details of credit note should be entered in sales

case of verification

large returns book.

ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ

AUDITING AND CORPORATE GOVERNANCE (BCOM)

Tax audit Module IV Board Committee Module V

Tax audit refers to verification of books of Corporate governance Board committee is a committee identified or formed by Major corporate governance failure

accounts maintained by a tax payer. The purpose Corporate governance may be defined as a broad range the board with the objective of supporting the board work. • BCCI (UK) • Maxwell communication • Enron USA

of tax audit is to validate income tax of policies and ethical practices which are adopted by an a. Audit committee • Satyam computers services ltd • Tata finance

computation made by the tax payer. organization in its dealings with the stakeholders. It is the one of the standing committee formulated by the • King fisher airlines

Objectives of Tax Audit Importance of corporate governance board. ◆ BCCI (UK)

• To ensure books of account of the assessee 1. Protect stakeholders. 2. Attract investors. Functions of audit committee Bank of credit and commerce international was an

are properly maintained. • To assist assessing 3. Promotes accountability. 4. Mitigate risk. • Appointment and removal of external auditor international bank established in 1972 by Agha

officer in computing total income of the 5. Ensure compliance. 6. Improve efficiency. • Observing of internal audit policies and its Hasan Abedi, a Pakistani financier. The bank was

assessee. • To enable proper assessment of tax 7. Ensure corporate social responsibility. implementation. • Connecting link between internal and established with the objectives of serving the need

by the department to reflect through income of Benefits of corporate governance external auditor. • Proper financial reporting • Performing of the Asian and third world countries.

the tax payer. • To ensure assessment are made ◆ Benefits to society internal control •Compliances with law and procedures. Reason for BCCI failure

simpler and faster. • To facilitate administration • It avoids banking crises and economic stability b. Nomination and remuneration committee • Lack of vigilance by the regulators • Supremacy of

of tax law by a proper presentation of accounts. • Provide larger and liquid capital market • More inflow of It is the standing committee of the board. The main the promoter • Lack of attention of auditors •

Management audit fund • It eliminates corruption • Development of better objective is to review the composition of full board and Laziness of the board

It is the systematic evaluation of the corporate strategy • Improvement of management check the expertise of the board. ◆ Maxwell communication

performance of management of an enterprise. It ◆ Benefits to corporations Functions of nomination committee Maxwell communication Ltd was a renowned British

is the critical review of all aspects and process • It avoids fraud • It follows law and regulation • It • Identify the qualified person to be a director. media company. It was established in 1964.

of management. improves rating grade • It improves the competitive • Appointing and removal of a board member. Reason for Maxwell communication failure

Objectives of management audit advantages • Shareholders interest will be taken care • Director’s performance evaluation. • Setting standards. • • Concentrated ownership • Inefficient board •

1. To ensure smooth running of business. 2. To Theories of corporate governance Succession planning. Unethical usage of professional standards • High

identify overall objectives of organization. 3. To 1. Agency theory c. Stakeholders relationship committee rate of borrowing • Lack of transparency in transfer

ensure optimum utilization of human resources. Agency theory defines the relationship between the It is established in accordance with company’s of asset • Issues in audit

4. To ensure proper utilization of physical principals and agents. Here the principle is the constitution to ensure statutory fiduciary and regulatory ◆ Enron USA

facilities. 5. To assist all level of management. shareholder and agent is the board of directors. responsibilities. Enron scandal was the largest of all corporate

6. To pinpoint deficiencies in functional areas. 2. Stewardship theory d. Corporate social responsibility committee accounting scandal which has surprised the entire

7. To suggest improved methods for managerial Under this theory manager act as a steward. Steward It is a committee to ensure corporate responsibility corporate world. The company was specialized in

operations. protect and maximizes shareholders wealth through firm practices in an organisation. natural gas, electricity marketing, energy and other

Features of management audit performance. The role of management is to facilitate and Credit Rating physical commodities.

1. It is purely voluntary in nature. 2. It is explore. Credit rating is an opinion of a particular credit agency Reason for Enron USA failure

performed on continuous basis. 3. No 3. Stakeholders theory regarding the ability and willingness of an entity. • Misleading accounting policies and practices

professional qualification required for This theory incorporated the accountability of Rating agencies • Hides huge amount of debts

management auditor. 4. The management management to a board range of stakeholders. According These are the independent financial service agency which ◆ Satyam Computers Services Ltd.

auditor submit report to management. 5. It is to this theory stakeholders are eligible for fair return from provides different types of rating to the organization. Satyam computers was one of the largest software

performed for a specific purpose. 6. Approach of the organization. Corporate governance rating development and Consultancy Company in India. It

management audit objective and constructive. 4. Resource dependency theory It is the evaluation or assessment of the system through was incorporated in 1987 as a private sector company

Advantages of management audit This theory focuses on the role of board of directors in which an organization is managed. Reasons for Satyam Computers failure

1. It help management to achieve target. 2. It is a providing access to resources needed by the firm. Hence, Global rating agencies • Misrepresentation of facts • Embezzlement of fund

good tool for management control. 3. It ensure the owners have to appoint resourceful directors into the • Moody’s Investors service • Insider trading • Accounting malpractices • Lack of

optimum utilization of men and material. 4. It board. It is a credit rating agency in New York to provide credit vigilance by auditors.

identify overall objectives of the enterprise. 5. It Models of corporate governance services across the globe and also to provide financial ◆ Tata Finance

ensure coordination among different 1. The American Model analysis. It is one of the company operated and owned by

departments 6. It ensure smooth running of It is a rule based model. This model gave emphasize on • Standard and Poor’s (S&P) Tata group, India’s largest and most social

business. 7. It pinpoint deficiencies in functional interest of shareholders, management and directors. It is S&P global is one of the global financial service agency responsible business group. It was incorporated as a

areas. also known as Anglo-Saxson model. In this model the provides various financial services to the global capital private limited company in 1984, later converted into

Limitations/ disadvantages/ criticism of chairman and CEO of the company will be one & the same market. public limited company.

management audit 2. United kingdom Model • Fitch Rating Reason for Tata Finance failure

1. It is a costly affair. 2. It is expensive, so no It is a principle based model. This model is mandatory to It is an international credit rating agency at New York. It • Poor investment policies by the management.

suitable for small firms. 3. It does not have a well follow code of governance. There is a clear separation provides all the rating services that generally done by any • Insider trading by the company executives.

-defined scope. 4. It locks management in taking between chairman and CEO. Self-regulation and credit rating agencies. • Backdated sales • Concealment of material facts.

risky decisions. compliance is voluntary in this model. Itis also called National Rating Agencies ◆ Kingfisher Airlines

Qualities of a management auditor commonwealth model • CRISIL Kingfisher airlines was a privately owned airlines

1. He should have knowledge in management. 2. 3. Continental European Model CRISIL is the first credit rating agency in India established company in India. This company played a significant

He should have knowledge in accounting. 3. He It is a rule based model. It is very common in European in 1987. It provides independent rating services to role in Indian aviation industry. It was the second

should have knowledge in marketing. 4. He countries. It is a two tier model. One is management corporate instruments. largest company in Indian aviation industry.

should have knowledge in economics. 5. He board dominated by top mangmnt and the other is • CARE Reason for Kingfisher Airlines Failure

should have knowledge in various tax laws. supervisory board dominated by employees. CARE rating is considered to be the second largest credit • Luxurious service in flight travel • High fuel prices

6. He should have ability to hard work 7. He 4. Japanese business network model rating agency in India. It provide independent rating • Adverse government policy by taxation

should be impartial. 8. He should have courage It is popularly known as Keiretsu. In this model financial regarding quality and the extent to which they have • Competition from other airlines.

and ability to discharge duties. institution plays an important role in governance adopted the corporate governance. Corporate governance problems/ Reasons for

Difference between financial audit and mechanism. This model follow • ICRA corporate governance failure

management audit stakeholders approach. Investors does not have a crucial ICRA is a leading credit rating agency. It provides various • Regulators mistake • Supremacy of the CEO

Statutory audit Management audit role in this model. grading services of financial instruments and assess • Lack of vigilance by auditors • Incompetent board

Compulsory Not compulsory 5. Asian family based model corporate governance practices. • Misleading accounting policies • Insider trading

Appointed by Appointed by a. Overseas Chinese model: E-governance • Poor investment policies • Exorbitant rate of

shareholders management They follow a paternalistic style of management. In this It is the usage of information and communication interest • Concentrated ownership

Conducted by Conducted by a model, families own the equity stake of the company. The technology by the government to provide and facilitate Cadbury Report on Corporate Governance

qualified chartered team of mangemnt board plays only a supportive role in decision making. government services, exchange of information, The Cadbury report is published in December 1992.

accountants experts b. Chaebol model communication transaction etc. Adrian Cadbury is the chairman of Cadbury committee.

It review historical It concerned with In this South Korean model, power is vested with a family. Green governance The major recommendations of Cadbury reports are

records past and future They will have great influence in government. The board It is a systematic life cycle approach for ensuring the as follows:

activities have limited role in the affairs of the business. The sustainability of the business. • A single person should not be vested with the

number of family members always exceeds the Objectives of green governance decision making power. • The non-executive

Report submitted Report submitted

independent directors. • To ensure sustainable development • To control the directors should act independently. • A majority of

to the shareholders to the mangmnt

Insider trading human intervention • To permit the companies for online directors should be independent non-executive

Accountable to Answerable to

It is an unlawful act when the insiders are using the complains • To conserve non- renewable natural directors • The term of the directors can be extended

shareholders management

unpublished information’s for their self-benefits. resources beyond three years only after the prior approval of

Difference between cost audit and management

Reason for controlling insider trading Features of green governance the shareholders. • The remuneration of the

audit

•To protect the interest of investors •To protect • Separate board committee • Distinct corporate directors should be both fair and competitive.

Cost audit Management audit governance code • Appointment of independent directors

reputation of the company • To maintain confidence in Codes and standards of corporate governance

Compulsory audit Not compulsory the stock market • To maintain stability in the financial • Reporting of disclosure • Board composition • Board development

Conducted by Conducted by a system Green governance initiative in India • Shareholders relations • Remuneration

qualified chartered team of Clause 49 listing agreement • E-certification of forms by professional • E-voting • Accountability • Audit

accountants or management The clause 49 has laid down seven conditions that are • Video conferencing facility for shareholders

cost accountant experts furnished by the listed companies in order to ensure their • Video conferencing facility for directors • Online

Limited scope Wider scope listing in the official list of stock exchanges. application and online fee payment • Issue of e-certificate

It covers period of It covers more than Provisions under clause 49 agreement by using digital signature

one year one year • Board of directors •Audit committee • Subsidiary Shareholders activism

Report submitted Report submitted companies • Disclosures • CEO/CFO certifications It is simply refers to shareholders intervention in the

to government to management • Report on corporate governance • Compliance affairs of the company.

Class action suit Reasons for shareholders activism

It is the law suit against the company or individual against 1. Self-dealing 2. Fragile management 3. Lack of

by plaintiff. transparency Objectives of shareholders activism 1. To

Whistleblowing act as monitor of management 2. To protect the interest

It is the act of reporting malpractices within an of the shareholders 3. To ensure accountability and

organization to the internal or external parties. transparency

ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ | ʀᴀsʜɪᴅ_ᴠᴇɴɢᴀʀᴀ

You might also like

- PIMCO COF IV Marketing Deck - Israel - 03232023 - 5732Document64 pagesPIMCO COF IV Marketing Deck - Israel - 03232023 - 5732moshe2mosheNo ratings yet

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- The World Nuclear Supply Chain: Outlook 2030 (2014)Document198 pagesThe World Nuclear Supply Chain: Outlook 2030 (2014)Greg KaserNo ratings yet

- Atal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Document2 pagesAtal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Rising Star CSC67% (3)

- Solution - Numericals Market Structure PDFDocument4 pagesSolution - Numericals Market Structure PDFpiyush kumarNo ratings yet

- Standard Purchase Agreement For Real Estate - BPDocument2 pagesStandard Purchase Agreement For Real Estate - BPMJ Aramburo100% (1)

- LU292 - ExternalvsInternalAuditsDocument1 pageLU292 - ExternalvsInternalAuditsAna LemosNo ratings yet

- Chapter 02 AnsDocument9 pagesChapter 02 AnsDave Manalo100% (1)

- Lesson 5 - Audit Planning PDFDocument4 pagesLesson 5 - Audit Planning PDFAllaina Uy BerbanoNo ratings yet

- Chapter 3 General Types of Audit - PPT 123915218Document32 pagesChapter 3 General Types of Audit - PPT 123915218Clar Aaron Bautista100% (2)

- Unit - 3: 1.preparation Before The Commencement of AuditDocument12 pagesUnit - 3: 1.preparation Before The Commencement of AuditNaga Raju DudalaNo ratings yet

- Chapt. 2 - The Professional StandardsDocument31 pagesChapt. 2 - The Professional StandardsJanna Hazel Villarino VillanuevaNo ratings yet

- Audit PlanningDocument21 pagesAudit Planningablay logeneNo ratings yet

- Lesson 5 - Audit PlanningDocument4 pagesLesson 5 - Audit PlanningAllaina Uy BerbanoNo ratings yet

- Auditing and Corporate Governance-JurazDocument47 pagesAuditing and Corporate Governance-JurazShami100% (3)

- Auditing Full Notes Auditing Full NotesDocument15 pagesAuditing Full Notes Auditing Full NotesMonikamit Tushir67% (3)

- 2017-1 Acct7103 01 L-BB PDFDocument7 pages2017-1 Acct7103 01 L-BB PDFStephanie XieNo ratings yet

- Auditing NotesDocument9 pagesAuditing NotesShubham Khess100% (1)

- PrologueDocument4 pagesPrologueVivek SuranaNo ratings yet

- Audit Management: Gede Leo Nadi Danuarta Kevin Harijanto Caren Angellina MimakiDocument15 pagesAudit Management: Gede Leo Nadi Danuarta Kevin Harijanto Caren Angellina MimakiLeo DanuartaNo ratings yet

- Aud1206 Operation Auditing Midterm ReviewerDocument3 pagesAud1206 Operation Auditing Midterm ReviewerJazmine Arianne DalayNo ratings yet

- Chater OneDocument12 pagesChater OneFasiko AsmaroNo ratings yet

- Cost 1 Chapter OneDocument12 pagesCost 1 Chapter Onealemuayalew01No ratings yet

- AUD 0 - (Compilation Report)Document21 pagesAUD 0 - (Compilation Report)Angela Miles DizonNo ratings yet

- Chapter 1: Auditing and Internal ControlDocument19 pagesChapter 1: Auditing and Internal ControlJeriel Andrei RomasantaNo ratings yet

- Revision Week: Auditing and Assurance 2 21 Mar 2019Document56 pagesRevision Week: Auditing and Assurance 2 21 Mar 2019Fatimah AzzahraNo ratings yet

- Auditing - Introduction To Auditing NotesDocument2 pagesAuditing - Introduction To Auditing NotesCharlize Natalie ReodicaNo ratings yet

- Michel Audit ManajemenDocument15 pagesMichel Audit ManajemenLeo DanuartaNo ratings yet

- TugasDocument11 pagesTugasSarah Sri KurniasihNo ratings yet

- Auditing For Non-AccountantsDocument229 pagesAuditing For Non-AccountantsRheneir Mora100% (2)

- Chapter TwoDocument38 pagesChapter TwoGemechu GuduNo ratings yet

- 74949bos60526 cp16Document37 pages74949bos60526 cp16Shivam KumarNo ratings yet

- Lesson 2 - Audit PlanningDocument24 pagesLesson 2 - Audit PlanningrylNo ratings yet

- QMS Internal Auditor TrainingDocument43 pagesQMS Internal Auditor TrainingJan Francis Wilson MapacpacNo ratings yet

- Course OutlineDocument3 pagesCourse Outlinefekadegebretsadik478729No ratings yet

- Audit and Assuarance C1Document62 pagesAudit and Assuarance C1Phạm Mình CongNo ratings yet

- Overview of The Audit Process and Pre Engagement Activities AsuncionDocument7 pagesOverview of The Audit Process and Pre Engagement Activities AsunciontjasonkiddNo ratings yet

- Part 2 For StudentsDocument34 pagesPart 2 For StudentsLea JoaquinNo ratings yet

- LECTURE 2 - Chapter 3 - AUDIT PLANING & TYPES OF AUDIT TESTSDocument34 pagesLECTURE 2 - Chapter 3 - AUDIT PLANING & TYPES OF AUDIT TESTSamyNo ratings yet

- 1498721945audit JoinerDocument70 pages1498721945audit JoinerRockNo ratings yet

- 1 - Overview of AuditingDocument13 pages1 - Overview of AuditingZooeyNo ratings yet

- Auditing Theory Cabrera 2010 Chapter 03Document8 pagesAuditing Theory Cabrera 2010 Chapter 03Squishy potatoNo ratings yet

- General Types of Audit: Review QuestionsDocument8 pagesGeneral Types of Audit: Review QuestionsUnnamed homosapienNo ratings yet

- Assets Increase Decrease Liabilities Decrease Increase Equity Decrease Increase Expense Increase Decrease Income/revenue Decrease IncreaseDocument25 pagesAssets Increase Decrease Liabilities Decrease Increase Equity Decrease Increase Expense Increase Decrease Income/revenue Decrease IncreaseJerome Eziekel Posada PanaliganNo ratings yet

- Bir Letter of IntentDocument8 pagesBir Letter of IntentHarvey RiveraNo ratings yet

- ACCA TTT 2020 - Audit and Assurance - KeypointDocument83 pagesACCA TTT 2020 - Audit and Assurance - Keypointyen294No ratings yet

- Sarah Sri Kurniasih - C1I021010 - Assignment Summary Topik Chapter 1-6Document13 pagesSarah Sri Kurniasih - C1I021010 - Assignment Summary Topik Chapter 1-6Sarah Sri KurniasihNo ratings yet

- PowerPoint PresentationDocument15 pagesPowerPoint PresentationMOHAMAD AMIRUL AINAN BIN BASHIR AHMAD MoeNo ratings yet

- Chapter 1Document34 pagesChapter 1Nurfatihah YusuffNo ratings yet

- Auditing Theory Cabrera 2010 Chap 2Document8 pagesAuditing Theory Cabrera 2010 Chap 2Squishy potatoNo ratings yet

- Chapter 03 AnsDocument7 pagesChapter 03 AnsDave ManaloNo ratings yet