Professional Documents

Culture Documents

Financial Analysis: BALANCE SHEET (Construction Period) Liabilities Amount Assets Amount

Financial Analysis: BALANCE SHEET (Construction Period) Liabilities Amount Assets Amount

Uploaded by

ayushcool_00079934Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis: BALANCE SHEET (Construction Period) Liabilities Amount Assets Amount

Financial Analysis: BALANCE SHEET (Construction Period) Liabilities Amount Assets Amount

Uploaded by

ayushcool_00079934Copyright:

Available Formats

FINANCIAL ANALYSIS

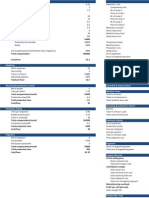

BALANCE SHEET (Construction Period)

Liabilities

Promoters Capital

Parent Company Captial

Amount

Assets

8000000 Machinery

42000000 Furniture

Cash In Hand

Cash at Bank

Amount

2000000

1500000

8000000

38500000

50000000

50000000

COST SHEET (Operating Year)

Particulars

Cost Per Unit

Total Cost

Raw Material

Direct Labour

Direct Expenses

Prime Cost

985

40

25

950

39400000

1600000

1000000

42000000

Power and Fuel

Repair and Maintenance

Depreciation Of Machinery

Depreciation Of Furniture

Loose Tools

15

4

0.47

0.31

0.01

600000

160000

18800

12400

400

Work Cost

969.79

42791600

Salaries of supervisor

Remuneration to MD

Cost of production

2

13

984.79

80000

520000

43391600

Advertisement expenses

Sales Commission

Travelling Expenses

5

2

8

4923950

38467650

200000

80000

320000

Cost of Sales

1099.79

39067650

Profit

400

14000000

Less: Closing Stock

(984.79*5000)

60

Selling price

52500000

1500

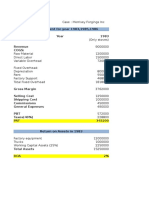

MANUFACTURING ACCOUNT

Particulars

To Work in

progress(opening)

TO Raw Materials

To Direct Wages

To Direct Expenses

To Factory Overheads

Power and fuel

Amount

Nil

Particulars

Amount

By Work in Progress

39400000 By Cost of Production

1600000

1000000

600000

42600000

Nil

42600000

42600000

TRADING and P&L A/c

Particulars

To cost of Production

To Gross Profit c/d

To Salaries

To Advertisement Exp

To Depreciation: Machinery

To Depreciation: Furniture

To Sales Commission

To Repair and Maintenance

To Travelling Expenses

To provision of tax

To Rent

To selling and distribution Exp

To profit c/d

To Reserve

To Net profit

Liabilities

Capital

Amount

Particulars

42600000 By Sales

14823950 By closing Stock

57423950

600000 By gross profit b/d

200000

18800

12400

80000

160000

320000

3150465

2400000

500000

7351085

14823950

By profit b/d from P&L

367554

a/c

6983531

7351085

Amount

8000000

Assets

Machinery

61

Amount

52500000

4923950

57423950

14823950

14823950

7351085

7351085

Amount

2000000

Add: Net Profit

Reserves

Provision of Tax

6983531

14983531 Less :- Dep @ 10%

367554 Furniture

3150465 Less :- Dep@ 10%

Closing Stock

Cash In Hand

Cash at Bank

Debtors

200000

1500000

150000

1800000

1000000

4923950

8000000

1000000

1777600

18501550

18501550

CASH FLOW

Particulars

Initial investment

Revenues

Operating cost

Business overhead

Depriciation

PBT

Tax @ 30%

PAT

+Depriciation

Operating cash

inflow

Net cash flow

outflow

0

50000000

52500000

37676050

4291200

31200

10501550

3150465

7351085

31200

58800000

41066894

4677408

31200

13024498

39073494

9117148

31200

66444000

44762915

5098374

31200

16551511

4965453

11586057

31200

76410600

48791576

5557228

31200

22024596

6607379

15417217

31200

90164508

53182818

6057379

31200

31493111

9447933

22045178

31200

7382285

9148348 11617257 15448417 22076378

50000000

Calculation of NPV

[7388285 x PVIF(15%, 1yr)+9148348 x PVIF(15%,2yr)+11617257 x PVIF(15%,3yr)+15448417 x

PVIF(15%,4yr)+22076378 x PVIF(15%,5yr)]-50000000

=[7388285 x 0.952+9148348 x 0.907+11617257 x0.864 +15448417 x 0.823+22076378 x0.784]-50000000

=[7027935.32+8297551.636+10037310.048+12714047.191+17307880.352]-50000000

=55384724.547-50000000

=5384724.547

62

63

You might also like

- Hardhat LTDDocument4 pagesHardhat LTDSonaliNo ratings yet

- Commercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Handle Production Runs Set Up Machine Admin PartsDocument3 pagesHandle Production Runs Set Up Machine Admin PartsAbdullah221790No ratings yet

- Result Sheet TASK 2Document4 pagesResult Sheet TASK 2Nishant KolheNo ratings yet

- M L FastenersDocument13 pagesM L FastenersKaran Oberoi33% (6)

- Solution: Assembling Units Processing Orders Supporting Customers Other Total Overhead Costs 800000Document6 pagesSolution: Assembling Units Processing Orders Supporting Customers Other Total Overhead Costs 800000Nishanth M S HebbarNo ratings yet

- Power Cost Per Hour 20 Operator Cost Per Hour 45 Annual Repairs 40000 Depreciation 25000 Insurance 15000 Estimate Number of Hours 5000 Compute The Machine Hour Rate Computation of Machine Hour RateDocument12 pagesPower Cost Per Hour 20 Operator Cost Per Hour 45 Annual Repairs 40000 Depreciation 25000 Insurance 15000 Estimate Number of Hours 5000 Compute The Machine Hour Rate Computation of Machine Hour Rateamitinfo_mishraNo ratings yet

- Cost of SalesDocument4 pagesCost of SalesparagtalkingNo ratings yet

- Wilkerson SolutionDocument3 pagesWilkerson SolutionAbdul Rauf JamroNo ratings yet

- FinancialsDocument5 pagesFinancialsdushakilNo ratings yet

- Cost Sheet Presented BY Chandan Jagtap Nilesh Ghadge Sachin MethreeDocument13 pagesCost Sheet Presented BY Chandan Jagtap Nilesh Ghadge Sachin MethreeSachin MethreeNo ratings yet

- Wilkerson Company Case Numerical Approach SolutionDocument3 pagesWilkerson Company Case Numerical Approach SolutionAbdul Rauf JamroNo ratings yet

- Chapter 15Document7 pagesChapter 15Rahila RafiqNo ratings yet

- Sippican CoDocument5 pagesSippican CoMagali Thibaut67% (3)

- Morrisey Forgings - STCM - Group 1Document8 pagesMorrisey Forgings - STCM - Group 1Parul JainNo ratings yet

- Product CostingDocument8 pagesProduct CostingHitesh RawatNo ratings yet

- Business Plan PrecisionDocument63 pagesBusiness Plan PrecisionDavidPrasojoNo ratings yet

- Classic Pen Company: Developing An ABC ModelDocument22 pagesClassic Pen Company: Developing An ABC Modeljk kumarNo ratings yet

- AAADocument7 pagesAAAHamis Mohamed100% (1)

- Classic Pen SolutionDocument4 pagesClassic Pen SolutionAlaka Kumari PradhanNo ratings yet

- CMC Company Fixed and Variable Cost 2014 2015 2016 2017 2018 Variable CostDocument3 pagesCMC Company Fixed and Variable Cost 2014 2015 2016 2017 2018 Variable CostMa Therese AbringeNo ratings yet

- Standard (I Unit Produced) ParticularsDocument11 pagesStandard (I Unit Produced) ParticularsForam Raval100% (1)

- Income Statement 2016Document1 pageIncome Statement 2016TANVIRNo ratings yet

- Initial Capital InvestmemtDocument4 pagesInitial Capital InvestmemtAJ QaziNo ratings yet

- Cost Sheet of ParleDocument3 pagesCost Sheet of Parlesucheta menon20% (5)

- Prepare The Contribution Margin Income StatementDocument4 pagesPrepare The Contribution Margin Income StatementCorvitz SamaritaNo ratings yet

- Cost Sheet SolutionsDocument8 pagesCost Sheet SolutionsPriya DattaNo ratings yet

- Cost SheetDocument5 pagesCost Sheetpooja45650% (2)

- Fma Excel SheetDocument1 pageFma Excel SheetLinda SmallNo ratings yet

- Financial StatementDocument24 pagesFinancial StatementSyarehim Che Mohd YusofNo ratings yet

- Cost Sheet ProblemsDocument22 pagesCost Sheet ProblemsAvinash Tanawade100% (4)

- Number of Fills Per Hour Peak Hours (L) 560 Lean Hours (L) 230 # Lean Hours 16 # Peak Hours 8 Total Sales Per Day 8160Document3 pagesNumber of Fills Per Hour Peak Hours (L) 560 Lean Hours (L) 230 # Lean Hours 16 # Peak Hours 8 Total Sales Per Day 8160priyaNo ratings yet

- Cost Sheet For The Month Ended 31st December, 2009Document2 pagesCost Sheet For The Month Ended 31st December, 2009123acvszNo ratings yet

- MACS WAC Waltham Motors 12040029Document5 pagesMACS WAC Waltham Motors 12040029Zargham ShiraziNo ratings yet

- Costing Sheet - Easiest WayDocument11 pagesCosting Sheet - Easiest Waypankajkuma981100% (1)

- Baron Service Station (BSS) Cost-Volume-Point AnalysisDocument6 pagesBaron Service Station (BSS) Cost-Volume-Point AnalysisNodiey YanaNo ratings yet

- Manufacturing AccountsDocument11 pagesManufacturing Accountslukamasia100% (1)

- Managerial Control & BudgetingDocument2 pagesManagerial Control & Budgetingmohdzarrin77No ratings yet

- Gastronaut Ice CreamDocument4 pagesGastronaut Ice CreamNAYANNo ratings yet

- Solution Case New Product LaunchDocument1 pageSolution Case New Product LaunchVinod KsNo ratings yet

- Classic PenDocument12 pagesClassic PenSamiksha MittalNo ratings yet

- Azam CFDocument10 pagesAzam CFsahala11No ratings yet

- Group 7 - Morrissey ForgingsDocument10 pagesGroup 7 - Morrissey ForgingsVishal AgarwalNo ratings yet

- Income:: Factory SuperintendenceDocument1 pageIncome:: Factory SuperintendenceIrish Liezl FuentesNo ratings yet

- Trading Summary TemplateDocument3 pagesTrading Summary TemplateWilliam ElizabethNo ratings yet

- Manufacturing Overhead Formula Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMDocument5 pagesManufacturing Overhead Formula Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMJacob ChinyokaNo ratings yet

- Vakho Tako SalomeDocument27 pagesVakho Tako SalomerbegalashviliNo ratings yet

- Unit 2Document4 pagesUnit 2elchido123No ratings yet

- Project of Manufacturing of Bitumen Emulsion Crum Rubber Modified BitumenDocument10 pagesProject of Manufacturing of Bitumen Emulsion Crum Rubber Modified Bitumencse10vishal100% (1)

- Project Investment Particulars No Per Unit CostDocument28 pagesProject Investment Particulars No Per Unit CostMirza JunaidNo ratings yet

- 2.2 Cost Sheet ProblemsDocument7 pages2.2 Cost Sheet ProblemsApparao ChNo ratings yet

- Enterprenuership Project For Garments Sticthing Unit Financail Section Xls 2012 13Document34 pagesEnterprenuership Project For Garments Sticthing Unit Financail Section Xls 2012 13Mohammad KamruzzamanNo ratings yet

- Classic Pen Company CaseDocument16 pagesClassic Pen Company CaseArif Aminun RahmanNo ratings yet

- Accounting Excel Budget ProjectDocument8 pagesAccounting Excel Budget Projectapi-242531880No ratings yet

- Task 2 A) : Profit Model For One Year Sales 3735000Document3 pagesTask 2 A) : Profit Model For One Year Sales 3735000Nishant KolheNo ratings yet

- 15 Bostek Marine Genset - BostekDocument23 pages15 Bostek Marine Genset - BostekGombal JayaNo ratings yet

- Operations ManagementDocument5 pagesOperations ManagementskripsianyaNo ratings yet

- Unit 8 - BudgetingDocument8 pagesUnit 8 - Budgetingkevin75108No ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet