Professional Documents

Culture Documents

Tax 3B Test 2 Q1 Solution

Tax 3B Test 2 Q1 Solution

Uploaded by

ironflash18Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax 3B Test 2 Q1 Solution

Tax 3B Test 2 Q1 Solution

Uploaded by

ironflash18Copyright:

Available Formats

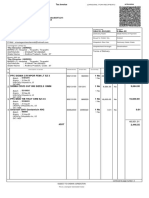

Transaction 1 Workings Debit Credit

Workings Debit Credit

Dr Bank =250 000)+32 000 282 000

Cr Output tax =32000 *15/115 ) 4 174

Cr Proceeds from insurance 277 826

The insurance award of R32 000 received by insurance company a deemed

supply under section 8(8)

The award of R32 000 is deemed to be consideration for supply of services

The award of R250 000 relates to the total reinstatement of 'motor car' for which

the input tax deduction was denied and the 'motor car' is damaged beyond

economic repair, therefore not a deemed supply

Time of supply is when the payment is received on 28 July 2023

Dr salaries 77

Cr Output tax 77

The right use of the motor car is a fringe benefit is a deemed suply as per s10(13)

R300000*85% *100/115 *0,3% = R665

R665-R85 = R580

R580 *15/115 =R77

Dr Bank 50 000

Dr loss on sale of the car 70 000

Dr Accumulated depreciation 90 000

Cr Motor car 210 000

Sale of scrap material of the 'motor car'

Non-supply- Input tax was denied on the purchase of the 'motor car' as defined

Dr Insurance premiums 104 348

Dr input VAT =120000*15/115 15 652

Cr Bank 120 000

Short term insurance premiums constitute standard rated supply

available

maximum

Transaction 2 Workings Debit Credit

Dr Bank charges 19 130

Dr Input tax =22000*15/115 2 870

Cr Bank 22 000

Bank charges are standard rated

Dr Bank 345 000

Cr Interest income 345 000

Interest income is exempt

available

maximum

Presentation and layout

Total Overall marks

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Answer Rak N Koll-Converted Answer Rak N KollDocument32 pagesAnswer Rak N Koll-Converted Answer Rak N KollAlyssah Grace EllosoNo ratings yet

- 7551D3AE48A145AC9BF8BDBEA5432DBDocument2 pages7551D3AE48A145AC9BF8BDBEA5432DBmurillorigo817No ratings yet

- Income Statement (T-Format)Document15 pagesIncome Statement (T-Format)Apryl TaiNo ratings yet

- Assignment 6 - SolutionsDocument4 pagesAssignment 6 - SolutionsEsther LiuNo ratings yet

- Far160 Debenture NotesDocument9 pagesFar160 Debenture NotesAINUL MARDIYAH MOHD AZMINo ratings yet

- CD FinalSanctionLetterDocument4 pagesCD FinalSanctionLetterletstea29No ratings yet

- Perpetual Bank: ReceivablesDocument13 pagesPerpetual Bank: ReceivablesYes ChannelNo ratings yet

- Accounting Principles Question Paper, Answers and Examiners CommentsDocument24 pagesAccounting Principles Question Paper, Answers and Examiners CommentsRyanNo ratings yet

- 高一簿记模拟试卷Document6 pages高一簿记模拟试卷Carpenters ForeverNo ratings yet

- Adeel Loan Calculatorr1Document237 pagesAdeel Loan Calculatorr1Adeel ArshadNo ratings yet

- Wellness Massage General Journal For The Period Ended December 31, 20x1Document26 pagesWellness Massage General Journal For The Period Ended December 31, 20x1John Paul TomasNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- Accruals and Prepayments: AlreadyDocument4 pagesAccruals and Prepayments: AlreadyLOW YAN QINNo ratings yet

- As Accounting Feb:March 2023 Paper2Document20 pagesAs Accounting Feb:March 2023 Paper2Ibrahim KhalilNo ratings yet

- Trial Balance Report: Kaplan FinancialDocument1 pageTrial Balance Report: Kaplan FinancialJenW12No ratings yet

- Redemption of DebenturesDocument22 pagesRedemption of DebenturesDhiraj BaldotaNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- Book 1Document4 pagesBook 1monteNo ratings yet

- Solution Example 3Document2 pagesSolution Example 3ashish panwarNo ratings yet

- Project Report On NurseryDocument6 pagesProject Report On NurseryManju Mysore100% (1)

- Total IncomeDocument4 pagesTotal IncomeSiddharth VaswaniNo ratings yet

- Simple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Document11 pagesSimple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Masood Ahmad AadamNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- ACC4002H Taxation III 2023 April Test FinalDocument6 pagesACC4002H Taxation III 2023 April Test FinalJessica albaNo ratings yet

- Acc203 Tut On LiquidationDocument7 pagesAcc203 Tut On LiquidationShivanjani KumarNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Q1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019Document3 pagesQ1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019kietNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- IT Detections From Gross Total Income Pt-1Document25 pagesIT Detections From Gross Total Income Pt-1syedfareed596100% (1)

- DOPrint PageDocument1 pageDOPrint Pagesales.gomtiNo ratings yet

- Additional Illustrations-20Document16 pagesAdditional Illustrations-20Gulneer LambaNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- ACC 503 FinalDocument14 pagesACC 503 FinalFarid UddinNo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- Spiceland FA 6e Chap01 PPTDocument62 pagesSpiceland FA 6e Chap01 PPTkongvalerie7No ratings yet

- Quiz Chapter-7 Leases-Part-1 2021Document3 pagesQuiz Chapter-7 Leases-Part-1 2021CENTENO, JOAN R.No ratings yet

- Group Facilitation Question 6.13 AnswersDocument6 pagesGroup Facilitation Question 6.13 AnswersSherryWooNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionDocument2 pagesACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaNo ratings yet

- Completing Financial Statements, Computing Ratios, Comparing Accrual Versus Cash Income, and Evaluating The Company's Cash NeedsDocument2 pagesCompleting Financial Statements, Computing Ratios, Comparing Accrual Versus Cash Income, and Evaluating The Company's Cash NeedscbarajNo ratings yet

- 4000CDKH529631 Statement of AccountDocument3 pages4000CDKH529631 Statement of Accountmaheshmonu9449No ratings yet

- Practice Set 5 Financial Statements of Sole ProprietorshipsDocument3 pagesPractice Set 5 Financial Statements of Sole ProprietorshipsBritney PetersNo ratings yet

- C.S. Executive - Answers For CC Test Paper - IDocument7 pagesC.S. Executive - Answers For CC Test Paper - Isekhar_gantiNo ratings yet

- 21 2plDocument1 page21 2plRAHUL NATH RNo ratings yet

- CARAGA Finals-FABM1 SHSABM11-6Document22 pagesCARAGA Finals-FABM1 SHSABM11-6eshanecaragaNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- 9.50% IDBI BANK LIMITED 2030 - The Fixed IncomeDocument3 pages9.50% IDBI BANK LIMITED 2030 - The Fixed Incomeqn7b7shm82No ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- Week 10Document3 pagesWeek 10xinghe666No ratings yet

- Solutions Tutorial 5 Accounting For LeasesDocument5 pagesSolutions Tutorial 5 Accounting For LeasesZakir HossainNo ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Financial Accounting and Reporting PDFDocument12 pagesFinancial Accounting and Reporting PDFanis athirahNo ratings yet

- TS1307 Financial Reports: Test 2 - Question BookDocument4 pagesTS1307 Financial Reports: Test 2 - Question Bookirma febianNo ratings yet

- 12 Accountancy Lyp 2017 Delhi Set1 PDFDocument39 pages12 Accountancy Lyp 2017 Delhi Set1 PDFAshish GangwalNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- FLIX Invoice 3006940168Document2 pagesFLIX Invoice 3006940168Alexsandro Alves FelippeNo ratings yet

- Circular Flow of DiagramDocument41 pagesCircular Flow of DiagramRishit KapoorNo ratings yet

- Level I:: Advanced Financial Modeler (Afm)Document1 pageLevel I:: Advanced Financial Modeler (Afm)sps fetrNo ratings yet

- Inc StatDocument9 pagesInc StatAleem JafferyNo ratings yet

- 71 - Association of Non-Profit Club, Inc. v. BIRDocument2 pages71 - Association of Non-Profit Club, Inc. v. BIRJoshua BorresNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- Inv 2433Document8 pagesInv 2433adarsh pagidiNo ratings yet

- Importent Classification of TallyDocument12 pagesImportent Classification of TallysivaNo ratings yet

- Extension Policies Policy Types Policy Formulatio-Wageningen University and Research 38371Document7 pagesExtension Policies Policy Types Policy Formulatio-Wageningen University and Research 38371abduNo ratings yet

- Future Generali India FinalDocument99 pagesFuture Generali India Finalsuryakantshrotriya67% (3)

- CENG 6108 Lesson 1 IntroductionDocument57 pagesCENG 6108 Lesson 1 IntroductionhaileNo ratings yet

- Ais Reviewer MidtermDocument9 pagesAis Reviewer MidtermCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Sahanubhuti UniqueDocument10 pagesSahanubhuti UniquePrashanth JogimuttNo ratings yet

- Writing Skills Practice: An Opinion Essay About Fast Food Exam QuestionDocument2 pagesWriting Skills Practice: An Opinion Essay About Fast Food Exam QuestionfrozenglxNo ratings yet

- BPCL Indemnity BondDocument2 pagesBPCL Indemnity Bondmilind kenjaleNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisSitiNorhafizahDollah100% (1)

- RFPDocument298 pagesRFPOlety Subrahmanya SastryNo ratings yet

- Federalism 2Document8 pagesFederalism 2Satpal LambaNo ratings yet

- Department of Labor: w-234Document2 pagesDepartment of Labor: w-234USA_DepartmentOfLaborNo ratings yet

- A.M. Khanwilkar and Dinesh Maheshwari, Jj. Civil Appeal No. 7865 of 2009 JULY 29, 2020Document46 pagesA.M. Khanwilkar and Dinesh Maheshwari, Jj. Civil Appeal No. 7865 of 2009 JULY 29, 2020Deeptangshu KarNo ratings yet

- G.R. No. 244602 - Mactel Corp. vs. City Government of MakatiDocument11 pagesG.R. No. 244602 - Mactel Corp. vs. City Government of MakatiLino MomonganNo ratings yet

- Board of Assessment Appeals, Province of Laguna v. National Waterworks and Sewerage Authority, 8 Phil. 227Document2 pagesBoard of Assessment Appeals, Province of Laguna v. National Waterworks and Sewerage Authority, 8 Phil. 227Icel Lacanilao100% (1)

- Reviewer English7Document3 pagesReviewer English7Allen Hendryx PangilinanNo ratings yet

- Catering Service Contract TemplateDocument5 pagesCatering Service Contract TemplateaiuraizuruNo ratings yet

- ECO 100 GUIDES Learn by DoingDocument17 pagesECO 100 GUIDES Learn by Doingveeru53No ratings yet

- BR.100 EBusiness Tax Setup DocumentDocument26 pagesBR.100 EBusiness Tax Setup DocumentFer SeveNo ratings yet

- Sea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Document5 pagesSea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Che Poblete CardenasNo ratings yet

- Bangalore Occupancy Certificate A Complete GuidelineDocument4 pagesBangalore Occupancy Certificate A Complete Guidelinemasta kalandarNo ratings yet

- Interest Rate On DepositsDocument4 pagesInterest Rate On DepositsPritam PaulNo ratings yet