Professional Documents

Culture Documents

Session 11

Session 11

Uploaded by

Noralyn DimnatangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Session 11

Session 11

Uploaded by

Noralyn DimnatangCopyright:

Available Formats

WEEK11: SUMMARIZING TRANSACTIONS

SESSION 33: TRIAL BALANCE

Objective:

At the end of this session, learners should be able to:

1. Understand what a Trial balance is and its purpose.

2. Prepare a trial balance.

3. Detect errors in account balances and correct the figures of the errors in the ledger

accounts.

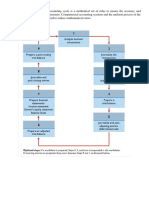

TRIAL BALANCE PREPARATION

The preparation of a trial balance is the 3rd step of the accounting process. This proves only one aspect

of the ledger, that is the equality of debits and credits. This report summarizes the debit and credit entries

of each account in the General Ledger.

A trial balance has the following headings:

1. Name of the business or proprietor

2. Title of the report

3. Period covered by the report.

The period covered by a trial balance depends upon the need of the bookkeepers or accountants in

preparing this summary report. It can be on a monthly, quarterly, semi-annually, or annually. This report

can be prepared in any given period regardless of whether financial statements are prepared or not.

The purpose of preparing a trial balance is to check the arithmetical or mathematical accuracy in

postings and footing of the debit and credit entries of accounts in the General ledger.

PROCEDURES IN PREPARING THE TRIAL BALANCE

Remember, all account titles that appear in the Chart of Accounts are provided with one page of the

ledger.

1st step See to it that the footing of each ledger account is properly done.

2nd step

− List down all accounts in the General Ledger with open balances following the sequence of filing

the accounts in the ledger.

− Simultaneously write down the accounts' amount balance in the debit and credit column of the

trial balance depending on what account balance they may have.

− No indentions are to be made in listing the account titles and no peso sign for the amount in the

actual practice.

3rd step

After listing the last account title, draw a single line across the two amount columns and foot the debit

and credit money columns. The single line drawn is called a single rule.

4th step

As the debit and credit totals are equal, draw a double line under the total of both columns. The double

line drawn is called Double Rule which signifies that the trial balance is already in balance.

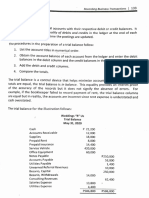

Shown on the next page is Illustration 33-1: Example of a Trial Balance of the ANIME WORLD GALLERY

for the month ended 31 May 2019. The source of the trial balance is the general ledger with open

balances that were found in the previous lesson’s illustration. The ones that were placed in shaded

boxes.

Limitations of a Trial Balance

A trial balance does not guarantee freedom from recording errors, however. Numerous errors may exist

even though the totals of the trial balance columns agree. For example, the trial balance may balance

even when:

1. A transaction is not journalized.

2. A correct journal entry is not posted.

3. A journal entry is posted twice.

4. Incorrect accounts are used in journalizing or posting.

5. Offsetting errors are made in recording the amount of a transaction.

As long as equal debits and credits are posted, even to the wrong account or in the wrong amount, the

total debits will equal the total credits. The trial balance does not prove that the company has recorded

all transactions or that the ledger is correct.

Possible Errors in the Trial Balance

1. Transposition - occurs when an order of two numbers is reversed

Example: 48 was erroneously written as 84

234 was erroneously written as 432

2. Trans placement or Slide - occurs when a decimal point has been moved or misplaced

Example: 100 was erroneously written as 10

67.89 was erroneously written as 678.9

Note: In both cases, the discrepancy between the two columns of the trial balance is divisible by 9

Locating Errors

Errors in a trial balance generally result from mathematical mistakes, incorrect postings, or simply

transcribing data incorrectly. What do you do if you are faced with a trial balance that does not balance?

First, determine the amount of the difference between the two columns of the trial balance. After this

amount is known, the following steps are often helpful:

1. If the error is P1, P10, P100, or P1,000, re-foot the trial balance columns and recompute the

account balances.

2. If the error is divisible by 2, scan the trial balance to see whether a balance equal to half the error

has been entered in the wrong column.

3. If the error is divisible by 9, retrace the account balances on the trial balance to see whether they

are incorrectly copied from the ledger. For example, if a balance was P12 and it was listed as P21, a

P9 error has been made. Reversing the order of numbers is called a transposition error.

4. If the error is NOT divisible by 2 or 9, scan the ledger to see whether an account balance in the

amount of the error has been omitted from the trial balance, and scan the journal to see whether a

posting of that amount has been omitted.

Illustration 33-1: Example of a Trial Balance

Anime World Gallery

Trial Balance

May 31, 2019

Debit Credit

Cash ₱ 373,660

Accounts Receivable 70,000

Art Supplies 7,200

Prepaid Rent 18,000

Prepaid Insurance 10,800

Office Equipment 180,000

Furniture and Fixture 40,000

Accounts Payable ₱ 32,200

Notes Payable 100,000

Utilities Payable 4,500

Unearned Painting Revenue 80,000

Ong, Capital 300,000

Ong, Drawing 18,000

Painting Revenue 210,000

Salaries Expense 4,000

Utilities Expense 5,040

Total ₱ 726,700 ₱ 726,700

You might also like

- Canadian Real Estate Investing PlaybookDocument117 pagesCanadian Real Estate Investing PlaybookSidNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AFAR Answer-KeyDocument8 pagesAFAR Answer-KeyShirliz Jane Benitez100% (1)

- The Trial BalanceDocument7 pagesThe Trial BalanceMARIA CECILIA PAGANANo ratings yet

- Module 5 Completion of The Accounting Process For ServiceDocument14 pagesModule 5 Completion of The Accounting Process For ServiceavimalditaNo ratings yet

- Senior High School Department: Quarter 3 - Module 11: Preparing Trial BalanceDocument8 pagesSenior High School Department: Quarter 3 - Module 11: Preparing Trial BalanceJaye RuantoNo ratings yet

- Suspense Accounts and Error CorrectionDocument6 pagesSuspense Accounts and Error CorrectionAmir NadeemNo ratings yet

- FABM FS and Closing EntriesDocument18 pagesFABM FS and Closing EntriesMarchyrella Uoiea Olin Jovenir100% (1)

- HANDOUT 5.0 Trial BalanceDocument2 pagesHANDOUT 5.0 Trial BalanceRemar22No ratings yet

- Suspense Accounts and Error Correction - ACCA Qualification - Students - ACCA GlobalDocument4 pagesSuspense Accounts and Error Correction - ACCA Qualification - Students - ACCA GlobalInga ȚîgaiNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Quarter 4 - Week 7Document6 pagesFundamentals of Accountancy, Business and Management 1: Quarter 4 - Week 7nicss bonaobraNo ratings yet

- Posting To The Ledger and Trial Balance PreparationDocument37 pagesPosting To The Ledger and Trial Balance PreparationRiz Vincent German-Cabrera AndoNo ratings yet

- 7-Completing The Accounting CycleDocument12 pages7-Completing The Accounting Cyclechobiipiggy26No ratings yet

- Closing EntriesDocument23 pagesClosing EntriesLeonabelle Yago DawitNo ratings yet

- Compilation Notes On Journal Ledger and Trial BalanceDocument14 pagesCompilation Notes On Journal Ledger and Trial BalanceAB12P1 Sanchez Krisly AngelNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- ACC111 Week-8-9 ULOa 2Document14 pagesACC111 Week-8-9 ULOa 2lhyn JasarenoNo ratings yet

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocument5 pagesThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburNo ratings yet

- ACCOUNTSDocument49 pagesACCOUNTSvishal gurungNo ratings yet

- Accounting FundamentalsDocument37 pagesAccounting FundamentalsRuhen Rj PanchoNo ratings yet

- Accounting Errors and Their CorrectionDocument32 pagesAccounting Errors and Their CorrectionmillzmartoNo ratings yet

- Accounting CycleDocument8 pagesAccounting CycleRescopin LorraineNo ratings yet

- Quiz and Performance Tasks For 2nd QTR 21 22Document22 pagesQuiz and Performance Tasks For 2nd QTR 21 22Cipher Amoz100% (1)

- Suspense Accounts and Error Correction: Related LinksDocument6 pagesSuspense Accounts and Error Correction: Related LinksABIZEYIMANA AimableNo ratings yet

- Trial Balance: Fundamentals of Accountancy, Business and Management 1Document15 pagesTrial Balance: Fundamentals of Accountancy, Business and Management 1Arminda VillaminNo ratings yet

- Lecture 3 Accounting Cycle-2Document26 pagesLecture 3 Accounting Cycle-2azizbektokhirbekovNo ratings yet

- Chapter 6 The Trial BalanceDocument17 pagesChapter 6 The Trial BalanceENG ZI QINGNo ratings yet

- Chap 5 & 6Document46 pagesChap 5 & 6kaleabNo ratings yet

- 05 - Completion of The Accounting Cycle (Notes) PDFDocument3 pages05 - Completion of The Accounting Cycle (Notes) PDFJamie ToriagaNo ratings yet

- Lesson 10Document12 pagesLesson 10Noralyn DimnatangNo ratings yet

- AE21 Lesson 6: Review of The Accounting Cycle: Worksheet and Adjusting EntriesDocument6 pagesAE21 Lesson 6: Review of The Accounting Cycle: Worksheet and Adjusting EntriesGlenda LinatocNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceSushank Kumar 7278No ratings yet

- GlobalisationDocument9 pagesGlobalisationMark Joseph TadeoNo ratings yet

- Fundamentals AccountingDocument5 pagesFundamentals AccountingDennis N. IndigNo ratings yet

- Journal Ledger and Trial BalenceDocument14 pagesJournal Ledger and Trial BalenceMd. Sojib KhanNo ratings yet

- FABM 2 Closing-Entries 1Document3 pagesFABM 2 Closing-Entries 1ariannekaryllemercadoNo ratings yet

- Journal-Entries GABONDocument29 pagesJournal-Entries GABONrose gabonNo ratings yet

- DLP Fs Analysis Concepts and FormatDocument14 pagesDLP Fs Analysis Concepts and FormatDia Did L. RadNo ratings yet

- Journal Entries - 1666100137Document12 pagesJournal Entries - 1666100137Van OneNo ratings yet

- ACCT5001 2022 S2 - Module 4 - Lecture Slides StudentDocument30 pagesACCT5001 2022 S2 - Module 4 - Lecture Slides Studentwuzhen102110No ratings yet

- Admas University: Answer SheetDocument6 pagesAdmas University: Answer SheetSamuel100% (2)

- Cook Vernice - AC 404 Accounting Info SystemDocument2 pagesCook Vernice - AC 404 Accounting Info SystemVernice LutoNo ratings yet

- Bookkeeping - Prepare-Trial-BalanceDocument7 pagesBookkeeping - Prepare-Trial-BalanceMik SantosNo ratings yet

- Suspense Accounts and Error Correction Are Popular Topics For Examiners Because They Test Understanding of Bookkeeping Principles So WellDocument12 pagesSuspense Accounts and Error Correction Are Popular Topics For Examiners Because They Test Understanding of Bookkeeping Principles So WellocalmaviliNo ratings yet

- Practice Questions With SolutionsDocument8 pagesPractice Questions With SolutionsrsaldreesNo ratings yet

- MODULE 8 Closing and Reversing EntriesDocument5 pagesMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNo ratings yet

- Closing and Post-Closing EntriesDocument13 pagesClosing and Post-Closing EntriesBrian Reyes GangcaNo ratings yet

- EN - 2022-2023 Spring - Final Exam 23.05.2022 (Solved)Document13 pagesEN - 2022-2023 Spring - Final Exam 23.05.2022 (Solved)tomasslrsNo ratings yet

- Financial Acctg Reporting 1 Chapter 6Document45 pagesFinancial Acctg Reporting 1 Chapter 6Charise Jane ZullaNo ratings yet

- Solution Manual For Accounting Information Systems Basic Concepts and Current Issues 3Rd Edition Hurt 0078025338 9780078025334 Full Chapter PDFDocument31 pagesSolution Manual For Accounting Information Systems Basic Concepts and Current Issues 3Rd Edition Hurt 0078025338 9780078025334 Full Chapter PDFjohn.twilley531100% (19)

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Incomplete RecordsDocument4 pagesIncomplete RecordsArsalan AliNo ratings yet

- Abm 1 Evaluation Q2 Week 3 and 4Document4 pagesAbm 1 Evaluation Q2 Week 3 and 4Christel Fermia RosimoNo ratings yet

- Financial Accounting: Step by StepDocument8 pagesFinancial Accounting: Step by StepPankaj PandeyNo ratings yet

- Mbaf0701 - Far - Unit - 2Document13 pagesMbaf0701 - Far - Unit - 2RahulNo ratings yet

- FUNDAMENTALS OF ABM 1 Section 7Document13 pagesFUNDAMENTALS OF ABM 1 Section 7Allysa Kim RubisNo ratings yet

- Abm 1 Midterm Marlowne Brialle T. GalaponDocument9 pagesAbm 1 Midterm Marlowne Brialle T. GalaponCharles Elquime GalaponNo ratings yet

- Requirements in Fundamentals of AccountingDocument7 pagesRequirements in Fundamentals of AccountingMoises Macaranas JrNo ratings yet

- Accounting: Postings UpdatedDocument1 pageAccounting: Postings UpdatedShoyo HinataNo ratings yet

- Suspense AccDocument4 pagesSuspense AccAhmad Hafid HanifahNo ratings yet

- Post Test KB Akuntansi UndoneDocument6 pagesPost Test KB Akuntansi UndoneKiras SetyaNo ratings yet

- Prism JohnsonDocument294 pagesPrism JohnsonReTHINK INDIANo ratings yet

- The Intercultural Challenges Faced by Tesco in PolandDocument16 pagesThe Intercultural Challenges Faced by Tesco in Polandgdrive0018No ratings yet

- SAG Mill LinerDocument7 pagesSAG Mill LinerHabram Miranda AlcantaraNo ratings yet

- ITSM&O Syllabus - SRMDocument2 pagesITSM&O Syllabus - SRMSanthosh Kumar PNo ratings yet

- BCM 2208 BBM 205Document3 pagesBCM 2208 BBM 205Hillary OdungaNo ratings yet

- NEW! F&B Package - Higi Creative LabDocument15 pagesNEW! F&B Package - Higi Creative LabMédanais CroissanterieNo ratings yet

- Implementation Process of Apple IncDocument7 pagesImplementation Process of Apple Incsardar hussainNo ratings yet

- Bahruz Sharbatov-Research ProposalDocument8 pagesBahruz Sharbatov-Research ProposalBahruz SharbatovNo ratings yet

- Plastic Jerry CanDocument26 pagesPlastic Jerry CanSivaratnam NavatharanNo ratings yet

- SRC Rule 68Document2 pagesSRC Rule 68Aimee Cute100% (1)

- Financial Accounting 2017 Ist Semester FinalDocument100 pagesFinancial Accounting 2017 Ist Semester FinalLOVERAGE MUNEMONo ratings yet

- Aswin 80303180002Document12 pagesAswin 80303180002Shambhawi Sinha100% (1)

- Competitor Analysis of ColgateDocument4 pagesCompetitor Analysis of ColgateJiawei Lee100% (3)

- UIPath CFRA Analyst ReportDocument9 pagesUIPath CFRA Analyst Reportdxlew10No ratings yet

- DHL Glo Freight Iso50001Document34 pagesDHL Glo Freight Iso50001Passwortistsehrgeheim123No ratings yet

- CA Notes Bill of Exchange and Promissory Notes PDFDocument28 pagesCA Notes Bill of Exchange and Promissory Notes PDFBijay Aryan DhakalNo ratings yet

- SHRM Green Workplace Survey BriefDocument6 pagesSHRM Green Workplace Survey Briefsoodsahil54No ratings yet

- ICSE 2017 Mathematics Class 10Document7 pagesICSE 2017 Mathematics Class 10machinelabnitaNo ratings yet

- 11th Commerce 3 Marks Study Material English MediumDocument21 pages11th Commerce 3 Marks Study Material English MediumGANAPATHY.SNo ratings yet

- Chapter IIDocument61 pagesChapter IIXhynah VillanuevaNo ratings yet

- Computing CosgDocument6 pagesComputing CosgAngelica BayaNo ratings yet

- Muhammad Usman: Cell: (+92) 332-1639985 EmailDocument2 pagesMuhammad Usman: Cell: (+92) 332-1639985 EmailMuhammed UsmanNo ratings yet

- Mindtree: Hostile Takeover Bid by Larsen and Toubro: Sudhir Naib Swati SinghDocument16 pagesMindtree: Hostile Takeover Bid by Larsen and Toubro: Sudhir Naib Swati SinghSoumya KesharwaniNo ratings yet

- Merger AND It'S TypesDocument14 pagesMerger AND It'S TypesSachinGoelNo ratings yet

- Pt. Steel Pipe Industry of Indonesia, TBK Daftar Shift Periode: 14 - 18 Februari 2022 Departemen: WarehouseDocument4 pagesPt. Steel Pipe Industry of Indonesia, TBK Daftar Shift Periode: 14 - 18 Februari 2022 Departemen: WarehouseSri Murniati LTDNo ratings yet

- Oracle Min Max Planning PDFDocument6 pagesOracle Min Max Planning PDFboddu24No ratings yet

- Accounting For Manufacturing Concern Lecture 1Document3 pagesAccounting For Manufacturing Concern Lecture 1marites yuNo ratings yet

- Case 4.2 Party Time, Inc: Keshav Kumar 1006 NaarmDocument14 pagesCase 4.2 Party Time, Inc: Keshav Kumar 1006 Naarmkeshav4naarmNo ratings yet