Professional Documents

Culture Documents

Capital Allowance

Capital Allowance

Uploaded by

Alfred MphandeCopyright:

Available Formats

You might also like

- R.E 2044 Complete NotesDocument189 pagesR.E 2044 Complete NotesLubinda Lubinda Jr.92% (148)

- LEED v4 BD+C Rating System Credit MatrixDocument2 pagesLEED v4 BD+C Rating System Credit Matrixadil271100% (2)

- Multi Functional Bamboo Lampshade Final PaperDocument106 pagesMulti Functional Bamboo Lampshade Final PaperMMCNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- BOI MC No. 2015-01Document48 pagesBOI MC No. 2015-01Raine Buenaventura-EleazarNo ratings yet

- Pig Calculation Tables: Date Batch Nr. Number of PigletsDocument7 pagesPig Calculation Tables: Date Batch Nr. Number of PigletsUrs SchaffnerNo ratings yet

- Chapter 1: Mastering Strategy: Art and Science: Learning ObjectivesDocument54 pagesChapter 1: Mastering Strategy: Art and Science: Learning ObjectivesAngelica PostreNo ratings yet

- Capital AllowancesDocument32 pagesCapital AllowancesMakoni CharityNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Provision For DepreciationDocument11 pagesProvision For Depreciationdpak bhusalNo ratings yet

- Capital AllowancesDocument11 pagesCapital Allowancesfaith olaNo ratings yet

- Chapter 6 Capital AllowanceDocument59 pagesChapter 6 Capital AllowanceKailing KhowNo ratings yet

- PGBP Book NotesDocument41 pagesPGBP Book NoteskrishnaNo ratings yet

- ACT 205 - Taxation Theory Practice - Lecture 4 (New)Document10 pagesACT 205 - Taxation Theory Practice - Lecture 4 (New)Kaycia HyltonNo ratings yet

- Scmpe RTP M23Document36 pagesScmpe RTP M23govarthan1976No ratings yet

- Chapter 6 Capital Allowance A231Document55 pagesChapter 6 Capital Allowance A231Patricia TangNo ratings yet

- Capital Allowances - July 2023Document9 pagesCapital Allowances - July 2023maharajabby81No ratings yet

- Lecture 10-Ca IDocument69 pagesLecture 10-Ca I魔鬼No ratings yet

- Areas of Tax PlanningDocument10 pagesAreas of Tax Planningabdulraqeeb alareqiNo ratings yet

- Capital AllowanceDocument6 pagesCapital AllowancedidieNo ratings yet

- Msme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Document67 pagesMsme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Majhar HussainNo ratings yet

- Deduction in Respect of Expenditure On Specified BusinessDocument5 pagesDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniNo ratings yet

- Capital AllowanceDocument11 pagesCapital Allowancemay leeNo ratings yet

- Capital Allowance Powerpoint PresentationDocument21 pagesCapital Allowance Powerpoint PresentationKaycia HyltonNo ratings yet

- Project PlanningDocument6 pagesProject PlanningIPS & Co.No ratings yet

- CDC Investors Guide - Annex ADocument13 pagesCDC Investors Guide - Annex ARalph Ronald CatipayNo ratings yet

- Proforma Profits Tax ComputationDocument2 pagesProforma Profits Tax ComputationVintonius Raffaele PRIMUSNo ratings yet

- Proforma Profits Tax ComputationDocument2 pagesProforma Profits Tax Computation余日中No ratings yet

- 08 - PGBPDocument42 pages08 - PGBPMujtaba ZaidiNo ratings yet

- Topic 6 Depreciation Allowance: DIPN 7 Provides Some Guidance On The Distinction Between Plant and Building As FollowsDocument14 pagesTopic 6 Depreciation Allowance: DIPN 7 Provides Some Guidance On The Distinction Between Plant and Building As FollowsSum YinNo ratings yet

- National Real Estate Development Council Pre - Budget Memorandum For 2012-2013Document18 pagesNational Real Estate Development Council Pre - Budget Memorandum For 2012-2013Adarsh MohanNo ratings yet

- Week 9 - Income From Self-Employment - Capital AllowancesDocument29 pagesWeek 9 - Income From Self-Employment - Capital AllowancesWinnie GNo ratings yet

- IAS 16 - PPE Question BankDocument31 pagesIAS 16 - PPE Question Bankcouragemutamba3No ratings yet

- Income Tax - 2 AssignmentDocument4 pagesIncome Tax - 2 AssignmentAnkit AgrawalNo ratings yet

- Taxation Unit 7 - Concept Questions 2023Document6 pagesTaxation Unit 7 - Concept Questions 2023havengroupnaNo ratings yet

- 2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtDocument19 pages2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtArham SheikhNo ratings yet

- 2014 IPP GuidelinesDocument48 pages2014 IPP GuidelinesAntonio ReyesNo ratings yet

- Capital AllowancesDocument11 pagesCapital Allowancesyi yi wiNo ratings yet

- Prelim Rem9Document3 pagesPrelim Rem9Josue Sandigan Biolon SecorinNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- Unit-3: Project SelectionDocument101 pagesUnit-3: Project SelectionMandeep Singh BhatiaNo ratings yet

- Profit Gains of Business and Profession PDFDocument43 pagesProfit Gains of Business and Profession PDFYogita VishwakarmaNo ratings yet

- BSNLDocument3 pagesBSNLPriyanshi AgarwalaNo ratings yet

- Income From BusinessDocument14 pagesIncome From BusinessPreeti ShresthaNo ratings yet

- Capital Allowances Lecture Summary (All) 2020Document50 pagesCapital Allowances Lecture Summary (All) 2020Tatenda RamsNo ratings yet

- 3.TAX 3A - Unit 3 Expenditure Allowances On Capital AssetsDocument14 pages3.TAX 3A - Unit 3 Expenditure Allowances On Capital AssetsHilary ChisokoNo ratings yet

- Chapter-4c PGBPDocument14 pagesChapter-4c PGBPBrinda RNo ratings yet

- 13.8 AS 16 Borrowing CostsDocument8 pages13.8 AS 16 Borrowing CostsAakshi SharmaNo ratings yet

- Chapter 5 Company TaxationDocument27 pagesChapter 5 Company TaxationamyNo ratings yet

- Deductible ExpenseDocument26 pagesDeductible ExpenseBuniNo ratings yet

- Allowable DeductionsDocument7 pagesAllowable DeductionsCOLLET GAOLEBENo ratings yet

- Chapter 2 Plant Asset PDFDocument20 pagesChapter 2 Plant Asset PDFWonde Biru100% (1)

- Business DeductionsDocument46 pagesBusiness Deductionsdavid.ellis1245No ratings yet

- Other Tax and Investment DevelopmentsDocument21 pagesOther Tax and Investment DevelopmentsShandru MurthyNo ratings yet

- Borrowing Cost (Ind AS-23) - Taxguru - inDocument5 pagesBorrowing Cost (Ind AS-23) - Taxguru - inalok kumarNo ratings yet

- Capital Allowance MaximisationDocument11 pagesCapital Allowance MaximisationChristy1127No ratings yet

- Tax Dep F Dec 2007Document9 pagesTax Dep F Dec 2007Saleem TahirNo ratings yet

- Fundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatDocument20 pagesFundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatYadeno GirmaNo ratings yet

- Review Ekotek Bab 7Document4 pagesReview Ekotek Bab 7Nia Adha RyantieNo ratings yet

- AS Part 2Document209 pagesAS Part 2hariinshrNo ratings yet

- AllowancesDocument52 pagesAllowancesbiggoboziNo ratings yet

- 007 - Chapter 04 - IAS 16 Property, Plant and EquipmentDocument7 pages007 - Chapter 04 - IAS 16 Property, Plant and EquipmentHaris ButtNo ratings yet

- PGBPDocument32 pagesPGBPMr UniqueNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Kliever The Reliability of Apostate TestimonyDocument8 pagesKliever The Reliability of Apostate TestimonyFreedom MagazineNo ratings yet

- Financial - Analysis (SCI and SFP)Document4 pagesFinancial - Analysis (SCI and SFP)Joshua BristolNo ratings yet

- Report Writing - Effective Samples TaskDocument4 pagesReport Writing - Effective Samples TaskRania FarranNo ratings yet

- WTO E-Learning Course CatalogueDocument22 pagesWTO E-Learning Course Cataloguellhllh 578No ratings yet

- The Rise and Fall of SpainDocument2 pagesThe Rise and Fall of SpainZahoor Ahmed100% (1)

- Lecture 4 - Modern Olympic Games PDFDocument34 pagesLecture 4 - Modern Olympic Games PDFgregory antoinetteNo ratings yet

- Ethical Case Study: The Concorde CrashDocument10 pagesEthical Case Study: The Concorde Crashmalhar patilNo ratings yet

- Cambridge English Vocab ListDocument42 pagesCambridge English Vocab ListseekusNo ratings yet

- 撰写一篇简短的演讲稿Document6 pages撰写一篇简短的演讲稿cjbw63weNo ratings yet

- Construction Contract: The Ethiopian ContextDocument20 pagesConstruction Contract: The Ethiopian ContextNathan yemane100% (1)

- Minimum Value (Threshold Tickets)Document6 pagesMinimum Value (Threshold Tickets)Nikita SharmaNo ratings yet

- Aby Warburg - The Collective Memory As A Medium For ArtDocument11 pagesAby Warburg - The Collective Memory As A Medium For ArtEni0% (1)

- Customer Relationship Management From Strategy To ImplementationDocument35 pagesCustomer Relationship Management From Strategy To Implementationrangu007No ratings yet

- TOEFL Itp Test Taker HandbookDocument3 pagesTOEFL Itp Test Taker HandbookXuan Xuan NguyenNo ratings yet

- Halo Effect PDFDocument16 pagesHalo Effect PDFbellecat2011No ratings yet

- KalayaanDocument8 pagesKalayaanmariNo ratings yet

- 2010 Fannie Servicing Guide VII and VIIIDocument370 pages2010 Fannie Servicing Guide VII and VIIIMike_Dillon100% (1)

- Core Network NFV Proposal For TelcelDocument8 pagesCore Network NFV Proposal For TelcelTELCELINNo ratings yet

- Brach Eichler LLC: BE:10982527.1/UNI285-278205Document75 pagesBrach Eichler LLC: BE:10982527.1/UNI285-278205RHTNo ratings yet

- Astrokrishna - Blogspot.in-My Encounters With AstrologyDocument7 pagesAstrokrishna - Blogspot.in-My Encounters With AstrologysubramanyaNo ratings yet

- Culture Impact On Organization Behavior in CapgeminiDocument2 pagesCulture Impact On Organization Behavior in CapgeminiShubhrant ShuklaNo ratings yet

- The Ultimate Prepper's Survival Bible - A Life-Saving Guide by Christopher JerkinsDocument65 pagesThe Ultimate Prepper's Survival Bible - A Life-Saving Guide by Christopher JerkinsVinicius Fortuna100% (3)

- Tibetan Buddhist Medicine and Psychiatry 282p PDFDocument282 pagesTibetan Buddhist Medicine and Psychiatry 282p PDFDharmaMaya Chandrahas89% (9)

- Result Sabuj JSCDocument1 pageResult Sabuj JSCMohiuddin ShovonNo ratings yet

- Aaakdog. The City of Davao NuguidpptDocument16 pagesAaakdog. The City of Davao NuguidpptAubreyNuguidNo ratings yet

Capital Allowance

Capital Allowance

Uploaded by

Alfred MphandeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Allowance

Capital Allowance

Uploaded by

Alfred MphandeCopyright:

Available Formats

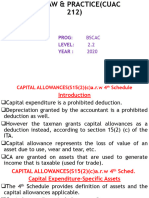

CAPITAL ALLOWANCES

Accountants provide for depreciation in accounts to indicate the loss in value of assets as they are

being used in trade. Depreciation is not an allowable deduction. This does not mean that the tax

law does not recognise that assets lose their values as they produce income. Under s33 the Act

allows a taxpayer to deduct capital allowances determined in accordance with the Second Schedule

from his assessable income. This is a means of standardising depreciation.

A capital allowance is an expenditure a business can claim against its taxable profit. A certain

percentage of the cost of a capital asset is allowed as a capital allowance during accounting period

in which it was purchased.

The basic principle of allowing capital allowance in the tax incentive regime is based on the

understanding that capital items depreciate at the end of each year and the loss in value of capital

items needs to be take into account as a business expenditure.

DEFINITIONS

INDUSTRIAL BUILDING - Paragraph 8

A building is said to be an industrial building if it is used for any of the following:

a. The making of an article or part of an article;

b. the subjection of goods or materials to any process including the breaking up or demolition

of an article;

c. the adapting for sale of an article;

d. the generation of power,

e. transport, dock, inland navigation, water refrigeration, electricity hydraulic power tunnel

or bridge undertaking;

f. a hotel

g. Fish ponds and other buildings and structures used for fish farming

h. any activity which the Minister declares in writing to be making in important contribution

to national development.

Paragraph 8 specifically excludes dwelling houses, shops, showrooms, storehouses and offices

from the definition of industrial buildings.

NOTE:

Protective fencing enclosing any industrial building is also an industrial building.

BCOM/07/02/15/ MANZY SHABA Page 1

COMMERCIAL BUILDINGS

From 2005/2006 fiscal year, onwards, an annual allowance at 25% is available on new commercial

buildings whose construction cost is K100m or more.

BUILDINGS WITH INDUSTRIAL AND NON INDUSTRIAL ELEMENTS

Where a building comprises of both industrial and non-industrial elements and the cost of the non-

industrial element is not greater than 20% of the total cost of the building, capital allowances will

be available on the total cost otherwise; allowances can only be claimed on the industrial element.

EXAMPLE

A building part factory and part office cost K100, 000 to construct. How much of the cost

qualifies for capital allowances if the cost of constructing the part is used as an office is

i. K18, 000

ii. K25, 000

SOLUTION

i. K18, 000 is only 18% of K100, 000 which means allowances are available on K100, 000.

ii. K25, 000 is 25% of K100, 000; allowance can be claimed on K75, 000 only (i.e. K100,

000 less K25, 000)

STAFF HOUSING

Although dwelling houses are specifically excluded from the definition of industrial buildings,

“Staff housing” qualifies as industrial buildings.

STAFF HOUSING means any dwelling house erected for occupation by an employee engaged in

the business or farming operations of a taxpayer who is a manufacturer or a farmer.

If staff housing is occupied by an employee who is

a. not a full-time employee; and

b. able directly or indirectly to control more than 5% of the voting rights attaching to

all classes of shares of the company;

the allowances available will reduced to one-third.

MANUFACTURER

A manufacturer is the owner of a business carried on within industrial buildings and the owner of

a plantation growing tea, coffee, tobacco, sugar cocoa, or such other crop as the Minister may

approve.

FARM IMPROVEMENTS

Any building or structure or work of a permanent nature, including any water furrow which is used

in the carrying of farming operations but excluding staff housing, work of a permanent nature to

which s58 applies (e.g. drilling of boreholes and any building used as a dwelling house by the

taxpayer.

BCOM/07/02/15/ MANZY SHABA Page 2

FARM FENCING

This refers to fencing which is used in the carrying on of farming operations.

RAILWAY LINES

This means the, sleepers and equipment pertaining thereto of any railway track, but does not

include ballast, embankments, bridges, culverts and other railway constructions.

TYPES OF ALLOWANCES

There are three types of allowances namely: Investment, Initial and Annual. Investment and Initial

allowances could be referred as First Year Allowance because they are only claimable in the year

an asset is purchased and/or brought into use.

An annual allowance is given to a taxpayer is respect of all assets that are used by a taxpayer on

the last day of a year of assessment.

A. INVESTMENT ALLOWANCES

Investment Allowance is claimable by a taxpayer who is also a manufacturer at the rate of

100% of the cost of new and unused industrial buildings and plant and machinery;

and at 40% of used industrial buildings and plant and machinery which.

a. is brought into use by the taxpayer during the year of assessment ; and

b. Is used by the taxpayer for the purpose of his business as a manufacturer.

The changes in the investment allowance rates were made as a way of providing incentives

to promote investments in tourism, agriculture and manufacturing sectors.

For the purposes of investment allowance the expression ‘plant and machinery’ does not

include motor vehicles intended for or adapted for use or capable of being used on roads.

Staff Housing does not qualify for investment allowance.

An Additional 15% investment allowance used to be available to a taxpayer who was

eligible for investments allowance if the taxpayer invested in an area designated for the

purpose of the additional allowance by the Minister. This was removed in the tax year

2011/2012.

B. INITIAL ALLOWANCE

Initial allowance is claimable is respect of capital expenditure incurred by a taxpayer during

a year of assessment on assets purchased for the purposes of the taxpayer’s trade. Initial

allowance cannot be claimed on an asset on which investments allowance has been

claimed. No initial allowance shall be claimed on private passenger vehicles as from July,

1998 financial year.

The rates of initial allowance are as follows.

Farm improvements 10% of cost

Industrial buildings 10% of cost

Railway lines 10 % of cost

Articles 20% Implements of cost

BCOM/07/02/15/ MANZY SHABA Page 3

Machinery e.g. motor vehicles, office equipment

Utensils e.g. furniture & fittings, computers etc

Farm fencing 331/3 Of cost

C. ANNUAL ALLOWANCES

Annual allowances are given to a taxpayer provided an asset is in use for the purposes of a

taxpayer’s trade at the end of the period of assessment regardless of when an asset was

purchased if it was purchased during that year of assessment. The allowances are given

on the reducing balance basis.

Those who qualify for both Initial and investment allowances are required to choose either

of the two but not both. Investment allowance is given to a taxpayer who is also a

manufacturer.

RATES OF ANNUAL ALLOWANCES

Farm improvements 5%

Industrial buildings 5%

Railway lines 5%

Farm fencing 10 %

Computers 40 %

For other assets the rates of annual allowances to be used are those determined by the

Commissioner as being appropriate in relation to the class of assets in question. Once the

rates have been determined they apply to subsequent years unless superseded by any other

determination by the Commissioner.

DISPOSAL OF ASSETS

If the disposal proceeds of an asset on which capital allowances have been claimed exceed

the tax written down value (i.e. the cost of the asset less capital allowances) - the “adjusted

basis’ there will be a CAPITAL GAIN which must be included in assessable income.

A CAPITAL LOSS occurs where the written down value (adjusted basis) is greater than

the disposal proceeds. A capital loss is deductible in full from assessable income (there

are no restrictions on the deductibility of capital losses realised on the assets on which

capital allowances have been claimed.

FORMAT FOR THE COMPUTATION OF CAPITAL ALLOWANCES

Asset pool 1 Asset pool 2 TOTAL

Tax written down

value at 1.4. x 0 A B A+B

Additions C D C+D

Disposals (E) - (E)

BCOM/07/02/15/ MANZY SHABA Page 4

Sub-total A +C – E B +D A+B+C+D+E

ALLOWANCES

Investment (%*C) - (%*C)

Initial (% *D) (%*D)

Annual (F) (G) (F+G)

------------ --------------- -----------------

Tax WDV at 31.3.x1 I J K

--------------- --------------- ----------------

SUMMARY OF CAPITAL ALLOWANCES

Investment %*C

Initial %* D

Annual F+G

Capital loss ?

xxxx

Capital gain (?)

Xxxx

EXAMPLE

Mr Chirwa has a manufacturing business and had the following balances in his claim for capital

allowances for the year ended 31 March, 2011:-

Annual allow Tax WDV as at

01.04.2011

K’000

Industrial building 5% 107,000

Plant and Machinery 10% 97,500

Car 20% 24,000

Lorries 20% 14,000

Office equipment 10% 10,000

During the year the following transactions took place:

a. He purchased plant for K30, 000,000 of which K10, 000,000 was second hand.

b. Sold the industrial building for K250, 000,000 original cost of the building was

K200,000,000.

c. He purchased a new industrial building for K300, 000,000.

d. A lorry purchased on 1 January 2010 for K20, 000,000 was involved in a road accident and

totally written off. The insurance company has settled the company’s claim for the loss of

BCOM/07/02/15/ MANZY SHABA Page 5

K10, 000,000.

e. He purchased two new cars for K8, 000,000 and K10, 000,000. He trades in a car in part

exchange which cost K6, 000,000 new on 6 February 2010. The trade in value was K3,

000,000.

REQUIRED

Prepare Mr Chirwa’s claim for capital allowances for 2011/2012 assuming he claims all

allowances to which he is entitled.

SOLUTION

MR CHIRWA

COMPUTATION OF CAPITAL ALLOWANCES FOR THE YEAR ENDED 31.03.2012

Indust. Plant & Cars Office Totals

Build Machi Equip.

K’000 K’000 K’000 K’000 K’000

Tax WDV at

1.4.2011 107,000 97,500 38,000 10,000 252,500

Additions 300,000 30,000 18,000 - 348,000

Disposal (107,000) - (12,480) - (119,480)

Sub-total 300,000 127,500 43,520 10,000 481,020

ALLOWANCES

Investment (300,000) (24,000) - - (324,000)

Initial - - (3,600) - (3,600)

Annual - (12750) (8,704) (1,000) (22,454)

WDV at 31.3.2012 - 90,750 31,216 9,000 130,966

SUMMARY OF CAPITAL ALLOWANCES

K’000

Investment 324,000

Initial 3,600

Annual 22,454

Capital Loss -

350,054

Capital Gains (143,520)

Total Allowances 206,534

Workings

Disposals - WDV

CAR LORRY

K’000 K’000

Cost 2010 6,000 20,000

Initial Allow (1,200) ( 4,000)

Annual Allow (1,200) ( 4,000)

WDV at 31.3.2010 3,600 12,000

BCOM/07/02/15/ MANZY SHABA Page 6

Annual Allow (720) (2,400)

WDV at 31.3.2011 2,880 9,600

Capital Gains

Industrial Car Lorry

Building

K’000 K’000 K’000

Proceeds 250,000 3,000 10,000

Written Down value 107,000 2,880 9,600

143,000 120 400

MINING ALLOWANCES

A person carrying on mining operations who incurs mining expenditure is entitled to an allowance

of 100% of the mining expenditure in the year the expenditure is incurred.

What is Mining Expenditure?

Paragraph 11 of the Second Schedule - Mining expenditure is capital expenditure incurred in

Malawi by a person carrying on or about to carry on mining operations in Malawi. Such capital

expenditure includes:

a. Searching for or discovering and testing or winning access to deposits of minerals.

b. The acquisition of or of rights in or over such deposits other than from a person who has

incurred mining expenditure in relation to such deposits.

c. The provision of machinery which would have little or no use at all if the mine ceased to

be worked.

d. The construction of buildings or works which would have little or no value if the mine

ceased to be worked.

e. The development, general administration and management prior to the commencement of

mining operations.

A provision to paragraph 11 specifically excludes from the definition of ‘mining expenditure’ the

acquisition of the site of deposits or of the site of buildings or works connected with mining

operations. Mining expenditure incurred after 1 November 1969 before commencement of mining

operations is deemed to have been incurred on the day mining operations commence. No mining

allowances can be claimed in respect of expenditure incurred prior to 1 November 1969.

A person engaged in mining operations shall not be eligible to claim any export allowance or any

transport allowance for goods, materials or products exported from Malawi.

Companies engaged in mining operations will be liable to an additional resource rent tax of

10% on profits after tax, if the company’s rate of return exceeds 20 percent. This is in addition

to the normal income tax charged on profits.

BCOM/07/02/15/ MANZY SHABA Page 7

TRANSFER OF AN INTEREST IN A MINE

1. BEFORE MINING OPERATIONS COMMENCE

If a person who has incurred mining expenditure sells or transfers his interest in a mine

before commencement of mining operations the following are the tax implications:-

- the price paid by the purchase less any allowance expenditure is deemed to be

taxable income of the vendor;

- the vendor may request the Commissioner in writing to have such taxable income

apportioned over a period not exceeding six years.

- The purchaser is deemed to have incurred mining expenditure equal to the price

paid by him on which mining allowances will be given.

EXAMPLE

Robert burn incurred mining expenditure of K1, 500, 000 during 1995/96 expecting to

commence mining during 1997/98. Robertburn decided to transfer the interest in the mine

to Hamlet during 1996/97 because he thought mining would be too involving since he had

other matters to attend to. Hamlet bought the interest for K2, 700,000. Hamlet commenced

mining operations on 1 July 1997. What are the tax implications?

SOLUTION

ROBERTBURN

He is deemed to have assessable income of K2, 700,000 in 1996/97

He can apply in writing to have the income spread over 6 years i.e. over 1996/97 to 2001/02

- an assessable income of K450,000 each year.

HAMLET

He is deemed to have incurred mining expenditure of K2, 700,000.

He is entitled to mining allowances of K2, 700,000, being 100% of the mining expenditure

incurred.

2. AFTER MINING OPERATIONS COMMENCE

If an interest in a mine is transferred after commencement of mining operations, the seller

will have claimed mining allowances on prior mining expenditures incurred.

The buyer will also be eligible to claim future mining expenditures in full in the year in

which the expenditures will be incurred.

Mining allowances cannot be granted in respect of expenditure on which capital

allowances are due.

No capital allowances can be claimed on expenditure incurred on the acquisition or

provision of machinery, and industrial buildings, which would have little or no use if mine

BCOM/07/02/15/ MANZY SHABA Page 8

ceased to operate; instead mining allowances will be given in respect of such expenditure.

SUMMARY

- Capital allowances are claimable by a taxpayer on ‘qualifying’ assets. Capital

allowances replace depreciation which is not a deductible expense.

- The Act defines certain terms for purposes of capital allowances such as Industrial

Buildings, Manufacturer, etc.

- The allowances available are:

- Investment - claimable on plant and machinery and

industrial buildings only (excluding motor vehicles, though

machinery and staff housing) in the year an asset is brought

into use in a manufacturing business.

- Initial - claimable in the year capital

expenditure is incurred.

- Annual - Available every year as long as the

asset is in use for business purpose at the end of that year on

the reducing balance basis.

- Disposal of an asset on which capital allowances have been claimed may give rise

to either a capita gain or a capital loss.

- Mining allowances are available to a person who has incurred mining expenditure

in Malawi. These are available in full at 100% of the expenditure in the year in

which they are incurred.

- Mining expenditure is capital expenditure incurred in Malawi by a person who is

carrying on mining operations or intends to carry on mining operations in Malawi.

- No mining allowances are available on assets on which capital allowance are due.

BCOM/07/02/15/ MANZY SHABA Page 9

You might also like

- R.E 2044 Complete NotesDocument189 pagesR.E 2044 Complete NotesLubinda Lubinda Jr.92% (148)

- LEED v4 BD+C Rating System Credit MatrixDocument2 pagesLEED v4 BD+C Rating System Credit Matrixadil271100% (2)

- Multi Functional Bamboo Lampshade Final PaperDocument106 pagesMulti Functional Bamboo Lampshade Final PaperMMCNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- BOI MC No. 2015-01Document48 pagesBOI MC No. 2015-01Raine Buenaventura-EleazarNo ratings yet

- Pig Calculation Tables: Date Batch Nr. Number of PigletsDocument7 pagesPig Calculation Tables: Date Batch Nr. Number of PigletsUrs SchaffnerNo ratings yet

- Chapter 1: Mastering Strategy: Art and Science: Learning ObjectivesDocument54 pagesChapter 1: Mastering Strategy: Art and Science: Learning ObjectivesAngelica PostreNo ratings yet

- Capital AllowancesDocument32 pagesCapital AllowancesMakoni CharityNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Provision For DepreciationDocument11 pagesProvision For Depreciationdpak bhusalNo ratings yet

- Capital AllowancesDocument11 pagesCapital Allowancesfaith olaNo ratings yet

- Chapter 6 Capital AllowanceDocument59 pagesChapter 6 Capital AllowanceKailing KhowNo ratings yet

- PGBP Book NotesDocument41 pagesPGBP Book NoteskrishnaNo ratings yet

- ACT 205 - Taxation Theory Practice - Lecture 4 (New)Document10 pagesACT 205 - Taxation Theory Practice - Lecture 4 (New)Kaycia HyltonNo ratings yet

- Scmpe RTP M23Document36 pagesScmpe RTP M23govarthan1976No ratings yet

- Chapter 6 Capital Allowance A231Document55 pagesChapter 6 Capital Allowance A231Patricia TangNo ratings yet

- Capital Allowances - July 2023Document9 pagesCapital Allowances - July 2023maharajabby81No ratings yet

- Lecture 10-Ca IDocument69 pagesLecture 10-Ca I魔鬼No ratings yet

- Areas of Tax PlanningDocument10 pagesAreas of Tax Planningabdulraqeeb alareqiNo ratings yet

- Capital AllowanceDocument6 pagesCapital AllowancedidieNo ratings yet

- Msme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Document67 pagesMsme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Majhar HussainNo ratings yet

- Deduction in Respect of Expenditure On Specified BusinessDocument5 pagesDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniNo ratings yet

- Capital AllowanceDocument11 pagesCapital Allowancemay leeNo ratings yet

- Capital Allowance Powerpoint PresentationDocument21 pagesCapital Allowance Powerpoint PresentationKaycia HyltonNo ratings yet

- Project PlanningDocument6 pagesProject PlanningIPS & Co.No ratings yet

- CDC Investors Guide - Annex ADocument13 pagesCDC Investors Guide - Annex ARalph Ronald CatipayNo ratings yet

- Proforma Profits Tax ComputationDocument2 pagesProforma Profits Tax ComputationVintonius Raffaele PRIMUSNo ratings yet

- Proforma Profits Tax ComputationDocument2 pagesProforma Profits Tax Computation余日中No ratings yet

- 08 - PGBPDocument42 pages08 - PGBPMujtaba ZaidiNo ratings yet

- Topic 6 Depreciation Allowance: DIPN 7 Provides Some Guidance On The Distinction Between Plant and Building As FollowsDocument14 pagesTopic 6 Depreciation Allowance: DIPN 7 Provides Some Guidance On The Distinction Between Plant and Building As FollowsSum YinNo ratings yet

- National Real Estate Development Council Pre - Budget Memorandum For 2012-2013Document18 pagesNational Real Estate Development Council Pre - Budget Memorandum For 2012-2013Adarsh MohanNo ratings yet

- Week 9 - Income From Self-Employment - Capital AllowancesDocument29 pagesWeek 9 - Income From Self-Employment - Capital AllowancesWinnie GNo ratings yet

- IAS 16 - PPE Question BankDocument31 pagesIAS 16 - PPE Question Bankcouragemutamba3No ratings yet

- Income Tax - 2 AssignmentDocument4 pagesIncome Tax - 2 AssignmentAnkit AgrawalNo ratings yet

- Taxation Unit 7 - Concept Questions 2023Document6 pagesTaxation Unit 7 - Concept Questions 2023havengroupnaNo ratings yet

- 2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtDocument19 pages2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtArham SheikhNo ratings yet

- 2014 IPP GuidelinesDocument48 pages2014 IPP GuidelinesAntonio ReyesNo ratings yet

- Capital AllowancesDocument11 pagesCapital Allowancesyi yi wiNo ratings yet

- Prelim Rem9Document3 pagesPrelim Rem9Josue Sandigan Biolon SecorinNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- Unit-3: Project SelectionDocument101 pagesUnit-3: Project SelectionMandeep Singh BhatiaNo ratings yet

- Profit Gains of Business and Profession PDFDocument43 pagesProfit Gains of Business and Profession PDFYogita VishwakarmaNo ratings yet

- BSNLDocument3 pagesBSNLPriyanshi AgarwalaNo ratings yet

- Income From BusinessDocument14 pagesIncome From BusinessPreeti ShresthaNo ratings yet

- Capital Allowances Lecture Summary (All) 2020Document50 pagesCapital Allowances Lecture Summary (All) 2020Tatenda RamsNo ratings yet

- 3.TAX 3A - Unit 3 Expenditure Allowances On Capital AssetsDocument14 pages3.TAX 3A - Unit 3 Expenditure Allowances On Capital AssetsHilary ChisokoNo ratings yet

- Chapter-4c PGBPDocument14 pagesChapter-4c PGBPBrinda RNo ratings yet

- 13.8 AS 16 Borrowing CostsDocument8 pages13.8 AS 16 Borrowing CostsAakshi SharmaNo ratings yet

- Chapter 5 Company TaxationDocument27 pagesChapter 5 Company TaxationamyNo ratings yet

- Deductible ExpenseDocument26 pagesDeductible ExpenseBuniNo ratings yet

- Allowable DeductionsDocument7 pagesAllowable DeductionsCOLLET GAOLEBENo ratings yet

- Chapter 2 Plant Asset PDFDocument20 pagesChapter 2 Plant Asset PDFWonde Biru100% (1)

- Business DeductionsDocument46 pagesBusiness Deductionsdavid.ellis1245No ratings yet

- Other Tax and Investment DevelopmentsDocument21 pagesOther Tax and Investment DevelopmentsShandru MurthyNo ratings yet

- Borrowing Cost (Ind AS-23) - Taxguru - inDocument5 pagesBorrowing Cost (Ind AS-23) - Taxguru - inalok kumarNo ratings yet

- Capital Allowance MaximisationDocument11 pagesCapital Allowance MaximisationChristy1127No ratings yet

- Tax Dep F Dec 2007Document9 pagesTax Dep F Dec 2007Saleem TahirNo ratings yet

- Fundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatDocument20 pagesFundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatYadeno GirmaNo ratings yet

- Review Ekotek Bab 7Document4 pagesReview Ekotek Bab 7Nia Adha RyantieNo ratings yet

- AS Part 2Document209 pagesAS Part 2hariinshrNo ratings yet

- AllowancesDocument52 pagesAllowancesbiggoboziNo ratings yet

- 007 - Chapter 04 - IAS 16 Property, Plant and EquipmentDocument7 pages007 - Chapter 04 - IAS 16 Property, Plant and EquipmentHaris ButtNo ratings yet

- PGBPDocument32 pagesPGBPMr UniqueNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Kliever The Reliability of Apostate TestimonyDocument8 pagesKliever The Reliability of Apostate TestimonyFreedom MagazineNo ratings yet

- Financial - Analysis (SCI and SFP)Document4 pagesFinancial - Analysis (SCI and SFP)Joshua BristolNo ratings yet

- Report Writing - Effective Samples TaskDocument4 pagesReport Writing - Effective Samples TaskRania FarranNo ratings yet

- WTO E-Learning Course CatalogueDocument22 pagesWTO E-Learning Course Cataloguellhllh 578No ratings yet

- The Rise and Fall of SpainDocument2 pagesThe Rise and Fall of SpainZahoor Ahmed100% (1)

- Lecture 4 - Modern Olympic Games PDFDocument34 pagesLecture 4 - Modern Olympic Games PDFgregory antoinetteNo ratings yet

- Ethical Case Study: The Concorde CrashDocument10 pagesEthical Case Study: The Concorde Crashmalhar patilNo ratings yet

- Cambridge English Vocab ListDocument42 pagesCambridge English Vocab ListseekusNo ratings yet

- 撰写一篇简短的演讲稿Document6 pages撰写一篇简短的演讲稿cjbw63weNo ratings yet

- Construction Contract: The Ethiopian ContextDocument20 pagesConstruction Contract: The Ethiopian ContextNathan yemane100% (1)

- Minimum Value (Threshold Tickets)Document6 pagesMinimum Value (Threshold Tickets)Nikita SharmaNo ratings yet

- Aby Warburg - The Collective Memory As A Medium For ArtDocument11 pagesAby Warburg - The Collective Memory As A Medium For ArtEni0% (1)

- Customer Relationship Management From Strategy To ImplementationDocument35 pagesCustomer Relationship Management From Strategy To Implementationrangu007No ratings yet

- TOEFL Itp Test Taker HandbookDocument3 pagesTOEFL Itp Test Taker HandbookXuan Xuan NguyenNo ratings yet

- Halo Effect PDFDocument16 pagesHalo Effect PDFbellecat2011No ratings yet

- KalayaanDocument8 pagesKalayaanmariNo ratings yet

- 2010 Fannie Servicing Guide VII and VIIIDocument370 pages2010 Fannie Servicing Guide VII and VIIIMike_Dillon100% (1)

- Core Network NFV Proposal For TelcelDocument8 pagesCore Network NFV Proposal For TelcelTELCELINNo ratings yet

- Brach Eichler LLC: BE:10982527.1/UNI285-278205Document75 pagesBrach Eichler LLC: BE:10982527.1/UNI285-278205RHTNo ratings yet

- Astrokrishna - Blogspot.in-My Encounters With AstrologyDocument7 pagesAstrokrishna - Blogspot.in-My Encounters With AstrologysubramanyaNo ratings yet

- Culture Impact On Organization Behavior in CapgeminiDocument2 pagesCulture Impact On Organization Behavior in CapgeminiShubhrant ShuklaNo ratings yet

- The Ultimate Prepper's Survival Bible - A Life-Saving Guide by Christopher JerkinsDocument65 pagesThe Ultimate Prepper's Survival Bible - A Life-Saving Guide by Christopher JerkinsVinicius Fortuna100% (3)

- Tibetan Buddhist Medicine and Psychiatry 282p PDFDocument282 pagesTibetan Buddhist Medicine and Psychiatry 282p PDFDharmaMaya Chandrahas89% (9)

- Result Sabuj JSCDocument1 pageResult Sabuj JSCMohiuddin ShovonNo ratings yet

- Aaakdog. The City of Davao NuguidpptDocument16 pagesAaakdog. The City of Davao NuguidpptAubreyNuguidNo ratings yet