Professional Documents

Culture Documents

SGMEDICOSE

SGMEDICOSE

Uploaded by

Vijay HemwaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SGMEDICOSE

SGMEDICOSE

Uploaded by

Vijay HemwaniCopyright:

Available Formats

M/s. S.G.

MEDICOS

CMA DATA

TRADING: MEDICAL SHOP

Prepared By: Vijay Hemwani & Associates

Chartered Accountants

San Gali, M.G.Road, Khandwa

Mob. No.: 9009239911

Office No.: 0733-2228800

Email: vijayhemwani@gmail.com

PROJECT PROFILE

1 NAME OF THE CONCERN M/S. S.G. MEDICOS

2 ADDRESS KHIRKIYA, KHANDWA

3 FIRM CONSTITUTION PROPRIETORSHIP

4 PROPRIETOR MR. MANOHAR SINGH TOMAR

5 NATURE OF BUSINESS TRADING: MEDICAL SHOP

6 PROJECT FINANCE C.C. LIMIT: RS. 9.50 LACS

7 BANKER CANARA BANK

KHIRKIYA BRANCH, KHANDWA

Disclaimer : This Project Report is prepared on the basis of Reasonable Assumptions,

Information and Quotations provided to us by the client.

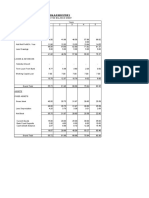

M/S. S.G. MEDICOS

Projected Balance Sheet

Particulars 2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

Sources of Funds:

Proprietor's Capital:

Opening Fund 33.10 35.82 38.63 41.87 46.32

Add: Profit for the year 3.75 3.52 4.32 5.93 6.82

Add : Subsidy - - - - -

Less: Drawings 1.03 0.71 1.08 1.48 1.70

Closing Balance 35.82 38.63 41.87 46.32 51.43

Loans:

C.C. Limit 5.04 8.99 9.50 9.50 9.50

Term Loan 11.00 9.21 7.00 5.00 3.00

Current Liabilities & Provisions:

Sundry Creditors 25.09 32.11 35.00 37.00 39.00

Total 76.95 88.94 93.37 97.82 102.93

Application of Funds:

Fixed Assets 1.85 1.58 1.35 1.16 1.01

Current Assets :

- Deposits 10.69 10.55 11.00 11.50 12.00

- Sundry Debtors 1.22 1.75 2.00 2.40 2.87

- Inventories

- Raw Material - - - - -

- Finished Goods 62.17 74.37 78.09 81.99 86.09

- Cash & Cash Equivalents 1.02 0.69 0.94 0.77 0.95

Total 76.95 88.94 93.37 97.82 102.93

M/S. S.G. MEDICOS

Projected Profitability Statement

Particulars 2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

I. INCOME

Sales 29.75 49.90 59.88 71.86 86.23

Change in Stock 9.20 12.20 3.72 3.90 4.10

Other Income - - - - -

Total 38.95 62.10 63.60 75.76 90.33

II. Expenditure

Purchases 33.13 55.36 55.00 65.00 78.00

Power & Fuel - - - - -

Direct Labour - - - - -

Other Direct Expenses - - - - -

Selling & Administrative Expenses 1.27 1.59 2.99 3.59 4.31

Total 34.40 56.95 57.99 68.59 82.31

III. Profit Before Int. & Dep. (I-II) 4.55 5.15 5.60 7.17 8.02

Interest :

- On CC Limit 0.48 1.36 1.05 1.05 1.05

- On Term Loan - - - - -

Depreciation 0.32 0.27 0.23 0.19 0.15

Tax - - - - -

IV. Total (Int., & Dep.) 0.80 1.63 1.28 1.24 1.20

V. Net Profit After Int, Dep & Tax(III-IV) 3.75 3.52 4.32 5.93 6.82

Debt Service Coverage Ratio:

Services:

Profit After Tax 3.75 3.52 4.32 5.93 6.82

Add: Depreciation 0.32 0.27 0.23 0.19 0.15

Add: Interest - - - - -

Total 4.07 3.79 4.55 6.12 6.97

Debt:

- Principal 2.00 1.79 2.21 2.00 2.00

- Interest on Term Loan - - - - -

Total 2.00 1.79 2.21 2.00 2.00

DSCR 2.04 2.12 2.06 3.06 3.48

Average DSCR 2.55

M/S. S.G. MEDICOS

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS

Form II : Operating Statements

(Amount - Rs in Lacs )

2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

1. Gross Sales

(i) Domestic Sales 29.75 49.90 59.88 71.86 86.23

(ii)Exports - - - - -

2.Less : Excise Duty - - - -

3.Net Sales (1 - 2) 29.75 49.90 59.88 71.86 86.23

4.% rise ( + ) or fall ( - ) in net sales as compared

to previous year 68% 20% 20% 20%

5.Cost of Sales

(i)Raw Materials including stores and other items

used ( in the process of manufacture)

(ii) (a) Imported - - - - -

(b) Indigenous (Adjusted) 33.13 55.36 55.00 65.00 78.00

(iii) Power and Fuel - - - - -

(iv) Direct labour (Factory wages and salaries) - - - - -

(v) Other direct expenses - - - - -

(vi) Depreciation 0.32 0.27 0.23 0.19 0.15

(vii) Sub-total ( i to vi ) 33.45 55.63 55.23 65.19 78.15

(viii) ADD:Opening stock in Process - - - - -

Sub-total 33.45 55.63 55.23 65.19 78.15

(ix) DEDUCT :Closing stocks in Process - - - - -

(x) Cost of Production 33.45 55.63 55.23 65.19 78.15

(xi) ADD: Opening stocks of finished goods 52.97 62.17 74.37 78.09 81.99

Sub-Total 86.42 117.80 129.60 143.28 160.14

(xii) DEDUCT: Closing stocks of finished goods 62.17 74.37 78.09 81.99 86.09

(xiii) Sub-Total ( Total cost of sales ) 24.25 43.43 51.51 61.29 74.05

6. Selling, general and admn. expenses 1.27 1.59 2.99 3.59 4.31

7. Sub-total ( 5 + 6 ) 25.52 45.02 54.51 64.88 78.36

8. Operating Profit before interest ( 3 - 7 ) 4.23 4.88 5.37 6.98 7.87

9. Interest 0.48 1.36 1.05 1.05 1.05

10. Operating Profit after interest (8 - 9 ) 3.75 3.52 4.32 5.93 6.82

11. (i) Add: Other non-operating income

(ii) Deduct Other non-operating expenses - - - - -

Sub-total ( expenses )

(iii) Net of other non-operating income /

expenses net of 11 (1) & (2) ) - - - - -

12. Profit before tax / loss ( 10 + 11 (iii) ) 3.75 3.52 4.32 5.93 6.82

13. Provision for taxes - - - - -

14. Net Profit / loss ( 12 - 13 ) 3.75 3.52 4.32 5.93 6.82

15. (a) Dividend (Proprietor's withdrawal) 1.03 0.71 1.08 1.48 1.70

(b) Dividend Rate 27% 20% 25% 25% 25%

16. Retained Profit ( 14 -15 ) 2.72 2.81 3.24 4.45 5.11

17. Retained Profit /Net Profit (% age) 73% 80% 75% 75% 75%

ANALYSIS OF BALANCE SHEET

FORM - III

(Amount - Rs in Lacs )

2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

CURRENT LIABILITIES

1. Short term borrowings from banks

( including bills purchased and

discounted and excess borrowings

placed on repayment basis )

(i) from applicant Bank-OCC& BILLS 5.04 8.99 9.50 9.50 9.50

(ii) from other banks - - - - -

(iii) of which BP

Sub-Total (A) 5.04 8.99 9.50 9.50 9.50

2.Short - term borrowings from others

3.Sundry creditors ( trade ) 25.09 32.11 35.00 37.00 39.00

4.Advances payments from customers / deposits

from dealers

5.Provision for taxation

6.Dividend payable

7.Other statutory liabilities (due within one year

)

8.Deposits/ Debentures/ Instalments under term

loans/ DPG's etc(due within one year ) - - - - -

9.Other current liabilities and provisions

(due within one year)

Sub-Total (B) 25.09 32.11 35.00 37.00 39.00

10. TOTAL CURRENT LIABILITIES 30.13 41.10 44.50 46.50 48.50

( Total of 1 to 9 )

TERM LIABILITIES

11.Debentures (not maturing within one year)

12.Preference shares

( redeemable a-fter one year

13. Term loans ( excluding instalments 11.00 9.21 7.00 5.00 3.00

payable within one year )

14. Deferred paym'ent credits (excluding

instalments p'ayable within one year

15.Term Deposits ( repayable after one year)

16.Other term liabilities (Unsecured Loans) - - - - -

17. TOTAL TERM LIABILITIES 11.00 9.21 7.00 5.00 3.00

( Total of 11 to 16 )

18. TOTAL OUTSIDE LIABILITIES (10 + 17) 41.13 50.31 51.50 51.50 51.50

NET WORTH

19.Capital Account 33.10 35.82 38.63 41.87 46.32

20.General reserve

21.Interest Subsidy

22. Own Contribution

23.Surplus (+) or deficit (-) in Profit and loss

account 2.72 2.81 3.24 4.45 5.11

24.NET WORTH ( Total of 19 to 23 ) 35.82 38.63 41.87 46.32 51.43

25.TOTAL LIABILITIES ( 18 + 24 ) 76.95 88.94 93.37 97.82 102.93

ANALYSIS OF BALANCE SHEET

FORM - III

2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

ASSETS

Current Assets

26.Cash and bank balances 1.02 0.69 0.94 0.77 0.95

27.Investments ( other than long term

investments)

28. (i) Receivables other than deferred and export

receivables ( including bills purchased and

discounted by bankers ) 1.22 1.75 2.00 2.40 2.87

(ii) Export receivables ( including bills purchases

and discounted by the bankers)

( payable within one year )

29. Instalments of deferred receivables

( due with in one year )

30. Inventory :( i )Raw materials (including stores

and other items used in the process of

manufacture

( a ) Imported

( b ) Indigeneous

( i ) Stock - in – process

( ii ) Finished Goods 62.17 74.37 78.09 81.99 86.09

( iii )Other consumable spares

( a ) Imported

( b ) Indigeneous

31. Advance to suppliers of raw materials Stores

and spares

32.Advance payment of taxes

33. Other current assets (major items To be

specified individually )

Advances and Deposits 10.69 10.55 11.00 11.50 12.00

34. TOTAL CURRENT ASSETS 75.10 87.36 92.02 96.66 101.92

( Total of 26 to 33 )

Fixed Assets

35.Gross block ( land and buildings, machinery,

work-in-progress ) 2.17 1.85 1.58 1.35 1.16

Addition - - - - -

36.Depreciation to date 0.32 0.27 0.23 0.19 0.15

37.NET BLOCK ( 35 – 36 ) 1.85 1.58 1.35 1.16 1.01

OTHER NON-CURRENT ASSETS

38.Investments/bookdebts/advances/deposits

which are not current assets

( I ) (a) Investments in subsidiary companies /

affiliates

( ii ) ( b ) Others - - - - -

( iii )Deferred receivables (maturity exceeding

one year )

( iv) Others

39. Non-consumable stores and spares

40. Other non-current assets including Dues

from Directors

41.TOTAL OTHER NON-CURRENT ASSETS 0.00 0.00 0.00 0.00 0.00

ANALYSIS OF BALANCE SHEET

FORM - III

(Amount - Rs in Lacs )

2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

42.INTANGIBLE ASSETS - - - - -

(patents, goodwill preliminary

expenses bad / doubtful debts not

provided for, etc.,)

43.TOTAL ASSETS 76.95 88.94 93.37 97.82 102.93

( Total of 34, 37, 41 & 42 )

44.TANGIBLE NET WORTH ( 24 - 42 ) 35.82 38.63 41.87 46.32 51.43

45.NET WORKING CAPITAL(34-09) 44.97 46.26 47.52 50.16 53.42

46.Current Ratio ( items 34 / 10 ) 2.49 2.13 2.07 2.08 2.10

47.Total Outside liabilities /

Tanible net worth ( 18 / 44 ) 1.15 1.30 1.23 1.11 1.00

Additional Information :-- NIL NIL NIL NIL NIL

( A ) Arrears of depreciation :

( B ) Contingent liabilities:

( i ) Arrears of cumulative dividends

( ii ) Gratuity scheme for staff

( iii ) Other liabilities not provided for

Form IV

COMPARITIVE STATEMENT OF CURRENT ASSETS & CURRENT LIABILITIES

(Amount - Rs in Lacs )

2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

A.CURRENT ASSETS

Raw material (including stores and other items

used in the process of manufacture )

a) Imported Months consumption

(b) Indigenious Months consumption

2.Other consumable spares excluding those

included in item ( i ) above

a) Imported Months consumption

(b) Indigenious Months consumption - - - - -

3.Stocks-In-Process

Months' cost of production - - - - -

4.Finished goods: 62.17 74.37 78.09 81.99 86.09

Months cost of sales

5. Receivables other than export and

deferred receivables including bill

purchased and and discounted by bankers 1.22 1.75 2.00 2.40 2.87

Months domestic sales excluding deferred

payment sales

6.Export receivables (including bill purchased

and discounted Months Export sales

7.Advances to suppliers of raw materials &

stores / spares consumables

8.Other current assets including

cash and bank balances and

deferred receivables due with

in one year ( major items )

Cash & Bank balances 1.02 0.69 0.94 0.77 0.95

Advance Taxes

Others 10.69 10.55 11.00 11.50 12.00

9.TOTAL CURRENT ASSETS 75.10 87.36 92.02 96.66 101.92

( To agree with 34 in form III )

B. CURRENT LIABILITIES

(Other than bank borrowings for working capital)

10.Creditors for purchase of raw materials, stores

& consumable spares 25.09 32.11 35.00 37.00 39.00

( Month's purchases )

11.Advances from customers

12.Statutory liabilities

13.Other current liabilities Instalments of TL &

DPG Public Deposits/ Unsecured Loans Others - - - - -

14.TOTAL 25.09 32.11 35.00 37.00 39.00

(to agree with Sub-total (B)

Form V

COMPUTATION OF MAXIMUM PERMISSIBLE BANK FINANCE FOR WORKING CAPITAL

(Amount - Rs in Lacs )

2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

1. Total Current Assets ( 9 in Form IV ) 75.10 87.36 92.02 96.66 101.92

2. Other Current Liabilities 25.09 32.11 35.00 37.00 39.00

(Other than bank borrowing)

( 14 in Form IV )

3. Working capital gap (WCG) ( 1 -- 2 ) 50.01 55.25 57.02 59.66 62.92

4. Minimum stipulated net working

Capital i.e., 25 % of WCG / 25 % of

total current assets as the case 12.50 13.81 14.26 14.91 15.73

may be depending upon the method of

lending being applied (Export recei

-vables to be excl. in both methods)

5. Actual / Projected net working capital 44.97 46.26 47.52 50.16 53.42

( 45 in Form III )

6. Item 3 minus item 4 37.51 41.44 42.77 44.74 47.19

7. Item 3 minus item 5 5.04 8.99 9.50 9.50 9.50

8. Maximum permissible bank finance 5.04 8.99 9.50 9.50 9.50

( item 6 or 7 whichever is lower )

Actual/Projected Bank Borrowings 5.04 8.99 9.50 9.50 9.50

9. Excess borrowings ( representing - - - - -

shortfall in NWC)

Form V1

FUNDS FLOW STATEMENT

(Amount - Rs in Lacs )

2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

SOURCES

1.(a) Net Profit 3.75 3.52 4.32 5.93 6.82

(b) Depreciation 0.32 0.27 0.23 0.19 0.15

(c) Increase in capital 33.10 - - - -

(d) Increase in Term Liabilities including

public deposits 13.00 - - - -

(e) Decrease in

(i) Fixed Assets - - - - -

(i) Other non-current assets

(f) Others : Unsecured Loans - - - - -

(g) TOTAL 50.17 3.79 4.55 6.12 6.97

USES

2.(a) Net Loss

(b) Decrease in Term Liabilities including public

deposits 2.00 1.79 2.21 2.00 2.00

(c) Increase in

(i) Fixed Assets 2.17 - - -

(ii) Other non- current assets 10.69 (0.14) 0.45 0.50 0.50

(d) Dividend (Proprietor's Withdrawals) 1.03 0.71 1.08 1.48 1.70

(e) Others - - - - -

(f) TOTAL 15.89 2.36 3.74 3.98 4.20

3. Long Term Surplus ( + )/Deficit (-) ( 1 – 2 ) 34.28 1.43 0.81 2.14 2.76

4.Increase / Decrease in Current Assets * ( as per

details given below ) 64.41 12.40 4.21 4.14 4.76

5.Increase / Decrease in Current Liabilities other

than Bank borrowings ) 25.09 7.02 2.89 2.00 2.00

6.Increase/Decrease in Working capital gap(4-5) 39.32 5.38 1.32 2.14 2.76

7. Net Surplus ( + ) / Deficit ( -- ) (5.04) (3.95) (0.51) 0.00 -

( difference of 3 & 6 )

8.Increase / Decrease in bank borrowings 5.04 3.95 0.51 - -

*Break-up of ( 4 ) :

(i) Increase / Decrease in Raw Materials - - - - -

(ii) Increase / Decrease in Stock-in-Process - - - - -

(iii)Increase / Decrease in Finished Goods 62.17 12.20 3.72 3.90 4.10

(iv)Increase / Decrease in Receivables

( a ) Domestic 1.22 0.53 0.25 0.40 0.48

( b ) Export

(v)Increase / Decrease in Stores & Spares - - - - -

(vi)Increase / Decrease in Other current assets 1.02 (0.33) 0.25 (0.17) 0.18

Total 64.41 12.40 4.21 4.14 4.76

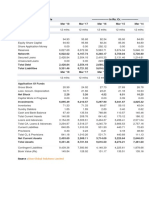

M/S. S.G. MEDICOS

Assesment of Working Capital Requirements

Financial Indicators

PARTICULARS 2021-22 2022-23 2023-24 2024-25 2025-26

Actual Actual Estimated Projected Projected

1. Net Sales 29.75 49.90 59.88 71.86 86.23

2. Operating Profit 4.23 4.88 5.37 6.98 7.87

3. Profit After Tax 3.75 3.52 4.32 5.93 6.82

3.1. Gross Profit 5.82 6.74 8.60 10.76 12.33

A. PAT / Net sales( % ) 12.61% 7.05% 7.22% 8.25% 7.90%

B. Operating Profit / Net Sales (%) 14.22% 9.78% 8.98% 9.71% 9.12%

B.1. Gross Profit Ratio 19.56% 13.51% 14.36% 14.97% 14.30%

4. Tangible Net Worth 35.82 38.63 41.87 46.32 51.43

5. Total Outside Liability 41.13 50.31 51.50 51.50 51.50

C. TOL / TNW 1.15 1.30 1.23 1.11 1.00

6. PBDIT 4.55 5.15 5.60 7.17 8.02

7. Interest 0.48 1.36 1.05 1.05 1.05

D. ISCR (PBDIT / Int.) 0.00 3.79 5.34 6.83 7.63

8. Current Assets 75.10 87.36 92.02 96.66 101.92

9. Current Liabilities 30.13 41.10 44.50 46.50 48.50

E. Current Ratio (CA/CL) 2.49 2.13 2.07 2.08 2.10

F. Bank Finance / TCA ( % ) 14.65% 10.54% 7.61% 5.17% 2.94%

G. Gross Sales / Total Current Assets 0.40 0.57 0.65 0.74 0.85

H. Operating Profit / TNW ( % ) 11.81% 12.63% 12.84% 15.06% 15.29%

10. Long Term Debt 11.00 9.21 7.00 5.00 3.00

11. Equity 35.82 38.63 41.87 46.32 51.43

I. Capital Employed 46.82 47.84 48.87 51.32 54.43

J. Debt/Equity Ratio 0.31 0.24 0.17 0.11 0.06

K. Net Profit / Capital Employed (%) 8.01% 7.36% 8.85% 11.55% 12.52%

12. Inventories 62.17 74.37 78.09 81.99 86.09

L. Inventory Turnover Ratio 0.48 0.67 0.77 0.88 1.00

M. Inventory Turnover Period 762.76 543.99 475.99 416.49 364.43

13. Receivables 1.22 1.75 2.00 2.40 2.87

N. Receivables Turnover Ratio 24.39 28.51 30.00 30.00 30.00

O. Receivables Turnover Period 14.97 12.80 12.17 12.17 12.17

14. Payables 25.09 32.11 35.00 37.00 39.00

15. Purchases 33.13 55.36 55.00 65.00 78.00

P. Payables Turnover Ratio 1.32 1.72 1.57 1.76 2.00

Q. Payables Turnover Period 276.42 211.71 232.27 207.77 182.50

You might also like

- NBFC Business PlanDocument6 pagesNBFC Business PlanVishnu Upadhyay67% (3)

- Internal Audit Dept Wise Check ListDocument31 pagesInternal Audit Dept Wise Check ListVijay Hemwani100% (2)

- Basis and Presumption of The ProjectDocument11 pagesBasis and Presumption of The ProjectVijay HemwaniNo ratings yet

- SHABNAMKHANDocument20 pagesSHABNAMKHANVijay HemwaniNo ratings yet

- CRDocument19 pagesCRVijay HemwaniNo ratings yet

- 28 - Swati Aggarwal - VedantaDocument11 pages28 - Swati Aggarwal - Vedantarajat_singlaNo ratings yet

- Cma DataDocument9 pagesCma Datapk9079885245No ratings yet

- Final ProjectionsDocument6 pagesFinal ProjectionsMohit JainNo ratings yet

- ECG Canara Bank Term Loan - 5 LakhsDocument11 pagesECG Canara Bank Term Loan - 5 Lakhsanil kumar thota AssociatesNo ratings yet

- Balance Sheet: (In Crores)Document5 pagesBalance Sheet: (In Crores)Ashwini KJNo ratings yet

- Pg1 3 MergedDocument10 pagesPg1 3 MergedAryan DhamechaNo ratings yet

- M/S. M/S. Sai Internet and ServicesDocument8 pagesM/S. M/S. Sai Internet and ServicesAkhil JamadarNo ratings yet

- Car WashingDocument21 pagesCar WashingKarthi KarthiNo ratings yet

- Balance Sheet of Reliance Power LTDDocument6 pagesBalance Sheet of Reliance Power LTDbhus_meshNo ratings yet

- Financial Analysis of NBFCDocument14 pagesFinancial Analysis of NBFCPKNo ratings yet

- Project ReportDocument8 pagesProject Reportsukhdev bhattarNo ratings yet

- PN L Oldest 5 YrsDocument2 pagesPN L Oldest 5 YrsAryan BagdekarNo ratings yet

- Project Report Printin PressDocument5 pagesProject Report Printin Pressmanohar michaelNo ratings yet

- Scooter TrendsDocument107 pagesScooter TrendsRima ParekhNo ratings yet

- Operating Statement Borrower's Name: XXXXXXXXXXXXXXXXXDocument13 pagesOperating Statement Borrower's Name: XXXXXXXXXXXXXXXXXAbhishek GoenkaNo ratings yet

- KMC Balance Sheet Stand Alone NewDocument2 pagesKMC Balance Sheet Stand Alone NewOmkar GadeNo ratings yet

- Cost of Project & Means of Finance Annexure-1Document12 pagesCost of Project & Means of Finance Annexure-1Siddharth RanaNo ratings yet

- TM Public School Jail Road OraiDocument10 pagesTM Public School Jail Road OraiCA Shubham PatelNo ratings yet

- Financial Projections (Part 3)Document7 pagesFinancial Projections (Part 3)Mohit JainNo ratings yet

- Financial Projections (Part 3)Document7 pagesFinancial Projections (Part 3)Mohit JainNo ratings yet

- Financials SaharaDocument19 pagesFinancials SaharaJitendra NikhareNo ratings yet

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenNo ratings yet

- Corporate Banking ProjectDocument48 pagesCorporate Banking ProjectrahulrelanNo ratings yet

- Osian'sDocument12 pagesOsian'sDiksha SharmaNo ratings yet

- Dividend Payout Ration On EPS CalculationDocument2 pagesDividend Payout Ration On EPS CalculationvanishaNo ratings yet

- Parle Biscut CompanyDocument5 pagesParle Biscut CompanyBharat RajputNo ratings yet

- QTzna 3 TD 6 W HQ CGTN5 He DHi Leaguh Utg DNAoje BYCDocument6 pagesQTzna 3 TD 6 W HQ CGTN5 He DHi Leaguh Utg DNAoje BYCmagibala50No ratings yet

- Ifm Assignment 2Document8 pagesIfm Assignment 2Kappala AbhishekNo ratings yet

- RatiosDocument2 pagesRatiosPRATHAMNo ratings yet

- Project Report Hatwal JiDocument14 pagesProject Report Hatwal JiCA Manoj BoraNo ratings yet

- Britannia X Ls XDocument15 pagesBritannia X Ls Xshubham9308No ratings yet

- Comparison - Ratios - Tyre - DistributionDocument15 pagesComparison - Ratios - Tyre - DistributionParehjuiNo ratings yet

- J SCX KGH 6 QOlpj B5 en KFYVqm 6 S CR2 DTX 4 LN 8 H2 QB QDocument7 pagesJ SCX KGH 6 QOlpj B5 en KFYVqm 6 S CR2 DTX 4 LN 8 H2 QB Qsaranlithesh1No ratings yet

- Sapm Stock AnalysisDocument23 pagesSapm Stock AnalysisAthira K. ANo ratings yet

- Unilever P&G Unilever P&G Assets: Add A Footer 1Document4 pagesUnilever P&G Unilever P&G Assets: Add A Footer 1Kathreen Aya ExcondeNo ratings yet

- Rafeeqa Begum (DPR)Document13 pagesRafeeqa Begum (DPR)syedNo ratings yet

- Raymond P&LDocument2 pagesRaymond P&LSJNo ratings yet

- Waa Solar Financial AnalysisDocument18 pagesWaa Solar Financial AnalysisINBASEKARAN PNo ratings yet

- CMA DataDocument19 pagesCMA Dataca.vitalconsultantsNo ratings yet

- Zydus Wellness Standalone Yearly Results Vanaspati & Oils Standalone Yearly Results of Zydus Wellness - BSE 531335, NSE ZYDUSWELLDocument2 pagesZydus Wellness Standalone Yearly Results Vanaspati & Oils Standalone Yearly Results of Zydus Wellness - BSE 531335, NSE ZYDUSWELLRozy SinghNo ratings yet

- AFS Assignment by Rimsha KhalidDocument14 pagesAFS Assignment by Rimsha KhalidAhmad SafiNo ratings yet

- Modi Rubber LimitedDocument10 pagesModi Rubber LimitedRohit BhatNo ratings yet

- AhujaDocument7 pagesAhujaShashikant Pandit RajnikantNo ratings yet

- Ch-3 Finance Department Trading & P&L AccountDocument4 pagesCh-3 Finance Department Trading & P&L AccountMit MehtaNo ratings yet

- HDFC PLDocument2 pagesHDFC PLfakavet723No ratings yet

- Petron TERM PAPER VERTICAL ANALYSISDocument4 pagesPetron TERM PAPER VERTICAL ANALYSISGeve LibertadNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Corporate Finance - 2 DR .Atul KarnDocument12 pagesCorporate Finance - 2 DR .Atul KarnChaitanya GembaliNo ratings yet

- Balance Sheet - in Rs. Cr.Document3 pagesBalance Sheet - in Rs. Cr.jelsiya100% (1)

- JaypeeDocument2 pagesJaypeeKintali VinodNo ratings yet

- FM Cce2Document7 pagesFM Cce2shrutiNo ratings yet

- Reliance Chemotex Balance SheetDocument2 pagesReliance Chemotex Balance SheetRushil GabaNo ratings yet

- Voith PDFDocument2 pagesVoith PDFABHAY KUMAR SINGHNo ratings yet

- Group 1 Adani PortsDocument12 pagesGroup 1 Adani PortsshreechaNo ratings yet

- Merged ReportDocument14 pagesMerged ReportMohit JainNo ratings yet

- Basis and Presumption of The ProjectDocument11 pagesBasis and Presumption of The ProjectVijay HemwaniNo ratings yet

- Compendium District Wise Industrial Profile of Madhya PradeshDocument589 pagesCompendium District Wise Industrial Profile of Madhya PradeshVijay Hemwani100% (4)

- Mrs. Basanti Bai Maavashkar: Cost of ProjectDocument1 pageMrs. Basanti Bai Maavashkar: Cost of ProjectVijay HemwaniNo ratings yet

- Cottonseed Oil OverviewDocument3 pagesCottonseed Oil OverviewVijay HemwaniNo ratings yet

- DPR PuducherryDocument259 pagesDPR PuducherryVijay HemwaniNo ratings yet

- Business Presentation - Venngage - Free Infographic Maker 1 PDFDocument2 pagesBusiness Presentation - Venngage - Free Infographic Maker 1 PDFVijay HemwaniNo ratings yet

- Tutti FruttiDocument7 pagesTutti FruttiVijay HemwaniNo ratings yet

- Document PDFDocument63 pagesDocument PDFVijay HemwaniNo ratings yet

- Lesson 1.2Document2 pagesLesson 1.2Kim SunooNo ratings yet

- EPCL Financial Model CY22Document87 pagesEPCL Financial Model CY22Umer FarooqNo ratings yet

- (Synopsis Towards The Partial Fulfillment of Assessment in The Subject of CommercialDocument6 pages(Synopsis Towards The Partial Fulfillment of Assessment in The Subject of CommercialAmita SinwarNo ratings yet

- Europe in TransitionDocument110 pagesEurope in TransitionVan NguyenNo ratings yet

- Retail Marketing - Unit 3Document49 pagesRetail Marketing - Unit 3Aafreen Shaik AP21311130022100% (1)

- Chapter 2 Bank FundDocument31 pagesChapter 2 Bank FundNiloy AhmedNo ratings yet

- UGRD-ACTG6153E Fundamentals of Accounting Theory & Practice 1BDocument9 pagesUGRD-ACTG6153E Fundamentals of Accounting Theory & Practice 1BVincent SungaNo ratings yet

- Chap 6 - Exercise - ST (Ans)Document19 pagesChap 6 - Exercise - ST (Ans)Phan Thien Nhan (K17 CT)No ratings yet

- Ship Chartering TermsDocument16 pagesShip Chartering TermsAli Osman YaşarNo ratings yet

- CNF, Cif, Fob & Exw Explained!Document68 pagesCNF, Cif, Fob & Exw Explained!joysinhaNo ratings yet

- Ancient Indian Commerce - Dr. B.R.ambedkarDocument21 pagesAncient Indian Commerce - Dr. B.R.ambedkarVeeramani Mani100% (2)

- Profit Loss and Interest Questions For CATDocument10 pagesProfit Loss and Interest Questions For CATSreeparna DasNo ratings yet

- BBA Fee Structure 2018-21Document2 pagesBBA Fee Structure 2018-21Syed Shamiul HaqueNo ratings yet

- Billed To: International Package Services InvoiceDocument2 pagesBilled To: International Package Services InvoiceBingmondoy Feln Lily CanonigoNo ratings yet

- Capital and Return On CapitalDocument38 pagesCapital and Return On CapitalThái NguyễnNo ratings yet

- DER2019 EN Report f4Document180 pagesDER2019 EN Report f4Diptiranjan PandaNo ratings yet

- Agriculture and Food Crops PDFDocument877 pagesAgriculture and Food Crops PDFAugusto Becerra Lopez-LavalleNo ratings yet

- Profit MaximizationDocument37 pagesProfit MaximizationNafiah Sholikhatun jamilNo ratings yet

- Jacb ExpensesDocument28 pagesJacb Expensesjohn dominic aldabaNo ratings yet

- Expansion and Consolidation of Colonial Power1Document74 pagesExpansion and Consolidation of Colonial Power1dhirajNo ratings yet

- Financial EnvironmentDocument20 pagesFinancial EnvironmentZahidul Islam SoykotNo ratings yet

- Discussion Question 2 Politicial Economy in International TradeDocument2 pagesDiscussion Question 2 Politicial Economy in International TradeCrizhae OconNo ratings yet

- Track DHL Express Shipments: Result SummaryDocument1 pageTrack DHL Express Shipments: Result SummaryRichard NegronNo ratings yet

- Quiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsDocument6 pagesQuiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsKyle EspinozaNo ratings yet

- Foreign Exchange: Presented To Coronation Merchant Bank - Training SchoolDocument24 pagesForeign Exchange: Presented To Coronation Merchant Bank - Training SchoolBlake SheltonNo ratings yet

- EZYPAY PLUS - Terms & ConditionsDocument14 pagesEZYPAY PLUS - Terms & ConditionsRanmishah AmizahNo ratings yet

- Nine Distribution Channel MembersDocument4 pagesNine Distribution Channel MembersShadik HossainNo ratings yet

- Roi BK 16975016122021Document1 pageRoi BK 16975016122021TEO EMIL TATEOSYANNo ratings yet

- Group - 3 - Assignment (Term Paper)Document13 pagesGroup - 3 - Assignment (Term Paper)Biniyam YitbarekNo ratings yet

- AR December 2023Document12 pagesAR December 2023HAbbunoNo ratings yet