Professional Documents

Culture Documents

Issue No 227 February 2018

Issue No 227 February 2018

Uploaded by

Luna ChenCopyright:

Available Formats

You might also like

- Issue No 228 March 2018Document53 pagesIssue No 228 March 2018Luna ChenNo ratings yet

- Issue No 229 April 2018Document40 pagesIssue No 229 April 2018Luna ChenNo ratings yet

- EC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22Document7 pagesEC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22SAMYAK PANDEYNo ratings yet

- EC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedDocument7 pagesEC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedSAMYAK PANDEYNo ratings yet

- Economic Highlights - Fuel and Sugar Prices Were Raised To Reduce - 16/7/2010Document3 pagesEconomic Highlights - Fuel and Sugar Prices Were Raised To Reduce - 16/7/2010Rhb InvestNo ratings yet

- Ingot Market - 6WResearch - VipulDocument41 pagesIngot Market - 6WResearch - Vipulvipul tutejaNo ratings yet

- Minerals-Energy-Outlook-May-2024- NABDocument5 pagesMinerals-Energy-Outlook-May-2024- NABhengkyn.daulayNo ratings yet

- Nilai Ekspor Migas-NonMigas, 2023-2024Document2 pagesNilai Ekspor Migas-NonMigas, 2023-2024kitajakartacenterNo ratings yet

- Economic Impact of Tariff HikesDocument19 pagesEconomic Impact of Tariff HikesThu Phương NguyễnNo ratings yet

- Vietnam-China Trade, FDI and ODA Relations (1998-2008) and The Impacts Upon VietnamDocument34 pagesVietnam-China Trade, FDI and ODA Relations (1998-2008) and The Impacts Upon VietnamNeos HeroNo ratings yet

- Table 1: Summary of Australia'S Trade (A)Document4 pagesTable 1: Summary of Australia'S Trade (A)Mã Tố ThanhNo ratings yet

- BRSbrsEng 20230915095948Document16 pagesBRSbrsEng 20230915095948Senda SurauNo ratings yet

- Management Report 01.2020 - GGDocument57 pagesManagement Report 01.2020 - GGmircearadu_1970No ratings yet

- First Quarter Report: For Period Ending 31 March 2021Document12 pagesFirst Quarter Report: For Period Ending 31 March 2021Liam GallagherNo ratings yet

- Table-1: Crude Oil Production (In TMT) : : ProvisionalDocument10 pagesTable-1: Crude Oil Production (In TMT) : : ProvisionalAvijoy SenguptaNo ratings yet

- Cambodia: Date: GAIN Report NumberDocument15 pagesCambodia: Date: GAIN Report NumberFaran MoonisNo ratings yet

- China Chlor Alkali Monthly Report 001Document20 pagesChina Chlor Alkali Monthly Report 001jucyapleNo ratings yet

- Common Excel Questions START v2Document10 pagesCommon Excel Questions START v2Apple StarkNo ratings yet

- The Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Document5 pagesThe Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Rohit AggarwalNo ratings yet

- mcs2023 PotashDocument2 pagesmcs2023 PotashSolaris VeritatisNo ratings yet

- Arbc 2018 PDFDocument8 pagesArbc 2018 PDFGita Aulia AzahraNo ratings yet

- Common Excel Questions START - v2Document11 pagesCommon Excel Questions START - v2Mark SalvañaNo ratings yet

- Keekonomian SimresDocument15 pagesKeekonomian SimresOnesiforus TappangNo ratings yet

- PEANUT MARKETING NEWS - December 16, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 16, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Daily Global Polyolefins Report - Monday, May 31, 2021Document19 pagesDaily Global Polyolefins Report - Monday, May 31, 2021sohailNo ratings yet

- UAE TradeDocument9 pagesUAE TradeHarshal AgarwalNo ratings yet

- 09ComInt 202210 ENDocument20 pages09ComInt 202210 ENRNo ratings yet

- Managerial Economics - Trend Analysis of Petroleum ProductsDocument5 pagesManagerial Economics - Trend Analysis of Petroleum ProductsTaha SuhailNo ratings yet

- Real Life. Real Answers.: NaborDocument4 pagesReal Life. Real Answers.: Naborapi-26167871No ratings yet

- Angkutan Bawahan 2020Document36 pagesAngkutan Bawahan 2020Luth NauvaldiNo ratings yet

- MNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFDocument8 pagesMNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFANIL PARIDANo ratings yet

- Daily Comm ME - Svb33of9Document3 pagesDaily Comm ME - Svb33of9The red RoseNo ratings yet

- Book 2Document12 pagesBook 2anasNo ratings yet

- (All Column Values) 39076110 4 Between 05/01/2020 - 05/31/2021Document12 pages(All Column Values) 39076110 4 Between 05/01/2020 - 05/31/2021shawon azamNo ratings yet

- Datos Actividad2Document5 pagesDatos Actividad2horizontempresarial.contactoNo ratings yet

- Weekly Commodities CommentaryDocument6 pagesWeekly Commodities CommentaryInternational Business TimesNo ratings yet

- Rice Price - Weekly - Bangkok - Thailand - TH2024-0006Document3 pagesRice Price - Weekly - Bangkok - Thailand - TH2024-0006grant.dinartoNo ratings yet

- American Cheminal Corp SpreadsheetDocument16 pagesAmerican Cheminal Corp SpreadsheetRahul PandeyNo ratings yet

- Final Assessment: Petroleum Economics Problem SolvingDocument4 pagesFinal Assessment: Petroleum Economics Problem SolvingSayaf SalmanNo ratings yet

- Real Life. Real Answers.: NaborDocument4 pagesReal Life. Real Answers.: Naborapi-26167871No ratings yet

- 2012-Noman TextileDocument3 pages2012-Noman TextileShahadat Hossain ShahinNo ratings yet

- Costflow Juli 2022Document6 pagesCostflow Juli 2022PT. PANDERA KILA MOROWALINo ratings yet

- TD Economics: Weekly Commodity Price ReportDocument6 pagesTD Economics: Weekly Commodity Price ReportInternational Business TimesNo ratings yet

- The Gordon Model Cost of EquityDocument35 pagesThe Gordon Model Cost of EquityMahmood AhmadNo ratings yet

- JBVN134 - SPL Feb 2021Document48 pagesJBVN134 - SPL Feb 2021Nguyen PhuongNo ratings yet

- Cost Saving 2020Document96 pagesCost Saving 2020marliyanaNo ratings yet

- PR-063 DT - 20.02.2023 - Export of Oilmeals - Apr.'22 To Jan.'23Document5 pagesPR-063 DT - 20.02.2023 - Export of Oilmeals - Apr.'22 To Jan.'23SAMYAK PANDEYNo ratings yet

- ReportDocument18 pagesReportfclmlchNo ratings yet

- Weekly Commodity Price ReportDocument6 pagesWeekly Commodity Price ReportInternational Business Times100% (3)

- Fuel UpdateDocument1 pageFuel UpdateM.RiadyNo ratings yet

- 0802PMDocument2 pages0802PMZerohedgeNo ratings yet

- Quarterly Bulletin of Statistics - Q1 2017Document6 pagesQuarterly Bulletin of Statistics - Q1 2017BernewsAdminNo ratings yet

- Ans To The 1st Part of MID PracticeDocument4 pagesAns To The 1st Part of MID PracticeMahmoud AlfarNo ratings yet

- CCFG - July Spandex Feedstock & Fiber Market ReportDocument13 pagesCCFG - July Spandex Feedstock & Fiber Market ReportNISHSHANKANo ratings yet

- I Energy Weekly Price Update 1680544822Document17 pagesI Energy Weekly Price Update 1680544822PRASANJIT MISHRANo ratings yet

- Cameroon Crude Oil and Petroleum Products Import and Export 1986-2012 - Cameroon Data PortalDocument1 pageCameroon Crude Oil and Petroleum Products Import and Export 1986-2012 - Cameroon Data Portalpeguy diffoNo ratings yet

- DieselDocument7 pagesDieselAbdulaziz Al OmarNo ratings yet

- Book1Document5 pagesBook1berlindo.citra.ucbNo ratings yet

- Weekly Commodity Price ReportDocument6 pagesWeekly Commodity Price ReportInternational Business TimesNo ratings yet

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryFrom EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- 3 KTP LSAT Campus Marketing 1 Page Flyer FINAL 220906Document2 pages3 KTP LSAT Campus Marketing 1 Page Flyer FINAL 220906Luna ChenNo ratings yet

- CH7 - 折舊及遞耗資產Document32 pagesCH7 - 折舊及遞耗資產Luna ChenNo ratings yet

- CH9 - 無形資產與其他資產Document74 pagesCH9 - 無形資產與其他資產Luna ChenNo ratings yet

- CH8 - 減損與處分Document64 pagesCH8 - 減損與處分Luna ChenNo ratings yet

- CH4 - 客戶合約之收入Document136 pagesCH4 - 客戶合約之收入Luna ChenNo ratings yet

- CH5 - 存貨Document72 pagesCH5 - 存貨Luna ChenNo ratings yet

- CH2 - 財務報導表達Document74 pagesCH2 - 財務報導表達Luna ChenNo ratings yet

- 1.1 Assignment - Audit of Cash and Cash EquivalentsDocument2 pages1.1 Assignment - Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Notice For FeeDocument1 pageNotice For FeeParth MaheshwariNo ratings yet

- Naga CLUPDocument25 pagesNaga CLUPfakepostaladress100% (1)

- Castor OilDocument3 pagesCastor OilarchawdaNo ratings yet

- Operations Management 11th Edition Heizer Solutions ManualDocument13 pagesOperations Management 11th Edition Heizer Solutions Manualorlaharveyykh4100% (32)

- Prelim Performance Task 1 Problems of Philippines AgricultureDocument12 pagesPrelim Performance Task 1 Problems of Philippines AgriculturePrince CaratorNo ratings yet

- Quiz 2 - Chapter 7 - Attempt Review Review 1Document8 pagesQuiz 2 - Chapter 7 - Attempt Review Review 1s11186706No ratings yet

- Toll Tariffs: Effective FromDocument8 pagesToll Tariffs: Effective FromVishalBeheraNo ratings yet

- Law of Diminishing ReturnsDocument7 pagesLaw of Diminishing Returnssrv 99No ratings yet

- Mid-1 Revision Worksheet-1Document6 pagesMid-1 Revision Worksheet-1Awaara AgentNo ratings yet

- 10 Plus Purchase Not in TallyDocument14 pages10 Plus Purchase Not in TallyAAKARNo ratings yet

- MSME CertificateDocument3 pagesMSME CertificatePuneet SharmaNo ratings yet

- 2.KCGFinancialLiteracy FarmersPerspectives MiteshPatelDocument5 pages2.KCGFinancialLiteracy FarmersPerspectives MiteshPatelFlorianNo ratings yet

- Module 5 Accomodation Reception ServicesDocument75 pagesModule 5 Accomodation Reception ServicesPearlane Hope LEHAYAN100% (1)

- Tai Lieu Denso PDFDocument82 pagesTai Lieu Denso PDFLê Đăng ThắngNo ratings yet

- Dulcotest Dt1B Photometer: Operating ManualDocument52 pagesDulcotest Dt1B Photometer: Operating ManualrudiNo ratings yet

- Operator Training: Customer Training Course ProgrammeDocument34 pagesOperator Training: Customer Training Course ProgrammePablo Valenzuela ArredondoNo ratings yet

- Auditing Summary Notes Chapter 1Document1 pageAuditing Summary Notes Chapter 1dipak tNo ratings yet

- Current Affairs Q&A PDF - November 2020 by AffairsCloudDocument214 pagesCurrent Affairs Q&A PDF - November 2020 by AffairsCloudraviNo ratings yet

- Nabl 700Document11 pagesNabl 700selvarajprabhu.0812No ratings yet

- Mod7 Part 1 Manufacturing OperationsDocument23 pagesMod7 Part 1 Manufacturing Operationsmarjorie magsinoNo ratings yet

- 10.1 Civil Liability Bunker CertificateDocument2 pages10.1 Civil Liability Bunker CertificateWILLINTON HINOJOSANo ratings yet

- 353 Idbi Statementqxec97Document13 pages353 Idbi Statementqxec97Mohammad Farhan Roll 16No ratings yet

- M-4 Barter CombinedDocument4 pagesM-4 Barter CombinedGokul PurohitNo ratings yet

- BHARATH AutooooDocument43 pagesBHARATH AutooooShashi ReddyNo ratings yet

- Baripada Daily ReportDocument103 pagesBaripada Daily Reportpandaashwinikumar44No ratings yet

- Customer Preference and Potential of Specialty Tea in Ernakulam DistrictDocument9 pagesCustomer Preference and Potential of Specialty Tea in Ernakulam Districtalan simonNo ratings yet

- Brand BookDocument413 pagesBrand BookMarry jayne AdamsNo ratings yet

- ASoal Tes Literasi Sains - PDFDocument11 pagesASoal Tes Literasi Sains - PDFRini Dwi YulianiNo ratings yet

- Kamdhenu Engineering CompanyDocument9 pagesKamdhenu Engineering CompanySwapnil KothavadeNo ratings yet

Issue No 227 February 2018

Issue No 227 February 2018

Uploaded by

Luna ChenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Issue No 227 February 2018

Issue No 227 February 2018

Uploaded by

Luna ChenCopyright:

Available Formats

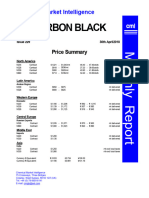

Chemical Market Intelligence

CARBON BLACK

Issue 227 28th February 2018

Price Summary

North America

N234 Contract $1,038 - $1,060/mt 47.20 - 48.20cts/lb ex-works

N326 Contract $834 - $851/mt 37.90 - 38.70cts/lb ex-works

N339 Contract $807 - $935/mt 36.70 - 42.50cts/lb ex-works

N660 Contract $726 - $741/mt 33.00 - 33.70cts/lb ex-works

Latin America

N339 Contract $900 - $950 mt delivered

N326 Contract $850 - $875 mt delivered

Western Europe

Domestic

N220 Contract $1,217 - $1,247 € 990 - € 1,015 mt delivered

N339 Contract $1,174 - $1,211 € 955 - € 985 mt delivered

N326 Contract $1,125 - $1,161 € 915 - € 945 mt delivered

Central Europe

N326 Contract $1,094 - $1,131 € 890 € 920 mt delivered

N660 Contract $1,020 - $1,057 € 830 € 860 mt delivered

Middle East

N220 Market $1,170 - $1,250 mt delivered

N330 Market $1,050 - $1,100 mt delivered

Asia

South Korea Exports

300 series Market $1,100 - $1,200 excl delivery

South East Asia

N220 Contract $1,150 mt delivered

N330 Contract $970 - $1,100 mt delivered

Currency $ Equivalent: € 0.810 £0.721 ¥106.30

Currency € Equivalent: $1.229 £0.891 ¥130.40

Chemical Market Intelligence

75 Crossways, Three Bridges

Crawley, West Sussex, RH10 1QT (UK)

Tel: +44 (0) 78 6659 6141

E-mail: cmigb@aol.com

Carbon Black Issue 227 – February 2018

Feedstock

Crude oil prices declined in mid February driven by fears that proposed US sanctions on steel and

aluminum could lead to a trade war and dampen economic growth, but have subsequently rebounded.

Global oil demand has been revised upwards slightly for 2018 to an increase of 1.4mbpd due to

optimistic global economic forecasts produced by the International Monetary Fund. Nevertheless the rate

of increase in demand will be slower than in 2017, in part caused by higher oil prices leading to fuel

switching in some emerging economies. In the US increasing crude inventories towards the end of

February are leading to suggestions that US crude demand has not increased as fast as the hike in crude

oil prices suggest.

Global oil supply declined marginally in January to 97.7mbpd, but increased year on year by 1.5mbpd,

driven by increasing output in the US. Crude oil output by the OPEC cartel declined month on month by

80,000bpd to 32.28mbpd in February, the lowest volume of output for ten months. The cut in output was

in part due to a decline in output of 30,000bpd in Venezuela, while oil output in the UAE declined by

50,000bpd due to maintenance. Saudi Arabia also cut its output by 80,000bpd in February from the

previous month to 9.88mbpd. The cartel is exceeding its agreed production cuts in order to speed the

depletion of high crude inventories.

Crude oil exports from Iraq reached a daily rate of 3.42mbpd in February despite no exports from the

northern oilfields in the Kurdish region, as oil output has been halted due to the take over of the region by

Iraqi forces.

In Libya, which is not part of OPEC’s current production reduction agreement, crude output increased by

70,000 bpd in February to 1.05mbpd, the highest rate of output since 2013. Despite continued political

instability foreign investors are securing supply agreements in Libya. In the past month PetroChina has

secured a contract with Libya’s National Oil company for the first time since 2013. This follows similar

agreements with BP, Shell and the French oil company Total, highlighting the recovery in crude oil output

in Libya. Crude output in Libya has stabilised at around 1.1mbpd, with higher oil output from the country’s

two largest oil fields offsetting the shutdown of the Italian Eni’s El-Feel oilfield.

Members of the OPEC cartel have met with US shale oil producers in Houston, Texas this month. The

talks suggest the cartel is seeking to broaden its dialogue with non OPEC oil producing countries and in

particular the US in order to address the on going over supply in the oil market. It seems unlikely that US

producers will be interested in any production quota arrangement with the OPEC cartel. Crude oil output

in the US just exceeded 10mbpd in November 2017, the highest volume of output for 47 years, before

declining by 108,000bpd to 9.94mbpd in December. With the number of US oil rigs increasing by almost

one third in the past year, the US Government is forecasting oil output will reach 11mbpd before the end

of 2018 due to increasing output in the shale regions of Texas and North Dakota.

With US oil production continuing to increase supported by higher oil prices, there is speculation that

OPEC could be forced to extend its current production cuts beyond 2018. However, OPEC’s chief

executive reports that the cartel expects the oil market to achieve a balanced position this year. Crude oil

inventories have declined from around 350mb in 2016, but remain 52m barrels above the five year

average.

There are suggestions that OPEC and its non OPEC partners, including Russia, could seek a longer term

agreement on production output in an effort to support crude oil prices. Both Saudi Arabia and Russia

need oil prices to stabilise in the range US$70pb to US$80pb to fund domestic budgets, and there are

signs that the two countries are developing closer relations since the current agreement has been

implemented.

With crude oil output in the US projected to increase at a faster rate than global crude demand in 2018, it

remains to be seen whether current crude oil price levels can be sustained. The International Energy

Agency is forecasting the rapid decline in crude oil inventories in 2017 will reverse in the first half of 2018,

due to the sharp increase in crude output in the US, which increased by over 800,000bpd in the three

months to November 2018. This could drive crude prices lower in Q2 2018.

© Chemical Market Intelligence 1

Carbon Black Issue 227 – February 2018

The table below details carbon black feedstock export oil exports from the US for the month of January

2018.

US Exports of Carbon Black Feedstock Oil

January 2018 - Prices are FAS (Free Alongside Ship)

Destination January 2018

Barrels Mt US$/Barrel US$/mt

India 420,777 76,505 59.40 326.70

Thailand 288,000 52,364 67.00 368.50

Indonesia 253,000 46,000 67.00 368.50

Singapore 217,667 39,576 60.00 330.00

Egypt 183,043 33,281 63.72 350.46

Canada 19,292 3,508 44.00 242.00

Total 1,381,779 251,233 62.83 345.57

Carbon black feedstock oil exports from the US increased by 22% year on year in 2017 to reach the

highest volume of exports since 2012, as detailed in the table below.

US Exports of Carbon Black Feedstock Oil

2012 –2017 - mt

Country 2012 2013 2014 2015 2016 2017 %

Change

2017

India 780 740 690 830 970 1,150 22

Thailand 460 230 240 290 310 370 19

Singapore 120 130 100 180 210 315 19

Italy 110 100 150 160 165 230 50

Egypt 220 170 200 300 200 200 39

S Korea 350 100 70 16 570 130 -

Other 600 410 390 380 195 325 -

Total 2,640 1,880 1,840 2,160 2,230 2,720 22

The increase in exports in 2017 was largely driven by an increase in shipments to India of 180,000mt and

to Singapore of 105,000mt.

© Chemical Market Intelligence 2

Carbon Black Issue 227 – February 2018

North America

Light vehicle sales in the US declined by 2% year on year to 1.3m vehicles in February. The decline in

sales could have been in part due to lower incentive spending on vehicles, which is assessed to have

declined year on year by $65 per vehicle in February. The seasonally adjusted light vehicle selling rate

declined to 16.9m vehicles in February down from 17.46m vehicles in February 2017, and from 17.18m

vehicles in January 2018. Tax reforms are expected to drive strong demand for light vehicles in the US

this year, however a surge in ‘off-lease’ vehicles coming onto the market, and increasing interest rates will

negatively impact overall volumes of demand.

Light vehicle production in North America declined by 1.6% or by 52,000 vehicles to 1.36m vehicles in

January 2018 versus 2017, as detailed in the table below.

Light Vehicle Production (North America) 2017 vs 2018 – One Month only – 000’s

Vehicle 2017 2018 % Change 2018

Passenger Car 476 415 -14

Light Truck 910 952 5

Total 1,420 1,368 -1.6

Passenger car output declined by 14% or by 61,000 vehicles to 415,000 vehicles in January, offset by an

increase in output of light trucks of 42,000 vehicles to 952,000 trucks.

In the US light vehicle output declined by 1.6% to 903,000 vehicles, with Ford reporting a 1.7% decline in

output to 200,000 vehicles, and Nissan an 8% decline to 68,000 vehicles. In Canada light vehicle output

declined by 10% in January to 171,000 vehicles with both passenger car and light truck output declining

by 10% year on year. Toyota reported a 13% decline in output to 46,000 vehicles in January. By contrast

light vehicle output in Mexico increased by 4% year on year to 293,000 vehicles, driven by a 27%

increase in light truck output. Much of the increase in light truck output was due to increased production

by Volkswagen of its Tiguan and Audi Q5 models in Mexico.

There is an expectation that vehicle output across North America will slow through most of Q1 2018.

Increasing vehicle inventories held by dealers is expected to lead to announcements by vehicle makers

that summer shutdowns will be extended, especially for those plants producing passenger cars, demand

for which is particularly weak.

General Motors reported a 7% decline in sales volumes to 220,900 vehicles in February, due in part to

lower sales of its best selling Chevrolet Silverado pickup truck, which declined by 16% year on year. GM

reported an increase in fleet sales of 7% year on year driven by a 15% increase in commercial shipments,

while sales to retail customers declined by 10% compared to exceptionally strong sales in February 2017.

Sales of passenger cars declined by 16% year on year to 46,900 vehicles.

Ford reported a 7% decline in sales year on year to 194,000 vehicles in February, despite a 3% increase

in sales of its F Series truck. Sales of Ford branded vehicles declined by 6%, and Lincoln sales decline by

23%. Retail sales declined by 8.5% for Ford branded vehicles and fleet sales by 3.8%.

Ford is forecasting it will increase production of its Expedition and Navigator large sports utility vehicles by

25% this year, from its plant in Kentucky. The company is seeking to gain market share in this high

margin sector of the market in order to address the erosion in its profit margins to 3.7% in Q4 2017

compared to 5.7% in Q4 2016.

Fiat Chrysler reported a 1% decline in sales volumes to 165,000 vehicles in February. Sales of Jeeps

increased by 12%, offset by a 14% decline in sales of Ram trucks, due to a decline in sales to fleet

customers. Fleet sales declined by 3% year on year, accounting for 26% of total sales volumes in

February.

Unit tyre production in the US declined for the second consecutive year in 2017, despite the opening of

three new passenger car and light truck tyres plants. The decline in tyre output reflects flat demand for

passenger car and light truck tyres in the US in 2017, with US tyre retailers reporting a 5.6% decline in

tyre sales. The table overleaf details unit tyre production in the US for the years 2015 to 2017.

© Chemical Market Intelligence 3

Carbon Black Issue 227 – February 2018

Unit Tyre Production (US) 2015 vs 2016 vs 2017 – 000’s

Tyre 2015 2016 2017

Passenger Car 126,100 123,700 121,300

Light Truck 26,400 28,300 26,100

Heavy Truck 14,800 13,700 14,000

Total 167,300 165,700 161,400

Unit passenger car tyre production declined by 2% or by 2.4m tyres to 121.3m tyres in 2017, reflecting a

4.1m decline in shipments to the OE market and only a marginal increase in the passenger car tyre

replacement market of 700,000 tyres to 209m tyres.

Unit light truck tyre production declined by 2.2m tyres to 26.1m tyres in 2017, reflecting a marginal decline

in demand in the replacement market of 700,000 tyres to 31.2m tyres, and despite an increase in demand

from the OE sector of 500,000 tyres to 5.4m tyres.

Medium and heavy truck tyre production increased by 300,000 tyres to 14m tyres in 2017, driven by an

increase in demand of 400,000 tyres in the OE truck tyre sector, and an increase in demand in the

replacement market of 900,000 tyres to 19.5m tyres in 2017.

The table below details demand for high performance passenger car tyres in the US for 2016 versus

2017.

High Performance Passenger Car Tyre Demand (US) 2016 vs 2017 – 000’s

Passenger Car Tyre 2016 2017 % Change 2017

OE 26,300 25,200 -4.1

Replacement 84,300 92,000 9.1

Total 110,600 117,200 5.9

The ten most popular tyre sizes in the OE tyre sector were all above 17” in diameter in 2017, with

Goodyear reported to remain the largest supplier to the OE consumer tyre market with an estimated

market share of 26.5% of the 17.2m light vehicles produced in North America, followed by Michelin and

then Bridgestone. Demand for H rated tyres and above increased by 9% to 92m tyres in 2017,

representing 44% of all consumer replacement tyre shipments. Replacement consumer demand for H

rated tyres increased by 11% to 48.8m tyres; V rated tyres increased by 8% to 25.8m tyres and Z rated

tyres increased by 3% to 17.4m tyres in 2017 versus 2016. Imports of tyres with a diameter of 17” or

above increased by 13% to 46m tyres in 2017, suggesting they accounted for 39% of high performance

tyre demand.

Sales of winter tyres declined by 36% year on year in 2017 accounting for just 2% of replacement

consumer tyre sales, compared to more than 35% in Canada.

The opening of the Hankook, Khumo and Giti tyre plants in the south east US in the past 18 months has

added almost 20m units of annual tyre production capacity in the US. However, declining demand for non

premium passenger car and light truck tyres with a diameter of below 17”, offset rapidly increasing

demand for tyres with a diameter of 17” or above in 2017. This factor together with reports from the tyre

industry that the conversion of light vehicle tyre production capacity from standard tyres to premium ones

can lead in a reduction in production capacity of 10-15% due to the complexity of the tyres being

produced and shorter production run lengths, will have contributed to lower passenger car tyre output in

2017.

Bridgestone reported an 8% increase in sales revenues from its Americas business in 2017 to ¥1,776.5bn

(US$16bn), with operating profit increasing by 6% year on year to ¥160.2bn (US$1.5bn). The company

reported a 3.5% increase in tyre output as measured in metric tonnes in the Americas in 2017 to

590,000mt of tyres from 570,000mt in 2016, with output increasing by 10,000mt year on year to

150,000mt in Q4 2017. It is possible that some of the increase in tyre output was in Brazil where the tyre

market started to recover in 2017. Bridgestone is forecasting sales of tyres to the North American OE

market will increase by between 6% and 10% in 2018, despite projected lower light vehicle output in

North America in 2018. In the North American light vehicle tyre replacement market Bridgestone is

forecasting a 5% increase in sales volumes in 2018. For the Americas Bridgestone is forecasting its tyre

output will increase by 5% in 2018 to 620,000mt of tyres.

© Chemical Market Intelligence 4

Carbon Black Issue 227 – February 2018

The table below details tyre output as measured in metric tonnes for Bridgestone in its North and South

America tyre division for the years 2010 to 2017, with a forecast for 2018.

Bridgestone Tyre Production (Americas) 2010-2018* – 000 mt

2010 2011 2012 2013 2014 2015 2016 2017 2018*

Tyre 540 580 550 570 570 560 570 590 620

* Forecast

In the North American truck tyre market Bridgestone is forecasting sales of its truck tyres to the OE

market will increase by 5% to 10% in 2018, with sales to the replacement market increasing by 5% in 1H

2018 and by between 11% and 15% year on year in 2H 2018. As a result then company is forecasting a

5% increase in sales revenues in its Americas tyre business in 2018 to ¥1,800bn (US$16.95bn), with

earnings increasing by 2% to ¥164bn (US$1.54bn).

Michelin reported a 2.2% increase in global tyre sales volumes year on year in Q4 2017, as demand

picked up after a strong half of the year when sales were pulled forward ahead of price increases.

Michelin reported demand for its passenger car tyres increased by 1% year on year in Q2, Q3 and Q4

2017 following a 4% increase in Q1 2017. The company reported demand for its 18” diameter tyres and

above increased by 19% globally in 2017, compared to a market, which increased by 13%. Michelin

reports that 18” diameter tyres and above account for almost all of its fitments of OE vehicles, and

account for one third of the company’s passenger car tyre sales globally. The company estimates

demand for 18” diameter and above passenger car tyres account for around 15% of the global passenger

car tyre market. For 19” diameter tyres Michelin reported a 34% increase in demand in 2017 from a

market, which increased by 16% globally. In the past the company has had a shortage of production

capacity for these premium tyres but new production capacity has not enabled the company to fully

benefit from strong demand for these premium tyres. Globally the company reported a 2% increase in

passenger car tyre sales volumes in Q4 2017, from a 1% increase in Q3, in part due to good demand for

winter tyres.

In North America Michelin reported OE demand for passenger car and light truck tyres declined by 4% in

2017, following an 8% decline in 2H 2017. In the replacement market demand in the US was flat in 2017,

while in Canada demand increased by 7%, and in Mexico declined by 5% year on year in 2017.

In the global truck tyre market Michelin reported a 3% decline in sales volumes in Q2, Q3 and Q4 2017

following a 3% increase in Q1 2017, when sales were pulled forward by price increases. In North America

the company reported the OE truck tyre market increased by 10% driven by fleet replacements as

demand picked up during the year. In the North American truck tyre replacement market demand

increased by 4%, with a slight decline in demand in 1H 2017, offset by a 9% increase in 2H 2017.

Michelin reports that the structural imbalance in the global truck tyre market caused by a large over

supply of production capacity and supply in China contributed to the deterioration in its earnings from its

truck tyre business in 2017. This is creating highly competitive markets globally, and particularly in

Europe, with truck tyre imports at record volumes. Michelin will take further steps to address high costs, in

order to improve profitability in its truck tyre business. Globally the company is forecasting zero growth or

at best a 1% increase in its truck tyre sales volumes in 2018.

In the specialty tyre sector Michelin reported a 19% increase in demand year on year in Q4 2017,

following a 13% increase in Q3 and a 17% increase in Q2 2017. The increase in demand was led by

strong demand from the mining sector which increased by between 5-10% in 2017, and steady growth in

the OE agricultural and earthmoving sectors. The company has added to its workforce for specialty tyres

to be able to deliver tyres in a timely manner. Michelin is forecasting demand for mining tyres will increase

by 30% in the years 2016 to 2020, having increased by around 15% in 2017. Michelin is forecasting a 5%

to 7% increase in demand for its specialty tyres in 2018, driven by a 5% to 10% increase in global

demand and a strong global economy.

As part of its competitiveness programme Michelin reported savings of €315m (US$389m) in 2017,

including €51m (US$63m) of raw material savings. The company is investing in research in new materials

as one its strategic priorities.

Cooper Tire reported a 7% decline in sales revenues from its Americas tyre business in Q4 2017 to

$645m, driven by lower sales volumes accounting for $43m of the decline, and $7m from an unfavourable

price mix. Unit tyre sales volumes declined by 6% year on year in Q4 2017 with volumes declining in both

North and South America, due to heavy promotional activity by competitors. Cooper’s sales of light

© Chemical Market Intelligence 5

Carbon Black Issue 227 – February 2018

vehicle tyres declined by 8.3% in the US, compared to an 0.8% increase for tyre companies which are

members of the US Tire Manufacturers Association. In Mexico Cooper reported a 1.7% decline in light

vehicle tyre shipments in Q4 2017, compared to a 6% decline in the Mexican light vehicle market.

For the full year of 2017 Cooper Tire reported a 7% decline in sales revenues from its Americas tyre

business to $2.41bn from $2.6bn in 2016, with operating profits declining to $325m, or 13.4% of sales,

from $440m or 16.9% of sales in 2016.

Cooper Tire reports its tyre sales volumes were challenged in the US throughout 2017 due to volatile

pricing and promotions, high raw material costs, and soft retail demand. The company also exited some

private branded tyre business, which had a significant impact upon its sales volumes. Indeed Cooper

reports sales of private branded tyres has declined by 5m tyres per annum since 2012, and are being

replaced by higher margin tyre sales.

Cooper Tire’s operating profit declined by 47% to $61m in Q4 2017 from $116m in Q4 2016, due to an

increase in raw material costs of $17m, lower sales volumes of $12m. A reduction in manufacturing

output in Q4 2017 in the US to manage tyre inventories due to lower sales volumes accounted for an

additional $17m from earnings in Q4 2017. Cooper Tire is forecasting its earnings will be at the low end of

the 9% to 11% of sales revenues in 2018 due to reduced output in Mexico, and a challenging US tyre

market. The company is seeking to launch new tyre models faster in future in the US.

Cooper is to take steps to reduce costs including balancing of production capacity within the network

automation in its plants, and has reduced its salaried workforce by around 5%. Due to the continuing

significant market decline in the Mexican tyre market, Cooper Tire has cut its workforce in Mexico by over

400 people, and reduced production from seven days to six days. Higher manufacturing overheads for

Cooper Tire in 2017 were due to the fact that the company was not running its US tyre plants at full

operating rates.

In the truck tyre market Cooper’s tyre sales volumes increased at a faster rate than the market in the US

in 2017. The company has recently announced an off take agreement with Sailun Vietnam for the

production of radial truck tyres.

Sumitomo Rubber is increasing tyre production capacity in the US to 2,950mt of tyres per month in 2018

from 2,700mt of tyres per month in 2017. Globally Sumitomo is forecasting a 5% increase in tyre output to

1,162,000mt of tyres in 2018 versus 2017, with output outside of Japan increasing by almost 9% to

452,000mt of tyres in 2018. Sumitomo Rubber is to start the production of medium truck tyres at its plant

in Tonawanda, NY this year. In 2016 Sumitomo announced an investment of US$87m at its Tonawanda

plant to double production capacity for passenger car and light truck tyres to 10,000 tyres per day by the

end of 2019.

Continental Tire is adding production capacity for procured tread rubber at its tyre plant at Mount Vernon,

in order to reduce delivery times to its retread customers. Currently the company supplies its retread

customers from a plant in Morelia in Mexico, which has an annual production capacity of 9,500mt.

A recent analyst report suggests the German tyre company Continental Tire is approaching Goodyear in

terms of the volume of passenger car tyres it sold in 2H 2017 globally. Both companies are assessed to

have been in the region 140-150m tyres per annum on an annualised rate in 2H 2017. Since 2012

Goodyear’s annual passenger car tyre sales volumes are assessed to have declined from around 160m

tyres per annum, while Continental AG passenger car tyre sales increased from around 125m tyres per

annum.

Hankook Tire reported sales revenues of KRW506bn (US$472m) in Q4 2017 in North America up 11%

from Q4 2016, driven by an increase in sales to both the OE and replacement markets, with an

improvement in mix towards larger diameter tyres. For the full year of 2017, Hankook Tire reported a 2%

increase in tyre sales revenues in North America to KRW1,920bn (US$1.79bn) from KRW1,874bn

(US$1.75bn) in 2016 of which high performance tyre sales accounted for 36% of total sales revenues.

Toyo Tire reported an 8% increase in sales revenues in North America in 2017 to Yen186.3bn

(US$1.75bn), with operating income increasing by 12% to Yen8.6bn (US$81m). The company reported a

6% increase in tyre sales volumes in North America in 2017. Toyo Tire reported its tyre output in North

America increased by 17% to 66,800mt of tyres in 2017 from 56,900mt in 2016. The company is

forecasting a 4% increase in tyre production in the US to 69,500mt in 2018.

© Chemical Market Intelligence 6

Carbon Black Issue 227 – February 2018

Market demand for carbon black in the US was assessed to have been flat in 2017 versus 2016 in the

last issue of this report. However, unit tyre production in the US has subsequently been published

indicating a reduction in both passenger car and light truck tyre output in 2017 versus 2016. Unit

passenger car tyre output declined by 2.4m tyres, and light truck tyre output by 2.2m tyres offset partially

by an increase in medium and heavy truck tyre output of 300,000 tyres. Unit passenger car tyre output in

the US has declined by 21m tyres in the past decade while light truck tyre output has increased by 1m

tyres to 26m tyres. The decline in passenger car and light truck tyre output is assessed to have led to a

reduction in market demand for carbon black from the tyre industry in the region 16,000mt in 2017, taking

into account a partial offset from the increase in heavy truck tyre output. With vehicle production in the US

also declining by almost 1m vehicles in 2017 it is estimated market demand for carbon black in the US

declined by up to 33,000mt in 2017. Both Goodyear and Cooper Tire reported reductions in tyre output in

2H 2017, which could have more than offset startup output at the three new tyre plants in the US in 2017.

With a lack of growth in the US consumer tyre markets projected for 2018, it remains to be seen whether

consumer tyre output will increase this year. Current reports indicates consumer demand for tyres in the

US was soft in January and February, but both Goodyear and Cooper Tire are projecting increases in

demand and output in Q2 and Q3 2018. There is an expectation that the downturn in demand for new

vehicles will support increased demand in the replacement consumer tyre market.

A decline in market demand for carbon black in the US is at odds with anecdotal reports, which suggest

demand was flat in 2017, or indeed increased. Reports of tight supply of some tread grades of carbon

black could reflect shifting production towards premium passenger car and light truck tyres. Reports

suggest that market demand for carbon black increased in some instances in Q4 2017, which supported

contract negotiations and the ability of the industry to implement base price increases for 2018 contracts.

Current reports suggest demand picked up in February following a relatively slow start to the year in

January.

Orion Carbons reported a 2.8% decline in carbon black sales volumes year on year in Q4 2017 to

272,900mt equivalent to a reduction of 7,700mt year on year. The decline in output was due to the

closure of the carbon black plant in France at the end of 2016, as well as lower rubber carbon black sales

volumes in the US caused in part by the closure of one production line at its plant at Orange Texas in Q4

2017. Also the conversion of production capacity at the company’s carbon black plants in South Korea to

specialty carbon black capacity caused some loss of sales volumes. Nevertheless Orion Carbons reports

industry demand for rubber blacks remained strong in Q4 2017. The company reports that technical

rubber grades of carbon black accounted for 36.5% or rubber grade sales volumes in Q4 2017, with

higher margin carbon black grades including specialty carbon blacks accounting for 51% of the

company’s global sales volumes in Q4 2017.

Orion Carbons reported a 4.9% decline in sales volumes year on year in the rubber blacks business to

210,300mt in Q4 2017, equivalent to a reduction 10,800mt year on year, due to the closure of standard

rubber grade production capacity in France and the US, and the conversion of standard rubber grade

capacity to specialty production capacity in South Korea.

Annually the company reported rubber blacks sales volumes of 826,000mt in 2017 down by 6% or by

60,000mt from output of 886,000mt in 2016. The reduction in output is assessed to have largely been due

to the closure of the rubber blacks plant in France at the end of 2016, which probably accounted for a

reduction in output of around 35-40,000mt in 2016.

Sales revenues in Orion Carbon’s rubber black business increased by €10.3m (US$12.7m) or by 5.7% to

€190.5m (US$235m) in Q4 2017, due to contract adjusted pricing, and base price increases in 2017

contract agreements. These increases more than offset lower sales volumes in the rubber blacks

business. Gross profit per ton declined year on year by 5% to €44.7m (US$55m) in Q4 2017, but by just

0.2% as measured in metric tonnes to €212.6/mt (US$262/mt) from €213.1/mt (US$263/mt) in Q4 2016.

The decline in gross profit was due to the impact of mix of product, and unfavourable regional feedstock

mix, as well as asset impairment charges related to Hurricane Harvey, and accelerated depreciation

charges related to the restructuring of production capacity in South Korea. Adjusted earnings per ton in

the rubber blacks business increased 17.7% year on year €134.9/mt (US$167/mt) from €114.6/mt

(US$141/mt) in Q4 2017, with adjusted earnings totalling €28.4m (US$35m) in Q4 2017 from €25.3m

(US$31m) in Q4 2016.

Orion Carbons reports globally demand for carbon black is improving across the globe, with demand

having strengthened towards the end of 2017. With demand increasing globally and only limited additions

to supply, the carbon blacks industry’s prospects look favourable. Orion Carbons reports its plant

utilisation rates in the US are in the mid to high 80% range and even higher in certain grades. In Europe

the company reports its utilisation rates are around 90%, and in Korea the company’s plant is full. As a

© Chemical Market Intelligence 7

Carbon Black Issue 227 – February 2018

result of only a limited volume of new production capacity in the carbon black industry globally Orion

Carbons reports global utilisation rates are tightening. Focus on improving its margins and is aiming to

increase earnings as a percentage of sales revenues from 15% at present. One way the company will do

this is increase its focus upon technical rubber grades, which the company reports requiring capital

investment to make changes to its reactors, and to downstream equipment, as well as feedstock

adjustments. It is believed the company has converted one rubber grade production line to a technical

rubber blacks lines in Texas in 2017. Orion Carbons is also accelerating initiatives to improve efficiencies,

and is to increase technical rubber grade production capacity in China. Indeed the company is seeking to

increase its market share in China, while maintaining its market share elsewhere in the world. However,

improving prices for rubber grade carbon black globally are making it less imperative to convert existing

rubber black production lines to specialty carbon black. This could result in the company investing in

additional production lines for specialty carbon black grades in the future.

Orion Carbons reported a 5% increase in sales volumes in its specialty carbon black business to

62,600mt in Q4 2017 from 59,500mt in Q4 2016. The increase in sales volumes was driven by increased

demand in North America and South Korea as well as in China. Orion Carbons reports all geographical

regions experienced increased demand for specialty carbon black. Demand is also reported to have been

strong in all sectors of the specialty carbon black market including coatings, inks, polymers and special

applications. However, demand is reported to have been particularly strong for coatings in the automotive

and architectural sectors, and in the polymers markets for piping and synthetic fibres.

Sales revenues for the specialty carbon black business increased by 2% year on year to €98m

(US$121m) in Q4 2017, due to increased sales volumes; an increase in base selling prices and higher

feedstock adjusted contract prices. These increases were offset in part by a negative regional product

mix.

Gross profit per ton in Orion Carbons specialty carbon black business declined by 16% year on year to

€563/mt (US$695/mt) from €670.5/mt (US$828/mt) in Q4 2016 due to a lag in the recovery of higher

feedstock costs, regional mix of product sold, higher fixed costs and costs associated with the

restructuring of the Korean carbon black capacity, and costs associated with Hurricane Harvey. These

costs were offset by an increase in sales volumes and efficiency gains. As a result gross profits declined

by 11.7 to €35.2m (US$43m) from the specialty carbon black business in Q4 2017 from €39.9m

(US$49m) in Q4 2016.

Adjusted earnings in Orion Carbons specialty carbon black business declined by 8.8% year on year to

€27.6m (US$34m) in Q4 2017, due to a lower gross profit offset in part by savings from sales and general

administrative costs. Adjusted earnings per metric ton declined by 13% year on year to €441.4/mt

(US$545/mt) in Q4 2017 from €509/mt (US$628/mt) in Q4 2016. Orion Carbons is seeking to implement

prices to recapture margins following the sharp increase in feedstock costs towards the end of last year.

As a result the company is prioritising restoring profit margins this year and consolidating its specialty

business rather than seeking large increases in market share. Nevertheless the company is projecting a

mid single digit increase in specialty carbon black sales volumes for 2018.

Orion Carbons reports the company is experiencing favourable dynamics with demand strengthening,

and limited growth in supply. The company reports price increases for major supply contracts for 2018,

and reports seeing substantial improvements in specialty carbon black pricing, as the company is working

to catch up with feedstock price increases from 2017. Orion Carbons is confident that large investments

made by tyre customers in the US will result in a long awaited upturn in demand for carbon black.

© Chemical Market Intelligence 8

Carbon Black Issue 227 – February 2018

Latin America

Argentina

The Argentine economy increased by 0.7% in Q4 2017 versus Q3 and by 4.2% year on year and

represented the fastest rate of growth for four years. For the full year of 2017 the economy increased by

2.9% up from 2.2% in 2016, driven by a strengthening of the domestic consumption which increased by

8.3% year on year in Q3 2017. Capital investment also increased by almost 14% year on year in Q3 2017

up from 7.7% in Q2 2017, driven by increased construction activity and transport equipment.

Passenger car sales in Argentina increased by an exceptional 29% year on year in January to 53,800

vehicles 24%. In 2017 passenger car sales in Argentina increased by 24% or by 124,000 vehicles to

642,000 vehicles in 2017. However, most of the increase in demand for new vehicles in Argentina in 2017

was met by an increase in the volume of imported vehicles. Demand for domestically produced vehicles

in Argentina declined by 8% or by 21,000 vehicles to 259,000 vehicles in 2017.

Commercial vehicle sales in Argentina increased by 19% to 241,000 vehicles in 2017 from 202,000

vehicles in 2016, but declined by 5% year on year in January 2018 to 10,500 vehicles. In 2017 light truck

sales increased by 27% to 199,000 vehicles in Argentina, while heavy truck sales increased by an

exceptional 52% year on year to 26,200 trucks from 17,200 trucks in 2016. Lower rates of inflation have

led to improved availability of vehicle financing.

Fiat is forecasting light vehicle sales across Latin America will increase by 7% or by 300,000 vehicles to

4.4m vehicles in 2018 versus 2017, driven by an increase in sales of 200,000 vehicles in Brazil. General

Motors is forecasting passenger car sales will increase by 8% in Argentina in 2018 and by 17% in Brazil.

Longer term forecasts suggest vehicle sales in Argentina will reach 880,000 vehicles per annum in the

next five years.

Vehicle production in Argentina was unchanged from 2016 volumes in 2017 at 472,000 vehicles, as

detailed in the table below.

Vehicle Production (Argentina) 2015 vs 2016 vs 2017 – 000’s

Vehicle 2015 2016 2017 % Change 2017

Passenger Car 308 241 204 -15

Commercial Vehicle 218 231 268 16

Total 526 473 472 -

Passenger car output declined by 15% or by 37,000 vehicles in 2017, offset by a similar increase in

commercial vehicle output. Passenger car output in Argentina declined despite an increase in domestic

car sales of 124,000 vehicles in 2017, due to an increase in imports from Brazil where vehicle demand

remained depressed in 2017. The decline in passenger car output in Argentina was also driven in part by

a reduction in export sales of 21% to 55,000 vehicles in 2017, from 70,000 vehicles in 2016. By contrast

the increase in commercial vehicle output in Argentina was driven by an increase in vehicle exports of

28% or 35,000 vehicles to 154,000 vehicles in 2017. Total vehicle exports from Argentina increased by

19,500 vehicles to 209,000 vehicles in 2017, despite a marginal decline in exports to the largest export

market of Brazil, by 1,700 vehicles to 135,900 vehicles. Vehicle exports to Mexico also declined by 6,500

vehicles, however exports to other Central American markets increased by 15,400 vehicles to 17,800

vehicles in 2017 accounting for most of the increase in vehicle exports from Argentina in 2017.

Most recent vehicle production data for January 2018 indicates an 18% decline in output year on year to

21,800 vehicles from 26,700 vehicles in January 2017. The decline in output was due to a near 8%

decline in sales of domestically produced vehicles in Argentina into the domestic market, while export

sales increased by 6% year on year to 10,400 vehicles.

With passenger car demand in Brazil projected to increase by 200,000 vehicles per annum in 2018, the

upturn in demand in Argentina’s largest export market should drive an increase in vehicle output in

Argentina in 2018. In addition an improving agricultural and mining industries across Latin America in

2018, should support further increases in exports of light trucks from Toyota, and Renault Nissan from

their Argentinean plants this year.

© Chemical Market Intelligence 9

Carbon Black Issue 227 – February 2018

The Chinese car maker Dong Feng is to invest in a new plant in Argentina to produce electric vehicles.

The company announced in 2017 it would invest US$300m to build an assembly plant to produce electric

vehicles in Argentina, although it is not clear whether these will be buses, light commercial vehicles or

passenger cars.

Toyota reported record vehicle output of 125,000 trucks in Argentina in 2017, and accounted for 40% of

vehicle exports from Argentina as 70% of its Hilux one tonne trucks were exported in 2017, equivalent to

86,400 vehicles. The company has been seeking to diversify its export markets to become less reliant

upon the Brazilian market. In 2018 Toyota has an objective of producing 140,000 vehicles in Argentina for

its Hilux one tonne truck, driven in part by a recovery in the Brazilian market. Toyota’s export sales to

Colombia also increased following the signing of a free trade agreement between the two countries. 40%

of the components for the Toyota Hilux are sourced in Argentina. In 2017 Toyota invested US$100m at its

Argentinean plant to produce the Innova mini van, which it currently imports from Thailand.

The Renault Nissan partnership has invested over US$800m in Argentina in the past four years, and in

2018 starts the production of its first pickup truck in the country. The Renault Nissan partnership has

invested in a pickup truck production line at a cost of US$600m. The new production line will produce

Nissan trucks in Argentina for the first time and will also produce Daimler pickup trucks under contract by

2020. The new production line has an annual production capacity of 70,000 vehicles. The investment

underlines Argentina’s position as the centre of pickup truck manufacturing in Latin America. Renault is

also shifting the production of two of its low priced Dacia models from Brazil to Argentina.

In December 2017 Fiat started the production of a new compact passenger car, the Cronos at its plant in

Argentina, following an investment of US$500m by Fiat at its Argentinean plant. The company has an

objective of producing 100,000 units of the new model per annum with 80% to be exported to other Latin

American markets, and with more than 50% of components sourced domestically. Fiat reported a 34%

increase in vehicle sales in Argentina to 105,000 vehicles in 2017. Across Latin America Fiat reported

vehicle sales of 513,000 vehicles in 2017 up from 473,000 vehicles in 2016.

In October 2017 General Motors announced an investment of US$500m to upgrade its vehicle plant at

Alvear in Sante Fe province in order to be able to be to produce the new Chevrolet Cruze and increase

production capacity at the plant. 80% of the output of the new model will be exported to Brazil, with

General Motors forecasting a 17% increase in vehicle demand in Brazil in 2018.

In 2017 Daimler announced an investment of US$150mt to produce the new Sprinter light commercial

vehicle at its plant in Argentina, with production expected to start in 2019. The investment underlines

Argentina’s increasing position as a centre of pickup trucks and light commercial vehicles.

Unit tyre production in Argentina is assessed to have increased marginally by 0.9% or 100,000 tyres to

12.8m units in 2017 versus 2016, as detailed in the table below.

Estimated Unit Tyre Production (Argentina) 2015 vs 2016 vs 2017 – 000’s

Vehicle 2015 2016 2017 % Change 2017

Passenger Car 12,300 11,600 11,600 -

Truck 1,210 1,100 1,220 10

Total 13,500 12,700 12,800 0.9

Unit passenger car tyre output in Argentina is assessed to have been unchanged from 2016 volumes of

output at 11.6m tyres in 2017, as detailed in the table below.

Estimated Unit Passenger Car Tyre Production & Demand (Argentina)

2015 vs 2016 vs 2017 – 000’s

Vehicle 2015 2016 2017 % Change 2017

Production 12,300 11,600 11,600 -

Imports 2,900 3,300 3,900 18

Exports 2,300 2,700 2,900 7

Apparent Demand 12,900 12,200 12,300 0.8

© Chemical Market Intelligence 10

Carbon Black Issue 227 – February 2018

A decline in passenger car tyre output was driven by a reduction in demand for car tyres from the OE

sector of around 15%, reflecting a similar decline in passenger car output in Argentina in 2017. This is

assessed to have been offset by a recovery in demand in the replacement market. Pirelli reports demand

for passenger car tyres across Latin America increased by 15% year on year in the first nine months of

2017. In Brazil the passenger car tyre replacement market is reported to have increased by 15% in 2017

versus 2016.

A recovery in demand for passenger car tyres in the replacement market in Argentina is reflected in an

18% increase in passenger car tyre imports in 2017, to 3.9m tyres. Indeed passenger car tyre imports to

Argentina increased by almost 600,000 tyres to 3.9m tyres in 2017, driven by an increase in imports from

Brazil of 400,000 tyres to 2.5m tyres, and from China by 140,000 tyres to 475,000 tyres in 2017 versus

2016.

Passenger car tyre exports from Argentina increased by 7% or by just under 200,000 tyres to 2.9m tyres

in 2017, driven by an increase in exports to the US of 190,000 tyres; to Canada of 47,000 tyres and to

Brazil of 32,000 tyres to 2m tyres in 2017.

Bridgestone is investing US$195m at its tyre plant in Argentina to diversify its production base, and is

seeking to increase its market share in the Latin American tyre market. The new investment will be

spread over the years to 2020.

Unit truck tyre output in Argentina is assessed to have increased by around 10% or 100,000 tyres to an

estimated 1.2m tyres in 2017 versus 2016, as detailed in the table below.

Estimated Unit Truck Production & Demand (Argentina) 2015 vs 2016 vs 2017 – 000’s

Vehicle 2015 2016 2017 % Change 2017

Production 1,210 1,100 1,220 10

Imports 570 800 900 10

Exports 80 220 220 -

Apparent Demand 1,700 1,700 1,800 6

The increase in truck tyre output is assessed to have been driven by a 16% increase in commercial

vehicle output in Argentina in 2017. The upturn in the Argentinean economy is also assessed to have

driven some recovery in demand in the domestic truck tyre replacement market. Indeed truck tyre imports

to Argentina increased by 10% or 100,000 tyres in 2017, driven by an increase in imports from Brazil of

72,000 tyres, and from Mexico of 6,000 tyres. Truck tyre imports from China increased only marginally by

700 tyres to 690,000 tyres in 2017.

Truck tyre exports from Argentina were largely unchanged from 2016 volumes in 2017 with exports to the

largest export market Brazil increasing by 13,000 tyres to 220,000 tyres in 2017.

Carbon black production data for Argentina in 2016 is now available and is reported to have been

52,000mt down sharply from output 63,700mt in 2015. It seems probable that a decline in both unit

passenger car and truck output in Argentina drove the decline in domestic carbon black output in 2016. A

recovery in both the domestic passenger car and truck tyre demand in Argentina in 2017 is assessed to

have largely been met by increases in both passenger car and truck tyre imports into the country. As a

result market demand for carbon black in Argentina is assessed to have increased marginally from 2016

volumes in 2017 based upon an increase in unit truck tyre output, as detailed in the table below.

Market Demand for Carbon Black (Argentina) 2016 vs 2017 – mt

Carbon Black 2016 2017 % Change 2017

Production 52,000 60,000 15

Imports 13,000 7,000 -46

Exports 21,000 22,000 4

Apparent Demand 44,000 45,000 2

No increase in vehicle output in Argentina in 2017, will have contributed to flat market demand for carbon

black in 2017. Investments by several vehicle makers in new models and production capacity should

drive a recovery in vehicle output in Argentina in 2018 and beyond. Meanwhile the tyre industry is

assessed to be operating well below available production capacity in Argentina. It remains to be seen

whether the domestic tyre industry is able to regain share of the domestic tyre market in Argentina as

© Chemical Market Intelligence 11

Carbon Black Issue 227 – February 2018

both truck and passenger car tyre imports have increased significantly in the past two years, probably

caused by the relaxation of import controls following a change of Government two years ago. Unit

passenger car tyre capacity in Argentina is assessed to be in the region 15m tyres per annum. With

output assessed to be in the region 11m tyres per annum there is clearly potential for substantial

increases in market demand for carbon black in Argentina if the industry is competitive versus imports.

Carbon black output in Argentina is reported to have declined by 17% or by 11,000mt to 52,600mt in

2016 from 63,700mt in 2015. A reduction in carbon black imports to Argentina of 6,000mt, due to a lower

volume of imports from Brazil and China is assessed to have driven an increase in domestic carbon black

output of 7,000mt at the Cabot plant in Argentina in 2017. In 2013 Cabot debottlenecked its plant in

Argentina taking annual production capacity to an estimated 80-83,000mt per annum. Carbon black

output reached 76,000mt in 2013, but has subsequently declined to a low of 52,000mt in 2016. On this

basis it is estimated the carbon black plant in Argentina was operating at around 63% of nameplate

production capacity in 2016.

Carbon black exports from Argentina increased by 1,000mt to 22,200mt in 2017 versus 2016, as detailed

in the table below.

Carbon Black Exports (Argentina) 2016 vs 2017 – mt

Destination 2016 2017 Average Import Price

US$/mt 2017

Chile 14,499 14,114 887

Brazil 6,216 4,814 795

Peru 252 2,898 762

Uruguay 186 118 2,518

India 0 202 799

Paraguay 31 55 3,197

Belgium 0 23 707

Bolivia 17 6 2,694

Other 1 0 -

Total 21,202 22,230 865

The increase in carbon black exports was due to an increase in exports to Peru of 2,600mt in 2017, and

to India of 200mt, offset by a decline in exports to Brazil of 1,400mt. The increase in carbon black exports

to Peru in 2017 look to have replaced exports to Peru from Mexico, which declined by 2,200mt in 2017. It

is possible Cabot reduced exports from its plant in Mexico to Peru in 2017 due to increased demand in

Mexico in 2017.

Carbon black imports to Argentina declined by 5,700mt to 7,400mt in 2017 versus 2016, as detailed in the

table below.

Carbon Black Imports (Argentina) 2016 vs 2017 – mt

Source 2016 2017 Average Import Price

US$/mt 2017

Brazil 9,171 5,498 1,217

China 2,800 377 1,149

United States 254 330 2,356

France 247 192 3,197

Japan 173 136 3,069

Canada 127 99 1,651

Netherlands 90 224 1,314

Belgium 84 33 2,088

Egypt 63 86 934

Venezuela 53 128 866

Germany 35 34 2,356

South Korea 20 83 1,705

United Kingdom 20 40 1,132

Other 27 149 -

Total 13,164 7,409 1,361

© Chemical Market Intelligence 12

Carbon Black Issue 227 – February 2018

Carbon black imports from Brazil declined by 3,600mt in 2017, and from China by 2,400mt.

The table below details estimated specialty carbon black imports to Argentina in 2017, based upon the

above table. High average import prices of carbon black and the source countries of imports have been

used to estimate specialty carbon black imports, as detailed in the table below.

Estimated Specialty Carbon Black Imports (Argentina) 2016 vs 2017 – mt

Source 2016 2017 Average Import Price

US$/mt 2017

United States 254 330 2,356

France 247 192 3,197

Japan 173 136 3,069

Canada 127 99 1,651

Belgium 84 33 2,088

Germany 35 34 2,356

South Korea 20 83 1,705

Total 940 907 -

Carbon black prices in Latin America are reported to be in the region US$850/mt–US$875/mt for tread

grade N326 and around US$900/mt for grade N339 on a delivered basis.

Western Europe

Netherlands

Passenger car sales in the Netherlands increased by 10% year on year in February to 35,400 vehicles,

and cumulatively by 6% to 57,800 vehicles in the first two months of 2018. Across West European

passenger car sales increased by 3.5% year on year to 1.05m vehicles in February 2018, driven by a 7%

increase in sales in Germany, a 13% increase in sales year on year in Spain and 4% increase in France.

Cumulatively passenger car sales have increased by 1.9% to 2.69m vehicles across Western Europe in

the first two months of 2018 versus 2017. Passenger car sales in Western Europe are forecast to

increase by 1.9% or by 270,000 vehicles to 14.57m vehicles in 2018 from 14.3m in 2017.

Vehicle production data is not available for the Netherlands for 2017, but is assessed to have increased

by 88,000 vehicles to an estimated 230,000 vehicles in 2017 versus 2016, as detailed in the table below.

Estimated Vehicle Production (Netherlands) 2016 vs 2017

Vehicle 2016 2017 % Change 2017

Passenger Car 87,000 170,000 95

Light Truck 0 0 -

Heavy Truck 56,000 61,000 7

Total 143,000 231,000 61

Passenger car production is based upon on the single car assembly plant operated by VDL, which

produces Mini’s under contract for BMW. Since mid 2017 VDL has also been producing the BMW X1

sports utility vehicle under contract for BMW. Passenger car output at the former Nedcar plant has

increased in recent years from around 40,000 vehicles to a reported 170,000 vehicles in 2017. Passenger

car output is expected to increase further in 2018, and the company is hiring an additional 400 workers

and adding a production shift on Saturdays.

The single truck manufacturer DAF reported it produced 56,500 trucks in 2016. The company reports a

marginal loss in market share in the European heavy truck market in 2017 to a share of 15.3% from

15.5% in 2016, when it produced 46,800 heavy trucks, and 5,300 light trucks. DAF reports it exported

9,000 trucks to markets outside of the EU in 2017, up from 5,200 trucks in 2016. On this basis it is

estimated the company hiked output by around 4,000 trucks to an estimated 61,000 trucks in 2017. DAF

is forecasting the European market for heavy trucks will be in the range 290,000 trucks to 320,000 trucks

in 2018 from 306,000 trucks in 2017.

Apollo Tyres, the Indian tyre producer which acquired the Dutch tyre producer Vredestein in 2009. The

company reported an increase in tyre sales volumes of 3% at its Netherlands plant in 1H 2017, but a 5%

decline in sales volumes in Q3 2017 from its Netherlands and Hungarian plants combined year on year.

© Chemical Market Intelligence 13

Carbon Black Issue 227 – February 2018

In Q4 2017 the company reported an upturn in sales revenues from its Netherlands plant to €121m, from

€118m in Q4 2016, due to the seasonal upturn in demand, with profit margins increasing to 12% in Q4

2017 from 8.5% in Q4 2016, most probably due to the increase in sale of winter tyres. The company

reports it has been operating its tyre plant in the Netherlands at high rates of available capacity. The

plant in the Netherlands is largely a passenger car tyre plant but also produces a small number of

agricultural tyres, with a daily production capacity of between 18,000 tyres and 19,000 tyres per day. In

2014 Apollo Tyres is reported to have increased annual passenger car tyre production capacity at the

plant in the Netherlands from 6m to 6.5m tyres per annum.

Apollo Tyres is projecting its daily production capacity at its plants in the Netherlands and in Hungary will

have a combined production capacity of up to 35,000 tyres per day at its two plants combined by 2020,

with the Hungarian tyre plant producing 7,000 tyres/day by April 2018 and expected to reach around

14,000 tyres/day by April 2019. In addition the plant will produce almost 2,000 radial truck tyres per day

by 2020, which should take daily production capacity at the plant to around 250mt of tyres per day, from

120mt of tyres per day when only producing passenger car tyres.

Truck tyre imports into the EU from China have reached record volumes in the past year, according to

tyre producers. The EU has started registering imports of truck tyres and retreaded truck tyres from

China, following the initiation of anti dumping proceedings in August 2017. Should the case of dumping

be found to be the case, the EU will now be able to retroactively apply dumping duties to tyres now being

imported from China. It has been alleged by complainants that an anti dumping margin of between 74%

and 152% should be applied to Chinese truck tyres, with an average underselling margin of between 26%

and 37%. Chinese truck tyre companies are alleged to have almost doubled the volume of truck tyres

exported to the EU from 2.3m tyres in 2013 to 4.4m tyres in 2016, which has resulted in Chinese

produced truck tyres accounting for 20.9% of the European truck tyre market in 2016 from 13.2% in 2013.

Passenger car and truck tyre imports to the five largest West European markets, Germany, France, Italy,

Spain and the UK from China are detailed in the table below.

Passenger Car and Truck Tyre Imports from China (Five Largest West European Markets

2013 – 2017* – 000mt

Tyre 2013 2014 2015 2016 2017* % Change

2013/ 2017

Passenger Car 286 304 334 369 379 32

Truck 91 121 136 150 169 86

Total 377 425 470 519 547 45

* Estimated based upon eleven months trade data

Passenger tyre imports from China increased by 32% or by 93,000mt to 379,000mt in the years 2013 to

2017, with imports to the UK accounting for 43% of the total volume of imports for the five countries.

Truck tyre imports to the five West European markets from China increased by 86% in the years 2013 to

2017 or by 78,000mt, with imports almost doubling to most of the five markets but increasing threefold to

the Spanish market. It seems probable that truck tyre imports from China have accounted for most if not

all of any increase in heavy truck tyre demand in Europe in recent years.

Michelin reported a 2.2% increase in global tyre sales volumes year on year in Q4 2017, as demand

picked up after a strong half of the year when sales were pulled forward ahead of price increases.

Michelin reported demand for its passenger car tyres increased by 1% year on year in Q2, Q3 and Q4

2017 following a 4% increase in Q1 2017. The company reported demand for its 18” diameter tyres and

above increased by 19% globally in 2017, compared to a market, which increase by 13%. Michelin

reports that 18” diameter tyres and above account for almost all of its fitments of OE vehicles, and

account for one third of the company’s passenger car tyre sales globally. The company estimates

demand for 18” diameter and above passenger car tyres account for around 15% of the global passenger

car tyre market. For 19” diameter tyres Michelin reported a 34% increase in demand in 2017 from a

market which increased by 16% globally. In the past the company has had a shortage of production

capacity for these premium tyres but new production capacity has not enabled the company to fully

benefit from strong demand for these premium tyres.

In Europe, Michelin reported there was a return to long term growth rates in the passenger car tyre

replacement market in Q4 2017, although the market remains amongst the most competitive globally at

present. Globally the company reported a 2% increase in passenger car tyre sales volumes in Q4 2017,

from a 1% increase in Q3, in part due to good demand for winter tyres. Across Europe demand from the

© Chemical Market Intelligence 14

Carbon Black Issue 227 – February 2018

OE sector increased by 2%, and in Western Europe by 1%, while demand in the replacement market

increased by 4% in Western Europe driven by a 5% increase in Spain and a 3% increase in France and a

1% increase in Germany offset by an 8% decline in the UK. Michelin is forecasting demand for its

passenger car tyres will increase globally by between 1.5% and 2.5% in 2018, a slower rate than in 2017

as strong demand in mature markets stabilises, and is partially offset by weaker OE demand.

In the truck tyre replacement market Michelin reported a 3% decline in sales volumes in Q2, Q3 and Q4

2017 following a 3% increase in Q1 2017, when sales were pulled forward by price increases. In 2017 the

European truck tyre market increased by 4% led by demand from the construction industry and increased

freight volumes. Demand in France increased by 7% and in Turkey by 9%, offset by flat demand in

Germany and a 2% decline in Italy and a 3% decline in Spain. In the European OE truck tyre market

demand increased by 8%, while in Eastern Europe demand increased by 14% in 2017.

Michelin has new truck tyre products and the re-launch of the BF Goodrich brand in Europe are expected

to drive an increase in demand for its truck tyres in 2018. However, it reports there is a structural

imbalance in the global truck tyre market caused by a large over supply of production capacity and supply

in China. This is creating highly competitive markets globally, and particularly in Europe, with truck tyre

imports at record volumes. Michelin will take further steps to address high costs, in order to improve

profitability in its truck tyre business. Globally the company is forecasting zero growth or at best a 1%

increase in its truck tyre sales volumes in 2018.

In the specialty tyre sector Michelin reported a 19% increase in demand year on year in Q4 2017,

following a 13% increase in Q3 and a 17% increase in Q2 2017. The increase in demand was led by

strong demand from the mining sector which increased by between 5-10% in 2017, and steady growth in

the OE agricultural and earthmoving sectors. The company has added to its workforce for specialty tyres

to be able to deliver tyres in a timely manner. Michelin is forecasting demand for mining tyres will increase

by 30% in the years 2016 to 2020, having increased by around 15% in 2017. Michelin is forecasting a 5%

to 7% increase in demand for its specialty tyres in 2018, driven by a 5% to 10% increase in global

demand and a strong global economy.

As part of its competitiveness programme Michelin reported savings of €315m in 2017, including €51m of

raw material savings. The company is investing in research in new materials as one its strategic priorities.

Market demand for carbon black in the Netherlands is assessed to have increased by around 2,000mt to

an estimated 39,000mt in 2017 versus 2016, as detailed in the table below.

Estimated Market Demand for Carbon Black (Netherlands)

2016 vs 2017 – Eleven Months only - mt

Carbon Black 2016 2017 % Change 2017

Production 65,000 88,000 35

Imports 40,000 30,000 -25

Exports 68,000 79,000 16

Apparent Demand 37,000 39,000 5

It is possible that the single Vredestein tyre plant operated by Apollo Tyres increased its output in 2017

based upon reported increases in demand in 1H 2017, and a strong end to the year in Q4 2017 probably

driven by demand for winter tyres. The increase in passenger car production in the Netherlands due to

the startup of production of the BMW X1 model at the Nedcar car plant in Eindhoven in mid 2017 could

also have driven an increase in demand for carbon black in the mechanical rubber goods sector if

suppliers for this model of the BMW X1 are also located in the Netherlands. A further ramping up of

output of the BMW model in 2018 is expected in the Netherlands.

A decline in carbon black imports to the Netherlands in 2017 of 10,000mt, combined with an increase in

carbon black exports from the Netherlands of 11,000mt is assessed to have driven an increase in carbon

black output at the single carbon black plant in the Netherlands operated by Cabot. The plant has a

nameplate production capacity of 70,000mt per annum but it seems probable the company has

debottlenecked the plant in recent years.

Cabot Corp reported a 31% increase in sales revenues year on year in Q4 2017 to $387m. The company

reported a 3% increase in sales volumes year on year due to increases in Europe and in the Americas.

However, volumes declined by 2% from Q3 2017 due to seasonally lower volumes in the Americas and

Asia. In Europe, the Middle East and Asia Cabot reported a 13% increase in carbon black sales volumes

© Chemical Market Intelligence 15

Carbon Black Issue 227 – February 2018

in Q4 2017 versus Q4 2016, and a 3% increase from Q3 2017. Cabot is also anticipating solid demand