Professional Documents

Culture Documents

Issue No 228 March 2018

Issue No 228 March 2018

Uploaded by

Luna ChenCopyright:

Available Formats

You might also like

- Anwal Gas-TnDocument35 pagesAnwal Gas-TnMaysam Kh67% (3)

- Yamaha XT1200Z Super Ténéré - Manual de Serviço BR 2012Document756 pagesYamaha XT1200Z Super Ténéré - Manual de Serviço BR 2012Fabio Gallo89% (9)

- Danbury Flight School Cessna 172SP G1000 ChecklistDocument13 pagesDanbury Flight School Cessna 172SP G1000 ChecklistGeorge SandovalNo ratings yet

- Contoh Report TyreDocument199 pagesContoh Report TyreDeny Adi IrawanNo ratings yet

- The Indian Tyre IndustryDocument47 pagesThe Indian Tyre IndustrySandeepNo ratings yet

- Hydraulic Spring Stiffness Testing MachineDocument2 pagesHydraulic Spring Stiffness Testing Machineरोहित मदान0% (1)

- Issue No 229 April 2018Document40 pagesIssue No 229 April 2018Luna ChenNo ratings yet

- Issue No 227 February 2018Document34 pagesIssue No 227 February 2018Luna ChenNo ratings yet

- Ingot Market - 6WResearch - VipulDocument41 pagesIngot Market - 6WResearch - Vipulvipul tutejaNo ratings yet

- All Jute Top 20 CountriesDocument1 pageAll Jute Top 20 CountriesSANCHIT DEKATE-IBNo ratings yet

- Common Excel Questions START v2Document10 pagesCommon Excel Questions START v2Apple StarkNo ratings yet

- Resources in ChinaDocument25 pagesResources in ChinaPrins KumarNo ratings yet

- Management Report 01.2020 - GGDocument57 pagesManagement Report 01.2020 - GGmircearadu_1970No ratings yet

- Keekonomian SimresDocument15 pagesKeekonomian SimresOnesiforus TappangNo ratings yet

- American Cheminal Corp SpreadsheetDocument16 pagesAmerican Cheminal Corp SpreadsheetRahul PandeyNo ratings yet

- Common Excel Questions START - v2Document11 pagesCommon Excel Questions START - v2Mark SalvañaNo ratings yet

- Top 20 Countries 1617 - 2122Document2 pagesTop 20 Countries 1617 - 2122Md Robin HossainNo ratings yet

- EC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22Document7 pagesEC-083 Dt. 12.07.2022 - Import of Veg. Oils - Nov.'21 - June '22SAMYAK PANDEYNo ratings yet

- PEANUT MARKETING NEWS - December 16, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 16, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- JBVN134 - SPL Feb 2021Document48 pagesJBVN134 - SPL Feb 2021Nguyen PhuongNo ratings yet

- I Energy Weekly Price Update 1680544822Document17 pagesI Energy Weekly Price Update 1680544822PRASANJIT MISHRANo ratings yet

- List of Countries by GDP (PPP) : Jump To Navigationjump To SearchDocument28 pagesList of Countries by GDP (PPP) : Jump To Navigationjump To Searchoussama bensassiNo ratings yet

- List of Countries by GDP (PPP) : Jump To Navigationjump To SearchDocument28 pagesList of Countries by GDP (PPP) : Jump To Navigationjump To Searchoussama bensassiNo ratings yet

- EC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedDocument7 pagesEC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedSAMYAK PANDEYNo ratings yet

- VietnamDocument2 pagesVietnamno_no19No ratings yet

- Vietnam-China Trade, FDI and ODA Relations (1998-2008) and The Impacts Upon VietnamDocument34 pagesVietnam-China Trade, FDI and ODA Relations (1998-2008) and The Impacts Upon VietnamNeos HeroNo ratings yet

- Iran Port 2019Document9 pagesIran Port 2019vaibhav raiNo ratings yet

- London Energy Brokers' Association Otc Energy Volume Report - April 2021Document4 pagesLondon Energy Brokers' Association Otc Energy Volume Report - April 2021Ilya ZiminNo ratings yet

- Table 1: Summary of Australia'S Trade (A)Document4 pagesTable 1: Summary of Australia'S Trade (A)Mã Tố ThanhNo ratings yet

- Carbon Footprint CalculatorDocument33 pagesCarbon Footprint CalculatorCandiceNo ratings yet

- Recipe 1Document15 pagesRecipe 1bewketNo ratings yet

- Results Continue To Demonstrate Stability of Portfolio and Provide Opportunities For High Quality GrowthDocument35 pagesResults Continue To Demonstrate Stability of Portfolio and Provide Opportunities For High Quality GrowthJavier Montecinos MalebranNo ratings yet

- Mcs2023 Iron OreDocument2 pagesMcs2023 Iron Oresantanu ChowdhuryNo ratings yet

- RMG Check Request: Pay To The Order ofDocument78 pagesRMG Check Request: Pay To The Order ofPenélope FatimaNo ratings yet

- mcs2023 PotashDocument2 pagesmcs2023 PotashSolaris VeritatisNo ratings yet

- Rank 1: Wal-Mart Stores BP Exxon Mobil Royal Dutch/ Shell GroupDocument4 pagesRank 1: Wal-Mart Stores BP Exxon Mobil Royal Dutch/ Shell GroupibtiNo ratings yet

- Ingot Market - Shankhadeep BanerjeeDocument38 pagesIngot Market - Shankhadeep Banerjeevipul tutejaNo ratings yet

- Conditional FormattingDocument15 pagesConditional FormattingAviralNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Brittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Kode Barang Laba Kotor/Unit Laba TotalDocument7 pagesKode Barang Laba Kotor/Unit Laba TotalRaihan Rohadatul 'AisyNo ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Project On Export FinanceDocument64 pagesProject On Export FinanceAnand Thakkar50% (2)

- Dashboard - Sales Performance Store SelectionDocument24 pagesDashboard - Sales Performance Store SelectionДима АлешинNo ratings yet

- 1,000 Acres Pounds/Acre Tons: Aug18-Jul19 Aug 19-Jul20 Jul19 Jul 20 Aug18-Jul19 Aug19-Jul20 Jul19 Jul20Document1 page1,000 Acres Pounds/Acre Tons: Aug18-Jul19 Aug 19-Jul20 Jul19 Jul 20 Aug18-Jul19 Aug19-Jul20 Jul19 Jul20Morgan IngramNo ratings yet

- LithiumDocument2 pagesLithiumDhruv BhattNo ratings yet

- Aboaboso DraftDocument12 pagesAboaboso DraftProsper AabullehNo ratings yet

- Costflow Juli 2022Document6 pagesCostflow Juli 2022PT. PANDERA KILA MOROWALINo ratings yet

- UAE TradeDocument9 pagesUAE TradeHarshal AgarwalNo ratings yet

- Datos Actividad2Document5 pagesDatos Actividad2horizontempresarial.contactoNo ratings yet

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Document1 pageU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeNo ratings yet

- mcs2023 StrontiumDocument2 pagesmcs2023 StrontiumDragos MihaiNo ratings yet

- Case Uk MCD - v3.1 Loans 3oktDocument8 pagesCase Uk MCD - v3.1 Loans 3oktsebastien.parmentierNo ratings yet

- Reservas Mundiales Del LitioDocument2 pagesReservas Mundiales Del LitioVictoria BarbatoNo ratings yet

- BRSbrsEng 20230915095948Document16 pagesBRSbrsEng 20230915095948Senda SurauNo ratings yet

- MNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFDocument8 pagesMNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFANIL PARIDANo ratings yet

- #GIR Investor Executive Summary V6-2018Document5 pages#GIR Investor Executive Summary V6-2018Neil GutierrezNo ratings yet

- 2023.04.28 Press Release - ICSG Copper Market Forecast 2023-2024Document2 pages2023.04.28 Press Release - ICSG Copper Market Forecast 2023-2024Pedro Jose Cardenas PyastolovNo ratings yet

- Cameroon Crude Oil and Petroleum Products Import and Export 1986-2012 - Cameroon Data PortalDocument1 pageCameroon Crude Oil and Petroleum Products Import and Export 1986-2012 - Cameroon Data Portalpeguy diffoNo ratings yet

- Angkutan Bawahan 2020Document36 pagesAngkutan Bawahan 2020Luth NauvaldiNo ratings yet

- PR-063 DT - 20.02.2023 - Export of Oilmeals - Apr.'22 To Jan.'23Document5 pagesPR-063 DT - 20.02.2023 - Export of Oilmeals - Apr.'22 To Jan.'23SAMYAK PANDEYNo ratings yet

- Assignment 3 Introduction To Financial Markets and InstitutionsDocument2 pagesAssignment 3 Introduction To Financial Markets and InstitutionsVenkatNo ratings yet

- Gem N JewelDocument36 pagesGem N JewelravdeepbansalNo ratings yet

- (All Column Values) 39076110 4 Between 05/01/2020 - 05/31/2021Document12 pages(All Column Values) 39076110 4 Between 05/01/2020 - 05/31/2021shawon azamNo ratings yet

- 3 KTP LSAT Campus Marketing 1 Page Flyer FINAL 220906Document2 pages3 KTP LSAT Campus Marketing 1 Page Flyer FINAL 220906Luna ChenNo ratings yet

- CH7 - 折舊及遞耗資產Document32 pagesCH7 - 折舊及遞耗資產Luna ChenNo ratings yet

- CH9 - 無形資產與其他資產Document74 pagesCH9 - 無形資產與其他資產Luna ChenNo ratings yet

- CH8 - 減損與處分Document64 pagesCH8 - 減損與處分Luna ChenNo ratings yet

- CH4 - 客戶合約之收入Document136 pagesCH4 - 客戶合約之收入Luna ChenNo ratings yet

- CH5 - 存貨Document72 pagesCH5 - 存貨Luna ChenNo ratings yet

- CH2 - 財務報導表達Document74 pagesCH2 - 財務報導表達Luna ChenNo ratings yet

- Wishek Tandem Disc Operators Manual 2012Document31 pagesWishek Tandem Disc Operators Manual 2012Patrik GubinaNo ratings yet

- Carbon Steel Tires For Railway and Rapid Transit ApplicationsDocument4 pagesCarbon Steel Tires For Railway and Rapid Transit ApplicationshernankrlosNo ratings yet

- Control Techniques Product Catalogue en Iss1 0781 0465 01Document264 pagesControl Techniques Product Catalogue en Iss1 0781 0465 01Aman RizdanNo ratings yet

- The Indian Tyre IndustryDocument11 pagesThe Indian Tyre Industryshivi yoloNo ratings yet

- Condition and Prospect of Tire Industry in Indonesia, 2011Document6 pagesCondition and Prospect of Tire Industry in Indonesia, 2011MEDIA DATA RISET, PTNo ratings yet

- t4 Hitech 00-02Document341 pagest4 Hitech 00-02Nicoleta Costea100% (3)

- กฎระเบียบการนำเข้ารถนยนต์และชิ้นส่วน ECE RegulationDocument33 pagesกฎระเบียบการนำเข้ารถนยนต์และชิ้นส่วน ECE RegulationWann BlurNo ratings yet

- Final FinalDocument5 pagesFinal FinalAnjinesh ShuklaNo ratings yet

- Impact Skid Tester PDFDocument0 pagesImpact Skid Tester PDFLaughlikesiao HeheNo ratings yet

- Availability Report HINO PT - BIIDocument353 pagesAvailability Report HINO PT - BIIMuhammad Maulani MuttaqinNo ratings yet

- At Iva Gear Up CatalogueDocument12 pagesAt Iva Gear Up Cataloguewave umaNo ratings yet

- Types of Tyres - Belu Mihai 1711 AEDocument8 pagesTypes of Tyres - Belu Mihai 1711 AEŞtefania ApostolNo ratings yet

- Bufori La Joya.: Be UniqueDocument34 pagesBufori La Joya.: Be Uniqueapi-25938659No ratings yet

- Pavement Engineering Lec-3Document15 pagesPavement Engineering Lec-3Aqib HussainNo ratings yet

- Keluck Tyre Catalog TBR PCR Agr OtrDocument18 pagesKeluck Tyre Catalog TBR PCR Agr OtrEsteban MenesesNo ratings yet

- Land Rover Freelander 2 Tyre MarkingsDocument2 pagesLand Rover Freelander 2 Tyre MarkingsJimmy TudeskyNo ratings yet

- Caster, Camber, ToeDocument6 pagesCaster, Camber, ToeASHUTOSH KUMARNo ratings yet

- Tyre Recycling Plant Business PlanDocument6 pagesTyre Recycling Plant Business Planprtar76zNo ratings yet

- Business Research Methods Chapter03Document32 pagesBusiness Research Methods Chapter03Syed Adnan Abbas NaqviNo ratings yet

- How To Inspect A Used Car Checklist FULLDocument2 pagesHow To Inspect A Used Car Checklist FULLMohammad Zainullah KhanNo ratings yet

- Am 09 601 Vehicle DynamicsDocument104 pagesAm 09 601 Vehicle DynamicsMuhammed HussainNo ratings yet

- #33 June 2013Document68 pages#33 June 2013OutdoorUAENo ratings yet

- LogDocument36 pagesLogClapshot GamerNo ratings yet

- Auto Chassis NotesDocument70 pagesAuto Chassis NotesSrinivas NadellaNo ratings yet

- Mullineaux, Neil-Light Vehicle Tyres-iSmithers Rapra Publishing (2010-02-09) PDFDocument132 pagesMullineaux, Neil-Light Vehicle Tyres-iSmithers Rapra Publishing (2010-02-09) PDFSanthosh Kumar100% (1)

Issue No 228 March 2018

Issue No 228 March 2018

Uploaded by

Luna ChenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Issue No 228 March 2018

Issue No 228 March 2018

Uploaded by

Luna ChenCopyright:

Available Formats

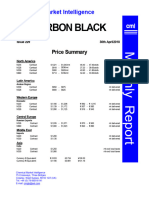

Chemical Market Intelligence

CARBON BLACK

Issue 228 31st March 2018

Price Summary

North America

N234 Contract $1,043 - $1,043/mt 47.40 - 48.40cts/lb ex-works

N326 Contract $836 - $854/mt 38.00 - 38.80cts/lb ex-works

N339 Contract $920 - $939/mt 41.80 - 42.70cts/lb ex-works

N660 Contract $728 - $741/mt 33.10 - 33.70cts/lb ex-works

Central America

N339 Contract $900 - $950 mt delivered

N326 Contract $850 - $875 mt delivered

Western Europe

Domestic

N220 Contract $1,216 - $1,246 € 990 - € 1,015 mt delivered

N339 Contract $1,173 - $1,210 € 955 - € 985 mt delivered

N326 Contract $1,124 - $1,160 € 915 - € 945 mt delivered

Central Europe

Russian Exports

N326 Contract $1,105 - $1,130 € 900 - € 920 mt delivered

N660 Contract $1,032 - $1,056 € 840 - € 860 mt delivered

Asia

China Exports

N220 Market $1,200 mt fob China

N330 Market $1,100 mt fob China

Malaysia Imports

N220 Thailand $1,400 mt cif Thailand

N330 Thailand $1,300 mt cif Thailand

Currency $ Equivalent: € 0.813 £0.712 ¥106.52

Currency € Equivalent: $1.228 £0.875 ¥130.93

Chemical Market Intelligence

75 Crossways, Three Bridges

Crawley, West Sussex, RH10 1QT (UK)

Tel: +44 (0) 78 6659 6141

E-mail: cmigb@aol.com

Carbon Black Issue 228 – March 2018

Feedstock

Crude oil prices have been volatile in recent weeks which is often the case during the seasonal downturn

in demand for crude, but also reflecting concerns about a trade war between the US and China. An

escalating trade dispute between the world’s two largest economies would clearly undermine bullish

sentiment in the oil market.

Global oil demand is currently reported to be strong in most parts of the world, with supply expected to

tighten as refiners come out of seasonal maintenance. Demand for crude has been revised upwards for

2018 in the past month due to stronger than expected demand for oil in OECD developed economies.

Demand for crude in China is reported to have increased by 8% year on year to average 12.5mbpd in the

first two months of 2018.

Global oil supply increased year on year by 700,000bpd in February to 97.9mbpd, driven by increasing

non OPEC output. The increase in non OPEC output is due to higher US oil output from US shale oil

fields, which is projected to drive an increase by 1.3mbpd this year. Total non OPEC output is expected to

increase by 1.8mbpd in 2018, from an increase of 760,000bpd in 2017. The large increase in non OPEC

output in 2018 is clearly slowing the rate at which global inventories of crude are being depleted.

Crude oil output by the OPEC cartel declined by 90,000bpd from February to 32.19mbpd in March. The

decline in output was due to a further decline in output in Venezuela, outages in Libya, and declining oil

exports from Angola. As a result compliance to OPEC’s production cuts of 1.2mbpd increased to 159% in

March, with no indications that individual countries increased output to profit from higher crude oil prices.

Saudi Arabia is reported to cutting the price of its crude for May by 50-60cents for all grades to the lowest

price for six months, despite the cuts undermining the OPEC cartels objective of reducing global

inventories of crude. The Saudi Crown Prince has suggested that OPEC and Russia are considering an

agreement to greatly extend their production agreement into the longer term in order to address the issue

of oversupply in the crude oil market in the context of increasing US shale oil output. The cartel and its

allies have successfully reduced the glut of oil inventories from 340m barrels above their five year

average to under 50m barrels in a year. This has been underscored by Saudi Arabia which has

committed the most to the production cuts accepting a production quota reduction of 500,000bpd. Saudi

Arabia is determined to see oil prices stabilise above $60pb in order to achieve a successful public

offering for the Saudi national oil company Aramco.

The Iraqi Government has approved a plan to increase crude oil production capacity to 6.5mbpd by 2022,

from current capacity of around 5mbpd. Currently oil production output in Iraq is around 4.4mbpd in line

with the OPEC production agreement. Iraq is to award oil and gas development contracts in 11 new

th

blocks on April 15 2018. Clearly a significant ramping up of output by 1-2mbpd by Iraq in the next three

years will pose a particular challenge to the OPEC cartel which is seeking to limit increases in output.

US crude oil output increased by 6,000bpd to 9.96mbpd in January. The total number of oil rigs reached

993 in March, an increase of 169 rigs year on year. Recent research indicates capital spending plans of

around 60 oil exploration and production companies suggests intentions to increase capital investment by

11% in 2018 to an estimated US$80bn. Oil companies have been steadily increasing spending since mid

2016 as crude oil prices began their recovery. As a result the number of US oil rigs is projected to

increase from an average 1,015 rigs in 2018 to 1,128 rigs in 2019. Other forecasts suggest US oil output

will increase to a record 10.7mbpd in 2018, and to 11.3mbpd in 2019, up from 9.3mbpd in 2017.

Crude oil inventories at Cushing Oklahoma, which are considered an indicator of US crude inventories,

are close to minimum levels. US refiners are importing less crude from OPEC countries, bringing crude oil

imports to their lowest volume since 2010. OECD stocks of crude are approaching their five year average

levels.

Russian oil output increased marginally to 10.97mbpd in March from 10.95mbpd in February, the highest

volume of monthly output since April 2017. Under the production agreement with OPEC, Russia agreed

to reduce its crude output by 300,000bpd from a baseline of 11.247mbpd, which it produced in October

2016. The Russian Energy Ministry reported the production cut in March was around 280,000 below the

October 2016 level of output representing a compliance of 93.4%.

© Chemical Market Intelligence 1

Carbon Black Issue 228 – March 2018

Crude prices have failed to breach recent highs of US$71.28pb. Geopolitical factors including an

escalating trade dispute between the US and China and a possible initiative by the US Government to

renegotiate the nuclear agreement with Iran could drive crude prices higher in the coming weeks. The

short term outlook for oil prices is for prices to trade in a range US$70pb to US$75pb during the summer,

as OPEC maintains compliance to its production quotas.

The table below details carbon black feedstock export oil exports from the US for the months of January

and February 2018.

US Exports of Carbon Black Feedstock Oil

January/February 2018 - Prices are FAS (Free Alongside Ship)

Destination January/February 2018

Barrels Mt US$/Barrel US$/mt

India 648,740 117,953 59.61 327.86

Thailand 391,846 71,245 66.21 364.16

Egypt 360,945 65,626 61.89 340.40

Singapore 307,667 55,939 52.54 288.97

Indonesia 253,000 46,000 67.00 368.50

Italy 134,208 24,401 60.00 330.00

South Korea 107,000 19,455 34.50 189.75

Canada 41,951 7,627 44.00 242.00

Total 2,245,357 408,247 59.53 327.42

Shipments for the month of February 2018 are detailed in the table below.

US Exports of Carbon Black Feedstock Oil

February 2018 - Prices are FAS (Free Alongside Ship)

Destination February 2018

Barrels Mt US$/Barrel US$/mt

India 227,963 41,448 60.00 330.00

Egypt 177,902 32,346 60.00 330.00

Italy 134,208 24,401 60.00 330.00

South Korea 107,000 19,455 34.50 189.75

Thailand 103,846 18,881 64.00 352.00

Singapore 90,000 16,364 34.50 189.75

Canada 22,659 4,120 44.00 242.00

Total 863,578 157,014 54.20 298.10

© Chemical Market Intelligence 2

Carbon Black Issue 228 – March 2018

North America

Current forecasts suggest the US economy will increase by around 2.6% in 2018, with strong job growth

underpinning buoyant consumer and business confidence. Job creation in the manufacturing sector

reached its highest level for four years in March. The prospects of a trade war look currently to have only

a very small impact upon the US economy with both the US and China, based upon current tariffs, but

could represent opening positions in negotiations between the two countries, while raising uncertainty in

the economy.

Light vehicle sales in the US increased year on year by 6% to 1.64m vehicles in March from 1.54m

vehicles in March 2017. The increase in sales volumes was supported by an additional selling day in

March 2018, increasing financial incentives by vehicle makers, and an increase in fleet sales volumes. On

a seasonally adjusted basis light vehicle sales reached 17.4m vehicles in March. As a result light vehicle

sales in the US increased 2% year on year in Q1 2018 or by 100,000 vehicles to 4.1m vehicles, driven by

strong demand for crossovers and light trucks. Sales of crossovers are assessed to have increased by

18% year on year in March, and by 15% in Q1 2018. Light truck sales also increased by 11% year on

year in Q1 2018. Sales of light trucks, crossovers and sports utility vehicles increased by almost 10% year

on year to 2.73m vehicles in Q1 2018 versus Q1 2017. By contrast sales of passenger cars declined year

on year by almost 11% in Q1 2018 to 1.37m vehicles.

Light vehicle sales to both retail and fleet buyers increased in March, with average financial incentives on

new vehicles increasing year on year by 5% in March. Rising employment in the US, and increasing

consumer confidence underlined by strong economic growth are underpinning consumer vehicle demand.

A recent forecast suggests light vehicle sales in the US will be around 16.7m vehicles in 2018, and will

stay in the range 16.5m to 16.7m in the years to 2020. Light vehicle sales reached 17.2m vehicles in

2017.

Light vehicle production across North America was unchanged from February 2017 volumes in

February 2018, with a 15% decline in passenger car output offset by an 8% increase in light truck output.

In the US vehicle makers cut output by 1% year on year in February, with cumulative output 2% below the

first two months of 2017 at 1.83m vehicles. In Canada light vehicle output declined by 5.6% year on year

in February to 176,000 vehicles driven by a 3% decline in passenger car output and a 6% decline in light

truck output year on year. Cumulatively light vehicle output in Canada declined by 9% year on year in the

first two months of 2018 to 344,000 vehicles. The table below details light vehicle production across North

America for the first two months of 2018 versus 2017.

Light Vehicle Production (North America) 2016 vs 2017 vs 2018 – Two Months only – 000’s

Vehicle 2016 2017 2018 % Change 2018

Passenger Car 1,113 999 846 -15

Light Truck 1,770 1,844 1,972 6

Total 2,883 2,843 2,818 -0.8

Lower vehicle output in the US and Canada in the first two months of 2018 was offset by a 7% increase in

light vehicle output in Mexico, equivalent to an increase of 42,500 vehicles to 633,000 vehicles in the first

two months of 2018.

Light vehicle output by General Motors is reported to have declined by over 40,000 vehicles year on year

in the first two months of 2018 to around 520,000 vehicles. Toyota is also assessed to have cut vehicle

output by around 20,000 vehicles in the first two months of 2018 to around 320,000 vehicles, and Nissan

by 20-30,000 vehicles to around 270,000 vehicles. By contrast Fiat Chrysler is assessed to have

increased its output by around 40,000 vehicles to just over 400,000 vehicles in the first two months of

2018, and Ford by around 10,000 vehicles to just over 500,000 vehicles in the two month period.

Nissan is reported to be slowing production at several assembly plants in response to weaker than

expected demand. The company reported a 2% increase in light vehicle sales in first two months of 2018

supported by generous financial incentives. Nissan held 60 days inventory of finished vehicles at the start

of March, and is seeking to reduce the level of inventory to 50 days supply until model changeovers start

in August.

© Chemical Market Intelligence 3

Carbon Black Issue 228 – March 2018

Honda is reducing output of its Accord model at its Marysville plant, Ohio due to inflated inventories of the

model which reached 104 days supply at the start of March. Sales of the Accord model declined by 13%

in 2018, reflecting a 15% decline in mid sized passenger car sales this year.

General Motors reported a 15% increase in vehicle sales in March to 296,000 vehicles in February, driven

by a 26% increase in sales of light trucks to 232,000 trucks, offset by an 11% decline in passenger car

sales to 63,000 vehicles. Sales to retail customers increased by 14% year on year. Cumulatively GM

reported a 3.8% increase in vehicle sales in Q1 2018 to 715,000 vehicles from 689,000 vehicles in Q1

2017, driven by an 11% increase in light truck sales to 568,000 vehicles, partially offset by an 18%

decline in passenger car sales to 146,000 vehicles.

Ford reported a 3% increase in vehicle sales to 243,000 vehicles in March, driven by a 7% increase in

light truck sales to 190,000 vehicles, offset in part by an 8% decline in passenger car sales to 52,000

vehicles. Cumulatively the company reported a 2% decline in sales to 596,000 vehicles in Q1 2018, with

light truck sales increasing 0.8% year on year to 468,000 vehicles, offset by a 13% decline in passenger

car sales to 128,000 vehicles.

Fiat Chrysler reported a 14% increase in vehicle sales year on year to 216,000 vehicles in March from

190,000 vehicles in March 2017. The company’s retail sales increased by 11% year on year to 162,000

vehicles, with fleet sales accounting for 25% of total sales volumes. The increase in vehicle sales was

driven by a 45% increase in sales of Jeep branded vehicles to 98,000 vehicles, representing the brand’s

best ever monthly sales volume. By contrast sales of Ram trucks declined by 13% to 44,800 trucks. Sales

of Chrysler branded vehicles increased by 15% to 19,500 vehicles driven by a 40% increase in sales of

the Pacifica minivan.

The German tyre and automotive component manufacturer Continental AG is forecasting vehicle output

across North America will decline by 5.9% or by around 1m vehicles to 16.55m vehicles in 2018 versus

2017, as detailed in the table below.

Vehicle Production (North America) 2016 vs 2017 vs 2018* - 000’s

Vehicle 2016 2017 2018* % Change

2018

Passenger Car & Light Commercial Vehicles 17,800 17,100 16,000 -6

Medium & Heavy Commercial Vehicles 475 513 559 8.9

Total 18,275 17,613 16,559 -5.9

* Forecast

The passenger car and light truck tyre market in North America has started the new year weakly.

Demand for tyres from the OE sector is reported to have declined by 3% year on year in February and

declined by 2% in the first two months of 2018. In the replacement market demand is reported to have

declined by 3% in February and by 3% in the first two months of 2018. Reports suggest demand for

premium passenger car and light truck tyres with a diameter of 18” or above in the replacement market

has increased by 7-8% in the first two months of 2018, but this has been offset by a reduction in demand

for tyres with a diameter of less than 17” of 4% year on year.

Demand for truck tyres in the OE sector across North America remained exceptionally strong in February

increasing by 22% year on year and by 22% in the first two months of 2018 versus 2017. However,

replacement truck tyre demand remains weak declining by 5% year on year in February and by 7% in the

first two months of 2018.

Continental AG is forecasting a pickup in replacement tyre demand across North America in 2018 versus

2017, as detailed in the table below.

Passenger Car and Commercial Vehicle Replacement Tyre Demand (North America)

2016 vs 2017 vs 2018* – millions

Tyre 2016 2017 2018* %

Change

2018

Passenger Car & Light Commerical Vehicle Tyres 285 285 290 1.7

Medium & Heavy Commercial Vehicle 23.6 24.5 25.3 3

Total 308.6 309.5 315.3 1.8

© Chemical Market Intelligence 4

Carbon Black Issue 228 – March 2018

Continental AG is forecasting replacement tyre demand for passenger cars will increase by around 5m

tyres to 290m tyres in 2018, and medium and heavy truck replacement demand will increase by 3% or by

800,000 tyres to 25.3m tyres. However, reports for the first two months of 2018 suggest declines in

replacement consumer and commercial vehicle tyre demand.

The US Department of Commerce has lowered antidumping duties on some manufacturers producing

passenger car and light truck tyres in China. Giti Tire has had its antidumping rate lowered from 30.74%

to 1.5%. Giti Tire also had its countervailing duty reduced to 20.6% from 36.7%, resulting in its overall

duty rate declining to 22% from 60.8%. Qingdao Sentury has had its dumping duty reduced to 4.4% from

25.30%. It remains to be seen whether the reductions in duties will be sufficient to lead to an increase in

passenger car and light truck tyre exports to the US from China this year.

Tyre manufacturers are urging the US President not to impose a 25% tariff on imported steel, as it argues

the domestic industry does not have the capacity to produce sufficient steel cord for the US tyre industry.

Continental Tire reported in produced 11m passenger car and light truck tyres at its Mount Vernon plant

in 2017 unchanged from 2016 output volumes. However the company increased output at its Sumter

plant to 3m tyres in 2017 up from an output of 2m tyres in 2016. The company also produced 6m

passenger car and light truck tyres at its plant at San Luis Potosi in Mexico in 2017, down by 1m units

from the 7m tyres it produced at the plant in 2016.

Continental AG produced 3.1m truck tyres at its Mount Vernon plant in 2017, up by 100,000 tyres from

the 3m truck tyres produced at the plant in 2016.

Continental AG is to increase passenger car and light truck tyre production capacity at its Mount Vernon

plant by 2m tyres per annum and truck tyre capacity by 400,000 tyres per annum by 2020/21. The

company will also increase production capacity for passenger car tyres at its plant at Sumter by 7m tyres

per annum by 2020/21 as part of its global plan to increase production capacity by around 37m tyres per

annum by 2020/21.

Sumitomo Rubber is to start producing Sumitomo branded medium truck tyres at its plant at Tonawanda,

NY.

Michelin estimates there was a 5% increase in mining activity globally in 2017, with several commodities,

and in particular coal, supported by higher commodity prices. While commodity prices are not expected to

reach their peak in 2018, prices are expected to be supportive of further increases in mining activity. This

should drive increases in demand for mining tyres in 2018. However, in the US, coal output is forecast to

decline by 2% by the Energy Information Agency following a 6% increase in output in 2017. Production of

coal in the Western US and Appalachia regions is forecast to decrease due to lower export sales, but

these could be offset by increases in output in other regions. A projected 10% increase in crude output in

the US in 2018 should also drive increased demand for off road tyres from the oil industry. Michelin is

forecasting strong demand across its range of mining tyres and for its giant 63” diameter tyres, which are

used in mining reflecting a desire to optimise mining production. By contrast small scale mining is

believed to becoming increasingly uncompetitive, which should result in less demand for smaller sized

mining tyres. Michelin has yet to restart production at its off road tyre plant at Starr, SC, which has been

idled for a third year.

Pirelli has a target of doubling the share of renewable materials in its tyres and reducing fossil based

materials by 30% from 2017 to 2025, as part of its corporate sustainability plan. The company reports the

average rolling resistance of its tyres has been reduced by 15% since 2009, and it is seeking to reach a

20% reduction in rolling resistance by 2020 versus 2009.

Pirelli is forecasting the volume of prestige and premium light vehicles in the NAFTA region will increase

from 38m vehicles in 2016 to 43m vehicles in 2020. This will drive an increase in replacement demand for

18” diameter tyres and above to an estimated 131m tyres per annum by 2020 from 95m tyres in 2016,

presenting an annual average growth rate of 8%. Pirelli reports that NAFTA represents the largest global

market for 18” and above passenger car tyres accounting for 55% of the global market for these sizes of

tyre.

Market demand for carbon black is reported to have been strong in March, with projections for April also

expected to be very strong. Increasing tyre output from new tyre plants in the US is contributing to the

upturn in market demand for carbon black. Despite relative weakness in demand in North American tyre

markets, tyre producers with new tyre plants in the US are believed to be ramping up tyre output,

supported by strong demand for high performance tyres with a diameter of 17” or more, demand for which

© Chemical Market Intelligence 5

Carbon Black Issue 228 – March 2018

continues to increase at a rate of 7-8% this year. It seems probable that Korean tyre producers and Giti

Tire will be reducing the volume of tyre imports to accommodate increased tyre production in the US.

Reports suggest the Korean tyre producers are also reducing the volume of carbon black being imported

from South Korea this year.

Supply of tread grade carbon black is reported to be very tight with some producers operating plants at

full operating rates, with supply of carcass grades also reported to be getting tight. This situation is being

caused in part by a number of carbon black plant outages, which combined with an upturn in demand for

product is causing tight supply conditions. Carbon black buyers are reported to be concerned about the

availability of product as several factors are inhibiting supply. As the carbon black industry ramps up

output there are suggestions that this is causing technical problems for plants, which have not been run

full for sometime or a number of years. As a result the industry is encountering a number of unplanned

outages. A second issue of concern is carbon black inventories which are reported to have started the

year relatively low. As a result there has not been an opportunity to build inventories. This is causing

problems for buyers seeking volume to cover planned outages in Q2 2018. Thirdly logistical problems are

causing delays with carbon black deliveries as the availability of hopper trucks is also tightening. Delays

to hopper trucks are becoming a serious issue for the industry as shipments are being delayed to due to

late hopper truck arrivals and delays in shipping. Freight rates for standard deliveries of sacks or big bags

are also increasing as economic activity in the manufacturing sector in the US picks up. Lastly, the

decline in carbon black imports to North America has contributed to the tightening supply situation for

carbon black this year.

Unplanned outages in the US carbon black industry combined with increasing demand is creating

concern amongst buyers as to continuity and security of carbon black supply. The shifting dynamics in the

market from an over supplied market towards a tightening supply situation in part reflects years of low

carbon black pricing in North America. Carbon black prices have been below a level that could justify

reinvestment in plant and equipment for many years. Indeed the large amount of capital being invested in

the tyre industry in North America has not been matched by reinvestment in plant and equipment by the

carbon black industry as it has not been economically justifiable. Some buyers are reported to believe

that the large capital investments required by the Environmental Protection Agency in the US will

contribute towards improving existing plant capabilities or efficiencies. Clearly this is not the case. As

carbon black producers reflect upon upcoming supply negotiations with customers for 2019 contracts,

unplanned plant outages this year underline the necessity for a more sustainable carbon black industry if

it is to meet the substantial increases in market demand for carbon black from the tyre industry in the next

four to five years. This issue is clearly becoming more pressing as the industry struggles to meet

increasing demand for product and plants are being operated at very high levels of utilisation. Changing

market fundamentals in the North American carbon black market will require a change in mindset on

behalf of major buyers, who need to appreciate the pressing need for more capital reinvestment in the

carbon black industry, as well as well publicised investments in reducing environmental emissions under

agreements with the EPA. These two issues equate to the necessity for substantial price increases in the

carbon black industry in North America. Price increases to meet the costs of the EPA agreements are

assessed to be at least in the region 6cts/lb to 7cts/lb. Adding the necessity for plant capital reinvestment,

then carbon black pricing in North America could require a price hike of 9cts/lb to 10cts/lb for 2019. The

industry has been able to implement such increases in the past when supply/demand fundamentals are

supportive. It remains to be seen whether current market conditions will be sustained through 2018 to

support initiatives that properly address the exceptional cost issues the North American carbon black

industry is currently facing.

© Chemical Market Intelligence 6

Carbon Black Issue 228 – March 2018

Canada

The Canadian economy increased by 3% in 2017, the fastest rate of increase in 2011, and significantly

faster than the 1.6% increase in 2016. However, the rate of economic growth slowed in 2H 2017,

increasing at an annualised rate of 1.7% in Q4 2017. Increased consumer spending was the largest

contributor to economic growth in 2017, followed by increased business investment. Exports from Canada

also increased for the second consecutive year in both goods and services. Economic uncertainty with

regards Canada’s trading relationship with the US could dampen an already slowing economy in 2018.

Passenger car and light truck sales in Canada declined by 0.6% year on year to 186,400 vehicles in

March, driven by a 12% decline in sales of passenger cars to 53,900 vehicles, offset by a 5% increase in

light truck sales volumes. On an annualised basis light vehicle sales were 2.08m vehicles, similar to the

previous two months. Cumulatively light vehicle sales increased by 1.8% to 429,000 vehicles in Q1 2018

versus Q1 2017, with passenger car sales declining by 8% to 121,000 vehicles, and light truck sales

increasing by 6% to 308,000 vehicles.

Light vehicle sales in Canada increased by 4% in 2017 versus 2016 reaching a record 2.03m vehicles,

the fifth consecutive year in which sales volumes have reached a new record. The increase in sales was

driven by an increase in sales of light trucks and sports utility vehicles equivalent to an increase of

112,000 vehicles to 1.39m vehicles partially offset by a 3% decline in passenger car sales to 639,000

vehicles. Demand for new vehicles has been particularly strong in Canada’s Western Provinces, which

had driven the increase in light vehicle demand. General Motors reported the largest increase in volume

of vehicle sales in Canada in 2017 increasing year on year by 13% to 302,000 vehicles. Ford remained

the largest vehicle seller in Canada reporting a 1% increase in sales to 308,000 vehicles in 2017, with

sales of its F Series truck reaching 155,300 vehicles.

Current forecasts suggest light vehicle sales in Canada will decline marginally by around 38,000 vehicles

to 2m vehicles in 2018, from a record 2.03m vehicles in 2017. Light truck sales are projected to increase

by 7,000 vehicles to 1.39m vehicles in 2018, offsetting a decline in passenger car sales of around 30,000

vehicles to around 600,000 vehicles.

Vehicle production in Canada declined by 8% or by 30,000 vehicles to 347,000 vehicles in the first two

months of 2018 versus 2017, driven by declines in both passenger car and light truck output.

Vehicle Production (Canada) 2017 versus 2018 – Two Months only - 000’s

Vehicle 2017 2018 % Change 2018

Passenger Car 123 116 -7

Light Truck 252 231 -8

Medium/Heavy Truck 2 N/a

Total 377 347 -8

Vehicle production in Canada declined by 7% or by 176,000 vehicles to 2.17m vehicles in 2017 versus

2016, as detailed in the table below.

Vehicle Production (Canada) 2015 vs 2016 vs 2017 – 000’s

Vehicle 2015 2016 2017 % Change 2017

Passenger Car 888 802 749 -6

Light Truck 1,380 1,555 1,430 -8

Medium/Heavy Truck 14 15 20 33

Total 2,283 2,355 2,179 -7.5

Canada’s largest vehicle producer Toyota produced 571,000 vehicles in Canada in 2017, down by 30,000

vehicles from the 601,000 vehicles it produced in 2016. Most of the decline in output was due to a

reduction in production of the Corolla, which declined by 27,000 vehicles to 210,000 vehicles in 2017.

Output of the Rav4 sports utility model also declined by around 3,000 vehicles to 247,000 vehicles in

2017.

The decline in vehicle output in Canada in 2017 was largely due to the shift in the production of General

Motors’s Equinox model from its Oshawa plant in Canada to two plants in Mexico. GM’s decision to shift

production of its Equinox model to its Mexican plants prompted industrial action by GM’s workers in

Canada in October, which also contributed to the decline in vehicle output in Canada in 2017. As a result

© Chemical Market Intelligence 7

Carbon Black Issue 228 – March 2018

vehicle output by GM in Canada looks to be in decline into the medium term. The company has

committed to sending the 2018 GMC Sierra model and Chevrolet light truck models to its Oshawa plant in

Canada for assembly and finishing, but it is not clear whether replacement 2019 models will also be

assembled at the plant. GM’s Chief Executive is reported to have suggested that the Oshawa plant will

produce 60,000 of the 2018 trucks per annum, while other of GM’s plants will build the 2019 equivalent

model. GM has invested US$310m to upgrade a production line at the Oshawa plant to a flex line to

produce multiple different vehicles at the same time.

The uncertainty surrounding the future of General Motors operations in Canada in the next few years will

have a major impact upon light vehicle production in the country. In recent years GM has been more

active in closing unprofitable operations in other parts of the world. The uncertainty surrounding the

NAFTA trade agreement, which is to be renegotiated, could also lead car makers such as GM to defer

long term decisions until the future of the NAFTA agreements is settled. In the meantime light vehicle

production in Canada looks set to decline from 2017 volumes in 2018, with output largely influenced by

market trends in the US market.

GM halted the production of the Cadillac XTS and Chevrolet Impala passenger cars in Canada for three

weeks in January, and only restarted one of two production lines when it did restart production. The single

production shift is expected to last until the end of May. The reduction in output reflects weak demand for

passenger cars across North America. However, GM is expected to increase light truck production in

Canada from June or July 2018.

In February 2018 GM also reduced production of passenger cars in Canada into April and May 2018 at

the Oshawa plant. A second shift is expected to start in 2H 2018.

In 2019 Toyota will cease production of the Corolla model at the Cambridge plant, and the plant will

produce Rav4 sports utility vehicles.

Unit passenger car and truck tyre output in Canada is assessed to have declined significantly in 2017

versus 2016, due to a surge in passenger car and truck tyre imports into Canada in 2017. The table

below details estimated unit passenger car and truck tyre output in Canada for 2016 versus 2017.

Estimated Unit Tyre Production (Canada) 2015 vs 2016 vs 2017 – 000’s

Vehicle 2015 2016 2017 % Change 2017

Passenger Car 15,500 12,600 7,900 -37

Truck 11,900 12,800 11,600 -9

Total 27,400 25,400 19,500 -23

Unit passenger car tyre output in Canada is assessed to have declined significantly in 2017, due to a

reduction in demand from the light vehicle OE tyre market of around 900,000 tyres, and an exceptional

increase in passenger car tyre imports of 4.7m tyres to 29.4m tyres, as detailed in the table below.

Estimated Unit Passenger Car Unit Tyre Output & Demand (Canada) 2016 vs 2017 – 000’s

Vehicle 2016 2017 % Change 2017

Passenger Car 12,600 7,900 -37

Imports 24,700 29,400 19

Exports 11,100 11,400 2

Apparent Demand 26,200 25,900 -1

While passenger car tyre output is unlikely to have declined as significantly as suggested in the table

above, the surge in the volume of passenger car tyre imports to record volumes in 2017 probably had a

negative impact upon passenger car tyre output in Canada in 2017.

Michelin reports there was a 7% increase in demand in the consumer replacement tyre market in Canada

in Q4 2017, following flat demand across North America for most of 2017. This would suggest an overall

increase in the Canadian replacement tyre market of around 500,000 tyres in 2017, insufficient to offset a

reduction in OE demand of around 900,000 tyres. The increase in tyre sales in Q4 2017 was probably

driven by increased demand for winter tyres. Reports indicate demand for winter tyres in Canada have

increased at an annualised rate of 4% over the past five years. Winter tyre use is compulsory in Quebec

Province and fitted on 60% of light vehicles outside of Quebec.

© Chemical Market Intelligence 8

Carbon Black Issue 228 – March 2018

Passenger car tyre imports to Canada increased by an exceptional 4.7m tyres to a record 29.5m tyres in

2017, with imports from the US increasing by almost 1.7m tyres to 9.3m tyres in 2017. Passenger car tyre

imports from China increased by 1.4m tyres to 6.6m tyres, and from Thailand by 470,000 tyres to 1m

tyres in 2017. The increase in imports from the US could reflect weaker than expected demand in the US

market in 2017, and an increase tyre production capacity as new tyre plants come on stream in south

eastern US states in 2017. In addition Chinese tyre producers are probably targeting the Canadian

market as high tariffs prevent them from profitably supplying passenger car tyres to the US market.

Passenger car tyre exports from Canada increased by 300,000 tyres to 11.4m tyres in 2017, driven by an

increase in exports of 340,000 tyres to the US to 11.3m tyres. Unit passenger car tyre exports from the

state of Ontario, where Goodyear operates a tyre plant, declined by 4% or by 300,000 tyres to 7.5m tyres

in 2017. Unit car tyre exports from the state of Nova Scotia where Michelin operates a tyre plant

increased by 4% or by 120,000 tyres to 2.8m tyres in 2017. This follows the decision by Michelin to

significantly reduce passenger car and light truck tyre production at its plant at Pictou County in Nova

Scotia in 2014. Unit passenger car tyre exports from Quebec from where Bridgestone operates a tyre

plant, increased by 75% or by 475,000 tyres to 1.1m tyres in 2017. It seems probable that tyre producers

in Canada switched production to produce more passenger car tyres instead of light trucks tyres in 2017.

Traced imports of passenger car tyres from Canada to the US increased by 1% or 100,000 tyres to 9.6m

tyres in 2017 versus 2016, as detailed in the table below.

Traced US Passenger Car Tyre Imports from Canada by Tyre Diameter 2016 vs 2017 – 000’s

Tyre Diameter 2016 2017 % Change 2017

13” or less 0 0 -

>13”<14” 0 0 -

>14”<15” 140 90 -37

>15”<16” 1,300 1,400 10

>16”<17” 3,500 4,000 11

>17”<18” 2,000 1,700 -15

>18” 750 900 20

Other 1,850 1,500 -18

Total 9,500 9,600 1

Passenger car tyre imports from Canada to the US declined in most diameter sizes in 2017. A lack of

production capacity for high performance passenger car and light truck tyres could have limited the

increase in the volume of exports of larger diameter tyres from Canada to the US market in 2017.

Alternatively an oversupplied US market for premium passenger car tyres could have limited the volume

of tyres being shipped from Canadian plants to the US in 2017.

Bridgestone is increasing tyre production capacity by 3,000 tyres/day to 20,000 tyres/day by 2023 at its

passenger car and light truck tyre plant in Joliette, Quebec. The investment will be spread over five years

and increase the plant’s production capacity for larger diameter tyres for pickup trucks and sports utility

vehicles, and increase the plants productivity.

Unit truck tyre output is assessed to have declined by around 800,000 tyres to an estimated 11.6m tyres

in 2017 versus 2016, as detailed in the table below.

Estimated Unit Truck Unit Tyre Output & Demand (Canada) 2016 vs 2017 – 000’s

Truck Tyres 2016 2017 % Change 2017

Production 12,800 11,600 -9

Imports 7,500 8,700 16

Exports 10,000 8,700 -13

Apparent Demand 10,300 11,600 13

The decline in truck tyre output is assessed to have been driven by an increase in imports of 1.2m tyres

to 8.7m tyres in 2017, probably driven by strong demand in the Canadian truck tyre market. Medium and

heavy truck output in Canada increased by an exceptional 33% or by 5,000 trucks in 2017. The OE truck

tyre market in North America is reported by Michelin to have increased by 10% or by 500,000 tyres to

5.8m tyres in 2017, with demand increasing throughout the year. The replacement truck tyre market in

North America is reported to have increased by 4% or by 900,000 tyres to 25.4m tyres.

© Chemical Market Intelligence 9

Carbon Black Issue 228 – March 2018

Truck tyre exports from Canada also declined by 12% or by 1.2m tyres to 8.7m tyres in 2017, due to a

similar increase in the volume of shipments to the US market in 2016. The decline in truck tyre exports

from Canada in 2017 probably reflects strong domestic truck tyre demand in Canada in 2017.

Truck tyre exports from Ontario where Goodyear operates a tyre plant declined by 11% or by 260,000

tyres to 2.2m tyres in 2017. Unit truck tyre exports from Quebec, from where Bridgestone operates a tyre

plant declined by 14% to 4.2m tyres in 2017 from 5m tyres in 2016. Truck tyre exports from Nova Scotia

where Michelin operates a truck tyre plant declined by 11% or by 300,000 tyres to 2.2m tyres in 2017.

Unit truck tyre output in Canada should increase over the next four years as Michelin invests US$73m at

its medium and heavy truck tyre plant at Waterville in Nova Scotia to increase production capacity for

wide base truck tyres.

Truck tyre imports to Canada increased by 15%, or by an exceptional 1.1m tyres to 8.7m tyres in 2017,

driven by an increase in imports from the US of 760,000 tyres to 4m tyres and an increase in imports from

China of 18% or 300,000 tyres to almost 2m tyres in 2017.

Assessing market demand for rubber grades of carbon black in Canada is complicated in 2017 by the

exceptional volumes of passenger car and truck tyre imports into the country. Passenger car tyre imports

increased by almost 20% or by 4.8m tyres to a record 29.5m tyres in 2017, far outpacing the rate of

increase in domestic passenger car tyre demand in Canada. It is probable that as new tyre production

capacity has come on stream in the US in 2017, and US passenger car demand remained flat, that US

tyre producers have sought to increase sales volumes in the Canadian market. This will probably have

had some impact upon domestic passenger car tyre production in Canada. Simple arithmetic suggests a

sharp decline in unit passenger car tyre production of up to 4.7m tyres of output in 2017. However,

passenger car tyre exports from Canada, which typically represent around 80% of car tyre output in

Canada, were unchanged from 2016 volumes in 2017. Unit truck tyre imports to Canada also increased

by an exceptional 1.2m tyres to a record 8.7m tyres in 2017. In the most pessimistic scenario market

demand for carbon black in Canada could have declined by around 20,000mt to around 150,000mt in

2017, as detailed in the table below.

Estimated Market Demand for Carbon Black* (Canada) 2015 vs 2016 vs 2017 – mt

Carbon Black 2015 2016 2017 % Change 2017

Production 197,000 203,000 208,000 2

Imports 81,000 77,000 62,000 19

Exports 105,000 111,000 121,000 9

Apparent Demand 173,000 169,000 149,000 -11

*Rubber Grades only

The sharp decline in market demand for carbon black in Canada is underlined by the reduction in carbon

black imports to 62,000mt in 2017, the lowest volume of imports since the financial crisis in 2009. Rubber

grade carbon black exports from Canada also reached a record 121,000mt in 2017. Increasing

passenger car and light truck tyre production capacity in the US in 2017 looks set to continue to put

pressure upon Canadian tyre producers in 2018, unless there is a significant upturn in consumer tyre

demand in the US tyre market in 2018. It seems high volumes of tyre inventories in Canada at present

could depress passenger car and light truck tyre output in 2018.

Despite a projected sharp decline in market demand for carbon black in Canada in 2017, rubber grade

carbon black output is assessed to have increased by around 5,000mt to an estimated 208,000mt. This

would suggest the two rubber grade carbon black plants in Canada were operating at close to available

production capacity in 2017, due in part to the increase in exports of 10,000mt to a record 121,000mt.

Carbon black imports to Canada declined by an exceptional 15,000mt to 61,700mt in 2017 versus 2015,

the lowest volume of imports since the global financial crisis in 2009, as detailed in the table overleaf.

Carbon black imports to Canada from the US declined by almost 5,000mt to 54,000mt in 2017. Carbon

black imports from Russia and China, historically priced lower than domestic carbon black producers in

the Canadian market declined by almost 12,000mt to 3,900mt in 2017. Imports from Russia declined by

7,300mt and from China by 4,500mt. The decline in the overall volume of carbon black imports into

Canada in 2017, suggests the reduction in imports from these two countries probably reflected reduced

market demand for carbon black as well as a lack of price competitiveness from producers in these two

countries in 2017. Sustained higher oil prices above US$60pb could lead to a recovery in carbon black

from Russian producers into the Canadian market in 2018.

© Chemical Market Intelligence 10

Carbon Black Issue 228 – March 2018

Carbon Black Imports (Canada) 2016 vs 2017 – mt

Source 2016 2017 Average Import Price

US$/mt 2017

United States 59,593 54,615 1,051

Russia 10,914 3,604 825

Venezuela 0 1,365 837

India 551 644 1,420

China 4,856 327 805

Germany 367 273 2,600

Italy 90 245 2,049

Mexico 284 165 1,260

Japan 60 154 2,371

Belgium 43 90 1,228

Sri Lanka 31 84 1,063

Netherlands 97 34 1,201

Poland 60 21 1,032

Ukraine 49 19 1,112

Serbia 0 19

Total 77,152 61,728 1,053

All of the decline in carbon black imports to Canada in 2017 is accounted for by a decline in imports to

Quebec Province by 14,500mt to 5,500mt. By contrast carbon black imports to the Province of Ontario

were unchanged at 38,500mt in 2017, while imports to New Brunswick Province increased by 1,000mt to

17,000mt in 2017 versus 2016.

Carbon black exports from Canada increased by 14,500mt to a record 164,000mt in 2017 versus 2016,

as detailed in the table below.

Carbon Black Exports (Canada) 2016 vs 2017 – mt

Destination 2016 2017 Average Export Price

US$/mt 2017

United States 116,362 127,228 1,085

China 6,769 6,048 1,436

Belgium 4,434 5,667 908

South Korea 3,353 3,651 1,348

Japan 2,096 2,991 1,415

Italy 2,170 2,675 1,290

France 1,886 2,107 1,233

United Kingdom 1,834 2,015 1,278

Germany 1,790 1,766 1,308

Taiwan 1,534 1,596 1,604

Singapore 1,010 1,357 1,188

Austria 920 1,347 1,344

India 1,093 1,223 1,271

Thailand 1,248 1,108 1,645

Spain 593 510 1,183

Malaysia 409 462 699

Brazil 213 368 586

Hong Kong 129 319 1,595

Turkey 316 314 1,419

Vietnam 262 312 1,785

Indonesia 191 186 1,553

Netherlands 356 182 1,014

Argentina 134 177 1,206

Denmark 123 142 1,123

Sweden 134 75 1,350

Other 133 217

Total 149,492 164,043 1,129

© Chemical Market Intelligence 11

Carbon Black Issue 228 – March 2018

Carbon black exports to the US increased by 10,800mt to a record 127,000mt in 2017. Exports of rubber

blacks from Canada are assessed to have increased by 8,000mt to 120,000mt in 2017, probably largely

driven by an increase in exports to the US market. Thermal grade carbon black exports from Canada are

assessed to have increased by 7,000mt to 44,000mt in 2017 from 37,000mt in 2016, based upon carbon

black exports from the Canadian Province of Alberta where the Tokai thermal carbon black plant is

located, with an average export price of US$1,490/mt in Q4 2017.

It seems probable that most of the rubber black exports from Canada were to the US with exports to

markets in other continents largely representing thermal blacks. Carbon black exports from Canada to

Belgium increased by 1,200mt to 5,600mt in 2017, and to Japan by 900mt. However, most of the

increase in thermal carbon black exports from Canada are assessed to have been shipped to the US

market, with exports assessed to have increased by 2,000mt to an estimated 6,700mt in 2017.

Central America

Mexico

The Mexican economy increased by 0.8% in Q4 2017 from the previous quarter, and by 1.5% year on

year from Q4 2016. Political uncertainty regarding trading relations with the US could impact economic

growth in Mexico in 2018, which is currently projected to increase by around 2%. There is concern there

will be a slowing of capital investment in Mexico until renegotiated trading relations with the US are

completed. Government spending on infrastructure following the earthquakes, which damaged parts of

the country in 2017, should contribute to economic growth in 2018.

Light vehicle sales in Mexico declined by 7% year on year in February to 109,300 vehicles, from a high

base comparison of 117,800 vehicles in February 2017. Passenger car sales declined year on year by

12% to 67,000 vehicles, partially offset by a 3% increase in light truck sales to 41,800 vehicles.

Cumulatively passenger car sales in Mexico declined by 9% or by 22,000 vehicles to 218,000 vehicles in

the first two months of 2018 versus 2017.

Light vehicle sales in Mexico declined by 4% or by 73,000 vehicles to 1.53m vehicles in 2017, driven by a

7% decline in passenger car sales to 984,000 vehicles, offset by a 1.6% increase in light truck sales to

546,000 vehicles in 2017.

Light vehicle production in Mexico increased by 6% or by 37,000 vehicles to 632,000 vehicles in the

first two months of 2018 versus 2017, as detailed in the table below.

Light Vehicle Production (Mexico) 2017 vs 2018 – Two Months only - 000’s

Vehicle 2017 2018 % Change 2018

Passenger Car 324 262 -19

Light Truck 270 369 36

Total 595 632 6

The increase in light vehicle output was driven by an 8% increase in export sales to 507,000 vehicles

equivalent to an increase of 40,000 vehicles year on year. The increase in output was driven by an

increase in output of 20,000 vehicles year on year by Kia; by 19,500 vehicles by Fiat Chrysler, and

13,000 vehicles by General Motors. By contrast Volkswagen reported a decline in output of 24,000

vehicles year on year, and Nissan a decline of 13,700 vehicles year on year in the first two months of

2018.

Vehicle production in Mexico is projected to reach 4m vehicles in 2018 and 5m vehicles by 2020.

Mercedes is expected to start vehicle production in Mexico this year at its new plant built at Aguasalientes

as a joint venture with Nissan. In 2019 BMW is to start production at its new plant, which is currently

under construction at San Luis Potosi.

Vehicle production in Mexico increased by 13% or by 468,000 vehicles to a record 4.06m vehicles in

2017 versus 2016, as detailed in the table overleaf.

© Chemical Market Intelligence 12

Carbon Black Issue 228 – March 2018

Vehicle Production (Mexico) 2016 vs 2017 – 000’s

Vehicle 2016 2017 % Change 2017

Passenger Car 1,193 1,900 -4

Light Truck 1,463 2,001 36

Medium/Heavy Truck 143 167 16

Total 3,600 4,068 13

The increase in vehicle output was driven by a 36% increase in light truck production reflecting US

consumers shift in taste towards crossovers, sports utility vehicles and light trucks. Mexican made light

vehicles are estimated to have accounted for 15% of US light vehicle sales in February.

Light vehicle output in Mexico increased by 8.9% or by 308,000 vehicles to 3.77m vehicles in 2017 versus

2016. The increase in output was driven by an increase in vehicle output by Fiat Chrysler of 180,000

vehicles, or 39% year on year to 638,000 vehicles in 2017, as detailed in the table below.

Light Vehicle Production by Manufacturer (Mexico) 2016 vs 2017 – 000’s

Vehicle 2016 2017 % Change 2017

Nissan 848 829 -2

General Motors 703 805 14

Fiat Chrysler 459 638 39

Volkswagen 414 461 11

Ford 390 315 -19

Kia 107 221 ++

Honda 253 208 -17

Toyota 139 151 8

Mazda 149 141 -7

Total 3,465 3,773 8.9

Kia reported an increased in vehicle output of 114,000 vehicles in Mexico in 2017, and General Motors a

20% increase in output equivalent to an increase of 102,000 vehicles in 2017.

Vehicle exports from Mexico reached a record 3.1m vehicles in 2017, representing a 12% on the previous

year, as detailed in the table below.

Light Vehicle Exports (Mexico) 2016 vs 2017 – 000’s

Vehicle 2016 2017 % Change 2017

Passenger Car 1,478 1,443 -2

Light Truck 1,289 1,658 28

Total 2,768 3,102 12

75% of vehicle exports from Mexico went to the US market in 2017, with Mexican produced vehicles

accounting for 13% of light vehicle sales in the US in 2017, equivalent to 2.4m vehicles.

Fiat Chrysler is forecasting more growth in vehicle output in Mexico in 2018 and 2019, despite a decision

to shift production of Ram heavy duty pickup trucks from Mexico to Michigan in 2020. This is seen as a

precautionary measure in case the US withdraws from the NAFTA free trade agreement. Pickup trucks

produced in Mexico would attract a 25% import tax under President Trump’s initial proposals. Fiat

Chrysler exported 276,000 Ram pickup trucks in 2017, 88% of them to the US market. Fiat will invest

US$1bn in the Michigan plant, while its plant in Mexico will be reconfigured to produce commercial

vehicles. The company operates five plants in Mexico, which it reports is a good base for vehicle exports

outside of North America as well as within.

General Motors reported a 14% increase in vehicle output in Mexico in 2017 equivalent to an increase of

100,000 vehicles, due to the moving of production of the Chevrolet Equinox and GMC Terrain from its

plants in Canada to Mexico. General Motors is preparing a plant in Silao in Mexico to construct a new

generation of pickup trucks.

Toyota and Mazda are to construct a new joint venture plant in Alabama at a cost of US$1.6bn, which will

have an annual production capacity of 300,000 vehicles per annum. Toyota will produce the Corolla

model at the plant and Mazda a crossover model in 2021.

© Chemical Market Intelligence 13

Carbon Black Issue 228 – March 2018

The increase in vehicle output in Mexico was also supported by the ramping up of output by Kia at its

plant near the northern city of Monterrey in the past year, and Audi’s Q5 crossover plant in the Central

Mexican city of Puebla where the company produced 158,000 Q5 sports utility vehicles in 2017.

Unit passenger car and light truck tyre output in Mexico was forecast to increase by around 5% in

2017 to around 31.3m tyres from 29.8m tyres produced in 2016, according to the Mexican tyre

association as detailed in the table below.

The table below details passenger car and light truck tyre production in Mexico together with net trade

and apparent demand.

Passenger Car and Light Truck Tyre Production & Apparent Demand (Mexico) 2014 – 2017 – 000’s

Passenger Car Tyre 2014 2015 2016 2017 % Change

2017

Production 20,000 21,600 29,800 31,300 5

Imports 18,700 20,400 20,500 23,100 13

Exports 14,000 15,800 16,600 18,000 8

Apparent Demand 24,700 26,200 33,700 36,400 8

Mexican tyre production statistics indicate a large increase in passenger car and light truck tyre output of

8.2m tyres per annum to 29.8m tyres in 2016. This would suggest a significant increase in market

demand for carbon black in Mexico in that year. The startup of tyre output by Goodyear of tyre production

at its new Mexican tyre plant in mid 2017 and Pirelli at its second Mexican tyre plant was projected to

drive an increase in unit passenger car tyre output of 1.5m tyres to 31.3m tyres in 2017. However, weaker

than expected demand in Mexico, and in the US tyre market, led to some reductions in tyre output in

Mexico in 2017. Nevertheless the increase in passenger car tyre exports of 1.4m tyres to 18.8m tyres in

2017 probably indicates some increase in unit car tyre output.

Continental AG reported unit passenger car and light truck tyre output at its Mexican tyre plant at San

Luis Potosi declined by 1m tyres from an output of 7m tyres in 2016 to 6m tyres in 2017. The company is

not planning to increase tyre production capacity in Mexico in the years to 2021. Rather it will increase

passenger car tyre production capacity in the US by 9m tyres, and truck tyre production capacity by

700,000 tyres in the US in the years to 2021.

Cooper Tire reported a decline in unit tyre production at its Mexican plant in Q3 2017 due to weak

demand and the earthquake and hurricane, which occurred in Mexico. However, Cooper Tire reported it

performed better than the industry as a whole in Mexico where the market declined by 15% year on year

in Q3 2017. The company also reports the volatile economic and political environment in Mexico also

contributed to the decline in demand, which contrasted to recent history where demand for tyres has been

increasing.

Pirelli reported a 5% increase in sales revenues in the NAFTA region to €984m (US$1.21bn) in 2017 from

€935m (US$1.15bn) in 2016. The increase in sales revenues came in spite of a decline in demand from

the OE market. Sales of high value added tyres increased by 5.9% year on year due to increased

penetration of the retail network. At the start of 2017, Pirelli projected its tyre output in Mexico would

reach an annualised rate of 7.5m tyres by the end of 2018 from 5m tyres per annum. Pirelli is constructing

a second tyre plant next to its existing one at Siloa, with production expected to start this year. The

company is expecting to reach an output of 7.5m tyres per annum by the end of 2018, from a current

production output of 5m tyres per annum.

Michelin is expecting to start production at its new plant at Leon in late 2018. The plant will have an

installed production capacity of between 4m and 5m tyres, most of which will be for 18” diameter tyres

and above.

The Indian tyre manufacturer JK Industries operates three tyre plants in Mexico under the JK Tornel

name, with a total annual production capacity of 5.2m radial passenger car tyres, 300,000 bias truck tyres

and capacity for 2.4m ‘other’ types of tyre. In total production capacity equates to 300mt of tyres per day.

The company has implemented a labour restructuring programme in the past year, which it expects will

improve its financial performance going forward. JK Tournel reported a 10% increase in sales revenues in

the year ending April 2017 to Rs12.1bn (US$187m) supported by an increase in passenger car tyre

production capacity in the past year.

© Chemical Market Intelligence 14

Carbon Black Issue 228 – March 2018

The table below details actual tyre passenger car tyre output in Mexico for the years 2014 to 2016, with

the projected increase for 2017, combined with net trade in passenger car tyres and apparent demand.

Passenger Car and Light Truck Tyre Production & Apparent Demand (Mexico) 2014 – 2017 – 000’s

Passenger Car Tyre 2014 2015 2016 2017 % Change

2017

Production 20,000 21,600 29,800 31,300 5

Imports 18,700 20,400 20,500 23,100 13

Exports 14,000 15,800 16,600 18,000 8

Apparent Demand 24,700 26,200 33,700 36,400 8

The Mexican tyre association reported 39.4m tyres were sold in Mexico in 2016, however illegal imports

of used low quality tyres from China and the US reached 2m tyres. These imported tyres are dampening

domestic demand for new tyres in Mexico. 60% of the commercial tyre market in Mexico are accounted

for by low priced imported used tyres.

Passenger car tyre imports to Mexico increased by 2.7m tyres to 23.2m tyres in 2017 versus 2016, driven

by an increase in imports from South Korea of 900,000 tyres; from Thailand of 670,000 tyres and from the

US of 450,000 tyres to 3.85m tyres in 2017. Passenger car tyre imports from China also increased by

240,000 tyres to 6.6m tyres in 2017.

Passenger car tyre exports from Mexico increased by almost 1.5m tyres to 18m tyres in 2017, driven by

an increase in exports to Brazil of 900,000 tyres, and 480,000 tyres to an unidentified country. Exports to

the US market increased by 300,000 tyres to 14.2m tyres in 2017, accounting for almost 80% of

passenger car tyre exports from Mexico in 2017.

Passenger car tyre output in Mexico is projected to increase by 10-12m tyres per annum in the next three

years as new tyre production comes on stream at Goodyear, Pirelli at Michelin.

Traced imports of passenger car tyres to the US from Mexico indicate unchanged volumes of imports in

the first six months of 2017 versus 2016, as detailed in the table below.

Traced Passenger Car Tyre Imports to the US from Mexico

By Tyre Diameter 2016 vs 2017 – 000’s

Source 2016 2017 % Change 2017

<13” 100 60 -46

>13”<14” 500 480 -3

>14”<15” 2,500 1,900 -23

>15”<16” 2,200 2,400 7

>16”<17” 2,600 2,500 -2

>17”<18” 1,200 1,600 26

>18” 2,300 2,800 22

Total 11,500 11,800 2

Unit truck tyre output in Mexico is assessed to have increased in 2017, based upon a 16% increase in

demand from the OE sector as heavy truck output increased to 167,000 trucks in 2017. Truck tyre export

data suggests an exceptional increase in truck tyre exports of 20m tyres to 47m tyres in 2017 versus

2016. Truck tyre exports from Mexico increased by 20m tyres to 47m tyres in 2017 versus 2016, driven by

an increase in exports to the US market of 5.8m tyres to 19m tyres and to Brazil of 5.5m tyres to 6.6m

tyres in 2017. This seems erroneous as traced imports truck tyres imports to the US from Mexico were

unchanged from 2016 volumes in 2017 at 1m tyres. Meanwhile the Mexican truck tyre replacement

market is reported to be dominated by low priced imports which account for an estimated 60% of truck

tyre sales with a diameter of 20” or above according to the Mexican Tyre Association.

Market demand for carbon black in Mexico is assessed to have increased by around 10,000mt to an

estimated 150,000mt in 2017 versus 2016, as detailed in the table overleaf.

© Chemical Market Intelligence 15

Carbon Black Issue 228 – March 2018

Estimated Market Demand for Carbon Black (Mexico) 2016 vs 2017 – mt

Carbon Black 2016 2017 % Change 2017

Production 140,000 137,000 -2

Imports 31,000 41,000 32

Exports 31,000 28,000 -10

Apparent Demand 140,000 150,000 7

The increase in demand for carbon black is assessed to have been driven by an exceptional increase in

vehicle output of 468,000 vehicles in 2017, as light truck output increased by 538,000 vehicles year on

year. Unit passenger car tyre output is also assessed to have increased by up to 1.5m tyres in 2017,

driven by an increase in demand from the OE sector of over 2m tyres, and an increase in exports of 1.4m

tyres to 18m tyres. These increases will have been partially offset by weaker domestic demand for tyres

in the consumer tyre replacement market in Mexico in 2017, with Continental AG reporting a decline in

passenger car tyre output of 1m tyres and Cooper Tire also reporting a decline in output in Q3 2017.

The ramping up of tyre output by Goodyear and Pirelli at their new plants in Mexico this year and the

startup of production by Michelin at its new Mexican plant in Q4 2018 should drive an increase in market

demand for Mexico in 2018 and beyond. Indeed unit passenger car and light truck tyre production

capacity in Mexico will increase by 12m to 13m tyres per annum in the next year as Goodyear, Michelin

and Pirelli bring new production capacity on stream. Current weak volumes of demand for consumer tyres

in the US could be slowing the rate at which new tyre plants are ramping up output.

The increase in market demand for carbon black in 2017, was largely met by an increase in carbon black

imports of 10,000mt, largely from the US of 11,000mt to 34,000mt, as detailed in the table below.

Carbon Black Imports (Mexico) 2016 vs 2017 – mt

Source 2016 2017 Average Import Price

US$/mt 2017

United States 23,753 34,792 1,241

Colombia 1,614 2,795 827

Canada 1,570 1,119 1,577

Russia 248 777 759

Germany 321 654 3,395

Japan 153 421 2,197

China 1,375 162 1,494

Korea South 63 129 3,269

United Kingdom 20 60 1,030

Belgium 42 36 4,573

India 10 17 2,708

Netherlands 20 13 4,989

Czech Republic 9 9 15,447

Venezuela 1392 0

Total 30,878 41,017 1,274

Carbon black imports from the US increased by 9,000mt to 16,800mt in the first six months of 2017.

Carbon black imports from Colombia increased by 2,500mt in the first six months of 2017. It is possible

that tighter supply of carbon black in Mexico resulted in Cabot importing some product from its plant in

Colombia in 1H 2017.

Carbon black exports from Mexico declined by 3,000mt to 28,000mt in 2017 versus 2016, as detailed in

the table overleaf.

Carbon black exports from Mexico to the US increased by 1,100mt in 2017; to Brazil by 990mt and to

India by 650mt. By contrast exports to Ecuador from Mexico declined by 1,900mt; to Peru by 1,800mt and

to Costa Rica by 1,450mt in 2017 versus 2016. It seems probable that Cabot plant in Mexico lost sales

volumes to the Venezuelan carbon black producer Negroven in the Andean region in 2017.

© Chemical Market Intelligence 16

Carbon Black Issue 228 – March 2018

Carbon Black Exports (Mexico) 2016 vs 2017 – mt

Destination 2016 2017 Average Export Price

US$/mt 2017

United States 15,743 16,841 1,575

Spain 3,938 4,020 1,449

Brazil 2,145 3,138 1,968

Poland 2,584 2,326 1,546

India 120 776 878

China 0 260 1,221

Guatemala 106 187 2,216

Hungary 0 122 1,788

Canada 262 112 1,191

Ecuador 2,059 99 786