Professional Documents

Culture Documents

Case Study - Strategy Formation

Case Study - Strategy Formation

Uploaded by

QuadriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study - Strategy Formation

Case Study - Strategy Formation

Uploaded by

QuadriCopyright:

Available Formats

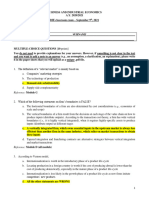

1.

GE was pursuing unrelated diversification, where it operated in multiple unrelated industries

such as home appliances, power turbines, jet engines, and financial services through GE Capital.

The sources of value creation with this type of diversification include spreading risk across

different industries, exploiting opportunities in different markets, and potentially achieving

economies of scale and scope. However, GE experienced a diversification discount, where its

stock price was valued at less than the sum of its individual business units, indicating that

investors may have perceived inefficiencies or lack of synergy among its diversified businesses.

2. GE lost $507 billion (more than 85 percent) of its market valuation since its peak due to several

factors. Firstly, the overreliance on GE Capital, which contributed more than half of its profits,

exposed the company to macroeconomic forces, especially during the 2008 financial crisis,

leading to significant losses. Additionally, poor strategic decisions, such as overpaying for high-

profile acquisitions like Alstom and Baker Hughes, contributed to financial difficulties.

Furthermore, the failure to adapt to changing market dynamics and overemphasis on financial

engineering rather than core industrial engineering also played a role in its decline.

3. Immelt's statement refers to the practice of combining financial services and industrial

companies, which was once considered a good idea but is now seen as a bad idea. He likely

believes this is a bad idea because it led to significant challenges for GE, including exposure to

financial market risks, difficulties in managing a diverse portfolio of businesses, and a lack of

focus on core industrial capabilities. Immelt's perspective suggests that the combination of

financial and industrial businesses may not create the intended synergies and can instead lead

to value destruction, as seen in GE's case. Whether one agrees with Immelt depends on various

factors, including the specific context of each company and industry. On agreeing with the

statement, the following are the reasons for the agreement.

a) Increased Complexity: Combining financial services with industrial operations adds

layers of complexity to a company's operations and management. Managing diverse

businesses with different risk profiles and market dynamics can be challenging and may

lead to inefficiencies.

b) Exposure to Financial Risks: Integrating financial services with industrial operations

exposes the company to additional financial risks, especially during economic

downturns. As seen in GE's case, reliance on GE Capital led to significant losses during

the 2008 financial crisis, highlighting the vulnerabilities inherent in such a business

model.

c) Lack of Strategic Focus: The integration of financial services may divert management's

attention away from the core competencies of the industrial business. Instead of

focusing on innovation, product development, and operational excellence, management

may become preoccupied with financial engineering and short-term financial metrics.

d) Value Destruction: The pursuit of unrelated diversification, particularly when combining

financial and industrial businesses, can result in a diversification discount. Investors may

penalize the company's stock price due to perceived inefficiencies and lack of synergies

among its diverse business units, ultimately leading to value destruction for

shareholders.

You might also like

- Magnetic Marketing System PDFDocument29 pagesMagnetic Marketing System PDFBogdan Oprea0% (1)

- Case Study - GMDocument8 pagesCase Study - GMAustin Bray100% (1)

- Diagnosis of Financial DistressDocument51 pagesDiagnosis of Financial DistressYASI SUNo ratings yet

- General Electric CaseDocument8 pagesGeneral Electric CaseTruong Le quang0% (1)

- Case Study 1: Oasis Hong Kong AirlinesDocument7 pagesCase Study 1: Oasis Hong Kong AirlinesVikas TanwarNo ratings yet

- Case Marriott A and Flinder ValvesDocument6 pagesCase Marriott A and Flinder ValvesGerardo FumagalNo ratings yet

- Industry Structure & Competitive Strategy: Keys To ProfitabilityDocument15 pagesIndustry Structure & Competitive Strategy: Keys To ProfitabilityAmi KarNo ratings yet

- Introduction ..2 Strategic Position of Ge Aviation ..3Document16 pagesIntroduction ..2 Strategic Position of Ge Aviation ..3Ibilola IbisankaleNo ratings yet

- Year End Activity Is SAPDocument13 pagesYear End Activity Is SAP233598No ratings yet

- Natureview Farms CaseDocument34 pagesNatureview Farms CaseChetan Dua100% (8)

- GE Strategy Gone WrongDocument5 pagesGE Strategy Gone WrongquincygwaroNo ratings yet

- Case Study Immelt & The Reinventing of General Electric - Bruno MognayieDocument5 pagesCase Study Immelt & The Reinventing of General Electric - Bruno Mognayiebodhi_bg100% (1)

- Soumya Sharma - Jet Airways Case StudyDocument2 pagesSoumya Sharma - Jet Airways Case StudySoumya SharmaNo ratings yet

- General Trading Companies20110713Document5 pagesGeneral Trading Companies20110713farmersproduce6No ratings yet

- MGT 480Document2 pagesMGT 480Nur Nahar LimaNo ratings yet

- Full Download Solution Manual For Managerial Economics 12th Edition by Hirschey PDF Full ChapterDocument36 pagesFull Download Solution Manual For Managerial Economics 12th Edition by Hirschey PDF Full Chapterdoomsmanaventailti63q100% (22)

- Solution Manual For Managerial Economics 12th Edition by HirscheyDocument36 pagesSolution Manual For Managerial Economics 12th Edition by Hirscheybowinglyriveryiukma100% (54)

- ASSIGNMENT3Document2 pagesASSIGNMENT3SandeepNo ratings yet

- General Electric CaseDocument12 pagesGeneral Electric CaseIshan GuptaNo ratings yet

- General ElectricDocument12 pagesGeneral ElectricRasha ElbannaNo ratings yet

- SFM A Note On Financial Distress NewDocument2 pagesSFM A Note On Financial Distress NewKaushali WeerakkodyNo ratings yet

- Primus Automation Division FinalDocument12 pagesPrimus Automation Division FinalreinharduyNo ratings yet

- Case Study PDFDocument11 pagesCase Study PDF1954032337thuyNo ratings yet

- MBASolvay SM GE Abdelkrim - Boujraf v1.00Document3 pagesMBASolvay SM GE Abdelkrim - Boujraf v1.00AbdelkrimBoujrafNo ratings yet

- General Electric Executive Summary: By: William Quinn MBA 510 - Financial Accounting August 10, 2009Document5 pagesGeneral Electric Executive Summary: By: William Quinn MBA 510 - Financial Accounting August 10, 2009bquinn08No ratings yet

- A) Distinguish Between Basic Restructuring and Financial Restructuring. Basic RestructuringDocument4 pagesA) Distinguish Between Basic Restructuring and Financial Restructuring. Basic RestructuringexsonuNo ratings yet

- CH 05Document14 pagesCH 05leisurelarry999No ratings yet

- CROCI Focus Intellectual CapitalDocument35 pagesCROCI Focus Intellectual CapitalcarminatNo ratings yet

- Marketing Ethics Assignments V.030Document11 pagesMarketing Ethics Assignments V.030Rosario HerreraNo ratings yet

- Case 03 JetBlue Airways TNDocument16 pagesCase 03 JetBlue Airways TNsabanspahic100% (1)

- Case StudyDocument6 pagesCase Studyandrei cihoNo ratings yet

- Chap 06Document32 pagesChap 06yakayuno4No ratings yet

- Audit Theory NotesDocument1 pageAudit Theory NotesMiraNo ratings yet

- Financial Statements of Titan CompanyDocument7 pagesFinancial Statements of Titan CompanyVrushieNo ratings yet

- Corporate StrategyDocument52 pagesCorporate Strategytomstor9No ratings yet

- General Electric Cas SturdyDocument4 pagesGeneral Electric Cas SturdyAditya JainNo ratings yet

- BPDocument2 pagesBPPankaj MeenaNo ratings yet

- MIS16 CH03 Case1 GEDocument5 pagesMIS16 CH03 Case1 GETuyền Nguyễn PhươngNo ratings yet

- Group5 - IAL Case AnalysisDocument13 pagesGroup5 - IAL Case AnalysisAKHIL KHERNo ratings yet

- General ElectricDocument4 pagesGeneral ElectricMJ Villamor Aquillo100% (1)

- Strengths and Weaknesses of New Industrial PolicyDocument5 pagesStrengths and Weaknesses of New Industrial PolicyRAJKUMAR GOSWAMINo ratings yet

- The Role of Profit in An EconomyDocument2 pagesThe Role of Profit in An Economyjaganath121No ratings yet

- New Trajectories For The Aerospace and Defense IndustryDocument12 pagesNew Trajectories For The Aerospace and Defense IndustryRavi Kr YadavNo ratings yet

- Investor Day 2021 Presentation FINAL (11!10!21)Document89 pagesInvestor Day 2021 Presentation FINAL (11!10!21)CARLOS FERNANDO PERUCHO QUINTERONo ratings yet

- Mergers Acquisitions Sam ChapDocument24 pagesMergers Acquisitions Sam ChapNaveen RaajNo ratings yet

- 3.0 ChallengesDocument4 pages3.0 ChallengesYoges Sweat HurtNo ratings yet

- Making Capital Structure Support StrategyDocument10 pagesMaking Capital Structure Support StrategyAnggitNo ratings yet

- Exam Sept 9th 2021 SolutionsDocument9 pagesExam Sept 9th 2021 SolutionsomerogolddNo ratings yet

- Solution Manual For Managerial Economics 12th Edition by HirscheyDocument37 pagesSolution Manual For Managerial Economics 12th Edition by Hirscheytubuloseabeyant4v9n100% (18)

- Case Study On Financial ModalityDocument6 pagesCase Study On Financial ModalityaryalsajaniNo ratings yet

- Introduction ..2 Strategic Position of Ge Aviation ..3Document16 pagesIntroduction ..2 Strategic Position of Ge Aviation ..3Ibilola IbisankaleNo ratings yet

- Referensi WajibDocument15 pagesReferensi WajibGilang Akun2No ratings yet

- Capital Structure - Bharati CementDocument14 pagesCapital Structure - Bharati CementMohmmedKhayyumNo ratings yet

- User Generated Electronics Industry SWOT Analysis:: Strengths WeaknessesDocument6 pagesUser Generated Electronics Industry SWOT Analysis:: Strengths WeaknessesMansoor KhanNo ratings yet

- Ey Joint Ventures For Oil and Gas MegaprojectsDocument16 pagesEy Joint Ventures For Oil and Gas Megaprojectsyudi100% (1)

- Corporate Restructuring - Types and ImportanceDocument15 pagesCorporate Restructuring - Types and ImportanceAbhijeetNo ratings yet

- AS-Solved Past Paper Business 9609 P1 2023-2022Document51 pagesAS-Solved Past Paper Business 9609 P1 2023-2022TheOfficialTitaniumNo ratings yet

- CP1A Solution 032022Document10 pagesCP1A Solution 032022Wilson ManyongaNo ratings yet

- Prova 630 2019Document7 pagesProva 630 2019Kenny FabricioNo ratings yet

- General Electric Power Business Unit: Strategic Analysis Tools and Techniques - Coursework 2Document13 pagesGeneral Electric Power Business Unit: Strategic Analysis Tools and Techniques - Coursework 2Ibilola IbisankaleNo ratings yet

- FandI ST2 200509 ReportDocument15 pagesFandI ST2 200509 ReportHafiz IqbalNo ratings yet

- AssignmentDocument1 pageAssignmentSheryar NaeemNo ratings yet

- Summary of Scott Davis, Carter Copeland & Rob Wertheimer's Lessons from the TitansFrom EverandSummary of Scott Davis, Carter Copeland & Rob Wertheimer's Lessons from the TitansNo ratings yet

- GE - McKinsey Matrix - ADKDocument3 pagesGE - McKinsey Matrix - ADKViz PrezNo ratings yet

- I. Executive SummaryDocument4 pagesI. Executive SummaryMans LaderaNo ratings yet

- 5010 XXXXXX 32021Document3 pages5010 XXXXXX 32021SHIVALAYA CONSTRUCTIONNo ratings yet

- Industrial Marketing - HawaldarDocument165 pagesIndustrial Marketing - Hawaldarraheel911100% (2)

- Account No Nama Akun Tipe Akun BalanceDocument24 pagesAccount No Nama Akun Tipe Akun Balancemustusach mustusachNo ratings yet

- Discussion ProblemsDocument23 pagesDiscussion ProblemsJemNo ratings yet

- Economic Order Quantity (EOQ)Document18 pagesEconomic Order Quantity (EOQ)DHARMENDRA SHAHNo ratings yet

- Consumer Evaluation and Competitive Advantage in Retail Financial Services - A Research AgendaDocument22 pagesConsumer Evaluation and Competitive Advantage in Retail Financial Services - A Research Agendajjle100% (2)

- Fixed Asset - Capitalization and Depreciation Guidelines - FinalDocument16 pagesFixed Asset - Capitalization and Depreciation Guidelines - FinalEunice WongNo ratings yet

- Pricing Strategy in The Product and Service MarketDocument24 pagesPricing Strategy in The Product and Service Market20911019No ratings yet

- Managerial Economics Chapter 2 PresentationDocument31 pagesManagerial Economics Chapter 2 PresentationtarekffNo ratings yet

- Assignment 1 WorksheetDocument1 pageAssignment 1 Worksheetgolemwitch01No ratings yet

- Microeconomics Cha 4Document8 pagesMicroeconomics Cha 4haile GetachewuNo ratings yet

- MFRS 116Document28 pagesMFRS 116nadNo ratings yet

- Re Positioning of BIO-AMLADocument24 pagesRe Positioning of BIO-AMLAnajeeb_khilji33% (3)

- Chapter 15Document51 pagesChapter 15castluci0% (1)

- Measuring The Quality of EarningsDocument15 pagesMeasuring The Quality of EarningstshimaarNo ratings yet

- MahindraDocument31 pagesMahindraSagar ZineNo ratings yet

- Council General Guidelines, 2008 & DISCIPLINARY MECHANISM NotesDocument3 pagesCouncil General Guidelines, 2008 & DISCIPLINARY MECHANISM NotesVrinda KNo ratings yet

- Multiple Choice Questions: Internal AnalysisDocument31 pagesMultiple Choice Questions: Internal AnalysiskwakuNo ratings yet

- Act CH 9 QuizDocument5 pagesAct CH 9 QuizLamia AkterNo ratings yet

- Hilton Solution Chapter 3Document58 pagesHilton Solution Chapter 3Wissam JarmakNo ratings yet

- A Study On Customer Satisfaction by The Products of Paytm" 1 EditDocument83 pagesA Study On Customer Satisfaction by The Products of Paytm" 1 EditPrerna GuptaNo ratings yet

- Bmec 21-Answers in Unit 2Document4 pagesBmec 21-Answers in Unit 2Mutia Malicay RubisNo ratings yet

- Bonds ProblemDocument9 pagesBonds ProblemLouie De La TorreNo ratings yet

- FA2 Syllabus and Study Guide 2021-22Document11 pagesFA2 Syllabus and Study Guide 2021-22Aleena MuhammadNo ratings yet