Professional Documents

Culture Documents

Ibs Vigyan September 2023

Ibs Vigyan September 2023

Uploaded by

santhoshbankofindiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ibs Vigyan September 2023

Ibs Vigyan September 2023

Uploaded by

santhoshbankofindiaCopyright:

Available Formats

SEPTEMBER 2023

IBS VIGYAN VISIONING BANKERS

Evangelistically Speaking

Dear Stakeholders,

The entire world faced the pandemic. Central Bank after the thirty day barrier. His rights to seek any other

chiefs mostly responded in unison forsaking inflation compensation have not been abrogated.

for liquidity. Post-pandemic, inflation raised its ugly

head. The responses of Shri Shakthikanta Das, Professional upskilling is more of a co-skilling activity

Governor, RBI in managing inflation stood out. London now. As one aspires to move up the hierarchy in BFSI

based “Central Banking”, a prominent organisation that segment, her all round proficiency is put to test. The

thoroughly covers and examines matters concerning Certification examinations of IIBF must be seen from

central banks and financial regulators globally chose to this perspective as the fundamental institutional

confer Governor of the Year to Shri Das. Reserve Bank of intervention to facilitate the intended skill upgradation.

Ukraine has also been a prize winner. He has been able Hence, my exhortation to all candidates to intensify

to lead the country on a growth path through a their preparations and score high marks in the ensuing

combination of innovative measures in managing examinations.

interest rates and exchange rates. The phased

withdrawal of the incremental Cash Reserve Ratio Happy Ganesh Chaturthi wishes.

completely by 7th October is a case in point.

Looking forward to a sustaining engagement with all.

After nearly 23 years, RBI has brought in major changes

in the classification and valuation of investment

portfolio by commercial banks in its Master Directions Sincerely Yours

of 12th September. This is extensively covered in this

month’s Curated Cube. Satheesh Kumar. S

Managing Director

Closely following the regulations on floating rate loans

that have been made more transparent and borrower

friendly, this month, RBI has issued guidelines making

it mandatory for regulated entities to return original

documents of properties taken as security, within thirty

days of closure of the loan and remove the charge from

records. This must be seen as another borrower friendly

move, where the borrower is eligible to be

compensated at ₹ 5000 per day for each day of delay

ibsbankcareer.in INSTITUTE OF BANKING STUDIES(IBS)

vigyan@ibsbankcareer.in CENTER POINT, KP ROAD

+91-479-2445593 KAYAMKULAM, KERALA– 690502

REGIONAL OFFICE : VIJAYANAGAR, BANGALORE

NOW AT : CHENNAI, HYDERABAD, PUNE, JAIPUR,

AHMEDABAD, LUCKNOW

ibsbankcareer.in

IBS VIGYAN

VISIONING BANKERS

vigyan@ibsbankcareer.in

+91-479-2445593

Curated Cube

Market players have always been cautioned not to The Held For Trading category has been subsumed

attempt to catch a falling knife. Loosely translated, it as a sub-category under a new category Fair Value

means not to attempt bottom fishing in a falling Through P&L (FVTPL). Those instruments which do

market. You never know how much more is the fall not satisfy the “Solely Payment of Principal and

going to be. RBI’s Master Direction of 12th Interest” (SPPI) criteria like equity shares, capital

September 2023 on Classification and Valuation of ranking AT1 and Tier 2 debt that carry loss

Investment Portfolio of Banks has upended this fear, absorption characteristics, mutual fund units etc.

by removing the impact of depreciation on will necessarily figure in this new category. Profit

investment portfolio arising from marking to market from sales from this category will go directly to P&L.

on balance sheet date from the P&L and permitting Profit from sale from HTM will be routed through

Banks to reflect it in another accounting head AFS P&L but will be taken to Capital Reserve account

Reserve Account, without touching P&L. Resultantly, below the line. Profit from sale of debt instruments

the bond market has rallied, pulling down the from AFS will be taken out from AFS Reserve

benchmark ten-year bond’s yield to below 7%. If the account and credited to P&L. In respect of equity,

AFS portfolio results in an appreciation, the balance the profit will be taken out from AFS Reserve

in AFS Reserve account will be eligible to be account and credited to Capital Reserve account.

reckoned as CET 1 Capital. In short, P&L will not be Investments in Associates and Subsidiaries will be

damaged, but Net Worth will be neutral under classified separately.

existing dispensation and under the new guidelines

.

In prevailing dispensation, while providing

depreciation on investments, the net gain in one

asset class could not be netted against the net loss

in another asset class, say gain in G Secs cannot be

offset against loss in equity portfolio. Under the

revised guidelines, the gains and losses across all

categories are netted, before reflecting in balance

sheet. Just like the premium is being amortised on

securities in HTM, discount will also accrue like the

amortization process. This treatment is also

applicable for AFS portfolio. The facility of shifting

securities from one category to another at the (Cube gives a third dimension in geometry. Curated Cube

beginning of the year has been withdrawn, except endeavors to conflate events in the market over the past

(Cube

with gives a third

permission dimension in geometry. Curated Cube

of RBI. endeavors to conflate events in the market over

month.)

the past month.)

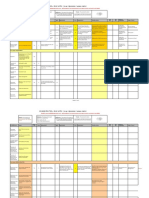

CAIIB HINDI CRASH COURSE - OCT/NOV 2023

FROM 20/09/2023

Online Zoom Classes, Whatsapp/Telegram support, Recorded Videos & Mock Test Series

ibsbankcareer.in INSTITUTE OF BANKING STUDIES(IBS)

vigyan@ibsbankcareer.in CENTER POINT, KP ROAD

+91-479-2445593 KAYAMKULAM, KERALA– 690502

REGIONAL OFFICE : VIJAYANAGAR, BANGALORE

NOW AT : CHENNAI, HYDERABAD, PUNE, JAIPUR,

AHMEDABAD, LUCKNOW

ibsbankcareer.in

IBS VIGYAN

VISIONING BANKERS

vigyan@ibsbankcareer.in

+91-479-2445593

FOURTH PILLAR

FINANCIAL SYSTEM STRESS INDICATOR: It RUPAY CARD GOES GLOBAL: To further

is a tool which monitors stress levels in the facilitate and expand payment options for

Indian Financial System. The current FSSI Indians travelling abroad, RBI has allowed

status indicates that the overall stress has issuance of RuPay Forex Cards by Indian

diminished, due to improvements of major Banks for use at overseas ATMs, POS

factors in both Banking & Non-Banking machines and online merchants. Now, RuPay

Financial sectors. However, financial Credit, Debit and Prepaid Cards will be

the

market stress indicator is not-so-good due to enabled for issuance in foreign jurisdictions

stress in equity market. that can be used internationally, including

India.

UPI LITE: Google Pay has introduced a new

feature called UPI LITE, which allows users to RBI PERMITS TO OPEN VOSTRO

load up to ₹4000 in a day for instant ACCOUNTS FROM 22 COUNTRIES FOR

transactions limited to ₹200 per transaction, TRADE IN RUPEE (₹): RBI has given

without the use of UPI PIN. Although UPI LITE permission to 20 banks in India to open

is linked to user’s bank account, but it does Special Rupee Vostro Accounts (SRVAs) of

not depend on real time on the issuing bank’s partner banks from 22 countries to promote

core banking system, that facilitates higher bilateral trade in local currencies. This would

payment success rates even during peak enable exporters and importers to invoice

transaction hours. and make payment in their respective

domestic currencies enabling the

CREDIT GUARANTEE SCHEME FOR development of a bilateral foreign exchange

LIVESTOCK SECTOR: Govt. has launched the market.

credit guarantee scheme for livestock sector,

which is aimed at revitalising the rural

economy, and empowering MSMEs. A Credit

Guarantee Trust Fund to the extent of ₹750

crore has been established to provide credit

guarantee to eligible lending institutions,

enabling improved access to finance for the

livestock sector. (Fourth Pillar strives to position beyond the

three pillars of Basel and is culled from the Four

Estates)

ibsbankcareer.in INSTITUTE OF BANKING STUDIES(IBS)

vigyan@ibsbankcareer.in CENTER POINT, KP ROAD

+91-479-2445593 KAYAMKULAM, KERALA– 690502

REGIONAL OFFICE : VIJAYANAGAR, BANGALORE

NOW AT : CHENNAI, HYDERABAD, PUNE, JAIPUR,

AHMEDABAD, LUCKNOW

ibsbankcareer.in

vigyan@ibsbankcareer.in

IBS VIGYAN

VISIONING BANKERS

+91-479-2445593

INQUISITIVELY SPEAKING

4. The tenor of the Sovereign Gold Bonds will

be for a period of __ years with an option of

premature redemption after 5th year to be

exercised on the date on which interest is

payable.

a. 5

b.6

c. 8

d. 10

5.Under Liberalised Remittance Scheme

(LRS), the limit for remittances is set at US$

__ to enable resident individuals, including

minors, to freely remit a specific amount

during a financial year for any permissible

current or capital account transaction or a

combination of both.

a. 100000

b. 150000

c. 200000

d. 250000

ANSWER KEY

1. c 2. b 3. d 4. c 5. d

Stretch n Speak

State Co-operative Bank

GIFT CITY: Gujrat International Financial Tech-

City

ESG: Environment Social & Governance

YONO: You Need Only One

EWS: Economically Weaker Section

WEO: World Economic Outlook

ibsbankcareer.in INSTITUTE OF BANKING STUDIES(IBS)

vigyan@ibsbankcareer.in CENTER POINT, KP ROAD

+91-479-2445593 KAYAMKULAM, KERALA– 690502

REGIONAL OFFICE : VIJAYANAGAR, BANGALORE

NOW AT : CHENNAI, HYDERABAD, PUNE, JAIPUR,

AHMEDABAD, LUCKNOW

You might also like

- The Rise and Fall of The Neoliberal Order America and The World in The Free Market Era Gary Gerstle Full ChapterDocument67 pagesThe Rise and Fall of The Neoliberal Order America and The World in The Free Market Era Gary Gerstle Full Chapterjamie.johnson157100% (8)

- 1 Economic Influences 2021Document69 pages1 Economic Influences 2021akshatNo ratings yet

- Pettigrew - The Awakening GiantDocument57 pagesPettigrew - The Awakening GiantC LeeNo ratings yet

- Ibs Vigyan Mar 2024Document4 pagesIbs Vigyan Mar 2024rattan24No ratings yet

- IDirect RBIAction Dec21Document4 pagesIDirect RBIAction Dec21PavankopNo ratings yet

- Non Performing Assets Management in TheDocument10 pagesNon Performing Assets Management in TheAyona AduNo ratings yet

- Industry Visit Group13Document26 pagesIndustry Visit Group13ANUPAM ROYNo ratings yet

- August 2022 BOLTDocument70 pagesAugust 2022 BOLTPankaj PawarNo ratings yet

- January Bolt 2023Document107 pagesJanuary Bolt 2023UKJ GamingNo ratings yet

- June 2022 BoltDocument77 pagesJune 2022 BoltRambabu PalepoguNo ratings yet

- Chinmaya Kumar Behera SipDocument27 pagesChinmaya Kumar Behera SipChinmaya Kumar BeheraNo ratings yet

- Monthly Bee Pedia December 6703Document142 pagesMonthly Bee Pedia December 6703Vikin JainNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument15 pagesProject Report "Banking System" in India Introduction of BankingshabnammerajNo ratings yet

- Project Report On "Credit Risk Management in State Bank of India"Document22 pagesProject Report On "Credit Risk Management in State Bank of India"Sandeep YadavNo ratings yet

- October 2022 BOLTDocument78 pagesOctober 2022 BOLTsauravNo ratings yet

- Project Report On Banking SystemDocument16 pagesProject Report On Banking SystemArun Kumar0% (1)

- Project On Various Credit Schemes of SBI Back PDFDocument46 pagesProject On Various Credit Schemes of SBI Back PDFAbhinaw KumarNo ratings yet

- Finance Project On Various Credit Schemes of SBIDocument46 pagesFinance Project On Various Credit Schemes of SBItaanvi00783% (6)

- Abstract 1 1-4Document90 pagesAbstract 1 1-4singhdhakshiNo ratings yet

- Analysis of Risk and Its Management in Indian Banks: A Case of SBI BankDocument19 pagesAnalysis of Risk and Its Management in Indian Banks: A Case of SBI BankRITIKANo ratings yet

- August 2020 BOLT PDFDocument85 pagesAugust 2020 BOLT PDFJohn MohammadNo ratings yet

- Non - Performing Assests in State Co-Operative Banks in India - An Empirical StudyDocument9 pagesNon - Performing Assests in State Co-Operative Banks in India - An Empirical StudykumardattNo ratings yet

- MBA Finance Project On Credit Schemes of State Bank of India (SBI) and Other Banks in IndiaDocument13 pagesMBA Finance Project On Credit Schemes of State Bank of India (SBI) and Other Banks in IndiaDiwakar BandarlaNo ratings yet

- Bolt Jun 201598705281117 PDFDocument113 pagesBolt Jun 201598705281117 PDFaaryangargNo ratings yet

- Banking and Financial Awareness Digest May 2 0 1 9Document6 pagesBanking and Financial Awareness Digest May 2 0 1 9Ritwick EkNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument9 pagesProject Report "Banking System" in India Introduction of BankingmanishteensNo ratings yet

- Bankers Weekly 230820Document46 pagesBankers Weekly 230820Narayanan RajagopalNo ratings yet

- Research Paper 2Document7 pagesResearch Paper 2Pooja AgarwalNo ratings yet

- Indian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Document188 pagesIndian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Debjit AdakNo ratings yet

- Literature ReviewDocument21 pagesLiterature ReviewGaurav JaiswalNo ratings yet

- Knowledgeable InformationDocument57 pagesKnowledgeable Informationrahul087-1No ratings yet

- And Unsecured Promises of Trade and Industrial Units. Their Incremental Deposit Liabilities in Shares and Debentures in The Primary and Secondary Markets. SecuritiesDocument31 pagesAnd Unsecured Promises of Trade and Industrial Units. Their Incremental Deposit Liabilities in Shares and Debentures in The Primary and Secondary Markets. SecuritiesPrithvi Nath TiwariNo ratings yet

- Impact of Non-Performing Assets On Profitability A Comparative Study of Public and Private Sector BanksDocument17 pagesImpact of Non-Performing Assets On Profitability A Comparative Study of Public and Private Sector BanksIJRASETPublicationsNo ratings yet

- BOLT June 2019 PDFDocument50 pagesBOLT June 2019 PDFSan JayNo ratings yet

- 2021 August BOLTDocument77 pages2021 August BOLTShraiya ManhasNo ratings yet

- December 2023 BoltDocument152 pagesDecember 2023 Boltmkz01041No ratings yet

- Reliance Mutual Funds ProjectDocument58 pagesReliance Mutual Funds ProjectShivangi SinghNo ratings yet

- March 2023: Monthly Current AffairsDocument149 pagesMarch 2023: Monthly Current AffairsSimran SharmaNo ratings yet

- Novembe 2022 BOLTDocument70 pagesNovembe 2022 BOLTSai Venkatesh.No ratings yet

- Bad Bank - A Good Initiative ? Challenges and AdvantagesDocument6 pagesBad Bank - A Good Initiative ? Challenges and AdvantagesVISHWANATH SAGAR S 18CBCOM105No ratings yet

- Unveiling Stock Market Trends With Capm Model: Master of Business AdministrationDocument20 pagesUnveiling Stock Market Trends With Capm Model: Master of Business AdministrationPradeepNo ratings yet

- Analysis of Risk and Its Management in Indian Banks: A Case of SBI BankDocument19 pagesAnalysis of Risk and Its Management in Indian Banks: A Case of SBI BankRITIKANo ratings yet

- Problems of NPADocument3 pagesProblems of NPAJay KoliNo ratings yet

- June 2021: Monthly Current AffairsDocument99 pagesJune 2021: Monthly Current AffairsAnusha KondayyagariNo ratings yet

- Final GK POWER CAPSULE FOR UIIC AO SBI CLERK MAINS 2016 PDFDocument70 pagesFinal GK POWER CAPSULE FOR UIIC AO SBI CLERK MAINS 2016 PDFKeerthipriya MuthyalaNo ratings yet

- Final GK Power Capsule 2016Document70 pagesFinal GK Power Capsule 2016Vishnu KumarNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument27 pagesProject Report "Banking System" in India Introduction of BankingShruti GargNo ratings yet

- Non Performing Assets - IdbiDocument7 pagesNon Performing Assets - IdbiKitten KittyNo ratings yet

- Satish Ashok Gaikwad: Encl.: As AboveDocument98 pagesSatish Ashok Gaikwad: Encl.: As AboveHemant PatidarNo ratings yet

- 7 Vol 5 No 1Document5 pages7 Vol 5 No 1DevikaNo ratings yet

- Capital MarketDocument11 pagesCapital MarketNiti KamdarNo ratings yet

- Allahabad BankDocument58 pagesAllahabad BankVARUN COMPUTERSNo ratings yet

- Bolt-September 2019 PDFDocument57 pagesBolt-September 2019 PDFShabarish AkkirajuNo ratings yet

- Jaypee SKS MicrofinanceDocument7 pagesJaypee SKS Microfinanceshobhitkhare1984No ratings yet

- Big Doc Industry Analysis - BankingDocument20 pagesBig Doc Industry Analysis - BankingSupragy BhatnagarNo ratings yet

- City Union ResearchDocument38 pagesCity Union ResearchamitNo ratings yet

- February 2021 BOLTDocument60 pagesFebruary 2021 BOLTbakede1552No ratings yet

- Basel I: CASA Ratio: The Percentage of Total Bank Deposits That Are in A CASADocument13 pagesBasel I: CASA Ratio: The Percentage of Total Bank Deposits That Are in A CASApratik deshmukhNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- Advanced Financial Management May 2018 Past Paper and Suggested Answers FWWKSVDocument22 pagesAdvanced Financial Management May 2018 Past Paper and Suggested Answers FWWKSVkaragujsNo ratings yet

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2018Document10 pagesBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2018MaricrisNo ratings yet

- BMO Harris - Disclosures-2Document4 pagesBMO Harris - Disclosures-2Andres GomezNo ratings yet

- Project Management The Managerial Process 5th EditionDocument4 pagesProject Management The Managerial Process 5th EditionRicardo GarcíaNo ratings yet

- Relaxo Footwear-Analyst Meet Update-25 September 2014Document6 pagesRelaxo Footwear-Analyst Meet Update-25 September 2014Gogul RajaNo ratings yet

- Eighth Plan EngDocument419 pagesEighth Plan EngMurahari ParajuliNo ratings yet

- Resume - Aditya WDocument3 pagesResume - Aditya WadityaNo ratings yet

- Griffin 9e IM CH 2 - EditedDocument26 pagesGriffin 9e IM CH 2 - EditedHo Hong Duc (FU HN)No ratings yet

- Case 4 - Yomn Al-ShamiDocument3 pagesCase 4 - Yomn Al-ShamiAbdulrahman DhabaanNo ratings yet

- ISO 26000 - Tool - Issue - MatrixDocument8 pagesISO 26000 - Tool - Issue - Matrixadistira jsNo ratings yet

- HanmiGlobal+Brochure Eng.Document62 pagesHanmiGlobal+Brochure Eng.Mugerwa CharlesNo ratings yet

- RPMES Forms No. 2 5Document5 pagesRPMES Forms No. 2 5Edmond BautistaNo ratings yet

- Business Combination: Consolidated Financial StatementsDocument9 pagesBusiness Combination: Consolidated Financial StatementsJuuzuu GearNo ratings yet

- MNGT1500 - SummaryDocument27 pagesMNGT1500 - SummaryAbdulwahab Almaimani100% (1)

- The Benefits of Free TradeDocument30 pagesThe Benefits of Free TradeBiway RegalaNo ratings yet

- Director VP Supply Chain Procurement in Atlanta GA Resume Lyman JordanDocument2 pagesDirector VP Supply Chain Procurement in Atlanta GA Resume Lyman JordanLymanJordanNo ratings yet

- Oe He Ur NursingDocument78 pagesOe He Ur NursingSA RAINo ratings yet

- List of Itemized ExpendituresDocument5 pagesList of Itemized ExpendituresRojen YuriNo ratings yet

- LBC 2016 PDFDocument186 pagesLBC 2016 PDFJC ReyesNo ratings yet

- 2.+Vol+1+No+2 Arina+Sofi+UlyaDocument15 pages2.+Vol+1+No+2 Arina+Sofi+UlyaAndi ratu zaqhilaNo ratings yet

- Indiabulls Group Presentation - 111113Document37 pagesIndiabulls Group Presentation - 111113Ritesh VarmaNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12Nadine JanganoNo ratings yet

- Youth Unemployment Essay (OCR)Document3 pagesYouth Unemployment Essay (OCR)Atom SonicNo ratings yet

- Challan 431798 02052018 112519 PDFDocument1 pageChallan 431798 02052018 112519 PDFchandrikaNo ratings yet

- Informal Urbanism Dan Layout PerumahanDocument46 pagesInformal Urbanism Dan Layout Perumahanalfariz haidarNo ratings yet

- AIS Chapter 2Document36 pagesAIS Chapter 2Ashenafi ZelekeNo ratings yet

- Coporate Governance Presentation 1Document10 pagesCoporate Governance Presentation 1nellaNo ratings yet