Professional Documents

Culture Documents

Topic 3 Banks and Bankings - Copie

Topic 3 Banks and Bankings - Copie

Uploaded by

farotaCopyright:

Available Formats

You might also like

- The Borrower Should Repay The Lender-Tom SchaufDocument6 pagesThe Borrower Should Repay The Lender-Tom Schaufrodclassteam100% (7)

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- Getoutofdebtfree - Ebook-Uk PDFDocument74 pagesGetoutofdebtfree - Ebook-Uk PDFWilliam Styles100% (2)

- 76 - Going To The Bank - USDocument12 pages76 - Going To The Bank - USCarlos Muñoz100% (2)

- The Doñ Quijoté School of Law: By: Don Quijote, JDDocument84 pagesThe Doñ Quijoté School of Law: By: Don Quijote, JDEL Heru Al AmenNo ratings yet

- You Funded Your Own Loan With Your Signature - On A Promisorry Note - Let's Roll ForumsDocument17 pagesYou Funded Your Own Loan With Your Signature - On A Promisorry Note - Let's Roll Forumslivingdaughter100% (11)

- Foreclosures-Don Quixote Law SchoolDocument74 pagesForeclosures-Don Quixote Law SchoolTommy Jefferson100% (3)

- Banking Domain DetailsDocument44 pagesBanking Domain DetailsAmit Rathi100% (5)

- Unit Three Money - Forms and FunctionsDocument6 pagesUnit Three Money - Forms and FunctionsMihai TudorNo ratings yet

- Cross Currency SwapDocument23 pagesCross Currency SwapcathmichanNo ratings yet

- Invoice - Ali Abid - 000660485Document1 pageInvoice - Ali Abid - 000660485AliAbidNo ratings yet

- Ing-5°-Ib-W1-Session 2Document33 pagesIng-5°-Ib-W1-Session 2Mya Nicole Armestar Ramos100% (1)

- Banking and Finance: A. Reading SectionDocument10 pagesBanking and Finance: A. Reading SectionLaili Zahrotul Maulinda LindaNo ratings yet

- Banking Basics PDFDocument46 pagesBanking Basics PDFomnep100% (1)

- Bank ForeclosuresDocument81 pagesBank ForeclosuresJoshua Sygnal Gutierrez100% (2)

- The Crisis of Credit Visualized - HD - mp3Document11 pagesThe Crisis of Credit Visualized - HD - mp3Lương TrầnNo ratings yet

- Money Makeover - Discussion NotesDocument35 pagesMoney Makeover - Discussion Noteselia23No ratings yet

- 2008 Financial CrisisDocument3 pages2008 Financial CrisisSandeepani MuthusingheNo ratings yet

- Banking BasicsDocument44 pagesBanking Basicssatstar100% (1)

- Unit 3 Microeconomics Chapter 17 Money and Banking Chapter 18 Workers Chapter 19 Trade UnionsDocument94 pagesUnit 3 Microeconomics Chapter 17 Money and Banking Chapter 18 Workers Chapter 19 Trade Unionseren parkNo ratings yet

- WE 3 UNIT 4 Vocabulary StudentsDocument32 pagesWE 3 UNIT 4 Vocabulary StudentsKatsuki yatogami100% (1)

- ESL Conversation QuestionsDocument8 pagesESL Conversation QuestionsjaycoolerfulNo ratings yet

- The Great Banking DeceptionDocument5 pagesThe Great Banking Deceptionmlo356No ratings yet

- The Author Skims The Surface of The Latte and Finds After Skimming The Surface There Is No More CreamDocument2 pagesThe Author Skims The Surface of The Latte and Finds After Skimming The Surface There Is No More CreamCharlton ButlerNo ratings yet

- Macroeconomics Module 5Document6 pagesMacroeconomics Module 5Jonnel GadinganNo ratings yet

- Getoutofdebtfree - Ebook-RoiDocument74 pagesGetoutofdebtfree - Ebook-RoiWilliam StylesNo ratings yet

- SL5 Review Test 1Document5 pagesSL5 Review Test 1solsol0125No ratings yet

- Lehman Brothers Case StudyDocument5 pagesLehman Brothers Case StudykrishhonlineNo ratings yet

- What Is MoneyDocument2 pagesWhat Is MoneyKim AciertoNo ratings yet

- 07-BANKSDocument2 pages07-BANKSalina vinnichenkoNo ratings yet

- Better Banking April 2010Document36 pagesBetter Banking April 2010dunadenNo ratings yet

- 76 Going To The Bank CanDocument14 pages76 Going To The Bank CanOlga Amy100% (1)

- 2008 Financial CrisisDocument5 pages2008 Financial CrisisAnonymous 8ihesVQRyNo ratings yet

- The Great Banking Scam: Is the American Banking System Stealing Your Money?From EverandThe Great Banking Scam: Is the American Banking System Stealing Your Money?No ratings yet

- Diagnostic Test ImprovedDocument7 pagesDiagnostic Test Improvedw7k7fqcpyvNo ratings yet

- Debt 101: From Interest Rates and Credit Scores to Student Loans and Debt Payoff Strategies, an Essential Primer on Managing DebtFrom EverandDebt 101: From Interest Rates and Credit Scores to Student Loans and Debt Payoff Strategies, an Essential Primer on Managing DebtRating: 4 out of 5 stars4/5 (3)

- Money InflationDocument11 pagesMoney InflationvaxyaNo ratings yet

- Lesson: Let'S Talk About Money: 1. Warm Up: Students Describe Pictures and Answer Questions About MoneyDocument5 pagesLesson: Let'S Talk About Money: 1. Warm Up: Students Describe Pictures and Answer Questions About MoneyannNo ratings yet

- Changes in Banking and Finance: Group 2: E-CommerceDocument30 pagesChanges in Banking and Finance: Group 2: E-CommerceDimpleNo ratings yet

- Objectives: Barter SystemDocument5 pagesObjectives: Barter SystemAmit MittalNo ratings yet

- (123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Document10 pages(123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Công MinhNo ratings yet

- Vocabulary Find The "Odd One Out".: There May Be More Than One Answer. Give Your ReasonsDocument4 pagesVocabulary Find The "Odd One Out".: There May Be More Than One Answer. Give Your ReasonstriflingNo ratings yet

- Bank Loan Secret ExposedDocument3 pagesBank Loan Secret ExposedRonald Blancaneaux Jr.0% (1)

- IG SSM Dir Sem01Document2 pagesIG SSM Dir Sem01aleshka.rivas.aNo ratings yet

- What Your Realtor, Loan Officer and Appraiser Forgot to Tell You!: A Guide for First Time Home BuyersFrom EverandWhat Your Realtor, Loan Officer and Appraiser Forgot to Tell You!: A Guide for First Time Home BuyersRating: 5 out of 5 stars5/5 (1)

- Money and CreditDocument3 pagesMoney and CreditArsh KhanNo ratings yet

- Answer Week 10 Segen Gandung S - Reguler SoreDocument4 pagesAnswer Week 10 Segen Gandung S - Reguler SoreLhutvi BasyoriNo ratings yet

- The Mortgage Loan Process: The Good, Bad, and Ugly but the Real - A Humorous, Sarcastic Walk-Through of a Dry, Boring Topic for BeginnersFrom EverandThe Mortgage Loan Process: The Good, Bad, and Ugly but the Real - A Humorous, Sarcastic Walk-Through of a Dry, Boring Topic for BeginnersNo ratings yet

- Borrow & LendDocument2 pagesBorrow & LendMaria Jose Corzo MelendezNo ratings yet

- Banking SystemDocument12 pagesBanking SystemDilip RCNo ratings yet

- Unit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkDocument9 pagesUnit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkThảo NhiNo ratings yet

- 5 Tiwxm MR Be 8 RKAk T0 UsgDocument28 pages5 Tiwxm MR Be 8 RKAk T0 Usgshanmuga Priya (Shan)No ratings yet

- What Is The Credit Crisis 1Document3 pagesWhat Is The Credit Crisis 1Yogi BearNo ratings yet

- Get Out of Debt Free User GuideDocument74 pagesGet Out of Debt Free User GuideVinny Vin100% (1)

- Money & Banks... The Hidden Truth Behind The Global Debt Scam by Richard GreavesDocument12 pagesMoney & Banks... The Hidden Truth Behind The Global Debt Scam by Richard GreavespoiuymNo ratings yet

- E BookDocument21 pagesE BookNatsuyuki HanaNo ratings yet

- Midterm Test English 2Document4 pagesMidterm Test English 2Nguyễn Ánh NgọcNo ratings yet

- Where Do We Keep Money?: How Banks WorkFrom EverandWhere Do We Keep Money?: How Banks WorkRating: 5 out of 5 stars5/5 (2)

- BS/MKT/21-22/0180 Date: 15/12/2021 Dear Business Partners, Bihar StateDocument2 pagesBS/MKT/21-22/0180 Date: 15/12/2021 Dear Business Partners, Bihar StateKrishna KumarNo ratings yet

- Net Present Value (NPV)Document12 pagesNet Present Value (NPV)Rustam AliyevNo ratings yet

- Builder NOC Format SBIDocument3 pagesBuilder NOC Format SBIarun1a0% (1)

- Auditing II AssignmentDocument9 pagesAuditing II AssignmentAnwarNo ratings yet

- Osceola County Real Property Records Forensic ExaminationDocument759 pagesOsceola County Real Property Records Forensic ExaminationStephen Dibert100% (2)

- Time Value of Money Time Value of MoneyDocument61 pagesTime Value of Money Time Value of MoneyAbubakr siddiqueNo ratings yet

- Ems Accounting Term 2Document39 pagesEms Accounting Term 2Paballo KoopediNo ratings yet

- Insurance Work BookDocument8 pagesInsurance Work BookBasanta K SahuNo ratings yet

- Practice Quiz M4 1Document4 pagesPractice Quiz M4 1sadiqpmp100% (1)

- PSA ACCOUNTS - MR Desmond AboagyeDocument17 pagesPSA ACCOUNTS - MR Desmond AboagyeGen AbulkhairNo ratings yet

- Jeevan Umang Comparison New TemplateDocument14 pagesJeevan Umang Comparison New TemplateDarshanNo ratings yet

- EMI Calculator - Prepayment OptionDocument18 pagesEMI Calculator - Prepayment Optionpranil deshmukhNo ratings yet

- January 2022 StatementDocument4 pagesJanuary 2022 StatementgatsbythackerNo ratings yet

- Nama Akun Akuntansi Dalam Bahasa InggrisDocument3 pagesNama Akun Akuntansi Dalam Bahasa Inggrisratih nikenNo ratings yet

- A.Rahman Salah AmerDocument14 pagesA.Rahman Salah AmerA.Rahman SalahNo ratings yet

- RBI Memorandum On DEAF SchemeDocument2 pagesRBI Memorandum On DEAF SchemeMoneylife FoundationNo ratings yet

- Passing Package AccDocument93 pagesPassing Package AccOM VNo ratings yet

- Training On Financial LiteracyDocument121 pagesTraining On Financial LiteracyFroy100% (5)

- 304.AUDP - .L III December 2020Document3 pages304.AUDP - .L III December 2020Md Joinal AbedinNo ratings yet

- Adobe Scan Dec 29, 2023Document1 pageAdobe Scan Dec 29, 2023jarnav003No ratings yet

- What Is Sap Fico An Introduction of Fi and Co ModuleDocument4 pagesWhat Is Sap Fico An Introduction of Fi and Co ModuleFahim JanNo ratings yet

- Ashish Bhattad: Contact: +91 7066105779Document2 pagesAshish Bhattad: Contact: +91 7066105779parth sarthyNo ratings yet

- SampleDocument8 pagesSampleTahir SirtajNo ratings yet

- 2023 Time Value of MoneyDocument81 pages2023 Time Value of Moneyk61.2212155031No ratings yet

- Quiz 2Document20 pagesQuiz 2randomlungs121223No ratings yet

- Official Receipt: Navarro Subd Brgy Gps Koronadal South Cotabato 9506 Agent Code: 007260276 Tin: Business Style AmountDocument1 pageOfficial Receipt: Navarro Subd Brgy Gps Koronadal South Cotabato 9506 Agent Code: 007260276 Tin: Business Style Amountmaizha namocaNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneysandhurstalabNo ratings yet

Topic 3 Banks and Bankings - Copie

Topic 3 Banks and Bankings - Copie

Uploaded by

farotaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 3 Banks and Bankings - Copie

Topic 3 Banks and Bankings - Copie

Uploaded by

farotaCopyright:

Available Formats

Topic three

BANKS AND BANKINGS

A bank will keep your money safe, or it will lend you money.

But its services do not stop there.

Banks were developed to keep people’s money safe and to make it available when they

needed it. Since money was invented, people have been borrowing and lending it. Italy had

famous moneylenders. In fact, the word bank comes from banco, the Italian word for bench,

for the moneylenders used to sit on benches.

Before there were banks, these services were provided elsewhere. Long ago some people

took their treasures to the temples for safekeeping. Jewelers also took valuable objects for

safekeeping, and when people needed money, they could borrow from them. But some people

did not trust others to keep their money. When they had more than they needed, they bought

things as a way of keeping their wealth. Some men bought cattle. Others bought land. Still

others bought valuable jewels and objects of gold and silver.

A modern bank accepts people’s money for safekeeping. It also lends money and offers

many other services. The experience of a businessman will show some of these. James Jones

has a furniture store and buys his goods from different parts of the country. It isn’t convenient

for him to send money through the mail, and he doesn’t want to keep big sums of money in

his store or in his home. So he goes to the bank and opens a checking account. He puts

money in the bank regularly, and the bank keeps it until he writes checks for that amount.

When Mr. Jones orders furniture from another city, he simply writes a check which looks like

the one on the following page. This check is as good as money to the owner of the Modern

Furniture Company. He can take it to his bank and cash it, that is, he get money for it.

Now and then Mr. Jones deposits money in a savings account at the bank. The bank then

uses this money and pays him a certain percentage on each dollar every year. For example, if

he deposits $1,000 and the bank pays him 4 percent, he will have earned $40 at the end of the

year. This payment is called interest. Of course, he doesn’t write checks on his savings

account.

Mr. Jones can usually borrow from the bank if he needs money. If the bank lends him

money, he must pay interest for its use. He arranges for a bank loan at the loan department.

Sometimes, instead of putting his money in a savings account, Mr. Jones wants to invest it in

some business firm, and he may ask the investment department of his bank for advice.

Mr. Jones does other business at the bank, too. He has the insurance department take care

of the insurance on his store and house; that is, he agrees to pay regular premiums and the

bank agrees to pay him a certain amount of money in case of fire or other damage to his

property. When he travels, he buys traveler’s checks from the bank to use instead of money.

And rents a safe-deposit box in the bank for his valuable papers.

Mr. Jones gets still other services from the bank. A man in the estate department helped

him write his will. When Mr. Jones dies, the bank will settle his affairs and advise his family

what to do about the business.

It’s hard to imagine what our complex business affairs would be like without the services of a

bank.

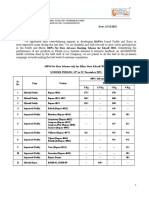

No. 205

Date : march18, 1964

Pay to the

order of : the modern furniture company $250.00

two hundred and fifty and no/100 dollars

AMERICAN SECURITY & TRUST CO.

Fairfield games g gones

Understanding ideas

1. Find two sentences that are true :

a. Some people did not trust others to keep their money.

b. People can write checks on their savings accounts.

c. A bank is a place where people can put their money for safekeeping.

d. Banks lend money without charging interest.

2. Match the different departments of a bank with the services they offer.

a. savings department a. accepts a person’s money and cashes his checks

b. estate department b. helps a person write his will

c. insurance department c. pays a person interest on money he keeps in the bank

d. loan department d. insures a person’s house against loss

e. investment department e. lends money to a person, charging him interest

f. checking department f. gives a person advice on investing money

Understanding words

Find words in the lesson that are opposites of these words: (a) lend, (b) worthless, (c) simple,

(d) save, (e) now and then.

Interpreting ideas

1. If you save any money, is it better to keep it in your house or in a bank? Why?

2. Which services in a bank could you make use now? Which ones might you make use

of later?

Let’s talk and write about banks

1. Why were banks developed?

2. Where does the word bank come from?

3. What are some of the ways in which people used to keep their wealth?

4. How does a checking account work?

5. How does a savings account work? What is interest?

6. What does a loan department do?

7. What does an investment department do?

8. What does an insurance department do?

9. Why does Mr. Jones rent a safe-deposit box?

10. What is a will? What will the bank do when Mr. Jones dies?

You might also like

- The Borrower Should Repay The Lender-Tom SchaufDocument6 pagesThe Borrower Should Repay The Lender-Tom Schaufrodclassteam100% (7)

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- Getoutofdebtfree - Ebook-Uk PDFDocument74 pagesGetoutofdebtfree - Ebook-Uk PDFWilliam Styles100% (2)

- 76 - Going To The Bank - USDocument12 pages76 - Going To The Bank - USCarlos Muñoz100% (2)

- The Doñ Quijoté School of Law: By: Don Quijote, JDDocument84 pagesThe Doñ Quijoté School of Law: By: Don Quijote, JDEL Heru Al AmenNo ratings yet

- You Funded Your Own Loan With Your Signature - On A Promisorry Note - Let's Roll ForumsDocument17 pagesYou Funded Your Own Loan With Your Signature - On A Promisorry Note - Let's Roll Forumslivingdaughter100% (11)

- Foreclosures-Don Quixote Law SchoolDocument74 pagesForeclosures-Don Quixote Law SchoolTommy Jefferson100% (3)

- Banking Domain DetailsDocument44 pagesBanking Domain DetailsAmit Rathi100% (5)

- Unit Three Money - Forms and FunctionsDocument6 pagesUnit Three Money - Forms and FunctionsMihai TudorNo ratings yet

- Cross Currency SwapDocument23 pagesCross Currency SwapcathmichanNo ratings yet

- Invoice - Ali Abid - 000660485Document1 pageInvoice - Ali Abid - 000660485AliAbidNo ratings yet

- Ing-5°-Ib-W1-Session 2Document33 pagesIng-5°-Ib-W1-Session 2Mya Nicole Armestar Ramos100% (1)

- Banking and Finance: A. Reading SectionDocument10 pagesBanking and Finance: A. Reading SectionLaili Zahrotul Maulinda LindaNo ratings yet

- Banking Basics PDFDocument46 pagesBanking Basics PDFomnep100% (1)

- Bank ForeclosuresDocument81 pagesBank ForeclosuresJoshua Sygnal Gutierrez100% (2)

- The Crisis of Credit Visualized - HD - mp3Document11 pagesThe Crisis of Credit Visualized - HD - mp3Lương TrầnNo ratings yet

- Money Makeover - Discussion NotesDocument35 pagesMoney Makeover - Discussion Noteselia23No ratings yet

- 2008 Financial CrisisDocument3 pages2008 Financial CrisisSandeepani MuthusingheNo ratings yet

- Banking BasicsDocument44 pagesBanking Basicssatstar100% (1)

- Unit 3 Microeconomics Chapter 17 Money and Banking Chapter 18 Workers Chapter 19 Trade UnionsDocument94 pagesUnit 3 Microeconomics Chapter 17 Money and Banking Chapter 18 Workers Chapter 19 Trade Unionseren parkNo ratings yet

- WE 3 UNIT 4 Vocabulary StudentsDocument32 pagesWE 3 UNIT 4 Vocabulary StudentsKatsuki yatogami100% (1)

- ESL Conversation QuestionsDocument8 pagesESL Conversation QuestionsjaycoolerfulNo ratings yet

- The Great Banking DeceptionDocument5 pagesThe Great Banking Deceptionmlo356No ratings yet

- The Author Skims The Surface of The Latte and Finds After Skimming The Surface There Is No More CreamDocument2 pagesThe Author Skims The Surface of The Latte and Finds After Skimming The Surface There Is No More CreamCharlton ButlerNo ratings yet

- Macroeconomics Module 5Document6 pagesMacroeconomics Module 5Jonnel GadinganNo ratings yet

- Getoutofdebtfree - Ebook-RoiDocument74 pagesGetoutofdebtfree - Ebook-RoiWilliam StylesNo ratings yet

- SL5 Review Test 1Document5 pagesSL5 Review Test 1solsol0125No ratings yet

- Lehman Brothers Case StudyDocument5 pagesLehman Brothers Case StudykrishhonlineNo ratings yet

- What Is MoneyDocument2 pagesWhat Is MoneyKim AciertoNo ratings yet

- 07-BANKSDocument2 pages07-BANKSalina vinnichenkoNo ratings yet

- Better Banking April 2010Document36 pagesBetter Banking April 2010dunadenNo ratings yet

- 76 Going To The Bank CanDocument14 pages76 Going To The Bank CanOlga Amy100% (1)

- 2008 Financial CrisisDocument5 pages2008 Financial CrisisAnonymous 8ihesVQRyNo ratings yet

- The Great Banking Scam: Is the American Banking System Stealing Your Money?From EverandThe Great Banking Scam: Is the American Banking System Stealing Your Money?No ratings yet

- Diagnostic Test ImprovedDocument7 pagesDiagnostic Test Improvedw7k7fqcpyvNo ratings yet

- Debt 101: From Interest Rates and Credit Scores to Student Loans and Debt Payoff Strategies, an Essential Primer on Managing DebtFrom EverandDebt 101: From Interest Rates and Credit Scores to Student Loans and Debt Payoff Strategies, an Essential Primer on Managing DebtRating: 4 out of 5 stars4/5 (3)

- Money InflationDocument11 pagesMoney InflationvaxyaNo ratings yet

- Lesson: Let'S Talk About Money: 1. Warm Up: Students Describe Pictures and Answer Questions About MoneyDocument5 pagesLesson: Let'S Talk About Money: 1. Warm Up: Students Describe Pictures and Answer Questions About MoneyannNo ratings yet

- Changes in Banking and Finance: Group 2: E-CommerceDocument30 pagesChanges in Banking and Finance: Group 2: E-CommerceDimpleNo ratings yet

- Objectives: Barter SystemDocument5 pagesObjectives: Barter SystemAmit MittalNo ratings yet

- (123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Document10 pages(123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Công MinhNo ratings yet

- Vocabulary Find The "Odd One Out".: There May Be More Than One Answer. Give Your ReasonsDocument4 pagesVocabulary Find The "Odd One Out".: There May Be More Than One Answer. Give Your ReasonstriflingNo ratings yet

- Bank Loan Secret ExposedDocument3 pagesBank Loan Secret ExposedRonald Blancaneaux Jr.0% (1)

- IG SSM Dir Sem01Document2 pagesIG SSM Dir Sem01aleshka.rivas.aNo ratings yet

- What Your Realtor, Loan Officer and Appraiser Forgot to Tell You!: A Guide for First Time Home BuyersFrom EverandWhat Your Realtor, Loan Officer and Appraiser Forgot to Tell You!: A Guide for First Time Home BuyersRating: 5 out of 5 stars5/5 (1)

- Money and CreditDocument3 pagesMoney and CreditArsh KhanNo ratings yet

- Answer Week 10 Segen Gandung S - Reguler SoreDocument4 pagesAnswer Week 10 Segen Gandung S - Reguler SoreLhutvi BasyoriNo ratings yet

- The Mortgage Loan Process: The Good, Bad, and Ugly but the Real - A Humorous, Sarcastic Walk-Through of a Dry, Boring Topic for BeginnersFrom EverandThe Mortgage Loan Process: The Good, Bad, and Ugly but the Real - A Humorous, Sarcastic Walk-Through of a Dry, Boring Topic for BeginnersNo ratings yet

- Borrow & LendDocument2 pagesBorrow & LendMaria Jose Corzo MelendezNo ratings yet

- Banking SystemDocument12 pagesBanking SystemDilip RCNo ratings yet

- Unit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkDocument9 pagesUnit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkThảo NhiNo ratings yet

- 5 Tiwxm MR Be 8 RKAk T0 UsgDocument28 pages5 Tiwxm MR Be 8 RKAk T0 Usgshanmuga Priya (Shan)No ratings yet

- What Is The Credit Crisis 1Document3 pagesWhat Is The Credit Crisis 1Yogi BearNo ratings yet

- Get Out of Debt Free User GuideDocument74 pagesGet Out of Debt Free User GuideVinny Vin100% (1)

- Money & Banks... The Hidden Truth Behind The Global Debt Scam by Richard GreavesDocument12 pagesMoney & Banks... The Hidden Truth Behind The Global Debt Scam by Richard GreavespoiuymNo ratings yet

- E BookDocument21 pagesE BookNatsuyuki HanaNo ratings yet

- Midterm Test English 2Document4 pagesMidterm Test English 2Nguyễn Ánh NgọcNo ratings yet

- Where Do We Keep Money?: How Banks WorkFrom EverandWhere Do We Keep Money?: How Banks WorkRating: 5 out of 5 stars5/5 (2)

- BS/MKT/21-22/0180 Date: 15/12/2021 Dear Business Partners, Bihar StateDocument2 pagesBS/MKT/21-22/0180 Date: 15/12/2021 Dear Business Partners, Bihar StateKrishna KumarNo ratings yet

- Net Present Value (NPV)Document12 pagesNet Present Value (NPV)Rustam AliyevNo ratings yet

- Builder NOC Format SBIDocument3 pagesBuilder NOC Format SBIarun1a0% (1)

- Auditing II AssignmentDocument9 pagesAuditing II AssignmentAnwarNo ratings yet

- Osceola County Real Property Records Forensic ExaminationDocument759 pagesOsceola County Real Property Records Forensic ExaminationStephen Dibert100% (2)

- Time Value of Money Time Value of MoneyDocument61 pagesTime Value of Money Time Value of MoneyAbubakr siddiqueNo ratings yet

- Ems Accounting Term 2Document39 pagesEms Accounting Term 2Paballo KoopediNo ratings yet

- Insurance Work BookDocument8 pagesInsurance Work BookBasanta K SahuNo ratings yet

- Practice Quiz M4 1Document4 pagesPractice Quiz M4 1sadiqpmp100% (1)

- PSA ACCOUNTS - MR Desmond AboagyeDocument17 pagesPSA ACCOUNTS - MR Desmond AboagyeGen AbulkhairNo ratings yet

- Jeevan Umang Comparison New TemplateDocument14 pagesJeevan Umang Comparison New TemplateDarshanNo ratings yet

- EMI Calculator - Prepayment OptionDocument18 pagesEMI Calculator - Prepayment Optionpranil deshmukhNo ratings yet

- January 2022 StatementDocument4 pagesJanuary 2022 StatementgatsbythackerNo ratings yet

- Nama Akun Akuntansi Dalam Bahasa InggrisDocument3 pagesNama Akun Akuntansi Dalam Bahasa Inggrisratih nikenNo ratings yet

- A.Rahman Salah AmerDocument14 pagesA.Rahman Salah AmerA.Rahman SalahNo ratings yet

- RBI Memorandum On DEAF SchemeDocument2 pagesRBI Memorandum On DEAF SchemeMoneylife FoundationNo ratings yet

- Passing Package AccDocument93 pagesPassing Package AccOM VNo ratings yet

- Training On Financial LiteracyDocument121 pagesTraining On Financial LiteracyFroy100% (5)

- 304.AUDP - .L III December 2020Document3 pages304.AUDP - .L III December 2020Md Joinal AbedinNo ratings yet

- Adobe Scan Dec 29, 2023Document1 pageAdobe Scan Dec 29, 2023jarnav003No ratings yet

- What Is Sap Fico An Introduction of Fi and Co ModuleDocument4 pagesWhat Is Sap Fico An Introduction of Fi and Co ModuleFahim JanNo ratings yet

- Ashish Bhattad: Contact: +91 7066105779Document2 pagesAshish Bhattad: Contact: +91 7066105779parth sarthyNo ratings yet

- SampleDocument8 pagesSampleTahir SirtajNo ratings yet

- 2023 Time Value of MoneyDocument81 pages2023 Time Value of Moneyk61.2212155031No ratings yet

- Quiz 2Document20 pagesQuiz 2randomlungs121223No ratings yet

- Official Receipt: Navarro Subd Brgy Gps Koronadal South Cotabato 9506 Agent Code: 007260276 Tin: Business Style AmountDocument1 pageOfficial Receipt: Navarro Subd Brgy Gps Koronadal South Cotabato 9506 Agent Code: 007260276 Tin: Business Style Amountmaizha namocaNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneysandhurstalabNo ratings yet