Professional Documents

Culture Documents

Buscom Seatwork

Buscom Seatwork

Uploaded by

Tintin AquinoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buscom Seatwork

Buscom Seatwork

Uploaded by

Tintin AquinoCopyright:

Available Formats

SEATWORK#1 - BUSCOM

NAME: _____________________________ SCORE: __________

SECTION: _________

ANSWER KEY:

1. ______________ 5. ______________ 9. ______________

2. ______________ 6. ______________ 10. _____________

3. ______________ 7. ______________ 11. _____________

4. ______________ 8. ______________ 12. _____________

PROBLEM 1

Mr. Nangamote the operation manager of Mamaya Na Company hired you to audit their

operations and asked you to prepare the combined financial statement with the Next Problem

Branch operation in accordance with the generally accepted accounting principle. Mr. Nangamote

gave you the authority to make all the necessary corrections and an adjustment of their records.

The following trial balances are for the main office and the branch as of December 31, 2025 are

presented below.

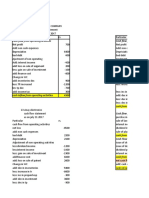

Unadjusted Trial Balance

Mamaya Na Next Problem

Cash 120,000.00 18,000.00

Accounts receivable 108,000.00 49,000.00

Inventory 1/1/25 175,000.00 46,200.00

Investment in Next Problem Branch 249,500.00

Building 1,200,000.00

Equipment 340,000.00 112,000.00

Shipment from Home Office 112,200.00

Purchases 348,000.00

Expenses 113,000.00 48,000.00

Total 2,653,500.00 385,400.00

Inventory 12/31/25 190,000.00 42,240.00

Total 2,843,500.00 427,640.00

Accumulated Depreciation 80,000.00 16,000.00

Accounts Payable 37,000.00

Notes Payable 820,000.00

Home Office 166,760

Common Stock 100,000.00

Retained Earnings 1/1/25 840,000.00

Sales - net of returns 598,360.00 202,640.00

Miscellaneous Income 12,500.00

Shipment to Branch 117,000.00

Allowance for overvaluation in Branch Inventory 48,640.00

Total 2,653,500.00 385,400.00

Income and Expense Summary 190,000.00 42,240.00

Total 2,843,500.00 427,640.00

Before the preparation of closing entries the following adjustments were discovered:

a. Merchandise is shipped to this store periodically using constant mark-up over cost. One

shipment amounted to P26,400 inventory has not yet been received or recorded by the

Branch.

b. Assigned expenses of P25,000 by the Main office to the Branch have been properly

recorded, no entry has yet been made by the branch.

c. Excess merchandise returned by the branch on October 15, 2025, amounted to P15,840

and were credited to one of the Home office customer’s accounts.

d. Collection of Home office of P12,000 from own accounts receivables was deducted in favor

of the branch.

e. The Home Office credited the remittance of the branch on August 21, 2025, to

Miscellaneous Income amounted to P12,500.

f. On December 1, branch office manager purchased P30,000 furniture and fixtures having a

useful life of 5 years failed to notify the Home Office. All plant assets are carried on the

Home Office books.

g. On December 28, 2025, the customer's check amounted to P15,000 received from the

remittances of the branch was returned by the bank to Home Office due to insufficient funds.

The home office adjusted but failed to notify the branch.

1. Branch true net income

2. Combined net income

3. Combined total assets

4. Combined total liabilities

5. Combined total shareholders’ equity

On January 1, 2026, the Mamaya Na Company was acquired by a larger conglomerate in the

name of Ayoko Na Company. Ayoko Na Company acquired 80% of Mamaya Na Company by

issuing 96,000 shares with a par value of P10 and a market value P25. At the date of the

acquisition, Ayoko Na Company also provided a control premium to Mamaya Na Company

amounting to P500,000 and a contingent consideration of 800,000 with a present value equal to

the one-fourth of Mamaya Na Company’s net assets at the date of acquisition.

The current value of Mamaya Na Company’s identifiable assets and liabilities were the same as

their carrying values except for the following assets:

Assets Increase Decrease Remaining

life

Inventory 200,000 25% sold in 2026

Building 600,000 20 years

Equipment 200,000 10 years

Acquisition costs paid were as follows:

Broker’s fee paid to firm that located Mamaya Na 10,000

Accountant’s fee for pre-acquisition 20,000

Legal fee for contract of business combination 35,000

Cost of SEC registration, including accounting and legal fees 20,000

Printing cost of stock certificates issued 10,000

General and administrative expenses 25,000

On the date of acquisition, the Ayoko Na Company’s balance sheet is presented as follows:

Assets: Book Value Fair Value

Cash 500,000 500,000

Accounts Receivables 3,200,000 2,800,000

Inventory 800,000 1,200,000

Building 2,400,000 3,000,000

Equipment 480,000 400,000

Total Assets 7,380,000 7,900,000

Liabilities and Equity:

Accounts Payable 480,000 480,000

Bonds Payable 1,100,000 1,120,000

Capital Stock 3,600,000 3,600,000

Additional Paid-in Capital 1,200,000 1,200,000

Retained Earnings 1,000,000 1,500,000

Total Liabilities and Equity 7,380,000 7,900,000

6. Consolidated Total Assets

7. Consolidated Total Liabilities

8. Consolidated Shareholders’ Equity

At the end of 2026, Ayoko Na and Mamaya Na reported a net income of 2,450,000 and

1,370,000, respectively, and declared cash dividends of 800,000 and 250,000, respectively.

Also, an impairment of 120,000 was incurred in the value of goodwill.

9. Consolidated Net income attributable to Parent Company

10. Consolidated Net income attributable to Subsidiary

11. Consolidated Retained Earnings

12. Non-controlling interest

You might also like

- CH 01Document4 pagesCH 01Rabie Haroun50% (2)

- Balance Sheet: Larry's Landscaping & Garden SupplyDocument2 pagesBalance Sheet: Larry's Landscaping & Garden SupplyBelle B.No ratings yet

- Pre ClassDocument4 pagesPre Classnavjot2k2No ratings yet

- 2 - BuscomDocument9 pages2 - BuscomDeryl GalveNo ratings yet

- GraydonUK Reading A Financial Statement For DummiesDocument45 pagesGraydonUK Reading A Financial Statement For DummiesMusonda100% (2)

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)

- Chapter 05 B Set ExercisesDocument5 pagesChapter 05 B Set Exerciseslucano350% (1)

- Financial Management July 18, 2021Document7 pagesFinancial Management July 18, 2021Bhie JaneeNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- C 1Document10 pagesC 1biniamNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Quiz 2 Cashflows Final PDFDocument4 pagesQuiz 2 Cashflows Final PDFChito MirandaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Project Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofDocument11 pagesProject Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofGetahunNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Advanced Accounting Part 2 Take Home Activity: - Total Present Value)Document3 pagesAdvanced Accounting Part 2 Take Home Activity: - Total Present Value)Airille CarlosNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- Review Test FarDocument10 pagesReview Test FarEli PinesNo ratings yet

- UAS-AKL 1 - IntlDocument2 pagesUAS-AKL 1 - IntlSweda ArifahNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- Flower Shop ProjectDocument9 pagesFlower Shop ProjectAbhilash Krishnan PNo ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- Subsidiary and Sub SubsidiaryDocument3 pagesSubsidiary and Sub SubsidiaryNipun Chandula WijayanayakaNo ratings yet

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- Tutor Statement Cash FlowDocument3 pagesTutor Statement Cash Flowlavie nroseNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Pas 1, Pas 2, Pas 7Document29 pagesPas 1, Pas 2, Pas 7MPCINo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- F3 - ACCA Chapter-16-1Document10 pagesF3 - ACCA Chapter-16-1Nile NguyenNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Financial Information Used in Ratios CompletedDocument1 pageFinancial Information Used in Ratios Completeddario.ramirezNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- Total Project Cost Fixed Assets/ Capital InvestmentsDocument8 pagesTotal Project Cost Fixed Assets/ Capital InvestmentsLorna BacligNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Financial StatementsDocument2 pagesFinancial StatementsMaria Teresa VillamayorNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Return On Capital EmployedDocument6 pagesReturn On Capital EmployedFrankie LamNo ratings yet

- 4.1 Cost of Capital Exercise ComputationDocument4 pages4.1 Cost of Capital Exercise ComputationNicole LasiNo ratings yet

- Interpretation of Financial Statements & Ratio AnalysisDocument35 pagesInterpretation of Financial Statements & Ratio Analysisamitsinghslideshare50% (2)

- Paper 32 - InsertDocument8 pagesPaper 32 - InserthtyhongNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- ACC030 T2 TUTORIAL 2 ACCTG CLASSIFICATION QsDocument8 pagesACC030 T2 TUTORIAL 2 ACCTG CLASSIFICATION QsZAWANI IRSALINA BINTI HAIRUL EMRAN MoeNo ratings yet

- Budget 2022-2024Document30 pagesBudget 2022-2024Khaled ShangabNo ratings yet

- PT Alkindo Naratama TBK.: Summary of Financial StatementDocument2 pagesPT Alkindo Naratama TBK.: Summary of Financial StatementRahayu RahmadhaniNo ratings yet

- Adjusting Process PDFDocument47 pagesAdjusting Process PDFJohn Oliver D. OcampoNo ratings yet

- Reviewer For First Periodical - ABM G12Document4 pagesReviewer For First Periodical - ABM G12ErleNo ratings yet

- Comparitive and Common Size StatementsDocument10 pagesComparitive and Common Size Statementsarushi sarafNo ratings yet

- The Income StatementDocument10 pagesThe Income Statementayoub mechouatNo ratings yet

- Module 3 Acctg. For Special TransactionsDocument25 pagesModule 3 Acctg. For Special TransactionsTanNo ratings yet

- 4.3. Example Scenario - Pro Forma ProblemsDocument6 pages4.3. Example Scenario - Pro Forma Problemskartik lakhotiyaNo ratings yet

- MQC - Quiz On Segment, Cash To Accrual, Single and CorrectionDocument10 pagesMQC - Quiz On Segment, Cash To Accrual, Single and CorrectionLenie Lyn Pasion Torres0% (1)

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- BCOM 1 Financial Accounting 1Document63 pagesBCOM 1 Financial Accounting 1karthikeyan01No ratings yet

- 1 Afar - Preweek Summary 1 RehDocument16 pages1 Afar - Preweek Summary 1 RehCarlo AgravanteNo ratings yet

- Chapter 4Document17 pagesChapter 4Mary MarieNo ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Tugas Plant Asset - Winda Gokma Fransiska Purba - 4112311090Document13 pagesTugas Plant Asset - Winda Gokma Fransiska Purba - 4112311090Winda FransiskaNo ratings yet

- How To Prepare Balance SheetDocument5 pagesHow To Prepare Balance SheetSIddharth CHoudharyNo ratings yet

- FSA - Intro PDFDocument10 pagesFSA - Intro PDFsingh somyadeepNo ratings yet