Professional Documents

Culture Documents

Elements of Cost Accounting Exam Questions

Elements of Cost Accounting Exam Questions

Uploaded by

Emilia JacobOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Elements of Cost Accounting Exam Questions

Elements of Cost Accounting Exam Questions

Uploaded by

Emilia JacobCopyright:

Available Formats

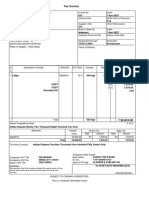

END OF SEMESTER EXAMINATION

COURSE TITLE: ELEMENTS OF COST ACCOUNTING

COURSE CODE:

PART A

ANSWER ALL QUESTIONS

1a. Describe the term Cost Accounting.

b. List three objectives of Cost Accounting.

c. List two functions of Cost Accounting.

2a. Define Cost Centres.

b. Explain the following;

i. Out-of-pocket cost and book cost

ii .Explicit and Implicit cost

3a. State 4 essentials of an ideal costing system.

b. List 3 differences between financial accounting and cost accounting.

c. State two importance of cost accounting.

PART B

ANSWER ONE QUESTION FROM THE FOLLOWING

1a.Calculate the factory cost for the following data

#

Cost of Direct Materials. 200,000

Direct Wages. 50,000

Direct Expenses. 10,000

Wages of Foreman. 5,000

Electric Power. 2,000

Lighting of the Factory. 4,000

Storekeeper’s Wages. 2,500

Oil and Water. 1,000

Rent of the Factory. 10,500

Depreciation in Plant 1,000

Consumable Store. 5,000

Repairs and Renewal Plant. 7,000

b. Calculate the production cost from the following data added..

Office Rent. 6,000

Office Lighting. 1,250

Office Depreciation 3,500

Director’s Fees. 2,500

Manager’s Salary. 10,000

Office Stationery. 1,000

Telephone Charges. 500

Postage and Telegrams 250

c. Calculate the cost of sales from the following data

Salesman’s Salary. 10,500

Travelling Expenses. 1,000

Carriage Outward. 750

Advertising. 3,500

Warehouse Charges 1,000

2. Calculate the prime cost, factory cost, cost of production cost of sales and profit form the

following particulars:

# #

Direct materials 200,000 Office stationery 1,000

Direct wages 50,000 Telephone charges 250

Direct expenses 10,000 Postage and telegrams 500

Wages of foreman 5,000 Salesmen’s’ salaries 2500

Electric power 1,000 Travelling expenses 1,000

Lighting: Factory 3,000 Repairs and renewal plant 7,000

Office 1,000 Office premises 1,000

Storekeeper’s wages 2,000 Carriage outward 750

Oil and water 1,000 Transfer to reserves 1,000

Rent: Factory 10,000 Discount on shares written off 1,000

Office 5,000 Advertising 2,500

Depreciation Plant 1,000 Warehouse charges 1,000

Office 2,500 Sales 379,000

Consumable store 5,000 Income tax 20,000

Managers’ salary 10,000 Dividend 4,000

Directors’ fees 2,500

You might also like

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Additional Practice Sums On Cost SheetDocument25 pagesAdditional Practice Sums On Cost SheetShiva AP67% (3)

- Dry Cleaning Home Delivery Business PlanDocument39 pagesDry Cleaning Home Delivery Business PlanDivya AggarwalNo ratings yet

- Group Number X - MACR - AssignmentDocument7 pagesGroup Number X - MACR - AssignmentRohitNo ratings yet

- Eos Elements of Cost Accounting Acc203Document3 pagesEos Elements of Cost Accounting Acc203Emilia JacobNo ratings yet

- Particulars Rs. in (000) Particulars Rs. inDocument2 pagesParticulars Rs. in (000) Particulars Rs. inLikitha Kiran PeramNo ratings yet

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Entrada Gericho TP-Costing-1Document3 pagesEntrada Gericho TP-Costing-1jessalyn carranzaNo ratings yet

- Unit 3 Part 1 - CostingDocument17 pagesUnit 3 Part 1 - CostingPrarthana R Industrial EngineeringNo ratings yet

- Chap 1 Problems Cost SheetDocument5 pagesChap 1 Problems Cost SheetRositaNo ratings yet

- Cost-V Sem BBMDocument10 pagesCost-V Sem BBMAR Ananth Rohith BhatNo ratings yet

- Day 2 Cost Template (My)Document36 pagesDay 2 Cost Template (My)Jhilmil JeswaniNo ratings yet

- Cost SheetDocument20 pagesCost SheetVannoj AbhinavNo ratings yet

- Cost Accounting and ControlDocument8 pagesCost Accounting and ControlJevbszen RemiendoNo ratings yet

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDocument11 pagesSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- HW 1 MGT202Document4 pagesHW 1 MGT202Rajnish Pandey0% (1)

- Cost Sheet 2Document2 pagesCost Sheet 2Junaid SiddiquiNo ratings yet

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- Cost Sheet QuestionsDocument3 pagesCost Sheet QuestionsankurmakhijaNo ratings yet

- Activity Based Costing-ExerciseDocument4 pagesActivity Based Costing-ExerciseKevin James Sedurifa OledanNo ratings yet

- Cost Sheet 19.08.2020Document6 pagesCost Sheet 19.08.2020VISHAGAN MNo ratings yet

- Day 2 - COST - TEMPLATEDocument27 pagesDay 2 - COST - TEMPLATEum23328No ratings yet

- Adm Excel EtDocument168 pagesAdm Excel EtShashank PullelaNo ratings yet

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- End of First Semester Examination Ordinary Diploma in Accounting Nta Level-6Document2 pagesEnd of First Semester Examination Ordinary Diploma in Accounting Nta Level-6DEODATUSNo ratings yet

- Cost Sheet and Single and Output CostingDocument21 pagesCost Sheet and Single and Output CostingHard WorkoutNo ratings yet

- Cost Sheet Class Practice QuestionsDocument2 pagesCost Sheet Class Practice QuestionsKajal YadavNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- Direct Material CostDocument29 pagesDirect Material CostRaj DharodNo ratings yet

- Soalan2 Quiz Chapter 3Document8 pagesSoalan2 Quiz Chapter 3biarrahsiaNo ratings yet

- Final Account - 6-9-21Document9 pagesFinal Account - 6-9-21rohit bhoirNo ratings yet

- Assignment #1 SolutionDocument18 pagesAssignment #1 SolutionJesse DanielsNo ratings yet

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- 1) Answer Any Two From The Following: 10X2 20Document2 pages1) Answer Any Two From The Following: 10X2 20Alvarez StarNo ratings yet

- Cost Analysis, Concepts & ClassificationsDocument43 pagesCost Analysis, Concepts & Classificationsmarget85% (13)

- AA025 Chapter AT3Document2 pagesAA025 Chapter AT3norismah isaNo ratings yet

- CA Assignment QuestionsDocument7 pagesCA Assignment QuestionsShagunNo ratings yet

- Problems On Cost SheetDocument3 pagesProblems On Cost Sheetvikasevil75No ratings yet

- Cost Sheet SumsDocument6 pagesCost Sheet SumsHanan MathewNo ratings yet

- Question Bank Unit 1Document5 pagesQuestion Bank Unit 1rajeevv_6No ratings yet

- Midterm Review QuestionsDocument6 pagesMidterm Review QuestionsnamiyuartsNo ratings yet

- Cost Accounting I-5. Case StudyDocument12 pagesCost Accounting I-5. Case StudyYusuf B'aşaranNo ratings yet

- Cost Sheet ProblemsDocument1 pageCost Sheet ProblemsK DIVYANo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Labor - Overhead - Set C - Question 1Document3 pagesLabor - Overhead - Set C - Question 1Trixie HicaldeNo ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Cost Sheet 1Document1 pageCost Sheet 1ARUNSANKAR NNo ratings yet

- Module 2 - Problems On Cost Sheet New 2019 PDFDocument7 pagesModule 2 - Problems On Cost Sheet New 2019 PDFJibin JoseNo ratings yet

- BusinessManagement MidtermDocument6 pagesBusinessManagement MidtermHoàng Thị Phương TrinhNo ratings yet

- Assignment 8Document13 pagesAssignment 8Jerickho JNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Ii - Mid Term Examination: Department of EEE VR Siddhartha Engineering CollegeDocument1 pageIi - Mid Term Examination: Department of EEE VR Siddhartha Engineering CollegekodalipragathiNo ratings yet

- CHP 1 - Problems Introduction To Cost AccountingDocument20 pagesCHP 1 - Problems Introduction To Cost AccountingMelissa CutinaNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- Completing The Accounting Cycle - Merchandising YtDocument1 pageCompleting The Accounting Cycle - Merchandising YtGoogle UserNo ratings yet

- Jose Fabian Jara Lara Workshop CostsDocument10 pagesJose Fabian Jara Lara Workshop CostsScribdTranslationsNo ratings yet

- Home Office and Branch HandoutsDocument4 pagesHome Office and Branch HandoutsbangtansonyeondaNo ratings yet

- Assignment ProblemDocument7 pagesAssignment ProblemAnantha KrishnaNo ratings yet

- Cost and Management Dec 23 AssignmentDocument7 pagesCost and Management Dec 23 Assignmentsureshgovekar98No ratings yet

- Handiman BusinessDocument7 pagesHandiman BusinessGARCIA, KYLA MAE A.No ratings yet

- Manufacturing Account (With Answers) : Advanced LevelDocument15 pagesManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- Princples of Econs and Intro To AccountingDocument2 pagesPrincples of Econs and Intro To AccountingEmilia JacobNo ratings yet

- Labour and Employment LawDocument1 pageLabour and Employment LawEmilia JacobNo ratings yet

- ACC757Document169 pagesACC757Emilia JacobNo ratings yet

- FORENSICACCOUNTINGDocument17 pagesFORENSICACCOUNTINGEmilia JacobNo ratings yet

- Performance MeasuresDocument17 pagesPerformance MeasuresMr BoredNo ratings yet

- INVESTMENT MANAGEMENT-lakatan and CondoDocument22 pagesINVESTMENT MANAGEMENT-lakatan and CondoJewelyn C. Espares-CioconNo ratings yet

- ACCA SBR S20 NotesDocument159 pagesACCA SBR S20 NotesMbee100% (1)

- CHAPTER 7 National IncomeDocument8 pagesCHAPTER 7 National IncomeAASHISH MISHRANo ratings yet

- Final Project Report of Birla Sun Life Mutual FundDocument84 pagesFinal Project Report of Birla Sun Life Mutual FundMohan Sharma62% (13)

- Acrow MisrDocument63 pagesAcrow MisrAmir MamdouhNo ratings yet

- (BOC) PickarooDocument19 pages(BOC) PickarooalfhyoNo ratings yet

- Patricia Kothe Form 1040Document2 pagesPatricia Kothe Form 1040John Bean100% (1)

- Target Cost AnswersDocument6 pagesTarget Cost Answerspaul sagudaNo ratings yet

- DAO No. 14-3 S. 2014Document8 pagesDAO No. 14-3 S. 2014Boss NikNo ratings yet

- Day AlanDocument1 pageDay AlanTechnetNo ratings yet

- Invoice 8763639678Document1 pageInvoice 8763639678Arjun VyasNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument25 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureConverse CareersNo ratings yet

- A Study On Impact of Jio On The Telecom Industry in IndiaDocument16 pagesA Study On Impact of Jio On The Telecom Industry in IndiaAmisha PrakashNo ratings yet

- Registration Kenya Print Pack Sign Expo 19-21 Jan 2021Document4 pagesRegistration Kenya Print Pack Sign Expo 19-21 Jan 2021MAYANK CHHATWALNo ratings yet

- Jodisec Logistics - Deal CalculationDocument1 pageJodisec Logistics - Deal CalculationXolani Radebe RadebeNo ratings yet

- Chapter 1Document13 pagesChapter 1Joshua CabinasNo ratings yet

- Dakshinanchal Vidyut Vitran Nigam LTD.: Connection DetailsDocument1 pageDakshinanchal Vidyut Vitran Nigam LTD.: Connection DetailsSuyash DixitNo ratings yet

- Statement of Financial Position: Business StudiesDocument8 pagesStatement of Financial Position: Business StudiesUpasana ChaubeNo ratings yet

- L.E.K Consulting:: Strategic Alliances-Exploiting Economic Uncertainty To Create ValueDocument57 pagesL.E.K Consulting:: Strategic Alliances-Exploiting Economic Uncertainty To Create ValueJinny Alice GeorgeNo ratings yet

- RSRCH-DFNDD - by Chapters Final Na JudDocument37 pagesRSRCH-DFNDD - by Chapters Final Na JudqwertyNo ratings yet

- This Study Resource Was: Quiz On Receivable FinancingDocument3 pagesThis Study Resource Was: Quiz On Receivable FinancingKez MaxNo ratings yet

- Unit 1Document87 pagesUnit 1rajeev318No ratings yet

- Audit Report UnqualifiedDocument19 pagesAudit Report Unqualifiedbona veronica viduyaNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Ppe TheoriesDocument4 pagesPpe TheoriesxxyyzzNo ratings yet

- BSBPMG637 - Presentation Week 1 V2Document14 pagesBSBPMG637 - Presentation Week 1 V2Natti NonglekNo ratings yet

- International FinanceDocument181 pagesInternational FinanceadhishsirNo ratings yet