Professional Documents

Culture Documents

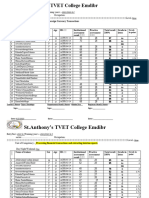

St. Anthony's TVET College Emdibir Department of Accounting and Finance Title of Occupation: Prepare Financial Reports

St. Anthony's TVET College Emdibir Department of Accounting and Finance Title of Occupation: Prepare Financial Reports

Uploaded by

tigistdesalegn2021Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

St. Anthony's TVET College Emdibir Department of Accounting and Finance Title of Occupation: Prepare Financial Reports

St. Anthony's TVET College Emdibir Department of Accounting and Finance Title of Occupation: Prepare Financial Reports

Uploaded by

tigistdesalegn2021Copyright:

Available Formats

St.

Anthony’s TVET College Emdibir

Department of Accounting and Finance

Title of Occupation: Prepare Financial Reports

Name-------------------------------------sex-------------------ID--------------------

Choose the Best Answer

1. Under the cash basis of accounting, the organization’s revenues are recorded in the

accounting period when cash is received and expenses are recorded when cash is paid.

A. True B. False

2. Accountants use the T-account format to enter the values for each account so that they

are easier to visualize.

A. True B. False

3. --------------------------are amounts that have been invested by the business into

financial instruments or securities such as shares, debentures and bonds.

A. Intangible assets B. Tangible assets C. Investments or financial assets

D. None

4. Tangible assets are also known as ‘property, plant and equipment’ or ‘fixed assets’.

They are physical assets.

A. True B. False

5. A Fixed Asset Register is an accounting method used for major assets of an

organization.

A. True B. False

6. ------------------------is the default method used to gradually reduce the carrying amount

of a fixed asset over its useful life.

A. Straight line depreciation B. Using the Sum of Years Depreciation

C. Using the Double-Declining Balance Depreciation D. None

7. Allowance method is a better alternative to the direct write-off method because it is

according to the matching principle of accounting.

A. True B. False

8. A --------------------is an account receivable that has been clearly identified as not being

collectible

A. Doubtful debt B. Bad debt C. A&B D. None

9. The bad debts expense account, just like any other expense account, is closed to

---------------------account of the period

A. balance sheet B. income statement C. cash flow D. All

10. The allowance for doubtful debts is contra-asset account.

A. True B. False

You might also like

- Financial Accounting and Analysis - Question BankDocument18 pagesFinancial Accounting and Analysis - Question BankNMIMS GA50% (2)

- Accounting Principles CH 01+02 ExamDocument7 pagesAccounting Principles CH 01+02 ExamJames MorganNo ratings yet

- (Retail) ASM 2 - Nguyễn Vũ Tiến - IELSIU20074Document7 pages(Retail) ASM 2 - Nguyễn Vũ Tiến - IELSIU20074Jay LeeNo ratings yet

- Fabm Summative 1Document3 pagesFabm Summative 1jelay agresorNo ratings yet

- Wrap Up Part 2 - Financial Accounting and ReportingDocument14 pagesWrap Up Part 2 - Financial Accounting and ReportingShaimer Cinto100% (1)

- Abc (1) 23234Document1 pageAbc (1) 23234tigistdesalegn2021No ratings yet

- Summative Exam I Answer Key (Fabm)Document5 pagesSummative Exam I Answer Key (Fabm)jelay agresorNo ratings yet

- Review of The Accounting ProcessDocument5 pagesReview of The Accounting Processrufamaegarcia07No ratings yet

- Ayu 22Document3 pagesAyu 22tigistdesalegn2021No ratings yet

- St. Anthony's TVET College Emdibir Department of Accounting and Finance Level 1: Institutional Final ExamDocument4 pagesSt. Anthony's TVET College Emdibir Department of Accounting and Finance Level 1: Institutional Final Examtigistdesalegn2021No ratings yet

- Chapter 4 - Completing The Accounting CycleDocument2 pagesChapter 4 - Completing The Accounting CycleGiang TrầnNo ratings yet

- ACC 230 Pre TestDocument2 pagesACC 230 Pre TestM ANo ratings yet

- ACCOUNTING 101 - No.4 - Theories - QuestionsDocument3 pagesACCOUNTING 101 - No.4 - Theories - QuestionslemerleNo ratings yet

- ACCOUNTING Quiz 5 6 9Document7 pagesACCOUNTING Quiz 5 6 9andreajade.cawaya10No ratings yet

- Accounting QuestionsDocument8 pagesAccounting QuestionsHuryaNo ratings yet

- Fabm Summative 2Document3 pagesFabm Summative 2jelay agresorNo ratings yet

- Mock Departmental Examination 2015 (BSA 1-5 & BSA 1-15)Document14 pagesMock Departmental Examination 2015 (BSA 1-5 & BSA 1-15)Edison San Juan100% (1)

- Pre and Post Test For Auditors TrainingDocument2 pagesPre and Post Test For Auditors TrainingJohn Ian LaudNo ratings yet

- Ae 13 Midterm ExamDocument2 pagesAe 13 Midterm ExamRizz Aigel OrillosNo ratings yet

- Acc 103 Quiz ReviewerDocument7 pagesAcc 103 Quiz Reviewerfernandezmaekyla1330No ratings yet

- 1) Match The Type of Accounting With The Skills RequiredDocument3 pages1) Match The Type of Accounting With The Skills RequiredThảo NhiNo ratings yet

- Weyino 111Document2 pagesWeyino 111tigistdesalegn2021No ratings yet

- Tai Lieu Ke Toan - Docx Khanh.Document20 pagesTai Lieu Ke Toan - Docx Khanh.copmuopNo ratings yet

- Midterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BDocument6 pagesMidterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BLENNETH MONESNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: CompletionDocument14 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Completionericacadago100% (1)

- AccDocument1 pageAccDIANE EDRANo ratings yet

- All of TheseDocument21 pagesAll of TheseLe Khang (K17CT)No ratings yet

- Financial Accounting MidexamDocument3 pagesFinancial Accounting MidexamaxmedjiinjeaxmedNo ratings yet

- Accounting Process DIYDocument8 pagesAccounting Process DIYMary PatalinghugNo ratings yet

- AssignmentDocument8 pagesAssignmentNegil Patrick DolorNo ratings yet

- A Journal Entry Is Only Partially PostedDocument2 pagesA Journal Entry Is Only Partially PostedJoko BudimanNo ratings yet

- Final Exam 1243Document2 pagesFinal Exam 1243steveiamidNo ratings yet

- St. Anthony's TVET College Emdibir Department of Accounting and Finance Level 2Document2 pagesSt. Anthony's TVET College Emdibir Department of Accounting and Finance Level 2tigistdesalegn2021No ratings yet

- Problems Problem 1: True or FalseDocument11 pagesProblems Problem 1: True or FalseSarah SantosNo ratings yet

- Integprac1 Quiz 1Document2 pagesIntegprac1 Quiz 1AMARO, BABY LIZ ANDESNo ratings yet

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- Principles of Accounting Code No. 8401Document18 pagesPrinciples of Accounting Code No. 8401Abdul SamadNo ratings yet

- Accounting Terms #3: Tudent: - Teacher: DateDocument2 pagesAccounting Terms #3: Tudent: - Teacher: DatepedroNo ratings yet

- Chapter 3 Adjusting The Accounts PDFDocument56 pagesChapter 3 Adjusting The Accounts PDFJed Riel BalatanNo ratings yet

- Accounting Principles 10e Chapter 2 NotesDocument18 pagesAccounting Principles 10e Chapter 2 NotesallthefreakypeopleNo ratings yet

- Chaper 15 & 20Document14 pagesChaper 15 & 20ansari.sl01No ratings yet

- Creative Teaching PlatformDocument36 pagesCreative Teaching PlatformHannah CaparasNo ratings yet

- UNIT 19 - Accounting and Financial StatementsDocument6 pagesUNIT 19 - Accounting and Financial Statementsbaogon39No ratings yet

- Quiz Financial Accounting NTTDocument34 pagesQuiz Financial Accounting NTTdatdo1105No ratings yet

- Fabm2121 Week 11-19Document40 pagesFabm2121 Week 11-19Jelyn Ramirez60% (5)

- Integprac1 Quiz 2Document2 pagesIntegprac1 Quiz 2AMARO, BABY LIZ ANDESNo ratings yet

- Accounting ReviewerDocument15 pagesAccounting ReviewerDeryll MacanasNo ratings yet

- Adjusting Quiz 8Document2 pagesAdjusting Quiz 8Jyasmine Aura V. AgustinNo ratings yet

- Cpa Review School of The Philippines Manila: Accounting ProcessDocument3 pagesCpa Review School of The Philippines Manila: Accounting ProcessAlliah Mae ArbastoNo ratings yet

- Fabm1 Quarter3 Module 8 Week 8 Week 9Document19 pagesFabm1 Quarter3 Module 8 Week 8 Week 9Princess Nicole EsioNo ratings yet

- Creative Teaching PlatformDocument36 pagesCreative Teaching Platformardee esjeNo ratings yet

- Fabm1 Quarter3 Module 8 Week 8 Week 9Document19 pagesFabm1 Quarter3 Module 8 Week 8 Week 9Princess Nicole EsioNo ratings yet

- Achieve Test 01Document7 pagesAchieve Test 01Aldi HerialdiNo ratings yet

- CH 3 Multiple SolutionsDocument3 pagesCH 3 Multiple SolutionsSaleema KarimNo ratings yet

- Lackings AccountingDocument5 pagesLackings Accountingjeffiversoncaneda32No ratings yet

- 2ND Online Quiz Level 1 Set A (Questions)Document5 pages2ND Online Quiz Level 1 Set A (Questions)Vincent Larrie MoldezNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesDocument11 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesAngelaNo ratings yet

- Basic Accounting Reviewer Corpo PDFDocument30 pagesBasic Accounting Reviewer Corpo PDFanthony lañaNo ratings yet

- ACC101 - Quiz Test 1 (ST)Document6 pagesACC101 - Quiz Test 1 (ST)Trân LêNo ratings yet

- MOCKSQE1stYEAR2015 Questionnairev4Document13 pagesMOCKSQE1stYEAR2015 Questionnairev4Jinky P. RefurzadoNo ratings yet

- TG - ... Lula MeDocument7 pagesTG - ... Lula Metigistdesalegn2021No ratings yet

- ST - Anthony's TVET College EmdibrDocument2 pagesST - Anthony's TVET College Emdibrtigistdesalegn2021No ratings yet

- 12 Prepare Financial ReportsDocument48 pages12 Prepare Financial Reportstigistdesalegn2021No ratings yet

- St. Anthony's TVET College Emdibir Department of Accounting and Finance Level 2Document2 pagesSt. Anthony's TVET College Emdibir Department of Accounting and Finance Level 2tigistdesalegn2021No ratings yet

- ST - Anthony's TVET College EmdibrDocument4 pagesST - Anthony's TVET College Emdibrtigistdesalegn2021No ratings yet

- Ayu 22Document3 pagesAyu 22tigistdesalegn2021No ratings yet

- Types of Exchange Rate Entry: A. True B. False 4Document1 pageTypes of Exchange Rate Entry: A. True B. False 4tigistdesalegn2021No ratings yet

- 2025Document2 pages2025tigistdesalegn2021No ratings yet

- Gabrielle Outfit: Ghea Stellarosari Nugroho ENTREE 19 - 29320103Document25 pagesGabrielle Outfit: Ghea Stellarosari Nugroho ENTREE 19 - 29320103Ghea StellarosariNo ratings yet

- Channel BehaviorDocument2 pagesChannel BehaviorLakkhanRobidas100% (1)

- Trends in Credit Risk MGMTDocument24 pagesTrends in Credit Risk MGMTr.jeyashankar9550No ratings yet

- Manish KumarDocument121 pagesManish KumarHirdesh JainNo ratings yet

- Fabm Module1Document24 pagesFabm Module1lol u’re not harry stylesNo ratings yet

- Supply Chain ManagementDocument18 pagesSupply Chain ManagementgeorgeNo ratings yet

- Accelerated Depreciation and The Allocation of Income TaxesDocument9 pagesAccelerated Depreciation and The Allocation of Income Taxesyasmine moumene.No ratings yet

- Verbal and Non-Verbal Marketing Strategies of Sellers in Tayabas MarketDocument41 pagesVerbal and Non-Verbal Marketing Strategies of Sellers in Tayabas MarketWilmerz Bloom100% (3)

- How Projects Really Work (Version 2.0)Document1 pageHow Projects Really Work (Version 2.0)icq4joyNo ratings yet

- Consumer Buying BehaviourDocument8 pagesConsumer Buying BehaviourWhitney ChaoNo ratings yet

- GO NEGOSYO-Entrepreneurial Mind-Setting - Mr. Voltaire Magpayo PDFDocument57 pagesGO NEGOSYO-Entrepreneurial Mind-Setting - Mr. Voltaire Magpayo PDFceniza nakilaNo ratings yet

- JOLLIBEE Final DoneDocument12 pagesJOLLIBEE Final DoneDinu Chacko100% (3)

- The Digital Marketing To Influence Customer SatisfDocument15 pagesThe Digital Marketing To Influence Customer SatisfIH RamayNo ratings yet

- Print Point & Yuno PackagingDocument1 pagePrint Point & Yuno PackagingAGNIK DUTTA 22100% (1)

- Receipt AccountingDocument24 pagesReceipt AccountingRohit Khairnar100% (1)

- Challenges Faced by Bata India LimitedDocument5 pagesChallenges Faced by Bata India LimitedJameel MuhammedNo ratings yet

- 08 Konys IncDocument44 pages08 Konys IncAshish Kumar0% (1)

- Bab 6-Transfer PricingDocument16 pagesBab 6-Transfer PricinghanifahNo ratings yet

- Recent Trends in MarketingDocument24 pagesRecent Trends in Marketingdazo linosNo ratings yet

- ch07 Jiambalvo 5e Test BankDocument46 pagesch07 Jiambalvo 5e Test Bankdev4c-1No ratings yet

- Module 4 Mark On Mark Down and Mark UpDocument46 pagesModule 4 Mark On Mark Down and Mark UpStacey VillanuevaNo ratings yet

- Cash To Accrual Basis of AccountingDocument6 pagesCash To Accrual Basis of AccountingChocobetternotNo ratings yet

- AAS Slides Chapter 6Document38 pagesAAS Slides Chapter 6Yousef M. AqelNo ratings yet

- Thesis On Retail IndustryDocument6 pagesThesis On Retail Industrydwtt67ef100% (1)

- 03 PrincAgentDocument39 pages03 PrincAgentlupavNo ratings yet

- Intro ERP Using GBI Exercises FI (A4) en v2.40Document10 pagesIntro ERP Using GBI Exercises FI (A4) en v2.40Joseph Andrew Caunca OrtizNo ratings yet

- Measuring The Quality of EarningsDocument15 pagesMeasuring The Quality of EarningstshimaarNo ratings yet

- Network DesignDocument23 pagesNetwork Designdishita kaushikNo ratings yet

- MARKET FAILURES NotesDocument5 pagesMARKET FAILURES NotesndumisoNo ratings yet